FRA: Hi, welcome to FRA’s Roundtable Insight .. Today we have Ronald-Peter Stoeferle. He is managing partner and investment manager at Incrementum. Together with Mark Valek, he manages a global macro fund which is based on the principles of the Austrian School of Economics. He’s also the co-publisher of In Gold we Trust report, and that is the focus of our discussion today. Welcome, Ronnie.

Ronald-Peter Stoeferle: Richard, thanks for being here again.

FRA: Great to have you. And so today we thought we’d do a focus on the report in terms of the highlights, the key messages as you see them. So just wondering about that if you want to give us a high-level broad overview?

Ronald-Peter Stoeferle: Well just to give you a quick note on the report itself, we’re publishing it for the 11th time now so I started writing the report when I was a research analyst at Erste Group in Vienna, and then I set up my own company together with some colleagues from Switzerland and Mark Valek who’s from the institutional fund management side. And what we try to do with this In Gold we Trust report is we want to deliver what we call the holistic view. So we don’t care about the annual supply demand of gold itself because we found out there are factors that are much more important for a gold price development such as opportunity costs, such as real interest rates, inflation, the debt situation. We also write about mining stocks, about the technical analysis, about the capital structure, very much based on the Austrian School. We’re writing about financial repression, the war against cash for example. We’re writing of course about Bitcoin and its advantages but also disadvantages over gold. We had a fascinating interview with Dr. Judy Shelton who is an economic advisor to Donald Trump. We’re writing quite a lot about the history of our monetary system, so as you can see it’s always quite a read, this year we had more than 160 pages. But if you don’t have a weekend or a whole vacation to spend reading the report, there’s also a compact version.

FRA: Yeah, it’s quite an international recognition with 1.2 million readers and is used extensively as a reference work for everybody in the precious metals sector.

Ronald-Peter Stoeferle: Yeah only this year, and we published it on the first of June, we had more than 1.2 million readers already. We were quoted in 60 countries all over the world from Phuket, Mali, Vietnam, of course, China, India. So we’ve got readers everywhere and it seems people are interested in the topics that we’re writing. And that makes us honestly very proud and is also good motivation to invest and dedicate so much time and energy into this publication.

FRA: Great, so let’s get started. You’ve been very kind in providing a number of slides that we will make available on the website in the write-up, so you can link to the website to download that. And we’ll also do a summary that will interweave the slides as a transcript. And so I urge all the listeners to look at that and that can form the basis of our discussion today. So you’ve got an executive summary slide that highlights the key messages if you want to start with that, that would be great.

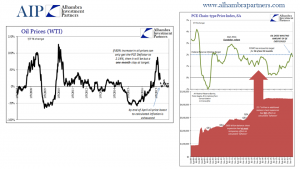

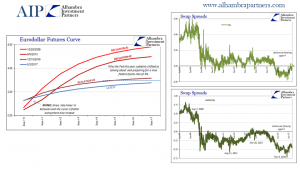

Ronald-Peter Stoeferle: Yeah of course. Well, I think even though nobody is really interested it seems in gold at the moment, I think last year we made the lows, I think we’re at the beginning of a new bull market, very early stage. Gold was up 8.5% last year and since the beginning of 2017 we’re up again, I think in dollar terms it’s slightly less than 8% now. The important thing is that we’re up in basically every currency. But nobody is really recognizing it, Mark called it once a sitting bull. It’s a bull market that nobody is recognizing, and the bull market will get going. Now the question is, what’s the trigger going to be? And from my point of view, the trigger will be a U-turn by the Federal Reserve. Once the market realizes that the emperor has no clothes, I think this will be the point when gold will really pick up momentum. And from my point of view, we’re pretty close to that. We’re seeing that inflation numbers, price inflation is way too low. So the Fed will have a hard time continuing rising rates. We’re seeing many signs that the U.S. economy is actually doing much worse than the mainstream economists see it. And therefore I think this in combination with the U.S. dollar that made its highs and that is at the beginning of a new bear market. And this is actually what Donald Trump, he says it very openly, he wants and he needs a weak dollar. He’s very very open about it, it’s no secret. So I think this is a very good combination for gold. Actually also given the fact that the sentiment at the moment is so low. So from a technical point of view, it’s interesting, yesterday marked the seasonal low in gold. So from a seasonal perspective, we’re having quite some tailwind in the next couple of months. I think the sentiment is negative and so I think from a short but also from a long-term point of view I think it’s an excellent setup.

FRA: Yeah, exactly. And I think as well that the idea that everybody has been expecting fiscal policy, fiscal stimulus policy. But it hasn’t really happened yet or not much. There was talk about infrastructure spending but it’s either been delayed or there hasn’t been much of it. So maybe monetary policy might still be the only approach by central banks and governments. Your thoughts?

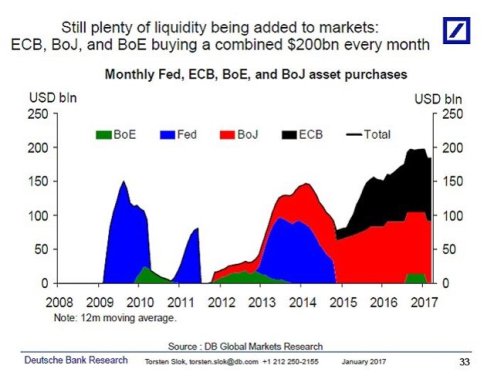

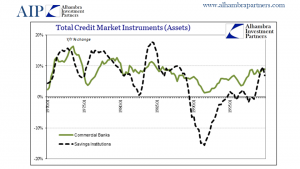

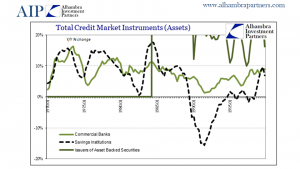

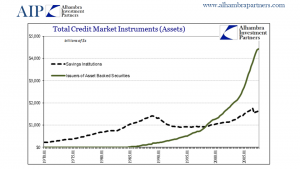

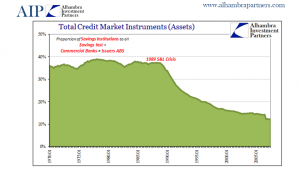

Ronald-Peter Stoeferle: Yeah I mean I was kind of wondering that. Actually last year gold had a tremendous run and then came Donald Trump. And from one point to the other, the markets change was such a big reversal. And there was so much confidence in Donald Trump, you know the reflation trade and so much hope for fiscal stimulus. But so far nothing really happened, I think it’s a complete disaster. He didn’t deliver on anything that is really important actually. So from my point of view, there will, as soon as the market or the economy gets weaker and there’s lots of signs Richard. We’ve got retail sales being very weak, we’ve got lots of numbers from the industrial sector being weak, we’ve got text receipts basically stagnating, we’ve got most importantly from my point of view credit growth for commercial loans but also for consumer credit is very very weak. And other sales of course. So from my point of view, we’re already in the downturn. So the Fed is actually tightening into the weakness as Jim Rickards always says. And therefore I think we will see this U-turn by the Federal Reserve. They will talk about lowering rates again, they will at some point consider implementing another round of QE. And believe me, 85 billion won’t be enough, it will have to be above 100 billion per month of course because there’s a declining marginal utility. And of course, as soon as the recession fears come up there will also be massive fiscal stimulus. So I think, and this is really going to be the point when gold will probably go a few hundred bucks higher within a couple of days or weeks.

FRA: In your executive summary you reference an exclusive interview with Dr. Judy Shelton, the economic advisor to Donald Trump. Can you speak to that?

Ronald-Peter Stoeferle: Yeah, it’s definitely one of the highlights of the report I would say. I’ve been following Judy Shelton for a while now, she wrote some really good books, for example Fixing the Dollar Now is a tremendous book, and A Guide to Sound Money is excellent. And I think it was really really encouraging to see that she was on the transition team of Donald Trump. Now I think many people get that wrong, she’s not like, and she said that to us, it’s not like their talking every day about implementing the gold standard. But I think that within the Trump administration there’s quite a lot of people actually knowing that many of the flaws that we are having and many many of the issues and problems are basically coming from our monetary system. So I think it was very interesting to see a speech by the vice president for example where he talked about sound money. We called the chapter in the report, we called it: Good-bye Dollar, hello gold? And we quoted Donald Trump for example quite often as well. He said, for example, I think we’ve never really heard it from a U.S. president in the last couple of decades probably, he said we used to have a very solid country because it was based on a gold standard, we don’t have the gold, other places have the gold. He said that the dollar is too strong, our companies can’t compete with them now because our currency is too strong and it’s killing us. So I think this is also one of the impressions I had after talking to Judy Shelton. I think sooner or later there will be a point in time when, probably on a weekend, there’s going to be some sort of speech by the president that the dollar will be weaker. I don’t know, 20-30% due to whatever reasons, but I think that the U.S. to succeed with this reindustrialisation, they actually will need a significantly lower and weaker U.S. dollar. And of course, on the flip side, that’s going to be a very very positive environment. And we know that this would really kick off the currency wars, because what would the Japanese do then? What would the Eurozone do then if the U.S. significantly weakened their currencies? I think they would basically imitate that and against what you value against hard assets and especially against gold.

