Link Here at 11am ET on Tuesday March 29 2022 for the live podcast:

https://www.youtube.com/c/FinancialRepressionAuthority

03/28/2022 - Live Podcast on YouTube – Zoltan Pozsar and Yra Harris Tues Mar 29 at 11am ET

03/28/2022 - Live Podcast on YouTube – Zoltan Pozsar and Yra Harris Tues Mar 29 at 11am ET

Link Here at 11am ET on Tuesday March 29 2022 for the live podcast:

https://www.youtube.com/c/FinancialRepressionAuthority

03/28/2022 - Yra Harris – Is Globalization Dead?

03/28/2022 - Yra Harris – Is Globalization Dead?

“It has been the benefit of global capital chasing billions of low paid workers that have worked to keep pressure on wages throughout the developed world. If Russia’s invasion and NATO‘s response leads to the to a suppression of global capital flows then interest rates, and especially EQUITY MARKETS, are in for some periods of great volatility. It has been the combination of “cheap” capital coupled with low-wage labor that has driven up equity values around the world. In 2013, Thomas Piketty captured this in his simplistic equation: R>G, meaning that return was greater than growth.

If Posen, Marks and Fink are correct the coming years will experience a dramatic repricing of P/E ratios as global capital loses it mojo. While there’s some glory in the use of sanctions, I advise holding off on popping the champagne corks. When will capital feel the pain of lower returns and higher interest rates? I have timetable but it is something to be concerned about. It certainly makes the FED‘s task of a neutral interest rate very difficult, especially as it also attempts to SHRINK its balance sheet in an effort to deleverage the financial system. Globalization has been great for equity capital, but I wonder if Daleep Singh has factored this into his sanctions formula. The world as seen from NOTES FROM UNDERGROUND rests on the premise that 2+2=5. Any answers for there certainly are a plethora of questions.”

03/22/2022 - The Roundtable Insight – Danielle DiMartino Booth and Yra Harris on the Economy and the Financial Markets

03/22/2022 - The Roundtable Insight – Danielle DiMartino Booth and Yra Harris on the Economy and the Financial Markets

03/18/2022 - The Roundtable Insight – Former Goldman Sachs Executive Leslie Manookian on the Great Reset

03/18/2022 - The Roundtable Insight – Former Goldman Sachs Executive Leslie Manookian on the Great Reset

Download the Slides for the Podcast

Note:

03/17/2022 - The Great Awakening – an alternative Great Reset based on the Principles of the Austrian School of Economics

03/17/2022 - The Great Awakening – an alternative Great Reset based on the Principles of the Austrian School of Economics

By Richard Bonugli, CEO and Founder of Cedargold

The World Economic Forum (WEF) announced at the onset of the COVID-19 crisis the launch of its Great Reset Agenda. This article explores the World Economic Forum and its Great Reset Agenda. While the Agenda targets very noble goals such as the UN Sustainable Development Goals (SDGs), the Agenda fails to meet many of these UN SDGs and poses significant adverse implications to society, to democracies, to freedoms and liberties, to economic development and to the overall general level of human happiness and satisfaction.

This article explores these adverse implications, and offers an alternative approach based on using the principles of the Austrian School of Economics. This alternative approach targets the same very noble goals of the Agenda while addressing the significant adverse implications of the Great Reset Agenda. We can refer to this alternative approach the Great Awakening Vision.

What is the World Economic Forum – Great Reset (WEF GR)?

The World Economic Forum (WEF) is an international organization, established in 1971 as a non-profit foundation, and headquartered in Geneva, Switzerland. From their website: “The World Economic Forum engages the foremost political, business, cultural and other leaders of society to share global, regional and industry agendas.”

The WEF has developed an agenda known as the Great Reset. This Great Reset Agenda encompasses an extensive set of projects, initiatives and programs as exemplified through the WEF Great Reset Agenda wheel, depicted below. Note the extensive and breadth around the entire wheel.

Note the inner spoke goals are: Shaping the Economic Recovery; Harnessing the Fourth Industrial Revolution; Strengthening Regional Development; Redesigning Social Contracts, Skills and Jobs; Restoring the Health of the Environment; Developing Sustainable Business Models; and Revitalizing Global Cooperation.

“Opportunity” Launch of the Great Reset Agenda

The WEF stated it took the “opportunity” of the COVID-19 crisis to launch its Great Reset Agenda. An article posted on the WEF website entitled “The COVID-19 recovery can be the vaccine for climate change” strongly linking COVID-19 and climate change – “There are clear connections between COVID-19 and the climate crisis” – and highlighting the benefits of the COVID-19 crisis in “containing” billions of people at home, thus helping reduce carbon/greenhouse gases. The article emphasizes how the COVID-19 crisis fostered climate change policies.

