FRA is joined by Peter Boockvar and Alasdair Macleod in discussing the effects of the US Trump presidency on the global economy and the resulting shifts in financial markets, along with infrastructure spending that will likely occur in the near future.

Alasdair Macleod writes for Goldmoney. He has been a celebrated stockbroker and Member of the London Stock Exchange for over four decades. His experience encompasses equity and bond markets, fund management, corporate finance and investment strategy.

Prior to joining The Lindsey Group, Peter spent a brief time at Omega Advisors, a New York based hedge fund, as a macro analyst and portfolio manager. Before this, he was an employee and partner at Miller Tabak + Co for 18 years where he was recently the equity strategist and a portfolio manager with Miller Tabak Advisors. He joined Donaldson, Lufkin and Jenrette in 1992 in their corporate bond research department as a junior analyst. He is also president of OCLI, LLC and OCLI2, LLC, farmland real estate investment funds. He is a CNBC contributor and appears regularly on their network. Peter graduated Magna Cum Laude with a B.B.A. in Finance from George Washington University.

PETER BOOCKVAR: EFFECTS OF THE US ELECTION

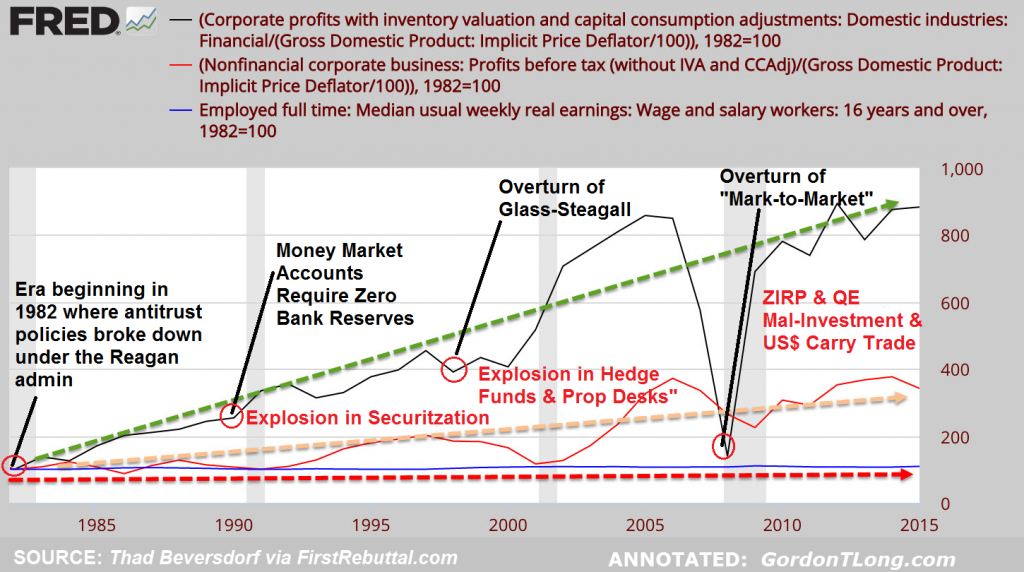

The reverse on markets is in hopes that Trump’s easing of the regulatory burden and cutting of taxes will kick-start the US economy. Inflation pressures have been building going into the election. We’re seeing this short rise in long-term interest rates. Interest rates are spiking at the same time that stocks are rallying.