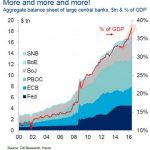

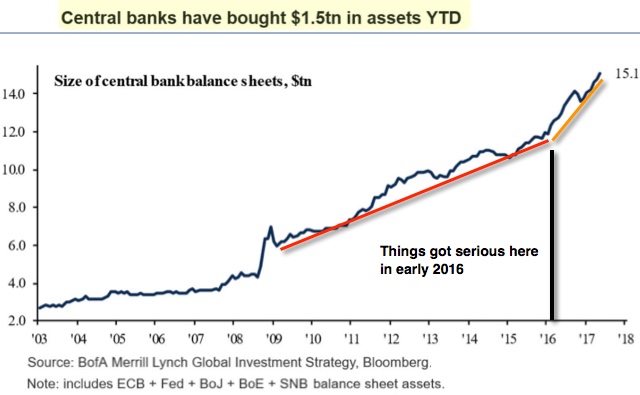

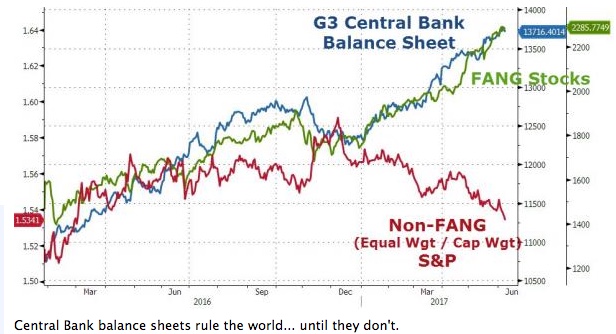

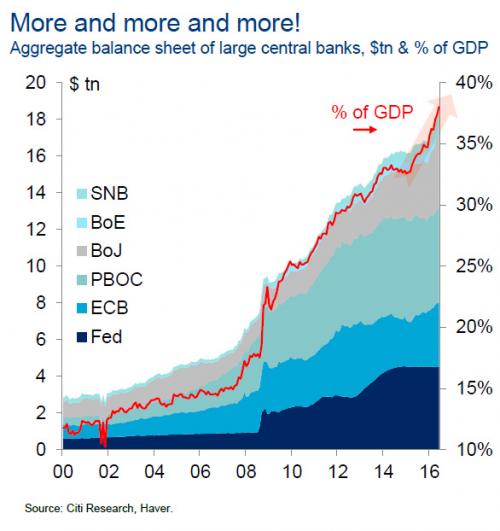

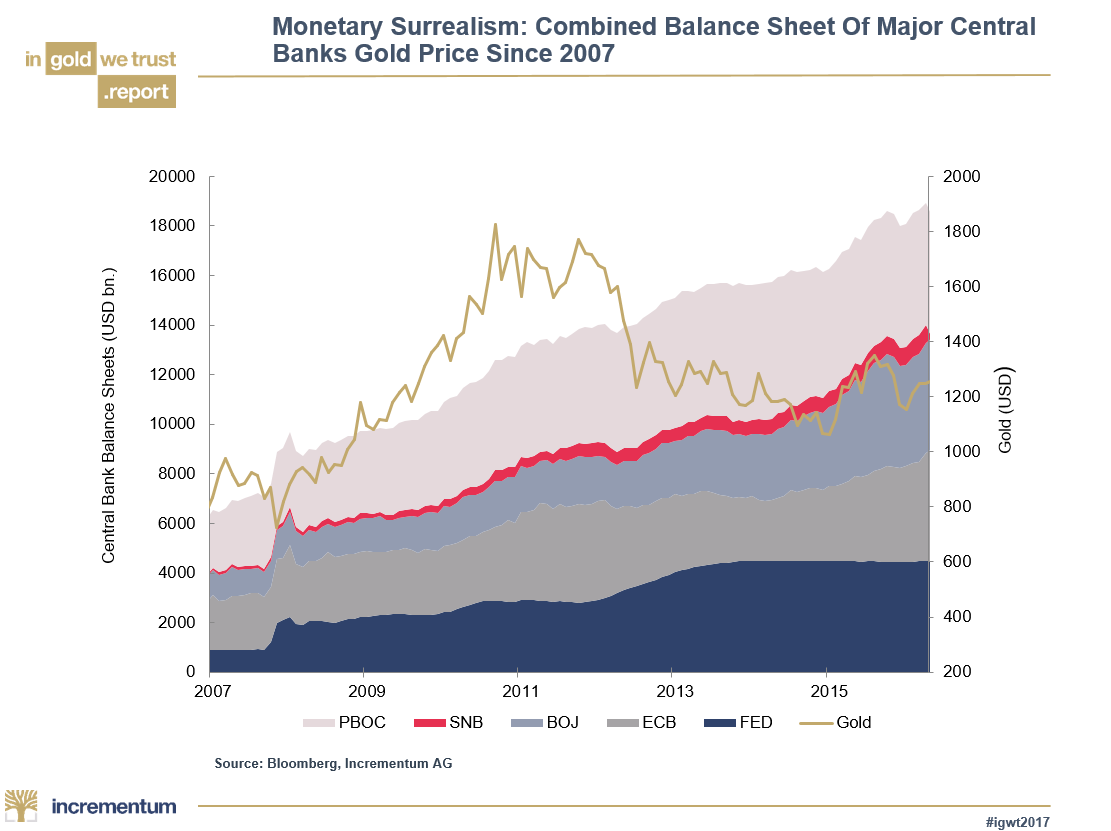

FRA: You’ve got some very interesting slides in terms of charts showing monetary surrealism, so the combined balance sheets of major central banks vs. the gold price. So it shows while the Fed has leveled off a bit, the other central banks of China, Switzerland, Japan, Europe are still increasing. Do you think there will be sort of a realignment of the gold price to that trend as there was for many years as shown on your chart?

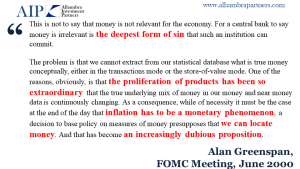

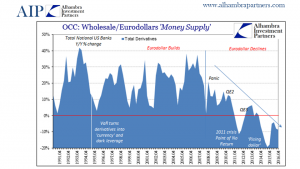

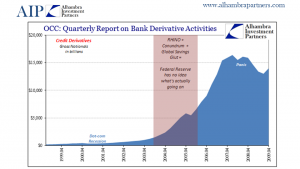

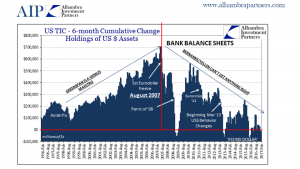

Ronald-Peter Stoeferle: Yeah, there’s a strong correlation between gold prices and the direction of the monetary aggregate, so sooner or later this will happen. We should not forget, we also got in the report that actually the gold backing of the U.S. dollar is very close to its all-time lows. So actually due to all this money printing, gold got significantly cheaper in monetary terms. And as you can see here on the chart, I mean we really crunched the numbers very thoroughly and we thought that we had miscalculated it so we double checked it. But the number is right, so the largest central banks only in the first quarter printed the amount of 1 trillion, so 1,000 billion U.S. dollars just in one quarter. And they printed it out of thin air of course, and I think therefore it’s no wonder that stocks, real estate, of course bonds are at or close to the all-time highs because of this massive monetary inflation that leads to asset price inflation. Now just to give you one perspective, or one comparison, what you could do with this 1 trillion of money printed just in one quarter, you could buy 20 Big Macs in Switzerland which is according to the Big Mac index the most expensive worldwide. You can buy for every person on earth, 20 big macs in Switzerland out of this I think 7.5 trillion people living at the moment. Perhaps a bit smarter investment would be you could buy one Ducat coin, it’s a beautiful coin from Austria which is one-tenth of an ounce of gold for every person on the planet. Just from the money that was printed in one quarter. Of course, we would recommend the ladder, buying the gold and not the big macs, but I think this gives you a perspective about this as we call it monetary surrealism. And we all know that basically, the central banks printed themselves into a corner, and they won’t get out of that because as you can see most countries really desperately need a weak currency. And as you’ve said the Federal Reserve their printing is kind of leveling off, the consequence is a very strong dollar which is obviously negative for the U.S. economy and for inflation numbers because it’s acting disinflationary or actually deflationary. So that’s some sort of a spiral that is getting out of hand, and this is a very very dangerous game, and basically a game that nobody will win.

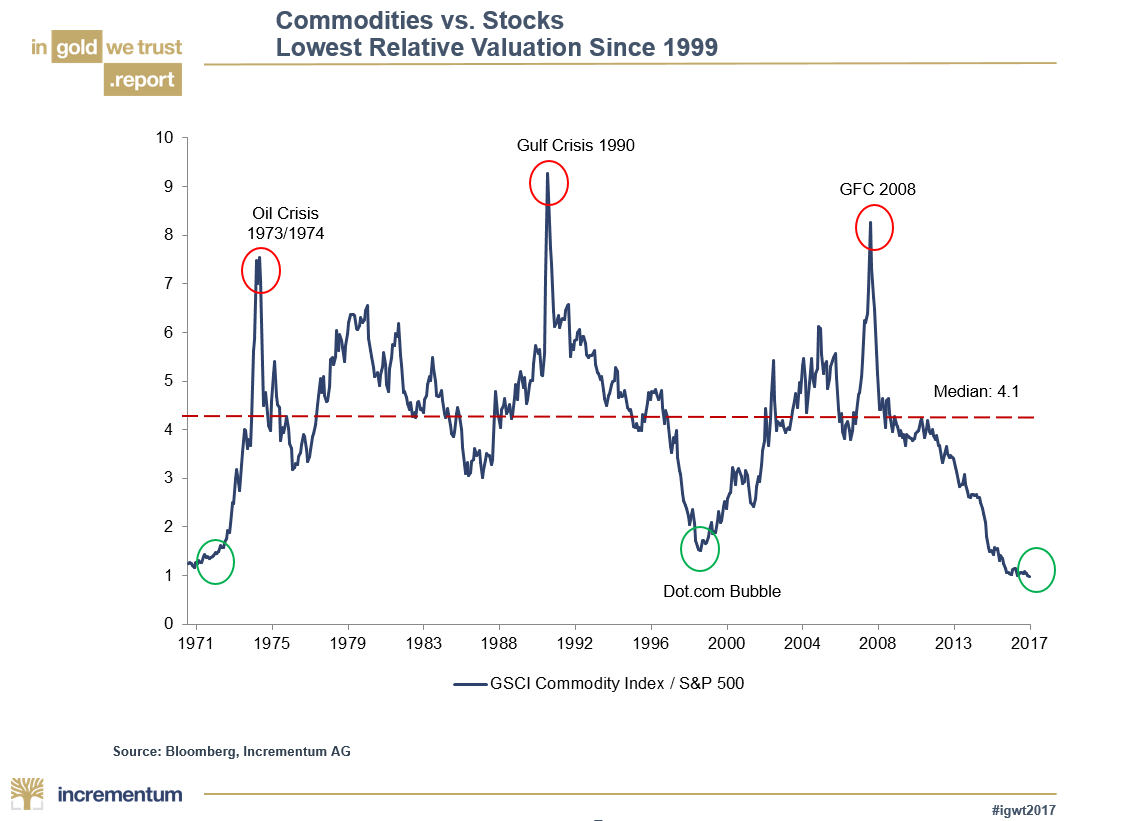

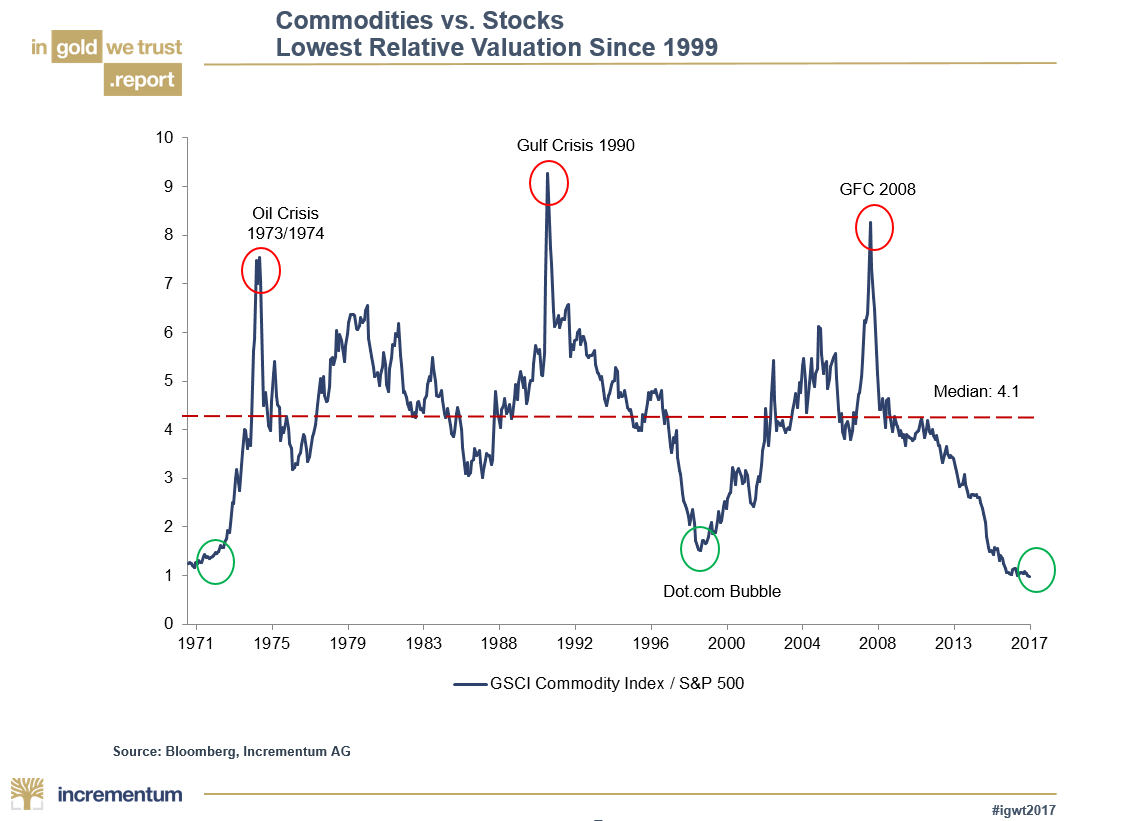

FRA: Another very interesting chart here, commodities vs. stocks lowest relative valuation since 1999. I know in the financial technical analysis world, analysts will look to commodities or gold in particular as a leading indicator for commodities. So this is an indicator that there showing a bottom for gold as well as commodities. Your thoughts?

