Blog

03/13/2016 - Negative Interest Rates On 40% Of Outstanding European Bonds!

03/13/2016 - Negative Interest Rates On 40% Of Outstanding European Bonds!

03/11/2016 - Jeffrey Snider: US$ STRENGTH IS A MANIFESTATION OF A US$ SHORTAGE

03/11/2016 - Jeffrey Snider: US$ STRENGTH IS A MANIFESTATION OF A US$ SHORTAGE

FRA Co-Founder Gordon T.Long and Jeffrey Snider, Head of Global Investment Research at Alhambra Investment Partners discuss a broad array of Global Macro subjects in this 48 minute video discussion with supporting slides.

As Head of Global Investment Research for Alhambra Investment Partners, Jeff spearheads the investment research efforts while providing close contact to Alhambra’s client base. Jeff joined Atlantic Capital Management, Inc., in Buffalo, NY, as an intern while completing studies at Canisius College. After graduating in 1996 with a Bachelor’s degree in Finance, Jeff took over the operations of that firm while adding to the portfolio management and stock research process.

In 2000, Jeff moved to West Palm Beach to join Tom Nolan with Atlantic Capital Management of Florida, Inc. During the early part of the 2000′s he began to develop the research capability that ACM is known for. As part of the portfolio management team, Jeff was an integral part in growing ACM and building the comprehensive research/management services, and then turning that investment research into outstanding investment performance. As part of that research effort, Jeff authored and published numerous in-depth investment reports that ran contrary to established opinion. In the nearly year and a half run-up to the panic in 2008, Jeff analyzed and reported on the deteriorating state of the economy and markets. In early 2009, while conventional wisdom focused on near-perpetual gloom, his next series of reports provided insight into the formative ending process of the economic contraction and a comprehensive review of factors that were leading to the market’s resurrection. In 2012, after the merger between ACM and Alhambra Investment Partners, Jeff came on board Alhambra as Head of Global Investment Research.

Jeff holds a FINRA Series 65 Investment Advisor License.

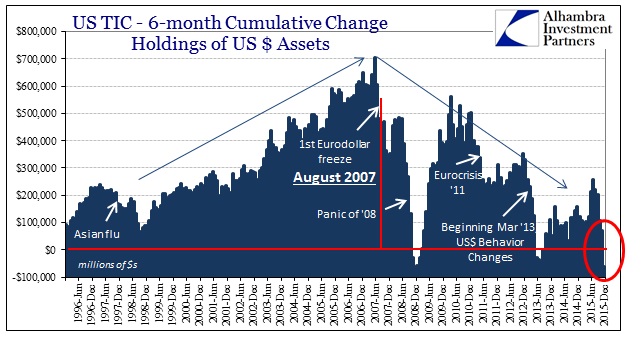

US TIC REPORT, TREASURY SALES

TIC is a compilation done by the US Treasury based on their access to data on foreign accounts and holdings of Dollar accounts and securities, and estimates the foreign Dollar market. Over the last decade or so, it is clear that the Eurodollar market grew steadily at a rapid rate until about August 2007, at which point it pivots and comes back down. The TIC data shows the tendency of dollar markets to essentially be stable, usually addressed through selling Treasury. However, the private dollar markets offshore are in disarray to the extent that central banks around the world are forced to fill the dollar deficiency with their own holdings. Of especial note is China’s reduction of their US Treasuries and foreign currency reserves, and OPEC countries incurring serious Current Account deficits in an attempt to maintain their pegs with the US dollar. In addition are the emerging markets who borrowed about $7-9T in USD, who now have difficulty paying back debts due to slowing trade and falling currencies.

This all leads to the US dollar strengthening, which is the manifestation of the dollar shortage. In recent days, Japan using NIRP will further disrupt the dollar system.

“US Dollar Strength is a manifestation of a US Dollar Shortage!”

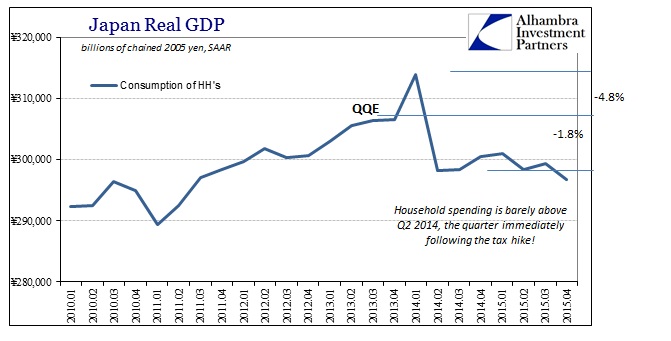

JAPAN: QE FAILURE AND WHAT NIRP MEANS

Under QE, Japan obtained a burst of inflation around 2014. Instead of leading to sustained economic activity, household income and spending dropped about 7%, which was also not offset by growth in GDP and demand. The surge in expansion, due to cheaper money, increases supply which then demolishes pricing power. In addition to the reduced value of savings, large companies have also shifted production offshore, thus increasing the effect and emphasizing the failure of QE/QQE to stimulate the economy.

NIRP also carries with it the threat of failing like QE, along with numerous other particle effects that cannot be currently measured or predicted, mostly as this type of system has not existed for over a hundred years. This is an indicator of the lack of power central banks have over the economy, but can be put down to overemphasizing the value of monetary policy over fiscal policy in the developed world. The dollar system has been artificially expanded past any control by banks and monetary policy, globally, over the last decade. The only way to stop it is to focus on other fiscal factors that would allow economic potential to be realized again and to refrain from following Keynesian economics once it has been proven to be ineffective.

“Japan is a test case in almost clinical conditions for QE and QQE, and it failed on every count.”

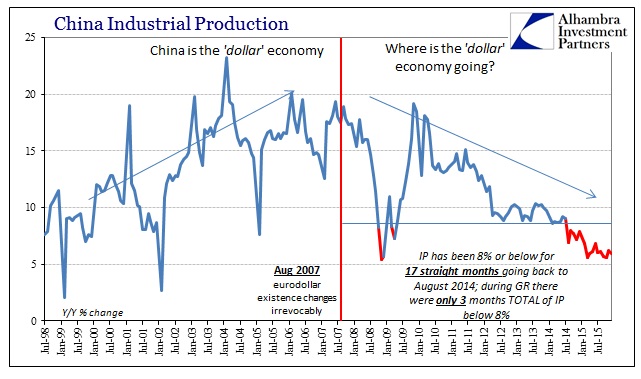

CHINA: COLLAPSING TRADE AND CREDIT

China is both an impediment to growth and a casualty of the rest of the world, but recently more of a reflection of the global dollar economy as they are most sensitive to changes there. The lack of growth over several years forces a fundamental shift toward a Keynesian response of fiscal and monetary stimulation that creates asset buffers at odds with overcapacity. Meanwhile, China still lacks any real method for economic growth and is forced to react to outside influences while juggling the problem of overcapacity with the falling export industry. This then leads to capital flight, which furthers the struggle to grow GDP.

China is clearly attempting to manage the Yuan by selling dollars to strengthen it, but will eventually falter like any pegged currency. Many currencies pegged to the US dollar, Eurodollar, and Petro dollar will likely collapse. Keynesian economists believed that 2007 was the beginning of a temporary deviation from sustainable global growth, but was in fact the structural revaluation of higher economics of the financial system. We are likely headed for a systemic reset and reorientation, which will be disruptive with significant risk but can be adapted to.

“I think we are headed for a systemic reset.”

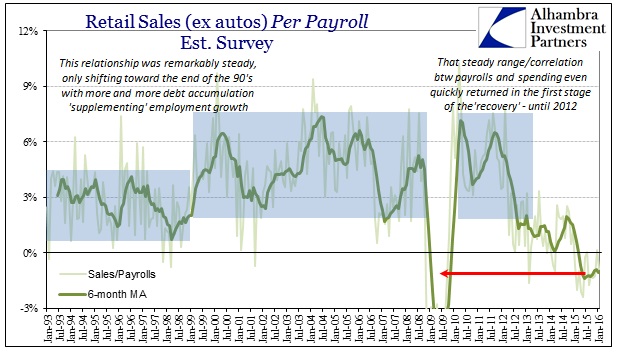

RETAIL: JANUARY SALES AND CONTINUING TREND

Retail sales have been near recession levels of low, indicating that consumers are under pressure, but inventories are still rising despite manufacturers cutting back. Retail slowing is a fixed trend starting from 2012, amplified in 2014-2015 with the disappearance of the manufacturing industry and loss of export goods. This is likely due to lack of real recovery that slowly eroded US consumers’ ability to continuously expand their activity. The middle class has no savings, so thus the capitalist system that relies on savings to reinvest into productivity.

