Interviews

04/23/2020 - The Roundtable Insight – Daniel Lacalle and Yra Harris on the Implications of the Virus on the Economy and Markets

04/23/2020 - The Roundtable Insight – Daniel Lacalle and Yra Harris on the Implications of the Virus on the Economy and Markets

03/05/2020 - The Roundtable Insight: Yossi Kaplan and Charles Hugh Smith on the Virus and the New World Order

03/05/2020 - The Roundtable Insight: Yossi Kaplan and Charles Hugh Smith on the Virus and the New World Order

02/28/2020 - The Roundtable Insight: Dr. Lacy Hunt and Yra Harris on the Virus and Economy/Markets Implications

02/28/2020 - The Roundtable Insight: Dr. Lacy Hunt and Yra Harris on the Virus and Economy/Markets Implications

02/28/2020 - The Roundtable Insight: David Rosenberg, Yra Harris, Peter Boockvar & Jim Bianco on the Virus and Economy/Market Implications

02/28/2020 - The Roundtable Insight: David Rosenberg, Yra Harris, Peter Boockvar & Jim Bianco on the Virus and Economy/Market Implications

02/12/2020 - The Roundtable Insight: Charles Hugh Smith on the Emerging Repo Crisis

02/12/2020 - The Roundtable Insight: Charles Hugh Smith on the Emerging Repo Crisis

12/18/2019 - The Roundtable Insight: Chris Whalen, Yra Harris & Peter Boockvar on the Markets & Views into 2020

12/18/2019 - The Roundtable Insight: Chris Whalen, Yra Harris & Peter Boockvar on the Markets & Views into 2020

12/05/2019 - The Roundtable Insight: Daniel Lacalle and Alejandro Tagliavini on Austrian School Economics, Argentina and the Global Economy

12/05/2019 - The Roundtable Insight: Daniel Lacalle and Alejandro Tagliavini on Austrian School Economics, Argentina and the Global Economy

11/30/2019 - The Roundtable Insight: Nick Barisheff on Precious Metals Markets, Trends and Outlook

11/30/2019 - The Roundtable Insight: Nick Barisheff on Precious Metals Markets, Trends and Outlook

11/27/2019 - The Roundtable Insight: Charles Hugh Smith on why Eastern Europe may be the Go To Place

11/27/2019 - The Roundtable Insight: Charles Hugh Smith on why Eastern Europe may be the Go To Place

11/04/2019 - The Roundtable Insight – Dr. Marc Faber and Yra Harris on the Markets and Investing

11/04/2019 - The Roundtable Insight – Dr. Marc Faber and Yra Harris on the Markets and Investing

10/28/2019 - The Roundtable Insight: David Rosenberg & Yra Harris on Risks and Trends in the Markets & Economy

10/28/2019 - The Roundtable Insight: David Rosenberg & Yra Harris on Risks and Trends in the Markets & Economy

10/25/2019 - The Roundtable Insight: Charles Hugh Smith new book – Will You Be Richer Or Poorer?

10/25/2019 - The Roundtable Insight: Charles Hugh Smith new book – Will You Be Richer Or Poorer?

09/26/2019 - The Roundtable Insight – Charles Hugh Smith Part 2 Millennial Advice on Jobs and Affordable Housing

09/26/2019 - The Roundtable Insight – Charles Hugh Smith Part 2 Millennial Advice on Jobs and Affordable Housing

podcast to be posted shortly ..

09/22/2019 - The Roundtable Insight – Yra Harris & Peter Boockvar on Liquidity and Interest Rates

09/22/2019 - The Roundtable Insight – Yra Harris & Peter Boockvar on Liquidity and Interest Rates

08/28/2019 - The Roundtable Insight: Guy Haselmann & Yra Harris on Central Bank Policies & the Financial End Game

08/28/2019 - The Roundtable Insight: Guy Haselmann & Yra Harris on Central Bank Policies & the Financial End Game

08/22/2019 - The Roundtable Insight: Charles Hugh Smith on Advice for Millennials: Low Cost Education, Affordable Housing and Where the Jobs Are!

08/22/2019 - The Roundtable Insight: Charles Hugh Smith on Advice for Millennials: Low Cost Education, Affordable Housing and Where the Jobs Are!

Download the Podcast in MP3

Charles Hugh Smith on Advice for Millennials: Low Cost Education and Where the Jobs Are!

Richard: Hi, this is FRA’s Roundtable Insight .. Today we have Charles Hugh Smith: He’s the author and leading global finance blogger and philosopher. He’s the author of several books on our economy and society including “A Radically Beneficial World: Automation, Technology and Creating Jobs for All”, “Resistance, Revolution, Liberation: A Model for Positive Change” and “The Nearly Free University and the Emerging Economy.” Also, most recently a book called “Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic.” His blog OfTwoMinds.com is one of CNBC’s Top Alternative Finance Sites. Welcome Charles!

Charles: Hey, thank you Richard! Well I’m really excited about today’s topic.

Richard: Yeah, today I thought we’d have an interesting topic to talk about in terms of what is on the minds of the Millennial Generation and what are their challenges? More specifically in the areas of jobs, education, housing and in just dealing with debt and overall work-life balance. To begin that, there was a recent article today, in the Bloomberg, that actually focused on Hong Kong in terms of what’s happening there with the Millennial Generation and there is a story with a focus on an individual there working very long hours and the real estate situation is quite extreme but it’s essentially symptomatic of most of the world and so what we’d like to do today is to first identify what those challenges are but more specifically to suggest solutions and ideas that while they may not work for everybody, in some cases, they would post really good solutions to some. So, you know what we can do is maybe begin with some topics on education and then go into jobs and then affordable housing and a lot of our discussion can be based on Charles’s books… his writings on the nearly free University, where the jobs are, how technology is affecting the job scene. So just wondering your initial thoughts Charles?

Charles: Well, this is a great topic Richard and for the article on Hong Kong I think what was a key takeaway for me was that many of the protesters are Millennials and the issues are not just legal about extradition and so on, they’re about what the Millennial Generation there feels hopeless about, which is having a middle-class life and that you can be working at you know a job that’s appropriate for a college-educated person like an accountant and all you can afford is a little tiny cubby hole in an apartment that’s been chopped up into six rooms and you’re working six or seven days a week.

So, I think the way that we can describe this and it’s a global problem as you say is social mobility has decayed around the world meaning that if you’re just starting out and you don’t have any huge you know advantages from family connections or family wealth, the ladder of social mobility has become very rickety and meaning that you can work really hard, you can study hard and still come up short because the number of elite jobs, that pay enough to get what we consider a middle-class life like you’d be able to buy a house, those jobs are the competition is so fierce that the meritocracy system that prevails around the world it’s actually failing us because the wealthy simply give their children a boost and ahead of everyone else and it there was actually a new book coming out called “The Meritocracy Trap”, that describes this that elite universities used to accept 30% of their applicants now it’s a you know sub ten percent, eight or nine percent. So, it’s just really hard to establish a middle-class life and this is what the Hong Kong Millennials were expressing that they realized that their parents lifestyle and security is completely out of reach for them and that’s the core problem and I think that we’re trying to address and come up with solutions for.

Richard: Okay, so let’s start with education. So, everybody knows it’s very high and costly and there’s an issue of accreditation that you’ve written a lot about, maybe cartelized industry sector and just the high availability of very low interest rate loans has been fueling that. So, what are some solutions here in terms of trying to lower the cost of education, lower the debt that students can get into but still get a good enough education for good jobs and you know being able to thrive in today’s society.

Charles: Well, that’s a great topic Richard and I think one of the key changes that’s occurring in the economy, that’s beneficial to Millennials who were willing to step out of the conventions, is corporations are realizing that a college diploma is not really a good indicator of productivity on the job and I think one of the vice presidents in Google recently wrote a book about this that Google used to follow you know used to only hire college grads and wanted your, you know, grade point average and all this kind of academic stuff and then they studied it and realized that those were not good indicators of productivity and talent in the job and so they started hiring people with no college diplomas or indeed no college at all and they were hiring them for their skill sets.

