A Financial Repression Authority (FRA) Brief:

What Is The Risk-Mitigated Way To Invest In Gold?

Is it going on the stock market and buying a gold ETF like GLD? Is it buying gold mining stocks? Is it buying some gold coins and burying them in your back yard? Is it buying into a limited partnership where the gold is stored offshore? Is it buying gold coins and gold bullion bars and storing them in a safety deposit box at your bank?

The answer to all of the above is no from a risk-based perspective. What does a risk-based perspective mean and why is it important to invest in gold using a risk-based perspective?

Courtesy of Matterhorn Asset Management GoldSwitzerland

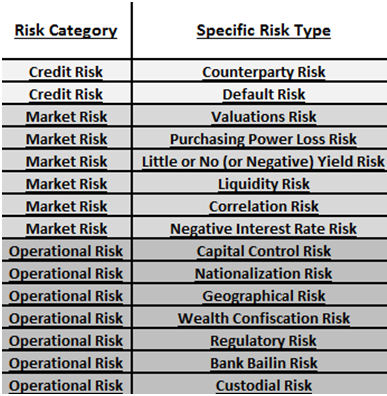

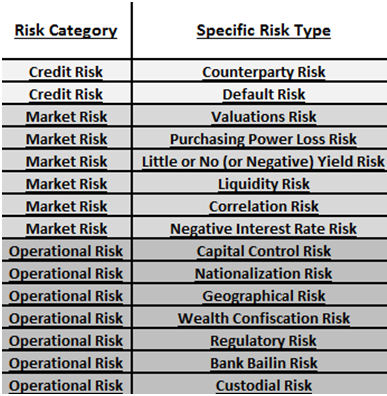

In this brief, we will answer those questions by assessing 15 different risks encompassing market risk, credit risk and operational risk. These risks are tabled below. These risks do not take into account certain risks such as the imposition of a windfall profits tax which may be taken by desperate indebted governments in certain jurisdictions. Our organization, the Financial Repression Authority (FRA), has assessed how well these risks are mitigated by a wide variety of provider firms buying, selling and storing gold.

But before we get into looking at the risks, let’s consider the big questions about owning and investing in gold – Why does it make sense and why now? Why should anyone invest in an asset that does not pay any yield? We point out below some of the simple yet powerful answers on why.

As to why now, we point out the trend so far this year has been bullish for gold in U.S. dollar terms, but emphasize how gold has already been bullish in most non-U.S. dollar terms over the past few years already.

In addition, gold is an asset which performs well in extreme inflation and extreme deflation environments[i], and serves as protection in times where there is a loss of confidence in government. There are strong deflationary forces in the world today[ii], and many like Martin Armstrong point out how a loss of confidence in government can lead to hyperinflation.[iii][iv] These trends are very bullish for gold now and we think very likely to persist for the remainder of the decade.

Why Gold?