Over the last several years, companies have been spending on buybacks instead of investing in productive capacity. 1900 of the S&P companies spent more on buybacks and dividends than they were earning, thus creating more debt.

“Recession is a necessary process, like anything else. It’s creative destruction.”

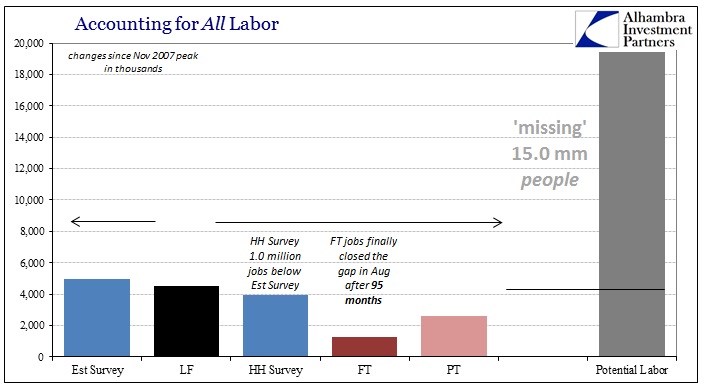

LABOR: FULL EMPLOYMENT – NOT REALLY!

There is a major disconnect between major unemployment statistics and the rest of the economy, where even having a job is not necessarily enough to support the expected standard of living. There are low prospects for growth in the job market, and people sense that there is a need for a restructuring of the system. Job growth is mostly in low income occupations, which results in potential workers entering college with a loan but failing to actually enter the labour force.

The current economic state is similar to the suppressed state of the 1930’s and 1940’s, and once the systemic reset is allowed to occur, the economic potential released will be tremendous. Recessions are necessary to allow risk to be properly priced, which in turn creates confidence in investment. The resulting reset should shift away from one centered around banks and the value of credit toward a capitalist system that prioritizes “money is money” over “money is credit”.

“Monetary policy is designed for companies to borrow more; it’s just that economists expected they’d borrow more for productive capacity rather than financial capacity.”

Abstract by: Annie Zhoua: zhou108@gmail.com

Video Editing by: Minjung Kim: minjung.kim@ryerson.ca

03/10/2016 - Former ECB Chief Economist: Negative Interest Rates Have Tremendous Negative Consequences For The Financial System

03/10/2016 - Former ECB Chief Economist: Negative Interest Rates Have Tremendous Negative Consequences For The Financial System

– Otmar Issing, the former Chief Economist of the European Central Bank & a former member of its Board

link here to the reference

03/10/2016 - Negative Rates Are Attempting To Inflate Away The Burden Of Government Debt

03/10/2016 - Negative Rates Are Attempting To Inflate Away The Burden Of Government Debt

Chris Ciovacco article references a recent Wall Street Journal essay on what is the real reason behind negative interest rates .. the surface reason is to get consumers to spend rather than save their money, but the real reason is to reduce the burden of government debt – this is the big driver behind financial repression.

03/10/2016 - Jim Puplava: Financial Repression Happens When Government Is $20 Trillion In Debt

03/10/2016 - Jim Puplava: Financial Repression Happens When Government Is $20 Trillion In Debt

03/07/2016 - Danielle DiMartino Booth: The Unintended Consequences Of Negative Interest Rates

03/07/2016 - Danielle DiMartino Booth: The Unintended Consequences Of Negative Interest Rates

Former advisor to the Dallas Federal Reserve Bank Danielle DiMartino Booth – president of Money Strong – on the Federal Reserve, highlights the unintended consequences of negative interest rates & global currency wars – the one asset she recommends is gold (imagine that a former advisor to the Federal Reserve!) .. Jim Rickards discusses investments which make sense in this environment – recommends gold, cash & 10-year U.S. Treasury bonds (though emphasizes these bonds are not “risk-free”) .. 1/2 hour total program

03/07/2016 - Martin Armstrong: Negative Interest Rates Are Inducing Banks To Hoard Physical Cash

03/07/2016 - Martin Armstrong: Negative Interest Rates Are Inducing Banks To Hoard Physical Cash

Martin Armstrong: “Bavarian banks have figured out that negative interest rates are insane. They must pay the ECB to hold their cash. They have decided it is better to store their cash and eliminate deposits at the ECB as reported by Spiegel Online. These people are just braindead. They think negative interest rates will somehow ‘stimulate’ the economy. No, they fail to grasp that people and banks can now be induced to just hoard money and not spend it.”

03/07/2016 - Jim Rickards On Fiscal Dominance and Financial Repression: Central Bank Capping Interest Rates & Bond Buying To Support Government Spending

03/07/2016 - Jim Rickards On Fiscal Dominance and Financial Repression: Central Bank Capping Interest Rates & Bond Buying To Support Government Spending

“We are now entering a new period of fiscal domination by the Treasury. TheFed will again have to give up control of its balance sheet and interest rate policy to save the U.S. from secular stagnation. The Fed will subordinate its policy independence to fiscal stimulus coordinated by the White House and the Treasury. The implications for you are enormous .. The Fed’s independence is again threatened: not by war, but by secular stagnation .. The central bank money printing and currency wars will not be over soon. Global elites are getting desperate to try something new to stimulate growth. These indications and warnings now are signaling loud and clear that the Fed must again surrender its independence to the big spenders. A new global consensus is emerging from elite voices such as Adair Turner, Larry Summers, Joe Biden and Christine Lagarde. The consensus is that the only solution to stagnation is expanded government spending on critical infrastructure, health care, technology, renewable energy and education. If citizens won’t borrow and spend, the government will! It’s the basic Keynesian idea from the 1930s without the monetarist gloss. More government spending means more government debt. Who will buy these added government bonds? How will the Treasury keep interest rates low enough so that a death spiral of higher deficits and higher rates doesn’t push the Treasury bond market to the point of collapse? The answer is that the Fed and Treasury will reach a new secret accord, just as they did in 1941. Under this new accord, the U.S. government could run larger deficits to finance stimulus-type spending. The Fed will then cap interest rates to keep deficits under control. The popular name for rate caps, and Fed bond buying to support government spending, is ‘helicopter money.’ The technical names are fiscal dominance and financial repression.”

03/06/2016 - Mish Shedlock: “Gold Remains The Best Hedge Against Central Bank Sponsored Financial Repression”

03/06/2016 - Mish Shedlock: “Gold Remains The Best Hedge Against Central Bank Sponsored Financial Repression”

Mish Shedlock references the BlackRock gold ETF challenges & an a WSJ on how negative interest rates are positive for gold prices .. WSJ: “One of the biggest factors behind gold’s rise has been negative rates. The Bank of Japan last month joined a growing number of central banks, including the Swiss National Bank and the European Central Bank, when it introduced negative interest rates in an effort to spur consumer spending. Sweden’s central bank said on Thursday it was moving interest rates further into negative territory, and warned it could cut again. Canadian officials are also weighing cutting borrowing costs below zero. And Federal Reserve Chairwoman Janet Yellen said this week the U.S. central bank is studying the feasibility of pushing short-term interest rates into negative territory if needed. Gold typically struggles to compete with any yield-bearing investments when interest rates rise, but that disadvantage matters less when borrowing costs are negative, opening the path for more investors to hold the metal.” .. Shedlock summarizes: “Gold remains the best hedge against central bank sponsored financial repression.”

Read our white paper on the risk-mitigated approach to investing in gold – LINK HERE

Consider some solutions to investing in Gold – see the options best suited to your requirements – LINK HERE

03/04/2016 - Dan Amerman: MARGIN RULE CHANGES FORCE NEW PRIVATE FUNDING OF PUBLIC DEBT

03/04/2016 - Dan Amerman: MARGIN RULE CHANGES FORCE NEW PRIVATE FUNDING OF PUBLIC DEBT

FRA Co-Founder Gordon T.Long and Dan Amerman have an in-depth conversation covering various topics such as financial repression, quantitative easing, devious actions of the Fed and much more. Daniel R. Amerman is a Chartered Financial Analyst, author, and speaker, with BSBA and MBA degrees in Finance, and over 30 years of professional financial experience. As an investment banking vice president in the 1980s he did groundbreaking work in the security originations and asset/liability management areas, including CMO/REMIC originations as part of portfolio restructurings for financial institutions, as well as the creation of synthetic securities for institutional clients. As an independent quantitative analyst in the 1990s and 2000s, he structured mortgage-backed bond financings and provided analytical services for real estate acquisitions by multifamily and commercial real estate owners, investment banks, and tax-exempt issuers.

