Jeremy Grantham, co-founder of Boston investment firm GMO, doesn’t expect valuations to drop back to normal levels for two decades. But he is keeping cash on hand to take advantage of any dip, which he says would need to be 15-20% to act.

04/04/2017 - GMO’s Jeremy Grantham: Stocks “Decently Different This Time”

04/04/2017 - GMO’s Jeremy Grantham: Stocks “Decently Different This Time”

Jeremy Grantham, co-founder of Boston investment firm GMO, doesn’t expect valuations to drop back to normal levels for two decades. But he is keeping cash on hand to take advantage of any dip, which he says would need to be 15-20% to act.

03/31/2017 - GMO’s James Montier Attempts To Model Financial Repression

03/31/2017 - GMO’s James Montier Attempts To Model Financial Repression

Article: “There is a massive move underway in markets, GMO’s resident contrarian James Montier noted in a white paper titled “Six Impossible Things Before Breakfast.” Like an Alice in Wonderland journey, James Montier goes down rabbit holes of ” financial repression ” of free market thought as he attempts a rare feat in the history of algorithmic analysis: Modeling an assumed free market to its correlation impact on a centrally-influenced market featuring negative interest rates. Modeling the point at which a “repressed” market impacts a free market is a feat rarely accomplished in public with a high degree of difficulty. The author’s resultant “two key assumptions, neither of which (he finds) very palatable,” question the linkage between interest rates and stocks as an investment priced based on assumed risk.” ..

Montier: “If bond markets are smoking weed, then the stock market appears to be hooked on crack.”

03/31/2017 - Danielle DiMartino Booth: The Fed Is Bedeviled by Keynes’ Paradox

03/31/2017 - Danielle DiMartino Booth: The Fed Is Bedeviled by Keynes’ Paradox

“The economist John Maynard Keynes warned that ultra-low interest rates would backfire on central banks seeking to spur borrowing and spending, yet they seemed surprised that the current recovery is the weakest in postwar history after cutting rates to near zero, or even below in some cases .. As Keynes’s paradox dictates, retirees have nothing but impossible choices to make. Either they sleep with one eye open, hoping they don’t outlive their prudently stashed savings which are not keeping pace with the rising cost of living. Or they sleep with the other eye open, with their principal at risk, the price they pay for being exposed to risky securities whose returns do outpace inflation. Paradox indeed.”

03/31/2017 - The Roundtable Insight – Yra Harris & Uli Kortsch On How Switzerland Is Performing Financial Alchemy

03/31/2017 - The Roundtable Insight – Yra Harris & Uli Kortsch On How Switzerland Is Performing Financial Alchemy

FRA is joined by Yra Harris and Uli Kortsch in discussing the impact of Switzerland on the Eurozone, along with the upcoming elections and the global debt.

Yra Harris is a recognized Trader with over 40 years of experience, with broad expertise in the cash currency markets. He has a proven track record of successful trading through a combination of technical work and fundamental analysis of global trends; historically based analysis on global hot money flows. He is recognized by peers as an authority on foreign currency. In addition, he has specific measurable achievements with the Chicago Mercantile Exchange (CME). Yra Harris is a Registered Commodity Trading Advisor, Registered Floor Broker and a Registered Pool Operator. He is a regular guest analysis on Currency & Global Interest Markets on Bloomberg and CNBC.

Uli Kortsch is the Founder of both the Monetary Trust Initiative (MTI) and Global Partners Investments (GPI). Currently most of his time is spent on MTI whose mission is to bring transparency and authentic principles to our monetary system. As President of Global Partners Investments and other ventures, he has worked in over 50 countries, written a bill for Congress, and conferred with approximately 15 national presidents, ministers of finance, and ministers of commerce. He has served on numerous corporate boards with both for-profit and not-for-profit organizations.

SWISS END OF THE EUROZONE

The Swiss print a lot of Swiss Francs as a means of intervening in the markets. They exchange those for primarily Euros, some Dollars, Yen, etc. They’re busy accumulating a massive equity portfolio along with their foreign exchange reserves. They hold $2B of Apple stock because their policy of intervention is to try and keep the Swiss Franc from appreciating too much. Back in January 15 2015, they let the peg to the euro go and we saw a giant move up in the Swiss Franc. The world sits back and lets the Swiss central bank actively be a currency interventionist, but the Swiss are smart enough to understand that they don’t want to just hold everybody else’s currency; they are buying real assets through their process of intervention.

The Swiss Franc represents the frugality of the global investment system as investors are willing to buy Swiss assets with negative yields out over 10 years. There’s a tie-in with potentially increasing its gold reserves. If you’re buying all those equities, you might as well start adding to your gold reserves.

GOVERNMENT GOLD HOLDINGS

The Swiss referendum on gold last year was to increase their gold holdings. They were selling gold and the referendum was to stop selling and repatriate the gold. The amount of paper gold out there out there is about a hundred times the amount of real gold, so what is really out there? No one really knows.

Switzerland is an island, surrounded by the Eurozone. Switzerland is an island of monetary stability. They’re trying to weaken their currency through the increase in reserves and purchase of various assets.

Italy is in very bad shape. If they were to use GAAP accounting for their banks, the country would instantly go bankrupt. France isn’t that much further behind, and we know where Greece is. About 40% of the Swiss National Bank (SNB) is owned by private individuals, so it’s a different system. The Fed is owned by its member banks and it’s impossible to go bankrupt; they can have negative equity and no one cares. But if the Swiss central bank were to go bankrupt that’s a different story. We are coming up against a global recession, our debt levels are again greater than they were in 2007 before the last recession, and this time we do not have the fallback position of the emerging markets like we did then. Plus the political problems, the shaking that is occurring is very substantial. When the debt levels again reach the point where we have another recession, what is going to be the fallback this time, other than more debt?

If we do go into that global recession, the overhang of debt is greater than it was in 2007-2008.

One of the arguments we get against the ‘evil of debt’ is that it’s owed to somebody. It’s not owed to anybody, it’s created by the banks because almost all of our money today is electronic. The money is created by the banks through debt. If we go back in history, nations inflated their way out of debt. The scenario doesn’t change. The central banks have turned the world upside-down and we’re not even close to understanding what right-side up is.

SUSTAINABILITY OF EUROPE AND SWITZERLAND

“The market can remain irrational longer than you can remain solvent.” – Keynes

This is at least the second longest running time between recessions since WW2. The question is whether or not the next recession will be deep enough that some of these abnormal situations fall apart, or will it take another recession past that. We have both political and market pressures, and if you talk China and Russia we have military pressures. The Russians are going to have the biggest Eastern European military exercise this September; a power play verses all the small nations immediately around there.

We have three aspects: a very unbalanced market, a very fragile political situation especially in Europe, and now very recently a military aspect.

One of the things Trump had right is the role of NATO in the world. It’s served its purpose for a long time. Just because we get into this mindset, we don’t have to see it to its illogical end and Trump is right in wanting to roll back Pax Americana. It’s served its time and you don’t have to serve out your Imperial desires until you go broke like Britain. People are up in arms about NATO but it’s the same people who were up in arms about the One China policy. The world is changing dramatically and Trump isn’t wrong to address these things.

Based on the political uncertainty, markets are not pricing correctly. The real risk factor is in these markets.

POSSIBLE EUROZONE EVENTS WITH MAJOR IMPLICATIONS

The probability of the ECB doing a full guarantee is virtually zero unless there was a split in the Eurozone between the north and the south. The probability of a Eurozone country leaving he euro monetary union is ~70%.

Even though Britain is invoking Article 50, it’s a two year process now. So much could happen in the next two years in Europe. Italy is in severe trouble. The only ones who can guarantee a European bond are the Germans, so the Brits are going to get a two year window and a lot of things can go topsy-turvy. If there’s one threat of it, they’ll come begging the Brits to come back because they’ll need them, and the British will be able to make the greatest deal ever where they’ll be able to get back their sovereignty for financial assurance.

The political system in France is weighted against Marine Le Pen and the odds of her winning are low, but then the issue becomes the German elections. Germans are not used to borrowing to finance asset purchases, but when you’re running negative real interest rates, the real yields are negative yields and you’ve got to protect yourself. Otherwise it’s the ultimate form of financial repression to bail out the rest of Europe, and that’s what this election in Germany may hinge on.

If it breaks up north/south and the north takes the Euro, the SNB will make a fortune. If the southern nations wind up with the Euro, everyone else goes about recreating a synthetic Deutschmark – that would be the most interesting outcome of all.