So, I think that the core advice I would have is focus on building skills not acquiring credentials because credentials only go so far and they are depreciating in today’s world because employers realize they’re not really good indicators of how productive you’re going to be on the job. So, I would say build your social capital skills like your ability to work with people, management skills, project management skills and in specific you know specialized skills in database management and data mining and the kind of topics that you’re interested in that use digital technology. That’s the solution, don’t even worry about getting a college diploma unless you can afford to do so and of course, the way to do that is go to Community College for the first couple of years if you can and then use the remote learning as much as possible at institutions that offer that and offer huge discounts for that so that you can get a diploma more or less digitally.

Richard: Yes, I would agree with that. In some cases, like a doctor or a lawyer you might need a jurisdiction based you know accredited education with a specific degree so that might be required but, in many cases, not. So, as you mentioned you can study online, there’s lots of internet-based courses, there’s the concept of distance learning and also, the areas to study I would suggest as being engineering, software and business. Those three areas in particular because engineering really gives you the know-how, the how to solve a problem, how to approach solving a problem so that’s quite beneficial in any job, any sector. Then there’s the software aspect, I just read something today about Goldman Sachs how they’re ready and willing to hire coders but that’s a key skill for the future especially given today the Internet is at the application layer so it’s all about inventing and coming up with new apps, the so-called app on anything in ordering services, products, whatever so software is a key skill. Then there’s business, of course, Business Administration whether it be from an MBA but you know how to set up a business, how to conduct business, understanding business drivers. So, I would emphasize those three skill sets. Your thoughts?

Charles: Yeah, I agree Richard and I think we were just before we started recording that you also have some apprentices, essentially they’re called interns, but you know the apprenticeship system it’s often limited to the building trades or perhaps cooking or these kinds of things but actually it works very well in higher-level skill sets and managerial situations. There’s really no better learning situation than the workplace and so if you can get in and find a mentor who’s willing to give you experience in the real world then you can really start seeing what the skill sets that employers want and what I think the criticism that I’ve heard from people, recent college graduates, even in the stem you know science, technology, engineering and math is that the employers wanted skills that they didn’t learn in the classroom, that it

was all well and good but they day ended up not using whatever they learned in college in four years. They learned they basically had to relearn whatever they were going to use on the job on the job so this is the problem with sitting in a classroom or even remotely spending four year of your life you may not be learning what employers really want.

So, I would say the most important thing is to network with actual employers in the field you’re interested in, on day one, don’t start after four years of college or five or six years. That’s what you do on day one and then you tailor your education to what the employers actually want and so we know that one of the deficiencies in our educational system is employers, large employers like famously IBM, used to spend enormous amounts of time and money training their employees and now you know that the general model is you poach your employees from some other corporation right so there’s very little on-site training. Everybody wants you to be able to do the work from day one and they don’t want to train you so you’re going to have to do that part yourself but if you do that part yourself and you manage your own education then you’re going to be well situated.

Richard: Yeah, exactly I can’t emphasize enough this concept and the value of an internship or apprenticeship type program. Europe does it a lot more than in North America, especially in Germany I’ve seen rates as much as 70 percent compared to only 10 percent in North America for apprenticeship approaches. So, it’s quite powerful, low cost and can provide longevity of employment in that sector for that company and that’s something I do personally as well. This sort of leads into our discussion on jobs whereby internship can be coupled with the nature of the job so I have some Millennials working for me as interns that I manage as best I can using an millennial approach. So, they like to work remote, they like to communicate using Whatsapp type of tools with email, with an occasional coffee and they are very happy in that type of model and likely to stay on for a longer period of time.

Charles: Yeah, let’s talk about that model of work and I think it does work well for the Millennial

Generation but also frankly Gen X and Gen Z I think anybody that’s grown up with technology is going to be comfortable with just working digitally and I want to mention that you know the limitations of depending on education, you know higher education, like I was talking to a friend who was consulting with students in a well-respected MBA program in a university on the East Coast and he was appalled to discover

that the students weren’t really interested in learning entrepreneurial skills, they were just trying to get an A.

So, if it’s really important to learn what it really takes to be an entrepreneur or to help an entrepreneur run their business and it’s not a skill set that I think comes through an MBA, which is basically tailored for corporate America and so very few people emerge from an MBA program with actual entrepreneurial skill sets so I would throw that out there too that, you know, entrepreneurial is like a buzz word but it’s really getting down to brass tacks and being able to run a business and keep it afloat until it can scale up and you know all this kind of stuff. It’s a specific skill set and it requires a lot of human capital, a lot of ability to manage projects, budgets, people and so I would encourage people to try to work with entrepreneurs who have been successful and learn the ropes of that and then once you do that then your attractiveness to employers goes up considerably as well as your opportunities.

Richard: And also closely associated with entrepreneurialism is innovation so where there’s

a small burgeoning company there may be elements of innovation involved in terms of some new technology, the use of robotics process automation, intelligent automation, software engineering, you know, for enhancement of services so that actually goes together with entrepreneurialism. Your thoughts?

Charles: Yes, exactly because innovation is another buzzword but it’s implementing the innovation that’s the tough part, right, it’s scaling innovation these are the difficult things. Having the good idea is one thing but getting it into the real world and creating value in the real world that’s the tough part. You know we were talking about remote work and I think that this is really the leverage in the digital economy is that productive people can work largely remotely from anywhere on earth and so and with teleconferencing and all the other communication tool as you mentioned it’s like face to face is like really not necessary and that’s a corporate structure that’s spreading or within corporations it can be divisional where people may be answerable to you know the division head in Amsterdam but they live in Singapore or something so this is the new model and it works really well, I think, because if you’re in a workplace, a physical workplace, there’s a lot of managerial issues that come up, whereas in a remote work world all we care about is you understand the task, you understand the timeline, you get the work done and then you submit it. It’s like, you know, it’s a very clean, less emotionally cumbersome process and I want to mention I’m the same thing that I was just reading a post from a Millennial who was leaving San Francisco Bay Area because of the high expense and you know impossible housing cost and so on and he said in his experience he’s never known a corporate employer to turn down a productive employee who wants to work remotely. So, what he was saying is if you have a couple of years’ experience and you have a track record of being reliable and producing value then no one’s going to turn you down if you say look I want to work mostly remotely and that frees you up to live anywhere you want.

Richard: And that doesn’t necessarily mean living in the middle of nowhere. I myself have a lot of my work decentralized I could go in the office but much more efficient operating out of a millennial café, just

sitting there and doing the actual work, taking conference calls. This particular cafe doesn’t have any music in the background so I’m able to take conference calls as well so it could be there in the middle of the city or it could be in small towns across the country or different countries so remote could mean anything. Your thoughts?

Charles: Yeah and Richard I think that one of the key topics we wanted to talk about was housing in the Hong Kong Millennials profiled in this article we’re referencing I mentioned the impossibility of owning an apartment, a flat in in Hong Kong and, of course, that’s an issue in Vancouver tremendous you know it’s impossible, there many cities in Australia, many cities in the Bay and in the U.S. as well. So, I think the asymmetry here is you can’t earn enough in a big city to buy a house when housing is 11, 12, 15, 20 times your income so you’re going to have to find a cheaper place to live and the weighted working remotely enables that and so we were discussing, before we started recording, the idea that there’s a lot of much cheaper towns and small cities in North America that are starting to get a café scene, starting to get a tech scene, starting to get some nightlife and yet you can still buy a house in these places for under a hundred thousand or if you were going to move to a little more develop place maybe two hundred, you know two hundred and fifty thousand, which is affordable on much less of money then then these out of reach places. So, I think that’s the ultimate solution to housing is find a place that you enjoy living and that you can afford to own a house without working yourself to death.