Courtesy of Matterhorn Asset Management GoldSwitzerland

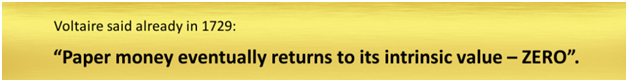

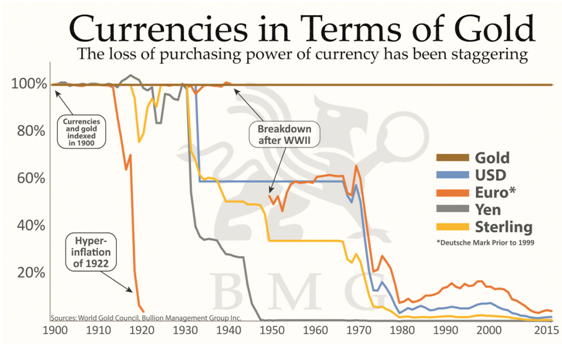

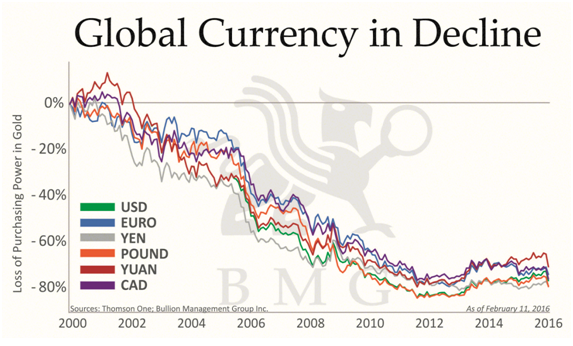

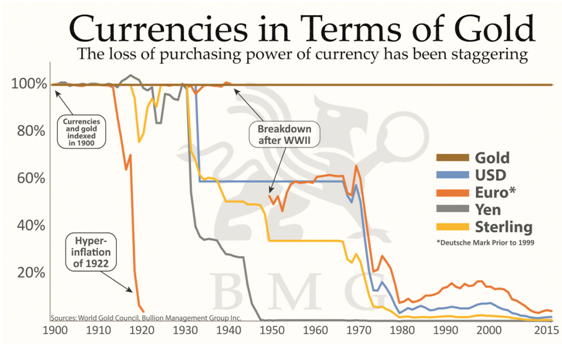

The quote from Voltaire has proven to be true for thousands of years. Paper money issued by governments eventually either loses its value or is taken out of circulation and existence. Here some long term charts showing this phenomenon[v][vi]:

Courtesy of Bullion Management Group Inc.

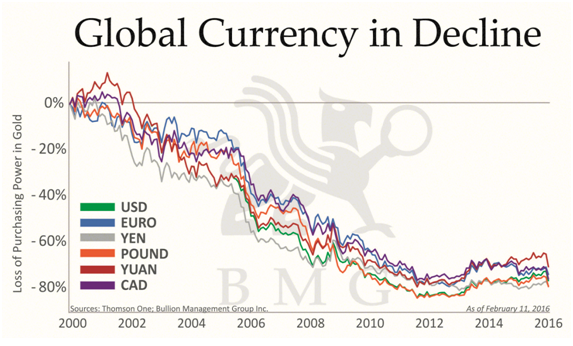

Courtesy of Bullion Management Group Inc.

In Roman history, coins were either phased out of existence or were chipped at the corner to reduce their value or were made with successively less gold and/or silver content.[vii][viii]

And since the creation of the Federal Reserve (U.S. central bank) in 1913, the purchasing power of the U.S. dollar has steadily decreased to a fraction of what it once had:

All of these charts and trends emphasize the importance of holding gold as an asset and a currency for wealth preservation – purchasing power protection. Indeed gold is real money as JP Morgan proclaimed:

We can also look at gold as money from the perspective of how the ancient Greek philosopher Aristotle defined money as. He detailed characteristics of money as follows – gold meets all of these[ix]:

1.) It must be durable. Money must stand the test of time and the elements. It must not fade, corrode, or change through time.

2.) It must be portable. Money holds a high amount of ‘worth’ relative to its weight and size.

3.) It must be divisible. Money should be relatively easy to separate and re-combine without affecting its fundamental characteristics. An extension of this idea is that the item should be ‘fungible’. Dictionary.com describes fungible as:

“(esp. of goods) being of such nature or kind as to be freely exchangeable or replaceable, in whole or in part, for another of like nature or kind.”

4.) It must have intrinsic value. This value of money should be independent of any other object and contained in the money itself.

This is all fine and dandy. But the real reasons why it makes sense to hold gold and to hold it now stem from the current risks in today’s economy, financial system and investment environment. And it is these risks and how to mitigate these risks which really determine how best to hold gold today. Let’s explore these risks and some associated mitigation strategies below.