In addition, the UN Green Climate Fund wrote[1]:

“While COVID-19 is causing untold suffering, the international response to this unprecedented health crisis in modern times offers an opportunity to direct finances towards bolstering climate action. GCF will continue to make critical investments in climate-resilient water resource management, health care facilities, agriculture and livelihoods – all of which are essential to subduing and overcoming the pandemic. Similarly, we will step up our efforts to catalyse green investment to relaunch economies on low-emission, climate-resilient trajectories.”

Government Interest in the Great Reset Agenda

The key questions are how and why are governments interested and subscribing to the Great Reset Agenda for their member countries. Over the years, World Economic Forum Chairman Klaus Schwab has managed to “penetrate”[2] government cabinets, and has distributed many copies of his books to market the Great Reset Agenda. There is no conspiracy here. Why have governments subscribed to this Agenda?

Quite simply, governments have reached the limits on their unsustainable government debt and unfunded liabilities. Government central banks have repressed interest rates to essentially zero across the entire spectrum of the yield curve, allowing higher levels of debt to accumulate for the same level of servicing level costs. Governments have no way out. They have no choices. Reckless government spending and borrowing has reached its limit. This is essentially the end of using the principles of Keynesian Economics.[3]

Governments are hoping the WEF Great Reset Agenda will offer a framework to do a financial “reset” of unsustainable government debt and unfunded liabilities.

The core of this framework entails the overall theme of containing citizens on their financial activities and their movements. This will require increased monitoring and controls to limit financial transactions and travel, increased repression on freedom of expression and democratic liberties and increased restrictions on access to services, countries, jurisdictions and buildings.

Citizens will be required to be tied down physically and virtually on all aspects of their lives. Monitoring and control systems and processes will be required to eliminate bank “runs”, to prevent brain drain and wealth drain of citizens from the impoverished, heavily indebted countries looking to relocate internationally to more attractive jurisdictions, and to allow repressive central bank policies such as negative interest rates and repressed interest rates. On negative interest rates, the hope is that this will help to stimulate spending and economic growth. On continued repressed interest rates, the hope is that it will allow easier servicing of the massive debt.

Pension funds, both public and private, and associated unfunded liabilities will likely be cancelled or significantly restructured. As such, and given the likely potential as well of currency devaluation, many freedoms and democratic measures will be effectively curtailed or eliminated to minimize rising social and civil unrest.

Much of the government rollout of the Great Reset Agenda will be a marketing campaign to the public highlighting the Great Reset Agenda as a process to address climate change upon which there is general public support, given the ability through the Great Reset Agenda implementation to monitor and control human behaviour through carbon-associated social credit monitoring and scoring. In this way, governments implementing the Great Reset Agenda hope the public will accept all of the aspects of the Great Reset Agenda, even if painful.

First Step – Implement the COVID-19 Program

As noted above, the “opportunity” trigger of the Great Reset Agenda was the COVID-19 crisis. This initiated a global COVID-19 Program that entailed “containing” billions of people around the world at home, and the setup of vaccine passport systems in many countries. The vaccine passport system monitors and controls access to services, buildings, movement and travel. The vaccine passport not only carries information on the COVID-19 vaccinations, but also has location data initially applied to COVID-19 contact tracing applications and later can be applied to GPS tracking-based applications especially in conjunction with the Central Bank Digital Currency (CBDC) – see below.

Second Step – Setup the Government Digital ID System

The next step is the Government Digital ID system, all about digital identification. A Digital ID system would enable or disable access to services including financial services, payment and banking. The Digital ID integrates information such as health information, government services, driving license and car registration.

Additionally at this step, a social credit scoring system can be integrated into the Government Digital ID system. Inputs to the social credit scoring system may include spending habits, web browser surfing history, patterns of movement and travel, and even relate to the nature of a person’s communications and network of friends, family, colleagues and other contacts.

Third Step – Introduce Central Bank Digital Currency (CBDC)

The next major step is likely then the setup of a government-based cryptocurrency called the Central Bank Digital Currency (CDBC). This is essentially creating a new currency system, based on blockchain cryptocurrency, effectively implementing a new government-based fiat currency system. At this point, existing government fiat currency can be carried over as a deposit into the new CDBC system, with the option by the government central bank of instituting a devaluation of the currency when this carry over happens or later on once the CDBC has been implemented and in operations – say 1 unit of the new currency for every 10 units of the old currency – representing a 90% devaluation of the currency purchasing power overnight. From the perspective of the Great Reset Agenda, these devaluations would significantly help the government in addressing its unsustainable debt and unfunded liabilities problems.