Ronald-Peter Stoeferle: Yeah I mean I think as you know the Austrian School has got a different view when it comes to prices and it says there are no fair values and so on. So prices are always subjective and therefore for us it’s important to focus not only on absolute prices but also on relative prices because one of the most important laws in finance and in the economy is probably the mean reversion. And as you can see on this chart, commodities vs. stocks were at the lowest level, we only had that twice in history, we had that in 1971 and we had that in 2000. So on a relative basis commodities are just extremely cheap vs. stocks. Of course, that means we’re far away from the median which is 4.1, we’re far away from the highs that are between 8 and 9 in this ratio. And of course this can happen in different ways, it can mean that commodities stay stable and stocks fall off the cliff, that can happen. It can happen with stocks being stable and commodities going through the roof or it can happen in both ways, so stocks going weaker and commodities going stronger. But what I want to say is there’s probably more from a relative perspective it’s just a more obvious trade being long commodities vs. stocks and I think we should not forget that last year despite a very strong dollar, the dollar I think the dollar index made a 40 year high, something like that. But still, many many commodities were actually really strong despite the fact that the dollar was that strong as well. So I think that’s a very positive sign and also similar to gold, this is a bull market that’s in the making that’s probably very very early, and as soon as price inflation will become a topic I think people will start getting bullish on commodities again.

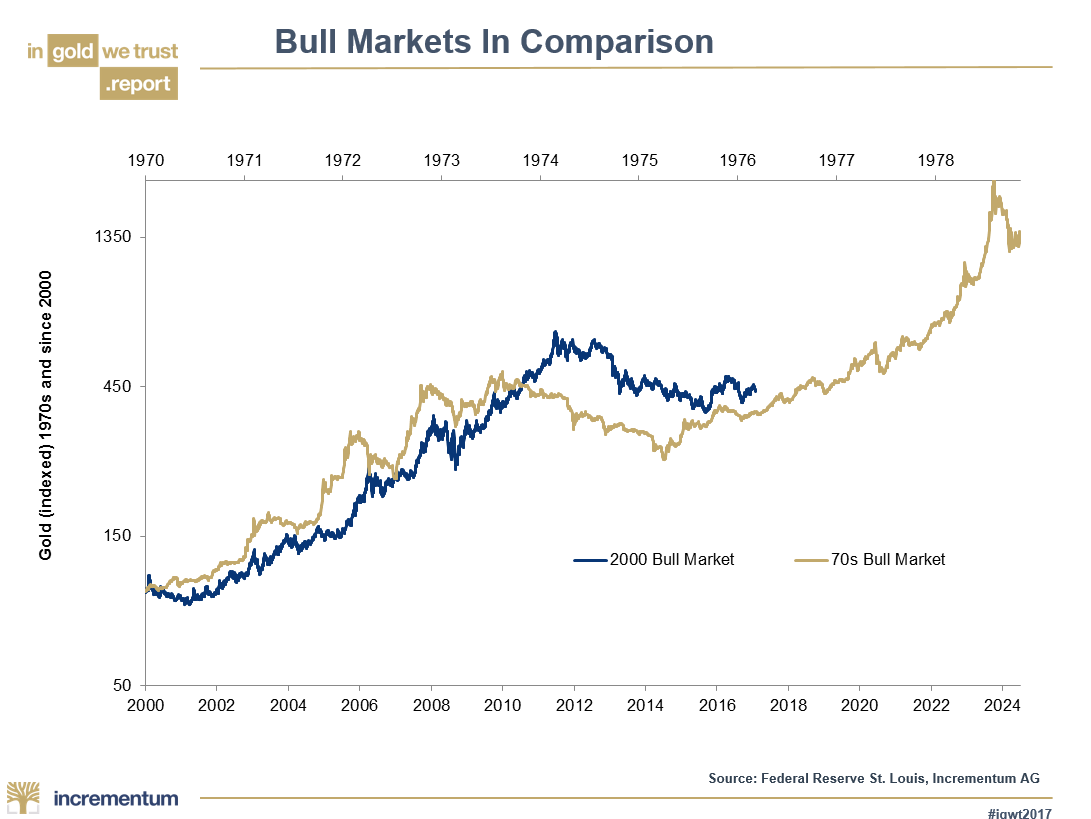

FRA: Yeah and speaking of bull markets, you have on the next slide the comparison between the 1970s gold bull market and the 2000s bull market still ongoing. Your thoughts on that?

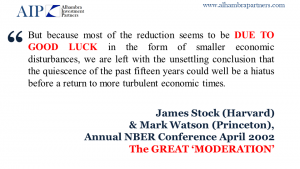

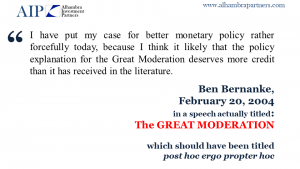

Ronald-Peter Stoeferle: Well, of course, bull and bear markets are never the same. However, there’s quite a lot of similarities and then we showed this chart already in the last couple of gold reports and what you can obviously see is that this bull market is definitely longer than the 70s bull market.

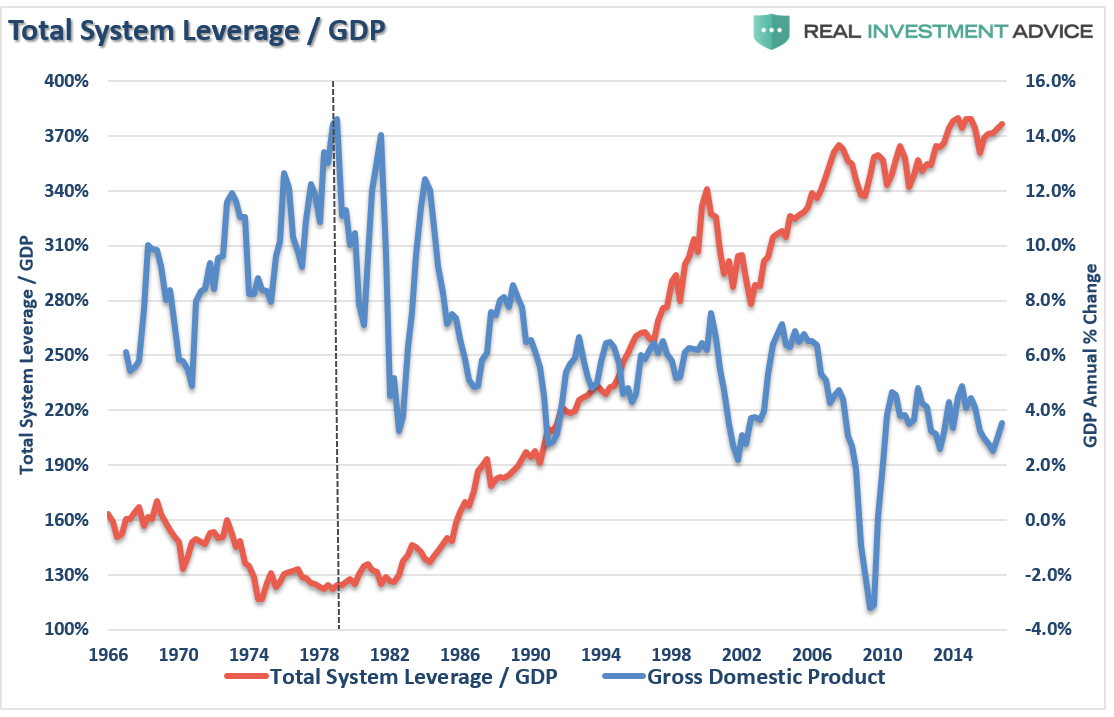

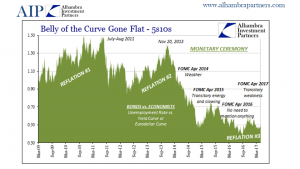

But there’s quite a lot of similarities because there was this big mid-cycle correction in the 70s from 1974-1976 when gold sold off from $200 down to $100 when disinflation was the name of the game, when everybody was gaining confidence in the U.S. economy again. And then we showed that last year there was a great article in the Wall Street Journal in I think August 1976, and you could really see the same article nowadays again. It’s just really bad bashing of gold and why it’s useless, and so we know what happened afterwards, gold went from $100 up to $850. So I think there’s quite a lot of similarities, I think in the 70s of course the big driver of gold was negative real interest rates and high inflation. And I think this is going to be the big driver going forward again because as you know we need negative real interest rates more than ever because the debt situation is getting out of control. So I’ve always said the level, as well as the direction of real interest rates, is the most important driver of gold. And if one believes that due to the debt situation we cannot afford high real interest rates again, then I think the consequence must be being bullish on gold, and that’s basically one of my main assumptions.