Richard: Absolutely and this doesn’t necessarily have to be in the middle of nowhere. There is that possibility though for some that may like that in terms of buying 100 acres for hundred fifty thousand, two hundred thousand living on that land but you know far away from the city but at the same time you can pick smaller cities perhaps like Austin, Texas, we were talking about before, is a burgeoning community and lots of Millennials live there, very affordable housing. Your thoughts?

Charles: Right and the tier of towns or smaller cities below Austin, say for instance a lot of people favor Asheville, North Carolina, it has access to some larger cities. Bend, Oregon is a favorite place because of its proximity to, you know, outdoor activities and I just looked up those populations before we started recording and Bend used to have like 36,000 people 20 years ago now it’s got 95,000 and Asheville used to have 70,000 now it’s 95,000. So, these areas are growing rapidly because of the amenities and the cultural scene and there’s still room to grow because they’re relatively small compared to, you know, these huge urban areas and, you know, we you mentioned the idea that it’s even possible and I know some people that are pursuing this model is they actually want like a farm or a rural household and there’s a model in Japan called “Half-Farmer, Half X” and that’s been around a while and the idea of there and mostly Millennials or maybe younger Gen X types is that you take your digital skills, you know, in graphic design or coding or marketing and you work part-time and then you live in the countryside where housing is incredibly cheap and so you only have to work halftime to either rent a really big farmhouse or buy the land and so that’s another model.

Richard: And, a sector of that that makes sense is in the whole development of applications or apps, you

know the APP, for everything or anything. There’s an app now that goes on your cell phone for just about any service but continuously being developed for new services, new innovative services. So that can be applied, you know, the software scale that I mentioned you can use that in those areas, as you mentioned, remote areas, smaller communities and do that development to develop apps.

Charles: Right and speaking of that, you know, those of us outside these specific industries tend to forget that virtually every industry in North America and any other developed country is all being revolutionized digitally. So, you could take a sort of old company say producing chemicals or iron or steel products and you say well that’s an old technology they don’t need but actually those companies are also undergoing tremendous digitization of a CNC machining that’s run by software, that they’re using new tools and apps, you know, all software to rationalize their accounting, to rationalize their supply chain so in other words there’s just practically an unlimited number of software jobs within industries that you wouldn’t think of as high-tech but of course all these old industries require high tech skills as they upgrade their own companies into, you know, the modern economy. So, even old industries have a lot of opportunities.

Richard: Exactly. And the whole idea of low skill, low education required manufacturing jobs are gone. Yeah, you really need to know at minimum three different areas and that’s software engineering, intelligent automation and robotics process automation. Those three areas are just completely revolutionizing the manufacturing sector.

Charles: Right right! And one of the examples that is close to home for me is my niece’s

husband is a welder, he’s especially welder meaning, he has accreditations for various special kinds of welding and of course, there are welding machines and these welding machines are getting, you know, smarter if you want to use that term but there’s a lot of custom jobs where there’s only the welding job is literally one item for say a custom home or replacing a railing or this kind of thing. So, there’s a need there for the trade craft skills, you know, which there’s typically a shortage of those skills and then there’s the other skill set of being able to program the robot to do the part of the job that the robot is best able to do and then whatever the robot can’t do the human takes care of. So, this interface between robot software and the technical skills, that’s another growth opportunity, I think.

Richard: And also think global. So, I myself have done work, lived and worked, overseas in Singapore, Kuala Lumpur, Jakarta, Dubai, Istanbul and in Sydney, Australia, all over Malaysia for two years altogether Indonesia one year and a lot of the work I did had to do with setting up Internet infrastructure, basically in many parts of the world, so I was fortunate to ride that whole internet revolution but yeah think globally and some basic industries also will work in developing markets like Burma, Myanmar. If you just take rental car agency that’ll work there, anything that works in the developed world will work in these emerging markets.

Charles: Yeah, I think you’re so right. Actually, I would have loved to have been your assistant during all your globe trial. All those sound really fun but you know a friend of mine just returned, he lives part time in China in Suzhou, and he was marveling at the way that China is more advanced than the U.S. in many ways, for instance, everybody uses their cell phone apps to pay for everything from tolls on the highway to you know sharing meals to the (Inaudible 27:58), you know, uber type taxi service and so on and so again if you can acquire the skills to apply that kind of technology to existing industries there’s just a lot of opportunity there like I can see that will come to the U.S. with time and it’s just who gets there first.

Richard: Another big area of growth is in ESG/CSR. So, that stands for Environment Social and Governance and CSR Corporate Social Responsibility. So, what this means is how a lot of companies getting into these areas where they’re promoting a very strong corporate social responsibility program towards socially responsible investing or practices within their organization. There’s a lot of international standards where companies can measure themselves to towards this and what it’s characterized by our ESG factor so things like what they’re doing in the environment, social type of things, activities and overall corporate governance. Your thoughts?

Charles: Yeah, interesting that there’s the overlap, if you will, of the social consequences of corporate and government policies sort of, you know, the interplay or the overlap of those sectors which we tend to think of as being separate but which are of course in terms of public policy and environmental impact directly related. You know, one of the topics that you mentioned that you’ve gotten some questions on was like debt and the so-called ‘Fire Phenomenon’, which is financial independence retire early and I don’t claim to have any expertise in this but I’ve noticed that it tends to be the Millennial Generation, which is extremely motivated and interested in the financial independence retire early concept. Have you noticed this too?

Richard: Yeah, the concept of a bleisure in terms of combining business and leisure so traveling the world but at the same time doing work. So, whatever that could mean in terms of maybe consulting work, consulting projects, you know, but at the same time fitting in the travel experience as well to different sites of the world.

Charles: Yeah, that’s a great concept. I think a lot of, again these are just generalizations but, I think that the idea that a college degree was so important so essential that it was worth taking on $100,000 worth of debt I think that idea is becoming increasingly discredited or at least questioned and so for those people who already have that tremendous debt load that is a problem right because you’re going to have to, despite various claims that it’s all going to be paid off or you can default on it and so on, all those things are either speculative or they’re consequential. So, it does complicate life to have a large student loan debt and it’s a burden that it’s better to sort of grasp the nettle and figure out some way to pay it down or pay it off and one avenue that I’ve heard of and I don’t know how available it is but some government agencies have figured out a way to reduce your debt if you work there X number of years so that’s one avenue or the other one is to figure out a way to make enough money and live cheaply enough in these kind of cheaper living areas that we’ve talked about so that you can just kind of pound down that student loan debt and free yourself of that, you know, within a limited number of years of work and just get rid of that. And that kind of fits in with the with the fire concept, which is live really frugally and save 40 percent or more of your salary and that’s one way to eliminate the student loan debt from your life and get rid of it so you can move on.

Richard: Now a related question from a Millennial friend is “should I get

a free education in Germany, Sweden, Denmark, Norway, Austria, Greece, or France not free but very low, Czech Republic and instead of paying lots to educational institutions in the U.S. or Canada that may rank lower in quality.” So, what are your thoughts on that approach?

Charles: Well you know you’re a Globetrotter more than I but I would say that’s a fantastic idea if you can figure out some way to do that like, in other words, get the proper visas or that whatever you know the paperwork you’d need that would be a wonderful option and it would also provide you an education in international living you know you’d have a wonderful experience living in another country and of course, you’d probably need to ramp up your language skills in order to do that because, you know, international programs maybe taught in English but you know maybe not everything so that might be a very attractive option if you are on the way towards fluency in a language other than English. Would you agree with that?

Richard: Oh, absolutely yeah and actually even teaching English itself I’ve seen a lot of jobs internationally, China, everywhere where that’s an opportunity as well to live and work overseas is basically to be an English instructor in different countries.

