“The bill also attempts to drop a major bomb on Bitcoin by including it in the list of monetary instruments that must be reported when entering or leaving the US.”

LINK HERE to the proposed regulation

06/15/2017 - Proposed New Regulation Against Cash, Bitcoin And Ether

06/15/2017 - Proposed New Regulation Against Cash, Bitcoin And Ether

“The bill also attempts to drop a major bomb on Bitcoin by including it in the list of monetary instruments that must be reported when entering or leaving the US.”

LINK HERE to the proposed regulation

06/15/2017 - James Grant On The History Of Interest Rates & The State Of Markets

06/15/2017 - James Grant On The History Of Interest Rates & The State Of Markets

James Grant reflects on the History of Interest Rates, the State of Markets, and the Future of Finance .. About the Interview: We stop to remember a time, in which the extraordinary measures and unprecedented actions of our monetary and fiscal authorities would have seemed unimaginable. We take a hard look at money. How does this shadow of wealth find its value? How is the rate of interest determined, and what is the role of financial markets in facilitating the discovery of that value? What happened, in 2008 and what are the consequences, realized and yet to be discovered, of those very extraordinary and unprecedented actions taken by governments around the world to douse the flames of deflation? What was done in order to contain the contraction and to prevent the discovery of prices? What does the future hold in 2017, what investments does one make and where might one find opportunity in these oceans of uncertainty.

06/15/2017 - Bundesbank’s Weidmann: Digital Currencies Will Make The Next Crisis Worse

06/15/2017 - Bundesbank’s Weidmann: Digital Currencies Will Make The Next Crisis Worse

“Essentially, Weidmann warned that digital currencies – whose flow can not be blocked by conventional means – make an instant bank run far more likely, and in creating the conditions for a run on bank deposits lenders would be short of liquidity and struggle to make loans.”

06/14/2017 - McAlvany Podcast: Will The Free Market Ever Exist Again?

06/14/2017 - McAlvany Podcast: Will The Free Market Ever Exist Again?

This week a discussion on the manipulated “free market” and if it will truly ever be free again. Central Bank “Buying” of Securities at $300 Billion Per Month!

06/13/2017 - Charles Hugh Smith: The Path To Inflation – “Helicopter Money”

06/13/2017 - Charles Hugh Smith: The Path To Inflation – “Helicopter Money”

“We all know real-world inflation for big-ticket expenses is far above the official rate of around 2% annually .. Yet conventional economists are virtually unanimous that deflation is the danger and inflation is a ‘good thing’ we need to spur so servicing existing debt becomes easier for debtors. Due to the deflationary pressures of technology and stagnant wages for the bottom 90%, the consensus sees low inflation as far as the eye can see. When the consensus is near-100% on one side of the boat, we can safely bet Reality will not conform to expectations. This leads to a question: what could cause official near-zero inflation to surprise the consensus and leap higher? One possible answer is ‘helicopter money’: money created by central banks that is distributed directly to households .. To fund ‘helicopter money,’ governments will have to borrow trillions more from central banks. If this flood of new money pushes inflation higher, the interest rates governments will pay on future ‘helicopter money’ will rise .. The general view in inflation is dead, essentially forever. Maybe. Maybe not.”

06/13/2017 - “Nothing Else Matters”: Central Banks Have Bought A Record $1.5 Trillion In Assets In 2017

06/13/2017 - “Nothing Else Matters”: Central Banks Have Bought A Record $1.5 Trillion In Assets In 2017

“One month ago, when observing the record low vol coupled with record high stock prices, we reported a stunning statistic: central banks have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, ‘the largest CB buying on record’ according to Bank of America. Today BofA’s Michael Hartnett provides an update on this number: he writes that central bank balance sheets have now grown to a record $15.1 trillion, up from $14.6 trillion in late April, and says that ‘central banks have bought a record $1.5 trillion in assets YTD.'”

06/13/2017 - Amin Rajan: The Digitization Of Asset And Wealth Management

06/13/2017 - Amin Rajan: The Digitization Of Asset And Wealth Management

LINK HERE to get the PDF Report

06/13/2017 - Bill Gross: “The Real Economy Has Been Usurped By The Financial Economy”

06/13/2017 - Bill Gross: “The Real Economy Has Been Usurped By The Financial Economy”

“Investors have discovered that making money with money is a profitable enterprise and have exchanged the support of central banks for the old-time religion of productivity growth as a driver of their strategy. The real economy has been usurped by the financial economy. Long live the financed-based economy!”

06/09/2017 - It’s All About The Central Banks

06/09/2017 - It’s All About The Central Banks

“Central banks are going to toe the policy line – support growth with accommodative policy. The result for markets is the massive QE distortion of financial asset prices will continue, supporting stocks for longer than we think feasible.”

06/09/2017 - David Rosenberg: Thoughts On The Deflationary Headwinds Facing The US Economy, Federal Reserve Policy

06/09/2017 - David Rosenberg: Thoughts On The Deflationary Headwinds Facing The US Economy, Federal Reserve Policy

“The big challenge is, if this [Boomers retiring] was happening 30 years ago, you could go to the government bond market and get 4, 5, 6%. You can’t do that today.”

“[Low Treasury yields] are why I don’t think the dividend theme is overdone. The equity market has become a more reliable generator of the reoccurring cash flows that the Boomers need than the government bond market has.”

06/08/2017 - The Roundtable Insight: Bill Laggner On Debt Bubbles & The Emerging FinTech Revolution

06/08/2017 - The Roundtable Insight: Bill Laggner On Debt Bubbles & The Emerging FinTech Revolution

FRA is joined by Bill Laggner to discuss non-housing debt, auto loans, and FinTech.