THE NEXT 6-12 MONTHS

Uli: There’s about a 30-40% probably that there’s going to be a serious crash by the end of the year. The problem is that we’re all on a tipping point. The system’s kind of like a plateau. 20 years ago the plateau was very wide. It’s become narrower and narrower and now it’s like a mountaintop. What would get us to fall off the edge of the cliff? The plateau is narrow, so initiating action becomes more and more likely to move us off one of these points, because it doesn’t take much.

Yra: There’s a huge amount of debt that plagues the global system, which is why the Border Adjustment Tax discussion is crazy. If you had a 20% appreciation of the Dollar, that would be the spark to ignite a terrible situation.

A huge amount of debt is Dollar financed. It makes the sub-prime situation ridiculous. Where will the world get their Dollars from, if the U.S. does not run a deficit?

The Trump people are talking tax reform, not tax cuts. It’s revenue neutral, which means there’s going to be winners and losers. If there’s really good winners it’ll be the middle class. That’s why Trump won. The cost of Britain leaving is just a soundbite. How are they going to force the Brits to pay? They’re already leaving. There’ll be no settlement of that debt ever.

Abstract by: Annie Zhou <a2zhou@ryerson.ca>

03/29/2017 - Paul Brodsky: “A Socialized Market With Guaranteed Positive Returns For All Must Fail”

03/29/2017 - Paul Brodsky: “A Socialized Market With Guaranteed Positive Returns For All Must Fail”

“When we step back and look at the broad macroeconomic setup, characterized by aging populations in the world’s largest economies, declining overall birth rates among the world’s wealth holders, record sovereign and household leverage, the continued economic emphasis of finance over production, the reliance on over-accommodating central banks (even during the Fed’s current rate hike phase), historically high equity, bond and real estate prices and record low asset and liability values (in real terms); we cannot help but conclude that asset prices are generally rising due mostly to inertia, in spite of unreason, and that the most likely outcome will be something unexpected and disappointing.

Even though it is a rejection of the established secular bull market in assets and the social, economic, political and financial cultures established and tweaked over the span of our career (almost to the day), our heart and mind (not to mention the vast sweep of investment and economic history) tell us structural change is coming. We can use our experience to forecast specific events and new trends that might occur, and we have, but we cannot know exactly what form structural change will take or when it might begin.

A socialized market framework with implicitly guaranteed perpetual positive returns for all must fail.”

03/29/2017 - Yra Harris: The Swiss Central Bank Is Performing Financial Alchemy, Printing Money To Buy Real Assets

03/29/2017 - Yra Harris: The Swiss Central Bank Is Performing Financial Alchemy, Printing Money To Buy Real Assets

“SNB President Thomas Jordan regularly opines that is Swiss currency is overvalued. The SWISS bank reserves are not increasing because of robust Swiss exports. However, the SNB regularly turns on the printing presses to produce Swiss francs to sell and purchase other currencies in an effort to meet the insatiable demand for the Swiss foreign currency. Currently, SNB foreign reserve holdings are equivalent to the entire GDP of the Swiss economy. The SWISS FRANC represents the fragility of the global financial and political system as investors are willing buy Swiss assets with negative yields out to over TEN years. The Swiss are doing nothing more than printing more SWISS FRANCS to meet the demand. When they use the fiat francs to purchase other currencies the SNB converts those currencies into EQUITY AND BOND assets in a symphony of some of the most high-quality worldwide corporations. THIS IS FINANCIAL ALCHEMY OF THE HIGHEST ORDER. The SNB owns almost $2 billion of APPLE Corporation .. No wonder the Swiss are so happy. They are laughing as the world keeps willing to swap its banknotes for real assets, helping Swiss citizens become the world’s largest hedge fund .. The SNB has discovered the PHILOSOPHER’S STONE and lo and behold it is a printing press. The VIX may represent investor complacency but the SNB’s attempts at financial alchemy represent something else. Not sure as of yet but if I were a Swiss national I would be voting for the SNB to be increasing its GOLD RESERVES.”

“The SNB reinforces my point and what reader Asherz wrote last night in the blog post: The Swiss are running the largest hedge fund in world and they can’t hedge because it would only put upward pressure on the Swiss franc. So the SNB needs to begin purchasing a basket of commodities, especially large amounts of GOLD as the ultimate hedge against global financial uncertainty. Just imagine the political uproar in Switzerland if global equity markets depreciated over the next five years. It’s alchemy at its finest.”

03/25/2017 - The Roundtable Insight: Alasdair Macleod And Jayant Bhandari On The Factors Driving The Purchasing Power Of Currencies Lower

03/25/2017 - The Roundtable Insight: Alasdair Macleod And Jayant Bhandari On The Factors Driving The Purchasing Power Of Currencies Lower

FRA is joined by Jayant Bhandari and Alasdair Macleod in discussing current trends in gold, along with Asian currency markets and their expectations for them.

Jayant Bhandari is constantly traveling the world looking for investment opportunities, particularly in the natural resource sector. He advises institutional investors about his finds. Earlier, he worked for six years with US Global Investors (San Antonio, Texas), a boutique natural resource investment firm, and for one year with Casey Research. Before emigrating from India, he started and ran Indian subsidiary operations of two European companies. He still travels multiple times a year to India. He is an MBA from Manchester Business School (UK) and B. Engineering from SGSITS (India). He has written on political, economic and cultural issues for the Liberty magazine, the Mises Institute (USA), Mises Institute (Canada), Casey Research, International Man, Mining Journal, Zero Hedge, Lew Rockwell, the Dollar Vigilante, Fraser Institute, Le Québécois Libre, Mauldin Economics, Northern Miner, Mining Markets etc. He is a contributing editor of the Liberty magazine. He runs a yearly seminar in Vancouver titled Capitalism & Morality.

Alasdair Macleod writes for Goldmoney. He has been a celebrated stockbroker and Member of the London Stock Exchange for over four decades. His experience encompasses equity and bond markets, fund management, corporate finance and investment strategy.

UPDATE ON INDIA

India is very rapidly becoming a police state. Last month the government announced that any cash transaction over 300,000 Rupees (approx. $4500USD) would no longer be legal. Any transaction over that amount, according to them, has to be through the banking system. But they have actually come out with 40 amendments in the last few days, and the latest one says that cash transaction limit is now 200,000 Rupees. If you make a transaction over that amount, you will be penalized with the same amount you tried to transact with. This is an absolutely crazy situation in a country where 96% of transactions are made in cash.

Last week Uttar Pradesh, the biggest province in India and which basically decides who runs the federal government as well, elected BJP (Bharatiya Janata Party) into power, and Modi appointed Yogi Adityanath as head of the state. Yogi Adityanath is a Hindu extremist, who has openly and publically asked for the killing of hundreds of Muslims for every Hindu killed. In the last few days that he has been the minister, they have already been establishing a very backward sort of law and order in the province, and a few Muslim shops have been brought down in the last few days. This can very easily escalate. In 1991, there was the destruction of a mosque in Uttar Pradesh, which Hindu extremists wanted to convert into a temple, and now that a Hindu extremist is in power he has no choice but to convert that mosque into a temple. This is a very delicate situation for India.

INDIAN DEMAND FOR GOLD

The gold demand is very subdued even today, and the reason is that people don’t have access to cash to buy gold. More than 50% of ATMs still do not have cash and banks are clogged with people. At the same time, the economy is stagnating, and in a negatively yielding environment people have a tendency to buy gold. People just don’t have access to their own cash.

In a police system, people will trust their institutions even less than they have in the past. And now tax authorities have the right to enter your house without reason. They still need a warrant, but the whole institution climate is such that savers and businessmen are extraordinarily afraid of the state. This will increase people’s interest in gold or in moving their money out of the country.

GOLD RETURNING TO CENTRAL BANK RESERVES

The reason this is happening is because China is getting rid of Dollars in order to stockpile the commodity it needs for its development over Asia. China will spend huge amounts of resources in developing not just the Silk Roads but also the associated infrastructure, and the industrial revolution that China will be bringing in effect. We’re talking about a massive, 20-year project. China will effectively be selling Dollars down against the price. The problem the other central banks who will be dealing with China has is that they will have to try and match, to some degree, the pace at which the Chinese central bank disposes of its Dollars and adds to gold. One way or another, central bank demand is being driven into gold.