Charles: Yeah and it’s interesting. That’s a great question because the countries that I’m

most familiar with would be Japan and France where I’ve spent time and a little bit of China and in Japan they’re very interested in attracting more foreign students. Now I don’t know the fee structure and of course Japanese is not a particularly easy language to learn but there may be opportunities in

European countries as well where they’re actually seeking some, you know, overseas or international students as an asset to their university system.

Richard: Another growth area that we haven’t touched upon but that leverages of what we mentioned on software, intelligent automation and robotics process automation is in the whole area of

agriculture and so lots of opportunity here internationally, you know, given the rise of population in the movement towards higher foods requiring higher water content or more protein and also just that the trade triumphs as well, you know, so opportunities for agriculture especially in South America as the Chinese shift towards sourcing more of their soybeans and weeds and all agricultural commodities versus North America so lots of opportunity there but even in North America lots of opportunity and medicinal so I just visited my friend’s farm for cannabis he’s growing 17 acres in a very remote area of Vermont all fully legal but you know strictly for the purpose of medicine. Your thoughts?

Charles: Great topic Richard because a friend of mine just mentioned that he was investing in a farm in the U.S. that was organic but it was automating many of the processes in the sense, say for instance, they were using drone technology to monitor the relative moisture levels in the soil, you know, so that they could turn on the drip irrigation at the right time to conserve water and feed the plants. There’s a sort of optimal levels of water and so again this is all high-tech stuff right I mean you’re talking about drone technology, imaging technology, database management and so on. So, yeah it’s really phenomenal how every industry is being revolutionized and what excites me about this is the model that you and I are describing, which is working remotely and flex work. This is what we need for, you know, sort of the life balance that we talked about and it this book I mentioned “The Meritocracy Trap”, the author goes on about how even if you’re earning, you know, large sums of money but if you’re working yourself to death you know on call, you’re taking work home, you know, you’ve got 24/7 connectivity, you have no time for your spouse or your children this is not living it’s simply not worth it. The goal and I think Millennials in

general realize this and they want live-work balance and so I think the key is find a way to live to work remotely, if at all possible, that aligns the income you can make in a normal workload, not a

crazy seven days a week, you know, 3,000 hours billing 2400 hours etc. No, have a reasonable lifestyle that makes a reasonable amount of money but live somewhere where that can be leveraged into a middle-class lifestyle.

Richard: And I think along with all of this goes as well some of your principles from the books that you’ve written is a movement towards decentralization so you know more local type economy, as well, and I would say also are more and more limited government. So, government is not the answer bigger government is not the answer it’s entrepreneurialism, the fostering of innovation and to do that there needs to be also a whole regulatory review process to eliminate duplicate regulations and also to address this whole concept of regulatory capture whereby you have large organizations, large companies that may do lots of lobbying with governments in order to lessen the teeth of regulations and also making it more difficult for a small entrance to go into that sector. So, that that needs to be addressed this whole regulatory capture phenomenon that that’s just taken over many different sectors and so in doing so that would foster massive innovation and massive entrepreneurial in many sectors. Your thoughts?

Charles: Yeah, absolutely Richard and this is one reason why it’s worth looking at smaller cities or counties with various cities in them because the large urban areas tend to be heavily regulated to where starting a business is simply unaffordable if you’re going to, you know, follow all the regulations and these regulations if they have to do with work safety fine, if they have to do with transparency fine, if they have to do with accountability that’s all great but most of the complexity you’re talking about the regulatory complexity serves no purpose it’s not protecting anybody from harm it’s simply burdening people that are trying to be productive.

So, I think you’re absolutely right when you’re going to look for a place that you want to live or work a place that is actually welcoming to enterprise and innovation in government as opposed to places where they give a lot of (inaudible 41:11) to that and so there’s a lot of (inaudible 41:14) given to things like one-stop permits and so on but it’s like you really have to explore that it when the rubber hits the road do they really expedite you know enterprise related stuff or is it just fancy talk because if they are willing to expedite enterprise stuff and they are interested in innovation in government as well as the private sector then that’s a place you’re going to be really comfortable with because the costs will be low and you’re going to have more opportunity.

Richard: Well, we’ve covered a lot of ground here. What are your final thoughts or can you give us a distinct summary?

Charles: Wow that’s a tough one but I think I would say, based on my own books and attempts to answer a lot of emails I get from Millennials is, don’t be afraid of trying something different, you know, the conventional thing of going to big cities that’s kind of a dead end because you cannot make enough money to have a nice life there and have any lifestyle balance. So, explore even if it takes a couple years of your life explore other options and be willing to experiment out there and that’s the only way to find something that hasn’t been exploited or that hasn’t been so overcrowded that there’s no opportunity there and the costs are just unaffordable. You’re going to have to experiment.

Richard: Yeah and I would say strive for fiscal prudence, continue learning, be very adaptive, take risk, think outside the box and also think globally.

Charles: That’s great advice. I think we should write that down.

Richard: Okay great we’ll end it there. How can our listeners learn more about your work Charles?

Charles: Yeah, visit me at OfTwoMinds.com. There’s lots free chapters of all my most recent books and huge archives on all the topics that Richard and I have discussed today.

Richard: Great. Thank you very much Charles.

Charles: Thank you

07/31/2019 - The Roundtable Insight: Caroline Miller and Yra Harris on the Global Economy and Financial Markets

07/31/2019 - The Roundtable Insight: Caroline Miller and Yra Harris on the Global Economy and Financial Markets

Richard: Hi, welcome to FRA RoundTable Insight. Today we have Caroline Miller and Yra Harris. Caroline is currently BCA’s Chief strategist Global strategy since joining BCA in 2012. She has had a cross-functional roll to both contribute to In-Shape the Global Research view while communicating this message to BCA clients at an executive level. Prior to joining BCA, she’s been 20 years as an Institutional Global fixed income asset manager, and Yra is a hedge fund manager, global trade, currencies, bonds, commodities, and equities for over 40 years as a floor trader. He has also served at CME director from 1997 to 2003. Welcome Caroline and Yra.

Caroline: Thank you.

Yra: Thank you, Richard

FRA: Great, I thought we’d begin with what your current global macro themes are, Caroline, at BCA research? If you can take us around the world in and what your views are at the economy level and the financial markets level.

Caroline: Sure, I’ll just start by saying that we see quite a divergence paths in in pricing. Bond market seemed to be at to have a very pessimistic view of the outlook for global growth and yet equity desert are close to recent highs and seem to be benefiting from low rates, but I was interpreting below, complex of interest rates as such an omen for the outlook for the business cycle. We think that that diversions will be resolved by a pickup in global gross into the end of this year. Certainly the manufacturing sector is weak and pretty ubiquitously so it’s as a vertically integrated component the economy, but if you look at the more domestic service areas, for example, of the US economy, it seems to us that it’s Gross still ticking along at an above trends pace and course US economy is a little bit less exposed to global trade then Europe and Asia. We see a lot of the weakness and Global manufacturing as coming out of China and and that this trend really predates the escalation of hostilities in the in the trade sector has been exacerbated by that but really you can trace the recent slowdown and go to manufacturing to type policy in China from a couple years ago that has slowed a fixed asset investment. They’re deliberately I think to a certain extent to control the pace of leverage growth are but the impact has been a reduction in China’s demand for resources and capital goods know that’s a large part of their import activity and that’s had a knock-on effect on Japan, and Europe, and you know most of global trade but we see the recent easing and financial conditions and also likely stimulus from China because it’s be no it does it suits them to prioritize deleveraging and containment of speculative risk when the economy strong, but we see them pivoting to a much more reflationary policy that we expect to manifest in the second half of the year. So we see global growth stabilizing and picking up and I think by the end of the year, the outlook for global growth could look a lot brighter than it does today.

FRA: And Yra, are you seeing the similar trends from your perspective?

