Over the last century, the central planners who run our world have not only made a mess by their constant interference, but they have made a mess that can only end one way—in total economic collapse.

Over the last century, the central planners who run our world have not only made a mess by their constant interference, but they have made a mess that can only end one way—in total economic collapse.

Will the Tide Stop Coming in Because We Tell It To?

Cycles are arguably the most dominant force in nature. There is a cycle to the planets, crops, radio waves, electricity, tides, people—pretty much everything.

And there is a cycle to economics. This has been known and understood since the days of old. Even the Bible talks about “fat years” and “lean years.”

With all this history, you would think the great economists of our day would understand this principle and work with it, rather than oppose it. You would be wrong. Horribly wrong.

This is not a fairytale; this is the world we live in right now. Inspired by the works of Keynes—a fairly young branch of economic theory that is still largely unproven and theoretical—these men are, in plain view, replacing traditional “free markets” (where price discovery is determined entirely by supply and demand, just like you learned in school) with their own “Frankenmarkets,” where they use their ability to create infinite money at the push of a button to force markets to do what they think is best.

And what is it they think is best? The evidence of the last 100 years suggests that their preference is an economy based on debt; markets dominated by clandestine manipulation from both internal government agencies (e.g., the Treasury) as well as external ones (e.g., the Federal Reserve, the BIS); ongoing cycles of boom and bust; and, most disturbing of all, the ongoing transfer of wealth, on a scale never before seen or imagined, to smaller and smaller groups of individuals and entities. Until we reach the point where the wealthiest one percent own more than the remaining 99% combined—a point, in fact, we have already reached. Based on empirical evidence alone, this seems to be their preferred way of running the world.

But there remains one small problem. This system is imploding. More correctly, to borrow a phrase from Alice Through the Looking Glass, our financial engineers are interfering more and more often simply to keep things in the state they were in already. In other words, as their efforts are failing, so is the distorted financial world they have created for us.

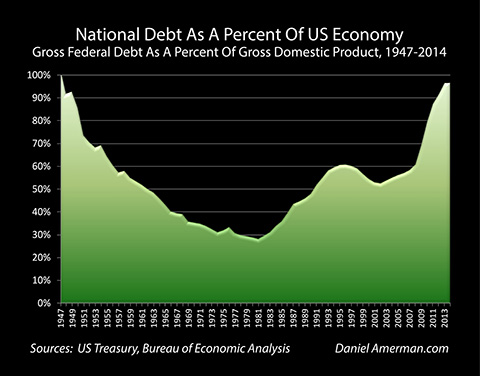

The first detailed, peer-accepted work to point this out was James Davidson’s superb book, The Great Reckoning: Protecting Yourself in the Coming Depression (Touchstone Press, January 1994). In his book, Davidson looked not only at the U.S., but also all the Western nations collectively and concluded that a century of building the trappings of prosperity on debt (borrowing to get what you do not have) rather than savings (working hard to afford what you need) was going to end badly—very badly.

The book was a worldwide bestseller, but lost some credibility when the aforesaid reckoning did not happen precisely on schedule in the last decade of the 20th century, just as Davidson had predicted.

In point of fact, the reason the world avoided an economic catastrophe in the 1990s was because of the so-called computer revolution. Just as with the invention of the steam engine, a new and unexpected technology produced not only observable efficiencies, but also captured the imagination of the public at large and gave them hope.

Hope that unfortunately collapsed in the 1999–2000 Dotcom boom. A period so bizarre that an entrepreneur with a business plan involving the Internet that he had penned on the back of a napkin during an all-nighter was, conceivably, able to secure millions the next day from a wide variety of venture capitalists.

The Dotcom Boom “Smartened the Chumps”

The expression “never give a sucker an even break” entered the common parlance in the 1940s after the launch of the film of the same name starring the top comedian of the era, W.C. Fields. In fact, there were two parts to the quote and the second portion is often overlooked. The lost part of the quote was “…and never smarten a chump.”

The manner in which the 1990s Dotcom boom conveniently delayed the reckoning that Davidson has written about was not lost on our financial planners. Quite the opposite, in fact. As former Washington deep-insider Catherine Austin Fitts explained, the 2007 mortgage-backed securities debacle—a financial catastrophe felt around the world!—was no accident. It was deliberate, it was planned, it was an attempt to mimic the momentum of the computer boom (which ended in a crash!) by creating a brand new “bubble” to give the impression that the economy was strong and self-sustaining (i.e., before the new boom itself also ended in a crash). (Source: “Sub-Prime Mortgage Woes Are No Accident – Fitts,” Solari, August 7, 2007.)