They also have the problem that if you’re looking at fiat currencies, where do you go instead of the Dollar? The Euro? The political situation in Europe suggests that currency might not exist in its current form within a 2-3 year timeframe. The Yen? Probably yes, but the problem with Yen is negative yields, and you don’t necessarily want to have Japanese government bonds that effectively yield nothing or very very little. There is not a lot of choice for the Asian central banks. For example, if Thailand just adjusted their portfolio, it probably means they’d have to pick up 60 tonnes of gold just to adjust their reserve portfolio by 10%. You can’t just walk into the market and buy that much easily. You can see that there is an underlying tendency for central banks to sell Dollars to buy gold.

MOVING AWAY FROM FREE TRADE

Last weekend the G20 finance ministers agreed to drop the reference for free trade. The Americans are changing the terms of global trade. They’re moving away from trade agreements, they’re moving away from WTO mandated minimums, and consequentially they’re saying that they’re going to run trade and they don’t care what anyone else says.

This is rather like the Smooth-Hawley problem we had under Hoover, which drove the whole world into a depression. The American move will lead to a contraction in global trade. The Chinese are mostly protected from this since they’re already moving away from selling cheap goods into developing the Asian continent. As the volume of trade contract in the coming years and global trade diminishes, Dollars will be returning home. And they will be returning home at the same time that Asian central banks are trying to reduce their exposure to the Dollar. We are at the peak value of the Dollar in terms of its purchasing power. The price of gold measured in dollars is going to go up quite sharply.

This goes as far as Saudi Arabia, whose market is Asia. Suddenly we have a situation where the Eurasian continent landmass is now the most economic driver in the world and America is receding into the distance. The consequences of this are not fully understood and will take time for us to work this one out. The importance of Asia is becoming paramount. Already China’s trade with Asia exceeds her exports to America. They need to redeploy the labour from the production of cheap goods into the further development of her own economy and move 200M people into new cities, expanding the middle class. This is the most populous country in the world, bar India, which is going upmarket. We really don’t understand this, if we still think America still runs the world. No longer. This is changing. Mr. Trump is going to find that the world is not quite as he thinks it is.

It’s only really been the last 200 years where the combined GDP of China and India have not been greater than the rest of the world, so a reversion of the mean is happening. The natural North American partner for China is Canada, not only because of raw materials and commodities, but because Trudeau Sr. was the first Canadian to go over to China and form the diplomatic bonds that persist until today.

SIMILAR TRENDS IN ASIA

The USD can continue to be very strong in the near terms. Emerging markets are facing huge financial and economic problems. They have taken on too much private and public debt which means that compared to the USD, their fiat currency has even less value in the future. As a result, the locals still prefer to own USD if they can get a hold of it. The USD can still hold its value, particularly if these emerging markets fail or if European currencies collapse.

The thing is that China is stockpiling all these resources. The effect China is having on the global supply of raw materials and energy is remarkable. The idea that if you get a recession in America, demand for raw materials go down because companies reduce their margins and prices start falling. But not this time. Raw material prices will continue to rise. These are precisely the conditions you have for stagflation, where you see your own economy going nowhere but prices are rising. People are latching onto the idea that the purchasing power of their domestic currency is not holding, and they prefer to hold fewer Dollars than normal to have lower exposure to that declining currency. When you start thinking that way, the purchasing power of the currency goes down irrespective of the quantity in circulation.

This hasn’t happened before. The idea that America runs the world is no longer true. They’re playing second fiddle to what China is doing to the whole of Asia.

SOUTHEAST ASIA DOLLAR DEVALUATION

This will not trigger a wave of global competitive currency devaluations, because the problem is that these countries have inherent problems in their economic structure. Devaluing their currencies against the US economy won’t help them, but the temptation will be there because this is how they’ve historically operated. If they do that, gold will be more attractive due to the loss of purchasing power in currencies worldwide. It’s becoming a subject of interest for people who not only want to buy commodities, they want to invest outside their own countries, and they want to own and hold gold outside their own country.

The world has changed. Governments still seem to think they can push their own people around, but it doesn’t work like that anymore. The amount of control that countries like India think they have over their people.

The loss of purchasing power in these currencies has been absolutely incredible. When the dollar goes down, other currencies will tend to lose their purchasing power on balance more rapidly. The Euro has potential for disintegration; the political developments in Europe are pointing to that being an escalating risk in 2017.

FINAL THOUGHTS

There’s a huge amount of accumulation of intellectual capital happening in China. You go to bookshops and you get books translated from English to Chinese. You see coffee shops, restaurants, offices trying to copy the western way of working. The Asian continent is where the excitement is. 90% of all engineers and scientists are Asians living in Asia.

Abstract by: Annie Zhou <a2zhou@ryerson.ca>

03/24/2017 - Global Investment and Economic Implications of Current Events

03/24/2017 - Global Investment and Economic Implications of Current EventsCurrent events during the last few months have caused overwhelming uncertainty throughout the global economy, and the consequences of this uncertainty are particularly difficult to foresee. In particular, there are two major developments that have global investors on the edge of their seats – a revamping of the Dodd-Frank Act, and a proposed Border Adjustment tax.

The Dodd-Frank Act

The Dodd-Frank Act was signed into U.S. law in 2010 in a reactionary attempt to prevent incidents such as the financial crisis of 2008 from occurring again. The law’s main purpose was to hold banks more accountable for their actions and improve their risk management practices and policies. It also tried to increase transparency between banks and the public, as well as monitor profitable banks to increase their reserve requirement should they become “too big to fail”. The Dodd-Frank act generally makes banks hold more capital, which they’d prefer to invest. U.S. President Donald Trump recently made headlines in February when he said he planned to revise or completely throw out the Act, claiming it was hurting small businesses and small banks.

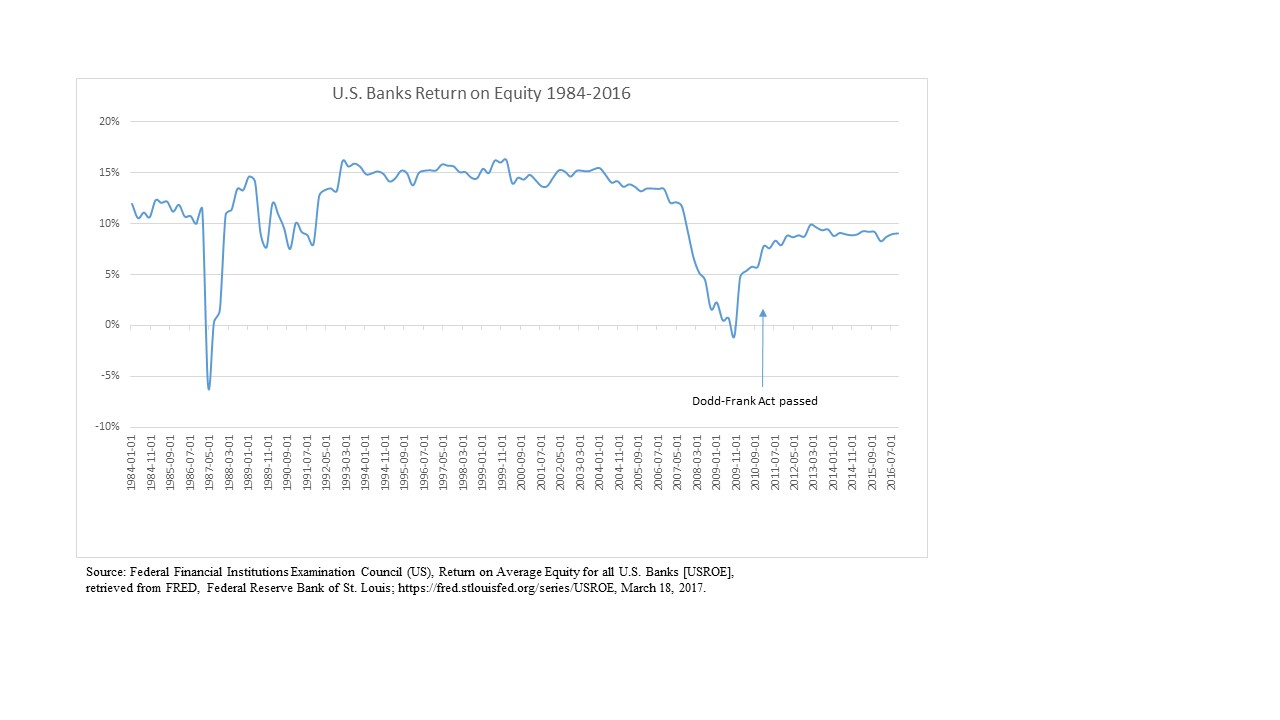

There would be several major implications for investors if the Dodd-Frank Act were revised or discarded completely. Estimating the consequences of this action requires some background information on how the Dodd-Frank act impacts banks. Below is a chart showing the average return on equity for all U.S. banks with every quarter from 1984-2016 (points shown every year).