Non-housing debt is being driven mainly by student debt and the auto loan, which are part of the echo bubbles created post ’09, and the figures are alarming. We know that some of the student loan industry is underwritten by the government and the large banks, but there’s an auto loan bubble where the figures range up to $1.5T. A lot of this industry is not securitized. There’s a chunk of the industry that’s essentially private automobile loans, and they’re bundled and sold among high net worth investors. The number is larger than what the graph reflects to the right.

The government is intervening with student debt to recast the debt, alter the terms of the debt, extend the terms etc. We know we’ve never had a true recovery; we’ve had asset bubbles but the real economy is still struggling. What’s happened is that now there’s been lobbying efforts where they essentially want to allow these people to file bankruptcy, and of course the taxpayers would eat it. It’s just another example of the Austrians’ looking at the idea of monetary fiscal distortions where the governments subsidize credit, and when you subsidize credit you end up getting a lot of these takers that take the debt and worry about repaying them later.

When Obama left office, they had one set of default figures, and subsequent to his departure another set were introduced and the figures were significantly higher. What is the real default rate? It’s likely that half of the loans are highly delinquent over 60 days or defaulted.

Looking at bubbles, in 1988 Kevin Duffy wrote a piece with the Wall Street Journal about how Japan isn’t going to take over the world for a number of reasons, one of which being that their economy is a bubble. They had owned a lot of US real estate etc., and what was interesting about their bubble and real estate is that real estate prices became wildly inflated and they were issuing 100 year mortgages. If the person borrowing money died, his wife could inherit the mortgage and when she died the children would inherit. That’s how you underwrite a bubble: you create these lunatic fringe-type policies underwritten by policy makers. We’ve seen this go on for longer than most people would’ve thought; altering the mortgages, altering the terms, the taxpayers were subsidizing the programs, they’d recast the mortgage with lower interest rates and try to paper over this. But the real economy is hollowed out. By essentially destroying the foundation of a true vibrant economy with low or no regulation, little or no taxes, and incentive for capital to be formed and reinvested, you wouldn’t see this.

The economy is fragile. We’re seeing sectors of the economy roll over, and asset prices following suit, but the broad market is levitating – these large platform-like companies have been levitating the market – and central banks are raising interest rates. Credit is starting to tighten in parts of the economy; usually when you have credit tightening and there are bubbles that it’s set upon, that’s usually a recipe for disaster. But we don’t know. We could see a scenario where the economy rapidly slows in the second half of the year, and the Fed could start cutting interest rates. Who’s to say the central banks don’t collectively go to negative 100 or 200 basis points to try and put a floor under housing? When you let your mind get creative in a fiat system, there’s no limit to what they could do. It’s a confidence game and as more and more people start fleeing the system and buying gold or Bitcoin or a farm, you could end up having a major currency crisis in a developed world.

The governments have come in and created various fiscal interventions to try and provide credit to different groups, and when banks and governments provide credit people either take it or don’t. In this case they took it, especially in the west, and we got to see nine year car loans, some of which were sold off to Wall Street and securitized while others were held by respective automobile dealers. Or a secondary market was formed. When you have a pool of savings, the central banks have pushed people into the deep end of the pool and people started doing things with safe money that they would not typically do. When enough people do it, and you’ve got a bit of momentum from this massive credit echo boom, part of this whole boom in subprime and non-subprime lending has been underwritten by historically safe money.

What’s happening is that someone will originate a loan that is non-securitized, and the default rates start going up. It’s a bizarre world of credit finding its way into a part of the market that would typically charge a high rate of interest and it wouldn’t attract as much capital as it has. Again, another distortion from central bank folly.

The lease bubble is primarily underwritten by the automobile companies themselves. The ability for these companies to, post ’09, go to the bond market to become credit providers of these “leases”, and then the terms in the lease market became loose. So it flows through on the purchase side or the lease side, and you get more of these cars leased.

Almost 4M vehicles are coming off lease in ’17 and ’18. There’s been enough leases coming off in ’16 where prices have rolled over, and at the end of this year and start of next year you’ll get a significant repricing of cars.

With regards to lending in the non-securitized, non-banking market, peer-to-peer lending has been massive over the last these years. Then you have these wealth advisers that offer credit lines against your stock and bond portfolio. Robo-advisors and these security lenders that are non-brokered dealers, non-bank lenders, have been lending money against securities. When you look at the peer-to-peer lending world, and then at some of the anecdotal pieces on other non-bank, non-securitization lenders against asset securities, you can see a number easily close to 300-400B based on all the new credit created in the last five years. Add that to the margin debt figures and then you’re talking about margin debt approaching $1T.

On the banking side, the bail-in model is going to be implemented throughout the developed world. The Fed is going to allow more failures this round and likely won’t step in for a non-bank lender. For housing, the government will do everything imaginable to prop up housing, but that’s not going to stop it from going down. They will come up with all types of creative ways to keep people in their homes. They’re not going to sit idle and watch housing go down 60-70%, but they’re not going to interfere with car loans and student loans and credit cards.

Housing prices in Canada will go down a lot. The government will lower rates and figure out ways to provide credit to people, but that’s not going to stop housing prices from going down to something closer to the norm in terms of wages. Over the last 6-7 years, we’ve essentially underwritten a casino-like economy. It’s amazing how many people are in this casino, gambling.