For those who watched the aftermath of the 2007 crisis with eyes open, it was clear that something very significant had suddenly changed in the halls of power. The tipoff? On TV screens all over the world, you had the spectacle of the U.S government declaring that there were banks and financial institutions within its borders that were “too big to fail” and, moreover, needed rescuing at the public’s expense. Nobody seemed to notice that the very concept did violence, simultaneously, to the notions of capitalism, democracy, free markets, and the Rule of Law. In fact, this notion went further than even Keynes himself had ever gone! Nor did government give the public a chance to even catch its breath, to blink, because they immediately followed that announcement with a wide variety of other initiatives—the most memorable of which was quantitative easing or “QE”—which continued the theme touched on above of bending markets to their will.

The Government’s Real Solution? — “Financial Repression”

The overall (and deliberate) impression was that our government had identified a problem and was working hard to fix it with a variety of clever and innovative solutions they had jerry-rigged at the last moment.

Some experts saw things differently, however. Some recognized the “solutions” offered by the government as part and parcel of a known and dreaded economic doctrine called “financial repression,” an insidious back-door method used by governments to extricate themselves from excessive debt by quietly passing the pain along to their own citizens.

The term is not new and was first coined in 1973 by Stanford economists Edward S. Shaw and Ronald I. McKinnon. The clear and visible markers of a “financially repressed” regime, they said, are:

(1) Policies that override supply and demand to artificially drive yields to, or below, zero (think QE, ZIRPs, NIRPs);

(2) Capital controls to limit the ability of money in the regime to leave on short notice (think “cashless,” in many ways the ultimate expression of capital control);

(3) Suppression of the precious metals complex, once again to limit alternatives; and

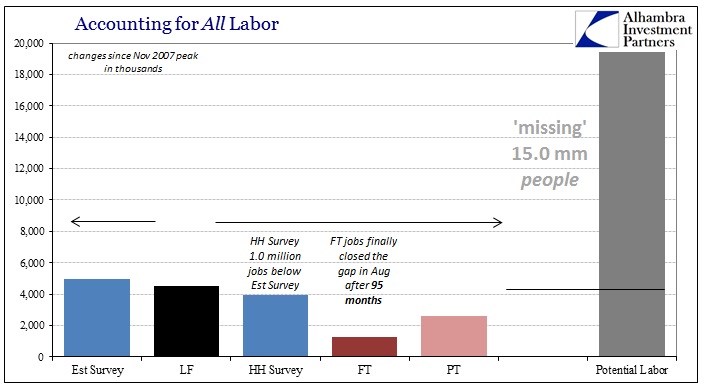

(4) Suppressing or distorting information so as to give an artificial sense of well-being (think, re-defining “employment” to exclude those who have given up and left the workforce…?)

The ultimate goal of the regime is to foster “policies that result in savers earning returns below the rate of inflation” in order to allow banks to “provide cheap loans to companies and governments, reducing the burden of repayments.” (Source: “Financial Repression Destroys Growth,” Wikipedia, last accessed February 1, 2016.)

The educational site Mises.org adds more detail:

“[…] Financial repression is a revolving set of policies where the government insidiously takes wealth from the private sector, and more specifically makes it easier for government to finance its debt. In today’s environment this includes: ZIRP or ‘zero interest rate policy’ where many of the world’s central banks keep their lending rates to banks at or near zero. Naturally, this makes the interest rate on government debt lower than it otherwise would be; QE or ‘quantitative easing’ is the central bank policy of buying up government debt from banks. This increased demand increases the price of government bonds and reduces the interest rates on those bonds… The combination of the two policies has allowed governments to borrow money, both short- and long-term bonds, at extremely low interest rates. This, in turn, has kept the government’s interest payments on the national debt relatively low.” (Source: Financial Repression, Mises.org, Last Accessed: January 15, 2016.)

Is financial repression the cure for economic ails? The Mises site suggests just the opposite, in fact:

“[…] Financial repression is an outgrowth of bloated government budgets and enormous government debts. It is the worst way of dealing with government debt and actually works against the proper ways of addressing fiscal problems which include: eliminating government programs, eliminating military bases, austerity based on cutting politicians and government employees’ salaries and benefits, and deregulation and privatization to increase economic growth.The effects of financial repression cause economic harm throughout the productive sectors of the economy including workers, savers, entrepreneurs, retirees, and pensions. It hurts the insurance industry that protects our lives, homes, health, and property. The (sole) economic beneficiaries include the big banks and Wall Street, the national government itself, and certain large corporations.” (Source: Ibid.)

Editorialist Daniel Amerman has spent literally years analyzing the impact of financial repression in jurisdictions where it has been deployed.

