– Yra Harris

LINK HERE to the commentary

10/16/2016 - Yra Harris: Global Politics Will Keep Volatility Elevated

10/16/2016 - Yra Harris: Global Politics Will Keep Volatility Elevated

10/14/2016 - New SEC Regulatory 270-2a-7 Has Pushed Nearly $1T Prime Money Markets into Government Funds, Treasuries & Agencies

10/14/2016 - New SEC Regulatory 270-2a-7 Has Pushed Nearly $1T Prime Money Markets into Government Funds, Treasuries & Agencies

The SEC’s 2a-7 money fund reform adopted in 2014 has now gone into affect.

REGULATORY “REFORM”

The intent of the regulation according to the SEC’s final ruling was to prevent the sort of chaos that hit the money market after Lehman Brothers Holdings Inc.’s 2008 bankruptcy.

GOAL

RESULT

Nearly $1 trillion in assets have rotated out of prime money markets into government funds. – ZeroHedge

According to the WSJ, the new money-market fund rules “have made life more difficult for corporate treasurers and chief financial officers” because they face a sometimes unfamiliar array of investment options as they seek both to preserve and earn some return on their collective trillions.

SEC’s changes make it possible for some money funds to lose value, limit redemptions, undermining their appeal – WSJ

LIBOR rates are now through the roof, to the highest level since the financial crisis, with consequences that have yet to be determined.

10/14/2016 - The Roundtable Insight: Uli Kortsch On Infrastructure Without Debt

10/14/2016 - The Roundtable Insight: Uli Kortsch On Infrastructure Without Debt

Hedge Fund manager Erik Townsend of Macro Voices is joined by Uli Kortsch in discussing his project Infrastructure Without Debt and the ways it will impact the current banking system.

Uli Kortsch is the Founder of both the Monetary Trust Initiative (MTI) and Global Partners Investments (GPI). Currently most of his time is spent on MTI whose mission is to bring transparency and authentic principles to our monetary system. He was asked to organize a conference on this topic at the Federal Reserve Bank in Philadelphia, the proceeds of which are now published as a book. He is a regular speaker at various conferences in different countries.

As President of Global Partners Investments and other ventures Mr. Kortsch has worked in over 50 countries, written a bill for Congress, and conferred with approximately 15 national presidents, ministers of finance, and ministers of commerce. He has served on numerous corporate boards with both for-profit and not-for-profit organizations.

INFRASTRUCTURE WITHOUT DEBT

The average infrastructure cost is twice the principle amount. The moment you talk infrastructure without debt, you’re saving 50% of all our infrastructure debt.

Right now most people think all of our money is created by private banks, when it’s actually created through deposit creation. If you sign a contract with the bank, that’s an asset to the bank that deposits into your account. The money was created out of nothing. We call that deposit creation, and that’s where our money comes from. If you were charged an interest rate, that interest payment is income for the bank, but the principle is destroyed. It did not exist at the beginning of the loan, and it does not exist when the loan is paid off.

That means in order to have price stability, as our overall production increases then the amount of money in circulation must also increase. And the only way that can increase is through more debt. So we’re constantly increasing the debt load. The US debt load ends up as part of the global debt load of all those who use US dollars. This is a very slow, long term process. Slowly we get to the level where this is not possible. It isn’t just that the government runs deficits, it’s the structure of our whole economy.

WAYS TO SOLVE

One of the way of solving this is to change who gets the seigniorage on the creation of that money. Today the indirect seigniorage goes to the bank, and they use it to charge you interest. People think that banks intermediate funds by moving funds from savers to investors and that the money moves in a circle. Long term, this will result in a crash. Short term, there are ways of solving that. President Lincoln used US notes to pay for the civil war and build infrastructure. It’s Treasury money deposited in the Federal Reserve bank with no interest rate, and the seigniorage goes to us as taxpayers. And that is infrastructure without debt.

Essentially it’s the creation of new Federal notes as opposed to Federal Reserve notes, which could be used to purchase infrastructure.

We are living in a temporary period of time where this could be done easily, because other than asset inflation we do not see much consumer inflation. We live in a time where this would work really well. The Federal government should create Federal Treasury money without the debt created when the Federal Reserve is used as an intermediary.

WHY INFRASTRUCTURE WITHOUT DEBT?

Private banks should not have the ability to create money. That should be taken away from them and given back to the government, so the amount of money created is equivalent to the increase in production. The current disinflationary state we’re in allows for temporary steps, and this has been done before multiple times over the course of history. Guernsey, for 200 years, has also used this method and the results have been spectacular.

No inflation has been triggered by this, though there was a strong inflationary during the 1870s and 1880s, but that had to do more with the terms of trade with the gold-based rest of the world. Because they do not create debt, there is no such thing as equity accounting in government accounts.

POSSIBLE DANGERS

What if this keeps going? This is a nuclear option and can be abused. The assumption is that the banks won’t be allowed to create money anymore, which takes the inflationary part out of this because the price stability portion is locked in. Part of the control is that it should never be 100%. So the US Federal government makes very few decisions about infrastructures; almost all of it is made by municipalities. The funding should never be 100%.

The danger is there, we’re headed for a major crash, and at that point it would be better for the system to radically change. If we could run infrastructure without debt for a few years, people might want to change the entire banking system.

HOW DO WE CONTROL THIS?

According to the system we’re using today, the government only owes what’s on its credit card. Government saving bonds are the “credit cards” of the government, and it only owes the issuance of its Treasuries. What does it actually owe in contract that it’s signed? Here in the US, we owe $205T.

Our money supply is constantly increasing through debt. We stabilize that through interest rates and the desires of banks to lend and borrowers to borrow. We are not going to increase the money supply; we’re currently doing that through debt anyway. We’re just shifting the methodology of how that money is created; only the seigniorage will go to the taxpayers. The amount of money created is identical.

The amount of money that is created, just as it is now, is strictly dependant on our ability to produce. Instead of gold-backed, this is production-backed money. The system is self-regulating, other than the control of the money, which you hand to a deliberately separate group of people under very strict rules. The downfall is that the banks will still make money.