FinTech is one of the most fascinating things we’ve seen in the last 25 years. There’s a lot of crypto-currency being created that are suspect, but some of it is real. It’s a borderless way of transacting value through the rail system known as the public bloc chain. What’s happening is that you have really smart entrepreneurs that are throwing technology and decentralization to create alternative ways of holding and sending value. It’s an industry run by centralized parties that take somewhere between $3-4T out of the global economy through foreign exchange fees, credit card fees, ATM fees, etc. By creating these alternative forms of exchanging value that are decentralized and innovative and creative, you create an ecosystem where more and more people are exchanging products and services without traditional friction points from all these authorities. You have these fiat currencies and people are losing confidence in them, and a parallel ecosystem competing with a fiat system that’s flawed and centralized.

It’s very volatile, but there are very interesting entrepreneurs throwing a lot of human and financial capital at it. What’s happening with smart contracts and peer-to-peer value exchange is interesting. A lot of these companies are private; there’s a company in Russia that’s toying with the idea of accepting Bitcoin and making it available to buy and sell. You’re probably a year or two away from these companies going public. There’s a lot that needs to get sorted out in terms of security, scalability issues, and trying to take something technical and very complex and filtering it down to something that’s convenient and user-friendly for people. People are moving to these platforms and the regulators are lightly regulating them, so you’ll see evolution happen.

The takeaway is that we now have true competition to fiat currency.

Abstract by: Annie Zhou <a2zhou@ryerson.ca>

LINK HERE to get the MP3 Podcast

06/08/2017 - WindRock Wealth- Investment Themes Your Wealth Manager Isn’t Telling You About: Cannabis

06/08/2017 - WindRock Wealth- Investment Themes Your Wealth Manager Isn’t Telling You About: Cannabis

Investment Themes Your Wealth Manager Isn’t Telling You About: Cannabis

Christopher P. Casey, CFA®

When investing, timing is as important as the choice of investment or asset class. In fact, time is a defining characteristic of an investment: observe the airline industry pre- and post-9/11, today’s lackluster performance of IBM versus its dominant position early in the computer era, or Kodak before and after the advent of digital photography.

Today, the cannabis industry is at a defining moment, for while the risks associated with early stage companies and industries have diminished, revenues and profits are poised for tremendous growth; perhaps solely analogous to the alcohol industry following Prohibition’s end in 1933.

Cannabis is a legitimate and potentially incredibly rewarding investment. The time has come for consideration of the cannabis industry within an investment portfolio.

The Cannabis Industry’s Current Size and Projected Growth

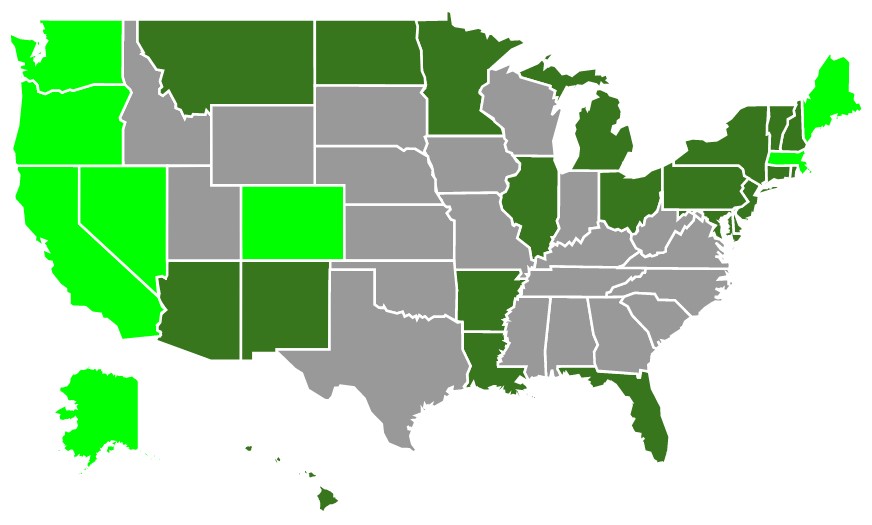

Today, 29 states, as well as the District of Columbia, have legalized medicinal marijuana (with eight states and Washington DC allowing recreational use) while many others permit CBD (cannabidiol) medical use.[1] Approximately two-thirds of Americans (and all of Canada) now live in areas that have some form of legalized marijuana usage.

This represents staggering growth since California first allowed medical marijuana in 1996. This growth should continue for several reasons:

Whether through increased state-level acceptance or federal action, the cannabis industry should continue to expand. With 2016 legal retail cannabis sales of $6.7 billion (up from $3.4 billion in 2015), industry resources and analysts still project significant future growth, including a sales projection of $35 billion by 2020 as issued by Bank of America.[4] [5] With the American tobacco, alcohol, and specific pharmaceutical markets such as pain management far exceeding $35 billion, the cannabis industry would still have significant room to grow.

Risks Within the Cannabis Industry

Two risks are commonly cited by reluctant investors. First, cannabis companies have experienced difficulty in securing adequate access to the banking system which can potentially impair growth and accounting transparency. This risk factor, while real, has greatly diminished over the years. In February 2014, the Department of Treasury issued guidance for banks to handle cannabis-related business.[6] Currently, over 300 financial institutions (e.g., state-chartered banks and credit unions) work with cannabis firms. This marks significant growth from even early 2015 (when there were less than 200). Accordingly, while the entire banking system is not open to cannabis companies, this situation has been transformed from an obstacle to a nuisance.