He writes the following:

“[…] the essence of Financial Repression is using a combination of inflation and government control of interest rates in an environment of capital controls to confiscate much of the purchasing power of a nation’s private savings. Rephrased in less academic terms – the government methodically destroys the value of money over a period of many years, and uses regulations to force a negative rate of return onto investors (in inflation-adjusted terms), so that the real wealth of savers shrinks… Over time Financial Repression can be every bit as destructive to wealth building through savings and retirement accounts as is austerity, default or high rates of inflation.” (Source: “Private Savings Pay Public Debts,” DanielAmerman.com, last accessed January 25, 2016.)

Amerman is also quick to underscore the hidden connection between inflation—something that Washington is forever telling us is “desirable”— and the financial repression regime:

“[…] a government that owes too much money (deliberately) destroys the value of those debts through destroying the value of the national currency itself. It doesn’t get any more traditional than that from a long-term, historical perspective. Without inflation, Financial Repression just doesn’t work… the higher the rate of inflation, the more effective Financial Repression is at quickly reducing a nation’s debt problem.

“[…] The goal…is to make sure that all savers are lending to the government at artificially low interest rates—even though the great majority of them never directly purchase a government security. One way of doing this is savers making deposits which pay very low rates of return, with banks using those very low cost deposits to purchase government debt that also pays a very low rate of return. While little remarked upon, that is exactly what has been happening on a multi-trillion dollar scale in the United States, as part of the Federal Reserve’s Quantitative Easing program.

“[…] There is nothing accidental going on here, all that is in question are the particulars of the strategies for cheating the investors, meaning the collective savers of the world. Again, the time-honored and traditional form that heavily-indebted governments use to cheat investors is to devalue the currency. Create inflation, and tax collections will rise with that inflation but the debts won’t, and meanwhile the savers of the world will be paid back in full with currency that is worth less than what was lent to the governments in the first place.” (Source: Ibid.)

This specific observation is especially important because now we finally have a connectionbetween different government narratives that, to this point, seemed disconnected and almost random. We have a government that admits to being some $17.0+ trillion in debt (not allowing for unfunded, revolving, and contingent liabilities) with no obvious way to repay that debt; and a Federal Reserve that is seemingly using tools designed to weaken the currency and thereby facilitate gradual repayment of the debt by the “hidden tax” of inflation, which, coincidentally, is a term that repeatedly pops up in the many iterations of Fedspeak as, presumably, a goal to be vigorously pursued…? (Note again that only Keynesian theory places any value on inflation in an economic eco-system. Older good-money economics—“Austrian economics” or “hard money economics”— clearly identifies inflation as a dangerous short-term fix that ultimately leads to more serious longer-term problems and, ultimately, collapse.)

“NIRP”—The Sound You Make When Your Money Vanishes

Understand that the above comments were voiced when the regime was limited merely to QE, ZIRP, and clandestine gold bashing (which, as mentioned above, is itself simply another form of capital control right from the financial repression toolkit (see, for example, my recent essay, “A Different Look at the Gold Sector”).

A NIRP—negative rates, you pay the bank for the privilege of guarding your money—is not here yet, but it’s well on its way. The Fed has mentioned (threatened?) it several times, as if testing the temperature of the bathwater before drowning the baby in it. Same, astonishingly, in Canada. These guys are chomping at the bit to try out—AT TAXPAYERS’ EXPENSE—a fresh, new modality that looks great on paper, but somehow fails to pass both the “smell test” and the “would this make sense to a 5th grader?” test.

All of which, of course, begs the question, if the pension system and insurance system (both pillars of the financial world as we know it) could not function at ZIRP, how would they fare at NIRP? (See, for example, “Warning: You May Be Next: 400,000 People Just Had Their Pensions Cut By 50%: ‘Going to Happen To The Rest Of Pensions in the United States’,” Silverdoctors, February 24, 2016.)

In February 2016, The Financial Times made a yeoman effort to explain NIRP to its readers and claimed to have received the highest number of reader responses in their history. This reader response, which focused mainly on the effects of ZIRP—or, simply, a zero rate—was typical and especially articulate:

“For any human being making economic decisions, everything changes at 0%. The decision making for savers, consumers, SMEs, etc. grinds to a standstill. If you are prudent and don’t want to speculate on buying various financial assets, 0% kills any reason you may have had to take any positive action. If all you can expect to get from your efforts is to still have the same as when you started, why bother? We as humans need a positive ‘Narrative’ to get out of bed in the morning, work, take risk, etc. Risk free interest at 0% translates into a clear statement that there is no future to discount cash flows over or to believe in. If an individual cannot imagine a positive result from his/her actions, he/she prefers to do nothing. Prolonged periods of 0% rates and no positive (inflation) price movement will lead to reduced economic activity. Not exactly the stated purpose of the QE experiment. QE will go to the history books as one of the greatest mistakes in history.” (Source: “Everything Changes at Zero,” Typepad.com, February 23, 2016.)