A POTENTIAL SYSTEM FOR THE FUTURE

Under the infrastructure without debt system, banks are divided into two windows dependant on function. There’s the depository window, which keeps your money as yours since there’s no merging of the funds. On the income and investment side, things are mutualized and equity based. During the crash of 2007*2008, mutual funds didn’t go bankrupt because they’re equity-based.

Government insurance can only protect against one bank failing, not a systemic run on the fractional reserve banking system, only a run on an individual bank. It’s nowhere near big enough to protect against a systemic run. In the US, by law, the FDIC has to hold 1.15% of the aggregated deposits.

This whole international system is running on models, and their models are the most important thing, and this should change to human well-being. We need to run our decisions based on true results, rather than what we think the model is.

Abstract by: Annie Zhou <a2zhou@ryerson.ca>

10/13/2016 - INDONESIA Forced Defensively to Aggressively Adopt Financial Repression.

10/13/2016 - INDONESIA Forced Defensively to Aggressively Adopt Financial Repression.

NOTE FROM FRA: Gordon T Long

SOURCE: 10-13-16 The Jakarta Post by PT Samuel Sekuritas Indonesia Economist – Rangga Cipta

Financial repression policy to maintain economic growth

The end of the commodity boom that peaked in 2011 has forced the government to consider more sustainable ways to cultivate economic growth. With the mining sector struggling mightily, it is easy to fathom why the manufacturing sector is now the government’s favored sector. Most of the recently released regulations aimed at supporting producers at the cost of consumers.

The end of the commodity boom that peaked in 2011 has forced the government to consider more sustainable ways to cultivate economic growth. With the mining sector struggling mightily, it is easy to fathom why the manufacturing sector is now the government’s favored sector. Most of the recently released regulations aimed at supporting producers at the cost of consumers.

With declining revenues from commodity exports, growth has been sluggish since 2011. Direct investment has become less attractive without sufficient US dollar liquidity to import capital goods.

Private consumption, contributing 55 percent to the gross domestic product (GDP), is usually the stronghold of growth, but government regulatory tendencies are repressing rather than stimulating private consumption. Government spending has been the savior of economic growth, but shrinking state revenues has reduced room for fiscal stimulus.

The budget deficit has consistently widened since 2011, forcing the government to seek alternative sources of income, ranging from tax intensification and extension to the tax amnesty program.

Even with the additional revenue from the tax amnesty program, an increase in outstanding government debt is inevitable to finance aggressive infrastructure spending. To compensate for the remaining revenue shortfall, a form of hidden taxation known better as financial repression, is already well under way.

Financial repression policies include forced lending to governments by domestic financial institutions, interest-rate caps, capital controls, macro-prudential policies and other policies that are aimed to capture and under-pay domestic savers (McKinnon 1973).

The unconventional monetary policy called Quantitative Easing of the US Federal Reserve, European Central Bank , Bank of Japan and Bank of England is also considered financial repression since the goal is to keep interest rates low and create captive domestic audiences (Reinhart 2011).

Starting in 2016, the government now requires non-bank institutions to increase the proportion of government bonds in their portfolios to at least 10-20 percent in 2016 and to 20-30 percent in 2017.

Separately, the government has also lowered various interest rates by force. This year, the micro lending rate has been squeezed down to 9 percent and is expected to be slashed further to 7 percent in 2017.

Additionally, the government has also set the maximum level of time deposit rates for certain banks to only 75-100 basis points (bps) above the 12-month policy rate (previously the Bank Indonesia rate) arguing that currently banks are enjoying too high margins.

This policy is clearly an effort to subsidize the borrower and tax both the lenders and savers, while at the same time encouraging the acquisition of more government bonds. This can also be seen as an attempt to soothe the crowding out effect resulting from the soaring public debt.

The growing middle-income segment could also provide additional strength since the bedrock of the strategy is to provide abundant cheap capital as well as labor. But again to attract foreign direct investment (FDI) and increase competitiveness at the same time, the government must maintain productivity growth running faster than inflation adjusted wage growth.

Starting this year, the government has set a legal formula for the fair amount of annual labor wage adjustment to prevent excessive increases. Labor unions are unlikely to be placated by wage increases being restrained as such so we can expect to witness more angry demonstrators on Labor Day years ahead.

To complete the export-led capital investment growth model, the government has launched numerous economic policies mostly aimed to lure FDI and boost export competitiveness. Mining sector wise, the government has set rules to discourage raw commodity exports, including minerals and crude palm oil (CPO), and is attempting to keep more resources such as coal for domestic needs. But this could mean mining producers receiving lower prices than what global markets can offer.

BI, besides maintaining foreign currency reserves in excess of US$100 billion, is also promoting tighter restrictions on international financial flow, ranging from the mandatory use of the rupiah for domestic transactions to the maximum purchase of foreign currencies. This is another clear example of financial repression. BI argues that the policy is crucial to maintain the stabilization of the rupiah.

In short, financial repression and the export-led capital investment strategy will push growth away from reliance on consumers toward producers instead. The benefits are obvious; Indonesia can escape from the curse of being reliant on natural resources while grabbing a larger share in global supply chains. FDI can more easily be attracted with Indonesia becoming a strategic and efficient production base.

But to be successful, this policy must be accompanied by a realistic long-term industrialization plan with export promotion as the main theme. China, Japan, and South Korea have taken this path and become large and efficient exporters of manufactured goods and have transformed themselves from net capital importers to exporters.

Yet some risks are unavoidable. It is important to note that financial repression goes against the law of economics by preventing adjustment of many macro variables such as interest rates, wages and exchange rates. Like the commodity based growth, this export-led capital investment growth model can easily lead to chronic economic imbalances. Global imbalances helped fuel the 1997 Asian Financial Crisis, even though it was not the initial primary cause. Grasping what went wrong in previous crises could be a good start as a precaution.

Indonesia might be tempted to utilize cheap funds provided from some countries like China and Japan that have systematically used financial repression but are now at the end of the cycle struggling to boost global demand by exporting capital.