Second, and of greater importance, many potential investors are concerned about the conflict with federal marijuana laws and fears of a future crackdown. Currently, marijuana is still classified by the Federal Government as a Schedule I drug (the category which requires high abuse potential with no medicinal benefits). Hopes for reclassification were quickly dashed by the appointment of Jeff Sessions as Attorney General who described marijuana as “slightly less awful” than heroin. In rather contorted but still negative language, Mr. Sessions further inflamed fears by stating he “won’t commit to never enforcing federal law.”[7]

However, a number of factors suggest the Attorney General’s personal views will neither translate into federal action nor a change to current policy. First, President Trump does not share Mr. Sessions views and is on record as stating he is in favor of medical marijuana “a hundred percent” and that “in some ways [legalization] is good.” Second, in April 2017, Congress re-authorized the Rohrabacher-Farr Amendment which prohibits the Justice Department from using federal funds to prosecute medical marijuana as legalized by states. Combine these factors with the sheer length of time medical (1996) and recreational (2014) marijuana has legally existed, as well as the administration’s continued adherence to the January 2013 “Cole Memo” (which outlined the circumstances federal prohibition would be enforced), and it is unlikely the Federal Government will interfere with state legalization.[8]

Why Now is a Defining Moment for Investing in the Cannabis Industry

Since California’s legalization of medical marijuana in 1996 and Colorado’s authorization of recreational use in 2014, the trend to legalize both has accelerated. In the last election, four states voted to legalize recreational use which doubled the number of recreational states. This election saw marijuana legalization (whether medical or recreational) pass in eight of the nine states holding referendums. Subsequent to the November elections, the Vermont state legislature voted on legalizing recreational usage. As all prior legalization acts have resulted from referendums, and not legislative action, this development is profoundly significant and demonstrates that even legislators feel protected enough to openly advance legalization. Legalization should continue.

Given these legalization trends, growing social acceptance, continued substantial fiscal constraints with governments, and now the widely accepted medical applications of marijuana, the Federal Government may eventually legalize marijuana (or at least recategorize it). When this occurs, American businesses currently prohibited from or reluctant to participate in the marijuana industry will enter the market in force. Companies in the alcohol, tobacco, and pharmaceutical industries are widely expected to rapidly acquire existing cannabis companies and seek to scale up operations (since state borders will no longer matter for sales and distribution).

When this day arrives, the cannabis industry’s landscape will instantly change. Cannabis companies will quickly be divided between winners are losers as the former are acquired and the latter must now compete with large-scale, potent competitors.

In addition, while private equity firms exist to pool investor money and seek cannabis investments, most major financial firms refuse to participate or engage within this industry. As such, the cannabis industry lacks capital for investments and expansion. This lack of capital has helped diminish valuations. Given the cannabis industry’s growth potential and the likelihood of federal legalization, cannabis investments today provide investors with a rare opportunity.

Ways to Invest in the Cannabis Industry

While no pure-play U.S.-based cannabis companies trade (with the exception of a real estate firm), there are a number of Canadian-listed publicly traded companies. These stocks have experienced explosive recent growth with the North American Marijuana Index up over 80% over the last 52 weeks.[9]

However, many publicly traded cannabis companies are penny stocks and not widely followed by security analysts. Accordingly, they entail heightened risk with even the potential for fraud or, at the very least, questionable practices. MedBox provides an illustrative example. After its stock price increased by almost 50 times within several months ending in January 2013, it was charged by the SEC for misrepresenting revenues through related-party transactions.[10]

The general lack of publicly traded companies relative to the overall number of cannabis-related businesses, combined with the elevated valuations embedded within the existing publicly traded companies, compels interested investors to at least consider private investments.

Investment Criteria Considerations

If investors consider private investments, what investment criteria should guide them in making investment decisions? In large part, the criteria are the same as for any industry. The following details various attributes which may guide investment decisions.

Unique Product and Branding

Anyone visiting a well-stocked marijuana dispensary will be shocked by the breadth of products as well as the variation of particular products (e.g., types of edibles, different buds or “flower”, vaporizer pens, etc.). Today, many cannabis companies are profitable regardless of their branding. But eventually, branding will determine long-term viability from mere current profitability. Additionally, branding must be realized as important by the eventual consumer. Many cultivations centers currently “brand” their particular strain of marijuana, but how many will translate this into consumer loyalty and increased profitability?

Scalable Across State Lines and National Boundaries

Due to current federal law prohibition, marijuana cannot cross state lines which limit the potential growth of many cannabis companies. Accordingly, cultivation companies are precluded from entering markets apart from the state where they grow marijuana. Retail stores will likewise fail to realize significant cost savings and encounter distribution issues when owning multiples stores across state lines. Scalability requires cannabis companies to either sell a cannabis-related product which does not contain marijuana (e.g., vaporizers), or easily enter and distribute product through joint ventures with other cannabis companies (which raises issues related to selecting an appropriate partner, etc.). Firms which successfully scale across state lines should not only realize increased profitability and revenue growth, but will also be more attractive targets when large-scale mergers and acquisitions develop.

Barriers to Entry

Intellectual property protection in the cannabis industry is largely nascent. Likewise, while some states facilitate barriers by limiting the number of issued licenses, this barrier to entry may eventually prove ineffective with legislative changes or federal legalization. Companies building brands and unique products with proprietary know-how and a prime mover advantage may possess the most effective barriers to entry within the industry.

Reasonable Valuation

Given the extraordinary sales growth and profitability, both experienced and expected within the cannabis industry, most start-up or established cannabis-related firms have unreasonable valuation expectations which do not correspond with financial reality. Investors should be wary of valuations which cannot be legitimately justified by management teams. The era of the dot.com bubble is perfectly analogous, for while many great businesses were created, they did not translate into great investments if the purchase price exceeded reasonableness.

