Blog

02/02/2022 - The Roundtable Insight – Nick Barisheff and John Crowley on Precious Metals

02/02/2022 - The Roundtable Insight – Nick Barisheff and John Crowley on Precious Metals

02/02/2022 - Yra Harris: Bernard Connolly Is Worth a Good Whiskey

02/02/2022 - Yra Harris: Bernard Connolly Is Worth a Good Whiskey

“The FED can raise rates in a slow process but to me the key to unlocking the speculation of myriad assets is found in quantitative tightening or shrinking the balance sheet. Chairman Jerome Powell pushed off the day of embarking upon QT but many FED presidents are raising the issue: Atlanta Fed President Rafael Bostic last week raised the prospect of the central bank starting its balance sheet unwind — a QT program of $100 billion a month — by around JUNE. If the FED begins that program the unraveling of highly leveraged risk assets will elevate us all to dust off Hyman Minsky’s work. Volatility will unsheathe its sword on the global financial system. The FED fears inflation for now but wait for the systemic risk unleashed by high risk positions being unwound.”

01/28/2022 - Dr. Albert Friedberg – The Federal Reserve has Lost Control – Quarterly Conference Call

01/28/2022 - Dr. Albert Friedberg – The Federal Reserve has Lost Control – Quarterly Conference Call

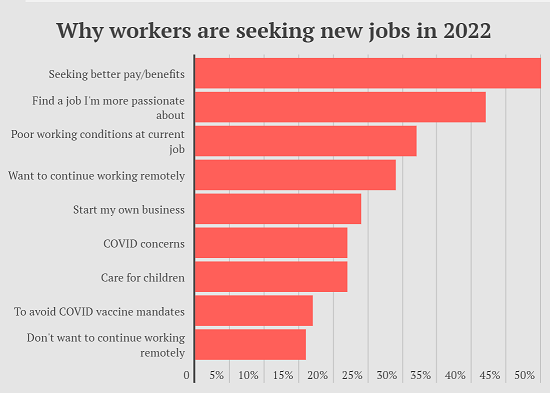

01/26/2022 - The Roundtable Insight – Charles Hugh Smith on Why Many are Resigning From Their Jobs

01/26/2022 - The Roundtable Insight – Charles Hugh Smith on Why Many are Resigning From Their Jobs

01/25/2022 - Alejandro Tagliavini – ¿Comprar Mercado Libre o shortear a los laboratorios?

01/25/2022 - Alejandro Tagliavini – ¿Comprar Mercado Libre o shortear a los laboratorios?

“Los mercados globales comenzaron la semana en negativo. Aunque el evento de la semana es la reunión de la Fed, lo cierto es que el consenso no espera subida de tasas al menos hasta marzo, por lo que la tensión geopolítica en Ucrania empieza a captar cada vez más la atención de los inversores.

Los analistas de Bankinter de España consideran 3 escenarios. Bueno: pacificación mediante diplomacia, con las bolsas rebotando según lo que diga la Fed el miércoles (más o menos liquidez, inflacionaria). Malo: “invasión light” y, según los daños y el tiempo en que tarde en estabilizarse la situación, serán de breves o prolongadas las caídas de las bolsas. Y, finalmente, el menos probable, el escenario pésimo, con fuerte caída de las bolsas en general.”

01/21/2022 - Jeremy Grantham: LET THE WILD RUMPUS BEGIN

01/21/2022 - Jeremy Grantham: LET THE WILD RUMPUS BEGIN

“GMO has a detailed set of recommendations available that I agree with. A summary might be to avoid U.S. equities and emphasize the value stocks of emerging markets and several cheaper developed countries, most notably Japan. Speaking personally, I also like some cash for flexibility, some resources for inflation protection, as well as a little gold and silver. (Cryptocurrencies leave me increasingly feeling like the boy watching the naked emperor passing in procession. So many significant people and institutions are admiring his incredible coat, which is so technically complicated and superior that normal people simply can’t comprehend it and must take it on trust. I would not. In such situations I have learned to prefer avoidance to trust.) ”

01/21/2022 - Dr. Albert Friedberg on Inflation and the Economy – Quarterly Investment Report