Risk Management Is The Key To Properly Investing In Gold

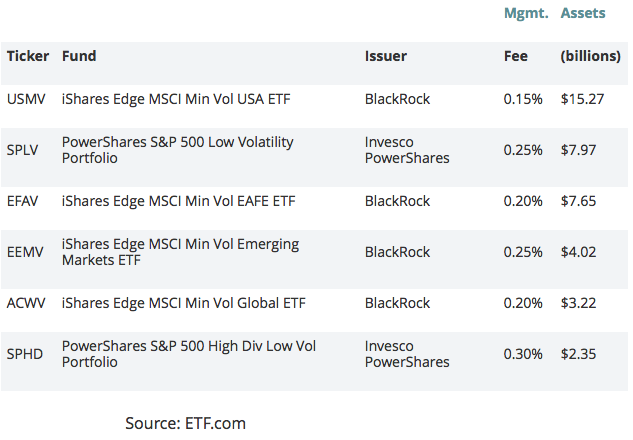

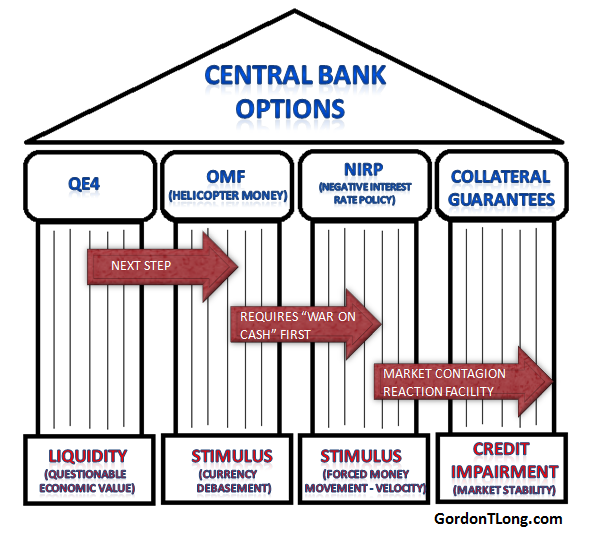

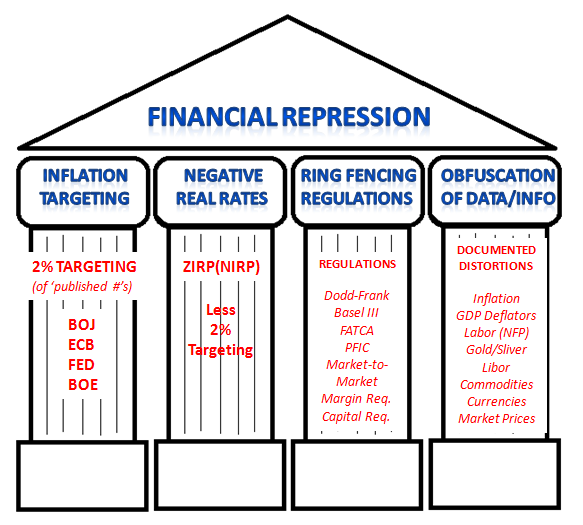

FRA has put together a nifty matrix (contact us to get more information on this risk matrix) of the risks stemming from the good-intentioned (macroprudential) central bank policies, government fiscal policies and financial regulations focused on controlling excessive government debt, attempting to stimulate economic growth and minimizing the potential for financial and economic crises. Let’s explore a few of these risks applicable to gold below.

Counterparty Risk

This is the risk relating to the entity or provider of an investment in which the entity or provider:

- does not live up to their contractual agreement

- presents adverse risks caused by changes in the regulations or environment where the entity or provider operates

- presents adverse risks caused by the limitations or vulnerabilities in how or where the investment is held or stored

For gold as an investment, examples are counterparty risks stemming from:

- insecure vaults or volatile environments where the gold is stored,

- a financially stressed or bankrupted limited partnership entity holding the gold as an asset for its partners

- a bank where there is the high potential for theft or confiscation resulting from changing financial regulations relating to gold held in a safety deposit box at that bank

- a provider offering low quality gold

Mitigation of Counterparty Risk: Gold as an investment already represents holding an asset with no liability to any party.

Also, buy the gold from a reputable provider which can deliver the highest quality gold – 999.9 or 99.99% for 1 kilo and 100 gram bars, and for 400oz bars a certification for London Good Delivery.