Mr. Amerman is the creator of a number of DVDs and books on finance, including two books published by McGraw-Hill (and subsidiary): Mortgage Securities, and Collateralized Mortgage Obligations: Unlock The Secrets Of Mortgage Derivatives. He has been a speaker and workshop leader for sponsors including The Institute for International Research, New York University, and many banking groups.

Mr. Amerman has spent a number of years in researching alternatives. Drawing upon his background outside the individual investor industry, he has developed an interrelated group of non-traditional solutions – including asset/liability management strategies – for such concerns as financial crisis, inflation, inflation taxes, low economic growth rates, and pervasive low yield markets.

REVISiTING THE EXPANSION OF FIAT CURRENCY

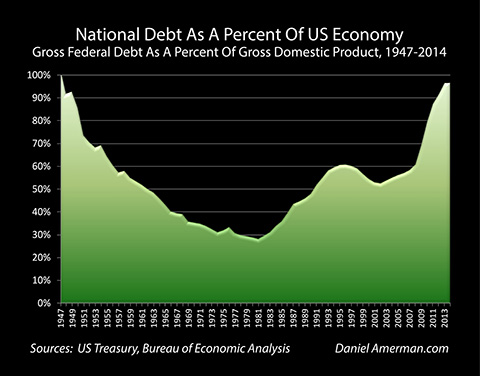

The bigger issue is that we had a change in the national debt super cycle. As of 1947 due to the expense of WWII, the outstanding US debt was approximately equal to the size of the total economy. This is as toxic for a country back in 1947 as it is today.

Historically the growth rate of heavily indebted countries is much slower. It is a slow economic growth and a high interest rate risk environment. This was not just the US alone, this was most definitely global. What world leaders did as a result was get together, and yes Bretton Woods was part of this and they agreed to put rigid financial controls on the population. Effectively the size of national debt was held down for approximately 25 years while the economies experiences periods of substantial growth. Eventually these national debts as a percent of the economy had dropped down to below 30%.

This decline promoted a rapid growth environment, free market interest rate, removal of capital controls, and lifted the limitations on private ownership which we have had since 1973; individuals in the US could not hold gold for investment purposes.

RING FENCING

“You’re not going to keep up with inflation and there is not much you can do about it. That’s the point of ring fencing.”

I split it into two ways. The first is capital controls and second, forcing intermediaries to participate in financial repression. Another component as well is repressing the ownership of precious metals so people do not have an alternative protection from inflation. What’s surprising is that the term financial repression has a conspiracy theory connotation associated with it, when in fact financial repression is an integral part of macroeconomics. It has been a core part of managing financial systems over a long period of time. What’s surprising is that the term financial repression has a conspiracy theory connotation associated with it, when in fact financial repression is an integral part of macroeconomics. It has been a core part of managing financial systems over a long period of time.

In the US in a relatively short period of time, particularly in 2010 all these elements were released for the first time since the 1970s. Interest rates were forced down below inflation by massive government intervention, quantitative easing and forms of capital controls all came out together and as a result dominated the markets ever since. The fascinating part is that there has been a series of developments over the last few months which may be the biggest round of financial repression that we have seen since 2010.

“Ring fencing which I consider as the third pillar is the forced participation of financial intermediaries in the name of public safety. Two key developments were what came out in 2015 was that the Fed has a part of the financial stability board. This board is the G20, the IMF, World Bank combined and all simultaneously agreed to change their money fund policy as well as their margin rules.”

Ring fencing which I consider as the third pillar is the forced participation of financial intermediaries in the name of public safety. Two key developments that came out in 2015 was that the Fed has a part of the financial stability board. This board is the G20, the IMF, World Bank combined and all simultaneously agreed to change their money fund policy as well as their margin rules. They changed regulation on money funds which are apparently done in the name of public safety such that it was an expensive burden for any funds to use anything other than federal debt for their money funds. Effectively creating an enormous financial advantage.

“This is a classic scenario. Take a financial intermediary and in the name of public safety make them hold US government debt.”

This is a classic scenario. Take a financial intermediary and in the name of public safety make them hold US government debt. In doing this you have expanded the market for government debt by whatever the net change is. Essentially locking in an additional trillion dollars of funding for the debt.

“A key thing to make note of is that these are all financial intermediaries, so when people ask who is funding the debt, the answer is all of us are.”

We are essentially financing the government through an intermediary. By changing regulations they are both increasing the relationship and locking into it. At this short term end of the yield curve we are doing this for virtually no yield whatsoever. We are providing the money to the federal government through an intermediary whose participation is forced.

FORCED MACROPRUDENTIAL POLICIES

“They are forcing ever lower interest rates on more of the population. This is providing larger low-cost funds to the government in an ever more constrained manner where it becomes harder for people to escape.”

On Nov 12, 2015 the financial stability board agreed to implement margin rule changes. They were talking about it being a blast from the past, it was what central banks used to do in the 1970s. This is now brought back out, but in this case it is also an expansion of the mandate of the Fed. Where we are with these changes is that the Fed will be without active congress and expanding their control over the US markets to all investment firms to participate in some sort of secured lending.

Financial firms often need cheap money on a short term basis. They can sell a treasury security to someone else at a given price and agree to buy it back at a higher price; in effect it becomes a short term loan. The difference in price is the interest rate that they are paying, this can be done without an actual sale and instead with the pledge of the securities as collateral.

“Central banks are concerned that these low quality collateral loans are now considered to be at risk for triggering a new financial crisis. That’s why they’re changing the regulations where they have the ability to change margin rules at will.”

The best known forms of margin deal with stock ownership where your borrowings become limited. If this was raised to 60% or 70% to bring down stock values, people will have to scramble to sell these securities or they will have to come up with the additional cash through some other means, otherwise there will be a forced liquidation.

What has been created is a major incentive to use US treasuries securities as collateral for repurchase agreements. Once everyone does this then you get a situation where the Fed is no longer in control of leverage in the market.

PREPARING FOR THE FUTURE

Funding for US national debt has just increased by $2.5 trillion. This is very similar to something that is far controversial and that is quantitative easing. Total US treasuries securities held by the Fed are between 2.4 to 2.5 trillion. They are holding this approximate level because they say they are not doing quantitative easing and rather doing purchases every time they take principal to keep at that level. This was major news and made headlines throughout the world, yet something just as big happened and nobody noticed; this is a forced funding of the federal debt that is just as large as what happened with QE.

“The Fed is in the process of deploying two massive stabilizers. Why are they doing this in 2016 when they hadn’t done so in 2010?”

The logical interpretation would be they are very concerned of what’s to unfold in the future. They are pre-emptively moving major stabilizers in place.

To follow Daniel Amerman and his work, please visit http://danielamerman.com/aHome.htm

Abstract written by, Karan Singh

Karan1.singh@ryerson.ca

03/04/2016 - BlackRock Suspends ETF Issuance Due To “Surging Demand For Gold”

03/04/2016 - BlackRock Suspends ETF Issuance Due To “Surging Demand For Gold”

Gold ETF Market Breaks: BlackRock Suspends ETF Issuance Due To “Surging Demand For Gold”

BlackRock’s Gold ETF (IAU) has seen fund inflows every day in 2016 (no outflows at all) and with the stock trading above its NAV for most of the year, the world’s largest asset manager has made a significant decision: It has suspended issuance of Gold Trust shares due to “surging demand for gold.”

It appears the huge demand for physical gold (and lack of supply) is finally catching up with the manipulation of paper prices.

