Media

10/26/2022 - Economist Nouriel Roubini on the Economy and the USD

10/26/2022 - Economist Nouriel Roubini on the Economy and the USD

08/28/2022 - Dr. Albert Friedberg Quarterly Report

08/28/2022 - Dr. Albert Friedberg Quarterly Report

“Until the Fed shows some understanding of the issues here discussed and until they move to implement policies that will remove inflationary pressures and incentives to misallocate resources, we see no need to abandon our investment stance. It can be summed up as bullish on inflation and not bullish on growth.”

08/17/2022 - Yra Harris – Neutral

08/17/2022 - Yra Harris – Neutral

“he EQUITY markets have recovered more than 50% of their first-half losses stoking the call from WALL STREET that it is all clear WEENA. BUT I CAUTION: This is not an INVESTING MARKET BUT TRADING MARKET as we await to hear from Chair Jerome Powell on the FED‘s future path, especially as the central bank’s balance sheet reduction ramps up to its maximum levels next month. NOBODY can be certain of the impact of removing liquidity from what has been an over-leveraged market living on the liquidity drug provided by QE.”

08/03/2022 - Charles Hugh Smith – A Rising USD and Geopolitical Risks/Aims

08/03/2022 - Charles Hugh Smith – A Rising USD and Geopolitical Risks/Aims

08/02/2022 - Yra Harris – We’re Back?

08/02/2022 - Yra Harris – We’re Back?

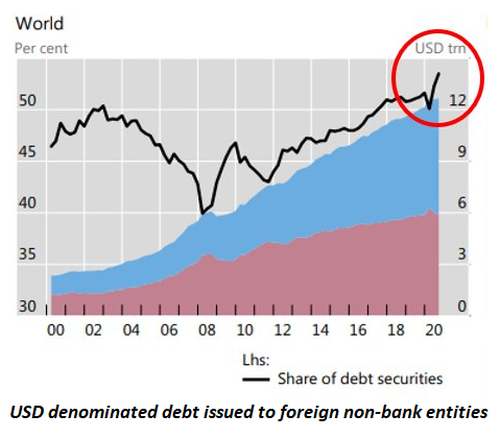

“The strong dollar is not a blessing in these tumultuous financial conditions as it places a great deal of stress on the world’s emerging markets, which are BORROWED in US DOLLARS due to the FOMC’s flooding the global system with very low interest possible loans. Cheap dollar loans become expensive when interest rates rise and the cost of DOLLARS rise along with it. A classic case of this was in January 2015, when Eastern European countries borrowed in Swiss francs because of low Swiss interest rates coupled with a guaranteed level of euro/Swiss franc at 1.20, A NO BRAINER.

But when the Swiss National Bank could no longer hold the PEG the market panicked and the SWISS FRANC rallied in dramatic fashion, leaving borrowers stuck having to repay with expensive Swiss francs. This is the current situation confronting the massive amount of loans held by private and public emerging borrowers with prior cheap dollar loans. This is just the beginning of this important discussion. ”

07/28/2022 - Alejandro Tagliavini – Inflación global: ¿cerrar los bancos centrales?

07/28/2022 - Alejandro Tagliavini – Inflación global: ¿cerrar los bancos centrales?

“No sé si Milei tiene razón en cuanto a la oportunidad y el método, pero definitivamente los bancos centrales son como un cáncer al que debería ponérseles fin.”

07/25/2022 - Larry McDonald – If the Fed Marches on, They’re Creating Another Lehman Situation

07/25/2022 - Larry McDonald – If the Fed Marches on, They’re Creating Another Lehman Situation

“Financial instability is going to force the Fed out of its proposed policy path. There is so much risk showing up in things like credit default swaps on European banks or emerging market bonds. Our 21 Lehman systemic risk indicators globally are the highest since the financial crisis, a lot of these risk metrics blew through Covid levels which is really bad. That means the Fed is not going to be able to complete the job on inflation which gets you to inflation sticking around at something like 3 to 6%.”

07/21/2022 - E.B. Tucker: U.S. Dollar rise will roil markets within 90 days

07/21/2022 - E.B. Tucker: U.S. Dollar rise will roil markets within 90 days

07/21/2022 - Edward Chancellor: Largely Impossible to Normalize Interest Rates Without Collapsing the Economy

07/21/2022 - Edward Chancellor: Largely Impossible to Normalize Interest Rates Without Collapsing the Economy

Historian and author Edward Chancellor in an in-depth interview about the failed monetary policy of central banks and the difficult path to a healthier and more robust economic and financial system.

07/19/2022 - Kevin Duffy – “Shakeout in Financial Markets has only just begun”

07/19/2022 - Kevin Duffy – “Shakeout in Financial Markets has only just begun”

“I think you want to look for companies that will be able to navigate this new world. They provide vital goods and services. They are self-funding and don’t rely on government subsidies. They are run by founders or owner-operators who take a long view. They try to remain apolitical. To me, the biggest risks lie in companies that suck up to the government and end up doing destructive things to shareholders. Nike for instance is trying to push certain official narratives that are going to alienate their customers in China. Yum Brands is unloading its chain of 1,000 KFC restaurants in Russia that took two decades to build. Those types of stocks are more likely to show up in the S&P 500 where everybody is positioned. If I’m right, the kinds of independent businesses I’m looking for will be seen as ports in the storm and trade at a premium.”