Yra: (inaudible) I think the bond markets are so badly distorted by Central Bank action that it’s hard for me to know what the impact they are telling me because of the national arbitrages. So, you know, I don’t go deep into data I’m searching for the geopolitical uncertainty. (inaudible) There is so much pressure put on global rates, especially the long end, because people are searching for yields where ever they can. (inaudible) I think that geopolitical uncertainties are increasing dramatically, and the uncertainty is whether to slow down the capital expenditures and I don’t its because of the trade I think it’s because of other things and the way that they’ll play out, of course. (inaudible)

FRA: And to what extent does your research, Caroline, factor in like Central Bank policies, monetary transactions, monetary policy, fiscal policy into the views that you come up with in terms of the global economy in the financial markets?

Caroline: Well, I would certainly share with Yra’s assessment of the fact that uncertainty is a big feature of the landscape today. And I think you can see that in the global turn Premia that are so unprecedentedly depressed partly as a result of Central Bank intervention, but if you think about what the term Premia embodies, it’s a measure of expectations about inflation and the volatility of inflation, and the volatility of gross. And so I think that uncertainty is has driven a lot of flows into the perceived safety quality government bonds. I think there’s no value in those markets. I think it’s a term premium to wear at a more normal level relative to history than the yield curve would look a lot more like it has in the past. And so I would agree that the signaling mechanism from the curve isn’t what it would it has been but I also think that mean if you think about the fed’s mandate, their mandate is to try to sustain full employment and their statutory definition of ability for you know, most of the time or as much of the time as possible and send the FED’s mandate expanded in 2012, not just to include full employment, but also this inflation target, you know, they haven’t met that. They have not defended the lower bound of that inflation targeting. So I think that’s.The reason that they are most likely tomorrow going to cut interest rates because they are they’re concerned about a lack of attitude based on the fact that interest rates are so low, I would say though that if if it were the case that interest rates were at a distorted low level relative to what you know, the supply and demand for credit then inflation would be a lot higher. So there’s some element of the low term structure of rates that is a reflection of a slower growth environments. I think it could turn out that in fact the US economy is more resilient (inaudible) hindsight we could look back. And they didn’t that monetary policy had been loose for too long. I don’t think that’s a story for now or or really the next 6 to 12 months that’s a story for a couple years from now. But the fact that you have coordinated Central Bank set of signaling in a fairly coordinated fashion the need to support growth and aggregate demand by continuing to keep rates low is partly in response to the political uncertainly, there is no question, but I think that people are ignoring the very high likelihood that the Chinese economy is it is going to turn around as a result of a fairly reflationary policy there. And so that’s Billy’s roof for a positive growth surprise, but I do concede that geopolitical risk is elevated.

FRA: And your thoughts Yra?

Yra: No, I is it just you at least I think that’s the trading the Chinese I think bought that doing certain things because, for the last at any time, he’s been on the cusp of the downturn, I think the Chinese have stepped into the global void and certainly ramped up from where they sit right now. So there is they are they tighten does is trying to talk about in their own methodology last year and it and it has slowed things down and I think you’re getting, you know, there are some people following who are following Trump, because if you look at the Japanese pushing on the South Koreans to the South Korean numbers that turn down, the Singapore numbers are weak. I think those indicators to whatever changes are going to be taking place when we start to see those started to shift and right now. They haven’t they still alive portending in pointing to some weakness. Now. You haven’t gotten to Europe yet, which is problematic in many ways and the fact that you know, I think well, I won’t open up your up until we’re ready to but you know, I I don’t I don’t disagree with that. I just didn’t you know, it’s more than a course interest rate Cuts. There’s that were talking about here. So where we go from here will be critical. And again, with them said tomorrow, I heard an interesting discussion about an hour ago on Bloomberg Radio. They were talking about the possibility that the feta and quantitative tightening tomorrow. So you get 25 basis-point cut – an end to the tightening immediately rather than waiting until September 30th, which gets you to get you almost in my estimation then almost at 37 and 1/2 basis point cut. So Powell will be able to shred the needle on that boom. (inaudible) If Europe really continues to slow, it will put some pressure on Germany for some fiscal stimulus.

FRA: What are your thoughts, Caroline, on Europe? Especially the interplay between what’s happening in the UK and the Euro Zone in terms of monetary, policy fiscal, and the relationships between the two.

Caroline: So I continue to believe that Brexit is in a European issue, but it’s Britain’s problem. I think that it’s convenient but erroneous to do a tribute to weakness on the continent terms of growth president. I think it has a lot more to do with global trade. I recited Singapore Japan and Korea exports slowing. I think a lot of that is related to China if you could say the same thing for Europe, but Europe’s also had some idiosyncratic, you know, domestically sourced headwinds unimportant won. Last year certainly was the election of the populist government in Italy that caused the riot and bond markets and doubling of interest rate there. Well, you know that tightening in financial conditions was with Thursday problematic positions and has since really completely reversed and if you look at some of the floor. If we look at the data, you know, Italian non-financial corporate credit growth on a second derivative basis is it looks like it’s starting to turn around in a very early statement. I think the ECB is as concerned about tighter lending standards in the area and they absolutely want to see more credits flowing to the private sector ,and I think you’re going to see that it’s a high chance that they reinitiate after asset purchase program via by more corporate bond, but I think if you look at France the consumer sentiment data is improving, and I would agree that overall the economy looks very weak. But again if you start to see a pickup in China, I think that will have a knock-on effect on Europe’s export sector. I think you need to see the effect of the recent drop and bond yields later in the year. And I absolutely agree. That fiscal policy is the big elephant in the room and it’s interesting. I think Europe doesn’t have a lot of monetary space left to ease rates are obviously already negative and that’s problematic for the European Banks profitability. European banks are a big part of it, but they do have a lot of physical space and I think it’s sort of the opposite of the U.S. where in the U.S. is a high-yield market. The short rate is it to 2 and 1/4 there’s room to cut. Yet fiscal policy in the states is going to turn out to be kind of maxed out. So if that’s how we see the policy landscape between the two I think over the coming year, if you look at the overnight index swap market, you’ll see that that investors expect the ECB to ease by 22 basis points over the next 12 months and the FED to ease by close to 90 and I think that it’s going to turn out that the FED does less than that and Europe may ratify the market expectations. So we see the spread between billings and treasuries possibly narrowing over the coming year.

FRA: And your thoughts, Yra, especially with the UK as a potential repeat of what happened during the financial crisis with a weakening pound sterling currency?

Yra: Yes, I think I’ll take a different view on Brexit. Not that I am worried about Europe, I just think that the negative aspect of the way that the market is viewed, the whole Brexit has just been wrong. And I think the weaker the pound sterling gets – easier it is for the safety valve and the pressure release for the UK because that’s the advantage of Britain has. The currency will go down, we are almost at 92 on the euro sterling cross today, but in the same vein where the German stock market really go whacked, maybe half percent, maybe .4 points not much for the gilt market has held up beautifully. So if you’re telling me that there’s going to be an absolute financial crisis in Britain due to a hard Brexit, I’m just not seeing it in the financial instruments and I will say that is actually genuine relative to what takes place in the European sovereign market because we know that the bank of England has not bought any QE for a number of years. I think they halted at 475 billion just after and they are not rolling it. If it rolls off, they renew it so just the numbers don’t change but it’s still reflects that people are buying gilts. And if I was worried about some type of really financial calamity some of the hard Brexit meaning of private investor doesn’t buy gilts, I understand that the banks are buying gilt but in Europe, would you really buy a French oath for negative 15 basis points?

