INDONESIA Forced Defensively to Aggressively Adopt Financial Repression.

NOTE FROM FRA: Gordon T Long

- NOTE: “Starting in 2016, the government (Indonesia) now requires non-bank institutions to increase the proportion of government bonds in their portfolios to at least 10-20 percent in 2016 and to 20-30 percent in 2017.”

- NOTE: “Separately, the government has also lowered various interest rates by force. This year, the micro lending rate has been squeezed down to 9 percent and is expected to be slashed further to 7 percent in 2017.” This tells us that lending and borrowing is primarily about Currency risk.

- NOTE: “Indonesia might be tempted to utilize cheap funds provided from some countries like China and Japan that have systematically used financial repression but are now at the end of the cycle struggling to boost global demand by exporting capital. But the government must understand the aim of these countries is to create artificial demand so trade protections must be carefully considered. We can see how aggressive Japan and China export capitals have been to Indonesia ranging in many forms from China-led Asian Infrastructure Investment Bank loans to a series of acquisition by Japanese banks.” Is this one of the real reasons for the creation of the $55T AIIB?

SOURCE: 10-13-16 The Jakarta Post by PT Samuel Sekuritas Indonesia Economist – Rangga Cipta

Financial repression policy to maintain economic growth

The end of the commodity boom that peaked in 2011 has forced the government to consider more sustainable ways to cultivate economic growth. With the mining sector struggling mightily, it is easy to fathom why the manufacturing sector is now the government’s favored sector. Most of the recently released regulations aimed at supporting producers at the cost of consumers.

The end of the commodity boom that peaked in 2011 has forced the government to consider more sustainable ways to cultivate economic growth. With the mining sector struggling mightily, it is easy to fathom why the manufacturing sector is now the government’s favored sector. Most of the recently released regulations aimed at supporting producers at the cost of consumers.

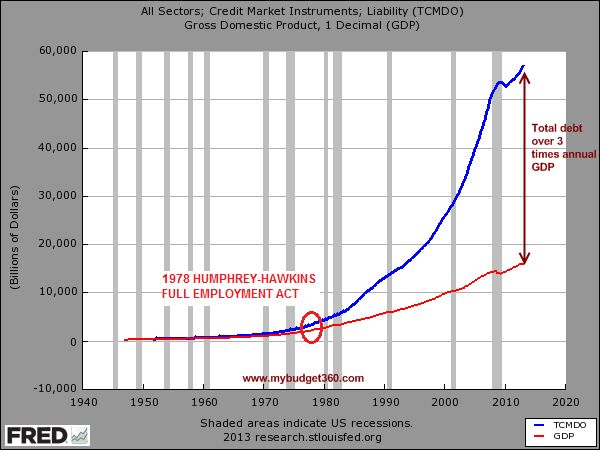

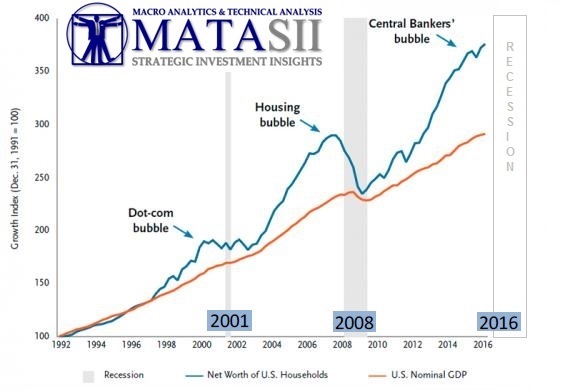

With declining revenues from commodity exports, growth has been sluggish since 2011. Direct investment has become less attractive without sufficient US dollar liquidity to import capital goods.

Private consumption, contributing 55 percent to the gross domestic product (GDP), is usually the stronghold of growth, but government regulatory tendencies are repressing rather than stimulating private consumption. Government spending has been the savior of economic growth, but shrinking state revenues has reduced room for fiscal stimulus.