01/21/2022 - Dr. Albert Friedberg on Inflation and the Economy – Quarterly Investment Report

“The single most important and pressing economic issue for the next few years will be inflation. Not the epidemic, not climate, not even growth but simply the accelerating rise in prices that was put into place by a succession of highly irresponsible and ignorant central bankers and blessed by irresponsible, trigger happy administration officials. Having been allowed to take root, inflation will destroy incomes and savings and decapitalize the wealth-producing sectors of the economy. Eventually, inflation will force the hand of normally timid central bankers to raise interest rates well above the rate of inflation. As the economy comes next to a screeching and painful halt, we should take to heart that the severity of the depression will be directly proportional to the debauchery that preceded it and to the unforgivable delay in taking proper measures.”

Link Here to Download the Report

01/20/2022 - Lacy Hunt on Negative Interest Rates

01/20/2022 - Lacy Hunt on Negative Interest Rates

“When governments accelerate debt over a certain level to improve faltering economic conditions, it actually slows economic activity. While governmental action may be required for political reasons, governments would be better off to admit that traditional tools would only serve to compound existing problems. For a restless constituency calling for quick answers to economic distress and where inaction would be likened to an uncaring and insensitive attitude, this is a virtually impossible task.”

01/19/2022 - Louis-Vincent Gave on Russia, China and the U.S. Dollar

01/19/2022 - Louis-Vincent Gave on Russia, China and the U.S. Dollar

“China and Russia are the most obvious natural trade partners in the world, right? Russia produces all the commodities that China needs. And China produces all the consumer goods and the finished goods and the capital goods that Russia needs to continue industrializing. So, you know, for them to, you know, if there’s one, you know, sort of bilateral trade relationship where you can imagine that trade will continue to expand at many times the rates of GDP growth, it’s got to be that one. And so, you know, and you know, the more trade you have between two countries, usually, you know, if you’re a believer in Ricardian equivalency and Ricardian comparative advantages, then, you know, you got to look at it positively.” – Louis-Vincent Gave on MacroVoices

Link Here to the MacroVoices Transcript

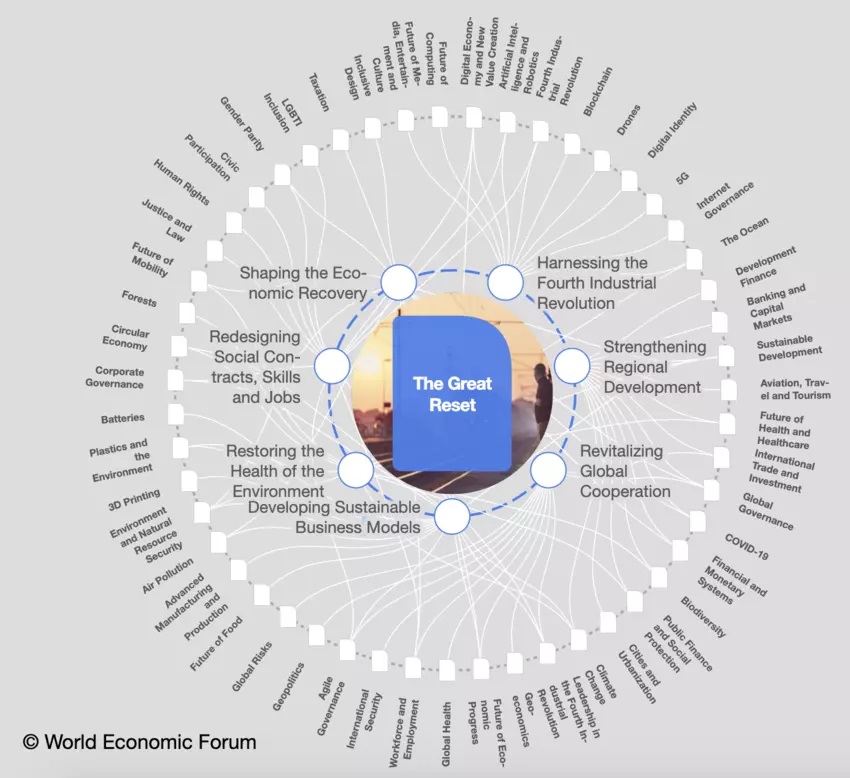

01/19/2022 - The Role of Central Bank Digital Currency in the Coming Financial Reset