It just pure insanity. And I know I know that they go up in value because European Central Bank ensures that they go up in value. It is really a difficult situation in Europe and even more so because of me what the Central Bank you email Richard I’ve been on quite a bit with you, I am not a Mario Draghi fan because I don’t worship the author of loose money driving asset prices. That’s not the game that I play. I think he’s been very dangerous, and it gets more and more dangerous. This is actually an article that we haven’t seen in years. But in the today’s FT by Clair Jones, the piece on the German Court hears AT&T CD bond-buying again and the name of the plaintiffs in the case. The number is 2000, so there is a lot of unhappiness and I’m not sure the way that that is totally going to play out. And I’ll say one more thing about Europe. Between the president Macron and Angela Merkel, Donald Trump is going to make their lives miserable. And as soon as he turns to the tariffs on China going to try to just stir the pot as I would say is easy always you like to do for the pot and will start to record some more conversation towards terrors, which would certainly will not do this. Well, we’ll see how they respond.

FRA: And Caroline, your thoughts on what Yra see?

Caroline: I’m not sure that it’s going to be in Trump’s interest to expand escalate and proliferate is trade conflict the closer we get to the election as we’ve already seen from the CEO round tables in the states that political uncertainty around trade policy does have an impact on capital spending intentions. The closer we get to the election the more business sentiment I think becomes relevant for him and to the extent. It’s clear that interest rates are very low, and if you start to see the typical, but domestic sectors of the US economy performing well and the more globally exposed actors doing poorly because of this concern about trade conflict. I don’t see how that that that lines up with his incentive structure. So I think Macrone is has actually defeated the yellow vest movement. I would just in France. Very clearly that that roar has slowed to a whisper and I think he’s going to get through quite a bit of needed structural reform there. I think in Germany, ironically the more weakness you see in Germany proper the higher the odds that they also abandon this obsession with some with balanced budgets in and it increases the odds of some physical stimulus. As far as Brexit goes, I agree every day that you see the Pound Down you see the relative performance at the ftse 100 which is the large cap multinational index which basically has very little to do with the British economy. But a lot of English domicile firms outperform the ftse 250 which is the more which is the index with the more domestic firms in itself. Is it very clear relationship between the ebon flow of Sterling and those two indices? I think about the uncertainty related to Brexit on a Continuum and a part of that is because I grew up in Quebec which had its own separatist movement for years that also involve to referenda that never actually, from a statutory perspective, was passed. But the drain on business sentiment confident talent and capital from The Province over the last generation is very clear to see and it is no cause to center of Canada finish leadership from Montreal to Toronto and I think the longer this issue stemmers or boils in Britain without resolution the worse it is physically for a country that turning a 4% current account deficit.

FRA: Just running out of time here. But the last question. Yeah, you mention, Carolina, and your global macro and market Outlook that Europe that populism repeat review dated physical austerity more than it has stoked Euro skepticism. And Italy is prioritizing growth over deficit-reduction. Can you elaborate on it?

Caroline: Sure! I think if you look at the polls in Europe on attitude toward EU membership deals support for the Euro area as a as a club is actually pretty strong and it’s what most of the anti-establishment parties the source of their support. Is there their criticism of the parties that have heated to the demands from Brussels for balanced budget? So I think what you’re seeing is more rejection of fiscal austerity then a big statement any individual. Not talking about the UK. But it really thinks that their world and their citizens and their standard of living would be better outside the earlier than inside it. If you look at Italy is an example of the Lega Nord a and the Five Star movement in this coalition government, you know, they really haven’t been champ exiting the area they have just stood up to the demands from the EU in Brussels that they balance their budget and actually I think won that argument. The rules around excessive deficit procedure in the finding that they could technically be subject to, because they’re in violation of the Maastricht treaty, haven’t been invoked. I think that’s a tacit acknowledgement that a country can only service debt by knowledge that they have it. If they’re growing and they grow. If the private sector is in leveraging mode andso in the public sector is as well and slowly, but surely, I’m more permissive attitude for some deficit spending to help support those economies. And I think you know that is the bigger issue than then, you know, wanting to be outside the EU. It’s really just a push to acknowledge that fiscal austerity is to the stationary and I think you’re going to see more of that.

FRA: Interesting. And Yra, your thoughts?

Yra: Well, if I would certainly push back on that because I’ll look to ramp up the deficit he was met with the threats and find some glasses. And I think that the threat is there and had a lot to say that Macrone would like to do that for France’s up against the limits to fax their numbers on our 90% and says the budget deficit as percentage of GDP so you can’t get away from these. So yes, if you relinquish all those I agree that there are two things that can make me very bullish on Europe: the creation of a harmonized fiscal authority coupled with a Euro bar, which is why I think they course, they put the garden because they’re going to try to hold the whole ECB balance sheet into a Euro bond. Europe is already built on the capital of fee, which will be critical to that process. But I think we’ll ways from that and I think the Germans have not been heard from yet as to how they’re going to feel about this because again, they do have that amendment or the statutory law about a balanced budget. They have been running all budget surpluses, which Caroline notes, gives them the flexibility to increase physical spending which would help all of Europe. So I believe that Macrone goes to sleep at night and prays for recession in Europe and that euro per say, in Germany, especially, that export sector turns down and then gets forced into a situation where they’re going to start to expand the deficit spending which one aid all of Europe but I just don’t see it on the rise to yet. I hope I’m proven wrong because Europe needs some reprieve some of the ridiculousness that they embarked upon, but I just see it. Germans are getting angrier

and as you can see this weekend, Merkel, which phone is trying to take advantage of. So, we’ll see how it goes.

FRA: Okay great insight and perspective. I guess we’ll have to end up here, Thank you very much both of you – Caroline and Ira.

Caroline and Ira: Thank you. Bye.

07/16/2019 - FRA – The Roundtable Insight – Charles Hugh Smith on the Market’s Obsession with the Federal Reserve

07/16/2019 - FRA – The Roundtable Insight – Charles Hugh Smith on the Market’s Obsession with the Federal Reserve

FRA: Hi, welcome to FRA’s Roundtable Insight .. Today we have Charles Hugh Smith: America’s philosopher, we call him. He is the author, leading global finance blogger and he is the author of several books on our economy and society, including “A Radically Beneficial World: Automation, Technology and Creating Jobs for All”, “Resistance, Revolution, Liberation: A Model for Positive Change” and “The Nearly Free University and the Emerging Economy.” And recently, “Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic.” His blog OfTwoMinds.com is one of CNBC’s Top Alternative Finance Sites. Welcome Charles!

Charles: Thank you Richard, it’s always a pleasure!

FRA: Great, I thought today we do a focus on the Federal Reserve. That’s been in the news, you know, quite heavily in recent weeks and even today, we are talking on Wednesday July 10th here.

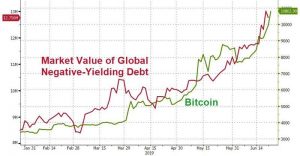

Just wanted to do a focus on how everybody has an obsession, the market itself has an obsession with the Federal Reserve as being essentially the sole driver of higher valuations. You know, is this healthy or not? It is essentially financial repression taken to an extreme. I just did a podcast yesterday between David Rosenberg, Yra Harris and Peter Boockvar. All three, who frequently appear on CNBC and Bloomberg. And we had a very similar discussion on the very similar theme. Even, David Rosenberg thinks that it is going to be very extreme on what the actions the Federal Reserve would take. Essentially going towards zero interest rates. More and more (Inaudible 1:58). And ultimately, debt monetization where the Federal Reserve buys whatever debt that is issued by the Treasury.

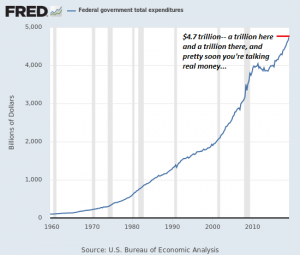

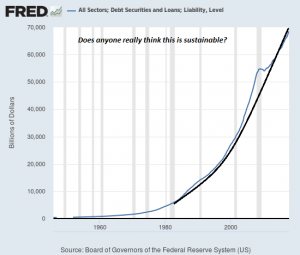

And so, on that theme that you have graciously provided some charts. One of which, is showing how the Federal government expenditures been going through the roof asymptotic and resulting in deficit spending essentially.