The implementation would involve setting up a CBDC account for every citizen using the above-setup Government Digital ID system. Everyone would be given a certain amount of time before the old currency would no longer be accepted or able to be converted into the new currency system.

In any case, it is likely the government will use this opportunity of the transition to the CBDC for defaulting most if not all of the government debt and negating most if not all of the unfunded liabilities at the same time.

Once this is setup, the government can transition the entire economy and political system to totalitarianism, given the potential uses and scenarios through all of the widely varying software-configurable configuration parameters available in the CBDC. Here is just a small list of what can be configured – see also statement by the Bank for International Settlements:[4]

Some or all aspects of the life and movement of any citizen can be shutdown at any time through simple software-configurable parameters on the CBDC.

As you can see, this presents a dystopian system with the potential for little or no freedoms and liberties, not to mention the coercion of behaviour to be in alignment with whatever the government narrative is, even if that narrative does not make sense, is ruthless or not based on science or reality. As such, given that people will not likely be happy or satisfied on this dystopian system, the system will very likely fail eventually as evidenced from human history where such systems have been attempted.

An alternative Great Reset – The Great Awakening Vision

Is there an alternative way to reach the same Great Reset Agenda target goals without having the adverse implications discussed above? Especially given the growing list of shortcomings or outright violations of the UN Sustainable Development Goals by the Great Reset Agenda.[5]

One alternative approach – The Great Awakening Vision – is to use the principles of the Austrian School of Economics (ASE) and the principles of an environmentalism movement aligned with the ASE called Market Environmentalism. This approach emphasizes:

Great Awakening Vision

The below is a framework depiction of this approach, forming an overall Great Awakening Vision. The depiction of the 17 UN Sustainable Development Goals is shown on the next page.

Austrian School of Economics

The Austrian School of Economics (ASE) is a body of knowledge in economic thought that initially developed in 1870 in Vienna Austria by a group of economists. Other than the fact that it originated there, it has nothing to do with the country of Austria. Followers of the ASE have been successful at anticipating major economic events like the Great Depression, the stag-inflationary environment of the 1970s, the Dotcom Bubble and the Housing Bubble.

The ASE emphasizes property rights, sound money, minimal efficient regulations, savings and investment, with minimal debt and leverage, and maintains that policy changes which allow markets to operate freely result in economic growth and wealth creation, whereas interventionist policies are not friendly to the markets and result in economic stagnation and wealth destruction.

Ludwig von Mises (1881-1973) – ASE Economist

A key aspect of the ASE is alignment with human nature – implementing economic policies that leverage the positive aspects of human nature to encourage and empower the economy through self-initiative, innovation and entrepreneurialism.

Market Environmentalism – Four Principles

The Great Awakening Vision takes a Market Environmentalism approach to the environment. As espoused by the Austrian Economics Centre and the American Conservation Coalition, there are four principles to this approach:

The Great Reset Agenda fails on this principle as it attempts to push agenda-based solutions with unattractive Profit and Loss (P&L) metrics, rather than allowing the market economy to identify innovative solutions with positive returns on investment and operations – alongside limiting ecological footprints at the same time.

The Great Reset Agenda fails on this principle as it promotes “you will own nothing and you will be happy”.

In contrast, that which no one owns, no one cares for. Ownership stimulates stewardship and responsibility. Strong property rights also include the ability to trade resources, which allows markets to reallocate natural resources for conservation purposes.

The Great Reset Agenda fails on this principle as it is based on centralized agenda policies, with little or no on-the-ground information.

In contrast, communities benefit from the dynamic, decentralized knowledge necessary to implement effective conservation strategies. Decentralizing power from government bureaucracies to local communities fosters closer cooperation, resource management, and environmental accountability.

The Great Reset Agenda fails on this principle in many respects. Much of the Great Reset Agenda relies on imposing in many cases draconian monitoring and controlling measures attempting to change or modify human behaviour in ways that people are not comfortable with or not happy in doing, or that take away from their sense of personal freedom and privacy. These include a social credit scoring and control system, a central bank digital currency with financial and social controls, and restrictions on movement, travel and flexibility of spending.

In contrast, the Great Awakening Vision places great emphasis on innovation and technology, while maintaining respect for human rights, freedoms and liberties at the same time. For example, high on the Great Awakening Vision list for new energy sources that can provide the requirements on not only scalability but also entailing little or no greenhouse gas emissions is the commercialization of nuclear fusion – virtually limitless, clean energy with the potential to provide all the power needed for the world’s electric vehicles.