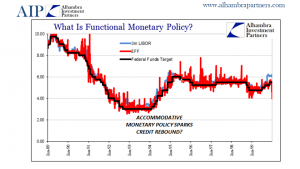

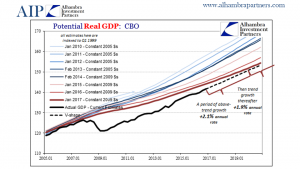

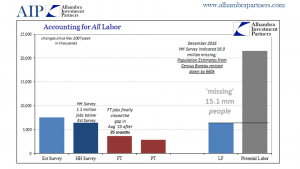

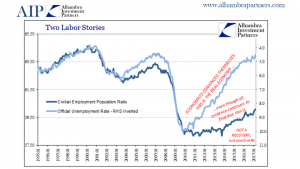

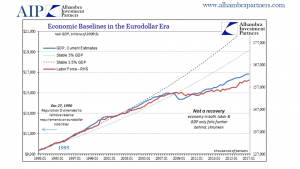

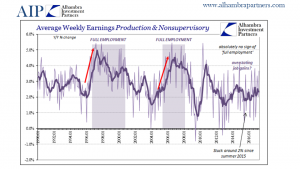

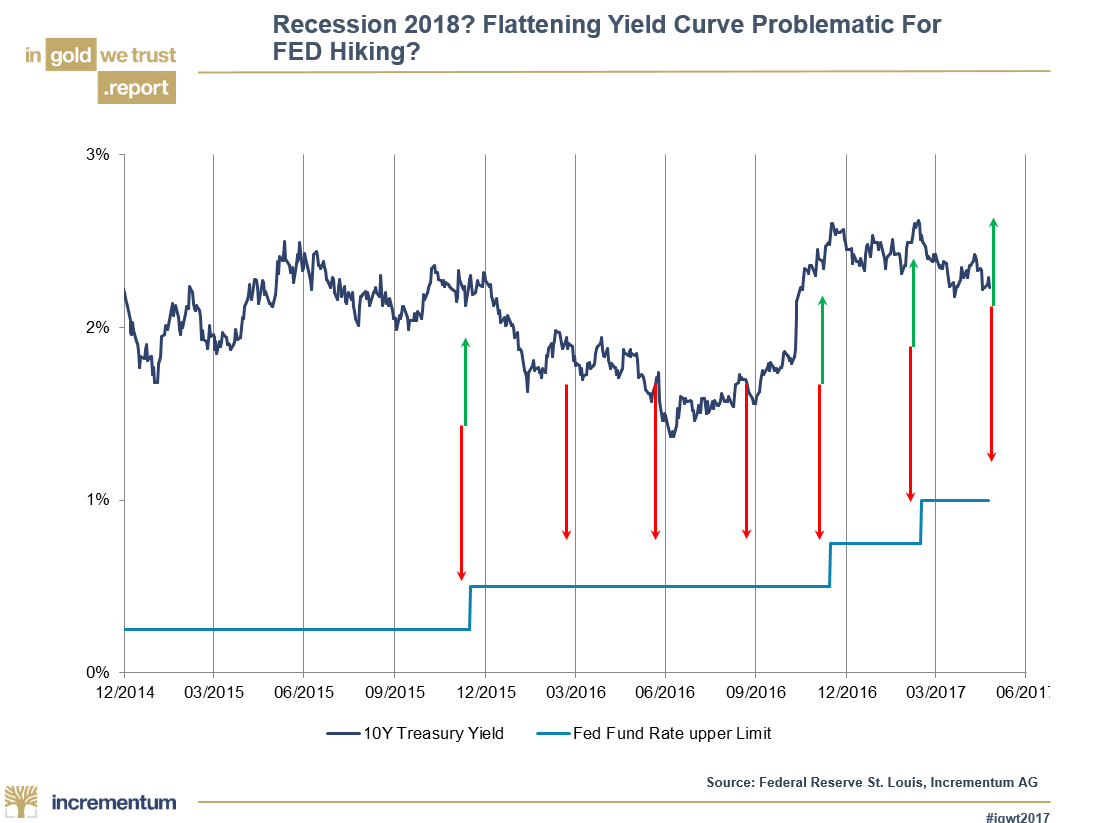

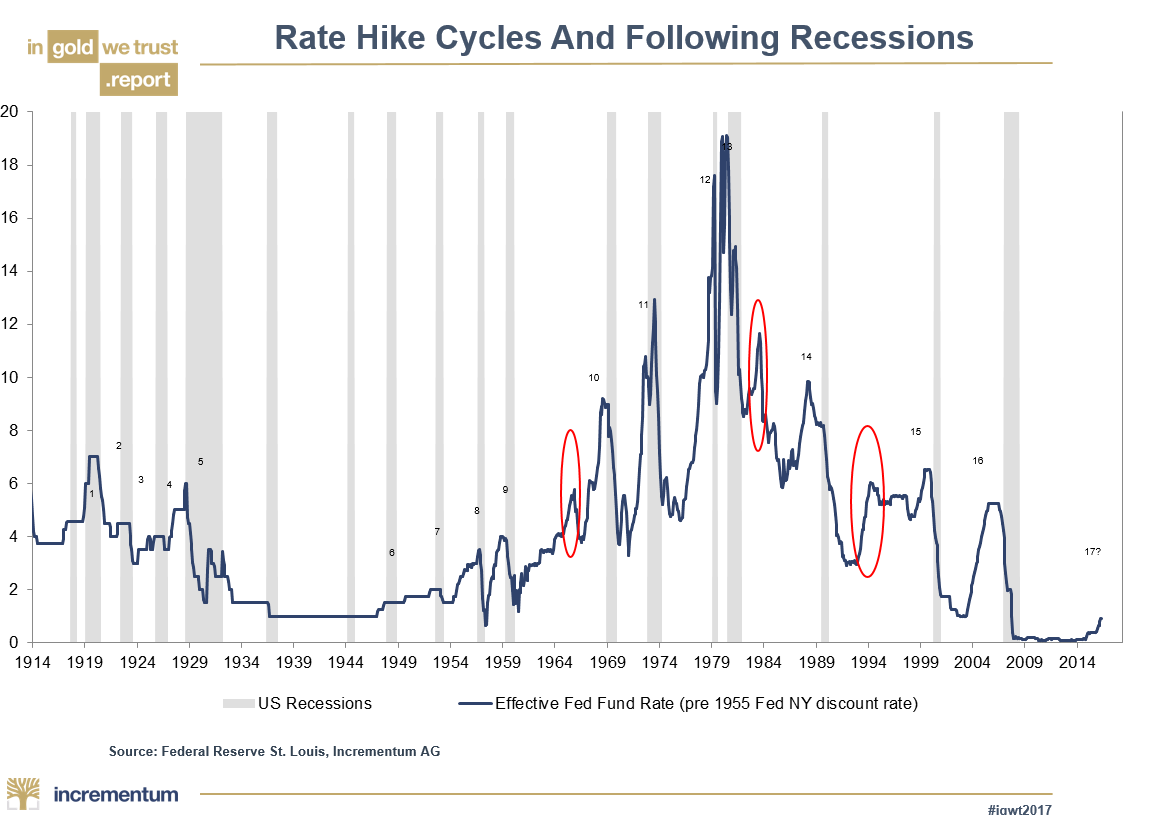

FRA: And the next few slides describe what you were talking about earlier in terms of how the Fed is becoming boxed in, the potential for a recession and the rate hike cycles, how that links with recessions. Can you provide some insight on those slides?