NIRP is already in Japan. According to Zerohedge, you cannot buy a safe in Japan; they are completely sold out. The always-practical Japanese would rather store their cash at home than pay a stranger for the privilege. (Source: “Safes Sold Out in Japan,” Zerohedge, February 22, 2016.)

Financial analyst Rob Kirby in a recent interview actually joked about the very idea of a NIRP, calling the name an outright lie: “Of course, the average borrower will never see a negative rate, no bank is going to pay you to take a mortgage, it’s the savers who are going to suffer!” (Source: “The Failure of Fiat Money,” Silverdoctors, February 24, 2016.)

Wait, it gets better. While the central banks of the world are quietly going full-tilt King Canute, some editorialists are starting to wonder if, prior to adopting the central bank system (see my essay, “Who Owns the Fed?”), governments should perhaps have first adopted a failsafe? Something similar perhaps to Asimov’s “First Rule of Robotics,” in order to protect themselves against just the situation we are now in? (The First Rule of Robotics, or AI, is that under no circumstances should your human creators ever be harmed. Presumably, governments should have placed similar constraints on their central planners before the latter woke up one morning and realized they had more in common with each other, and their banking pals, than they did with the citizens of the very countries they were supposed to serve…?)

What a Tangled Web We Weave…

Another problem with a financial repression regime is that once started, there is no “off” button. The governments and their cronies must keep tweaking the formula until the citizenry learns, one way or another, to obey.

For example, in January 2016, the U.S. Federal Reserve proposed a new set of margin rules for trading financial instruments. Most commentators missed the import of these new rules, but Daniel Amerman found a hidden, strategic, underlying purpose, which he explained as follows:

“[…] The key loophole is that when (their own) U.S. Treasury obligations and agency securities are used as the collateral, the borrower will be immune from the new margin regulations. This then creates a split market, with two kinds of secured financings. For those who own Treasuries and agencies and use them as collateral, they are not subject to the planned new rules. According to the US Office of Financial Research, about two thirds of the collateral currently being used is Treasuries and agencies, so this will be true for most of the current market borrowers. For the remaining one third of borrowers, however, there is a potentially substantial increase in risk. The dangers are those of liquidity and market risk. If the Fed increases margin requirements in order to pull leverage from the system, then more or less by definition, that action creates a liquidity crunch for borrowers who were not invested in Treasuries and agencies.”

What Amerman has done is to identify a seemingly innocent-looking change in Federal Reserve regulations—one that initially looks like all it wants to do is pull liquidity from the system—and re-classify it as part of the overall financial repression toolkit.

According again to Mises.org, financial repression is most effective when combined with some form of “capital controls” or mechanisms that limit what the average citizen can freely do with his or her own capital.

Indirectly, Amerman says, these proposed regulations will place a burden on all trades not involving government debt. To avoid that burden, traders are being herded, like sheep, to create ever-broadening demand for government debt even at the currently low yields. Amerman classifies this approach as yet another form of capital control, in this case one designed to condition larger players to continually absorb and trade U.S. debt, even as sovereign nations from other parts of the world are divesting it as fast as they can. (Sources: “New Margin Rules Force Investors into Treasuries,” DanielAmerman.com, last accessed January 24, 2016; “China, Russia, Norway, Brazil, Taiwan Dump US Treasuries..,” Wolfstreet, October 8, 2015.)

A World Where the Inmates Now Run the Asylum…

Other commentators examining the Fed’s policies have come to essentially the same conclusion as Amerman. Bill Bonner, the prolific American author and journalist, is especially articulate in his critique of how this drama is playing out:

“[…] (the so-called) the ‘era of price stability’ under the Fed…their inflation targeting theory is not only completely bereft of theoretical and empirical support, it is in fact plainly contradicted by both theory and the empirical studies that do exist, some of which have been undertaken by the Fed’s own economists! In short, it is complete hokum… Interest rates by Fed diktat, for example, send completely phony signals, since they disguise the true cost of credit. The theory goes that low interest rates motivate people to borrow and spend. But where’s the evidence? … There’s a reality, as well as a myth. Reality is that resources are limited. Prices tell us what we’ve got to work with. Falsify prices and you get errors of omission and commission. After a while, the system suffers from things it ‘shouldna, oughtna’ done. As Hjalmar Schacht, Germany’s minister of economics in the 1930s, put it: ‘I don’t want a low rate. I don’t want a high rate. I want a true rate’.” (Source: “The End is Nigh – Bill Bonner,” Zerohedge, January 23, 2016.)