======

POSTED AT: ZERO HEDGE

BlackRock’s Gold ETF (IAU) has seen fund inflows every day in 2016 (no outflows at all) and with the stock trading above its NAV for most of the year, the world’s largest asset manager has made a significant decision:

- *BLACKROCK SAYS ISSUANCE OF GOLD TRUST SHARES SUSPENDED

- *BLACKROCK SAYS SUSPENSION DUE TO DEMAND FOR GOLD

Issuance of New IAU (Gold Trust) Shares Temporarily Suspended; Existing Shares to Trade Normally for Retail and Institutional Investors on NYSE Arca and Other Venues

Suspension results from surging demand for gold, which requires registration of new shares

iShares Delaware Trust Sponsor LLC, in its capacity as the sponsor of iShares Gold Trust (IAU), has temporarily suspended the creation of new shares of IAU until additional shares are registered with the Securities and Exchange Commission (SEC).

This suspension does not affect the ability of retail and institutional investors to trade on stock exchanges. Retail and institutional investors will continue to be able to buy and sell shares in IAU.

IAU holds gold as a physical asset. IAU is an exchange-traded commodity (ETC), which therefore is not eligible for registration as an investment company under the ’40 Act. IAU may only be registered under the ’33 Act as a grantor trust. Under the ’33 Act, subscriptions for new shares in excess of those registered requires additional filings with the SEC.

Nearly all other U.S. iShares are exchange-traded funds (ETFs), registered as investment companies under the ’40 Act. The ’40 Act provides for the continuous offering of shares and does not require registration of additional shares as the fund grows due to investor demand in connection to new subscriptions.

Since the start of 2016, in response to global macroeconomic conditions, demand for gold and for IAU has surged among global investors. IAU has $8 billion in assets under management, and has expanded $1.4 billion year to date. February marked its largest creation activity in the last decade.

This surge in demand has led to the temporary exhaustion of IAU shares currently registered under the ’33 Act.We are registering new shares to accommodate future creations in the primary market by filing a Form 8-K to announce the resumption of the offering of new shares. The ability of authorized participants to redeem shares of IAU is not affected.

It appears the huge demand for physical gold (and lack of supply) is finally catching up with the manipulation of paper prices.

If this is anything other than a brief technical suspension, it could well unleash panic-buying as we already pointed out – there is no physical gold!

As we previously concluded, the reality that there are just two tons of gold to satisfy delivery requsts based on accepted protocols should in itself be troubling, ignoring the latent question why so many owners of physical gold are de-warranting their holdings.

Considering there are now less than 74,000 ounces of Registered gold at the Comex, or just over 2 tonnes, we may be about to find out how right, or wrong, the skeptics are, because at this rate the combined Registered vault gold could be depleted as soon as the next delivery request is satisfied. Or isn’t.

Meanwhile, this is how gold is taking the news – it would appear that some gold is still available… one just has to pay up for it.

03/04/2016 - Negative Interest Rates Are Leading To The End Of Capitalism

03/04/2016 - Negative Interest Rates Are Leading To The End Of Capitalism

John Rubino highlights the recent developments in Japan with increasing negative interest rates there, with Japan’s government debt now requiring the lenders to pay rather than receive interest rates for 10 years .. “The world’s central banks are creating so much excess cash that there seems to be nowhere else for it to go. The longer, but way more interesting and scary explanation is that capitalism as it used to function is over, and the result will be catastrophic.” .. there has been so much quantitative easing going such that now Japan’s central bank is directly funding its government, something once widely understood to be the last gasp of a dying regime but now seen as just part of the new normal .. Pension funds, meanwhile, operate the same way, taking in and investing contributions against future obligations. Many U.S. pension plans are already borderline broke and in a NIRP environment they’ll suffer a mass extinction. Again, big industry, many employees, huge potential impact on both Wall Street and Main Street. The slowing growth that results from negative interest rates is thus profoundly deflationary, which presents another explanation for investors’ willingness to park cash in places that cost rather than generate income: They expect the currency they get back to be worth more than the currency they put in. This is exactly the opposite of what rate-cutting central banks are hoping for — which might in the end be the moral of this tale: Economic laws are like their natural counterparts. You mess with them at your peril.”

03/04/2016 - Mitigating Risks Of A Bank Bailin

03/04/2016 - Mitigating Risks Of A Bank Bailin

Sovereign Man highlights the trend to negative interest rates across the indebted western world, what to do to mitigate the risks from bank bailins .. “U.S. rates right now are just 0.25%. So even with a tiny cut the Fed is almost guaranteed to take interest rates into negative territory in the next recession .. We can see the effects of this in Europe and Japan where negative interest rates already exist .. Negative interest rates destroy banks. They eat into bank profits and force them to hold money losing toxic assets. Bank balance sheets become riskier, and people start trying to withdraw their money as a result. In Japan (which just recently made interest rates negative), one of the fastest selling items is home safes, which people are buying in order to hold physical cash. In Europe (where negative interest rates have existed for a while longer), bank controls have already been put in place to prevent people from withdrawing too much of their own money out of the banking system. This is a form of capital controls– a tool that desperate governments use to trap your savings within a failed system and steal your prosperity. Wherever you see negative interest rates you are bound to see capital controls close behind. One of the easiest things you can do is withdraw some physical cash out of the banking system.”

03/03/2016 - The Government’s Real Solution? — “Financial Repression”

03/03/2016 - The Government’s Real Solution? — “Financial Repression”

QE Absolutely, Positively Must End in Economic Collapse

Over the last century, the central planners who run our world have not only made a mess by their constant interference, but they have made a mess that can only end one way—in total economic collapse.

Over the last century, the central planners who run our world have not only made a mess by their constant interference, but they have made a mess that can only end one way—in total economic collapse.

Will the Tide Stop Coming in Because We Tell It To?

Cycles are arguably the most dominant force in nature. There is a cycle to the planets, crops, radio waves, electricity, tides, people—pretty much everything.

And there is a cycle to economics. This has been known and understood since the days of old. Even the Bible talks about “fat years” and “lean years.”

With all this history, you would think the great economists of our day would understand this principle and work with it, rather than oppose it. You would be wrong. Horribly wrong.

This is not a fairytale; this is the world we live in right now. Inspired by the works of Keynes—a fairly young branch of economic theory that is still largely unproven and theoretical—these men are, in plain view, replacing traditional “free markets” (where price discovery is determined entirely by supply and demand, just like you learned in school) with their own “Frankenmarkets,” where they use their ability to create infinite money at the push of a button to force markets to do what they think is best.

And what is it they think is best? The evidence of the last 100 years suggests that their preference is an economy based on debt; markets dominated by clandestine manipulation from both internal government agencies (e.g., the Treasury) as well as external ones (e.g., the Federal Reserve, the BIS); ongoing cycles of boom and bust; and, most disturbing of all, the ongoing transfer of wealth, on a scale never before seen or imagined, to smaller and smaller groups of individuals and entities. Until we reach the point where the wealthiest one percent own more than the remaining 99% combined—a point, in fact, we have already reached. Based on empirical evidence alone, this seems to be their preferred way of running the world.

But there remains one small problem. This system is imploding. More correctly, to borrow a phrase from Alice Through the Looking Glass, our financial engineers are interfering more and more often simply to keep things in the state they were in already. In other words, as their efforts are failing, so is the distorted financial world they have created for us.

The first detailed, peer-accepted work to point this out was James Davidson’s superb book, The Great Reckoning: Protecting Yourself in the Coming Depression (Touchstone Press, January 1994). In his book, Davidson looked not only at the U.S., but also all the Western nations collectively and concluded that a century of building the trappings of prosperity on debt (borrowing to get what you do not have) rather than savings (working hard to afford what you need) was going to end badly—very badly.

The book was a worldwide bestseller, but lost some credibility when the aforesaid reckoning did not happen precisely on schedule in the last decade of the 20th century, just as Davidson had predicted.

In point of fact, the reason the world avoided an economic catastrophe in the 1990s was because of the so-called computer revolution. Just as with the invention of the steam engine, a new and unexpected technology produced not only observable efficiencies, but also captured the imagination of the public at large and gave them hope.

Hope that unfortunately collapsed in the 1999–2000 Dotcom boom. A period so bizarre that an entrepreneur with a business plan involving the Internet that he had penned on the back of a napkin during an all-nighter was, conceivably, able to secure millions the next day from a wide variety of venture capitalists.

The Dotcom Boom “Smartened the Chumps”

The expression “never give a sucker an even break” entered the common parlance in the 1940s after the launch of the film of the same name starring the top comedian of the era, W.C. Fields. In fact, there were two parts to the quote and the second portion is often overlooked. The lost part of the quote was “…and never smarten a chump.”