Additionally counterparty risk needs to be mitigated for storage provider and jurisdictional concerns. For that, invest and store physical gold outside of the banking system and diversify the location of the storage in different jurisdictions. Ensure that the gold is held in an allocated and segregated format with direct ownership (in your name or entity, not that of the provider or a limited partnership). And in the event that the storage providers go out of business, ensure that you still own the gold, and that you can easily and promptly get your gold. Also ensure that the gold is insured by a major international insurance company. And ensure that you can inspect your gold upon request, that you can collect your gold when you request to even in the event of a financial or economic crisis.

Default Risk

This is the risk for an entity or provider of an investment and its associated storage to not meet its payment or debt obligations. For example a gold storage provider is not able to, or does not pay, its loans, debt or bonds, and which provider subsequently goes bankrupt.

Mitigation of Default Risk: Invest and store gold with entities which have financially strong balance sheets, little or no loans or debt, and which are located in secure, stable legal jurisdictions protected through bailment and other laws which will clearly and promptly allow you to get your gold without any legal hassles or potential for confiscation in the event of a default with the entity or provider. And also ensure that the gold is insured by a major international insurance company.

Valuations Risk

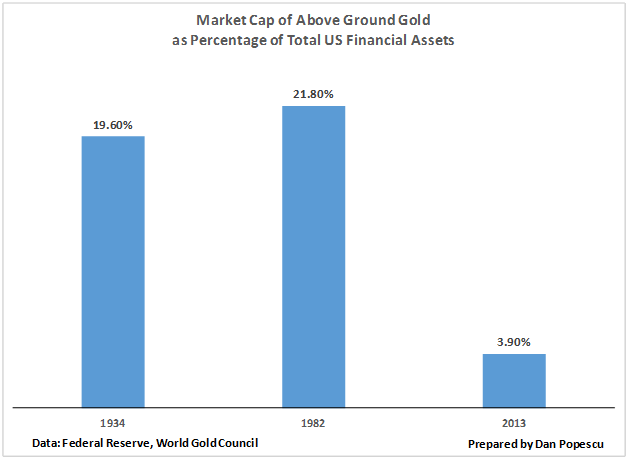

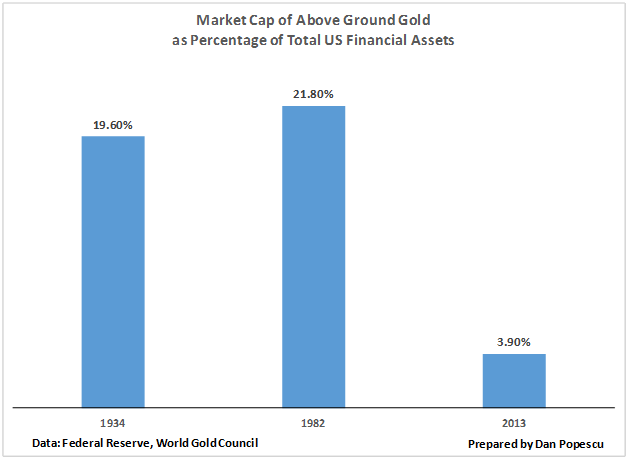

This is the risk of entering into an investment when the valuation of that investment is not attractive. An example is like buying a stock at a stock market peak. For gold, it is difficult to put a valuation to it as it lacks corporate earnings and yield. However, here is a chart showing how little interest there is now in gold as an investment asset class. With such a miniscule interest, it is not likely that its valuation is very high currently.

