FRA is joined by Ronald-Peter Stoeferle in discussing his predictions for the next year, along with his thoughts on the state of the global monetary system.

Ronald is a managing partner and investment manager of Incrementum AG. Together with Mark Valek, he manages a global macro fund which is based on the principles of the Austrian School of Economics. Previously he worked seven years for Vienna-based Erste Group Bank where he began writing extensive reports on gold and oil. His benchmark reports called ‘In GOLD we TRUST’ drew international coverage on CNBC, Bloomberg, the Wall Street Journal and the Financial Times. Next to his work at Incrementum he is a lecturing member of the Institute of Value based Economics and lecturer at the Academy of the Vienna Stock Exchange.

GOING INTO THE NEW YEAR

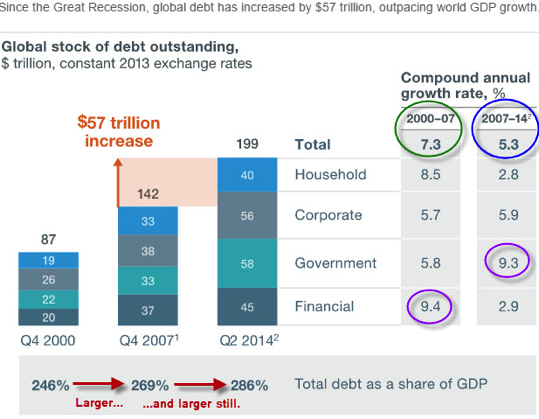

It’s all about politics. We’re seeing quite a lot of drastic changes last year, but in 2017 political uncertainties will most likely come from the Eurozone where we’ve got elections in France, Germany, and the Netherlands. There will be much more surprises coming in, politically. It’s going to be an interesting year, and the interplay between inflation and deflation will be crucial for investors. Inflation numbers and expectations were picking up significantly, while the enormous strength in USD and the major correction in bond markets were very deflationary. There might be some surprises on the deflationary side going forward, though the mainstream is concerned about inflation.

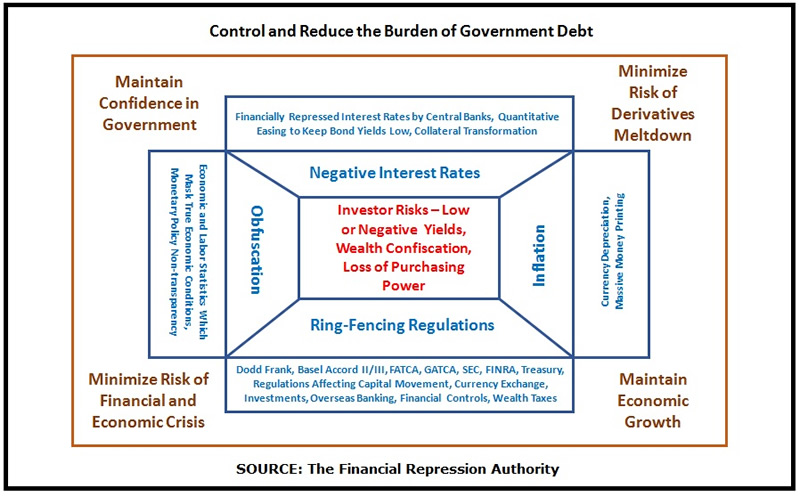

At the end of the zero interest rate trap is going to be inflation. Every fiat money system in history collapsed because of inflation, not deflation, but we can imagine there might be some sort of deflationary shock. And central bankers will act extremely inflationary and this might be the tipping point where people will lose trust in fiat money.

Gold is in the very early stage of of a bull market, and now we’re at the beginning of the public participation phase and gold will rise in purchasing power verses fiat currencies. Already since the beginning of the year, gold is up 3% in dollar terms. The fact that the market became very bearish on gold in the last weeks is a good sign. It’s going to be a great year for gold, but even more bullish on silver.

