“Financial repression is a term used to describe measures used by governments to boost their coffers and/or reduce debt. These measures include the deliberate attempt to hold down interest rates to below inflation, representing a tax on savers and a transfer of benefits from lenders to borrowers. The resulting effect means funds are channeled to the government that would otherwise flow elsewhere.”[1]

It is an approach that indebted governments resort to, as a final measure to service their debt. Unfortunately it is the very thing that has been crippling the lives of seniors and/or anyone approaching retirement. The cost of living is increasing every year, pension payments are either insufficient or not being paid at all, money set aside from a lifetime of saving is inadequate and economic data being released by governments is skewed. In the midst of all this, how can pensioners enter a comfortable retirement? How can they survive on a $900/month pension when property taxes alone are double, triple and in the case of New Jersey, even quadruple that? They answer is, they can’t. Pension is just not enough.

In a recent publication, Charles Hugh Smith outlines a demographic issue; the weak purchasing power that pension funds will provide due to an inefficient ratio between full time workers and retirees:

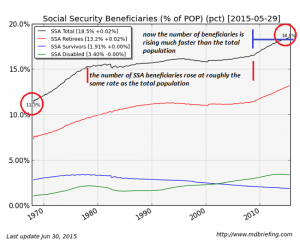

“Today we are living nearly 20 years longer, and yet the ratio between full time workers and retirees has dropped to 2:1. There are 115 million full time workers and 57 million people drawing social security benefits, this is an unsustainable ratio. Two full time workers cannot support a retiree drawing medicare and social security.”[2]

A major mistake that came with the creation of pension funds was that the government did not account for an increase in life expectancy. In an era of low returns, and an increase in an individual’s life span, the promises that were made decades ago can no longer be kept today.

Financial repression cuts income to seniors and makes pension funds, a once reliable source of revenue, ineffective and unsustainable. This forces retirees to eat into their savings, which places pressure on welfare programs for the elderly and requires the government to spend more money to fulfill pension guarantees.

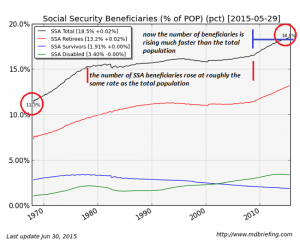

[3]

[3]

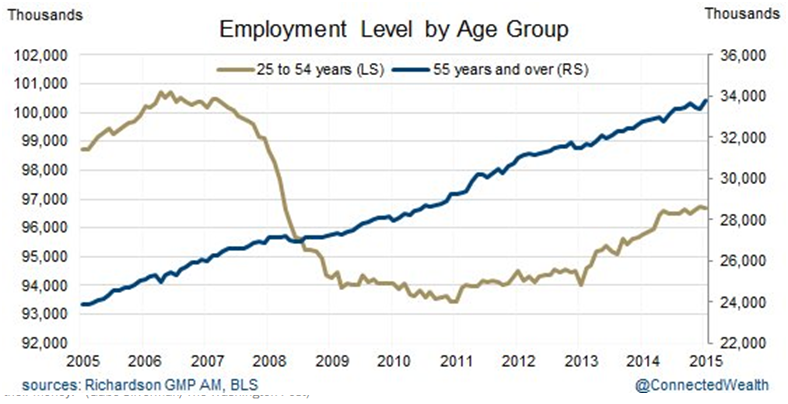

Above is a chart taken from Charles Hugh Smith in his article, The Coming Era of Pension Poverty. The chart shows the relationship between time and the percentage of the population receiving social security benefits. From the late 1970s until 2008, the number of people receiving these benefits grew at rate similar to that of the total population. This constant growth was halted by a major event; the 2008 financial crisis. As a method to push the economy out of a recession, the Federal Reserve adopted a sustained low interest rate policy, but implementing this policy came at a severe time. It was during this time that the economy saw the largest workforce demographic shift, as the core workforce population, the baby boomers began to enter retirement.

The Pension Gap

Canada is facing a large disconnect in pension benefits between public and private sector employees. According to Canada’s Two-tier Retirement[4] a report by the Canadian Federation of Independent Business (CFIB), two-thirds of Canadians working in the private sector, or 80% of the country’s employees, do not have a company pension plan, whereas 87% of public sector employees have workplace pension plans which ensure benefits. To replace 70% of their working income in retirement, federal government employees currently contribute about 7% of their salary. To yield the same result, private sector workers would have to contribute up to 21% of their income.[5]

The CFIB illustrates the data by using an example with two characters, Mary, a public worker, and Jane, an employee in the private sector. They start working at the same time, earning the exact same annual salary over 35 years and making the same pension contributions. However, by the time they both retire in 2029 at age 65, Jane will have saved only $605,000 for retirement, while Mary will have accumulated roughly $1.38 million. This variance is because Mary receives greater contributions from taxpayers and she has a defined benefits plan which guarantees her benefits even in the instance of her pension plan performing poorly. This example clearly highlights a major unjust advantage of being a government employee. With millions of Canadians in the private sector having no workplace pension plan, even those with an employer-sponsored plan cannot hope to retire nearly as comfortably as government employees. The only way for retirees to increase their yields is to either continue working, or take on far riskier investments where seeing any return is bleak.