01/19/2022 - The Role of Central Bank Digital Currency in the Coming Financial Reset

01/13/2022 - The Roundtable Insight: Bernard Connolly and Yra Harris on Europe and Risks to the Global Economy and Financial System

01/13/2022 - The Roundtable Insight: Bernard Connolly and Yra Harris on Europe and Risks to the Global Economy and Financial System

01/05/2022 - The Roundtable Insight – Doug Casey on the Economy, the Financial Markets, Migration and Freedom

01/05/2022 - The Roundtable Insight – Doug Casey on the Economy, the Financial Markets, Migration and Freedom

12/29/2021 - Felix Zulauf Interviews and Public Domain Quotes

12/29/2021 - Felix Zulauf Interviews and Public Domain Quotes

Another Interview from Grant Williams – Link Here

Another Interview from Financial Sense – Link Here

Notes from Financial Sense – Link Here and some public domain quotes:

“I do believe that we are looking at a very important medium-term peak. But I do not believe that is the end of this current market cycle. I think the market cycle will most likely stretch into 2024. But what we are facing now is a is a medium-term top in the next few weeks, and then a very decisive decline. And this is because, first of all, I see the world economy weaker or slowing (faster) than the consensus. I think the overshooting of retail sales on the pre-pandemic trend by 16% in the US, is an aberration and will be corrected because the fiscal impulse that was so positive will turn negative in 2022, negative by about 4 – 6%. This will dampen economic activity; real personal income is now negative and not positive anymore. I think the rest of the world is slowing too, particularly China, which continues to slow and is in a recession and will most likely stay in a recession into midyear. And while they are loosening up the tight policies, they are not stimulating yet. I expect that (to happen) from spring on, only not before. And all of this tells me that the world economy and the US economy will most likely disappoint in terms of growth, and particularly in the first half… Usually when a market corrects, you have a plain vanilla 8 – 12% correction or anything on that order. But we have had tremendous excesses of capital flows into equities. US equities, including equity products, was on the order of over $1 trillion in the last 12 months. And this compares to the same amount for the last 20 years combined. So, this is an excess of a century. And usually, when you go into a correction, highly positioned, highly leveraged, high margin accounts surprise on the downside. So, it’s very possible and conceivable that when we have usually a 10% correction, all of a sudden, it could trigger a 20 – 30% correction. And therefore, I think the first half of the year, will most likely show a very serious correction. And that could shake the authorities. And instead of the interest rate hikes that the Fed has been forecasting, I think they will rather turn around and stimulate again around the middle of the year, when the correction in the market arrives. And that should give us the next run-up to new highs. So, I could see equity indices, declining 30%, and then go up 100% to the Peak in 2024. And if the peak in 2023 – 2024 is a better economy, I think you will have another run in the commodity complex; you will have wages going higher, and you will then see the CPI probably around 10%. And, at that time, you have higher bond yields, and you have a central bank and probably around the world that has no choice but to tighten. And that I think will be the end of the bull market that we have been seeing from 2009. And that will lead to major crises probably for a few years thereafter. So, the big picture has been stretched a little bit. But, nonetheless, I see a serious and painful decline in the first half of 2022.”

12/29/2021 - Dr. Lacy Hunt Interview

12/29/2021 - Dr. Lacy Hunt Interview

12/28/2021 - Central Bank Digital Currencies – Implementing Financial Controls?

12/28/2021 - Central Bank Digital Currencies – Implementing Financial Controls?