Ability to Serve Both the Medical and Recreational Markets

There is no bright line which distinguishes a medical user from that of a recreational consumer. Consumers may utilize marijuana for different purposes at different times or they may use marijuana for both its medicinal and recreational effects at the same time. Accordingly, if a company can survive solely with medical usage but also prosper with a recreational market, an upside is captured as states continue to legalizing recreational markets.

Strong and Experienced Management Team

Given the age of the legal cannabis industry, few companies possess management teams with experience and depth. Simply being experienced in growing marijuana will rarely translate into an effective management team, especially as the industry matures and develops. Investors should also seek management which is effective in the particular areas critical to the company’s growth (e.g., marketing, scientific or technical know-how, etc.).

Conclusion

Higher returns typically possess increased risk. The cannabis industry is no different and demonstrates all of the issues typical of a growing and relatively new industry. Combined with the unique legal landscape surrounding the industry, risks are certainly abundant. However, investors can navigate these risks and maximize returns when strictly scrutinizing key investment criteria. If timing defines investments, investors cannot afford to wait any longer in considering the cannabis industry.

WindRock Wealth Management is an independent investment management firm founded on the belief that investment success in today’s increasingly uncertain world requires a focus on the macroeconomic “big picture” combined with an entrepreneurial mindset to seize on unique investment opportunities. We serve as the trusted voice to a select group of high net worth individuals, family offices, foundations and retirement plans.

In 2016, WindRock formed Singularity Capital Management, a private equity pioneer focusing on the growing opportunities for accredited investors in the cannabis industry.

06/07/2017 - Dr. Lacy Hunt: How Federal Reserve Monetary Policy Has Destabilized The Economy

06/07/2017 - Dr. Lacy Hunt: How Federal Reserve Monetary Policy Has Destabilized The Economy

Dr. Lacy Hunt’s explains how Quantitative Easing has undermined economic growth and affected financial stability while increasing downside risk in asset markets.

06/05/2017 - “Everything Bubble Chart” From Incrementum’s New Report

06/05/2017 - “Everything Bubble Chart” From Incrementum’s New Report

06/05/2017 - Gordon T Long: Global Central Banks Won’t Ever Decrease Balance Sheets?

06/05/2017 - Gordon T Long: Global Central Banks Won’t Ever Decrease Balance Sheets?

Jason Burack of Wall St for Main St interviews Gordon T Long .. discussion on if Janet Yellen and the Federal Reserve can continue to raise interest rates? .. Gordon says that the Fed could possibly do 2 more 25 basis point interest rate increases in the near future before something in the real economy or markets breaks, but that the Federal Reserve and other major global central banks cannot ever reduce their balance sheets without collapsing markets and the real economy .. Gordon highlights how the ECB now has a balance sheet over $4 trillion and so does Japan’s central bank, the Bank of Japan. Balance sheets for the PBOC and Bank of England are also massive .. Gordon thinks the Federal Reserve will have to start rapidly expanding its balance sheet in the near future rather than reducing their balance sheet .. Gordon also discusses shorting opportunities he is positioning his clients for.

06/05/2017 - Hot Off The Press – Incrementum’s In Gold We Trust Report

06/05/2017 - Hot Off The Press – Incrementum’s In Gold We Trust Report

Incrementum is out with their latest annual “In Gold we Trust” report. As always, they try to deliver a holistic analysis of gold and financial markets in general, of course from a very Austrian perspective ..

Key topics and takeaways of the report:

• High expectations of Trump’s growth policy dampened the gold price increase in 2016 – Still up 8.5% in 2016 and 10.2% since Jan. 2017

• The further development of the normalization of monetary policy in the US will be the litmus test for the US economy.

• Bitcoin: Digital gold or fool’s gold?

• White, Gray and Black Swans and their consequences for the gold price

• Exclusive Interview with Dr. Judy Shelton (Economic advisor to Donald Trump) about a possible remonetisation of gold

• 5 Reasons why the gold bull market will continue

06/04/2017 - Central Banks Now Own A Third Of The Entire $54 Trillion Global Bond Market

06/04/2017 - Central Banks Now Own A Third Of The Entire $54 Trillion Global Bond Market

“While the point is critical, what we would like to highlight in the chart below is the staggering amount of debt instruments owned by central banks: as of the latest data, central banks own just over a third of the global tradable bond universe of $54 trillion, or roughly $18 trillion. How this amount of debt on bank balance sheets is ever unwound, i.e. sold – even with central banks’ best intentions – without crashing the bond market, we don’t know.”

06/04/2017 - Peak Prosperity’s Adam Taggart On Financial Repression: The Currency End-Game Of Too Much Debt

06/04/2017 - Peak Prosperity’s Adam Taggart On Financial Repression: The Currency End-Game Of Too Much Debt

“The Federal Reserve .. has chosen to sacrifice the many — the savers and those dependent on a fixed income — to benefit an elite few. Rock-bottom interest rates are greatly helpful to the banks, as well as the financial assets that the bankers and their wealthy clients own .. And just to add to the outrage factor here, when your local TBTF bank stores its own money at the Fed, the Fed pays it a full 1% in interest — nearly 20 times what your bank is paying you. Your bank simply pockets the rest as pure risk-free profit .. The data clearly shows that this suppression of interest rates, combined with the central banking cartel’s Herculean efforts to flood the world with liquidity (to the tune of $1 trillion so far in 2017), accrues benefits in a grossly lopsided and unfair manner to those at the top of the wealth pyramid .. This is a situation societies have found themselves in before. In fact, it has happened so often throughout history that there’s actually a playbook (for the government) when you get to this stage. It’s called financial repression .. While financial repression extends the lifetime of an over-indebted economic system, it does not avoid the consequences of Too Much Debt. It merely serves to shift the worst of the inevitable losses from the government onto the public.