The bottom line? The experts are telling us that what initially seemed like a clever short-term solution (to a problem that, arguably, the central planners themselves created!) is anything but.

They suggest that QE—and its upcoming wicked stepsister, NIRP—are merely individual tools in a much larger arsenal of devices and methodologies that have been shown over time to have one single primary goal—bailing out profligate governments at the expense of the unwary taxpayer.

And one very specific, hi-probability result: financial catastrophe and the end of our financial world and standard of living as we know it.

Just like the 12th Century story of King Canute who, as lord of his realm (Denmark, England, Norway, and parts of Sweden), determined that his power was so great he could sit by the shore and order the tide not to come in—no, the tide didn’t pay any attention—today’s masters of our economic universe are convinced they, too, can abolish cycles and bend the world to their will.

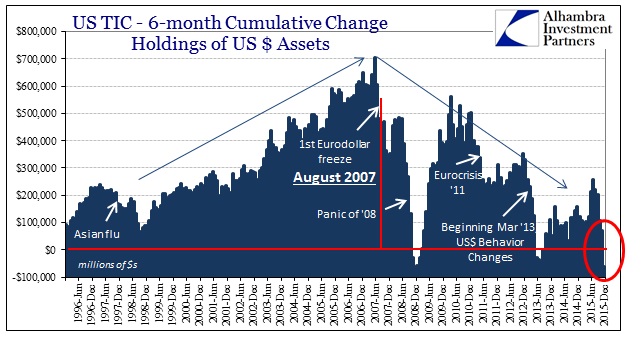

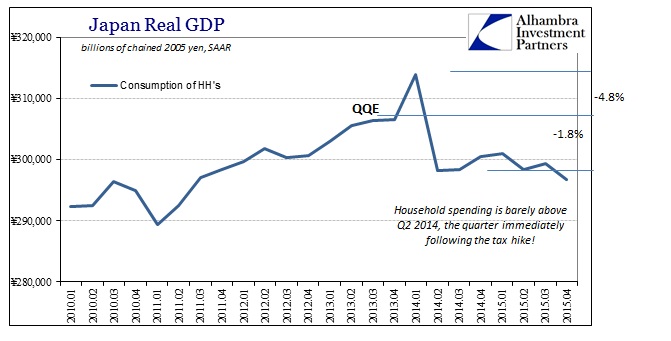

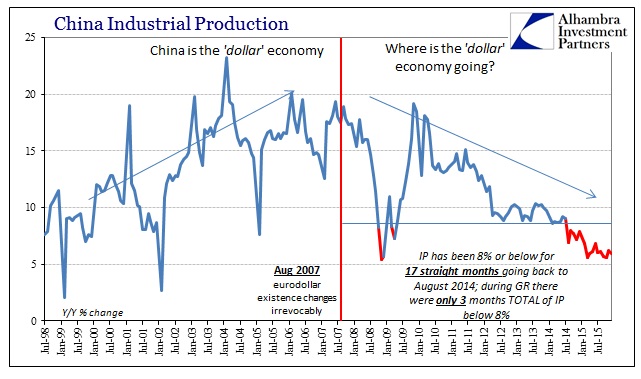

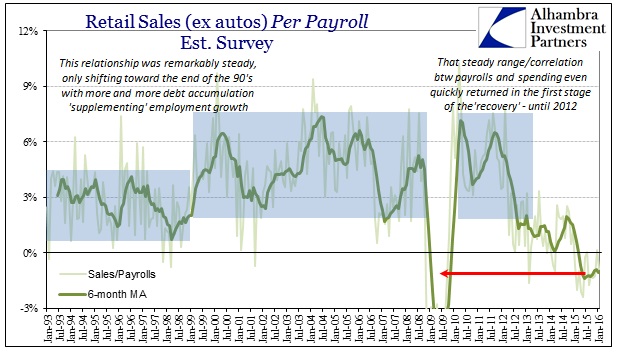

03/11/2016 - Jeffrey Snider: US$ STRENGTH IS A MANIFESTATION OF A US$ SHORTAGE

03/11/2016 - Jeffrey Snider: US$ STRENGTH IS A MANIFESTATION OF A US$ SHORTAGE

Over the last century, the central planners who run our world have not only made a mess by their constant interference, but they have made a mess that can only end one way—in total

Over the last century, the central planners who run our world have not only made a mess by their constant interference, but they have made a mess that can only end one way—in total