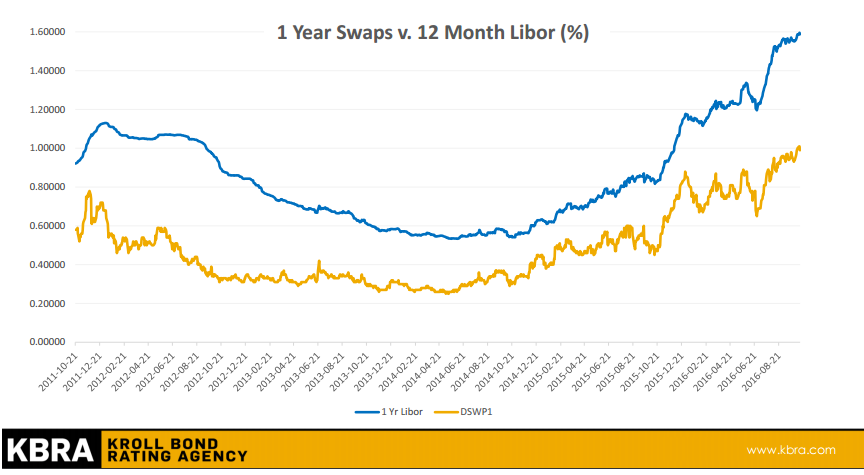

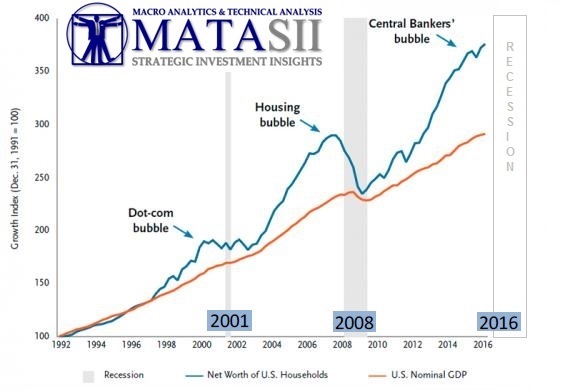

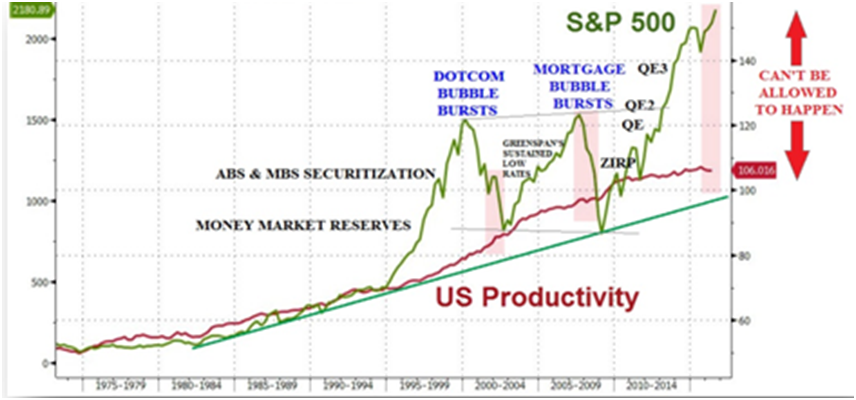

We saw a bottom in the 10-year yield at 1.53% right after Brexit, and right now we are basically fifty plus points higher. It’s not because the US economy has gotten much better, but interest rates are likely to continue to rise in the long end and the Fed is going to be playing catch-up when they raise rates in the short end. It will be a challenge for stocks to continue to rally in the face of the rising rates, as a large part of the bull market in stocks predicated on artificially low interest rates.

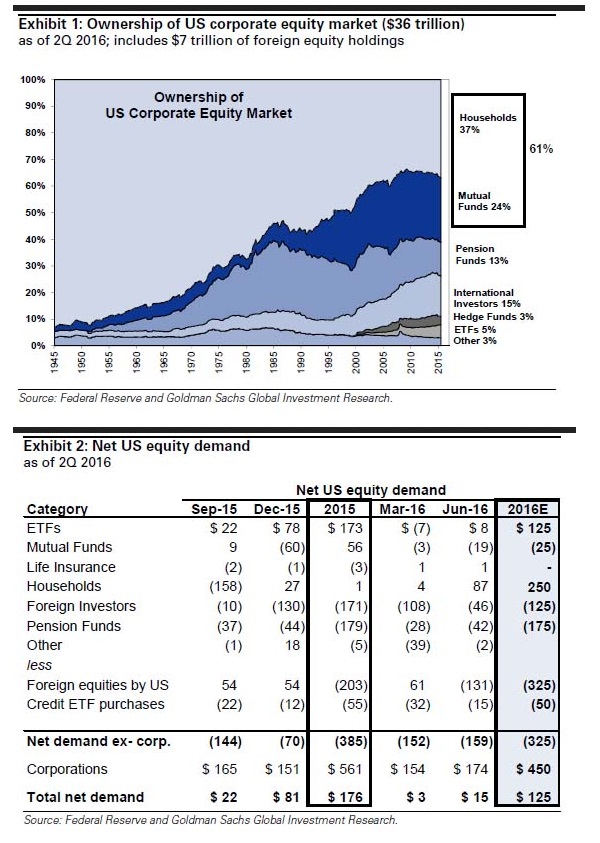

There’s no such trend that the fall in the bond market represents outflows from the bond market would then be taken back as inflows into the stock market. A lot of people had long puts going into the election, hedging against a potential Trump victory, and now we’re seeing massive put-selling which lends upward pressure to the market. We’re seeing some overvalued stocks that are being challenged today by the rising interest rates.