As von Mises’ guarantees:

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final or total catastrophe of the currency system involved.

~ Ludwig von Mises

Negative interest rates are a milestone down the slippery slope of the latter: currency destruction. The central banks are intentionally devaluing their currencies, but betting that they can do so at a controlled pace.

But as von Mises warns and as history has shown again and again, currency regimes burdened by too much debt eventually reach a critical failure point where a uncontrollable cascading collapse becomes inevitable.”

06/04/2017 - The Roundtable Insight: Jayant Bhandari On The Economic Effects Of Going Cashless

06/04/2017 - The Roundtable Insight: Jayant Bhandari On The Economic Effects Of Going Cashless

FRA: Hi, welcome to FRA’s roundtable insight today we have Jayant Bhandari. Jayant is a specialist in the natural resources sector, he travels the world looking for investment opportunities in this sector. He advises institutional investors about his findings and he worked for 6 years with U.S. Global Investors, a boutique natural resource investment firm, and also for one year with Casey Research. Welcome, Jayant.

Jayant Bhandari: Thanks very much for having me, Richard.

FRA: Great, so I thought we’d start with an update on the situation in India, as you know we’re trying to keep an eye on this as what’s happening there could affect other locations or could evolve in a similar way in terms of what’s happening to physical cash and the currency there. Any updates from your end?

Jayant Bhandari: Sure, though Richard, as I have talked with you in the past, on the 8th of November 2016 Indian Prime Minister demonetized 86% of monetary value of cash in circulation. The result was that the economy started to stagnate, this was my experience and this has been my experience in the last 6-7 months. The World Bank, the IMF, and the Indian government continued to claim that Indian economy was actually starting to do better. Now, yesterday they came out with new numbers and they now accept that the economy is starting to show signs of the stagnation. Instead of the economy growing at 7.5% according to them, it is now growing at only 6.1%, again according to them. In my view, the growth is negative not even positive. I see, as I have repeatedly said on your show, India is actually becoming a police state. And this police state is going to be a horribly chaotic place because Indians are very chaotic people. Trying to propose a totalitarian system on this country will lead to a disaster in India.

FRA: And you see the Totalitarian approach as being indicative from the developments on physical cash, is that directly related to that? And in turn is that what is causing the slowdown in the economy?

Jayant Bhandari: Well, that is one part of the story in a country where 95% of consumer transactions are cash based transactions. You cannot really impose internet and banking on these people, this led to a massive slowdown in the economy. Now Richard, one funny example I want to tell you about and that will give you a glimpse of what is actually happening; I bought a New Delhi to London plane ticket two months back, I paid for it using my debit card, not my credit card because I refuse to have a credit card in India. The money left my bank account, I got no ticket. And no one knows where my money is today two months after the event.

FRA: Wow.

Jayant Bhandari: Now in a society like this, you can’t really impose digitalization and banking because Indians are not capable of, and it’s totally not structured for high-tech movement of cash, they have to have physical cash to do transactions, physical cash invariably will come back into existence. But in the meantime, Indian government will have destroyed the economy, lives of hundreds of millions of people, old people are going hungry in my opinion because food prices continue to be half as much priced as they should be.

FRA: So what are the trends at this point or recently in the areas of the inflation-deflation situation in terms of inflation on food prices or consumer prices in general? And also the trend in the currency strength or value as well, like what is it relative say to the U.S. dollar, any trend you are seeing there?

Jayant Bhandari: Sure, so what has been happening with inflation is that this has because of demonetization it has created a deflationary environment. People are simply not buying anything. Now, deflation is a good thing as long as it happens because of excess supply. The reality with India is that deflation is happening because of significant reduction in demand. People are simply not buying anything that they don’t need right now. But that also includes food now, so this deflation is a horrible deflation which is destroying businesses and the economy. And I keep meeting the small businesses who tell me that they are shutting down, not just because of the cash crunch, which is a major part of course, but regulations have increased, the rapaciousness the corruption of the bureaucrats has increased very significantly. Now the other side of this story is the Indian stock market is booming and Indian currency has gained a lot of value in the few months. Now firstly talking about the stock market, the stock market is not necessarily correlated with the growth of the economy which a lot of people erroneously believe. Now the thing with the stock market is that people’s cash is stuck with the bank, so they have really no option but to buy stock. At the same time there is an increased bullishness about India in the Western countries which is completely wrong, these people will eventually lose a lot of their money but because they have continued to send more money into India, Indian currency has improved and the Indian stock market has improved but as I said, Indian economy is stagnating and in my view, passing through a negative growth rate right now.

FRA: And what about inflation? Do you see consumer price inflation happening? Any trends there?

Jayant Bhandari: Well it will eventually happen because once they have destroyed the economy, once businesses are shut down, the supply won’t be there anymore. So inflation has to happen, and also the cost structure of creating everything has gone up because of the rapaciousness of the government, the bureaucracy and the regulation and the enforcement of digitalized cash on people. Which people are incompetent to use if at all the system works which has increased to cost of doing business, eventually it will lead to huge inflation in my view, but for the moment its deflation but this is only in the transitionary time, and that is mostly because the mint has been destroyed, it’s a horrible sign for the future of the economy in my view.