But the government must understand the aim of these countries is to create artificial demand so trade protections must be carefully considered. We can see how aggressive Japan and China export capitals have been to Indonesia ranging in many forms from China-led Asian Infrastructure Investment Bank loans to a series of acquisition by Japanese banks.

Moreover, in most cases, a financial repressor country will support trade protection and at the same time promote an undervalued currency not only to maintain competitiveness but also as another way to discourage the demand for imported goods although this can’t be likened to import substitution-industrialization policy.

This could nourish a great systematic risk in the future considering what misery exchange rate controls can bring to Indonesia, a country with huge foreign currency liabilities. To avoid this situation in the future, the speed of how the government can raise the onshore participation in domestic financing is crucial.

______________________________

The writer is an economist at PT Samuel Sekuritas Indonesia. The views expressed are his own.

10/03/2016 - Allianz’s CIO Andreas Utermann says: Expect to Suffer a Generation of Financial Repression

10/03/2016 - Allianz’s CIO Andreas Utermann says: Expect to Suffer a Generation of Financial Repression

Andreas Utermann, Allianz’s Global CIO was commended recently by Tom Keene on Bloomberg’s Surveillance for willing to even mention Financial Repression on a public broadcast, a subject it appears that is frowned upon in polite, well connected Wall Street circles.

What comes out in this short video interview by Bloomberg is that Allianz’s CIO expects Financial Repression to be around for the next generation. It simply isn’t about a few more years but rather about the next generation learning to live with it.

“It isn’t a question of years but about generations!”

He firmly believes it has become quite evident that the current policy targets aimed at increasing inflation to 2% are not working. Policy makers just don’t know how to solve the problem. However, this will not stop the Macroprudential policies of Financial Repression.

Maybe most significant in the Bloomberg interview is that Utermann is willing to state publicly that he believes the Federal Reserve is intentionally behind the curve. The Fed want’s rates to rise behind increasing rates of inflation.

The Federal Reserve is intentionally behind the curve.

Because of Financial Repression the Fed want’s rates to rise behind increasing rates of inflation.

Listen to how Allianz believes you solve today’s yield problem …

Utermann: Suffering a Generation of Financial Repression

Andreas Utermann, global chief investment officer at Allianz Global Investors, discusses the factors holding back global central banks from normalizing interest rates, differing economic philosophies in the Eurozone, and dealing with chronic financial repression. He speaks on “Bloomberg Surveillance.”

09/30/2016 - The Roundtable Insight: Macleod, Stoeferle, Boockvar, Townsend On Central Bank Effects

09/30/2016 - The Roundtable Insight: Macleod, Stoeferle, Boockvar, Townsend On Central Bank Effects

Hedge Fund manager Erik Townsend of Macro Voices is joined by Alasdair Macleod, Ronald Stoeferle, and Peter Boockvar in discussing the effects of central bank policy on global markets, along with debating the option of investing in gold versus mining stocks.

Alasdair Macleod writes for Goldmoney. He has been a celebrated stockbroker and Member of the London Stock Exchange for over four decades. His experience encompasses equity and bond markets, fund management, corporate finance and investment strategy.

Ronald is a managing partner and investment manager of Incrementum AG. Together with Mark Valek, he manages a global macro fund which is based on the principles of the Austrian School of Economics. Previously he worked seven years for Vienna-based Erste Group Bank where he began writing extensive reports on gold and oil. His benchmark reports called ‘In GOLD we TRUST’ drew international coverage on CNBC, Bloomberg, the Wall Street Journal and the Financial Times. Next to his work at Incrementum he is a lecturing member of the Institute of Value based Economics and lecturer at the Academy of the Vienna Stock Exchange.

Prior to joining The Lindsey Group, Peter spent a brief time at Omega Advisors, a New York based hedge fund, as a macro analyst and portfolio manager. Before this, he was an employee and partner at Miller Tabak + Co for 18 years where he was recently the equity strategist and a portfolio manager with Miller Tabak Advisors. He joined Donaldson, Lufkin and Jenrette in 1992 in their corporate bond research department as a junior analyst. He is also president of OCLI, LLC and OCLI2, LLC, farmland real estate investment funds. He is a CNBC contributor and appears regularly on their network. Peter graduated Magna Cum Laude with a B.B.A. in Finance from George Washington University.

EFFECT OF US PRESIDENCY ON GLOBAL MARKETS

Trump has managed to appeal to the disaffected masses, so we have very little clue how he’ll perform if elected president. The possibility he’ll win is higher than the polls and media discount, as the public seems to be disgusted with the political establishment and want change. But regardless of who the next president is, in the early part of their term they’re going to preside over a recession. Both will face the same challenges. Central banks have manhandled markets over the past eight years, and will still be the deciding factor.

Trump has set up a situation where if it looks like he’s going to be elected, markets will tank. And Hilary will keep things at the status quo, where the government and policies are still for sale to Wall Street through bribe money in the form of political campaign contributions.

FED POLICY AND A BEAR MARKET IN BONDS

Increasingly the central banks are trying to stop a bear market in bonds from materializing. If you look at central banks in Europe, some of them are overloaded with sovereign debt. If you get a substantial bear market in sovereign debt, those banks basically go under. 2017 is going to see an acceleration in price inflation, to the point where the Fed and other central banks are going to have to raise interest rates, but they can’t do that without breaking the system.

Price inflation will be a concern going forward. Gold is a good signal regarding future price inflation, and the price is rising in every currency now. Most people forget that in 2011 in the US had CPI rates at 4.5%, and last year oil prices started to collapse. Therefore the base effect will be kicking in in the next four months.

Four months ago the 40-year JGB yield touched 7 basis points. Within two months that was 67 basis points. The Bank of Japan acknowledged that they were doing major damage to their banking system and therefore needed a steeper yield curve. For the first time a central bank is acknowledging the limits of their policy, and a bond market is fighting against that. This is all combining for a possible mix that’ll be negative for global bond markets, and any asset that is priced off low interest rates, particularly equities.