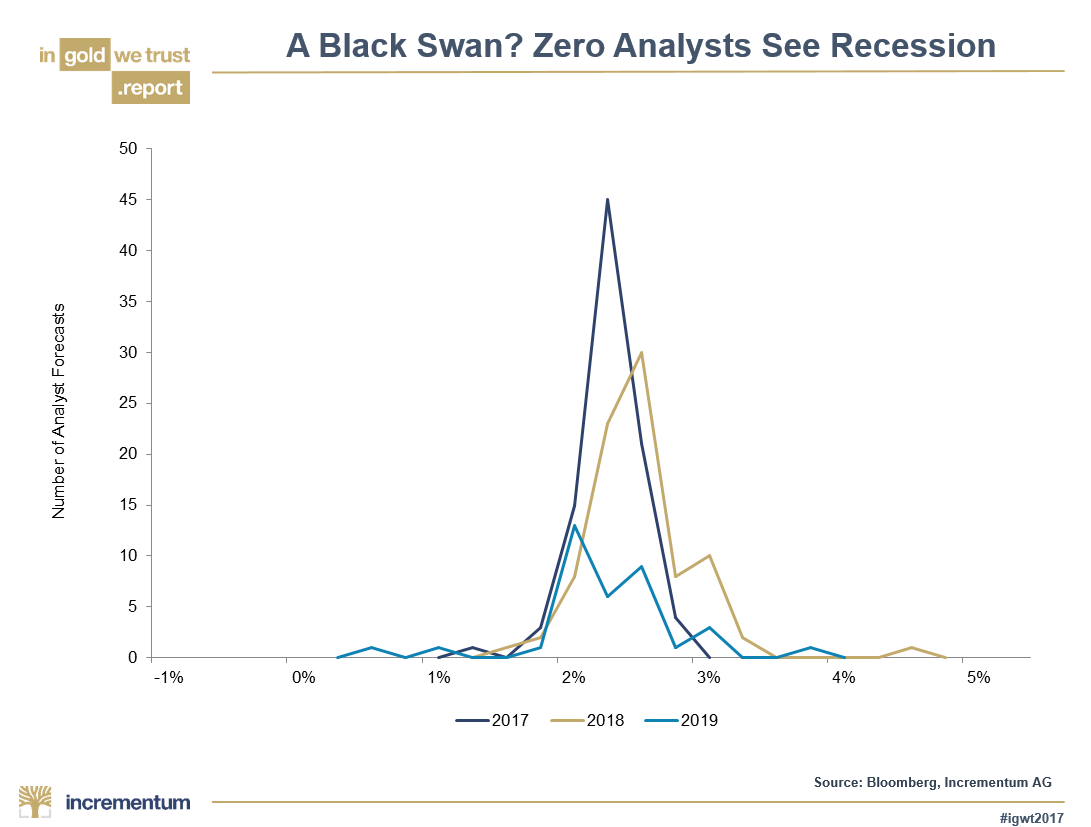

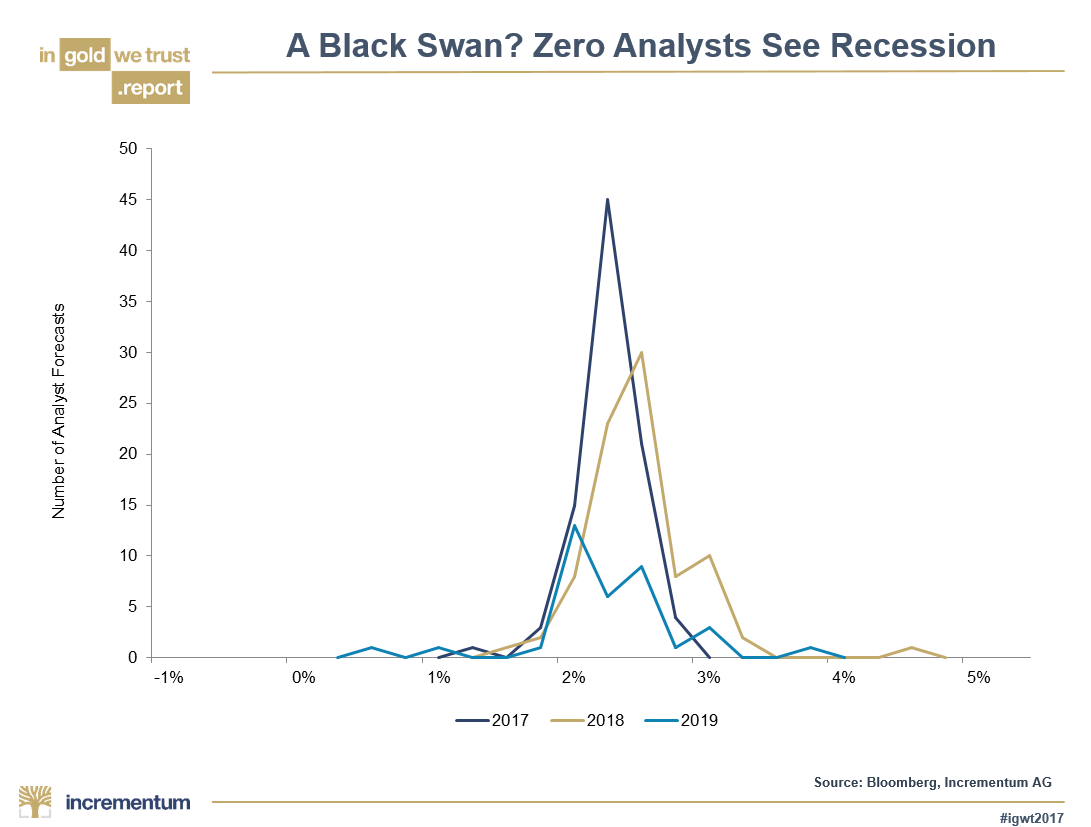

Ronald-Peter Stoeferle: Yeah, of course. That’s out of one of my favourite chapters in the report, it’s called: White, Grey, and Black Swans. And we’re starting off this chapter with a fantastic quote by Ray Dalio, the founder of Bridgewater. I don’t know if it’s still the biggest, but one of the biggest hedge funds out there. And he said, “The two main risk factors for the average portfolio are less than expected growth and more than expected inflation.” And for us, some sort of stagflationary environment similar to the 1970s is definitely in the cards. And as I’ve said before, from our point of view, a recession will happen in the U.S. sooner or later. Of course, that’s quite an easy call. And don’t get me wrong, a recession is from our point of view something normal, something healthy within a business cycle it’s like breathing in and breathing out, you need both parts. And a recession although it hurts, it hurts on many participants, it lays the foundation for a sound recovery, for a more healthy system actually. But I think the most interesting number in that chapter was that we checked on Bloomberg and it said out of 89 analysts that are surveyed by Bloomberg, not a single one, not a single economist currently expects a GDP contraction in 20017, 2018, or 2019.

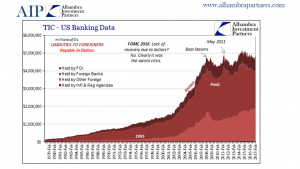

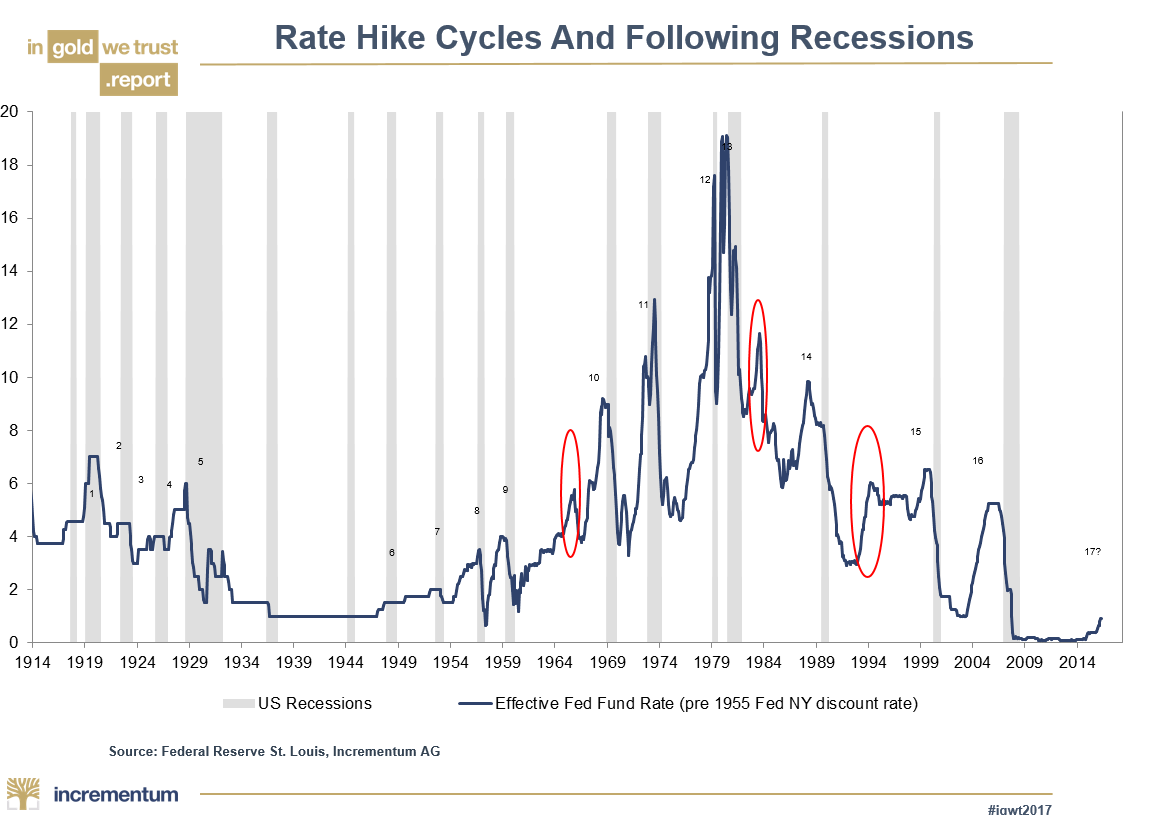

So nobody is seeing a recession within the next few years and everybody basically thinks we’re going to see growth rates between 2.2% and 2.4%. That’s such a strong consensus, I’ve never seen something like that before. And of course, if the positioning is that strong, if everybody is sitting on one side of the boat, there will be tremendous opportunities and tremendous moves as soon as people are switching to the other side of the boat. Meaning okay, there are recessionary fears and recessionary tendencies coming up, this will be a moment that it’s going to be very interesting in financial markets. And I think that there’s quite a lot of signs and we’re quoting some of them in the report. First of all, we’re seeing as I’ve said before, quite a lot of numbers are actually showing us that a recession will happen sooner or later. Another one of my favourite charts it shows the interest rates since 1914, and actually in the past 100 years, 16 out of 19 rate hike cycles were followed by recessions. Only three cases turned out to be the exception to the rule.

Now we’re in a hiking cycle and I actually think that the tightening already started when Ben Bernanke announced tapering. So we’re seeing a tightening environment for quite a while now. And this normally leads to recessions or a combination of a recession and major market disruptions. Then we’re seeing this massive artificial asset price inflation. I mean the idea was that there was some sort of wealth effect meaning due to rising stock prices and real estate prices it would trickle down and then everybody would do well and will start spending. It didn’t really work that way, we all know that this wealth effect is something that economists want to see but it’s actually not really happening. So from our point of view, we’re in the everything bubble. It’s not only specific sectors of the market, now it’s real estate, it’s stocks, especially tech stocks, it’s bonds of course which are all at their all-time highs and being what we call the everything bubble. So this makes it even more dramatic than the subprime bubble or the tech bubble of 1999-2000. So this shows that the next recession or the next crash will probably make the preceding ones look like a kindergarten party. We’re seeing that consumer debt levels are extremely high and we’re seeing a massive slowdown in monetary growth which always leads to recessions. We’re seeing that the duration of the economic upswing is already extremely long. So although Janet Yellen said recently in her lifetime we won’t see any financial crisis again and so on, I think the duration of this boom or this upswing that we’re seeing, it’s already very very very long. So should the current economic expansion go for another 23 months, it would actually become the longest in history. So therefore I think that there’s quite a lot of reasons actually that we will enter a recession sooner or later, from my point of view sooner. And this will have massive consequences for financial markets and also massive consequences for gold of course.

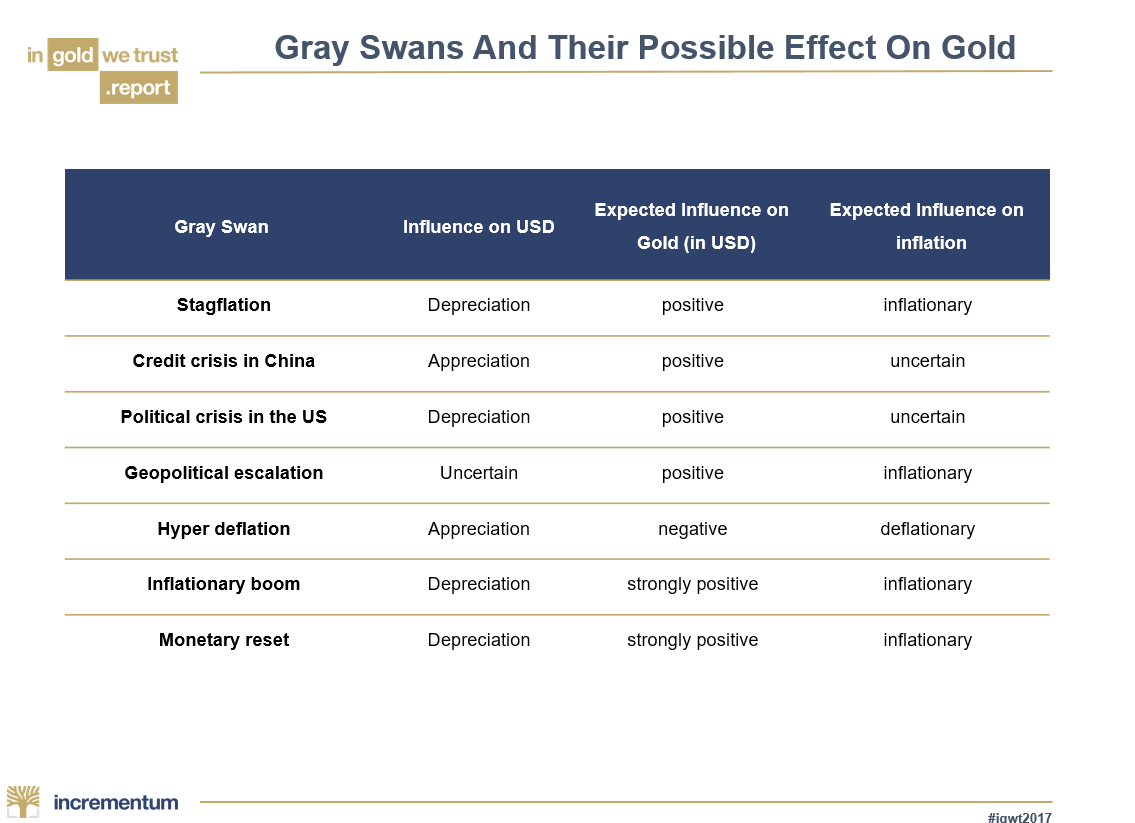

FRA: And the next couple of slides are very interesting, you talk about gray swans and their possible effect on gold.