Roadmap Plan

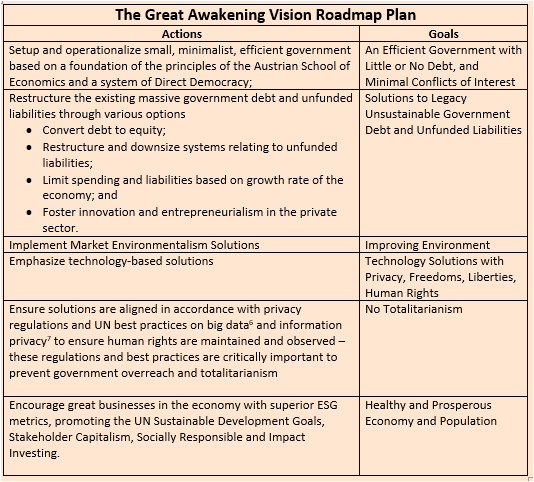

So how can the proposed alternative Great Reset – the Great Awakening Vision – be implemented? Here is a suggested high-level roadmap plan based on the above detailed framework:

In summary, there is an alternative Great Reset that can lead the world to the same target destination target goals as the World Economic Forum Great Reset Agenda and the UN Sustainable Development Goals, but without the dystopian implications and its shortcomings on environmentalism stemming from the Great Reset Agenda. It is The Great Awakening Vision. The basis of this alternative Great Reset is on the principles of the Austrian School of Economics and Market Environmentalism, aligned with human nature, innovation, entrepreneurialism, sound money, minimal debt and leverage, minimal efficient regulatory structure, freedoms, strong property rights and minimalist efficient government.

Richard Bonugli is the CEO and Founder of global services firm Cedargold, offering risk and wealth management services including The Cedar Portfolio, an exemplary investment model portfolio of great businesses from around the world helping society and the environment, using the principles of the Austrian School of Economics.

[1] https://www.greenclimate.fund/news/responding-impacts-covid-19-global-pandemic-interlinkages-between-people-planet-and-prosperity

[2] https://gloria.tv/post/oQV6i6QAuin21KQjqsvGMYqAc

[3] https://rumble.com/vtz9mw-episode-253-canceling-covid.html and https://new.awakeningchannel.com/28-international-network-of-lawyers-the-cv19-crisis-is-a-fraud-and-those-responsible-will-be-sued-28-28-grand-jury-5/

[4] https://www.youtube.com/watch?v=9FM4Fu2ujDE

[5] Contact info@cedarportfolio.com for a spreadsheet list of these shortcomings and violations

[6] https://unsdg.un.org/sites/default/files/UNDG_BigData_final_web.pdf

[7] https://www.ohchr.org/en/universal-declaration-of-human-rights

03/17/2022 - The Roundtable Insight with Charles Hugh Smith on The Great Awakening Vision

03/17/2022 - The Roundtable Insight with Charles Hugh Smith on The Great Awakening Vision

View also part 1 on the Great Reset – link here

03/12/2022 - Implications on Inflation and Commodities from the Geo-Political Events

03/12/2022 - Implications on Inflation and Commodities from the Geo-Political Events

“Russia is a major supplier of the most wanted raw materials including: palladium, 46% of global production, platinum 15% of global protection as well as gold, oil, natural gas, coal, nickel, aluminum, copper and silver, as well as wheat.”

03/09/2022 - Zoltan Pozsar: Bretton Woods III

03/09/2022 - Zoltan Pozsar: Bretton Woods III

“We are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West.”

03/09/2022 - Cryptocurrencies (and the metaverse) a universe for peace

03/09/2022 - Cryptocurrencies (and the metaverse) a universe for peace

” In other words, cryptocurrencies -with all the instability typical of a new and still incipient world- are increasingly presented as an alternative to peace, that is, to evade sanctions and violent actions by governments that can do little to control them. , they can eventually control the people who use them, but not the cryptocurrencies themselves.”