The manner in which the 1990s Dotcom boom conveniently delayed the reckoning that Davidson has written about was not lost on our financial planners. Quite the opposite, in fact. As former Washington deep-insider Catherine Austin Fitts explained, the 2007 mortgage-backed securities debacle—a financial catastrophe felt around the world!—was no accident. It was deliberate, it was planned, it was an attempt to mimic the momentum of the computer boom (which ended in a crash!) by creating a brand new “bubble” to give the impression that the economy was strong and self-sustaining (i.e., before the new boom itself also ended in a crash). (Source: “Sub-Prime Mortgage Woes Are No Accident – Fitts,” Solari, August 7, 2007.)

For those who watched the aftermath of the 2007 crisis with eyes open, it was clear that something very significant had suddenly changed in the halls of power. The tipoff? On TV screens all over the world, you had the spectacle of the U.S government declaring that there were banks and financial institutions within its borders that were “too big to fail” and, moreover, needed rescuing at the public’s expense. Nobody seemed to notice that the very concept did violence, simultaneously, to the notions of capitalism, democracy, free markets, and the Rule of Law. In fact, this notion went further than even Keynes himself had ever gone! Nor did government give the public a chance to even catch its breath, to blink, because they immediately followed that announcement with a wide variety of other initiatives—the most memorable of which was quantitative easing or “QE”—which continued the theme touched on above of bending markets to their will.

The Government’s Real Solution? — “Financial Repression”

The overall (and deliberate) impression was that our government had identified a problem and was working hard to fix it with a variety of clever and innovative solutions they had jerry-rigged at the last moment.

Some experts saw things differently, however. Some recognized the “solutions” offered by the government as part and parcel of a known and dreaded economic doctrine called “financial repression,” an insidious back-door method used by governments to extricate themselves from excessive debt by quietly passing the pain along to their own citizens.

The term is not new and was first coined in 1973 by Stanford economists Edward S. Shaw and Ronald I. McKinnon. The clear and visible markers of a “financially repressed” regime, they said, are:

(1) Policies that override supply and demand to artificially drive yields to, or below, zero (think QE, ZIRPs, NIRPs);

(2) Capital controls to limit the ability of money in the regime to leave on short notice (think “cashless,” in many ways the ultimate expression of capital control);

(3) Suppression of the precious metals complex, once again to limit alternatives; and

(4) Suppressing or distorting information so as to give an artificial sense of well-being (think, re-defining “employment” to exclude those who have given up and left the workforce…?)

The ultimate goal of the regime is to foster “policies that result in savers earning returns below the rate of inflation” in order to allow banks to “provide cheap loans to companies and governments, reducing the burden of repayments.” (Source: “Financial Repression Destroys Growth,” Wikipedia, last accessed February 1, 2016.)

The educational site Mises.org adds more detail:

“[…] Financial repression is a revolving set of policies where the government insidiously takes wealth from the private sector, and more specifically makes it easier for government to finance its debt. In today’s environment this includes: ZIRP or ‘zero interest rate policy’ where many of the world’s central banks keep their lending rates to banks at or near zero. Naturally, this makes the interest rate on government debt lower than it otherwise would be; QE or ‘quantitative easing’ is the central bank policy of buying up government debt from banks. This increased demand increases the price of government bonds and reduces the interest rates on those bonds… The combination of the two policies has allowed governments to borrow money, both short- and long-term bonds, at extremely low interest rates. This, in turn, has kept the government’s interest payments on the national debt relatively low.” (Source: Financial Repression, Mises.org, Last Accessed: January 15, 2016.)

Is financial repression the cure for economic ails? The Mises site suggests just the opposite, in fact:

“[…] Financial repression is an outgrowth of bloated government budgets and enormous government debts. It is the worst way of dealing with government debt and actually works against the proper ways of addressing fiscal problems which include: eliminating government programs, eliminating military bases, austerity based on cutting politicians and government employees’ salaries and benefits, and deregulation and privatization to increase economic growth.The effects of financial repression cause economic harm throughout the productive sectors of the economy including workers, savers, entrepreneurs, retirees, and pensions. It hurts the insurance industry that protects our lives, homes, health, and property. The (sole) economic beneficiaries include the big banks and Wall Street, the national government itself, and certain large corporations.” (Source: Ibid.)

Editorialist Daniel Amerman has spent literally years analyzing the impact of financial repression in jurisdictions where it has been deployed.

He writes the following:

“[…] the essence of Financial Repression is using a combination of inflation and government control of interest rates in an environment of capital controls to confiscate much of the purchasing power of a nation’s private savings. Rephrased in less academic terms – the government methodically destroys the value of money over a period of many years, and uses regulations to force a negative rate of return onto investors (in inflation-adjusted terms), so that the real wealth of savers shrinks… Over time Financial Repression can be every bit as destructive to wealth building through savings and retirement accounts as is austerity, default or high rates of inflation.” (Source: “Private Savings Pay Public Debts,” DanielAmerman.com, last accessed January 25, 2016.)

Amerman is also quick to underscore the hidden connection between inflation—something that Washington is forever telling us is “desirable”— and the financial repression regime:

“[…] a government that owes too much money (deliberately) destroys the value of those debts through destroying the value of the national currency itself. It doesn’t get any more traditional than that from a long-term, historical perspective. Without inflation, Financial Repression just doesn’t work… the higher the rate of inflation, the more effective Financial Repression is at quickly reducing a nation’s debt problem.

“[…] The goal…is to make sure that all savers are lending to the government at artificially low interest rates—even though the great majority of them never directly purchase a government security. One way of doing this is savers making deposits which pay very low rates of return, with banks using those very low cost deposits to purchase government debt that also pays a very low rate of return. While little remarked upon, that is exactly what has been happening on a multi-trillion dollar scale in the United States, as part of the Federal Reserve’s Quantitative Easing program.

“[…] There is nothing accidental going on here, all that is in question are the particulars of the strategies for cheating the investors, meaning the collective savers of the world. Again, the time-honored and traditional form that heavily-indebted governments use to cheat investors is to devalue the currency. Create inflation, and tax collections will rise with that inflation but the debts won’t, and meanwhile the savers of the world will be paid back in full with currency that is worth less than what was lent to the governments in the first place.” (Source: Ibid.)

This specific observation is especially important because now we finally have a connectionbetween different government narratives that, to this point, seemed disconnected and almost random. We have a government that admits to being some $17.0+ trillion in debt (not allowing for unfunded, revolving, and contingent liabilities) with no obvious way to repay that debt; and a Federal Reserve that is seemingly using tools designed to weaken the currency and thereby facilitate gradual repayment of the debt by the “hidden tax” of inflation, which, coincidentally, is a term that repeatedly pops up in the many iterations of Fedspeak as, presumably, a goal to be vigorously pursued…? (Note again that only Keynesian theory places any value on inflation in an economic eco-system. Older good-money economics—“Austrian economics” or “hard money economics”— clearly identifies inflation as a dangerous short-term fix that ultimately leads to more serious longer-term problems and, ultimately, collapse.)

“NIRP”—The Sound You Make When Your Money Vanishes

Understand that the above comments were voiced when the regime was limited merely to QE, ZIRP, and clandestine gold bashing (which, as mentioned above, is itself simply another form of capital control right from the financial repression toolkit (see, for example, my recent essay, “A Different Look at the Gold Sector”).

A NIRP—negative rates, you pay the bank for the privilege of guarding your money—is not here yet, but it’s well on its way. The Fed has mentioned (threatened?) it several times, as if testing the temperature of the bathwater before drowning the baby in it. Same, astonishingly, in Canada. These guys are chomping at the bit to try out—AT TAXPAYERS’ EXPENSE—a fresh, new modality that looks great on paper, but somehow fails to pass both the “smell test” and the “would this make sense to a 5th grader?” test.

All of which, of course, begs the question, if the pension system and insurance system (both pillars of the financial world as we know it) could not function at ZIRP, how would they fare at NIRP? (See, for example, “Warning: You May Be Next: 400,000 People Just Had Their Pensions Cut By 50%: ‘Going to Happen To The Rest Of Pensions in the United States’,” Silverdoctors, February 24, 2016.)