Courtesy of Dan Popescu

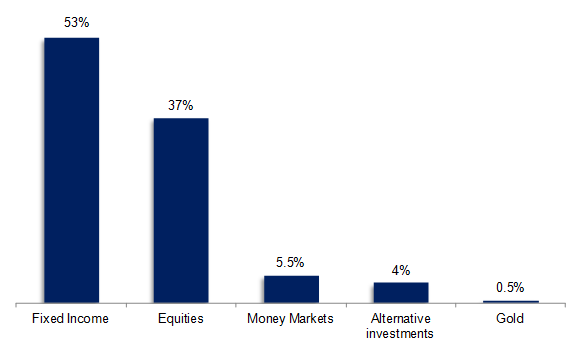

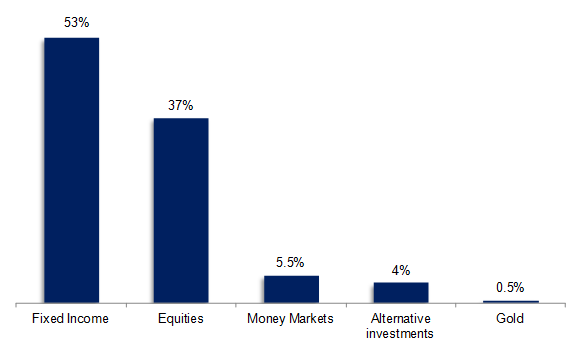

Gold is under owned relative to financial assets at this time. Incrementum has a great chart showing how small gold is relative to other investment asset classes[x]:

Courtesy of Incrementum Liechtenstein

Mitigation of Valuation Risk. At this time investing in gold already mitigates this risk due to the above considerations.

Purchasing Power Loss Risk

This is the risk of an investment not able to preserve how well it, or the proceeds from it after selling it, can be used to purchase the goods and services you need or want. It’s about preserving your wealth when a currency loses purchasing power from inflation or currency depreciation/devaluation.

If this year you have an investment from which you could liquidate to buy 100,000 cups of Starbucks Tall Dark Roast coffee priced at $200,000 but in 5 years from now the same investment only allows you to buy say 50,000 cups of Starbucks Tall Dark Roast cups of coffee, even though the price at that time is say $300,000, what good is the $100,000 gain in that investment?

A key characteristic of gold which has held for thousands of years is the preservation of purchasing power. The old saying of one ounce of gold is equivalent to a fine European cut suit is an illustration of this[xi].

Mitigation of Purchasing Power Loss Risk. Simply keeping a certain allocation of one’s assets in gold is sufficient to mitigate the purchasing power loss risk. The optimal percentage depends upon what assets you hold, what currencies those assets are in, and the correlation of those assets with gold. It is generally recommended to hold more or less 10% of your assets into gold – some say as low as 5% while some say as much as 25%.

Negative Yield Risk

This is the risk that an investment yields a negative yield, such as with many bonds and some bank deposits today around the world as central banks push us into the twilight zone of negative interest rates. For gold, there is no yield, so that there is no issue of negative yield risk.

Mitigation of Negative Yield Risk. Simply owning physical gold entails a yield of 0%, higher than a negative yield.

Liquidity Risk

This is the risk that an investment cannot be sold easily or quickly due to limitations in market participants or to the insufficient volume of a market. For gold, this means the ability to sell your gold easily and quickly at reasonable market-based rates and to get the proceeds from such a sale easily and quickly as well.

Mitigation of Liquidity Risk. A provider setup to offer and store allocated, segregated and directly owned gold translates into gold that can be easily and quickly sold.