03/07/2022 - The Roundtable Insight – Jacob Shapiro and Yra Harris on the Geo-Political Risks to the Economy and Financial Markets

03/07/2022 - The Roundtable Insight – Jacob Shapiro and Yra Harris on the Geo-Political Risks to the Economy and Financial Markets

03/07/2022 - Yra Harris: A Quick Hit On the State of Chaos

03/07/2022 - Yra Harris: A Quick Hit On the State of Chaos

“The best things going right now for the global financial system are the FED‘s dollar swap lines to many banks and the Foreign International and Monetary Authorities Repo Facility, which the G-30 pushed Chair Jerome Powell to make permanent. This provides generous backstop for foreign institutions, which is important because something is definitely ROTTEN in DEMARK, FRANCE, GERMANY, ITALY, et al. What it is I don’t know but at this point, watch the European system. All acts of war and the sanctions will deliver unintended consequences. Be patient and let the false headlines be played by those relying on the newest expert to fill the airwaves. And also, let’s see where the FED goes in response to political systemic risk.

We’re only just beginning to evaluate and assess but the longer this goes on the more damage will be done as FOOD becomes scarce as countries are forced to protect their populations and four million barrels of Russian OIL go searching for buyers. Upon listening to the Chair of the House Agricultural Committee David Scott at Powell’s testimony last week I wouldn’t be surprised to see the Biden White House move to limit U.S. ag exports if prices continue to push higher and worries of scarcity arise. The optics of headline inflation are harming the Dems’ chances in November. As always in politics, OPTICS provide an incentive when policy is failing.”

03/03/2022 - The Roundtable Insight with Charles Hugh Smith on The Great Reset Agenda

03/03/2022 - The Roundtable Insight with Charles Hugh Smith on The Great Reset Agenda

Link to the Article on the Great Reset and the alternative Great Reset – the Great Awakening

02/23/2022 - Alejandro Tagliavini – NFTs or the real (and good) new normal

02/23/2022 - Alejandro Tagliavini – NFTs or the real (and good) new normal

“Over the past week and early this week, Bitcoin (BTC) saw unstable pendulum swings, moving in a range and closing in a downtrend just like most altcoins. Factors such as geopolitical tensions in Ukraine, rising global inflation, speculation on interest rates and its supposed correlation with the US stock market are affecting its price.”

02/18/2022 - The Roundtable Insight – John Dizard in the Trading Room on Geopolitical Risks, the Economy and the Financial Markets

02/18/2022 - The Roundtable Insight – John Dizard in the Trading Room on Geopolitical Risks, the Economy and the Financial Markets

02/17/2022 - Yra Harris: Is It George Bailey or Henry Potter?

02/17/2022 - Yra Harris: Is It George Bailey or Henry Potter?

“As noted in the latest podcast with Dr. Faber, QT would be the area in which the FED WOULD DISCOVER HOW MUCH LEVERAGED EXISTED ACROSS MYRIAD ASSETS RAISING THE IDEA OF SYSTEMIC RISK AS THE OVERLEVERAGED BEGAN RAISING CASH. The FED has created a very difficult situation for itself as it confronts the global problem of inflation.”

02/09/2022 - The Great Reset from the Perspective of the Austrian School of Economics

02/09/2022 - The Great Reset from the Perspective of the Austrian School of Economics

Link Here to an alternative Great Reset based upon the Principles of the Austrian School of Economics – Short Form

Link Here to an alternative Great Reset based upon the Principles of the Austrian School of Economics – Long Form

02/09/2022 - Alejandro Tagliavini – Times of uncertainties and critical global shortages

02/09/2022 - Alejandro Tagliavini – Times of uncertainties and critical global shortages

“The markets are experiencing weeks of high volatility and most analysts highlight the «confusion» shown by many investors in relation to the future macroeconomic scenario. To begin with, because of the fact that all the restrictions “due to the pandemic” have not been lifted, the global economies, after the rebound in 2021, are still weak.”

02/08/2022 - The Roundtable Insight – Dr. Marc Faber & Yra Harris on the Economy and Opportunities in the Financial Markets

02/08/2022 - The Roundtable Insight – Dr. Marc Faber & Yra Harris on the Economy and Opportunities in the Financial Markets

02/04/2022 - The Roundtable Insight – Bill Blain on the Economy, Financial Markets and ESG

02/04/2022 - The Roundtable Insight – Bill Blain on the Economy, Financial Markets and ESG

02/04/2022 - Yra Harris: The Soft Bias of Low Expectations

02/04/2022 - Yra Harris: The Soft Bias of Low Expectations

“It seems the Hawkish outlook stems from a leak out of the ECB Governing Group that the meeting had experienced dissonance about the slow pace of changing monetary policy. If Lagarde is suffering the slings and errors of the hard money members look for the GOLD to gain against all fiat currencies for the issue going forward will be CENTRAL BANK CREDIBILITY. Sorry, ZERO RATES at the time of 5% headline inflation is just not monetary stridency.”