Blog

11/30/2023 - The Roundtable Insight – Tom Luongo and Yra Harris on Gold, Bonds and Geopolitical Risks

11/30/2023 - The Roundtable Insight – Tom Luongo and Yra Harris on Gold, Bonds and Geopolitical Risks

11/12/2023 - Dr. Marc Faber – Headed for a Breakdown, Disappointing Market Returns

11/12/2023 - Dr. Marc Faber – Headed for a Breakdown, Disappointing Market Returns

11/10/2023 - WTFinance with Dr. Marc Faber

11/10/2023 - WTFinance with Dr. Marc Faber

11/10/2023 - The Roundtable Insight – Judd Hirschberg Analyzes the Financial Markets Update

11/10/2023 - The Roundtable Insight – Judd Hirschberg Analyzes the Financial Markets Update

11/09/2023 - The Roundtable Insight – Luke Gromen and Yra Harris on the Oil, USD and Treasuries Interplay Dynamic

11/09/2023 - The Roundtable Insight – Luke Gromen and Yra Harris on the Oil, USD and Treasuries Interplay Dynamic

11/09/2023 - Chris Wood Bullish Long Term on India

11/09/2023 - Chris Wood Bullish Long Term on India

11/09/2023 - The Roundtable Insight – Marc Chandler and Yra Harris on the Economy and the Financial Markets

11/09/2023 - The Roundtable Insight – Marc Chandler and Yra Harris on the Economy and the Financial Markets

11/01/2023 - The Roundtable Insight – Tom Lam and Yra Harris on the Economy, Fed and BoJ Policy Trends, Investment Environment

11/01/2023 - The Roundtable Insight – Tom Lam and Yra Harris on the Economy, Fed and BoJ Policy Trends, Investment Environment

10/31/2023 - Louis-Vincent Gave on China and Investing in the Fertile Crescent/Global South

10/31/2023 - Louis-Vincent Gave on China and Investing in the Fertile Crescent/Global South

10/26/2023 - The Roundtable Insight – Joseph Wang and Yra Harris on Interest Rates, Liquidity Issues and Sovereign Bond Trends

10/26/2023 - The Roundtable Insight – Joseph Wang and Yra Harris on Interest Rates, Liquidity Issues and Sovereign Bond Trends

10/19/2023 - The Roundtable Insight – Dr. Marc Faber and Yra Harris Discuss Geo-Political Effects on the Economy and International Investing

10/19/2023 - The Roundtable Insight – Dr. Marc Faber and Yra Harris Discuss Geo-Political Effects on the Economy and International Investing

10/17/2023 - Macrovoices Discussion with Leigh Goehring on the Global Food Crisis

10/17/2023 - Macrovoices Discussion with Leigh Goehring on the Global Food Crisis

Some Key Points by Leigh Goehring of Gorozen from the discussion with host Erik Townsend:

Sunspot Cycles and the Weather and Agricultural Production:

“I’m a big believer that there is a very loose, loose relationship between sunspot cycles and weather patterns. And one of the most interesting things is that in the last 20 years, we have been in a very pronounced declining sunspot cycle. And what’s so interesting about that is, declining sunspot cycles have often been associated with periods of global cooling. And in periods of global cooling, I should point out weather patterns become much more disruptive to global grain producing regions. And that’s exactly what we’ve seen in the last four or five years. And I think this is just going to continue as we go through this decades. So, you still have very, very strong global grain demand. And that’s brought about by the big increases in per capita GDP that’s happening in multiple parts of the world, primarily in all the emerging markets. And this global grain boom is bumping up against very, very adverse weather patterns. And it’s going to produce. It’s produced the first leg of this crisis and as we go on and talk in this podcast, it’s going to produce other crises as we go through this decade.”