INFRASTRUCTURE AND GOVERNMENT STIMULUS

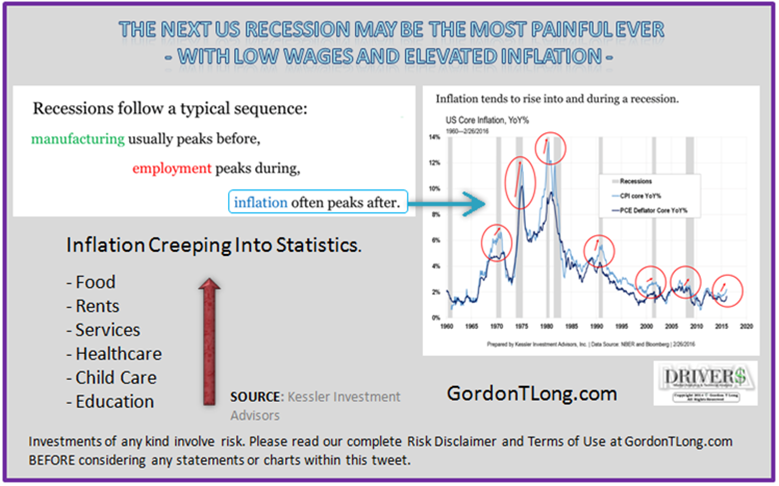

In 2008 we had an almost trillion dollar ‘stimulus package’. The government is always throwing money out there and spending it, and it’s not always the most efficient use of money. There are plenty of estimates out there saying the multiplier effect is below zero, so the idea that we’re building bridges as panacea are hugely misplaced. An increase in infrastructure would potentially contribute to the trend of rising inflation if the demand for raw material exceeds the supply. The continued deficit spending would be potentially inflationary as well.

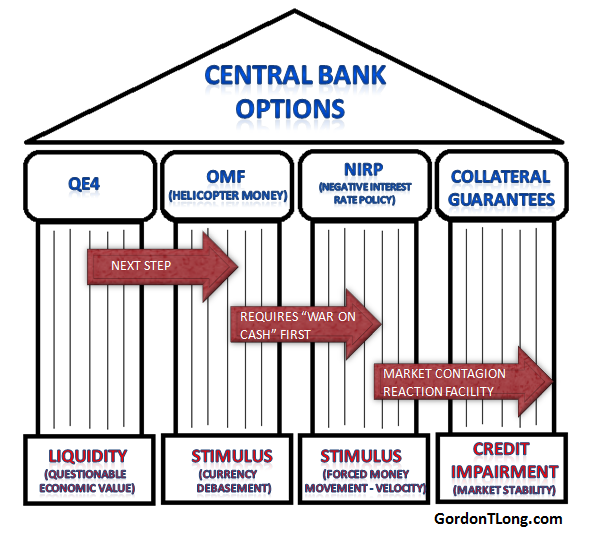

In terms of Fed policy, it would be extraordinarily dangerous if there was a greater linkage between fiscal policy and monetary policy. Trump is likely to take a step back and stop criticizing the Fed. Janet Yellen’s term is up in January 2018 and she’s just going to retire and be replaced by someone else.