White Paper by the Bank of Canada explores a feature of central bank digital currencies (CBDC) called loss recovery. Note how the assumption is that CBDC will have a time expiry meaning the currency held in the CBDC account will have a time limit after which it will no longer be usable or accepted. As CBDC are implemented, it will be interesting to see the development of potential financial and social controls:

- time expiry of a certain amount of currency, effectively implementing a Keynesian-based policy of fostering spending in the economy

- jurisdictional applicability of the currency – in other words the currency may not be usable outside of the jurisdiction, effectively implementing capital and exchange controls

- limits or prohibitions of spending the currency on certain products or services

- climate and social controls on spending behaviors, effectively implementing a social credit control system

- negative interest rates, effectively implementing negative interest rate policies by the central bank and eliminating the potential for bank “runs”

- devaluation of the currency – periodically implemented through coordination with monetary policies or through currency exchanges with other CBDCs, other payment systems or physical cash

Bank of Canada White Paper on CBDC

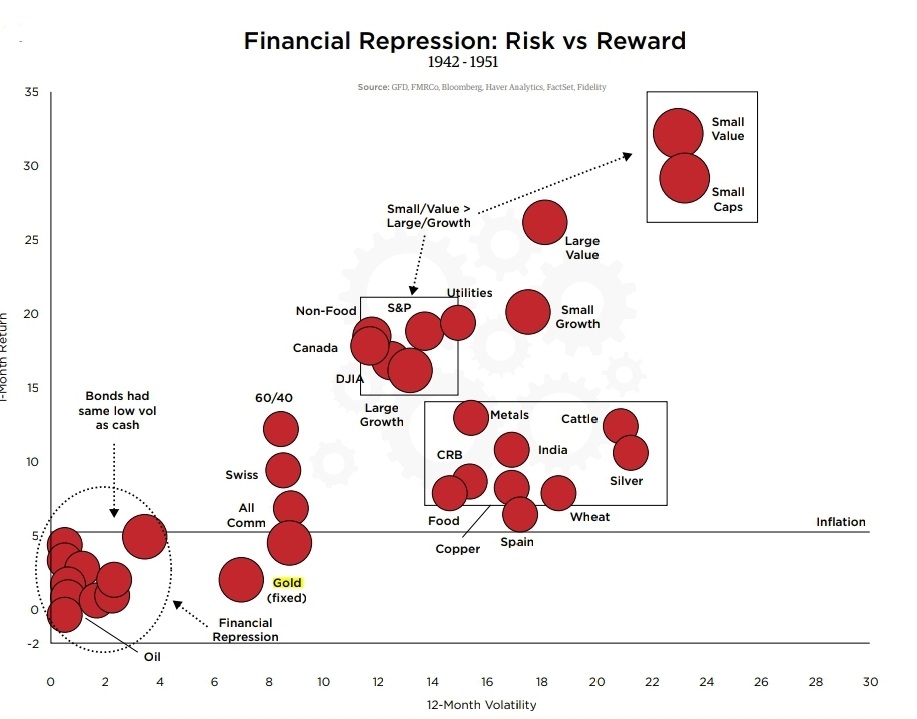

12/21/2021 - Chart on Investment Asset Classes in the Financial Repression Era of 1942 to 1951

12/21/2021 - Chart on Investment Asset Classes in the Financial Repression Era of 1942 to 1951

Note: Economist Russell Napier has pointed to considering the 1942 to 1951 era as an analogy to what type of financial repression is potentially in store over the next few years. Economist Stephanie Kelton in The Deficit Myth also provide analysis on the financial repression era from 1942 to 1951.

Source: GFD, FMRCo, Bloomberg, Haver Analytics, FactSet, Fidelity

12/20/2021 - Dr. Marc Faber on the Markets, Inflation and the Economy

12/20/2021 - Dr. Marc Faber on the Markets, Inflation and the Economy

12/20/2021 - Yra Harris: The Week That Was

12/20/2021 - Yra Harris: The Week That Was

“By week’s end the global stocks were down as the onset of OMICRON concerns were spreading fear of additional global restrictions. Over the weekend, it was reported that the DUTCH were shutting down and other nations raised their protocol levels. That should stem travel, especially during the winter holidays. Be patient as this is a liquidity-starved week and the algos will be delivering plenty of volatility.”

12/15/2021 - Marillac Saint Vincent Family Services – see note from Yra Harris

12/15/2021 - Marillac Saint Vincent Family Services – see note from Yra Harris

Marillac Saint Vincent Family Services

c/o Peter Beale-DelVecchio

6340 N. Magnolia Ave #1 S

Chicago, IL 60660

12/14/2021 - The Roundtable Insight – Michael Pettis and Yra Harris on China

12/14/2021 - The Roundtable Insight – Michael Pettis and Yra Harris on China