Between 1984 and when the Dodd-Frank Act was signed in July 2010), banks made an average of 11.99% on their investments. After the Act was signed, banks’ return on equity fell to an average of 8.63%, meaning on average, banks made 3.36% less equity on their investments per quarter. This suggests that a weakened Dodd-Frank Act would create much more profitable banks on average. It’s also worth noting that smaller banks bear the largest burden from the Act since many cannot afford the external audits required by the Act.

It’s important to note that since the Dodd-Frank Act was signed, the banks’ return on equity only had a standard deviation of .992%, while from 1984-2016, that same figure was a whopping 4.403%. This means that before Dodd-Frank, we would expect, on average, that a banks’ return on equity to deviate 4.403% from the mean each quarter, as opposed to a mere .992% after the Act was signed. This indicates that banks have been a much safer and more consistent investment under the Dodd-Frank Act.

That being said, the 4.403% standard deviation was heavily influenced by low and even negative equity returns in 1987 and 2008, due to economic recessions. It’s difficult to say whether or not the Dodd-Frank Act would have prevented these harsh economic conditions, but it’s reasonable to assume that it would have helped. After all, Dodd-Frank was enacted as a direct response to the financial crisis of 2008.

If the Dodd-Frank Act was changed or revised, a likely target would be the Volcker Rule. A report by the Federal Reserve defines the rule as an intention to “limit bank risk-taking by restricting or prohibiting certain speculative activities,” which limits a bank’s ability to engage in trade that doesn’t benefit their customers. This rule is very unpopular among banks, and eliminating it would mean a massive increase in proprietary trading. In September 2016, the Federal Reserve released an analysis of the Volcker Rule called “The Volcker Rule and Market-Making in Times of Stress”[1] in which they tested how the Volcker Rule affected bond liquidity. The analysis concluded that “the Volcker Rule has a deleterious effect on corporate bond liquidity, and dealers subject to the Rule become less willing to provide liquidity during stress times”. If this rule is eliminated, it could really shake up the financial investment market, and we see a reason to believe that there may not be enough support to keep the rule in place.

It’s difficult to judge the Dodd-Frank Act’s full impact because it hasn’t had to withstand a recession. In any case, reducing the regulations would alleviate the many burdens banks face today by allowing them to give out more loans and make more investments, which usually results in higher profits, but at a greater risk. Despite the increased risk, eliminating or weakening the law would be welcomed as good news by banks and financial investors. To be sure, the extent of their delight will depend on the degree to which the Dodd-Frank act will be changed.

[1] Bao, Jack, Maureen O’Hara, and Alex Zhou (2016). “The Volcker Rule and Market-Making in Times of Stress,” Finance and Economics Discussion Series 2016-102. Washington: Board of Governors of the Federal Reserve System, https://doi.org/10.17016/FEDS.2016.102.

What the Experts think

A great deal of notable investment experts would generally like to ease the burden that Dodd-Frank puts on banks to some degree. Peter Boockvar, the Chief Market Analyst to the Lindsay group, is hopeful the currently unknown changes to the Dodd-Frank act will be able to help small banks. He points out that “Smaller banks have been the most burdened by Dodd-Frank. The bigger banks, they can afford to hire thousands and tens of thousands of the compliance officers. It’s the small banks that have really suffered, and hopefully they get the most relief from any changes.” He also hopes changing the act will result in banks’ lending more. To do this, changes would have to focus on Dodd-Frank requiring banks to hold less of their capital; that way they could lend more.

However, he also points out that this is not an absolute solution to making banks lend more, saying, “We still need a willing lender and a willing borrower, hopefully this will facilitate that.” Yra Harris, a renowned trader with over 30 years of experience in all commodity trading, with additional expertise in currency markets, would prefer the Dodd-Frank act be replaced with Glass-Steagall, a piece of older legislation that would allow commercial banks and investment banks be separated. This would help improve banking transparency in line with Dodd-Frank’s goal, while also avoiding regulation that can once again be very harmful to the small banks.

Even though Dodd-Frank was passed to help prevent a financial crisis, many are afraid that it could actually exacerbate one. As stated before, the Federal Reserve has already concluded that at least the Volker rule makes it difficult to liquidate in times of stress, which could make banks very vulnerable should there be a crisis. Warren Buffet, one of the most famous and successful investors in the world, agrees with this. He has been quoted as saying that “Dodd-Frank has taken away the Federal Reserve’s ability to act in a crisis.”[2] As stated before, we haven’t been able to see what happens under the Dodd-Frank act during a recession, but Buffet believes that in the event of a financial crisis, the Dodd-Frank act could cause the Federal Reserve to be unable to respond effectively.

While most experts agree changing the Dodd-Frank act can be a good thing, it’s important to change the correct parts. The goal of the revision is ultimately to increase lending and investment, and as Peter Boockvar has pointed out, the impact on lending will depend on what’s changed. For this reason, many are reserving judgment until we have a clearer understanding on the areas of Dodd-Frank that will updated.

[2] Quote from http://www.investopedia.com/news/buffett-doddfrank-fed-and-national-debt/

A Potential Border Adjustment Tax

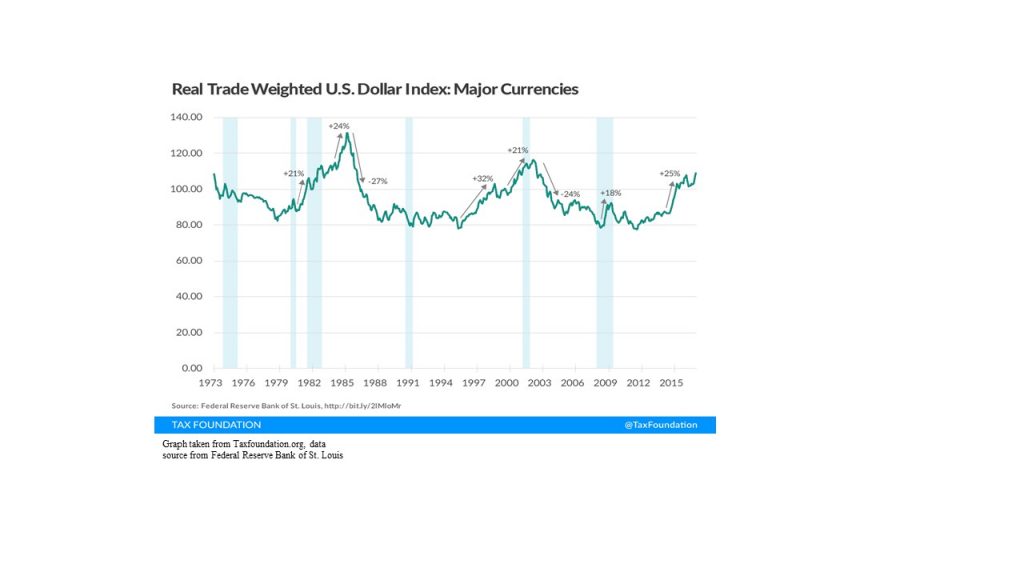

There would be a tremendous impact on the global economy if the Trump administration is able to follow through on its promised Border Adjustment tax. The general idea is that U.S. exports produced domestically would not be taxed, but foreign U.S. imports would be subjected to the nation’s corporate tax. The resulting burden on importers would be offset by a projected 20% appreciation of the USD.

A 20% appreciation of the USD has the potential be very problematic for the rest of the world. The USD is extremely important in the context of global economic dealings. If U.S major trading partners are faced with a 20% appreciation of the USD and a significant Border Adjustment tax, it could cause major harm to the global economy, and be detrimental to worldwide trade. Foreign currencies rely heavily on the USD because of the current amount of debt floating around in USD, which makes it extremely dangerous for it to fluctuate.

In the United States, if the dollar does appreciate as expected, it won’t do so overnight. Between the Border Adjustment tax being implemented and the dollar reacting to the changes, the U.S. may see massive price increases on imported goods, leading to an overall decrease in consumption and spending in the short term.