In February 2016, The Financial Times made a yeoman effort to explain NIRP to its readers and claimed to have received the highest number of reader responses in their history. This reader response, which focused mainly on the effects of ZIRP—or, simply, a zero rate—was typical and especially articulate:

“For any human being making economic decisions, everything changes at 0%. The decision making for savers, consumers, SMEs, etc. grinds to a standstill. If you are prudent and don’t want to speculate on buying various financial assets, 0% kills any reason you may have had to take any positive action. If all you can expect to get from your efforts is to still have the same as when you started, why bother? We as humans need a positive ‘Narrative’ to get out of bed in the morning, work, take risk, etc. Risk free interest at 0% translates into a clear statement that there is no future to discount cash flows over or to believe in. If an individual cannot imagine a positive result from his/her actions, he/she prefers to do nothing. Prolonged periods of 0% rates and no positive (inflation) price movement will lead to reduced economic activity. Not exactly the stated purpose of the QE experiment. QE will go to the history books as one of the greatest mistakes in history.” (Source: “Everything Changes at Zero,” Typepad.com, February 23, 2016.)

NIRP is already in Japan. According to Zerohedge, you cannot buy a safe in Japan; they are completely sold out. The always-practical Japanese would rather store their cash at home than pay a stranger for the privilege. (Source: “Safes Sold Out in Japan,” Zerohedge, February 22, 2016.)

Financial analyst Rob Kirby in a recent interview actually joked about the very idea of a NIRP, calling the name an outright lie: “Of course, the average borrower will never see a negative rate, no bank is going to pay you to take a mortgage, it’s the savers who are going to suffer!” (Source: “The Failure of Fiat Money,” Silverdoctors, February 24, 2016.)

Wait, it gets better. While the central banks of the world are quietly going full-tilt King Canute, some editorialists are starting to wonder if, prior to adopting the central bank system (see my essay, “Who Owns the Fed?”), governments should perhaps have first adopted a failsafe? Something similar perhaps to Asimov’s “First Rule of Robotics,” in order to protect themselves against just the situation we are now in? (The First Rule of Robotics, or AI, is that under no circumstances should your human creators ever be harmed. Presumably, governments should have placed similar constraints on their central planners before the latter woke up one morning and realized they had more in common with each other, and their banking pals, than they did with the citizens of the very countries they were supposed to serve…?)

What a Tangled Web We Weave…

Another problem with a financial repression regime is that once started, there is no “off” button. The governments and their cronies must keep tweaking the formula until the citizenry learns, one way or another, to obey.

For example, in January 2016, the U.S. Federal Reserve proposed a new set of margin rules for trading financial instruments. Most commentators missed the import of these new rules, but Daniel Amerman found a hidden, strategic, underlying purpose, which he explained as follows:

“[…] The key loophole is that when (their own) U.S. Treasury obligations and agency securities are used as the collateral, the borrower will be immune from the new margin regulations. This then creates a split market, with two kinds of secured financings. For those who own Treasuries and agencies and use them as collateral, they are not subject to the planned new rules. According to the US Office of Financial Research, about two thirds of the collateral currently being used is Treasuries and agencies, so this will be true for most of the current market borrowers. For the remaining one third of borrowers, however, there is a potentially substantial increase in risk. The dangers are those of liquidity and market risk. If the Fed increases margin requirements in order to pull leverage from the system, then more or less by definition, that action creates a liquidity crunch for borrowers who were not invested in Treasuries and agencies.”

What Amerman has done is to identify a seemingly innocent-looking change in Federal Reserve regulations—one that initially looks like all it wants to do is pull liquidity from the system—and re-classify it as part of the overall financial repression toolkit.

According again to Mises.org, financial repression is most effective when combined with some form of “capital controls” or mechanisms that limit what the average citizen can freely do with his or her own capital.

Indirectly, Amerman says, these proposed regulations will place a burden on all trades not involving government debt. To avoid that burden, traders are being herded, like sheep, to create ever-broadening demand for government debt even at the currently low yields. Amerman classifies this approach as yet another form of capital control, in this case one designed to condition larger players to continually absorb and trade U.S. debt, even as sovereign nations from other parts of the world are divesting it as fast as they can. (Sources: “New Margin Rules Force Investors into Treasuries,” DanielAmerman.com, last accessed January 24, 2016; “China, Russia, Norway, Brazil, Taiwan Dump US Treasuries..,” Wolfstreet, October 8, 2015.)

A World Where the Inmates Now Run the Asylum…

Other commentators examining the Fed’s policies have come to essentially the same conclusion as Amerman. Bill Bonner, the prolific American author and journalist, is especially articulate in his critique of how this drama is playing out:

“[…] (the so-called) the ‘era of price stability’ under the Fed…their inflation targeting theory is not only completely bereft of theoretical and empirical support, it is in fact plainly contradicted by both theory and the empirical studies that do exist, some of which have been undertaken by the Fed’s own economists! In short, it is complete hokum… Interest rates by Fed diktat, for example, send completely phony signals, since they disguise the true cost of credit. The theory goes that low interest rates motivate people to borrow and spend. But where’s the evidence? … There’s a reality, as well as a myth. Reality is that resources are limited. Prices tell us what we’ve got to work with. Falsify prices and you get errors of omission and commission. After a while, the system suffers from things it ‘shouldna, oughtna’ done. As Hjalmar Schacht, Germany’s minister of economics in the 1930s, put it: ‘I don’t want a low rate. I don’t want a high rate. I want a true rate’.” (Source: “The End is Nigh – Bill Bonner,” Zerohedge, January 23, 2016.)

The bottom line? The experts are telling us that what initially seemed like a clever short-term solution (to a problem that, arguably, the central planners themselves created!) is anything but.

They suggest that QE—and its upcoming wicked stepsister, NIRP—are merely individual tools in a much larger arsenal of devices and methodologies that have been shown over time to have one single primary goal—bailing out profligate governments at the expense of the unwary taxpayer.

And one very specific, hi-probability result: financial catastrophe and the end of our financial world and standard of living as we know it.

Just like the 12th Century story of King Canute who, as lord of his realm (Denmark, England, Norway, and parts of Sweden), determined that his power was so great he could sit by the shore and order the tide not to come in—no, the tide didn’t pay any attention—today’s masters of our economic universe are convinced they, too, can abolish cycles and bend the world to their will.

03/03/2016 - The Tragedy of California Public Pensions

03/03/2016 - The Tragedy of California Public Pensions

The Tragedy of California Public Pensions

It is well known that California has a pension problem that offers a challenge for public officials and current and future retirees alike. Even if people aren’t aware of the details, it has been talked about for quite some time that there are underlying aspects of the public retirement system that need to be addressed, sooner or later. The fact of the matter is that such problems can’t be ignored by the State forever; and what is perhaps more important to me, as one who professionally helps people secure their financial futures, is that the beneficiaries of these public pensions need to understand what is going on and work to prepare themselves for what is ahead.

Thus, the purpose of this short overview of the problem is to help awaken people to their own unique scenarios, to inspire them to make the proper moves before it is too late. Everyone is in a different situation and there is no one-size-fits-all approach to figuring out what one should do personally; but hopefully after considering the following, the reader will be encouraged to reflect deeper on how the pension crisis may affect their futures.

The first thing to understand is that California’s public pension system is made up of a conglomeration of “6 state plans, 21 county plans, 32 city plans, and 27 special district and other plans” according to the Independent Institute Senior Fellow Lawrence J. McQuillan (McQuillan, page 3). The majority of these operate on a “defined benefit” model, which means that, upon retirement, these plans pay a specific amount per month for the rest of the retiree’s life. By far, the three largest of these 86 CA pension systems are CalPERS (1.68 million retirees), CalSTRS (868k retirees), and UCRP (253k retirees). For the remainder of this article, we will refer to these as the Big Three.

The “defined benefit” for these retirees rests on a relatively complicated formula which includes the number of years employed with the employer, one’s age at retirement, and one’s “final compensation.” There are fluctuations and other variables within this formula as well and factors can also include the specific employer, the occupation, and even variations of contract specifics. However, as Jon Ortiz reports in the Merced Sun-Star:“the largest group of state workers is under a “2 at 55” formula. To give an example here, assume an employee has worked for 30 years before retiring at age 55, her final compensation being $100,000. The “2 at 55” formula would indicate that she gets 2% of her salary (100k) multiplied by the 30 years she worked. 2% of her salary is $2k, which multiplied by 30 giving her a total of $60k per year for the rest of her life.