US Dollar LIBOR has been ticking up, well above the Fed rates. If you look at the LIBOR rate and tie it in with the increase in bank lending, that tells us that interest rates should rise, and very soon. The market as a whole will begin to understand that the rate that matters is the free market rate measured by LIBOR.

This is getting beyond the Fed’s control. The potential for a bond market crash is very large. A banking crisis similar to 2008 would definitely be deflationary. If the US implements negative rates, then this crazy bull market in bonds could accelerate. We’re seeing a lot of recession signal right now, and if we fall into recession it’s possible that we can see even lower yields.

The game of negative interest rates is over. It’s proven to be awful policy that central banks will be embarrassed to quickly backtrack on, and for that reason the US is unlikely to go to negative interest rates.

BULLION VS MINING SHARES

If you regard gold as insurance or money, owning mines is a speculation. Anyone investing in gold mines has to understand that there are risks you don’t have in bullion itself. Overall the bear market was pretty positive for the sector. It’s a highly volatile sector, so it might not be suitable for every investor – you have to live with the volatility and enormous political risk.

The gold bull market in the beginning part of the bull market should outperform the underlying, but as the gold bull market matures and prices get higher, it’s probably best to switch from mining to bullion. But for now, miners should outperform the underlying.

Abstract by: Annie Zhou <a2zhou@ryerson.ca>

LINK HERE to listen to or to download the MP3

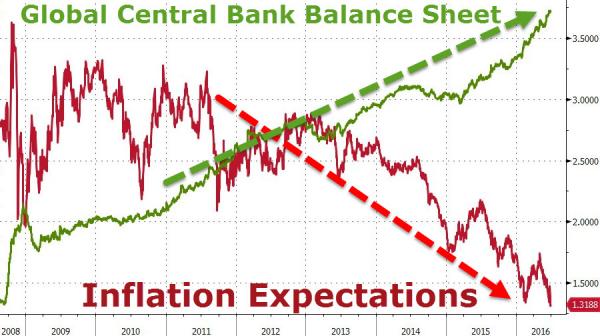

09/28/2016 - CHART: Why the Central Banks must minimally print $200B/Mo.

09/28/2016 - CHART: Why the Central Banks must minimally print $200B/Mo. 09/28/2016 - FINANCIAL REPRESSION & A CHRONIC UNEMPLOYMENT PROBLEM

09/28/2016 - FINANCIAL REPRESSION & A CHRONIC UNEMPLOYMENT PROBLEM

What is little appreciated today is that the Humphrey Hawkins Full Employment Act in 1978 assisted in “birthing” Financial Repression and placing us firmly on the Monetary policy path the Federal Reserve is presently imprisoned by.

Deep State planners fully understood then that employment would become an increasingly larger problem in America and within the developed nations as leveraged buyouts with immediate “downsizing”, “rightsizing” and “outsourcing” were beginning to dominate the financial engineering game of the day.

Driven by the political concerns in the late 1970s about rising unemployment, the Humphrey-Hawkins legislation in 1978 fundamentally compelled the U.S. central bank to drive interest rates progressively lower (see chart below).

Casual observers of the Fed speak of a “dual mandate” for U.S. monetary policy incorporating full employment and price stability, but careful reading of the Humphrey-Hawkins law shows that the former is paramount and must be satisfied by the Fed before price stability may be considered. Federal Reserve chairs have followed the single mandate of full employment to its logical conclusion, namely zero interest rates and the expropriation of private income.

With the peak in nominal rates in the late 1970’s the Fed switched priorities and became focused on the single mandate of full employment. This policy fixation on targeting at least nominal employment had significant costs, including a steady level of underlying inflation that has slowly undermined consumer purchasing power (thus, today’s discussion of “income inequality”). The single mandate of full employment also facilitated periodic financial bubbles and crises resulting from the manic swings in Fed policy.

WHAT THEN FOLLOWED

I found the remarks presented by Christopher Whalen of Kroll Bond Rating Agency (KBRA), at the Central Banking Series sponsored by the Global Interdependence Center in Dublin, Ireland and Madrid, Spain, September 29 and October 3, 2016 to be particularly supportive of the Financial Repression Authority’s position. As Chris Whalen highlights in Navigating an Uncertain Global Economy in the Age of Financial Repression, Financial Repression has fostered deflation and crippled income growth.

Central to any new approach to monetary policy must be the realization that the secular decline of interest rates, which is the centerpiece of financial repression, necessarily also drives deflation. Today, the Federal Open Market Committee frets over whether to raise the benchmark rates for federal funds and bank reserves a mere quarter of a percentage point. Yet anyone looking at the bond markets and, in particular, at bond credit spreads knows that there is not yet sufficient demand for credit to justify an increase in interest rates. Without a sustained increase in the yield on investment assets, the world faces a protracted period of low or no growth and the eventual destruction of public and private financial institutions that depend upon investment returns.

Just as many organizations used to rely upon the returns on investments to bolster profitability in particular, today the global economy is suffering from a diminution of income as a result of more than 30 years of financial repression. The trillions of dollars annually that is transferred from private organizations and individuals to public sector institutions via negative interest rates and quantitative easing (QE) ranks among the most regressive, anti-growth policies ever witnessed in peacetime.

….

Since the 2008 financial crisis, global growth has slowed and the overall level of debt has grown. Individuals in many nations have made an attempt to reduce their level of indebtedness, but in aggregate since 2008 nations have gone on a debt-fueled spending binge encouraged by the fact that the cost of servicing public sector debt has fallen. Open market purchases of public and private debt have been employed by global central banks to push interest rates down to zero or lower, this in an overt effort to stimulate asset prices, shift investor risk preferences, and thereby, it is hoped, stoke higher levels of aggregate demand.

Stepping back, we can see that in 20th century America, credit has been used to increase sales as opposed to forcing consumers to save sufficient cash to purchase an automobile or home in the future.

