FRA Co-founder Gordon T. Long discusses with Yra Harris about the yield curve of US Treasury bonds along with the G7 meeting and the effect of Germany and ECB on the rest of the world.

Yra Harris is a recognized Trader with over 32 years of experience in all areas of commodity trading, with broad expertise in cash currency markets. He has a proven track record of successful trading through combination of technical work and fundamental analysis of global trends; historically based analysis on global hot money flows. He is recognized by peers as an authority on foreign currency. In addition to this he has Specific measurable achievements as a member of the Board of the Chicago Mercantile Exchange (CME). Yra Harris is a Registered Commodity Trading Advisor, Registered Floor Broker and a Registered Pool Operator.

He is a regular guest analysis on Currency & Global Interest Markets on Bloomberg and CNBC. He has been interviewed for various articles in Der Spiegel, Japanese television and print media, and is a frequent commentator on Canadian Financial Network, ROB TV.

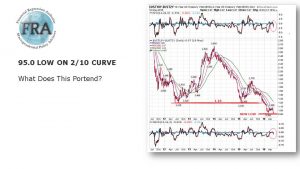

LOW ON 2/10 YIELD CURVE

It looks like we have another temporary bottom. After we took out that previous level we were talking 120 basis points, but now we’re trading at 95. The big problem is going to be the 75 basis point area, but we’ve already taken out the lows that were made in 2007-2008. What it reflects is that the Fed is flattening as they’re talking about raising rates.

It looks like we have another temporary bottom. After we took out that previous level we were talking 120 basis points, but now we’re trading at 95. The big problem is going to be the 75 basis point area, but we’ve already taken out the lows that were made in 2007-2008. What it reflects is that the Fed is flattening as they’re talking about raising rates.

Usually with this flattening of the curve, the 2/10 which is called the “investor’s curve” instead of the “speculator’s curve”, indicates one of two things. Firstly, rates are either too high or going too high on the short end relative to what the market perceives is its potential growth in the future. They’re getting nervous.

“Usually I would say this is a very solid indicator and that the Fed has really waited too long to do anything. Which flies in the face of everything we’ve heard in the last two weeks.”

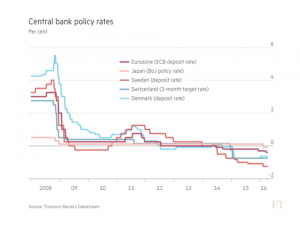

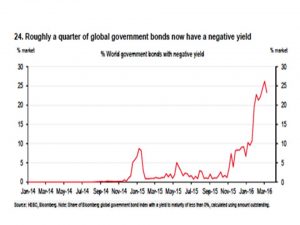

There is a dynamic in play in the global markets. With the vast amount of central bank purchases, they have skewed the markets so badly that the markets are trying to get a read on what this all means. Because everything is relative value, 60% of the developed market bonds are in negative territory. That skews everything, so we can’t get a real feel for what this curve means. If that’s the reason the curve is flattening, then we’re in a whole new ballpark because it’s a global phenomenon at a level we’ve never seen before and that’s going to affect everything. It breaks the Fed’s own mechanism.

“Bond markets need to be a signally mechanism to be effective, and if you’ve broken the signalling mechanism, well, we’re flying here in uncharted territory… then it becomes a question of, who’s in the pilot’s seat?”

That’s what the world is trying to figure out: do the people in the pilot’s seat know what they’re doing and have confidence in what they’re doing or are we really flying blind here?

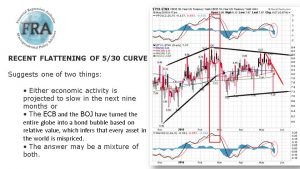

5/30 CURVE FLATTENING

The 5s30s is where speculators like to play and that curve is actually flattening more as they seem to be able to exert more pressure, but that might be reflective of relative value. In a yield-starved world, yield-starved because central banks have so dynamically shifted everything everything through their massive purchases, people are stuck having to really reach for things.

The 5s30s is where speculators like to play and that curve is actually flattening more as they seem to be able to exert more pressure, but that might be reflective of relative value. In a yield-starved world, yield-starved because central banks have so dynamically shifted everything everything through their massive purchases, people are stuck having to really reach for things.

“The 5/30 is more dynamically telling me that the Fed may be erring in raising rates, that they waited too long.”

People in Europe have 3/10% of GDP yield. It’s not even enough to cover their budget situations. Europe is in a very difficult situation here. That might mean the Fed has waited too long.

THE PREVIOUS G7 MEETING IN SHANGHAI

“I don’t think anything major came out of Shanghai because I’ve been around this business for a long time and nothing could’ve kept that quiet.”

Maybe something did take place, but then we consider June of 1998, when the Chinese were much more concerned, and two weeks before Bill Clinton goes to China, Bob Rubin makes a speech about the strength of the Dollar and the US Treasury started buying Yen and selling Dollars contrary to what Rubin said. The Chinese were very upset with the weakening of the Yen and put pressure on the US to try and correct it. Now in Shanghai, we get the sense that the Chinese were displeased with the recent 30% depreciation of the Japanese Yen and made their voices known.