So, that will all continue, but essentially the message is there that the Fed is there as a backstop. It’s there to do the monetization, outright monetization of whatever debt is needed. Your thoughts?

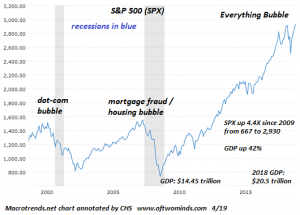

Charles: Yeah, thank you for that excellent summary of this situation Richard. I guess my first response is just to go back a bit in history and I have a chart here of the last three bubbles in a S&P 500.

Going back to the 1990s dot-com bubble which burst and then the mortgage housing bubble in the late 2000s which burst. And now, the so-called Everything Bubble. And what strikes me about this, as you say, single-minded obsession with the Federal Reserve Policy. Like, what’s the latest easing going to be to push valuations higher. That strikes me as what happens at the top of equity bubbles, right? Because, when the market seems to be relying on one driver and (Inaudible 3:38) solely on that. That seems to mark a top and when I think back to the 1999 NASDAQ bubble and the dot-com bubble, there was of course the underlying sense that the internet was going to be growing for decades and so, you know, you couldn’t go wrong on investing in internet companies. But there was also like an almost comical obsession with something called the “book-to-bill ratio” which was a measure of orders compared to current billings in the semi – conductor industry. And the semi – conductor industry was part of a proxy for the entire tech sector at that time. And so, you see these huge swings in equity valuations across the entire tech sector, not just semi – conductors based on this week’s book-to-bill ratio.

And so, it was laughable even then, how focused the market was on one indicator, right? Which as valid as it might have been in some certain circumstances, it was like the whole market was being swung up or down by this one indicator. And then in the mortgage housing bubble of mid-late 2000s: 2005, 2006, 2007. Then we were told, well you know, housing never goes down and well people were interested in what the Fed had to say, in terms of the effect on mortgage lending rates and so on. The obsession was really with how fast real estates appreciating this (Inaudible 5:10). And so, I guess that’s part of what I feel is it feels extremely fragile here is this obsessive concern with Fed Policy as the only thing that could possibly push markets higher. So that means higher profits, higher sales, innovation, you know, higher wages. It’s like none of the things actually make a healthy economy are of any concern and that should trouble us.

FRA: Yeah, it is and it’s almost perverse because as you can see in the announcements of labor statistics, for example, the market is keenly looking to those statistics as a driver of monetary policy and ultimately affecting equity valuations. So, that if the labor statistics are bad, then there is a sense that the Fed will be pumping more, easing more, so therefore the markets go higher. On the other hand, if the labor statistics were good, then that would translate to “Oh no, the Fed is not going to give us that drug.” And so, we won’t get it, so therefore equity valuations go lower. So, it’s just totally crazy and perverse. Your thoughts?

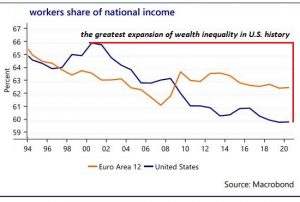

Charles: Yeah, and I am glad you brought that up because in terms of labor statistics and whether wages and earned income is rising or not, I have a chart here that shows workers share of the national income.

And what’s really striking is it’s been in decline since the (Inaudible 6:50) 21stcentury here in the U.S. And so, in this period in which the Federal Reserve and other central banks have made the greatest expansion of quantitative easing and the greatest expansion of central bank balance sheets and massive financial repression to keep rates near zero. It hasn’t benefited people with depend on earned income which is the vast majority of people, right? I mean certainly the bottom, say 90% of households, store their wealth based on their income. Not on, you know, their equity ownership. And so, it’s been a disaster for the bottom 80-90% of households and it’s only benefited the top 10% of which the vast majority of that is actually goes to the top 5% and top 1%. So, it hasn’t benefited the economy as a whole or society as a whole. So, you’re right, it’s just massively perverse.

FRA: And even then, it’s very fragile. The whole system, as you can see on your chart, for all sectors; debt securities and loans; liability, level is that little blip in the financial crisis that just seems to be a hiccup, but caused massive financial crisis globally and things are just getting worse.

We are going higher and higher on a swimming pool plank with less and less water and more and more instability. It’s just crazy. Your thoughts?

Charles: Yeah, I’m glad you brought that chart up because this is total systemic debt, basically, you know, public and private. And it’s pushing 70 trillion in the U.S. And GDP is around 21 trillion, so it’s over three times GDP. And what’s really frightening is the rate of increased, you know, that it’s from that little blip in the 2008 – 2009 crisis. Total debt was around 55 trillion and now it’s 70. So, we have added, you know, 15 trillion dollars very quickly and it doesn’t seem to be any reduction in the rate of that debt accumulation. And this rapid rise in debt across public and private is sort of mirrored by the rise here in Federal expenditures, which also this chart I have here from St. Louis Fed database shows Federal spending. It also had a little hiccup, you know, right after the recession. And it resumed very fast increase, so the Federal government is spending 4.7 trillion a year and taking in roughly a trillion less in revenues. And so, here we are floating another trillion a year in Federal debt in so-called “good times.”

And then of course, we would have to add in state of local government are also borrowing a lot of money, in terms of municipal bonds (Inaudible 10:29) and that kind of debt. And then there’s private and corporate debt. So, is this a healthy economy that’s so dependent on debt and therefore dependent on central banks dropping interest rates. How would you say, in terms of financial repression, everybody knows the positive effects of the Federal Reserve dropping interest rates, right? But what about the negative effects? Nobody seems to talk about that. I mean there are negative effects, right?

FRA: Yeah, exactly. It’s in all different aspects: the economy, the financial markets, social implications, widening income, wealth inequality, resulting from all this. And we’re rapidly approaching what central banks can do or have the capability of doing these other charts as well that can show how more and more debt is needed for an incremental increase in economic growth and that is getting bigger and bigger. More and more debt needed for just a slight amount of economic growth and that’s in the economy. And then in the financial markets, if we look at the bond market, more and more of the major central banks are getting into the situation where there they may be the only buyer, the last and only buyer. And, you know we look at, for example, bank of Japan that’s been in the case already for quite some time. European central bank is essentially is there now and the Fed is approaching that situation as well. And those areas are pretty dire situation. If you have the point where only the central banks are buying, basically there’s no market for it. Your thoughts?

Charles: Yeah, it’s interesting. I call that mechanism “a perpetual motion machine.” In that, you know, the Japanese model and what you referenced earlier in our talk that David had said when the central banks are going to monetize debt, then it’s like a perpetual motion machine because your national government can borrow a trillion dollars and spend it. And then your central bank buys those bonds and they basically vanish without a trace into the central bank balance sheet. And there’s no cost to society, in the sense that the Federal Reserve returns much of its income to the Treasury. So, it looks like, well there is nothing here? I mean, why couldn’t the Federal Reserve just go ahead and monetize 2 trillion dollars a year in deficit spending and let the balance sheet go from 4 trillion to 20 trillion or 30 trillion. And of course, a lot of people are looking at Japan as the model for this, as they more or less gotten away with this. And then everyone says, well you know, the train is still run on time and Japan is still a wealthy nation and everything works. And so, why not monetize debt and just let your balance sheet go crazy? Who cares? And so, it’s hard to answer. It’s hard to come up with a reason why that doesn’t work because Japan seems to be proving it does work.

FRA: Yeah, I mean, essentially there’s the two-lever situation with debt, right? So, that you have the quantity of debt and the interest rate. So, as the interest rates have gone down through financial repression, it’s allowed governments to go on a debt binge essentially for more and more debt. Much more debt now than we were at the financial crisis, for example. Problem with that is that is very high levels of debt and as the interest rates creep up ever so slightly, it becomes higher and higher servicing costs and that could get out of hand. So, you could be boxed in, you know, in terms of what governments can spend. Your thoughts on that?