The judicious use of credit increased demand for goods and services, and employment. Today, however, the policy of using ever cheaper credit to pull tomorrow’s demand into the present day seemingly has lost its efficacy. With most nation-states unwilling or unable to use fiscal expansion to stoke short-term demand, global central banks acting alone have been asked to somehow address the burdens of global over-capacity, excessive debt, rising unemployment and slack consumer demand – simply an impossible feat!

THE ROADMAP OF HOW FINANCIAL REPRESSION WAS FURTHER SUSTAINED VIA REGULATORY LEGISLATION

09/28/2016 - McAlvany Financial: Negative Interest Rates & Cash Control To Address Debt

09/28/2016 - McAlvany Financial: Negative Interest Rates & Cash Control To Address Debt

McAlvany Financial .. Negative interest rates and cash control seen as best way to slough off debt over to you .. Who’s the Patsy?—If you don’t know it’s probably YOU .. TRUMP Terrifies the Establishment…Proof?…Bush Sr. supports Hillary! .. 48 minutes

09/25/2016 - The Roundtable Insight: Erik Townsend & Mark Valek With Barry Habib – Where Are Interest Rates & Real Estate Prices Heading?

09/25/2016 - The Roundtable Insight: Erik Townsend & Mark Valek With Barry Habib – Where Are Interest Rates & Real Estate Prices Heading?

Hedge Fund manager Erik Townsend of Macro Voices is joined by Mark Valek and Barry Habib in discussing the possible consequences of the recent FOMC meeting and the likely effects on the future.

Mark, born 1980 in Moedling, Austria is Chartered Alternative Investment Analyst (CAIA) charterholder and Certified Portfolio Manager (CPM). He studied business administration and finance at the Vienna University of Economics and Business Administration. In 2002, Mark joined Raiffeisen Capital Management. He was ultimately part of the multi-asset strategies team, with total assets under management of more than EUR 5 bn. His responsibilities included fund selection of alternative investments and as well as inflation protection strategies. In this role, he was fund manager of an Inflation Protection Fund as well as fund manager of various alternative investment funds of funds. In 2014 he published a book on Austrian Investing („Österreichische Schule für Anleger – Investieren zwischen Inflation in Deflation“)

As founder and CEO of MBS Highway, Barry is also Chief Market Strategist for Residential Finance Corporation, a leading national mortgage banker. Barry has also enjoyed a long tenure as a market commentator on FOX and CNBC Networks. He can be seen presenting his Monthly Mortgage Report on “Squawk Box,” the early-morning CNBC business news show. Barry also serves as a professional speaker on the financial markets, housing, negotiation, technical trading analysis, sales training, building relationships and motivation. He is also co-creator and currently Principal Managing Director of Health Care Imaging Solutions.

WILL THERE BE ANOTHER RATE HIKE IN THIS CYCLE?

The Federal Open Market Committee announced that there will be no rate hike in September. There was initially a big spike up in everything, but most of that retraced. This tells and confirms a lot of things. We did not think the Fed was going to rate hike in September, but what they did was show us that December looks like a likely hike. Last year, they want to “get one in” before the end of the year, and they’re going to want to get one in before the end of 2016.

Of the seventeen Fed members participating, we saw that fourteen believed there would be a hike before the end of the year. It’s very likely that we’ll see a rate hike in December, which means that the equity market do similar activity to last year: as far as yields and mortgage rates go, we’ll more than likely see an improvement. Historically, every time the Fed hikes rates you see money flowing into the bond market initially.

The Fed would like to hike rates but have some problems doing it. Even if they should hike rates in December, the curve and the expected rate path by now is so flat that it could be the end of this anticipated hiking cycle.

IS THERE A CASE FOR LOWER BOND YIELDS?

We could see a US 10 Year Treasury 1% yield if we’re headed to a recession, which is at a 50% chance over the next 24 months. Outside of an event like that, it’s difficult because things have changed around the world. We broke below 0 yield, which theoretically made upside potential and capital depreciation endless and the amount of negative yield could be infinite in theory. Now we’re seeing this move back toward 0, and this means that maybe capital depreciation and downside in yield truly is limited and in absence of an event, this means yields won’t go much higher since we don’t have much inflation, but they’re going to go much lower.

In the last weeks we saw a little raise in interest rates on the long end. A blow off event is more likely, from a bond price perspective. A major bull market usually ends with a blow off. The thing that will end this bull market is inflation. The latest move in correction in long term bonds was triggered from less than expected from ECB or Bank of Japan. We need these low interest rates, and they can’t afford to decrease those. ECB will likely enhance their stimulus program after March 2017 and Bank of Japan may try to also taper down. The debt situation will prevent them from stopping these QE programs and they will have to increase once more, which could bring this blow up in Treasury or bond prices.

For the time being, it’s going to be difficult for the banks to justify pushing rates below zero because they haven’t been yielding the desired result.

BANNING CASH?

There been talk of banning cash. But it seems like a far cry. It was pretty obvious a few months ago in Europe where more and more people came out with all kinds of arguments against cash. Now they’ve gotten rid of the biggest Euro note. They will have a difficult time decreasing the cash in circulation. If you can cut the amount of outstanding debt by negative interest rates over the years, that’s a very elegant way of getting out of it.

The US is looking at the PCE at 1.6% year over year, but not the ten months in a row of the CPI being over 2%, which likely more accurately reflects real inflation.

We know the Fed is horrible at forecasting. Now you’ve got a group of Fed members that promised it’d be easy to exit QE, but now they’re saying it’s here to stay for a while.

EFFECTS OF MONETARY POLICY ON ASSET MARKETS

Lots and lots of people are saying the equity market is tremendously overvalued and we’re going to enter a recession. If one hits, the equity markets are expected to go down. In reaction, central banks will continue with their intervention policies. If it’s a big one, then equities really have to tank in nominal terms, maybe even real terms, and what could really tank is the Dollar. It’s been expecting this rate hike cycle since the last four years when they announced the tapering of the third round of QE. They were able to stop printing money and raise interest rates about 25 basis points. If this turns around, all these expectations that made the Dollar the relatively greatest currency could turn sharply.