Pension Liabilities

Pension liabilities are the difference between the total amount owed to retirees and the actual amount of money the company has on hand to make those payments. A pension liability will only occur within defined benefits. These are traditional pensions where workers and their employers agree to contribute a certain amount into the pension fund over time for a guaranteed source of retirement income. Liabilities arise from 3 main sources:

- Direct Funding. Organizations do not usually pay a pension directly. Instead, instead they buy annuities to pay the pensioner over the course of a lifetime. However the amount of money the organization needs to fund a guaranteed pension can fluctuate from year-to-year which can prove to be problematic.

- Diverted funding intended for pension contributions but diverted elsewhere. Organizations may divert money scheduled for pension contributions to other areas of spending, while promising to fund the pensions at a later date.

- Number of pensioners. A large amount of workers hitting retirement age at roughly the same time (the current case for Baby Boomers) represents a potential shortfall in the ability to meet pension obligations.

Canadians have known for a long time that the public sector pension scheme is unfair to taxpayers and small business owners, but it is also becoming clear that many public plans are structurally unbalanced and in need of immediate change. According to Statistics Canada, the unfunded shortfall for public pension plans across the country likely exceeds $300 billion. [6]

Governments have placed too much reliance on solving their pension problems through the revenue route, asking taxpayers to contribute more to compensate for shortfalls. Public sector pensions are seemingly unaffordable, increasing tax costs, further adding to public employees already high pension contribution obligations, or forcing governments to divert resources away from public services toward paying for retired employees.

With public sector earners collecting 8-17% more in wages per year than private sector earners in the same kinds of jobs[7], and pension entitlements that generously treadle off past retirement earnings, it is time to deal with the cost side of pension.

Miscalculated Living

For years the real purchasing power of social security benefits has been falling. In other words, the benefits seniors receive are considerably less than what their parents received decades prior.

The Bureau of Labor Statistics (BLS) uses a cost-of-living adjustment called CPI-W each year to calculate how much social security benefits should grow to keep up with inflation. The problem is CPI-W underestimates how much the cost-of-living for seniors increases each year and furthermore it distorts weights of goods within the basket. To fix that, the BLS created a new index called CPI-E (E for elderly). Yet despite this addition social security benefits are still calculated using CPI-W.

An appropriate alternative to CPI is called the Chapwood Index. The components of this index were selected based the prices of the 500 most commonly purchased items on which Americans spend their after tax dollars on. The Chapwood Index found was that through CPI, the government completely underestimates the real cost of living increase for Americans. According to Ed Butowsky, founder of the Chapwood Index, “this is the main reason that more people are falling financially behind, and why more American’s rely on government entitlement programs.”[8]

“The data solidly supports what all Americans have suspected for years. The CPI no longer measures the true increase required to maintain a constant standard of living. Unfortunately, this negative trend has been in place for 28 years and has resulted in creating a crucial situation where most Americans need to start their own personal austerity measures by reducing their expenditures while demanding more from their savings and financial advisors.”[9]

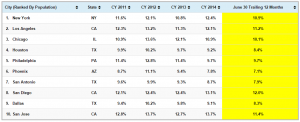

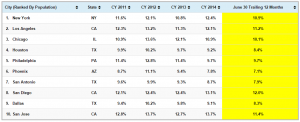

Chapwood Index: Top 10 US Cities by Population[10]

The Chapwood index reveals that the combined Trailing 12 Month average for the top 10 U.S. cities was 9.7%; far more than the rate of the Bureau of Labor statistics CPI published. San Diego (12.0%) and San Jose (11.4%) top the list of U.S. cities with the highest cost of living increase nationwide, while Phoenix (7.1%) and San Antonio (7.9%) have the lowest.

The goal of the Chapwood Index is to shine light on a growing pandemic being fueled by the government. Information obfuscation and misrepresentation has been the cause of mass financial suicide. People need to take their finances in their own hands an impose austerity measures on themselves. Blind acceptance of statistics reported by the government is a problem which creates a false perception of reality and prohibits people from making appropriate financial decisions within their best interest.

The Means Test

Means testing is a controversial method for determining whether someone qualifies for a financial assistance program. Means testing was originally proposed for child benefit and is now being suggested for a wider range of benefits, particularly for retirees.

Means testing does not justly compensate the interest of the most disadvantaged people. The screening process involved to determine who is worthy of receiving government assistance is flawed. Large numbers of people miss out on benefits from either not knowing about them, not realizing they are eligible for them and most importantly, they are reluctant to claim them.[11] This is because of societal stigmas associated with receiving benefits flag people as being dependent. This is a common situation amongst retirees and can result in them encountering health and other problems from under claiming, leading to increased costs.