As McQuillan explains (page 6), however, there are also a variety of COLAs (cost of living adjustments) and automatic “step increases” that can substantially effect the annual increase in pension benefits. These are a result of a variety of collective bargaining aspects that are part and parcel of the California pension system. Essentially, what these features allow is for the “final compensation” levels to be boosted above their actual levels so that “lifetime annual pensions for some retired government workers exceed their final year’s pay.” In other words, due to this practice of “pension spiking,” future state obligations can in many cases exceed the levels that existed while the retiree was still employed. This has a significant “snowball effect” on the obligations faced by the state (and future taxpayers).

There are two sources of funding for these pensions that are to be paid out to millions of California retirees: taxpayers and investment market returns. The taxpayer originated funds flow through both employer (the government agency) and employee payroll contributions. These contributions are invested and, at least in theory, both the contributions plus investment earnings are paid out as the defined benefits to retirees. In other words, the employer/employee contributions (originated as taxes) plus the investments gains needs to be at least equal to the pension obligation levels in order to be sustainable. Where things start to get interesting, and overwhelming, is that, according to McQuillan (page 12), over the last 20 years, “for every dollar paid in CalPERS pension benefits, CalPERS’s employer members contributed 21 cents, employees contributed 15 cents, and the remaining 64 cents came from investment earnings.” In other words, historically, 64 percent of the funds paid out needed to rely on the performance of capital markets.

Now, what happens when the total assets (contributions + investment earnings) are less than the pension promise? The answer is that a deficit is created and these deficits are referred to as an unfunded liability. This unfunded liability is the total amount between the assets of the pension and the liabilities of the pension. Whenever the liabilities (what are owed) are greater than the assets (the contributions + investment earnings), there is an unfunded obligation. It is the sheer level of CA’s unfunded obligation that is the primary face of the California Pension Crisis.

According to the U.S. Census Bureau, the pension obligations for the largest six pension systems in CA came to a stunning $613 billion in 2013. Of this, only a portion is covered by the pension’s current assets, resulting in a sizable unfunded obligation level. The specific dollar amount of these unfunded obligations depends upon which calculations are being used. According to the calculations of the Big Three pension systems themselves, the unfunded portions are as follows: CaPERS $85.5 billion, CalSTRS $50.6 billion, and UCRP $6.5 billion. These represent the amounts, calculated by the agencies themselves, that the pension plans are short what is needed in order to meet what they owe to retirees. Collectively, this number is $143 billion short of what retirees are expecting to live off of for the rest of their lives. To give the reader a sense of the absurdity of these numbers, these were calculated in 2011 and since that time the US stock market has experienced large multi-year rally; however, in that time, the assets have only gained $7 billion in investment earnings so that today the unfunded liability still sits at the impossible goal of $136 billion. That’s $136 billion in the hole.

This, after a massive stock market rally!

This means that the “funding ratio” of assets and liabilities is such that CalPERS is only 77% funded, CalSTRS is only 67% funded, and UCRP is only 80%funded. McQuillan quotes the American Academy of Actuaries on the issue of funding ratios to say: “Pension plans should have a strategy in place to attain or maintain a funded status of 100 percent or greater over a reasonable period of time.” McQuillian comments on this quotation by noting that “a lower funding ratio implies that a pension system has a greater potential not to pay its promised benefits.” And yet, as can be seen according to the pension’s own numbers, the funding ratio is troubling.

Unfortunately, the bad news does not stop here. As emphasized above, the numbers thus far have all been merely reflective of the pension fund’s own estimates. According to a 2011 study conducted by the Stanford Institute for Economic Policy Research (SIEPR), the unfunded obligation levels for the Big Three pensions in CA were as follows: $169.8 billion for CalPERS, $104 billion for CalSTRS, and $16.8 billion for UCRP. This means that the funding ratios too are in a much worse condition, according to the SIEPR calculations.

The chart shows the unfunded obligation levels and the funding ratios (in parentheses) for each pension according to both the agency and SIEPR estimates (remember, the greater the unfunded liability, the lower the funding ratio):

Needless to say, in the words of McQuillan, “by [the above] measure, California’s Big Three public pensions are dangerously underfunded, putting current and future taxpayers at risk.”

Without getting into too much detail, the reasons that there is such a severe discrepancy between the third party calculations and the agency’s estimates of itself have to do with the various assumptions that the agencies are making. Specifically, these agencies, in order to make their numbers look better (and, sadly, negative $136 billion is “better”) misrepresent the actual reality by massaging factors in the following ways:

- Overestimating investment return potential (they are assuming between a 7.75 and 8% average annual return— compare this to private pension assumptions between 3 and 4%).

- Implementing an abnormally large “smoothing recognition period,” which basically allows the potential market losses to be hidden in an average of many years (15 yrs, compared to the private sector smoothing period of 2 yrs).

- Refusing to include the reality of increasing life expectancy into their models, so that their numbers assume they will have to pay for a shorter “lifespan” than what the recent mortality data reflects. Even Governor Brown’s office calculated that “CalPERS needs an additional $1.2 billion a year to pay for added pension expenses due to longer life expectancy.”

- Overestimating the length to which public employees will keep working (therein overestimating how many years of contributions will be made and underestimating how many years these employees will be recipients of the pension system).

McQuillan quotes Stanford Professor Joe Nation to say: “In short, public pension systems utilize assumptions and methods supporting a consistent theme of understating liabilities, overstating assets, and pushing costs into the future.”McQuillan himself goes so far as to say: “The bottom line is that officials at California’s public pensions are permitted to engage in behavior that would be considered criminal under ERISA [Employee Retirement Income Security Act—CJE] if done by officials overseeing private-sector pensions.”

To bring things here to a close, let it be said that the systemic problems underlying the numbers themselves are such that there is no easy way to fix this. Even on their face, the numbers summarized above tell a frightening tale of severely underfunded pension obligations, problem which is growing worse and worse.

What needs to be remembered too, and this is the thing that far fewer people talk about, is that we are on top of a major bull market that has only since January threatened to come back down. The chart below is of the “S&P 500” which is an index of stock market price levels.

As can be seen, we are at much higher levels than we were before both the 2000 “dot com” crash and the 2008 financial crisis. In other words, all these pensions that are relying on years of 7% returns in order to be, well, hundreds of billions of dollars in the hole, may in fact be facing an era of negative returns if we are confronted with the likely situation of a stock market correction.

Needless to say, far from having “their future taken care of,” those relying on public pensions for their retirement are not only going to be requesting funds that simply aren’t there, they are going to be requesting funds from pension systems who have yet to face the third recession in 15 years. A recent report from Casey Research wrote that:

“Public pensions are a slow motion train wreck that can’t be stopped. Millions of workers who expect a steady stream of income when they retire will get nothing. The U.S. public pension system is mathematically guaranteed to crash.

According to the National Association of State Retirement Administrators (NASRA), U.S. public pensions expect to earn 8% per year on average.

That’s a wildly optimistic number. They’re extremely unlikely to earn anything close to 8% per year.

Earning 8% per year in normal times is difficult enough. And as Casey readers know, we’re not in normal times.

Returns on both bonds and stocks will likely be low or negative for the next many years. With interest rates at historic lows, bonds barely pay anything. And U.S. stocks have very little upside because they’re so expensive today.

Expecting returns to average 8% per year going forward is foolish. And we’re not the only ones who think so. BlackRock (BLK), the world’s largest asset manager, says state and local pensions should expect to earn 4% per year or less going forward.

The average public pension earned just 3.4% last year. And Bloomberg Business reports that the California Public Employees’ Retirement System (CalPERS), the largest pension fund in the U.S., earned just 2.4% last year.”

Moreover, while many assume these pensions can “just go to the taxpayers” to fulfill their obligations, the fact of the matter is that this is politically and financially impossible in the context of a recession, especially when the taxpayers themselves are facing the reality of this very same market downturn. It is one thing to attempt to siphon off a little bit from taxpayers during a 7 year bull market, but it is an entirely other thing to do the same during a painful downturn. The long and short of the situation is this: those relying on public pensions for their retirement are quite possibly not going to receive the full extent of what they are expecting.

Practically speaking, therefore, any attempt to protect one’s non-pension assets, retirement accounts, and cash flows, is to be well heeded. This means that it is time to face the reality of the situation before retirement and before it becomes publicly obvious that there is a massive problem. There are many who are putting things off and looking to figure things out down the road. Unfortunately, I am not convinced that the prudent individual can afford this luxury. Some readers may need some creative strategies, capital preservation efforts, and an honest assessment of just how, exactly, one should minimize their dependency on public pensions. This is the key: separating one’s dependency on the pension system for retirement is the only way to avoid pain later on down the road.