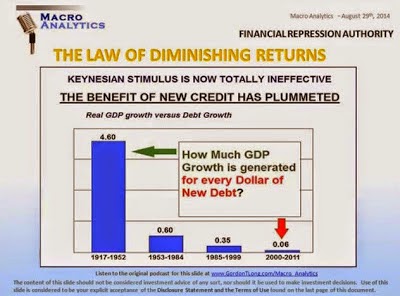

INFLATION ON THE MONETARY SYSTEM

We all know that at the moment the US dollar is a leading global currency. Normally strength in the USD will affect emerging markets as the weakest links first, and we’re seeing enormous stress in Mexico, Turkey, Brazil and so on, and this will have effects. If the Fed delivered more rate hikes the dollar will go through the roof, and the dollar is the most important driver that one should follow in the market at the moment.

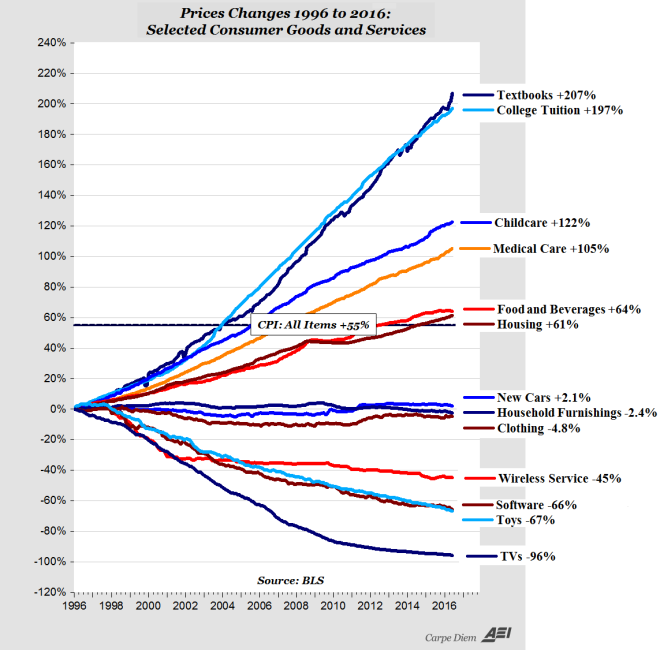

We may be having a transition from very low interest rates to forced inflation. This is going to go hand in hand with social upheaval and more socialist politicians because 4% real inflation is going to hurt the average person the most. The rich don’t care because they’ve diversified their real assets, but for the average person this is going to be a real problem, and this is going to be the point in time where things really get ugly.

The root cause comes from our central banks and the monetary system. Where the money is created first, those regions prosper from. Normally this means financial hubs like London and New York, where people really profit from monetary inflation. This is why in big cities people mostly voted for the status quo while people in rural areas that suffer from monetary inflation voted for change.

Sooner or later in the US there might be a recession.

GLOBAL STAGFLATION

Stagflation is something we should focus on, and is a very realistic scenario. Inflation rates, due to the base effect, may rise 3-4% in the next few months. If economic activity cools off, which is what we’re seeing, then we’re already in stagflation! People should prepare for stagflation, and what works is precious metals.

Stocks in general leave the comfort zone at inflation rates of 3%. Once we get over that level it’s a negative environment for stocks. As a rule, higher inflation rates are not positive for stocks in general.