From a global investment perspective, a U.S. border tax would be harmful to other traders and currencies in the world. How likely is the dollar to appreciate? It’s difficult to say because the U.S. has never had a tax system like this before. Traditional economic models predict some amount of appreciation, but the extent is subject to debate. History shows that the USD has appreciated to these heights before, and been subject to high fluctuations.

One thing is clear: the U.S. government must proceed very cautiously if it does decide to levy a Border Adjustment Tax. Keeping in mind how much debt there is today and how many people rely on U.S. currency, implementing a Border Adjustment Tax has the potential to hurt both the world economy and U.S. economy simultaneously.

Foreign Response

The other factor to consider is how the rest of the world will respond to a Border Adjustment Tax. Many international leaders have made it clear they strongly oppose this tax and are prepared to fight it.

The Telegraph has reported that the EU is already preparing to take legal action against the World Trade Organization (WTO), in what could be one of the biggest cases in WTO history[3]. The Border Adjustment Tax seems to violate the rules set by the WTO, but a lawsuit would likely take many years to settle.

With this in mind, it seems likely that China will take swifter and more aggressive actions. Tax-news.com confirmed that China’s Minister of Commerce indicated that his country would indeed react were the U.S. to impose any sort of border tax[4]. Due to the large debt the U.S. owes China, the Chinese government has the ability to devalue the USD at any point and could use this to offset the tax. China could even impose its own tax on U.S. imports.

China would like to avoid resorting to these extreme measures, as it relies heavily on the U.S. for trade and would be hurting its own economy. Still, the Chinese government has made it clear that it will retaliate in some way if the tax is implemented. The impact of China’s response on the global economy will depend on what actions they choose to take. China’s response could help alleviate the damage the tax might inflict at a global level, but as of right now all we can do is wait and see.

[3] Source http://www.telegraph.co.uk/news/2017/02/14/eu-preparing-legal-challenge-against-donald-trumps-us-border/

[4] Source http://www.tax-news.com/news/China_Would_Respond_To_Any_US_Border_Tax____73557.html

What the Experts think

It’s important to remember that we’re looking at this from a global perspective and to anyone besides maybe in theory the United States, a Border Adjustment tax is incredibly dangerous. With that in mind, most economists and investment experts are extremely critical of how the Border Adjustment Tax is currently proposed. In a recent interview, Yra Harris warned of “a massive global slowdown” if the USD did indeed appreciate 20% on top of their border tax. He also warns that one of the most dangerous aspects of this is the massive amount of debt in dollars looming in the current global financial markets. If the USD appreciates by this extent, it poses a huge threat to all of the dollar-denominated debt being held in dollars overseas, “The variable of being the world’s reserve currency puts you in a far different position” Yra Harris adds. In short, much of the world economy relies on the relative strength of the USD and changing it without considering the unintended consequences is very short sighted. Peter Boockvar agrees, saying the tax would cause “a hit to the global financial system would bring on a wave of deflationary liquidation of assets that could really wreak havoc.”

He also points out that almost any way you cut it, the tax is a huge gamble because the U.S. is placing all of their chips in the value of other currencies and the dollar. He goes on to say, “Maybe the Dollar rallies, maybe it takes three years to adjust, and in the meantime the economy goes into recession because the price of goods rises to an extraordinary extent on an economy that’s dependent on consumer spending. And you throw in the $10T of Dollar related debt held by companies overseas that will get killed by the strengthening Dollar. If the Dollar weakens from this border adjustment tax, then the US goes into recession.”

Summary

The stocks for many banks have already gone up in expectation of less restrictive regulations. Whether or not this will be a continuing trend will largely depends on the extent to which banks can take advantage of having more freedom for their investments. The current regulations from the Dodd-Frank Act have caused banks to hold a high volume of bonds. If a change meant that banks would no longer need to hold as much, this could give them the freedom to be able to sell more, thereby raising the supply of bonds. If this happens, we can see a situation where the price of bonds lowers and the yield rises. Although, as Peter Boockvar pointed out, there still needs to be a willing buyer, and it will be interesting to see if the how the U.S. decides to deal with it. They can turn to the central banks to buy them, or when the Dodd-Frank Act is adjusted, they can add brand new regulations or incentives for the retail public to buy more bonds. There’s a very good chance it will come down to the central banks since it seems the main goal of revising Dodd-Frank is to reduce regulation as much as possible. Overall changes to the Dodd-Frank Act is a positive thing for investors in almost all scenarios, as it stands to increase banks’ profits as well as lending and general investment.

For the Border Adjustment tax, at least in the short run, we will likely see an increase in the price of commodities. Oil and gas prices are particularly vulnerable to rise if the tax is passed. In most scenarios, the tax will cause inflation throughout the U.S., but at the same time slow the country’s economic growth. That formula threatens to cause stagflation, which is a scary prospect to the United States, as it finally managed to consistently keep unemployment at a healthy level after the 2008 crisis. However, if this happens it can pose an opportunity for investors who can foresee the resulting inflation. Many investments such as oil and real estate move with inflation and tend to benefit during times when inflation is high.

Although the tax is expected to increase the value of the USD, we’re not sure if this will really be the case or not. This will depend on how the United Sates reacts to the short-term effects of implementing the tax, and how other countries respond. That being said, if the tax is implemented we can generally expect to see a rise in the USD unless others step in to change the scenario.

Author – Jacob Dougherty jdougherty@Ryerson.ca

03/23/2017 - Financial Literacy Day – Mark Your Calendar – Live Stream on March 30th – Link From Here

03/23/2017 - Financial Literacy Day – Mark Your Calendar – Live Stream on March 30th – Link From Here

LINK HERE to get the Live Stream

Cumberland Advisors and the University of South Florida Sarasota-Manatee are proud to invite you to our Financial Literacy Day being held on March 30, 2017. This event will feature panel discussions by experts on:

The keynote remarks will be given by William C. Dudley, President and CEO of the Federal Reserve Bank of New York.

Location:

USF Sarasota-Manatee at the Selby Auditorium

8350 N. Tamiami Trail

Sarasota, FL 34243

Parking Information:

Please use the parking lots on the south side of Seagate Drive. You will not need a parking permit if you’re attending this event.

The day will also feature the dedication of the new David Kotok/Cumberland Advisors Financial Information Laboratory equipped with Bloomberg Professional Services. This new Lab will provide access to the same data and analysis used by financial experts and managers around the world to students across the Sarasota-Manatee region. David Kotok and Cumberland Advisors were recently featured in the October 2016 edition of SCENE Magazine (pg. 50 – 51), explaining the importance of having these services accessible to financial professionals and students in the Sarasota-Manatee area.

03/22/2017 - McAlvany: Printing Money To Save The System Will Not Work Anymore

03/22/2017 - McAlvany: Printing Money To Save The System Will Not Work Anymore

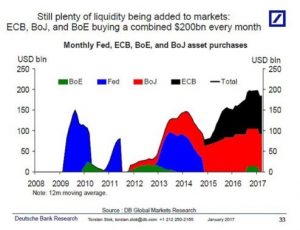

Who’s absorbing the liquidity from international money printing? The FED’s grand stimulus experiment has lost its effectiveness, Negative consequences soon to be felt. Inflation risks create key changes in the market that could lead to 2017 being an inflection year.

03/22/2017 - The Roundtable Insight: Chris Casey on The Austrian School of Economics and Why It May Be Time To Change Our Perspectives

03/22/2017 - The Roundtable Insight: Chris Casey on The Austrian School of Economics and Why It May Be Time To Change Our Perspectives

Chris Casey is a trusted advisor to many business owners and companies alike on their pool of investments within their portfolios. With a specialty in the Austrian School of Economics, the far less popular thread of the study especially here in North America, Chris combines a unique viewpoint on traditional economic themes with an expertise on the Austrian way of thinking.

As name would suggest, the Austrian School of Economics did in fact originate in Vienna, Austria. It was powered by what was called the “marginalist” revolution in the 1870’s, which aimed attention at diminishing marginal utility-that an individual’s given choice is made on the margin. With that said, the Austrian school is a body of thought that puts emphasis on the value products as being determined by its utility to the consumer. This is balanced with Keynesian economics which focuses on the importance of dissecting the nature of various aggregate economic variables such as output, employment, interest rates, and inflation.