Charles: Yeah, I think that’s a great point Richard. And of course, in Japan, every few years I try to keep track of what percentage of their central government’s tax revenues go to just pay the interests on their enormous sovereign debt. And I believe it was 40%. Now, this interest rates are basically .01 or less, right? I mean, you couldn’t get anything closer to zero than Japanese sovereign debt. And yet, it’s already consuming 40% of their tax revenues. I’m just saying that as an example of the mechanism you are describing, that eventually even at a tenth of one percent interest, you get boxed in because you are just servicing that debt. Makes it more difficult to take care of the rest of your social and government spending. And of course, the other downside is that no one could earn any money safely, right? The only way that anybody could earn money is by speculating that the central bank is going to lower interest rates below zero. So, that your bond that you bought is paying .01% will go up in value because now that the rate is minus .5% or something.

But you know, in terms of like safety and safe returns on investments for insurance companies and pension funds and so on, that’s also been basically destroyed, right? I mean, for people that are much younger, they may not remember that back in the 70s, it was a regulation that savings and loans would pay five and a quarter percent interest on your savings. And so, that was actually fairly hefty. And now of course, it’s impossible to earn five and a quarter percent safely. You know, you’re taking on enormous risks in buying junk bonds or corporate debt to get that. And so, I think that’s another element of fragility, you know. As well as the size of debt, in getting boxed in by the debt. We’re also boxed in because everyone has to gamble now in highly risky dangerous asset markets, in order to earn some sort of return.

FRA: It’s crazy. It’s unsustainable and where do we go from here? What is the way out? Another theme yesterday that was discussed is essentially inflating. There’s only essentially one way is to inflate the way out to make that burden of debt less burdening by increasing the inflation rate to much higher levels. Your thoughts?

Charles: Right. That’s what a lot of us have been anticipating and of course, we know for a variety of reasons governments understate inflation. We think the real-world inflation is, as you and I discussed many times, running more like 6 to 7 to 10%, instead of the 2.1 or whatever the official rate is. But yeah, we have all been anticipating that and I think what’s interesting is there’s got to be a deflationary element in the system that has been offsetting the inflationary impacts it should be registering, in terms of deficit spending and money creation and so on. And so, you know, it could be that like say, going back to Japan as an example that deflation is a factor in Japan because their workforce is shrinking. So, there’s less consumption and there’s fewer drivers to push up real estate and equity. So, there’s just fewer workers. And so, then you get deflation in consumer prices and then in assets. You also have a huge overhang of that debt from the Japanese bubble of the late 80s. And so, as loans are defaulted and get written off, then that’s also deflationary.

So, it makes me wonder what happens when you don’t have any deflationary impacts. Then we might get an inflationary shock, if say, the Federal government decides to pursue modern monetary theory ideas of huge stimulus programs: universal basic income. And, you know, we can (Inaudible 20:05) about numbers in general. It’s like, maybe, a limited universal basic income would probably add about a trillion to Federal spending and it’s pretty easy to add a trillion more in infrastructure and other fiscal spending stimulus. So, if you are going to create and push out 2 trillion a year in a 20 trillion-dollar economy, I think maybe we will finally get inflation.

FRA: Yeah, and if you look at one other great thinker in the Austrian School of Economic tradition, I was talking with Ronald-Peter Stöferle of incrementum a couple weeks ago. He wrote the book on Austrian School Investing and he pointed out that Murray Rothbard has the view of the three phases of inflation. He was one of the great thinkers in the Austrian School and he says first we look at the monetary inflation. We had that. We had a lot of that. That then goes into Asset inflation. Obviously, we had that and still have that. A lot of that. And then, the third phase is consumer price inflation. Eventually, all comes into consumer price inflation. So, that 8-10% a year, roughly, where if you look at the Chapwood Index of inflation more accurately measures inflation than any other index, including government statistics that indicate 8-10% per year in inflation in most of the U.S. cities. That is likely to get higher as time goes on. Your thoughts?

Charles: Yeah, absolutely. I’m glad you brought up Rothbard’s work because a lot of people I think have been lulled into a false confidence that we can basically create essentially endless amounts of money or credit, and there’s never going to be an inflationary impact because we gotten away with it for 20 years. Or, in the case of Japan, 30 years. But that may be a false assumption. You know, I want to mention a social impact here. When we talk about finance, we have to remember (Inaudible 22:32) there’s a social impact to this kind of financial repression of jacking up asset valuations with quantitative easing and super low rates. And so, I spend some of my time in the San Francisco Bay Area. And, as we all know, there’s many real estate bubbles, where you are in Canada and Vancouver as well. Many West and East Coast cities in the U.S. are reaching absurd levels of housing valuations. And so, approximately 5% of the population in the San Fransisco Bay Area can’t afford houses there. And of course, this is a region with very high incomes and say, a top 5% income in the Bay Area is, I believe it’s $400,000. Where in the rest of the U.S., is more like $250,000 or $300,000. So, you have to make really enormous sums of money to afford a bungalow in the Bay Area. And so, what’s the net result of this socially? As well as economically?

One social result was just a poll that was published in the San Jose Mercury News that said, “60% of millennials in the San Franciso Bay Area (now there’s people around 30 or under) want to leave or plan to leave the Bay Area in a few years.” Because there’s just no point in staying in a place where you have no future. Where you are going to be struggling to pay the rent. And that’s it. You will never afford a house. And, they had a young couple that (Inaudible 24:21) and saved and worked two jobs and so on. And bought, like a little bungalow for $700, 000 a few years ago. And their quote was worth thinking about because they said, “We are working at a 150% to maintain a lower middle-class life.” In other words, it wasn’t like they were really getting ahead. So, that’s the social costs of central banks pumping up assets, in order to please the current owners of all these assets, right? And, I think that’s going to cause a social disorder on a massive scale at some point.

FRA: Yeah and also, I have a feedback loop into the whole problem making it worse. Because if you got this effectively brain train happening, as well as some level of wealth train as well. You know, as the millennials believe from some economic activity representing that. And this not just in the Bay Area, I see it here in Toronto. There’s a lot of articles and charts showing it for all over. In particular, by the way with Chicago Illinois, what’s happening there the millennials will not likely be as idealistic as they have been portrayed. But they will believe that it will begin moving out. And this will make the whole problem worse, because then there will be more draconian, financial repression, higher levels of taxation and just making the whole thing worse and so on and so forth. And cause more and more people to drive out. So, that social problem and effect that you just mentioned could get worse. Your thoughts?

Charles: Yeah, no absolutely. I think that’s, as you say, a feedback loop. I just got an email from a reader in Chicago, said she mentioned Chicago, and he said his property tax had gone up by 48%. Partly from valuation, but partly from higher rates. And so, he says, “I don’t know how many people can withstand this kind of increase.” And then, you know, the Federal Reserve we were talking can monetize sovereign debt, right? The Treasury could issue a trillion in bonds and the Federal Reserve can buy that. But what about real estate? There’s roughly 15 trillion in real estate, private real estate in the U.S. Is the Federal Reserve going to start buying houses in Chicago to prop up the house values there? And so, in other words, I guess my point being that the Federal Reserve and other central banks have a pretty easy mechanism for propping up equities and bonds. Because they can just monetize the bonds to debt and they can just print money and buy the stocks, right? As part of Swiss Central bank and so on.

But the vast majority of people’s assets in the middle-class are in their house. And so, if the housing bubble pops, then what’s the Federal Reserve going to do? Well, they are going to lower interest rates to try to create negative mortgages. Where if you take out a mortgage, you end up getting paid. I’m not sure how that’s going to work. But I guess my point is, I think we’re really pushing on a string because you can’t prop up all asset bubbles everywhere without, basically as you say, destroying any notion that there’s a market there at all.