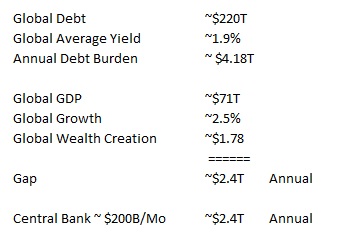

The budget deficit has consistently widened since 2011, forcing the government to seek alternative sources of income, ranging from tax intensification and extension to the tax amnesty program.

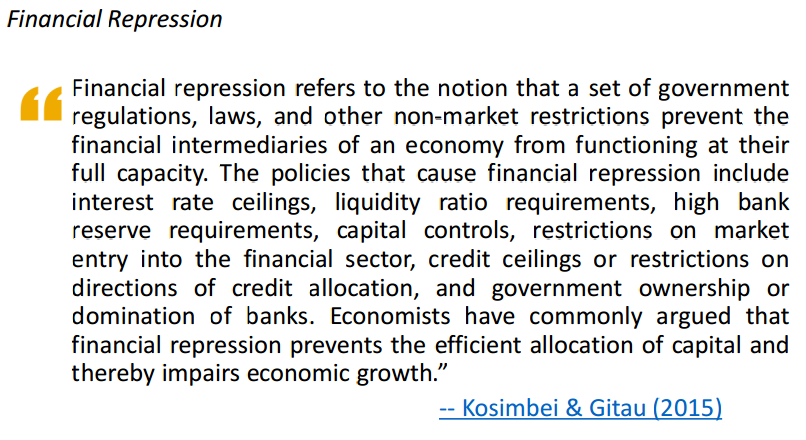

Even with the additional revenue from the tax amnesty program, an increase in outstanding government debt is inevitable to finance aggressive infrastructure spending. To compensate for the remaining revenue shortfall, a form of hidden taxation known better as financial repression, is already well under way.