The Western world is largely exposed to only the Keynesian study of economics, possibly causing narrow perceptions of the principles themselves. With the emphasis of both schools of thought centered around two very different principles, a basic understanding of both is essential to better understand the world around us and how it functions.

FRA: Hi, welcome to FRA’s roundtable insight. Today we have Chris Casey. He combines a degree in economics From the University of Illinois with a specialty in the Austrian School of Economics. He advises clients on their investment portfolios in today’s world of significant economic and financial intervention. He has also written a number of publications on websites including the Ludwig Von Mises Institute, Casey Research, and Laissez-faire Books. He’s a board member of the Economics Development Counsel with the University of Illinois, a policy advisor for Heartland Institute Centre and Finance, Insurance and Real-Estate. Welcome, Chris.

Chris Casey: Thanks for having me on today.

FRA: Great! Today we wanted to discuss an approach to investing that uses the principles of the Austrian School of Economics. Chris takes that approach with his clients, and we just wanted to explore in detail how he does that, and how it gives an edge to investing. Chris?

Chris: Sure. Well, anyone’s portfolio has exposure to two very significant and primary forces; and that is the business cycle, and that recessions could pop any kind of financial bubbles out there whether it’s the stock or bond markets, as well as inflation, although that’s not talked about in today’s circles as often as it should be, it’s certainly a significant threat to anyone’s portfolio as anyone who lived through the 70’s certainly witnessed.

The Austrian school has unique explanations for both of those economic phenomena as well as interest rates. Having a unique economic perspective, truly understanding the way the world works, and being able to interpret the repercussions of various economic actors within the economy whether it’s the federal reserve, other central banks, or the treasury issuing bonds etc. is really key to structuring one’s portfolio to protect yourself from these significant threats that are out there.

FRA: How do you apply this process…is it sort of like a flow chart-based approach? Do you look for certain characteristics, or do you look at the macro view first from that economics perspective? How do you actually approach that?

Chris: Well, we’re always trying to interpret what the true effects or repercussions of, for instance, Federal Reserve actions would be on the economy. For instance, while some people may believe that raising rates will stifle inflation, we realize that that’s one of but several tools that federal reserve uses to inject money into the economy, and therefore doesn’t have much significance nor does it happen right away relative to other tools at their disposal. It’s really an interpretation of the actions that are out there and it lends itself well to Contrarian Investing because it’s a great way to truly make money in any market. So in Contrarian Investing, you’re looking at any kind of price levels that are extreme highs or extreme lows and just as importantly, you have to look at a catalyst to bring those extreme price levels to their median or mean average over time. And if you have a catalyst that is out there that’s a true interpretation of how the economy works and you understand it but everyone else believes in something different even though you’re looking at the same data, I think that’s a significant advantage in structuring your portfolios.

FRA: That’s right the Austrian view places a strong emphasis on how the “interventionary”-type policies are distorting the price of risk, the price of money, interest rates, so that wouldn’t make sense. Do you do this on a daily basis; do you monitor central bank policies, fiscal stimulus policies, government regulations…how do you monitor what’s happening and the potential distortionary effects in the investment environment?

Chris: Sure, well, we’re looking at same data as everyone else is, it’s not like we have some special insights or we’re necessarily looking at different data, it’s really the interpretation of the data. Let me give you a couple of examples. A lot of people, a lot of mainstream wealth management firms, a lot of media within the finance industry take a lot of stock with what the Federal Reserve believes and does and says, which astounds me because they are the absolute worst predictors of future events of any prognosticator out there. Think about it like this, it’s one thing if you’re wrong about predicting the future, but the Federal Reserve is even wrong about predicting their own actions. I mean, how many people can you say that, or economic actors can you say that, are simply wrong in predicting what they will do in the future. Yet time and time again, they are. If you look at the Federal Reserve, you could look at previous pronouncements, you have Ben Bernanke in January of 2008 saying they don’t see any kind of recession, and famously he did the same with the housing bubble. I don’t know why anyone believes these people on anything that they believe will happen to the economy. It’s not because they have obviously more access to data than we do, it’s simply an interpretation of what’s going on. They simply have an unsound and fundamentally flawed understanding as to what causes recessions. They cannot explain a business cycle. If you cannot explain the root causes as to why something happens, then predicting when something will happen is no different than reading tea leaves. The whole point is that it’s a different interpretation, it’s a different lens on the same data that’s out there.

FRA: Can you provide some specific examples of investment asset classes and how they are tied into an Austrian school of economics view?

Chris: Well the one everyone always talks about is of course precious metals, and that’s because they understand the true nature of money and what money represents, what it does not represent, and therefore they understand the dangers of a Fiat currency in today’s world and its ability to create inflation. Let me just reiterate what a Fiat currency is because a lot of people just assume it means paper money, it doesn’t. Fiat means by force. It’s government required use of money, legal tender laws, and the ability to print money that’s unbacked by any kind of commodity. So we’ve obviously had that in full blown mode since 1971, and because of that we’ve experienced significant inflation in the 1970’s. The Federal Reserve has printed a huge amount of money since the 2008 recession, so people think, well why haven’t we had inflation since then? There’s a couple forces at play, it’s not a simple matter of the stock of money goes up and prices go up automatically. There are some deflationary forces to the extent that loans are called in or loans are repaid, there’s time elements, there’s a lag. It’s very possible that the demand for money has gone up, and that’s a key element to the price level equation…what is the demand for money? In times of uncertainty and in times of extreme low growth when people are afraid, the demand for money, I’m sure, goes up, so that’s been keeping a damper on inflation as well.

FRA: What types of investments would provide yield and preservation of purchasing power?

Chris: In addition to, obviously precious metals, I think you want to look for any kind of investment or economic activity where you are getting paid in more stable and increasingly valuable foreign currency, but you have your costs in dollars. Let me give you a couple of examples that exist in the real world: in Russia over the last couple of years the Ruble has fallen tremendously relative to the US dollar, but if you look at their commodity producers, if you look at an oil company there, they’re getting paid in international markets in dollars. Meanwhile their costs are lower relative to their revenue. Another example would be in Brazil, we have the same thing happening with producers, their costs have fallen dramatically and yet they’re getting paid on the international market in dollars. And so people should look at that and think about what will happen next in the US, how could they position themselves to benefit from any kind of US inflation. US farmlands are a good example. Much like Brazil, the same thing could happen here, we saw that in the 1970’s when the price level essentially doubled over a ten year period, farmland prices went up about threefold, so they more than kept pace with inflation because the more farmers started exporting, as dollars became cheaper for foreigners to buy, their real sales went up in real terms, their land value went up in real terms. So that’s another way to play inflation, not just a knee-jerk reaction to precious metals but actually looking at other areas where you could benefit between the discrepancies in currencies.

FRA: What about other investments in agriculture, does that make sense as well in agricultural commodities or companies focused in that sector?

Chris: If farmers are doing better, if they’re wealthier, if their underlying land values are better, I’m sure that there’s a lot of by-products that they will do very well. We haven’t looked at any in particular, but there are certainly a ton of products that would do quite well on that scenario

FRA: Given the Austrian School of Economics places a big emphasis on debt, in a negative sense, would it make sense to look at investments where there are business with little or no debt, little or no leverage?

Chris: I wouldn’t say that the Austrians necessarily view debt per se, negatively, they certainly view the non-repayment of debt negatively because that affects everyone in the economy, and they are strong believers in property rights and contractual obligations. But they do view government debt extremely negatively, for a number of reasons: morally, constitutionally, and just economically. They would advocate a balanced budget and much lower debt levels to the extent where there is no debt overall which we haven’t seen since the time of (pres.) Andrew Jackson.

FRA: Yeah, exactly. Would it be possible for the government to consider some type of migration plan from a Keynesian based to an Austrian based management of the debt? Is that possible or could that be proposed, perhaps, as an evolutionary?

Chris: Well I don’t think anyone in government actually subscribes to the Austrian school of economics, which is unfortunate, but out of the thousands of economists, very few of them would even be aware of the school, let alone understand or believe in any of its principles. I just don’t see anyone within the government, in any significant way, migrating economic policies towards an Austrian viewpoint.

FRA: Do you know of any studies or empirical analysis with regard to using the principles of the Austrian School of economics for investing? Are there any past performance studies that indicate taking this approach has advantages and can provide an edge to investing?