El Niño and La Niña Phenomena and Effects on Weather and Agricultural Production:

“Well, it’s interesting what the El Niño phenomenon is, it’s oscillation that takes place in the Pacific Ocean, where it… during the El Niño phase, what you do is you get a very warm upwelling of water warm water on the west coast of South America. And that is called know, that’s the El Niño phenomenon. Conversely, there is the La Niña phenomenon. And the La Niña phenomenon is when you have cold water that presses up against the west coast of South America. Now these El Niño – La Niña go in cycles. And what drives the switching from the La Niña to the El Niño to the El Niño back to the La Niña. We don’t know no one really has a very good idea other than this phenomenon usually happens with differing regularity. But one of the interesting things is that we’ve been in a relatively strong La Niña for the last four years with classic La Niña effects in the sense that we’ve had good La Niña which traditionally produce very adequate rainfall Southeast Asia, India, Australia, and will produce much drier conditions in South America and North America. And West Africa will also have waster than normal precipitation trends. Now when you switch from an La Niña to El Niño that all reverses. Southeast Asia, India, Australia will become much drier and be much more prone to drought. West Africa will become much more prone to drought. And North America and South America will become more prone to more precipitation. And those that doesn’t mean that this happens every time. But those are the very very general trends that grip the agricultural world when we when we switch from flooding to El Niño and then back again.”

Gleissberg Phenomenon and Negative Pacific Decadal Oscillation, and Effects on Agricultural Production:

“There’s a there’s a cycle called the Gleissberg cycle and Gleissberg existed all the way back in the middle of the last, not the 20th century, the 19th century. And what he noticed is that every eight solar cycles and every cycle is 11 years long, is that there’s this modulation that takes place in their amplitude. And one of the interesting things is the last occurrence of the Gleissberg cycle happened right in the middle 1930s. And there’s a lot of people that believe that the Gleissberg cycle had a lot to do with the incredible drought that gripped the Midwest part of the of the United States for literally five to six years and produced the great Dust Bowl. And for you know, for those that like to study this, you know, the 88 year cycle would put, if the Dust Bowl really happened during 1934 and 35, that would put the Gleissberg cycle and its impact on the weather into 2023-2024 which is where we are right now. So what’s interesting about this is that if you look at, like if anyone’s curious, you can go on the website, just punch or browser and punch in US Drought Monitor, and you will get US drought conditions in the US. And if you punch that up today, you will look at how extremely dry the central part and the eastern part of the United States is. So is this the beginning of the Gleissberg effect on North American weather? …

But another strange effect is that like I said, we’re transitioning now from La Niña to El Niño which traditionally would mean that we should expect more precipitation in the North American continent. However, this La Niña to El Niño transition is happening. There is another climatological effect taking place. And that’s called the negative Pacific Decadal Oscillation. Historically, would you slide from La Niña into El Niño, where the Pacific Decadal Oscillation is negative, that’s produced drought conditions in North America. And the last great episode of that happened in 2012, which was a big drought year in North America, where I should point out remember, corn yields fell 20% below normal in the US, and grain price corn prices spiked to their all time highs. So the thing is, are we beginning to see a combination of these effects to grip North America. The fact that we’re going from La Niña to El Niño, with a negative Pacific Decadal Oscillation with a Gleissberg overlay on top of the whole thing. Who knows, I mean, maybe this is going to produce really severe drought conditions in North America, this growing season. And what’s so interesting is that, like I said, if anyone’s interested go punch out US Drought Monitor. And it will show you the very, very strong levels of dryness. Your drought conditions that are gripping large parts of the United States today. So the thing is that this is just another series of weather events that seem to be creeping up that could potentially cause the next great agricultural, global agricultural crisis.”