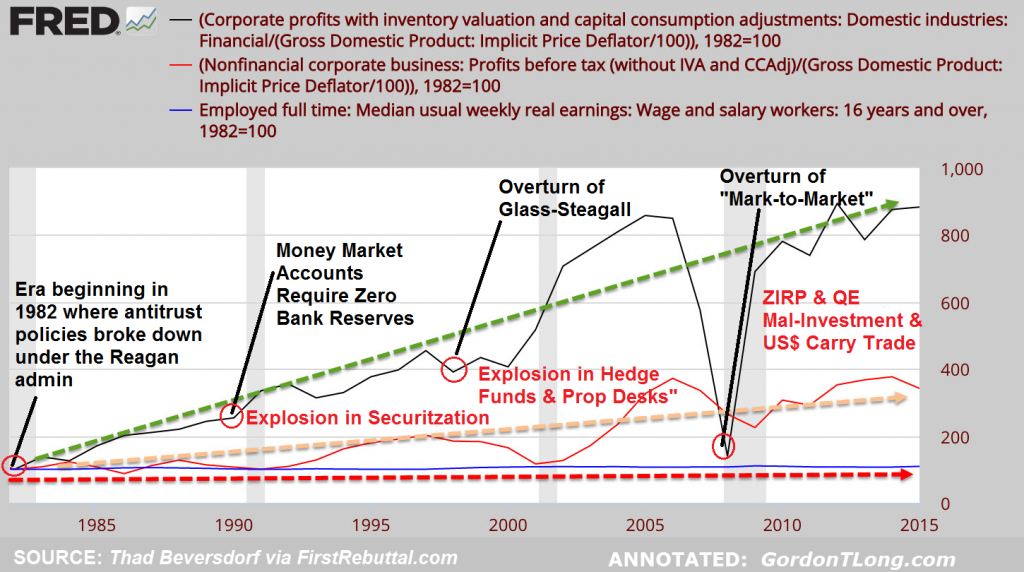

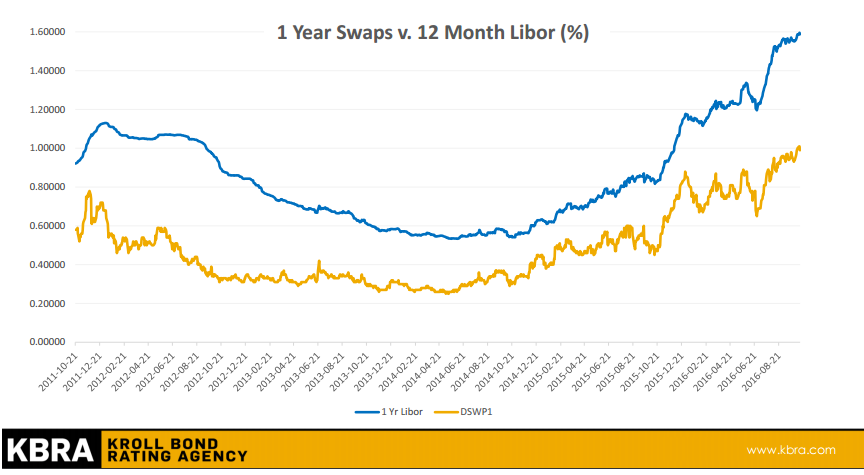

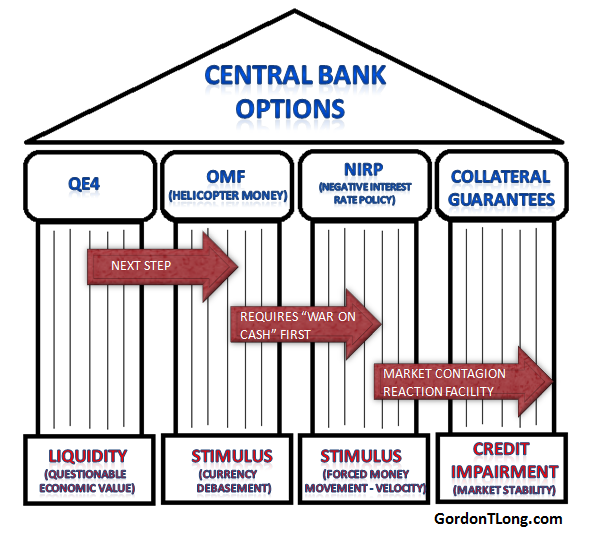

Financial repression policies include forced lending to governments by domestic financial institutions, interest-rate caps, capital controls, macro-prudential policies and other policies that are aimed to capture and under-pay domestic savers (McKinnon 1973).