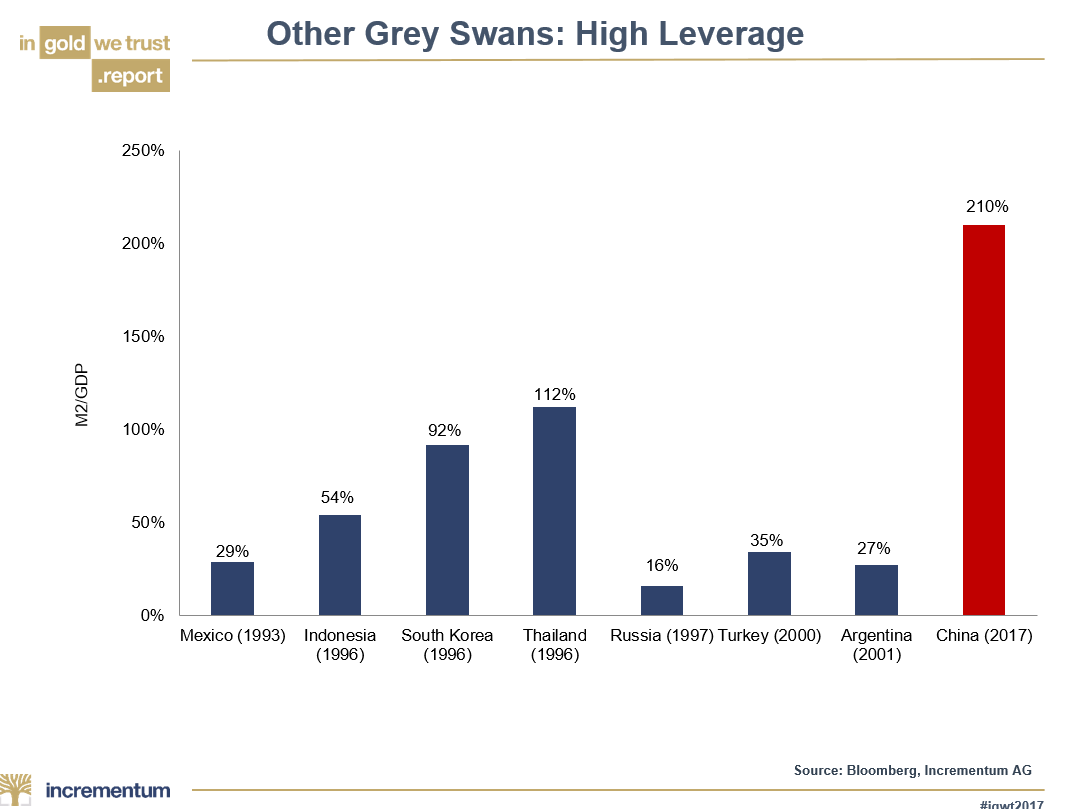

So you’ve got a table showing different gray swans and the effects on the U.S. dollar and gold prices. One slide also mentions a gold swan of high leverage showing where China is relative to other past events, financial events, financial crisis’s, Russia, Argentina, Mexico. Can you speak to that and do you see the possibility of one or more of these gray swans happening?

Ronald-Peter Stoeferle: Yeah, of course. I think that’s the beginning of the chapter, by definition it’s impossible to anticipate a black swan because if it would be possible then it wouldn’t be a black swan. For grey swans, this is something highly unlikely but this can kind of be anticipated. And you know what’s happening in China at the moment it’s just a massive credit bubble and the Peoples Bank of China reacted in 2008 and 2009 acted much much more aggressive than every other central bank so they acted much more aggressive than the Federal Reserve, then the ECB, even then the bank of Japan. And of course it leads to growth, but low-quality growth. And from my point of view just from an intuitive GDP perspective their up 210% which we’ve never seen in a let’s say emerging market in the last couple of decades. So, of course, this might go on a bit longer but it’s already really extreme. So this is probably going to be a credit crisis in China, would be some sort of a grey swan. We also got some other grey swans like stagflation, a scenario that we are talking about for quite a while now. And we dedicated a big chapter in our last book to stagflation which would basically be the pain trade for every investor, especially for institutional investors because times of strongly rising inflation and weak growth are actually the worst environment you can imagine for bonds, as well as for stocks. And the only asset classes that do well in the stagflation environment are actually gold and silver and commodities, especially energy and soft commodities. What else do we have as a grey swan? A political crisis in the U.S. some sort of impeachment of Donald Trump, probably not unlikely. A geopolitical escalation, well we had a very interesting discussion with Jim Rickards quite recently and he very openly said he expects a war between the U.S. and North Korea in 2017 or 2018 at the latest. So he’s absolutely sure about that. That makes me pretty nervous actually because we’ve got no idea how that’s going to develop, if it’s going to be just the U.S. against North Korea, I don’t think so. This is actually really really dangerous and I don’t know what this might mean for the U.S. dollar, perhaps a stronger dollar. Not sure about it but I think it would definitely be inflationary and it would be a positive environment for gold. Then we’ve got hyperinflation I think the effect on gold would be negative but only for nominal prices.

FRA: This would be hyperdeflation, right? Hyperdeflation.

Ronald-Peter Stoeferle: Hyperdeflation, yes. The nominal prices wouldn’t do really well but on a real basis, I think it would be an excellent environment for gold. An inflationary boom of course, strongly positive for gold and negative for the U.S. dollar. And the monetary reset, actually something that also Judy Shelton is talking about, and something that will happen sooner or later, it’s inevitable. There will be a reset, there have always been monetary resets in economic and monetary history. And in every reset gold played a major role. And I think this is also the reason why the big guys like the U.S. but also the Eurozone but also the Chinese, the Russians and so on. They all hold massive amounts of gold and those nations that don’t hold too much yet, especially the Chinese and the Russians, they’re constantly accumulating gold. And Rickards said if you want to play poker with the big guys, you have to bring enough chips to the table. And those chips are actually gold. And Therefore I think that within the context of a monetary reset there will be a revaluation of gold, I’m absolutely sure of that.

FRA: And that seems to be a key message theme of your report in terms of dollar, de-dollarization, goodbye dollar hello gold. So those are the next few slides, how is this happening? What is the mechanism, is it through geopolitical alliances in Asia along the Silk Road route or like the Shanghai Corporation Organization counsel there, the sort of NATO of the East if you will, is it happening through that mechanism or how do you see that playing out?

Ronald-Peter Stoeferle: Well the thing is there’s actually so much going on at the moment, it’s really hard to follow and we had our advisory report discussion yesterday with Luke Gromen who’s writing Forest for the Trees it’s a tremendous newsletter focusing on those topics and I think there’s just so much going on at the moment. For example, with the first oil contract trading in Chinese Huajin now, it will start at the end of July. We’ve got the whole Qatar crisis which is no coincidence, I think it’s no coincidence that Donald Trump’s first trip abroad, that he went to Saudi Arabia and they signed like a $300 billion deal on aircrafts and military equipment. I think that the big picture is extremely interesting and we’re seeing this de-dollarization for a couple of years now. And I think it’s now definitely picking up momentum because we’ve got the Shanghai gold exchange which is becoming more and more important. I think that gold plays a key role for the Chinese, the Chinese don’t want to develop or implement a reserve currency, but a trade currency. And so many things are happening at the moment, bilateral trade agreements between the Chinese and basically every important emerging market, new stock exchanges and trading platforms being set up. There’s just so much going on at the moment, but I think we’re seeing this de-dollarization and of course the central role of the U.S. dollar plays a crucial role for financial markets. And I think that this is also something that Judy Sheldon mentions, there will have to be some sort of new agreement because the U.S. they actually realized that they cannot afford the current situation and they need a significantly weaker dollar. So the big question is if the new currency system architecture will be introduced through a former process like a conference in a G20 framework, G20 is actually meeting now in Hamburg, or through a revaluation of gold reserves by the market. Will the U.S. adopt a proposal of Judy Sheldon and issue for example gold backed bonds? It can happen. Or perhaps, the U.S. will join what we call the Euro model and will it mark its gold reserves to market? Because the Eurozone gold reserves on a quarterly basis are marked to market in the U.S. they’re still valued at I think $42 for some reason. Or a third way would probably be, will the rest of the world just abandon the valuation of gold reserves based on market prices and follow the U.S. into a system of fixed exchange rates similar to some sort of classical gold standard? So we’ve written a couple of pages about that and there’s still so much to follow regarding those topics. I think it’s really interesting to follow at the moment what’s going on with the big picture, especially Russia, China, and the U.S. and as I’ve said before I think that gold will play a major role in that game.