The stock market is frothy. They have high PEs, but that’s hard compare historically at because there’s been a change in options based accounting so PEs are suppressed artificially compared to other periods of time, and record stock buybacks that make PEs look better. People are buying stocks today because they have no other choice because of yield. The stock market has a way of inflicting the most pain on the most people at the worst time. We’re probably going to see a lot of problems that it’s going to cause. It’s a matter of when, not if.

Real estate in the US has a lot of legs still. There’s high demand and very good demographics, enough to surpass Baby Boomer rates. There’s very low supply, and low rates of home ownership. We have a really strong real estate market overall, and it’s going to remain strong for years to come. Things are the same in Europe. With the negative interest rate, the middle class is flocking into real estate. These population isn’t favorable toward investing in securities, but they love real estate. Part of that is because they did well in real estate but tended to invest in securities at the wrong times. Real estate had steady increase over the last few years, which is a function of interest rates, and as long as the environment is like this the fundamentals for real estate look good. But due to the indebtedness, investors should be cautious about investing too much as this asset class which can be easily taxed.

LINK HERE to the PODCAST – MP3

Abstract by: Annie Zhou <a2zhou@ryerson.ca>

09/23/2016 - Charles Hugh Smith: The ZIRP/NIRP Gods & Their PhD Priesthood Have Failed

09/23/2016 - Charles Hugh Smith: The ZIRP/NIRP Gods & Their PhD Priesthood Have Failed

“Let’s start with the Fed Funds Rate, which the Federal Reserve has pinned near zero for years. This Zero Rate Interest Policy (ZIRP) is the god the PhD economists in the Fed and other central banks worship as the supreme force in the Universe, along with its even more severe sibling god, NIRP (negative interest rate policy), which demands that banks and depositors must pay for the privilege of holding cash .. Precisely what have ZIRP and NIRP fixed in the global economy? The short answer is ‘nothing.’ Instead of fixing what’s broken, ZIRP and NIRP have pushed a broken system further along the path of self-destruction. The priesthood’s insane obsession with forcing people to spend their savings by punishing savers with ZIRP/NIRP has failed spectacularly for a simple reason: it completely misunderstands human psychology. Now that ZIRP and NIRP have destroyed the income that was once earned on savings, the only rational response is to save more, not less, despite the priesthood’s policy of negative rates .. The priesthood is absolutely blind to another key aspect of human psychology.The policy of negative interest rates is so extreme and so destructive that it proves the priesthood and its Keynesian Cult have completely lost their way, yet their grip on power only increases. The Keynesian Cult Priesthood is not just clueless–it is forcing everyone to drink its toxic Kool-Aid. Like the crazed dictator in the Woody Allen comedy, the Keynesian Priesthood may well order us all to wear our underwear on the outside of our clothing, if they reckon that would boost ‘aggregate demand.'”

– Charles Hugh Smith*

LINK HERE to the essay

09/20/2016 - Economist Ken Rogoff: Advocates Banning Cash

09/20/2016 - Economist Ken Rogoff: Advocates Banning Cash

A Ban On Paper Currency

Rogoff’s new book The Curse of Cash proposes a ban on paper currency .. “It’s terrifying piece of work, for several reasons .. the cashless society, which Rogoff proposes in order to make it easier for the U.S. government to confiscate private wealth, in effect, amounts to an admission that Washington can’t pay back its debts.” .. even Rogoff himself admits that cash is a problem for central banks & governments to carry out their financial repression for addressing the escalating challenges of government debt: “In principle, cutting interest rates below zero ought to stimulate consumption and investment in the same way as normal monetary policy .. Unfortunately, the existence of cash gums up the works.” . the essay points out that “the fact that Rogoff, Ben Bernanke and others are proposing negative rates despite the considerable evidence that they will do no economic good suggests that they believe that the U.S. government cannot pay back its debts – that it is already insolvent.”

link here to the essay

09/20/2016 - David McAlvany: All Markets Are On Monetary Life Support

09/20/2016 - David McAlvany: All Markets Are On Monetary Life Support

Wall St For Main St .. discussion about the cashless society, war on cash, financial repression & negative interest rate policy that academic PhD Keynesian Economists & central bankers are discussing & implementing .. what negative interest rates & trying to eliminate cash means (way less freedom for everyone) & how desperate governments are now & how they will become more desperate .. 47 minutes

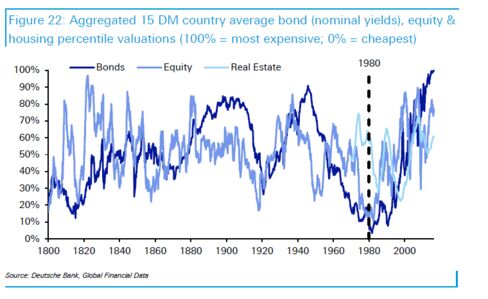

09/19/2016 - Intensifying Financial Repression as a New Global Bond Cycle Kicks Off

09/19/2016 - Intensifying Financial Repression as a New Global Bond Cycle Kicks Off

The signs abound from the current political rhetoric that trade and financial protectionism is in the wind. This is a major problem, especially with weak economic growth, central banks committed to higher inflation and stagnant (and even falling) productivity in the developed economies.

This has the potential to reverse 35 years of the “Bankers’ Bond Bonanza” and further intensify advancing Financial Repression.

Deutsche Bank Strategist Jim Reed concludes:

An oncoming lurch towards trade and financial protectionism — combined with aging populations and weak worker output — will intensify financial repression as a new multi-decade-long economic cycle kicks off this year.

……

Central bank bond-buying and stronger financial regulation in recent years, forcing financial institutions to up their domestic bond purchases, highlight how financial repression is in full swing. It’s going to get a lot worse

…….

“Maybe it will be more difficult in today’s integrated world to limit international capital flows in the same ways as after WWII (the last time Financial Repression was used to solve a US sovereign debt problem), so perhaps the cushion will come from a long period ahead of money printing and bond purchasing to ensure that there is no run on debt markets given the likely negative real returns.”