FORECAST ON DIFFERENT ASSET CLASSES

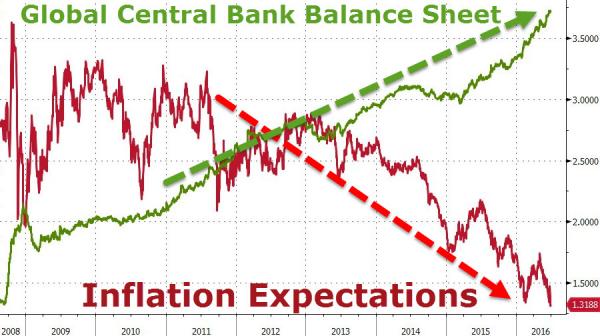

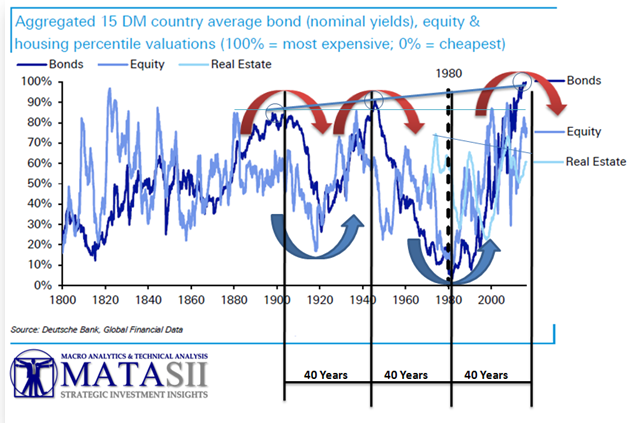

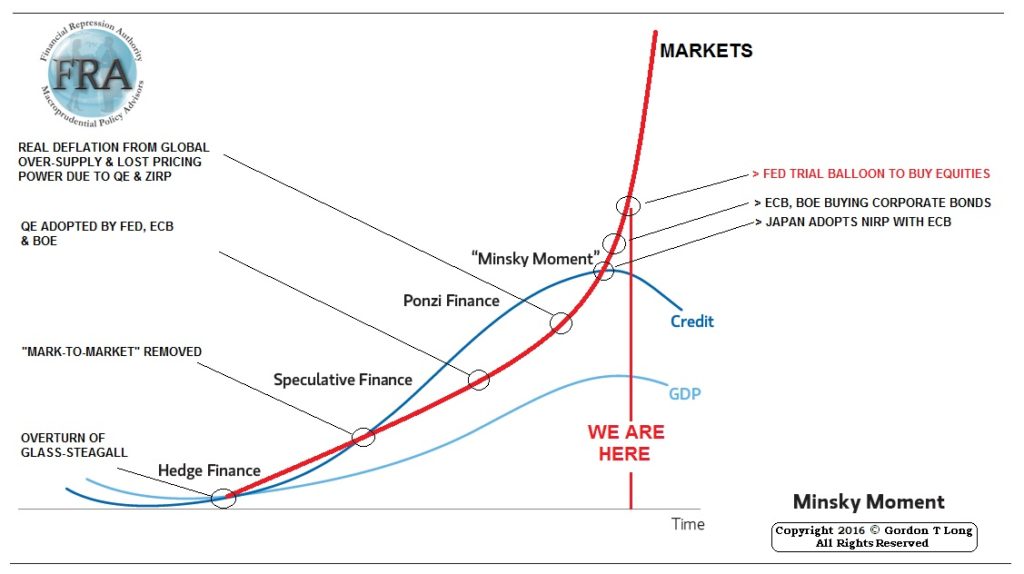

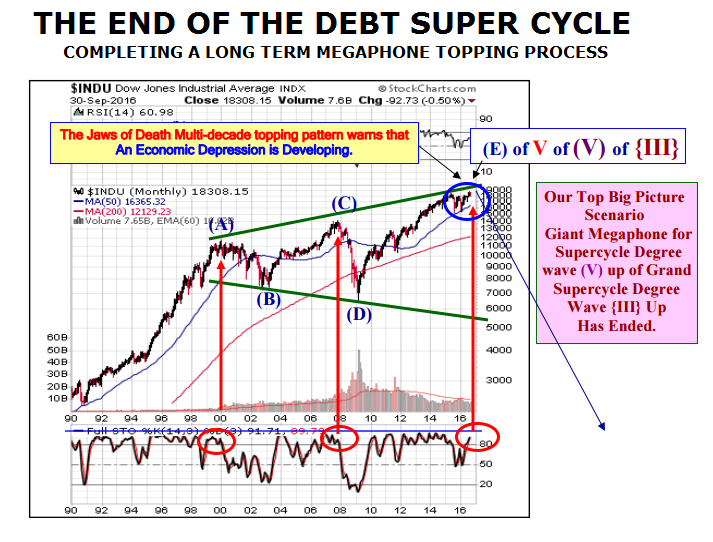

The action of the bond market is the main driver of the equity bull market, with the suppression of interest rates to near zero and multiple rounds of quantitative easing. We’ve built this economic construct based on an artificial level of interest rates that, if rising, potentially threatens economic activity and market multiples. If interest rates continue to rise, there will be some short-term correction in the stock market.