If you tied that into Shanghai, you can see that the Japanese sent a signal saying, ‘when we have displeasure, and since we’re an autocratic government, we can move in a very quick, dynamic fashion. And when we move, we’ll disrupt the markets, so you better take care of this situation cause we believe the Yen is too weak against the Yuan.’ So now the Japanese are unhappy, so this will get interesting. The Japanese have voiced their concern with this one sided depreciation.

SPECULATION ON RESULTS OF THE G7 MEETING

The Japanese could seriously weaken the Yen if they started buying other countries’ bonds. So there was a conservative effort by the BOJ to buy US treasuries and European debt.

“Any time a central bank intervenes or starts to buy some of these assets in an aggressive manner, it’s being done to weaken your currency. There’s no better way to word it.”

The Swiss are actively intervening in the market, the Norwegians are maintaining stability. If the BOJ were to start buying US Treasuries, the Dollar-Yen would weaken dramatically cause that would be a central bank policy to directly weaken their currency by buying other countries’ assets. They will be warned against doing that, but the Japanese retail investors and pension funds are under a lot of pressure to deliver some modicum of return with negative rates in Japan hampering their ability to achieve a positive return.

The Swiss are actively intervening in the market, the Norwegians are maintaining stability. If the BOJ were to start buying US Treasuries, the Dollar-Yen would weaken dramatically cause that would be a central bank policy to directly weaken their currency by buying other countries’ assets. They will be warned against doing that, but the Japanese retail investors and pension funds are under a lot of pressure to deliver some modicum of return with negative rates in Japan hampering their ability to achieve a positive return.

“What I think the biggest issue the G7 will speak to is what I call the Larry Summers Agenda… he’s trying to get a global fiscal stimulus.”

He wants everyone to bring forward all their infrastructure spending now. It would make the Chinese very happy, but it certainly seems to be a desire to craft some type of global fiscal stimulus to take the pressure off the fiscal monetary policy.

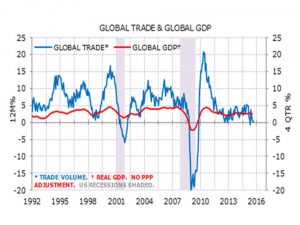

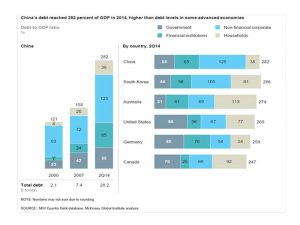

People talk about the Chinese, but the Germans are much more a propagator of current account surpluses, but they save and save and save.

“We are totally opposed to nations using their currencies to gain a trade advantage. There will be a lot spoken about the need for fiscal stimulus.”

THE PROBLEM OF EUROPE

Europe is 27 different situations looking for a common policy, and that just can’t possibly happen. Germany has full employment and budget surplus, current account surplus, and it sits there with negative interest rates, then everything you’ve told me is wrong. What has to happen is you get very robust inflation in Germany, cause you’re keeping rates way below whatever metric is used.

“Your work is in financial repression. Nobody in the world right now is more financially repressed than the German people.”

We have the German constitutional court ruling against these OMTs and the ability of the ECB to actually perform fiscal policy through their monetary policy.

The markets are complacent. The European bond markets have yields that are preposterous.

“Germany is Europe’s credit card; the ECB, yes, they can print money but they have no credibility without the German credit card.”

No one would buy German debt without someone guaranteeing it. There is no Euro bond. It doesn’t exist. People keep saying they need it, but in order to do that there has to be someone guaranteeing that credit, and that’s the Germans. European debt is at 8-9% and this is going to be the wild card. They have swallowed the concept that the ECB is some sort of brilliant organization with credibility. It has x amount of balance sheet assets which are growing tremendously.

The ECB would be equivalent to the Great Depression in 1932 Austria, when the credit gestalt went under. The ECB sits in that role. If the Germans say they’re not going to be a part of this, the world blows apart financially. They’re hoping to pile all this on so the world will tell the Germans they can’t leave. This is such a surreptitious way of forcing them to be the guarantors.

Meanwhile the ECB is buying 80b more Euro’s worth of credit every month. They don’t even have to buy it. They’re doing it because they need product. They’re in a hurry to keep piling all this debt on the ECB, who kept saying ‘we’ll do whatever it takes’ and the market accepted that, and over the course of this “whatever it takes” they kept piling on this debt.

“If you want to see an accord, there’s going to be a fiscal stimulus accord.”

Abstract by: Annie Zhou: a2zhou@ryerson.ca

Video Editor: Min Jung Kim: minjung.kim@ryerson.ca

05/25/2016 - YRA HARRIS: WE’RE IN A WHOLE NEW BALLPARK – THE FED’S OWN MECHANISM MAY BE BROKEN!

05/25/2016 - YRA HARRIS: WE’RE IN A WHOLE NEW BALLPARK – THE FED’S OWN MECHANISM MAY BE BROKEN!

Click Here to Download to Listen to the Audio

Click Here to Download to Listen to the Audio