SOURCE 09-09-16 Deutsche Bank via ZeroHedge

Weak growth, higher inflation, and stagnant productivity in developed countries will roil bond investors in the decades to come, as the benign global forces that have buoyed returns on financial assets for the past 35 years stage a sharp reversal. That’s the big-picture call from Deutsche Bank AG analysts who predict an oncoming lurch towards trade and financial protectionism — combined with aging populations and weak worker output — will intensify financial repression as a new multi-decade-long economic cycle kicks off this year.

“In our opinion we’re getting closer to a binary outcome for the global economy and financial markets,” the strategists, led by Jim Reid, wrote in a report on Thursday.

Now, there’s an inflection point in the global economy that is poised to create a perfect storm for bond investors: higher inflation, and strengthening political incentives to erode high debt burdens by hitting bond holders with effective haircuts, the bank argues.

Scenario 1 – The best case

Put bluntly the best realistic scenario for financial stability in the new era is that bond holders around the world see a slow real adjusted haircut over several years, probably over at least a couple of decades. The best example of this through history was the post WWII period where government debt was at similar levels to that currently seen. Over the next 35 years this debt was successfully eroded by a long period where nominal GDP was notably above bond yields. So bond holders took a large real haircut.

Scenario 2 – The hard break

Rather than an artificial reflation and slow successful non-systemic deleveraging, there is a genuine risk of a more binary outcome where a major country (countries) see(s) a hard default on its debt taking a lot of other debt with it domestically and possibly internationally. This is probably most likely to happen via politics – especially in Europe if a country decides to leave the single currency.Under this scenario, non-core government bond markets could see huge losses as the central bank backstop bid is removed.

A slew of analysts have warned bond investors in the coming years will be hit by negative real returns, citing stretched valuations, the prospect of rising price pressures from a low base, and monetary tightening in the U.S. Yesterday, DoubleLine Capital Chief Investment Officer Jeffrey Gundlach recommended that bond investors gear up for higher inflation and higher bond yields, saying, in a webcast, “This is a big, big moment” for financial markets, citing the prospect of rising rates. Japan’s sovereign debt market is embroiled in its biggest rout in 13 years with the 10-year benchmark climbing to minus 0.025 percent on Friday (compared with minus 0.06 percent on Wednesday, after a record-low of minus 0.3 percent in July) while the German 10-year benchmark rose to minus 0.010 percent as of 8:42 a.m. in New York. The 30-year note is at its highest level since June, after the Eurpoean Central Bank downplayed the need for more stimulus on Thursday.

ECB inaction is also the catalyst that has triggered a slide in 10-year U.K. gild and U.S. Treasury prices.

The Deutsche analysts take a structural view for fixed-income prospects with a sweeping sketch of the economic landscape, drawing upon a detailed data set going centuries back that suggest current asset valuations in 15 developed markets have hit their cyclical peak, after a bull run from the 1980s onwards. Valuations for housing and bonds relative to their historic inflation-adjusted prices now look stretched. The bank calculates that’s the case for equities too, relative to nominal GDP.

Benign globalization and demographic forces have tamed inflation in recent decades fueling stunning real returns in fixed income from the 1980s, while equities, despite the higher returns on offer, saw a much smaller level of outperformance in this period.

Central bank bond-buying and stronger financial regulation in recent years, forcing financial institutions to up their domestic bond purchases, highlight how financial repression is in full swing. It’s going to get a lot worse, the analysts say, though the counterpoint from some economists is that monetary policy is appropriately calibrated to the underlying natural rate of interest and beefier regulations are designed to make the financial system safer.

The Deutsche analysts say:

“It seems the status quo can’t hold for much longer. Monetary policy can’t be used as the predominant policy tool to the exclusion of the alternatives. Inequality surely can’t continue much further without a political backlash. Globalization and perhaps free movement/immigration can’t continue in its current form without a similar such social/political response.”

They conclude:

“Maybe it will be more difficult in today’s integrated world to limit international capital flows in the same ways as after WWII, so perhaps the cushion will come from a long period ahead of money printing and bond purchasing to ensure that there is no run on debt markets given the likely negative real returns.”

While equities will likely outperform bonds in the decades to come, the bank argues that the data suggests stocks will still lag their long-term return average. Although the prospect of lower real GDP in advanced economies is bad for both financial and real-economy assets, there’s at least one quantum of solace: Real wages are likely to rise amid a decline in populations of working age, the analysts conclude.

Deutsche Bank’s warnings follow Bank of America Corp. analysts last month, who reckon that financial assets are poised to underperform real-economy assets — such as commodities and collectible items — citing high financial-market valuations, and the prospect of looser fiscal policy, trade protectionism and wealth redistribution in developed countries. The bearish prognostications are premised on one big call, of course: there will be no positive productivity shock in advanced economies in the coming decades.

09/16/2016 - Thorsten Polleit: Central Banks May Choose Helicopter Money Over Negative Rates

09/16/2016 - Thorsten Polleit: Central Banks May Choose Helicopter Money Over Negative Rates

Free market economist Thorsten Polleit sees policymakers as realizing that the policy of 0% interest rates is not working .. “Central banks are quite unlikely to abandon the idea of pushing real — that is inflation-adjusted — interest rates into the negative. What they might have in mind is allowing for “somewhat higher” nominal interest rates, accompanied by ‘somewhat higher’ inflation, making sure that real interest rates remain in, or fall into, negative territory.” .. references the Federal Reserve of San Francisco paper published on 15 August 2016 that monetary policy should rethink & possibly allow for an inflation of more than 2% … “Inflation — be it 2, 4, or more percent — doesn’t make a society better off. On the contrary. For instance, inflation corrupts economic calculation, thereby causing entrepreneurs to make the wrong decisions. The stimulus inflation initially is due to the errors which it produces .. Consider a case in which the central bank promises an inflation rate of 2 percent. After people have entered into their contracts, the central bank increases inflation to 4 percent. People will learn and expect future inflation to be 4 or even 5 percent. The central bank, if it wants to stimulate again the economy, has to bring inflation further up .. This kind of policy would ultimately lead to high or even hyperinflation — which has been observed in many countries around the world.” .. Polleit says this policy will help governments to manage their massive debt levels .. “It would be surprising if governments and their central banks will not opt at some stage for higher inflation in an attempt to escape the problems their policies and the issuance of unbacked paper money has caused in the first place. Alas, it wouldn’t be the first time in monetary history that unbacked paper money would be deliberately debased.”