The drawback of means-testing gets even worse when it comes to how the policy shapes financial decisions. Means-testing entitlement benefits punish the very people who work the hardest and save the most. Majority of the population does not have the liberty to choose how many hours to work. For the majority, the choice is out of necessity and it is to work a full-time job (40 hours per week). Furthermore, because of the complicated ways in which federal welfare programs and taxes correlate, the effective marginal tax rates can be nearly impossible to decipher; their implicit negative externalities thus become difficult to act upon. The result is that most people in the prime of their working years will work as much as they can, regardless of marginal incentives.[12] Gracious retirement for our elderly should be a chief aim. Pensions are dwindling, and despite the assortment of retirement plans available, people still can’t save enough for a comfortable retirement.

In Closing

The current system in place to ensure comfortable retirement is obsolete. Pension, this ingenuous allowance from the government is not nearly enough to even make ends-meat with. Lack of information combined with distribution of biased data prevents people from making financially responsible decisions. If you are like the most of us and are not a government employee, consider all your fruitful retirement plans gone. As mentioned in the earlier example, public sector workers receive from return from their savings and higher wages. But not just wages; it also includes benefits such as pensions, health, dental, and job security.

Harold Meyerson of The Washington Post proposes a simple plan; require employers to put a small percentage of their revenue, and a small percentage of their workers’ wages, into a private, portable, defined-benefit pension plan. To offset the increased costs, transfer the costs of paying for workers’ health care from employers and employees to the government, and pay for the increased costs to the government with the kind of value-added tax that most European nations charge. [13]

Additionally, allowing early access of pension benefits to middle income earners would encourage greater contribution. The thought of people having their money confiscated for many decades, with no access to it even in an emergency, often repels people from the entire notion of pensions. Allow people to access their own contributions but not the tax relief or employer contribution, which would be left to grow until retirement. End the transition to defined contribution plans. These plans are more confusing, expensive and less reliable than defined benefit plans, leading in most cases to inadequate pensions. Find ways to share the risk between employers and employees.

An immediate and drastic transformation is long overdue. With time the problem has only been getting worse as more and more people are entering retirement, and the portion of the population in retirement age increasing. The current pension crisis is a problem which affects everyone, regardless of age. Whether it will affect you or not is not a question of ‘if’ but rather, ‘when?’ Options are available and solutions do exist, but nothing can be done until more information on the issue is shed, for action cannot be done if a problem seemingly does not exist. Under the current structure it is without a doubt that pension is famine.

Karan Singh, Financial Repression Authority Columnist

email – karan1.singh@ryerson.ca

References

[1] http://lexicon.ft.com/Term?term=financial-repression

[2] Smith, Charles Hugh. “The Coming Era of Pension Poverty.” Web log post. Oftwominds.com. N.p., 2 July 2015. Web.

[3] iibd

[4] Petkov, Plamen. Canada’s Two-Tier Retirement. Rep. no. 5. Pension Research Series.

[5] Dodge, Laurin and Busby: The Piggy Bank Index: Matching Canadians’ Saving Rates to Their Retirement Dreams. C. D. Howe Institute, 2010.

[6] Statistics Canada. Table 280-0007 – Trusteed pension funds, funds and members by sector, type of plan

and contributory status, occasional (number), CANSIM (database). (accessed: 2015-12-26)

[7] Canadian Federation of Independent Business, Wage Watch: A comparison of public-sector and private

sector wages, Dec 2008. http://www.cfib-fcei.ca/cfib-documents/rr3077.pdf

[8] http://www.chapwoodindex.com/

[9] iibd

[10] iibd

[11] Lawson, Richard C., Noel Card, Heather Jerbi, and Craig Hanna. Means Testing for Social Security. Rep. Washington: American Academy of Actuaries, 2004.

[12] Brewer, M., Saez, E., & Shephard, A. (2010). Means-testing and tax rates on earnings. Dimensions of tax Design: the mirrlees Review, 90-173.

[13] Meyerson, Harold. “Steering America Toward a More Secure Retirement.” The Washington Post 26 Mar. 2013

Disclaimer: The views or opinions expressed in this blog post may or may not be representative of the views or opinions of the Financial Repression Authority.

01/22/2016 - YRA HARRIS: “There is No Wizard Behind the Curtain!”

01/22/2016 - YRA HARRIS: “There is No Wizard Behind the Curtain!”

[3]

[3]

ed approximately 40 million dollars in towing fees and police fines. “Red-Light cameras” have become huge revenue raising tools in many areas of the country. In Los Angeles, revenue from red-light cameras has doubled from $200,000 a month in 2007 to $400,000 a month at the end of 2009.

ed approximately 40 million dollars in towing fees and police fines. “Red-Light cameras” have become huge revenue raising tools in many areas of the country. In Los Angeles, revenue from red-light cameras has doubled from $200,000 a month in 2007 to $400,000 a month at the end of 2009.