FRA I see, and what about elsewhere in Asia? Any trends there in terms of an economic slowdown or inflation-deflation, other parts of Asia?

Jayant Bhandari: I see the same thing in the rest of the Asian countries; Sri Lanka, Thailand, Myanmar Pakistan, Bangladesh, Nepal, they are all starting to stagnate, the East is blowing up. So I think that the economic future of these countries is not good at all, the only place where I see optimism and actual growth happening that’s in China, Korea, Singapore, and Hong Kong.

FRA: In what areas is that growth happening?

Jayant Bhandari: In China I see growth happening everywhere, in the infrastructure the investment continues to exist. I think the cities the manufacturing continues to grow, consumption of commodities continue to grow in China. Now the reality is that the perception among resource investors is that China is slowing down and Chinese demand for these commodities is falling, which is actually not true. What is happening is Chinese consumption of commodities continues to grow, the problem is that we have increased supply more than the demand has increased in commodities, hence the destruction of pricing of commodities. But the Chinese continue to buy a lot of commodities, and maybe they have reduced the chasing of iron ore, but that’s only because recycled steel is now coming back to the market which means that iron ore needs might have fallen off a bit, but that is not a result of a fall in economic growth, it’s just a result of increased recycling.

FRA: From that perspective, what opportunities are you seeing in the natural resources sector, are there opportunities in Asia or elsewhere in the world?

Jayant Bhandari: Again, China is still heading growth around the world in my view. And in both cases, in the case of precious metals and in terms of commodities. Commodities because they continue to grow, China is putting into place this one road, one belt road. Which is the Chinese attempt to link countries in Asia and Africa economically which I think will be a great thing for these countries because China is the only country in my view which has the capability for leadership among the third world. So commodity consumption I think will continue, I just hope natural resource investors do not pump up the supply more than the demand goes up. At the same time, in my view precious metals consumption will continue to grow in China, not actually because of volatility partially because of increased political risk, but mostly because the Chinese need to diversify. These people are diversifying their world for the very first time really. I mean, China was a completely closed economy 30 years back, it’s only in the last 10-15 years the Chinese are internationalizing themselves. It’s not necessarily a bad sign in my view, neither is it a sign of their increased fear about China, but they are merely diversifying. If you and I become rich, we want to diversify.

FRA: And will this leadership by China still be maintained given their current challenges with lots of government and corporate based debt? You know the shadow banking system, the non-banking sector has a lot of non-performing loans, and then overall there’s a problem with the wealth management products in terms of a potential bubble there from sort of a Ponzi nature of WMP products. Any thoughts there? Like will China still be able to maintain their development on the Silk Road?

Jayant Bhandari: I think that China will continue to grow. And the reason is that the rest of the emerging markets are in much much worse shape. Look at what’s happening in Venezuela, Brazil, which actually comprises almost half of South America, more than half of South America probably. Yes, there are problems with China. There’s a shadow banking system, there’s a problem with corruption in China, there’s a problem with overcentralized politics of China. But really, China has continued to grow for the last 30 years and this must mean that overheating must have happened in parts of the economy and parts of the society and politics. Corrections will happen, but again it’s a centrally managed system. I don’t think they will have a major crisis anytime soon. They will be able to deal with some of these smaller issues, they do have to deal with too much credit given to state government-run companies, and all those kind of things. But I think China has the capabilities and the resources to deal with the short-term crisis. In the long term, certainly, but who has seen the long term? In the long term maybe there will be more problems.

FRA: And in terms of investment opportunities, which countries in Asia, Southeast Asia, East Asia do you see as offering opportunities in different areas?

Jayant Bhandari: I love China. I love China I invest in China, I invest in China via Hong Kong. Hong Kong is a great place, Singapore in my view continues to be a great place. Singapore and Hong Kong continue to be places where the wealth goes to for protection. I also like Australia and New Zealand, I think both these countries despite that they are very socialistic in their orientation, have done a lot of good work in their countries and their societies are relatively stable societies far from the problems of the world, problems of the western world, problems of Europe and huge problems of the emerging markets in my view.

FRA: And are the opportunities in areas of industrial commodities or agricultural commodities or other sectors of the economy?

Jayant Bhandari: In Australia and New Zealand, yes. Australia continues to grow big at providing a huge amount of commodities. Iron ore, coal, gold and the rest actually to China and the rest of the world. And these commodities have been extremely helpful to Australia in terms of the growth in their economy. They have also been able to attract a lot of wealthy, good investors and migrants into Australia where it might not have been the case with Europe. So yes, I think natural resources continue to be a big part of Australian economy today.

FRA: Moving to North America, we were talking just before our discussion began today on what’s happening politically and the ramifications of that on the economy. Can you bring us up to speed? What’s recently happened politically in British Columbia, Canada?

Jayant Bhandari: Sure, Richard. I’m currently in Vancouver and it’s very sad to see that as much as 17% of the votes in the recent provincial elections went to the green party. Now the vote green probably made the party very attractive to a lot of people, 17% which is a massive increase from less than 1% that they used to get in the past. And it is twice as many votes than what they got in the last elections. So there’s a huge shift towards the left in British Columbia from what I see. Now, the results will be that the next government will very likely be a leftist government, a combination of the Green party and NDP which is left to the center party. Now, these people have already promised in their election manifesto that they would want to kill Kingdom Morgan gas pipeline which is going to be a pipeline from British Columbia to Alberta. Now, this is supposed to be a $7.5 billion pipeline and they want to destroy construction of this pipeline despite that most of the permits have already been issued. They also want to destroy a hydroelectric project in British Columbia, they want to increase minimum wages to $15.00 per hour in British Columbia, and they want to impose massive taxes on foreign buys of properties in British Columbia. So far there’s a 15% tax on foreign buyers just in Vancouver, now they want to make it 30% and they want to impose it across the province. These are not good news in my view for the future of British Columbia.