Correlation Risk

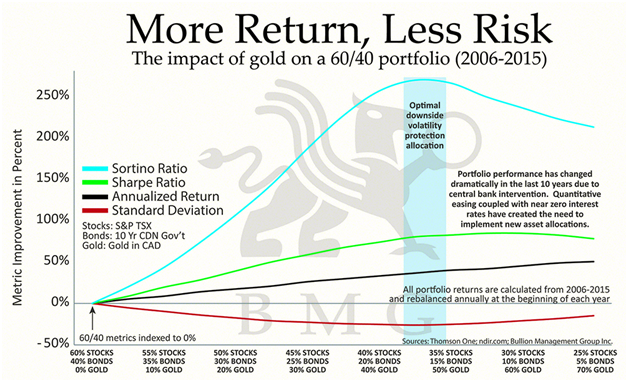

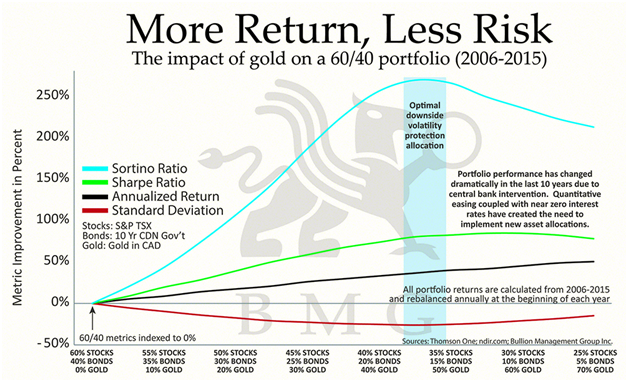

This is the risk of linkages and similarities in the performance between investments. For gold, the historical data indicates an inverse correlation with stocks[xii]. Also many studies have shown that adding gold as an asset in a traditional stocks/bonds portfolio not only adds performance but also reduces overall risk & volatility to the portfolio.

Courtesy of Bullion Management Group Inc.

Mitigation of Correlation Risk. In an environment in which stocks are in a bear market, such as what appears to be in place for this year so far, gold is a great asset to own, given the inverse correlation to stocks. And even if stocks are not bearish, it is nice to have an asset allocation to gold just for purposes of balancing the correlation risks within a portfolio in general. And there is a case to be made for holding gold in a portfolio for asset allocation optimization[xiii].

Negative Interest Rate Risk

This is the risk of negative interest rates, whether they be nominal negative interest rates or real negative interest rates (nominal minus inflation rate), representing a loss of purchasing power over time. As an asset in a negative interest rate environment, gold performs very well[xiv].

Mitigation of Negative Interest Rate Risk. Simply holding gold as an asset in a negative interest rate environment addresses this risk.

Capital Controls Risk

This is the risk of restrictions placed on the movement of capital and assets, whether physically or via wire transfer across international borders or between different jurisdictions. For gold, this means the ability to transport gold across international borders and also the ability to wire transfer the funds to purchase to buy gold, or to wire transfer the sales proceeds from sold gold holdings.

This is the risk of restrictions placed on the movement of capital and assets, whether physically or via wire transfer across international borders or between different jurisdictions. For gold, this means the ability to transport gold across international borders and also the ability to wire transfer the funds to purchase to buy gold, or to wire transfer the sales proceeds from sold gold holdings.

Mitigation of Capital Controls Risk. Consider buying and holding gold in jurisdictions which are stable, secure and with strong legal infrastructures, a gold-friendly history and little or no debt, and the ability for capital and assets to freely (through minimal paperwork and restrictions) move across its international borders. In this regard, we see jurisdictions like Switzerland, Hong Kong and Singapore as being some of the best. The mitigation of this risk is also tied to the mitigation of nationalization risk.

Nationalization Risk

This is the risk of assets, funds or companies or even specific resources being taken over, managed or controlled by the government. For gold, this could mean a declaration or regulation instituted by the government to take over the ownership of gold within a country or jurisdiction.

Mitigation of Nationalization Risk. Monitor in an on-going basis your investment-related jurisdictions worldwide. Keep abreast of new or changing government regulations, edicts or legislations affecting any aspects of the purchase, sale or storage of gold. The mitigation of this risk is also tied with the mitigation of geographical risk.

Geographical Risk

This is the risk of geo-political events and jurisdictional regulations adversely affecting the valuation, holding or storage of an investment. For gold, this could mean events like war or social unrest affecting the safety and security of the storage of your gold. Or for another example, a regulation stipulating the illegality of investing in, holding or storing gold in a particular jurisdiction – like the U.S. for many years from 1933 referred to in the above under nationalization risk.

Mitigation of Geographical Risk. Diversify internationally where gold is held and how it is held from a country and jurisdictional perspective. An emphasis on stable and secure political, economic and financial jurisdictions is important. In this regard, we see jurisdictions like Switzerland, Hong Kong and Singapore as being some of the best.