07/14/2022 - Larry McDonald on Federal Reserve Risks to Emerging Markets

07/14/2022 - Larry McDonald on Federal Reserve Risks to Emerging Markets

“If the Fed keeps its policy path promises, take the tragedy in Sri Lanka and multiply it by ten across the globe over the next six months. Check-mate FOMC.” – Larry McDonald

07/14/2022 - Russia Pivots To Asia

07/14/2022 - Russia Pivots To Asia

- China is taking advantage of cheap Russian oil and coal.

- Shunned by the West, Russia is looking to Asia to offload coal and oil at steep discounts.

- China’s industrial power is being fueled by U.S. adversaries in Russia and Iran, Hudson Institute’s Duesterberg notes.

07/12/2022 - Dylan Grice on the Fed Pivot

07/12/2022 - Dylan Grice on the Fed Pivot

“The Fed is about to trigger a significantly harder landing than they intend. If they truly want to bring inflation down to 2%, a severe downturn would be inevitable. Another leg down in financial markets is to be expected.”

07/11/2022 - The Black Swan is Still Flying

07/11/2022 - The Black Swan is Still Flying

“On December 27, 2021 I wrote an op-ed saying the Black Swan is now flying. My recommendation at the time: Purchase long-term puts on Tesla, then trading around $1,200 and long-term puts on Bitcoin then trading near $50,000. Not much more than six months later, Tesla is around $750 and Bitcoin is struggling to stay near $20,000. Yet, in my opinion the worst is yet to come.

Why? Financial markets are beginning to recognize that the central bank emperors are naked. Central banks have kept the markets rising ever since money printing began on a global scale in 2009 in the US and in 2011 in Europe.”

Link Here to TheMarket.ch Article

06/27/2022 - Alejandro Tagliavini – “No more questions, Your Honor”

06/27/2022 - Alejandro Tagliavini – “No more questions, Your Honor”

“As I always had great admiration for nature -the true one, not the one that is imposed by force since violence is that which violates the natural order, as the Greek philosophers already knew- I was very suspicious of this supposed enemy of the human being. I always knew that nature is infinitely wise -more than human reason that doesn’t even know how far the universe reaches- and dedicated to the growth of life, particularly of man.”

06/13/2022 - John Collison in Conversation with Stanley Druckenmiller

06/13/2022 - John Collison in Conversation with Stanley Druckenmiller

06/03/2022 - Alejandro Tagliavini – Many will be left behind…

06/03/2022 - Alejandro Tagliavini – Many will be left behind…

“The “old world”, where politicians build borders -create «international» conflicts- and impose “laws” with their monopoly on violence (the State), is inevitably being left behind, simply because borders and violent impositions are unnatural. Of course, this will take years and it will not be a revolution, but – like everything in the real, natural world – a slow evolution, a maturation. But beware, beyond the fact that the digital world is still incipient and, therefore, with errors and deceptions, many are being left out because the technological development that drives this «new world» is accelerating by leaps and bounds to the point that an enormous most don’t even have enough time to catch up.”

05/26/2022 - Alejandro Tagliavini – Disrupted markets (BTC, so bad?)

05/26/2022 - Alejandro Tagliavini – Disrupted markets (BTC, so bad?)

“Obviously, and therefore the great fear of the establishment, the Defi replace traditional banks -which today operate in an oligopoly with central banks- favoring people who interact directly without having to go through the banks and pay their commissions, but that the commissions are distributed completely among the individuals who interact in the market.”

05/16/2022 - Daniel Lacalle – A Choice of Global Financial Meltdown or Prolonged Inflation

05/16/2022 - Daniel Lacalle – A Choice of Global Financial Meltdown or Prolonged Inflation

“One day someone may finally understand that supply shocks are addressed with supply-side policies, not with demand ones. Now it is too late. Powell will have to choose between the risk of a global financial meltdown or prolonged inflation.”

05/05/2022 - Dr. Albert Friedberg on Inflation, Gold & Investing in the Current Challenging Environment

05/05/2022 - Dr. Albert Friedberg on Inflation, Gold & Investing in the Current Challenging Environment

“A word about gold: The freezing of Russian currency reserves and the reserves of Russian oligarchs has given the coup de grâce to an international monetary system that started as a gold standard, morphed into a gold exchange standard (1922), and morphed further into a convenient dollar standard (1971). For international transactions, we may soon go back to a new gold standard or to a commodity standard of sorts. But no proud sovereign will again maintain its last-resort reserves in the currency of its potential rival or keep them in its banking system. The next step in this evolution will surely be taken by China, the holder of 3 trillion dollars’ worth of currency reserves. When it does, gold will no longer be trading at $2,000/oz., or $2,500/oz., or even $3,000/oz. It stands to reason that it will trade at a multiple of the latter.”

Download the publicly posted Quarterly Podcast