LINK HERE to the essay

09/14/2016 - Carmen Reinhart: Financial Repression Requires A Captive Audience

09/14/2016 - Carmen Reinhart: Financial Repression Requires A Captive Audience

McAlvany Commentary .. The opaque transfer of wealth using negative interest & regulation .. Inflation is hidden by making the same priced potato chip bag even smaller .. Never underestimate the Government’s ability to create a “captive audience” .. about 1 hour

09/13/2016 - Tim Price: Investing In The Era Of Financial Repression

09/13/2016 - Tim Price: Investing In The Era Of Financial Repression

In his latest missive, Tim Price analyzes the “permanent portfolio” from Harry Browne .. this portfolio managed to survive the stagflationary 1970s, the crash of 1987 & even the death of communism .. “But it has been dealt a devastating blow by the financial repression of the past eight years, which has effectively dismantled two of its four pillars.” .. bonds are negative yielding & cash is targeted for being abolished .. the 2 that still make sense: “Stocks because there can be no investment rationale for owning negative-yielding bonds – and because stocks offer fractional ownership of real, productive businesses .. Gold because there is still every reason to expect further inflationism and monetary debauchery from the world’s major central banks. But nominal assets make no sense when nominal rates are the plaything of increasingly desperate policy makers, and heading inexorably below what was previously thought to be an absolute lower bound constrained at the level of zero.”

LINK HERE to the missive in PDF

09/13/2016 - Negative Interest Rates: Not Without Consequences

09/13/2016 - Negative Interest Rates: Not Without Consequences

Essay highlights the unintended negative consequences of financial repression on investors .. “An important criticism of the low-rate environment we are in is that many people who want to save their money in a bank to gain interest wind up paying the price—particularly when inflation is factored in. Instead of earning interest on their deposits, they are essentially charged money to keep it in the bank!” .. negative interest rates are making the situation worse .. “The negative rates are shrinking bank profit margins and thus, making them reluctant to lend. Many people who would normally deposit their money in the bank now simply keep their cash in safe deposit boxes or under the floorboards. The lack of interest earnings make people who are not able to invest the money elsewhere feel that they are financially disadvantaged. Many pension funds are in trouble since the safety they sought from government bonds normally held in their portfolios has not been earning any yield to speak of, and some are forecasting they will not be able to meet their obligations to pensioners in this prolonged low-rate environment. The result is a search for yield among those institutional investors, leading them to more toward risky bonds and equities. This, some observers fear, could lead to another financial market bust if the risky investments come home to roost .. we must be mindful of the macro developments engendered by unconventional central bank policies which could have unforeseen consequences for many investors.”

LINK HERE to the essay

09/06/2016 - Central Banks Are Continuing With Financial Repression

09/06/2016 - Central Banks Are Continuing With Financial Repression

“Central banks are screwed. They’re out of bullets. They know it. And they also know the rest of the world will catch on soon enough .. They’ve cut interest rates 667 times since Lehman Brothers collapsed .. They’ve also purchased $25 trillion of financial assets. That’s larger than the gross national product of the U.S. and Japan, the first and third largest economies in the world, respectively .. And through their sadistic negative interest-rate schemes, there’s now $8 trillion of negative-yielding sovereign debt. That’s 54% of all sovereign debt. And $13 trillion in negative yielding global bonds. That’s 28% of all bonds .. The markets have been flooded with historic torrents of liquidity to supposedly spur economic growth. But none of these experiments have prevented the world’s developed economies from flatlining .. Look at the numbers .. The developed economies are failing .. And even China’s world-beating economy is now sucking fumes .. Now that NIRP is destroying European banks and creating mass cash hoarders in Japan, central bankers will go for ‘helicopter money’ next .. Central bankers are simply trying to extend the credit bubble as long as they can so it doesn’t burst on their watch. They are politicians after all. They only care about naked power .. So, ladies and gentlemen, we are in the real life Matrix—billions of people hooked to feeding tubes waiting for someone to turn the lights out at night .. And all this is happening while the major economies that drive global growth get weaker each day.”

– Michael Covel

link here to the essay

09/06/2016 - How Much Of The S&P 500 Stock Index Is Due To Central Bank Stimulus?

09/06/2016 - How Much Of The S&P 500 Stock Index Is Due To Central Bank Stimulus?

Deutsche Bank’s Dominic Konstam writes over the weekend, “various Fed officials have raised the issue of financial stability in the context of the reach for yield and riskier products to make up for low rates. This is part of financial repression. The logic might be that once the Fed has normalized, elements of that reach for yield and risk would be unwound and this could lead to disruptive financial market volatility.” .. the worry is that once interest rates go up, stocks will crash .. “We can illustrate this aspect of financial repression in terms of the equity market. In the post crisis world, all assets seem closely correlated to breakevens and real rates but with varying betas. We note that the equity market recently looks very expensive even to these rates through the shift in the beta on inflation expectations – so despite low inflation expectations, equities have done even better than otherwise warranted by low real rates. This shows up as a fall in the equity risk premium and defines well the hunt for yield in a repressive financial regime. How does the decompsition of performance look visually: we can illustrate the extent to which this is unprecedented with the historical performance of the equity market. Decomposing equity returns into earnings growth, changes in P/E and changes in the risk premium shows that the bulk of equity performance is best captured by the shunt lower in equity risk premium .. Central bank policies are directly responsible for approximately 40% of the ‘value’ in the market, and any moves to undo this support could result in crash that wipes out said ERP contribution, leaving the S&P500 somewhere in the vicinity of 1,400.”

LINK HERE to the article