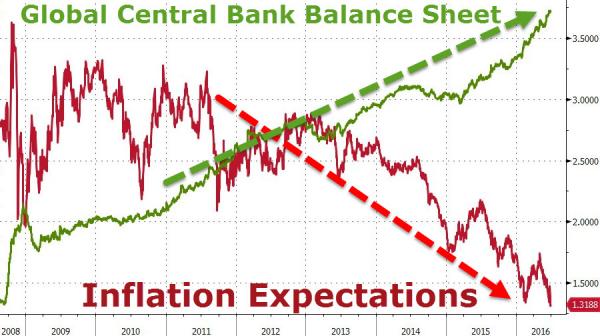

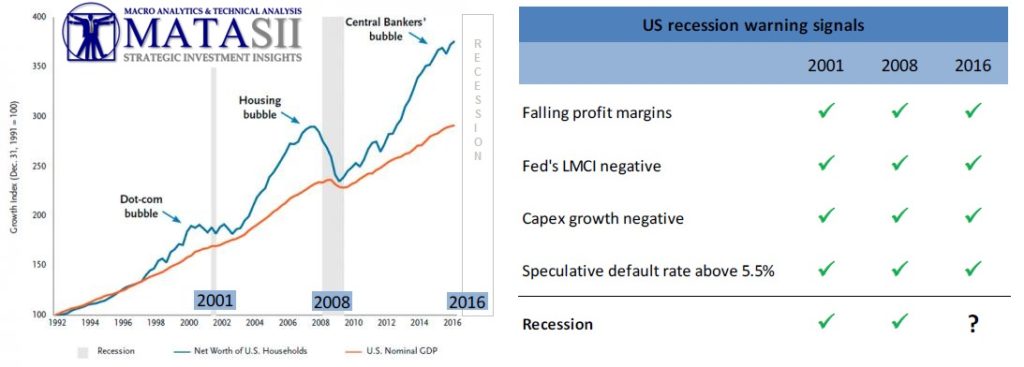

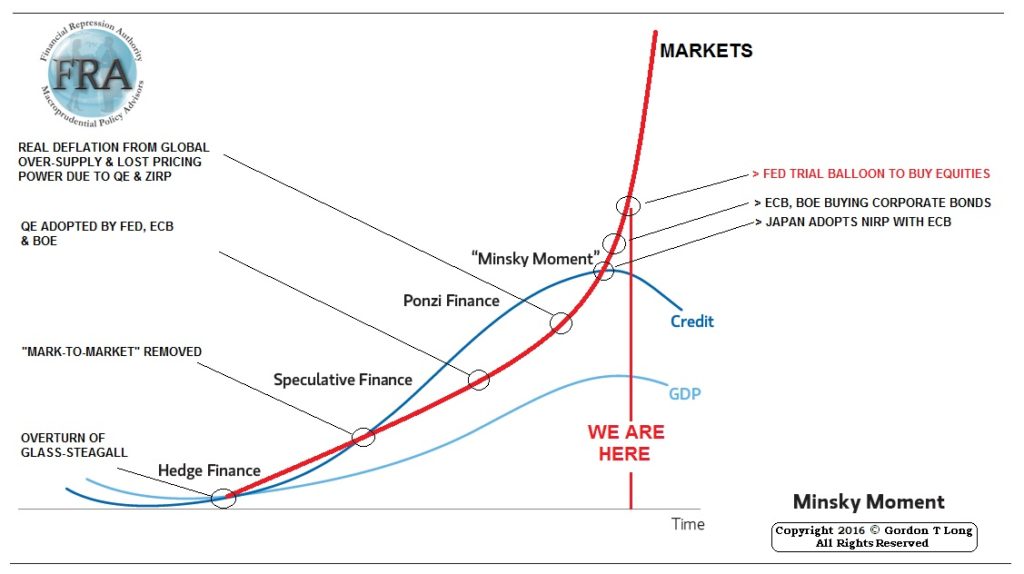

The unconventional monetary policy called Quantitative Easing of the US Federal Reserve, European Central Bank , Bank of Japan and Bank of England is also considered financial repression since the goal is to keep interest rates low and create captive domestic audiences (Reinhart 2011).

Starting in 2016, the government now requires non-bank institutions to increase the proportion of government bonds in their portfolios to at least 10-20 percent in 2016 and to 20-30 percent in 2017.

Separately, the government has also lowered various interest rates by force. This year, the micro lending rate has been squeezed down to 9 percent and is expected to be slashed further to 7 percent in 2017.

Additionally, the government has also set the maximum level of time deposit rates for certain banks to only 75-100 basis points (bps) above the 12-month policy rate (previously the Bank Indonesia rate) arguing that currently banks are enjoying too high margins.

This policy is clearly an effort to subsidize the borrower and tax both the lenders and savers, while at the same time encouraging the acquisition of more government bonds. This can also be seen as an attempt to soothe the crowding out effect resulting from the soaring public debt.

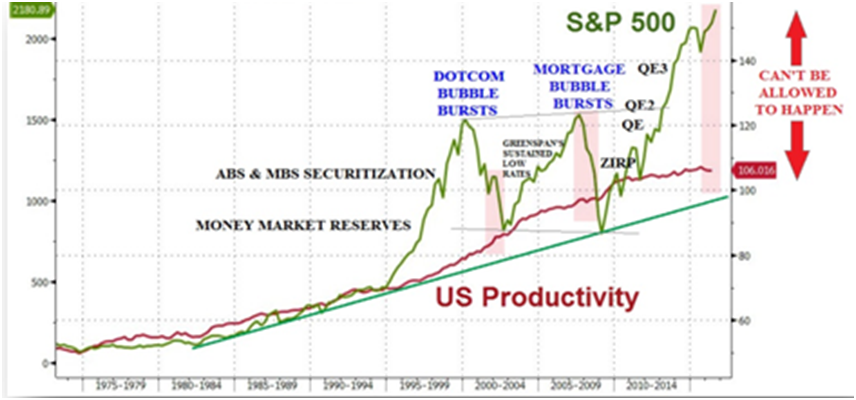

The growing middle-income segment could also provide additional strength since the bedrock of the strategy is to provide abundant cheap capital as well as labor. But again to attract foreign direct investment (FDI) and increase competitiveness at the same time, the government must maintain productivity growth running faster than inflation adjusted wage growth.