Wealth Confiscation Risk

The risk here is the outright confiscation of assets through bank bailins, wealth taxes or changes in ownership structure. For gold, this could mean bank bailins or bank account dormancy involving the confiscation of safety deposit contents, or the imposition of wealth taxes on gold profits or the valuation of holdings.

Mitigation of Wealth Confiscation Risk. Consider buying and holding gold in jurisdictions which are stable, secure and with strong legal infrastructures and a gold-friendly history and little or no debt. In this regard, we see jurisdictions like Switzerland, Hong Kong and Singapore as being some of the best. The mitigation of this risk is also tied to the mitigation of nationalization risk (addressed above).

Regulatory Risk

This is the risk of changes in regulations or legislation affecting the viability or operation of an investment. For gold, it could mean changes in how or where gold is bought or stored, by method, volume, timeframe, or use.

Mitigation of Regulatory Risk. The mitigation of this risk is covered by the mitigation of capital control risk, wealth confiscation risk, nationalization risk and geographical risk – addressed above.

Bank Bailin Risk

This is the risk of banks assigning or confiscating assets from bank depositors, which could extend also to bank safety deposit boxes, in the event of a banking crisis. For gold, it could mean getting your gold simply taken by the bank to shore up the capital adequacy of the bank in the event of a banking crisis.

Mitigation of Bank Bailin Risk. The mitigation of this risk is covered by the mitigation of capital control risk, wealth confiscation risk, nationalization risk and geographical risk – addressed above.

Custodial Risk

This is the risk of loss or theft on assets resulting from events or actions (such as insolvency, lawsuits, or expropriation) of the storage provider, holder, custodian or manager of the assets. For gold, this could mean a bankruptcy in the storage provider, resulting in difficulties or impossibilities on getting your gold, or a long drawn-out entanglement in court with unclear and confiscatory liquidation actions on bank assets, bank buildings and operations, and bank safety deposit boxes.

Mitigation of Custodial Risk. Invest and store physical gold in safe, secure non-bank vaults outside of the banking system and diversify the location of the storage in different stable, secure jurisdictions with little or no debt, minimizing the potential for insolvencies, lawsuits or expropriations. Ensure that the gold is held in allocated, segregated and direct ownership (in your name or entity, not that of the provider) format. And ensure that you still own the gold, and that you can easily and promptly get your gold in the event that the storage provider goes out of business. And also ensure that the gold is insured by a major international insurance company. And ensure that you can inspect your gold upon request, that you can collect your gold when you request to, even in the event of a financial crisis.

Conclusion

Investing in gold makes sense now and very likely for the remainder of the decade. However the way you invest in gold Is very important as there are many market, credit and operational risks which affect gold investing. These risks pose potentially adverse outcomes to vulnerabilities which could mean your investment in gold may not meet your expectations or worse, could translate into capital losses or legal complications.

A Financial Repression Authority (FRA) Brief

See our website for more information – www.financialrepressionauthority.com

FRA Macroprudential Policy Advisors, 200-131 Bloor Street West, Toronto Canada M5S1R8, tel/fax = +14163525508

[i] http://dailyreckoning.com/how-inflation-could-be-caused-in-15-minutes/

[ii] http://goldsilverworlds.com/economy/jim-rickards-what-will-the-fed-decide-in-2016/

[iii] http://news.goldseek.com/GoldSeek/1437940421.php

[iv] https://www.armstrongeconomics.com/history/ancient-economies/punic-wars-the-economic-confidence-model

[v] https://goldswitzerland.com/why-gold/

[vi] http://bmgbullionbars.com/gold-is-money/

[vii] http://www.armstrongeconomics.com/research/monetary-history-of-the-world/roman-empire/monetary-history-of-imperial-rome/294-360-ad

[viii] http://history.econtrader.com/devaluation_of_the_roman_currency.htm

[ix] http://www.marketoracle.co.uk/Article10370.html

[x] http://www.incrementum.li/research-analysis/in-gold-we-trust-2013/

[xi] http://www.bmgbullion.com/doc_bin/gold_investor_vol_4_infographic.pdf

[xii] http://www.bmgbullion.com/doc_bin/RethinkingAssetAllocation_Jul08.pdf

[xiii] http://www.merkinvestments.com/downloads/2014-03-20-case-for-gold-optimal-portfolio-allocation.pdf

[xiv] http://dollarcollapse.com/gold/gold-in-a-negative-interest-rate-world/

Disclaimer: The views or opinions expressed in this blog post may or may not be representative of the views or opinions of the Financial Repression Authority.

