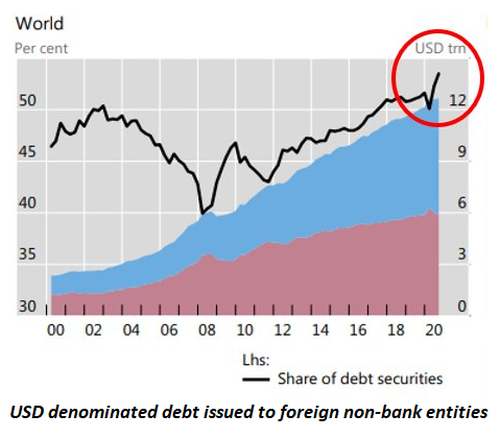

“The QE program fomented by Ben Bernanke in response to the 2008 financial crisis ran interference for the ECB, BOE, BOJ and others so as to prevent their currencies from rapidly appreciating against a DOLLAR. That is, massive amounts of liquidity were injected into the financial system to “forestall” deflation. The US and Europe experienced a deflation but the FED allowed for all to keep the monetary spigots wide open. The only country that experienced actual deflation was/is Japan. Now that global inflation is the result of massive liquidity infusions the question remains how to extract the liquidity without causing too much stress on a global system awash in QE-fueled debt.

The FED seems to be intent on raising rates ever HIGHER in an effort to break inflation, but maybe it’s time to halt the rate rises and increase the pace of the balance sheet runoff? This is the prevailing question as we head into 2023, but for us we will rely on the wisdom of Louis Gave : We adapt, not forecast.

Last week, Bank of Austria President and ECB Board member Robert Holzmann said in a Financial Times story he favored a 75 basis point increase at the next meeting in December. But Holzmann also warned that it is imperative that the ECB begin shrinking its BOND PORTFOLIO “before it had finished raising rates, adding that it is important to avoid short-term borrowing costs rising above long-term ones.” Holzmann wants to avoid an inverted yield curve because “it would be a challenge for Europe’s banking sector, which relies on being able to borrow cheaply in the short term to make longer-term loans at higher rates.” As Holzmann said, “We have to make sure it doesn’t get to that point.”’

Link Here to the Blog Post

Disclaimer: The views or opinions expressed in this blog post may or may not be representative of the views or opinions of the Financial Repression Authority.

03/21/2023 - Yra Harris – How Many `Whatever It Takes’ …

03/21/2023 - Yra Harris – How Many `Whatever It Takes’ …