Chris: I’m not aware of any, and frankly it would be very difficult to conduct those, but more importantly I’m not sure exactly what those results would show meaning I’m not sure how beneficial someone simply believing in Austrian economics would have an advantage over others. I mean, we use it, we believe it is an advantage but just knowing about it doesn’t necessarily do anything, you have to really act on it. It’s not foolproof either. The Austrian Economics will help you identify bubbles and the catalysts to pop those bubbles. It will tell you about the direction and magnitude of markets, perhaps, but it won’t tell you anything about the timing, or at least that’s the trickiest part. In my mind, timing is far less significant when you have those other attributes nailed down because otherwise you’re “picking up nickels in front of a steamroller”. So, I’m not aware of any studies that would be interesting down the road, it’s also a pretty small data set of people who actually believe in this and act on it.

FRA: Given the level of government intervention of central bank policies that intervene in the economy and in the investment environment on a long term basis, how does one address the challenge of timing, as you just mentioned? Is it a matter of waiting a certain period of time or are there tipping points where the distortions have just become too large and there will be a reversion to the meaning of Contrarian type-based approach? How do you actually look at the timing challenge?

Chris: I do believe that direction and magnitude are more important. Let me give you an example: 2008 was a horrendous time. You had businesses thinking about where they have their cash, whether or not it’s even safe in a bank, that’s how fearful they were. The unemployment rate literally shot up in 7/8 months to 10% from maybe a high 4(%) in early 2008. You cannot understate the severity of that recession. Now from that, the government and Federal Reserve and treasury did exactly what they should not have done. They should have let these liquidations happen, they should have let the recession run its course but instead they did everything wrong. They printed a lot of money, they ran huge deficits, and all they did was cause dramatic and increased distortions within the economy. So make no mistake, what happened in 2008 was devastating, could be dwarfed by what comes down the pike based on what’s happened, because the distortions are even greater. The longer this has gone on, the greater the distortions are allowed to run their course and the more severe will be the contraction; the beneficial time period where we restore the structure of production to how it should be. So, timing to me just isn’t as important as magnitude and direction.

FRA: I see, yeah. Given what’s happening in the economy and what’s happening with central bank policies, not only with the central bank of the US, the Federal Reserve, but other central banks around the world, as well as government policies on fiscal stimulus, the potential for increased infrastructure. Given that, and from an Austrian school perspective, where do you see the asset classes preferable to be in over the next 6-12 months, 1-2 year period?

Chris: Well perhaps more importantly, is to what you should be in, is to what you should NOT be in. I think everyone should start looking at Cryptocurrencies in some form, emerging markets are very tempting based on not only the disparity in values between currencies but based on the disparity in relative values between their markets. Farmland, as I mentioned, I think is attractive. There are certain one-off sectors that have nothing to do with the economy which should do well regardless as to what happens. So for instance, uranium, or cannabis for that matter. But more importantly than these areas that one may want to consider, are areas that you should avoid; certainly anything within the equity markets that’s highly overvalued based on historical norms, I think, people should think about not having it in their portfolio. Certainly any kind of debt instruments are potentially at risk with rising interest rates, so you may want to lighten up on those. So in general, those are some themes to embrace or consider as well as what to avoid.

FRA: Great, and how can our listeners learn more about your work and your services?

Chris: More importantly than that, is what we believe in and how we apply Austrian economics. We have a lot of content on our website. I would just encourage people to check out our website which is WindRockWealth.com, and certainly our contact information is on there as well.

FRA: Excellent! We will be posting this podcast as well as a number of charts and graphs that Chris will be providing on the website. We will also do a write-up abstract-transcript of this interview for anyone who wants to read that, including the charts and graphs. Thank you very much, Chris.

Chris: Thank you.

Abstract written by: Tatiana Paskovataia <tatiana-p28@hotmail.com>

LINK HERE to download the MP3 Podcast

03/21/2017 - Alasdair Macleod: Exporting Nations Are Aligning With Sino-Russia Trade Policies And Selling U.S. Dollars

03/21/2017 - Alasdair Macleod: Exporting Nations Are Aligning With Sino-Russia Trade Policies And Selling U.S. Dollars

“Most exporting nations accumulating foreign currency reserves are turning into sellers of dollars. This is either for strategic reasons, such as in the case of Russia and China, or because their commercial interests are becoming increasingly aligned with Sino-Russian trade policies. China, Russia, Japan and the Middle East are therefore all future sellers of the dollar, and of the underlying US Treasuries and T-bills in their possession. All other central banks will also be aware of these developments by now, and should be re-examining their exposures accordingly .. The coming months will almost certainly see a further deterioration of the Eurozone’s survival prospects, and an objective analysis must embrace the consequences of its demise and that of the whole euro financial system. The only way capital flight within the system can be reconciled is by a systemic collapse. That puts two major reserve currencies on the sell list of most central banks: the dollar and the euro .. Together, they are the world’s reserve currency and the currency for the world’s next largest economic area. They account for 40% of the world’s GDP, the part that represents the world of yesterday. Therefore, there is a sea-change underway in nearly all central banks attitude to gold, if only because other than the yen, yuan, sterling and the Swiss franc, what else is there?”

03/21/2017 - Felix Zulauf: Rising Inflation Is A Global Phenomenon

03/21/2017 - Felix Zulauf: Rising Inflation Is A Global Phenomenon

“France could be a game changer, and very late this year or early next year, Italy could be a game changer .. The problems in Europe started with … the introduction of the euro .. The currency is not right for anybody. It is cheap for Germany, it is too expensive for Italy, and it creates all sorts of messes.”

If Marine Le Pen wins in France, who wants to pull out of the EU, Zulauf believes we’ll see a selloff in the the euro and European assets .. He also predicts: The world will be very fearful of Europe entering the next stage of a slow, decaying process of the current institutional architecture, which will cause capital to move out.

Zulauf says what we are seeing is the beginning stages of monetary policy changes towards less easy-money and even toward some tightening. That means the major force behind this bull market is going to disappear.

Inflation — specifically core inflation and not headline inflation — is coming back, he said, and will continue to creep upward during the rest of this year and next year. This is a global phenomenon .. “The impact could be quite dramatic .. Inflation will continue to creep up, and inflation in many countries is already above declared target levels.”

“Because of the excesses we see today, I think we will see an above-average bear market that will probably bottom in 2020 – I cannot say how deep it will go – I just want to first see the highs in place and all the non-confirmations, which may be seen in the next six months.”

03/21/2017 - Sweden’s Central Bank – Another Example Of The Failure Of Negative Interest Rates

03/21/2017 - Sweden’s Central Bank – Another Example Of The Failure Of Negative Interest Rates

“It is clear that the negative rate experiment is neither sustainable nor helpful to economic growth. It only inflates bubbles while widening the wealth gap in Swedish society. A once prudent and financially conservative people are now getting drunk on debt, wrecking their futures. The very premise of Swedish society is under attack. Nevertheless, it does not appear that this policy will abate anytime soon. There seems to be one lever in the Central Banker’s control room: interest rates. If anything, they may get more aggressive with it.”

03/17/2017 - The Roundtable Insight: Daniel Amerman On How Varying Forms Of Financial Repression Will Need To Be Applied To Address Surging U.S. Social Security And Medicare Benefits

03/17/2017 - The Roundtable Insight: Daniel Amerman On How Varying Forms Of Financial Repression Will Need To Be Applied To Address Surging U.S. Social Security And Medicare Benefits

FRA is joined by Daniel Amerman in a thorough discussion on the future of the US national debt and the impact of the upcoming surge in social security and medicare benefits.

Daniel R. Amerman is a Chartered Financial Analyst, author, and speaker, with BSBA and MBA degrees in Finance, and over 30 years of professional financial experience. As an investment banking vice president in the 1980s he did groundbreaking work in the security originations and asset/liability management areas, including CMO/REMIC originations as part of portfolio restructurings for financial institutions, as well as the creation of synthetic securities for institutional clients. As an independent quantitative analyst in the 1990s and 2000s, he structured mortgage-backed bond financings and provided analytical services for real estate acquisitions by multifamily and commercial real estate owners, investment banks, and tax-exempt issuers.

Mr. Amerman is the creator of a number of DVDs and books on finance, including two books published by McGraw-Hill (and subsidiary): Mortgage Securities, and Collateralized Mortgage Obligations: Unlock The Secrets Of Mortgage Derivatives. He has been a speaker and workshop leader for sponsors including The Institute for International Research, New York University, and many banking groups.