Starting this year, the government has set a legal formula for the fair amount of annual labor wage adjustment to prevent excessive increases. Labor unions are unlikely to be placated by wage increases being restrained as such so we can expect to witness more angry demonstrators on Labor Day years ahead.

To complete the export-led capital investment growth model, the government has launched numerous economic policies mostly aimed to lure FDI and boost export competitiveness. Mining sector wise, the government has set rules to discourage raw commodity exports, including minerals and crude palm oil (CPO), and is attempting to keep more resources such as coal for domestic needs. But this could mean mining producers receiving lower prices than what global markets can offer.

BI, besides maintaining foreign currency reserves in excess of US$100 billion, is also promoting tighter restrictions on international financial flow, ranging from the mandatory use of the rupiah for domestic transactions to the maximum purchase of foreign currencies. This is another clear example of financial repression. BI argues that the policy is crucial to maintain the stabilization of the rupiah.

In short, financial repression and the export-led capital investment strategy will push growth away from reliance on consumers toward producers instead. The benefits are obvious; Indonesia can escape from the curse of being reliant on natural resources while grabbing a larger share in global supply chains. FDI can more easily be attracted with Indonesia becoming a strategic and efficient production base.

But to be successful, this policy must be accompanied by a realistic long-term industrialization plan with export promotion as the main theme. China, Japan, and South Korea have taken this path and become large and efficient exporters of manufactured goods and have transformed themselves from net capital importers to exporters.

Yet some risks are unavoidable. It is important to note that financial repression goes against the law of economics by preventing adjustment of many macro variables such as interest rates, wages and exchange rates. Like the commodity based growth, this export-led capital investment growth model can easily lead to chronic economic imbalances. Global imbalances helped fuel the 1997 Asian Financial Crisis, even though it was not the initial primary cause. Grasping what went wrong in previous crises could be a good start as a precaution.

Indonesia might be tempted to utilize cheap funds provided from some countries like China and Japan that have systematically used financial repression but are now at the end of the cycle struggling to boost global demand by exporting capital.

But the government must understand the aim of these countries is to create artificial demand so trade protections must be carefully considered. We can see how aggressive Japan and China export capitals have been to Indonesia ranging in many forms from China-led Asian Infrastructure Investment Bank loans to a series of acquisition by Japanese banks.

Moreover, in most cases, a financial repressor country will support trade protection and at the same time promote an undervalued currency not only to maintain competitiveness but also as another way to discourage the demand for imported goods although this can’t be likened to import substitution-industrialization policy.

This could nourish a great systematic risk in the future considering what misery exchange rate controls can bring to Indonesia, a country with huge foreign currency liabilities. To avoid this situation in the future, the speed of how the government can raise the onshore participation in domestic financing is crucial.

______________________________

The writer is an economist at PT Samuel Sekuritas Indonesia. The views expressed are his own.

Disclaimer: The views or opinions expressed in this blog post may or may not be representative of the views or opinions of the Financial Repression Authority.

11/02/2016 - Dodd-Frank represents Regulatory Policy that assures sub-standard credit and job growth in an Era of Financial Repression!

11/02/2016 - Dodd-Frank represents Regulatory Policy that assures sub-standard credit and job growth in an Era of Financial Repression!

The end of the commodity boom that peaked in 2011 has forced the government to consider more sustainable ways to cultivate economic growth. With the mining sector struggling mightily, it is easy to fathom why the manufacturing sector is now the government’s favored sector. Most of the recently released regulations aimed at supporting producers at the cost of consumers.

The end of the commodity boom that peaked in 2011 has forced the government to consider more sustainable ways to cultivate economic growth. With the mining sector struggling mightily, it is easy to fathom why the manufacturing sector is now the government’s favored sector. Most of the recently released regulations aimed at supporting producers at the cost of consumers.