10/16/2023 - Dr. Albert Friedberg Conference Call on the Economy and the Financial Markets

10/16/2023 - Dr. Albert Friedberg Conference Call on the Economy and the Financial Markets

- Latest views on the Economy and the Financial Markets

- Extent of monetary stimulation (Covid/Post-Covid) underestimated, effects into 2023

- Sees some deflationary trends developing, this will become unexpected by the markets over the next 6 months

- Is long on bonds – sees lower yields coming

- As deflation trends emerge, likely the USD weakens .. likely to be good for gold

- China and other countries via central banks/govts buying gold – adding gold to diversification (targeting 15% to 25% of reserves)

- Owning gold costs 5% a year on carry

- Inflating the currency is the likely way out of massive government debt

- Has some long positions in Argentinian banks, which are at very depressed levels

- Sees potential opportunities in Argentina if monetary conditions change positively

- Highlights estimates of Argentinians holding $250 Billion USD under mattresses and overseas – if monetary conditions in Argentina improve, some of these funds could repatriate, fostering a boom in Argentina

Link Here to the Conference Call Replay

10/10/2023 - Kuppy Kupperman and Louis-Vincent Gave on Emerging Markets and Uranium

10/10/2023 - Kuppy Kupperman and Louis-Vincent Gave on Emerging Markets and Uranium

Harris “Kuppy” Kupperman, founder and CIO of Praetorian Capital, and Louis-Vincent Gave, CEO of Gavekal Research to learn their global economic outlook and why they think a boom is coming for emerging markets and uranium

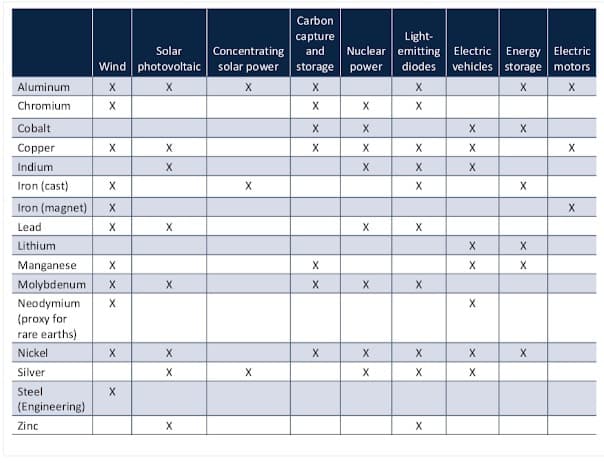

10/02/2023 - The Metals behind the various types of Renewable Energies

10/02/2023 - The Metals behind the various types of Renewable Energies

09/29/2023 - The Roundtable Insight – Jay Martin on Investing in Commodities

09/29/2023 - The Roundtable Insight – Jay Martin on Investing in Commodities

09/29/2023 - The Roundtable Insight – Charles Hugh Smith on How Regulatory Capture is a Net Negative to Society

09/29/2023 - The Roundtable Insight – Charles Hugh Smith on How Regulatory Capture is a Net Negative to Society

Download the podcast in mp3 voice format – Link Here to Download

Also the referenced podcast by Bill Gurley of Benchmark – Link Here to Watch

09/20/2023 - The Roundtable Insight – Louis-Vincent Gave, Prof. Michael Pettis and Yra Harris on China and the Global Economy

09/20/2023 - The Roundtable Insight – Louis-Vincent Gave, Prof. Michael Pettis and Yra Harris on China and the Global Economy

09/18/2023 - Joseph Wang – Potential for March 2020 Liquidity Event Rising

09/18/2023 - Joseph Wang – Potential for March 2020 Liquidity Event Rising

“The potential for a replay of a March 2020 liquidity event in markets is on the rise as the rate of growth of debt continues to far exceed growth in the market’s capacity to provide liquidity.”

Full article is available on Joseph Wang’s Substack

09/15/2023 - Argentina’s next President could be Javier Milei, Austrian School Economist – Libertarian

09/15/2023 - Argentina’s next President could be Javier Milei, Austrian School Economist – Libertarian

https://www.youtube.com/watch?v=Oxt2MzaVFOIClick here to view Interview on Twitter

Here are some podcasts we have done with Javier Milei: