FRA is joined by Peter Boockvar and Yra Harris in discussing their expectations for 2017, along with predictions for Europe and the global debt crisis.

Yra Harris is a recognized Trader with over 32 years of experience in all areas of commodity trading, with broad expertise in cash currency markets. He has a proven track record of successful trading through combination of technical work and fundamental analysis of global trends; historically based analysis on global hot money flows. He is recognized by peers as an authority on foreign currency. In addition to this he has Specific measurable achievements as a member of the Board of the Chicago Mercantile Exchange (CME). Yra Harris is a Registered Commodity Trading Advisor, Registered Floor Broker and a Registered Pool Operator. He is a regular guest analysis on Currency & Global Interest Markets on Bloomberg and CNBC. He has been interviewed for various articles in Der Spiegel, Japanese television and print media, and is a frequent commentator on Canadian Financial Network, ROB TV.

Prior to joining The Lindsey Group, Peter spent a brief time at Omega Advisors, a New York based hedge fund, as a macro analyst and portfolio manager. Before this, he was an employee and partner at Miller Tabak + Co for 18 years where he was recently the equity strategist and a portfolio manager with Miller Tabak Advisors. He joined Donaldson, Lufkin and Jenrette in 1992 in their corporate bond research department as a junior analyst. He is also president of OCLI, LLC and OCLI2, LLC, farmland real estate investment funds. He is a CNBC contributor and appears regularly on their network. Peter graduated Magna Cum Laude with a B.B.A. in Finance from George Washington University. Check out Peter’s new site at www.boockreport.com.

2017 OUTLOOK

There’s going to be this tug-of-war over Trump and the tax and regulatory policies he hopes to pass and initiate, and financial conditions that will continue to tighten in the interest rate perspective. Since November, the focus has been on the positives of Trump, and when people start looking at the details, people will have to acknowledge that what got us to record highs in the stock market was QE and zero interest rates. At some point we’ll have to shift back to interest rates and the uncertainty of what Trump will pass and the offsets in terms of tax policy.

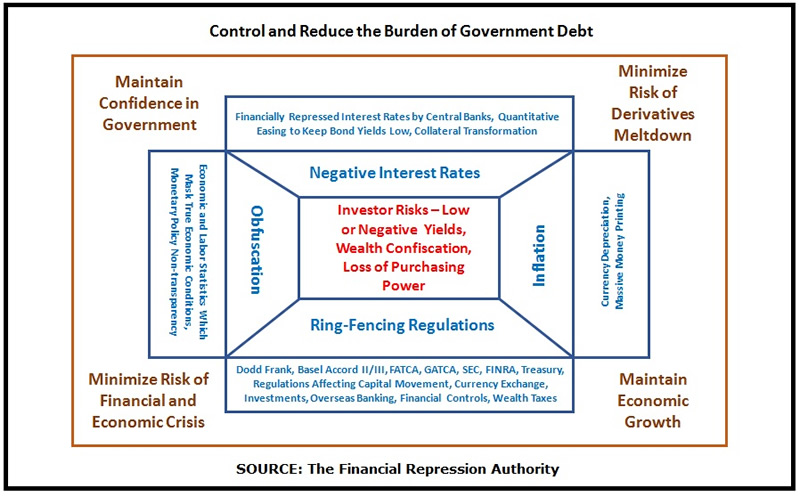

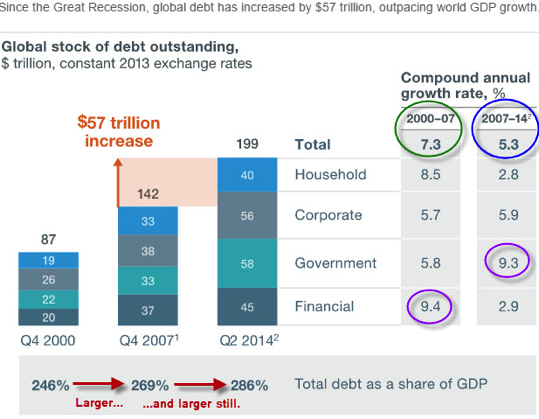

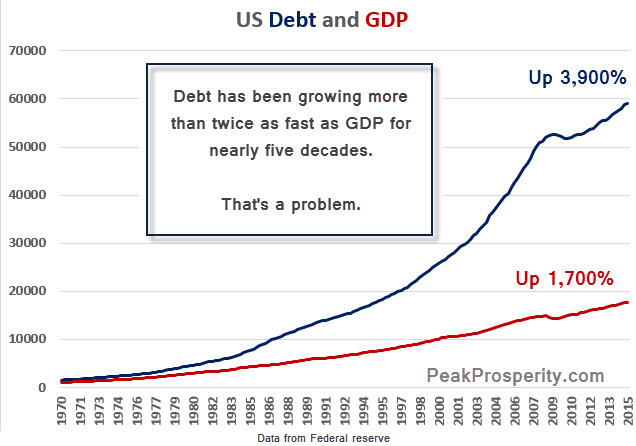

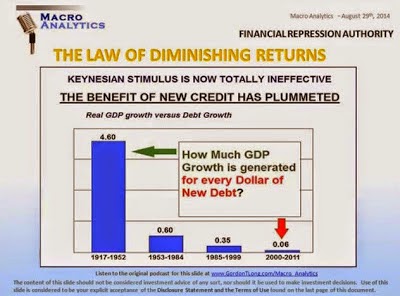

What you failed to see materialize was a lot of year-end tax selling, except for losses. This is not a Reagan phenomenon. There are so many vast differences, mainly the debt load piled on the US and global economy. For every 100 basis point increase in interest expense is $470B. Despite all this excitement over the corporate tax income cut, there’s not enough attention being paid to the potential offsets. There’s a potential border adjustment tax, and a credit addicted economy where they may be taking away the deductibility of future interest expense.

Debt has to be serviced. It’s not all coming due in this year, but we don’t know how much of it is floating. If Trump changes the tax code, a lot of people will see when interest deductions will not be part of the equation anymore, just how great the impact will be on corporate earnings. If Trump doesn’t get these offsets, the corporate tax rate isn’t going to make it to 15-20%. People are going to start digging into the details of the Trump plan, and they’re going to realize there’s no free lunch here. Because of the size and depth of the deficit, he can’t just cut taxes. There’s going to be an offset, and that’s what people have to start paying attention to.

FISCAL DEBT DRIVING US DEBT

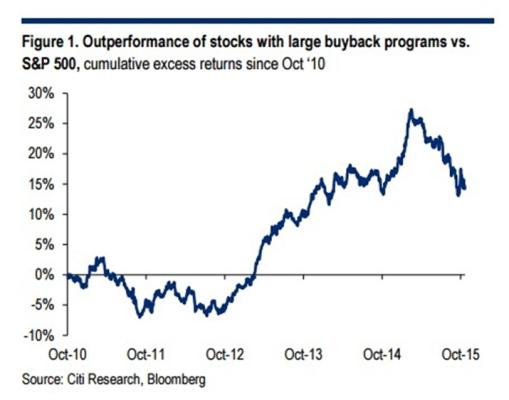

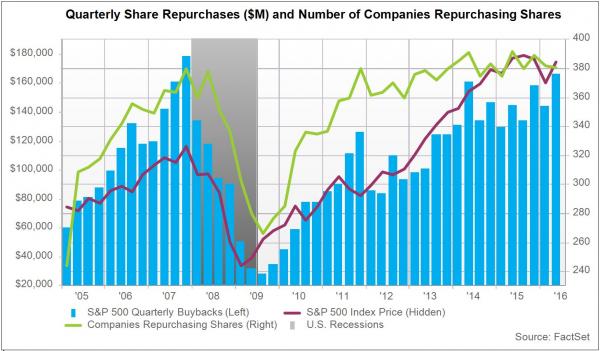

Entitlement obligations are now at 10% of GDP and rising. This trend is expected to escalate, give then trillions of unfunded liabilities obligated toward entitlement. On the private side, corporations have taken out about $620B for the share buybacks, and if rising interest rates begin to reverse that trend, that’s a big factor that could have the markets going in the other direction.

We’re seeing some political maneuvering from Trump, who’s controlling his narrative. We’re about to see the difference between campaigning and governing, and the reality of the latter.

KEY THEMES GOING INTO THE NEW YEAR

Rising inflation; slowing growth

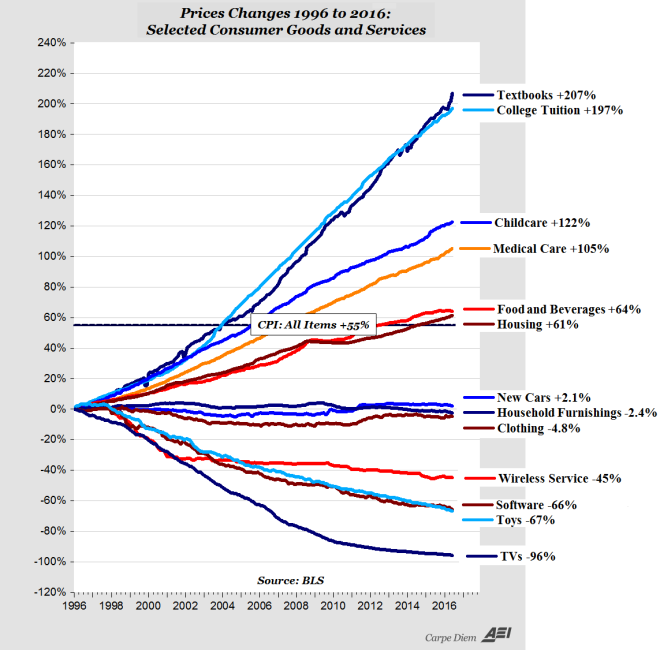

US growth is still around the 2% level, but the question for 2017 is how much of the positive sentiment numbers that we’re seeing in manufacturing etc. is hopes and how much is actual improvement in business activities. Right now it’s still hopes, and GDP for 2017 is still going to be around the 2% level and we’re not going to see the benefits of Trump until 2018. Inflation levels are moving higher, partly due to the rate of change of the base effects of the decline in energy, on top of high prices of medical care and rent. We’re seeing inflation expectations rise in Europe and the US, and it gets down to how the Fed responds to that.

Interest rates may mug the markets and trump over reality. What got us here was QE, negative interest rates, and zero interest rates in the US. To think that that can reverse with no pain, and somehow fiscal policy will offset that, is delusional.

THE PROBLEM OF GERMANY

The most important area is going to be the Euro. The only way out of some of the mess that they’re in is for Germany to have higher inflation. Right now with the Deutschmark 10% lower, the German current account surplus is about 8.5% of GDP. And yet, there’s nothing they can do about it because Germany is tied into this weak economic consortium, and they’re benefitting from it with phenomenal growth. The weaker the Euro goes, the more benefit Germany gets anyways. This is the year where Germany will have to decide if they’re going to be the transfer agent for all this growth. The operative question for this year is: who guarantees the ECB’s balance sheet?

We’re going to see firsthand the fallacy of demanding 2% inflation. Draghi doesn’t realize the epic bond bubble that he’s created. When you have huge amounts of negative yielding bonds in Europe and anemic levels of interest rates, and at the same time he wants 2% inflation. He’s desiring something that’s going to blow himself up.

As we head into 2017, Europe is going to become the centerpiece of the global financial system. It was a 50% decline in the value of Japanese and European banks that finally got them to realize flattening your yield curve into the ground is not a good idea. We are in the last inning of this last bout of monetary easing. People should not lose sight that interest rates, while still extraordinarily low, will move higher in the coming years and they should be prepared for that.

The markets are beginning to take some control. We’re going to get a rise in interest rates, and we have a very sensitive equity market.

As of 2015, of the profit pie, labour got the smaller share since WWII. That’s now beginning to shift, but there’s a lot of catch up on the labour side in terms of wages. While that’s good for earners, it’s not going to be good for corporate profits and companies will have to either slow down hiring or absorb those costs, or pass it on as higher prices.

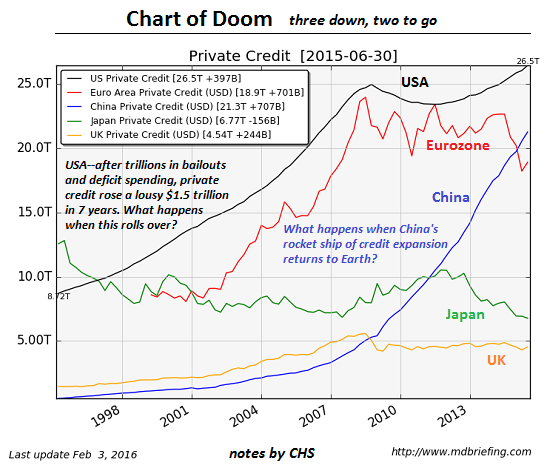

EFFECTS OF CHINA

Right now non-performing loans in China are at 15-20% of GDP levels. China’s fallen into the same trap as the US, where it takes more and more debt to generate more GDP. This obsession with 6-7% growth has put them in this trap. The level of credit it takes to generate this level of GDP is out of their control. Growth will continue to slow, and debt will continue to become a big problem, but China’s one big black box in the sense that they could throw a lot of things under the rug and keep it there in some controlled way. It’s very difficult to forecast how Chinese authorities are going to manage that.

If China were to implode and let their currency depreciate, then we’d have to change our scenarios because that could send a tidal wave of disinflation around the globe and they’ll just be exporting regardless of price. Their problem is far too much capacity, and unless they can miraculously shift their economy from an export oriented to a phenomenally domestic economy, and that won’t be an easy task with that debt load. If China makes the transition, food will be an important thing.

COMMODITY MARKETS FOR THIS YEAR

Gold’s going to trade where real interest rates are, and if you think Janet Yellen will be slow in raising interest rates in response to a rise in inflation, then you should be positive in gold and silver. It’s handled two rate hikes and a 14 year high in the dollar, and it’s still a hundred off the lows of last year. That was the bottom in this bear market, and higher prices are expected. With respect to emerging markets, Brazil and South Korea have good political direction and should be positive.

If you see the German inflation numbers, it’s obvious they’re debasing their currency as a way to bail out the EU.

BitCoin is up 150% year over year. Over the last couple of months it’s doubled. There’s something very wrong that BitCoin is doubling like that while gold is suffering. There’s a push for a non-fiat type currency. Right now they’re buying BitCoin, but the difference between gold and BitCoin is nonsensical.

The ECB will become the big issue for the German elections come September.

Abstract by: Annie Zhou <a2zhou@ryerson.ca>

01/06/2017 - The Roundtable Insight – Peter Boockvar And Yra Harris On The 2017 Outlook

01/06/2017 - The Roundtable Insight – Peter Boockvar And Yra Harris On The 2017 Outlook