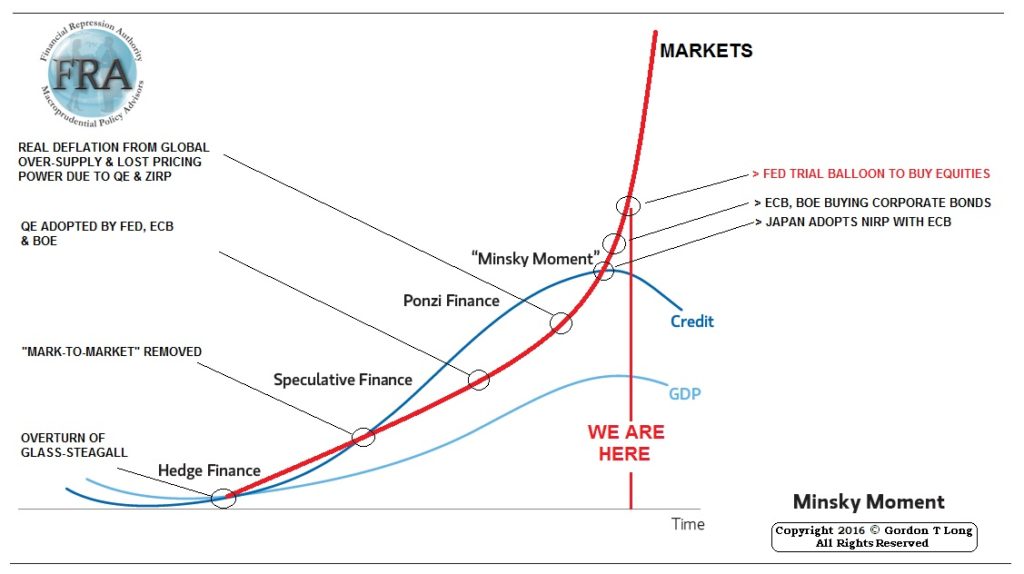

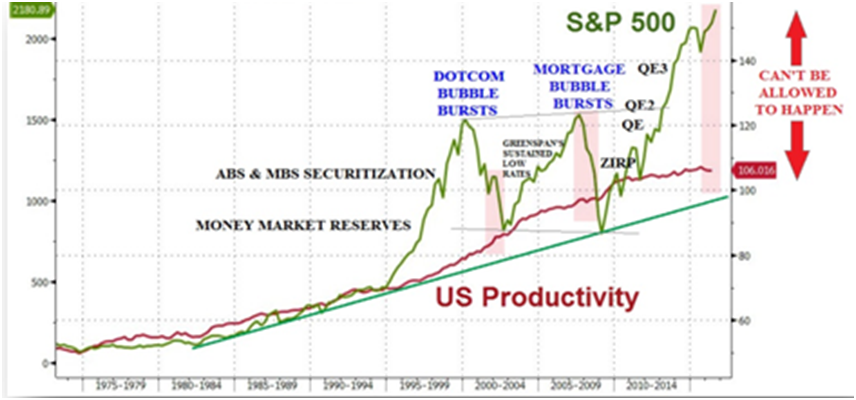

Gordon T. Long says that the credit cycle has turned.

Gordon T. Long says that the credit cycle has turned.

04/04/2017 - Former Federal Reserve Advisor Danielle DiMartino Booth On The Adverse Effects Of Monetary Policy On Savers

04/04/2017 - Former Federal Reserve Advisor Danielle DiMartino Booth On The Adverse Effects Of Monetary Policy On Savers

Click Here to Listen to the Audio

Click Here to Listen to the Audio