CHINA’S EFFECT ON THE MACRO VIEW

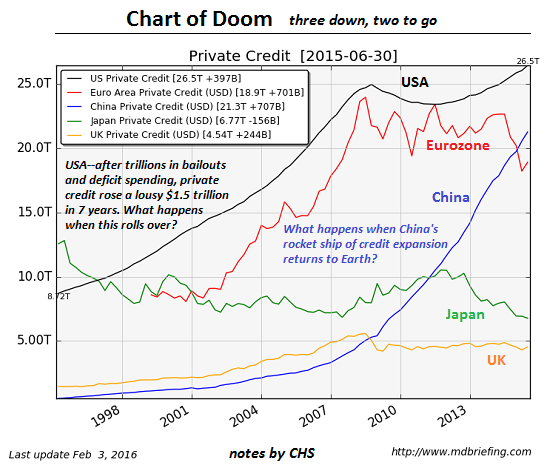

Perhaps their credit bubble already burst. There’s very aggressive fiscal stimulus in China, and credit growth only came from state owned banks. At the moment capital controls are slowly being put in place, and BitCoin is going crazy because of China, and the RMB is at a seven year low. There’s quite a lot of stress in China, and this will have enormous effects on commodity markets and precious metals.

There are many similarities between BitCoin and gold, but they are competing currencies. There’s so much going on in the crypto-currency space, and a technological revolution will be happening. Our whole world is digitized, so why should that end with money?

It’s not either BitCoin or gold; there’s room for both. The worst financial repression will become, the more people will pile into BitCoin or physical gold.

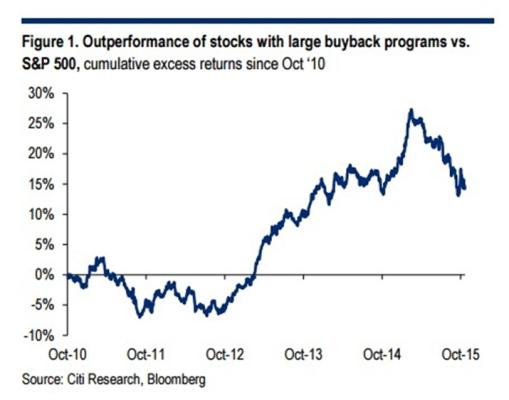

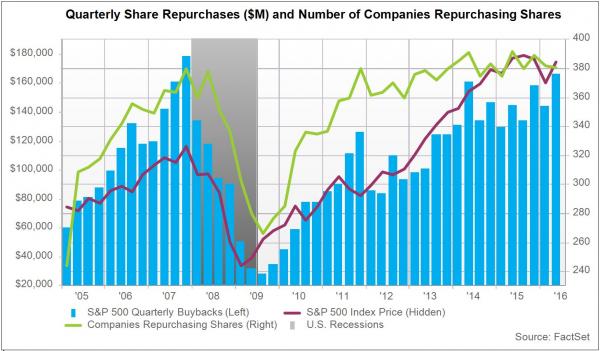

Companies might stop buying their own stock, and this would have enormous consequences for the equity market. In the corporate world, we’ve been in an earnings recessions for four or five quarters now, and some economic factors already show us that the economy isn’t as well off as people would suggest. Equity markets are overpriced, but for market participants right now greed is much more important than fear. It’s hard to anticipate reasons for such a shift, but it’ll happen very quickly.

GENERIC ASSET CLASSES TO CONSIDER

No one’s talking about business models or valuations anymore; everyone’s only trying to anticipate what central banks might do next. This shows how dependent we are on cheap liquidity and central bank bubble. In this environment you should protect your downside and diversify, and find ways to profit from falling markets.

There’s plenty of opportunities, like in silver and uranium, and if institutional investors start buying into the silver space it’ll have enormous effect as it’s a tiny market. The biggest threat is definitely from China, so one has to be cautious and follow the signs coming out of China, but you should take those signs with a grain of salt.

We’re seeing huge volatilities in emerging market currencies, and this will have global effects. Normally crises start from the periphery. Before every major market crash we’ve actually seen rising rates and rising inflation rates, and we’re seeing both right now. There may not be a crash, but the odds are much higher than the market is seeing.

Abstract by: Annie Zhou <a2zhou@ryerson.ca>

01/13/2017 - The Roundtable Insight – Incrementum’s Ronald-Peter Stoeferle On The 2017 Outlook

01/13/2017 - The Roundtable Insight – Incrementum’s Ronald-Peter Stoeferle On The 2017 Outlook