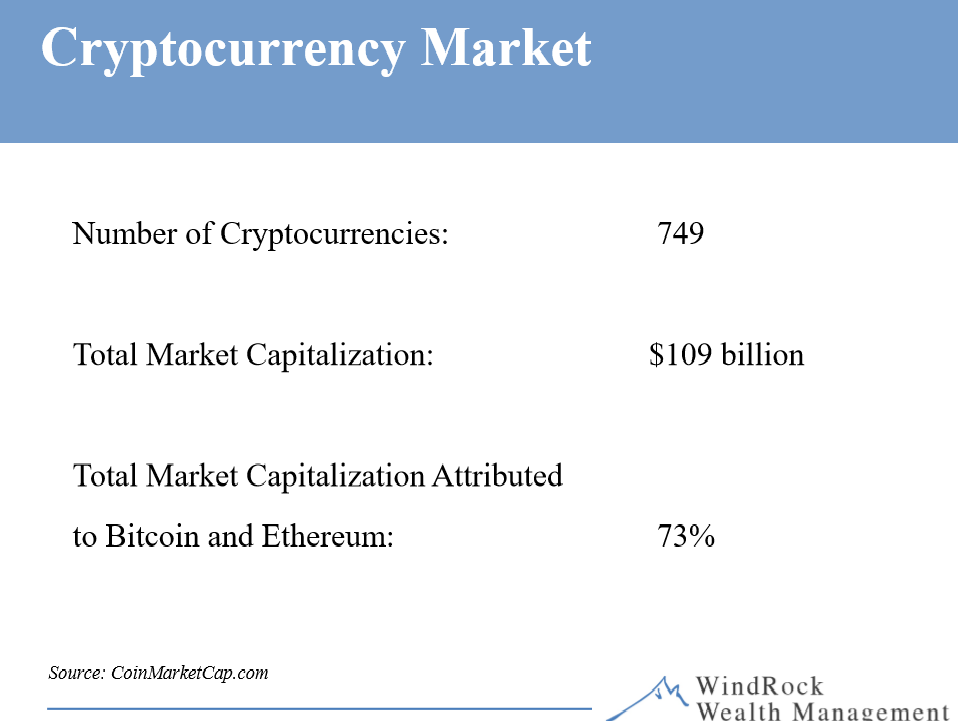

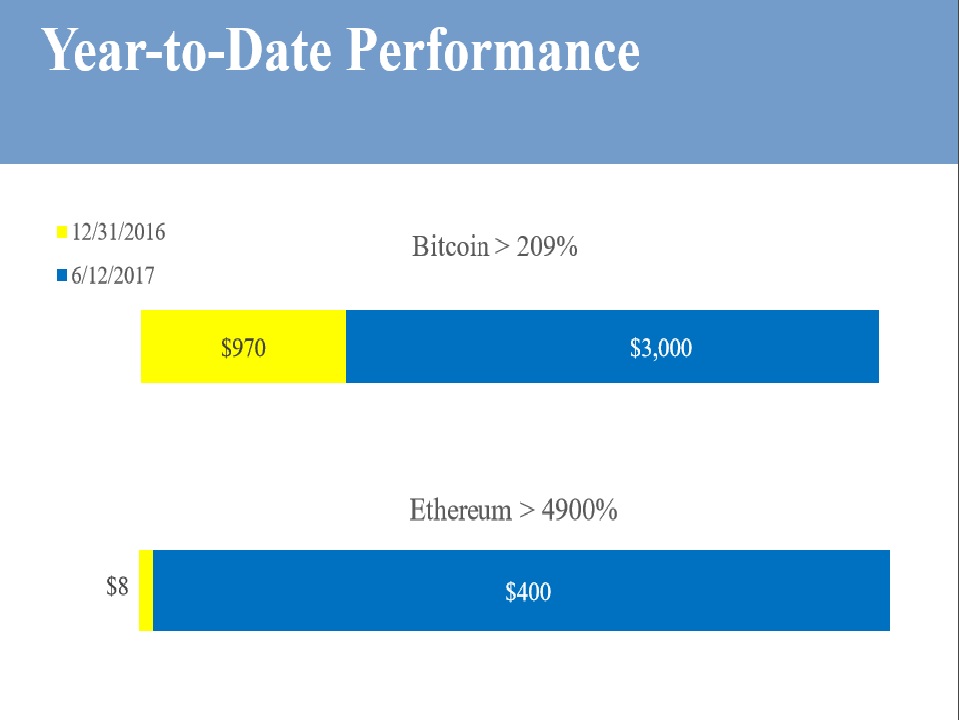

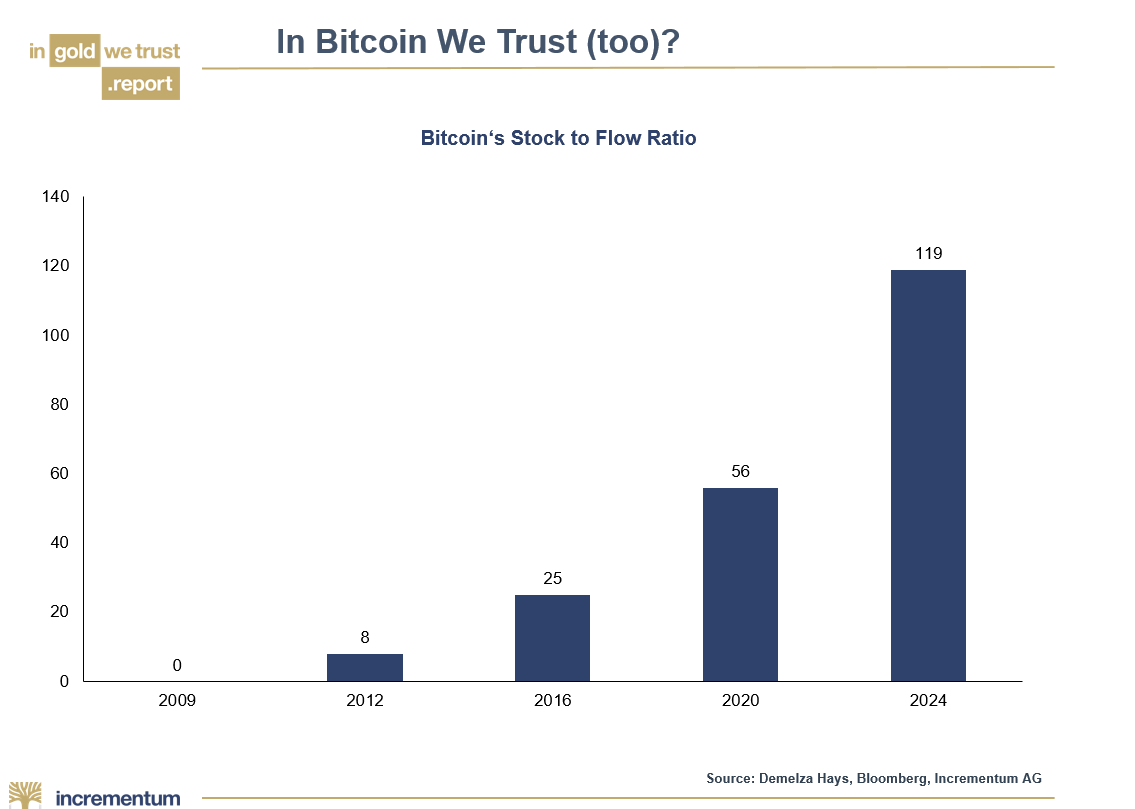

FRA: And you’ve got a slide on in Bitcoin we trust, playing on the in gold we trust report. Your thoughts on the cryptocurrency movement? Bitcoin, do they have value, are they seen as a currency, are they seen as a store of value or simply a payment system? And how does the value and the utility of gold as a currency compare to Bitcoin and other cryptocurrencies?

Ronald-Peter Stoeferle: Well, first of all, I think that if you read the white paper by Satoshi Nakamoto there are many similarities and I think that they really want to create some sort of digital gold. For example, stock to flow ratio but also the logo and some other terms like “mining” Bitcoin. That already shows that the creators of Bitcoin, they actually have gold in mind. And they’ve got a sound understanding of money, they know the Austrian School of Economics. So I think there’s many similarities, there’s also many many differences. For example, gold has a track record of many of thousands of years, Bitcoin’s been around for only a couple of years. But I think that you know, from my point of view, first of all what I love about the whole discussion is, and I said that in the discussion with Yra Harris a couple of days ago, I love the fact that people are actually thinking and talking about money again. What is money? What are the characteristics of good and sound money? So that’s definitely very positive.

I don’t know if Bitcoin will be around in 2 or 3 years, probably yes. I’m pretty sure that all of those ICOs that are happening at the moment that probably 95% or 99% of them are rubbish and they won’t be around in a couple of years. But the market will decide which currencies to choose and I think from an Austrian point of view, we’re seeing competing currencies and market participants are deciding if they prefer to hold or pay with Bitcoin, gold, euros, dollars whatever. So I really want to let the market decide. But I think we should not forget, we should not underestimate the fact that Bitcoin and the cryptocurrencies, they didn’t go through a business cycle yet. So we actually don’t know what the characteristics of Bitcoin and other cryptocurrencies will be in a massive downturn, in a recession, in a crash. Will Bitcoin significantly stronger or weaker? Richard, I don’t know, I can imagine both ways. So this is going to be interesting, but for us in Incrementum, at the beginning, it was just from an intellectual point of view just interesting. But we’re developing quite a lot of things in the crypto space, and you should expect some big news from our side regarding Bitcoin and cryptocurrencies. Because as I’ve said before, it is some sort of digital gold. And I think of course Bitcoin faces several hurdles, but I think the technology that is being developed now will change many industries. And there will be losers and there will be winners of this technological process and of the innovation, we try to be on the winning side of course.