FRA: Wow, 30%. In Ontario, the percentage has gone to 15 like they have there now. Is this having any effect on the Canadian housing market? Is there any indications it’s slowing down or prices are falling?

Jayant Bhandari: Well from what I have seen in the media, no the prices aren’t necessarily falling, they did stagnate for a while when they imposed the taxes, but from what I see, the prices continue to go up. So no, it hasn’t really made any real impact onto the housing market.

FRA: And coming back to our point on the movement to the left in British Columbia, do you see this as a trend overall in North America, a sort of backlash if you will against the recent elections in the U.S. with U.S. President Donald Trump, we are apolitical, we don’t take sides but just what are your thoughts on that? Do you see as we mentioned on other shows a potential for a movement to the far left in the sense of socialism perhaps led by the millennial generation?

Jayant Bhandari: I think that’s actually happening Richard. And it seems to me from whatever number I see that most of the leftist votes tend to come from relatively educated urban people. Richard such an irony because educated people should know better that socialism does not work and it is the free market that has given us all these nice things that we enjoy in our lives. But I guess urban environment and schooling system has a dyadic effect on people’s minds, it makes them simplistic in their thinking, they start to forget about second order consequences. And the problem is, when I wake up in Vancouver and when I switch on my light, they always switch on. And so life becomes so predictable in rich technologically advanced countries, particularly in urban centers, but people tend to become simplistic because they don’t really have to deal with chaos on a day to day basis. I don’t know how you can change that, but simplistic thinking also leads to leftists, because the promises of leftists are simplistic promises, and they look attractive to simplistic people.

FRA: And what would be the effects of this on the economy, economic development, and the financial markets in North America?

Jayant Bhandari: Well I am, Richard, optimistic about Trump, I think he’s trying to change a few things. I am increasingly pessimistic about Canada. We have to remember Canadian currency has fallen about 30%-35% or even more in the last four or five years. This has seriously hurt the Canadian economy I guess, now that of course has made Canada more attractive to foreigners, foreign tourists, foreign investments, and foreigners who want to buy housing in Canada. But despite just the short term gain for Canada economically, it might come at a huge cost in the future. Given that now we have leftist governments in many provinces, many important provinces like Alberta, British Columbia, and of course in the federal government with Justin Trudeau, who in my view has no understanding of economics or pretty much anything actually.

FRA: And what about just overall like in the U.S. North America? Do you see this as a trend and a negative effect on the economy, slowing it down?

Jayant Bhandari: I think so, yes. I think people in the western world are becoming increasingly leftist, and we also have to accept that most of the migrants who have come to the Western society tend to predominately vote for the left, the left in any governments, and they want to covert the Western governments into many governments. And that means that our politics is increasingly becoming leftist and you go to the government offices, government offices are over-represented, have a higher proportion of migrants working in government offices then the proportion of migrants in the society. So I think there’s a clear trend in the society in all of the west to become increasingly leftist, and this will have a harmful effect on our society going forward.

FRA: And how would the emerging pension prices, government in particular government pensions, especially in the U.S. initially before Canada, although it’s likely to affect Canada as well. Is this all going to be exacerbated by that in terms of these trends happening and an overall slowdown? There’s been some recent reports like the wealthy are now leaving Connecticut due to the pension crisis already, so do you see that happening?

Jayant Bhandari: Well from what I read it does not look like as if people are really going to have access to their pensions 10-15 years from now, and maybe much sooner than that. So, people who are hoping to benefit from their pensions in the future, it’s probably not going to happen. Particularly when unemployment is increasing hugely in the west, peoples need for welfare from the government is increasing. So government really does not have the resources to continue to give money to people when the tax revenues might actually start to fall at a certain point in time given mostly stagnant economies in the western society.

FRA: Great insight, wow that’s great as always Jayant, how can our listeners learn more about your work?

Jayant Bhandari: Richard, I have a website, www.jayantbhandari.com/ and everything I do is on that website.

FRA: Great, thank you very much once again, thank you Jayant.

Jayant Bhandari: Thanks very much for the opportunity Richard.

FRA: Yup, we’ll do it again, thank you, take care.

LINK HERE to download the MP3 Podcast

06/01/2017 - Danielle DiMartino Booth: The Demographic Divide: A Police State Of Mind

06/01/2017 - Danielle DiMartino Booth: The Demographic Divide: A Police State Of Mind

“It comes down to the demographic divide that’s opened up since President Ford was in office. In the 1970s, the typical public pension’s active employees outnumbered retirees by a factor of four-to-five times; today that ratio is 1.5-to-1 and continues to fall as Boomers retire in droves and Millennials fail to fill the yawning gap.

After a grisly year that ended with a tally of 4,000 homicides, Chicago has begun to coordinate with federal authorities to control a crime wave driven by gangs’ unencumbered access to firearms. The last thing the city can withstand is further cuts to public service funding. By the same token, taxpayers have already begun to vote with their feet as rising taxes and foundering pensions promise to beget more tax hikes to come.

It’s plain that the last thing any of us want to see is a Police State of any kind. But the growing risk is that the next recession and deflating asset prices could well alter the rules of engagement between federal and state authorities on more levels than any of us care to envision.”