Planning today will put you in a much better position to face whatever may come tomorrow. And this is precisely what we at The Sullivan Group aim to do on a daily basis with our clients. We are especially in tune with the the systematic problems with the California public pensions, and we want to help figure out where, exactly, the right solutions can be found to minimize personal dependency on a struggling retirement system.

03/01/2016 - Pension Fund Strategy For Financial Repression – Liability Driven Investment

03/01/2016 - Pension Fund Strategy For Financial Repression – Liability Driven Investment

This article is part of our on-going series on what strategies are being used by pension funds this year to address the risks of financial repression in their asset allocation and investment process.

LDI, or liability driven investment is a form of investing in which the main purpose is to gain a sufficient amount of assets to meet all liabilities, in the future and in the present; in other words, have enough money to pay for liabilities in the future. This strategy has been described to be the most prominent with pension plans, where assets and liabilities can reach in the billions of dollars on a larger scale.

The way pension fund investors do this is by closely tying assets to long term liabilities such as bonds, long and extended, intermediate bonds, and stocks. LDI is a highly used approach because the value of future pension payments are directly linked to inflation, interest rates and the longevity of pension plans . Bonds are mainly used because the volatility is low. To gather a proper solution, pension plans have to consider important factors while investing – one is managing liability risks and another is seeking appropriate investment returns. If they are successful at this, the fund level volatility will decrease over a period of time and assets will grow faster than liabilities. On solution for managing liability risk is hedge the liability risks by backing up investments with cash and very low risk bonds such as U.S. Treasury Bonds. For asset growth, pension planners aim for a specific growth, higher than the growth of their liabilities. , so they invest in stocks, corporate bonds, absolute return strategies, property and infrastructure. Pension fund managers only need to invest a certain about of assets into LDI, meaning they can diversity the rest of their assets to reduce risk. If both work effectively, assets will grow fast than liabilities and liability driven investment will be an effective strategy.

LINK HERE to a report by BNY Mellon

03/01/2016 - Mish Shedlock: Why 0% Interest Rates Are Bad

03/01/2016 - Mish Shedlock: Why 0% Interest Rates Are Bad

“1. Low interest rates spawn asset bubbles. As bubbles expand, banks make loans on asset prices that rise higher and higher. When bubbles burst, they leave behind a pool of debt that cannot be paid back. It was unusually low interest rates that created the housing bubble and the junk bond/equity bubbles we are in now.

2. Low interest rates spur all kinds of economic development that is not productive. That development sends a signal that things are OK and that shortages exist. In 2005, people actually believed there was a shortage of Florida condos. A couple years back it seemed like going into massive debt to drill oil wells was a good idea. Today we know it was not such a great idea.

3. The Fed, central bankers in general, want 2% inflation. However, there is no reason to believe 2% is a magic number.

4. Inflation benefits those with first access to money: the banks and the already wealthy. Rising income and wealth inequality is a direct result of interest rates set too low. Think back to the housing bubble. By the time money was available for liar loans, the party was nearly over. Those who bought late in the game got crushed.

5. In foolish attempts to hit 2% inflation, desperate central banks have now tried negative rates. Outside of central bank intervention, negative rates are impossible. Negative rates imply one would rather have 90 cents ten years from now than a dollar today. Clearly that is absurd. While we do not yet know precisely what problems may arise from such economic silliness, we can say for sure there will be more economic distortions.

6. What should the interest rate be? I don’t know, nor does anyone else, especially central banks. Rates are best left to the free market. In an environment with no fractional reserve lending and a stable money supply, interest rates would likely be low, and prices stable.”

03/01/2016 - John Mauldin: ZIRP & NIRP Are Killing Retirement

03/01/2016 - John Mauldin: ZIRP & NIRP Are Killing Retirement

“The zero interest rate and now negative interest rate policies of our central banks are gumming up the global retirement machinery. The Federal Reserve and other central banks have spent so many years subsidizing debt and punishing savings that it is now extremely difficult to guarantee future income streams at a reasonable present cost. And future income streams are the very heart and soul of retirement. Without adequate future income streams, retirement as we know it today is off the table. Whether this sad fact is what the central bankers intended or not, it is indeed a fact, whether you are an individual saver or a trillion-dollar pension fund .. Neither you nor a massive pension plan acting on your behalf can generate enough risk-free income to assure you a comfortable retirement. Why not? Because our monetary overlords decreed that it should be so. Retirees and their pensions are being sacrificed for what now passes as “the greater good.” Because these very compassionate overlords understand that the most important prerequisite for successful future retirements is economic growth. And they think that an easy monetary environment is the necessary fertilizer for that growth. So, when they dropped rates to zero some years ago, they believed they would soon be able to raise them again – and get people’s retirements back on track – without risking future economic growth. The engine of growth would fire back up, and everything would return to normal. So much for the brilliant plan. You and I, the expendable foot soldiers in the war to reignite growth, now gaze about, shell-shocked, as the economic battlefield morphs from the Plains of ZIRP to the Valley of NIRP.”

– John Mauldin*

LINK HERE to the report

02/26/2016 - Reggie Middleton: OBSOLETING BANKS, BROKERS, CLEARINGHOUSES & EXCHANGES

02/26/2016 - Reggie Middleton: OBSOLETING BANKS, BROKERS, CLEARINGHOUSES & EXCHANGES

FRA Co-Founder Gordon T. Long has an in-depth discussion on the future of Bitcoins and Block Chain technology with serial entrepreneur, Reggie Middleton. Middleton’s experience has given him the ability to recognize value, or the lack thereof, well before much of the professional populace. His ability to identify opportunity and his “out-the-box” mind-set are due to years of entrepreneurial pursuits in insurance, financial valuation/modeling, technology, media, and real estate. He is the founder of Veritaseum and the finance and technology blog, Boom Bust Blog. Until 2011, he wrote about financial evaluation and the global financial crisis at the Huffington Post.

After graduation with a degree in business management from Howard University, he worked for Prudential Insurance and trained in the sale of financial products. Since then, he worked in the fields of financial securities and risk management. He was also a significant investor in residential real estate.

Middleton is known for making predictions about the crash of markets and large financial institutions long before they occur. Aaron Elstein of Crain’s New York Business said “Mr. Middleton has been startlingly accurate in the past. He forecast the collapse of the housing market in 2007, and in early 2008 warned of the demise of Bear Stearns weeks before it happened. Earlier this year, he said that Ireland’s finances were in terrible shape long before Standard & Poor’s got around to downgrading that nation’s credit rating.”

In 2007, he founded Boom Bust Blog, a commercial financial advisory reported to have over 3000 subscribers. In February 2013, he won CNBC’s first-ever stock draft competition, beating out six other professional traders. He then went on to win the second CNBC stock draft in 2014 by an even larger margin, beating out all other professional participants.In 2014, he founded his current venture, Veritaseum, the progenitor of UltraCoin technology. According to Mr. Middleton, UltraCoin exploits modern cryptography in the fields of finance, economics and value transfer to disintermediate legacy financial institutions such as Wall Street banks.

THE EUROPEAN BANKING SYSTEM

“The problems from 2006-2009 are the same problems we have now.”

I call it the great global macro experiment. Authorities attempted to do things they have never done before. Things such as negative interest rates and particularly QE which was a practise adopted from the Japanese. It is important to note that Japan began QE within their economy 30 years ago and still to this day the desired results from it have not been achieved; Japan is still fighting inflation.

“Central bankers believe that if they prolong the problem long enough they can export their economic problems to other countries, not realizing that it is a global economy.”

The way it works is, we have a bubble; and a bubble is defined as an instance when prices shoot above the fundamental value of the good or service. Once this bubble pops and instead of allowing a natural reset of prices and value, instead people try to further push prices up.

Blockchain Technology

“It is essentially bitcoin revamped with a different name.”

Bitcoins underlying foundation is essentially a new way of dealing with databases. It is a database that is distributed amongst many individuals. In essence it is a database run by 3 million machines which each shares a full copy of the database and each having full functionality of the database.

With this much territory, you get a system which cannot be taken down by a single or even multiple authorities. In addition it solves something called the “double spending problem” which is the risk that a digital currency can be spent twice.