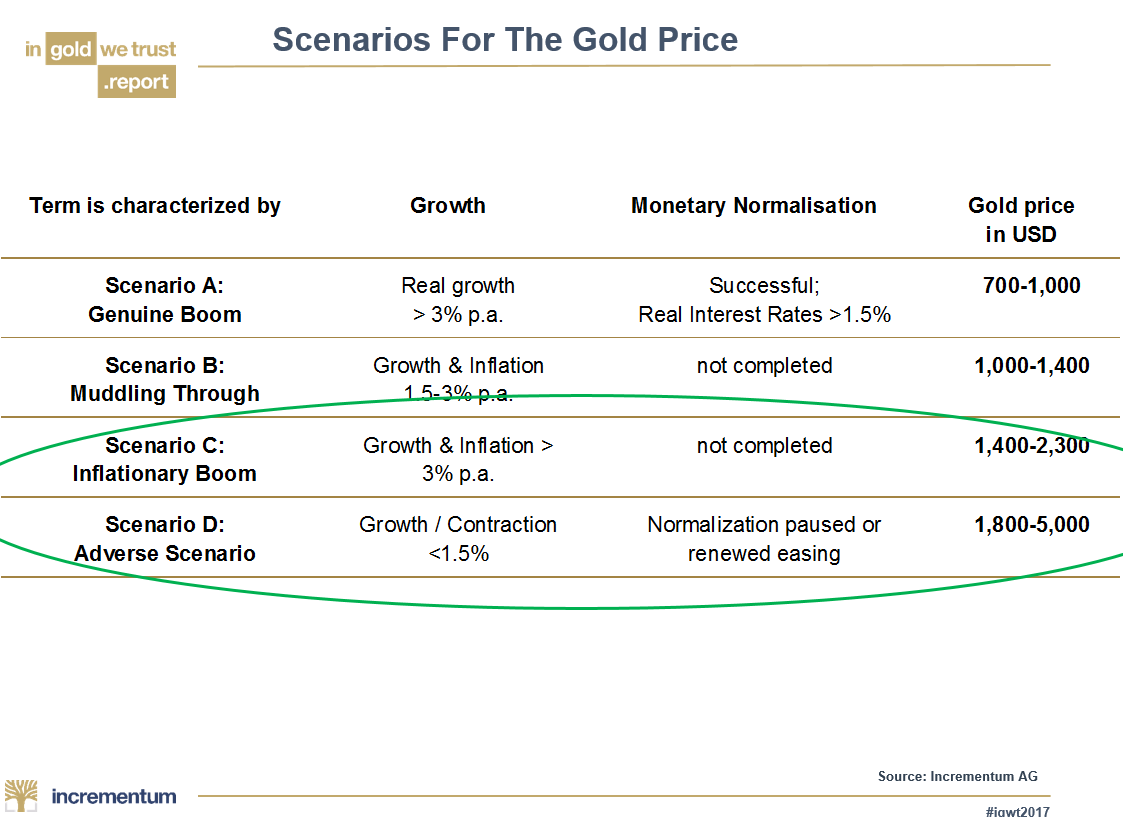

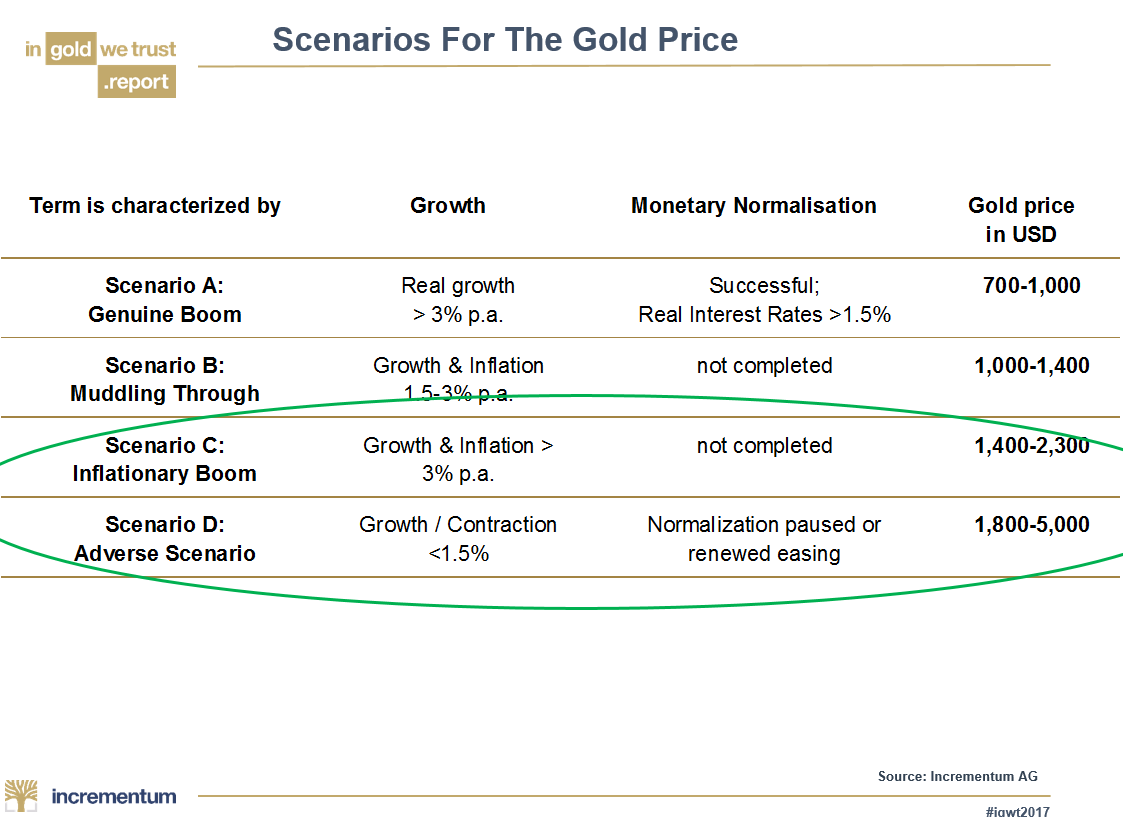

FRA: And let’s close our discussion with the last slide you have scenarios for the gold price. So you list four scenarios, A, B, C, and D. And then you circle C and D, indicating I guess what’s likely to happen, scenario C and scenario D. Just what are your thoughts, why do you think that? And scenario C is showing prices from 1,400-2,300 U.S. dollars per ounce, and scenario D is 1,800-5,000 U.S. dollars per ounce.

Ronald-Peter Stoeferle: Yeah, well of course the Austrian School is quite different when it comes to forecasting because it’s basically, and that’s a very modest call I would say, it’s impossible to forecast the future. You can analyze what’s happening and you can read from history of course and make assumptions but it’s impossible to forecast the future. And this is also why we’re thinking in scenarios and we’re weighing those scenarios. And of course there’s the Goldilocks scenario when everything is just going fine, we’re seeing perfect inflation rates below 2%, we’re seeing high growth, everything is fine, deleveraging and so on. Then you probably don’t need any gold and this would lead to gold price between $700-$1,000. This is basically the scenario that many market participants expect at the moment. Then there would be scenario B which is muddling through, with weak growth but inflation not really picking up. We wouldn’t see any real monetary nominalization so rates would rise but not significantly, there would be talks about this quantitative tightening but we all know that it’s kind of a joke. In this environment, we’re seeing gold between $1,000 and $1,400. And then scenario C and scenario D, and scenario C is the inflationary boom. High growth and high inflation, probably some sort of stagflationary environment. Then gold could go up to $2,300. And D, scenario D would be the adverse scenario. When there would be a contraction or recession, there would be another round of QE significantly higher than the round before. And we don’t know what else central bankers have in their toolbox, probably negative rates, probably more financial repression. There’s probably many more things to expect, buying stocks, whatever. And in this environment, that’s obviously the most positive environment for gold, we would see it between $1,800-$5,000. So for the timing, we say this is our scenarios for the term of Donald Trump, until 2021 if there’s no impeachment or anything else. So those are basically the main scenarios that we’re having but I think what is also really interesting if you’re taking it from a different perspective and if you ask yourself, when will I not need any gold in my portfolio? And our assumptions would be you don’t need any gold in your portfolio when the debt levels can be sustained or are reduced, when the threat of inflation is small, when real interest rates are high, when the confidence in monetary authority is strong, when the political environment is steady and predictable. When the geopolitical situation is stable, and when governments deregulate, markets simplify tax regulations and respect civil liberties. From my point of view, unfortunately, we don’t see any of those points. And therefore I think gold should be in every portfolio. And if it’s 2%, 5%, or 50%, it just depends, it depends on your scenarios, on your risk taking, on your time horizon and so on. But I think one should definitely own gold at the moment.

FRA: Well that’s great insight, charts, and analysis. How can our listeners learn more about your work, Ronnie?

Ronald-Peter Stoeferle: Well we’ve got a completely new web page https://www.incrementum.li/ where we’ve got a journal with all our publications. You can sign up for free for our in gold we trust report, we’ve got a special web page just dedicated to the in gold we trust report with an archive where you can find all the prior issues of the report, it’s ingoldwetrust.report. And of course, we’re regular guests at your services. So yeah, just google it up and find out more about what we’re doing, what we’re thinking and what we’re actually also selling our clients.

FRA: Great, thank you very much for being on the program, Ronnie.

Ronald-Peter Stoeferle: Thank you, Richard, thanks for inviting me. It’s been a great pleasure, thanks.

Podcast will be posted shortly ..

Transcript written by Jake Dougherty <jdougherty@ryerson.ca>

Summary

Today we are joined by Ronald-Peter Stoeferle. He is managing partner and investment manager at Incrementum. Together with Mark Valek, he manages a global macro fund which is based on the principles of the Austrian School of Economics. He’s also the co-publisher of In Gold we Trust report, and that is the focus of our discussion today.

Key messages from the report

We seem to be at the very early stage of a new bull market. Gold was up 8.5% last year and since the beginning of 2017 it has continued to rise, gold is up in basically every currency. It’s a bull market that nobody is recognizing and it will get going. We’re seeing price inflation is way too low, so the Fed will have a hard time continuing rising rates. There are many signs that the U.S. economy is actually doing much worse than the mainstream economists see it, and the U.S. dollar is far too strong. Donald Trump says very openly that he wants and he needs a weak dollar, it’s no secret. So there is an expectation that the dollar will become weaker in the near future. This is a very good combination for gold also given the fact that the sentiment at the moment is so low. Gold has an excellent setup both from a long-term and a short-term perspective.

Commodities vs. Stocks

Gold is typically a good indicator of commodities, and the valuation of Commodities vs. Stocks are at their lowest relative valuation since 1999. The Austrian School has got a different view on prices, it says there are no fair values. So prices are always subjective and it’s important to focus not only on absolute prices but also relative prices because of the mean reversion. And as you can see on this chart, commodities vs. stocks are at a historically low level.

We’ve only seen levels like this twice in history, in 1971 and just before 2000. So on a relative basis commodities are just extremely cheap vs. stocks. We’re still far away from the median which is 4.1 and we’re very far away from the highs that are between 8 and 9 in this ratio. The ratio can even out in a few different ways. Commodities could stay stable and stocks could fall off the cliff, or stocks could be stable and commodities go through the roof. Or it could be a mixture of both with stocks becoming weaker and commodities becoming stronger. It’s also important to remember that last year despite the dollar index making a 40 year high, many commodities were actually really strong. So that’s a very positive sign and also similar to gold, this is a bull market that’s in the making. As soon as price inflation will become a topic I think people will start getting bullish on commodities again.

An Incoming Recession

A survey by Bloomberg showed out of 89 analysts that are surveyed, not a single one currently expects a GDP contraction in 20017, 2018, or 2019.

So nobody is seeing a recession within the next few years, and many of them expect growth rates between 2.2% and 2.4%. Despite all of this confidence, there are still many signs a recession may indeed be looming. We’ve got retail sales being very weak, lots of numbers from the industrial sector being weak, and most importantly credit growth for both commercial loans and consumer credit is very weak. Another one of my favourite charts it shows the interest rates since 1914, and actually in the past 100 years, 16 out of 19 rate hike cycles were followed by recessions.

Only three cases turned out to be the exception to the rule. Now we’re in a hiking cycle and I actually think that the tightening already started when Ben Bernanke announced tapering. We’re seeing that consumer debt levels are extremely high and we’re seeing a massive slowdown in monetary growth which always leads to recessions. The duration of the economic upswing is already extremely long, should the current economic expansion go for another 23 months, it would actually become the longest in history. So there’s quite a lot of reasons actually that we will enter a recession sooner or later, and maybe sooner rather than later. And this will have massive consequences for financial markets and also massive consequences for gold.

Future Scenarios For The Gold Price

Forecasting future prices using the Austrian School is quite different than using more traditional methods because they recognize that it’s nearly impossible to forecast the future. You can analyze what’s happening and you can read from history and make assumptions, but it’s impossible to perfectly forecast the future. This is why it’s so useful to think in scenarios and weigh those scenarios. Scenario A, or the Goldilocks scenario, is when everything is going well within an economy. We’re seeing perfect inflation rates below 2%, high growth, deleveraging and so on. You probably don’t need any gold in this case and we would expect gold to be priced between $700 and $1,000 per ounce. This seems to be the scenario that many market participants expect at the moment. Scenario B, muddling through, expects weak growth but inflation not really picking up. We wouldn’t see any real monetary nominalization so rates would rise but not significantly, there would be talks about this quantitative tightening but we all know that it’s kind of a joke. In this environment, we’re seeing gold between $1,000 and $1,400 per ounce. Scenario C is the inflationary boom, high growth, and high inflation, probably some sort of stagflationary environment. Then gold could go up to $2,300 per ounce. Scenario D would be the adverse scenario, when there would be a contraction or recession. There would be another round of QE significantly higher than the round before and we don’t know what else central bankers have in their toolbox, probably negative rates, probably more financial repression. This is the most positive environment for gold, we would expect to see it between $1,800 and $5,000 per ounce. We say this is our scenarios for the term of Donald Trump, so until 2021 if there’s no impeachment or anything else. However, if you’re taking it from a different perspective and if you ask yourself, when will I not need any gold in my portfolio? Our assumptions would be you don’t need any gold in your portfolio when the debt levels can be sustained or are reduced, when the threat of inflation is small, when real interest rates are high, when the confidence in monetary authority is strong, when the political environment is steady and predictable. When the geopolitical situation is stable, and when governments deregulate, markets simplify tax regulations and respect civil liberties. Unfortunately, we don’t see any of those points happening today. And no matter the scope, it seems one should definitely own gold at the moment.

If you would like to learn more about Ronald-Peter Stoeferle and Incrementum you can visit https://www.incrementum.li/ where you can find a journal with of their publications. You can sign up for free for the in gold we trust report, they’ve got a special web page just dedicated to the in gold we trust report with an archive where you can find all the prior issues of the report.

Summary written by Jake Dougherty <jdougherty@ryerson.ca>

07/09/2017 - The Roundtable Insight: Ronald-Peter Stoeferle On “In Gold and Bitcoin We Trust”

07/09/2017 - The Roundtable Insight: Ronald-Peter Stoeferle On “In Gold and Bitcoin We Trust”