US NATIONAL DEBT AND THE FUTURE OF INTEREST RATES

The easiest way to talk about financial repression is to look back at the classic financial repression period of roughly 1945-1970, when all the developed economies in the west were engaged in financial repression. In this case, financial repression means forcing negative real interest rates, which is how they escaped from very high government debt levels relative to the economy the last time we were in this situation. Many things today are different from that time, and the difference is that when financial repression was occurring the first time, what was happening was that the baby boomers gave us a tremendous number of workers producing real goods and services, which gave the the economy a boost and helped get government debts under control.

The difference this time is that the boomers are retiring, and the expenses of paying for them are about to get far more expensive. You can see that we have a tremendous increase in projected benefit payouts. You take the entire US government expenditures right now, and just paying out anticipated social security and medicare that so many boomers are going to be collecting, we’re expecting to be adding another trillion dollars per year by 2024. We have this tremendous increase in cost at the same time that we’re starting with a $20T national debt.

There are a number of different ways that social security and medicare costs can be effectively reduced by nicking it in small little ways that reduce overall payments for everybody substantially over the years to come. In the US, social security payments are not tied to the CPI, but a different index that tracks wages that increases at a slower rate than overall consumer prices.

HIGH DEBT, SOCIAL SECURITY & MEDICARE COSTS

The key point is that we can’t really look at financial repression in the post-WW2 example because it’s fundamentally very different. They used financial repression to hold the debt level in inflation-adjusted terms for a 25 year period. We went from the national debt exceeding the total size of the economy to being under 30% of the size of the economy, but they weren’t facing this tremendous challenge we are with benefits costs. Because of that, the impact on investors and anyone who is expecting social security or medicare benefits means things have to work differently this time around.

We know for a fact that in the coming years we’re going to have this force that’s getting more powerful every year that we’re just not used to dealing with. We have twinned unprecedented situations: a $20T debt and much higher social security and medicare costs on the way quickly, and those two are happening at the same time.

When you look at these, the key column is net interest which is exploding upwards. It doesn’t happen instantly because the weighted average life of the debt outstanding is 5.8 years, so it takes a number of years for it to actually reflect in the interest payments going out. What would happen is that we’d still have this surge in the deficit that’s going up almost dollar for dollar with the net interest payments. If you look at the overall impact on the economy and total governmental debt, what economists usually do is compare the size of the government debt to the economy, and you can see that the debt crosses the size of the economy by the mid 2030s and accelerates from there.

BENCHMARK OF “INSANITY”

We define insanity as if benefits and interest payments consumes all government taxes and every other dollar of government spending has to be borrowed. By the 2020s, we’re more than halfway there, and in that dangerous yellow zone that could shift at any time.

From AC3, with benefits being paid in full, the net interest column has been negated. But now the problem is in the net benefits column, where the deficit is shooting up out of control again. You can see how the red line is pulling the yellow line up step by step, and by the time it reaches 2039 the annual deficit exceeds all normal governmental spending.

We have two entirely independent compelling major financially problems out there. There’s the $20T debt being held in check by some the lowest interest rates in history, and we also have the tremendous increase in social security and medicare payments that’s going to hit soon. The problem is that in reality, we have both of these hitting us at the same time.

AD3 shows what would happen if we return to historically accurate interest rates. It takes some time for it to be reflected, but we still go from $400B in net interest payments to almost $2T at the same time that we have net benefits almost doubling. When those two hit together, it’s like we have two exponential series hitting each other simultaneously and reinforcing it. If you look at AD15, you see that we’re in the insanity range in under ten years. The future national debt, the future social security and medicare, and the future interest rates are all intertwined.

GOVERNMENT REACTION

The point is not to say these scenarios will happen, the point is that this will happen if we had normality in the same way most people are building their assumptions when it comes to long term retirement planning. People are expecting to get their benefits in full because that’s what the government has assured them. They’re looking for long term historical returns in terms of investment allocations, and the point is that if everyone’s expectations were met simultaneously, then the country’s very quickly in the insanity range.

Even with 2% economic growth rate, you can stay in the green the entire time. You can do that with interest rates, you can do that with benefits, you can do that prioritizing interest rates over benefits, you can do it prioritizing benefit changes over interest rates, you can do it with tax changes, and you can do it with inflation. All of these are valid ways of staying within the range.

If you look at paying everything with taxes, the degree taxes would have to rise is shocking. This would be very difficult politically to do. Part of the appeal of financial repression to the government is that there is virtually no political cost to this. People pay personal cost in their lives, but this is generally not understood by the voters. Some of the methodologies of staying in the green are far more politically palatable than others, so we’re more likely to see those used and those are the ones where individuals need to have their defenses in place for. Every single one of these possibilities for staying in the zone has very broad effects on all investment categories.

Much depends on the specific methods being used and the exact approach the government takes. Bonds in general are not a good idea during financial repression, though there are some time periods where they could be a good investment for a period of time. Real estate, gold, silver, and things like that are good investments.

There is very much a direct personal cost for savers, and working in a different way but related, a direct personal cost for beneficiaries.

CLOSING REMARKS

Social security is not fully inflation indexed. Most people have their medicare premiums deducted from their social security payments, and there is a provision called hold harmless which allows the government to strip away all inflation indexing to the extent that medicare premiums are increasing. Often times when people look at things at this, they take a high drama approach.

All it takes is a tweak of a half percent here and next thing you know these seemingly huge problems have gone away. But when you follow through to the impact on individual savers and individual beneficiaries, they are in fact being paid in full. If you’re going to make a $100T problem go away, $100T in pain has to be shifted somewhere. It happens, but not in a way where people can say, this is happening to me right now because this change was made here.

Abstract by: Annie Zhou <a2zhou@ryerson.ca>

LINK HERE to get the podcast in MP3

03/17/2017 - Paul Brodsky: “Stagflation On The Horizon”; Coordinated Currency Devaluation Ahead

03/17/2017 - Paul Brodsky: “Stagflation On The Horizon”; Coordinated Currency Devaluation Ahead

“We argue the US economy, US assets, the Fed and US fiscal policy makers are displaying obvious signs of late-stage fatigue associated with protecting the current global regime at all costs. As in the 1970s, the triggers for goods and service inflation within a slowing global economy will be currency related and a dearth of supply flowing through the trade channel, but rather than oil, this time the world will lack an adequate supply of increasingly scarce dollars needed for debt service.

Milton Friedman famously noted “inflation is always and everywhere a monetary phenomenon”. In the post-Bretton Woods monetary system, the pricing and supply of money and credit are not determined by production, but rather by monetary and currency exchange policies. Central banks and treasury ministries manufacture inflation through policy administration .. The organic need for more production in the US (and everywhere else) is falling, as evidenced by declining global output growth. The only lever US policy makers will soon have left to pull, if they want to maintain the USD-centric global system, will be coordinated currency dilution (i.e., devaluation) .. The Fed will have to turn on the spigots and create dollars for US and foreign creditors and, if they are lucky, debtors too. Stagflation will appear. The markets should begin getting a whiff of this soon.”

03/13/2017 - The Roundtable Insight: Charles Hugh Smith On Inequalities And Distortions Caused By Central Bank Policies

03/13/2017 - The Roundtable Insight: Charles Hugh Smith On Inequalities And Distortions Caused By Central Bank Policies

FRA is joined by Charles Hugh Smith in discussing income inequality as a result of central bank policies

Charles Hugh Smith is a contributing editor to PeakProsperity.com and the proprietor of the popular blog OfTwoMinds.com. He is the author of numerous books, including Why Everything Is Falling Apart: An Unconventional Guide To Investing In Troubled Times.

ENGINES OF INEQUALITY

A lot of people are connecting the dots between rising income inequality and central bank policy. Wages as a percentage of GDP is a very broad-based method of saying how much the economic activity in a nation is ending up in the hands of wage earners as opposed to owners of capital or rent-seekers. We want to differentiate between rent-seeking – monopolies and cartels getting the government to protect their income streams and eliminate competition – as opposed to the innovative, creative destruction side of capitalism where growth and income inequality might be rising because the most talented and the most successful at allocating capital are benefiting. We can see that both of those forces are at work. A lot of people have noted that the top 5% of wage earners are scooping up most of the gains in wages while the bottom 90-95% are seeing stagnating wages.

If you look at GDP as a percentage of wages, it’s been declining since 1970. Something else is going on. Why are wages declining for decades? Clearly it’s connected to policies. 1970 coincides with the decoupling of the USD from gold, so from that point it all comes down to central banking policies and interventions by the Fed in the US.