The reflation trade is going to continue. Commodity prices have been in a five year bear market, gold and silver in particular, and we’re going to see a rise in inflation and fall in real rates. Cash is also a good asset right now, and emerging markets are still an attractive place. Interest rates will rise in December and next year as well if inflation continues to creep higher. The last position the Fed wants to be is being forced to raise interest rates rather than doing it from their own volition.

MORE EFFECTS OF THE TRUMP PRESIDENCY

That’s the potential danger of the Trump presidency. Tariffs and protectionism is essentially a tax, and that in itself is inflationary as well. So it would be a toxic mix if he actually implemented it. The hope is that he’ll surround himself with more rational economical minds and that a lot of what he said is just talk.

We’re already seeing the 10-year yield move up 20 basis points. The level of infrastructure spending could be limited by what the financial markets are reacting to. The market multiplier in government spending, in many cases, is barely above zero and some will argue below. The hope is that the regulatory noose that’s been put around the banks will ease up, but regulations across the entire country will hopefully ease up on businesses and individuals. Areas that have been driven down by the fear of a Hilary presidency are bringing back the market.

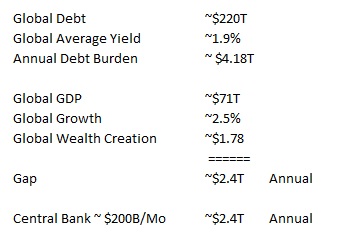

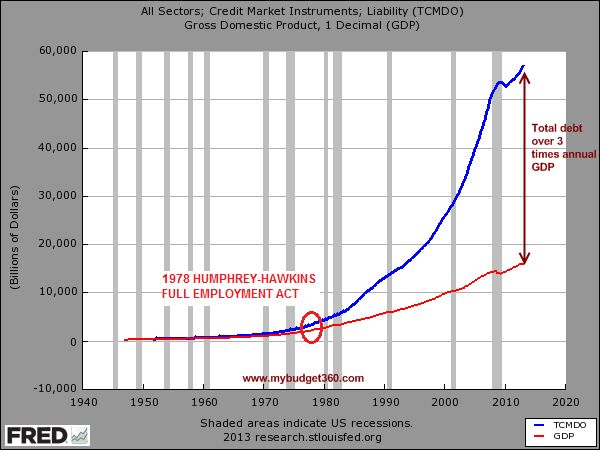

People have to keep their eyes on interest rates. That’s going to be the main driver of interest rates, which need to normalize and go higher. There’s going to be a painful transition to more normalized interest rates, which is needed in the big picture. The debasement of currencies will continue, and will get worse if we continue to build up all these debts and deficits.

ALASDAIR MACLEOD: EFFECTS OF THE US ELECTION

The problem is not infrastructure projects. Trump’s real problem is that everyone is underestimating how rapidly government finances are deteriorating. There’s going to be a pickup of inflation in 2017, which means government incomes get squeezed. The index of non-food raw materials will rise, getting more expensive than originally thought, and at the same time the lags in tax collection means government income will not keep up with the pace of inflation. The underlying budget deficit is going to keep getting larger. It’s difficult to see how Trump will finance infrastructure projects while cutting taxes as it is too dangerous to borrow excessively.

Base metals are going up, and the effect of these raw material increases is going to feed through to wholesale and retail prices. The Fed is going to find itself in a place where inflation at the CPI level is at 4%. They’re worried about raising interest rates because of the level of indebtedness in the economy, and if interest rates rise more than 2.5% there’s a severe risk that the whole economy will fall over from the outstanding debt. The last thing you want is to exacerbate that by borrowing money to finance tax cuts and infrastructure spending.

EFFECT ON DIFFERENT ASSET CLASSES

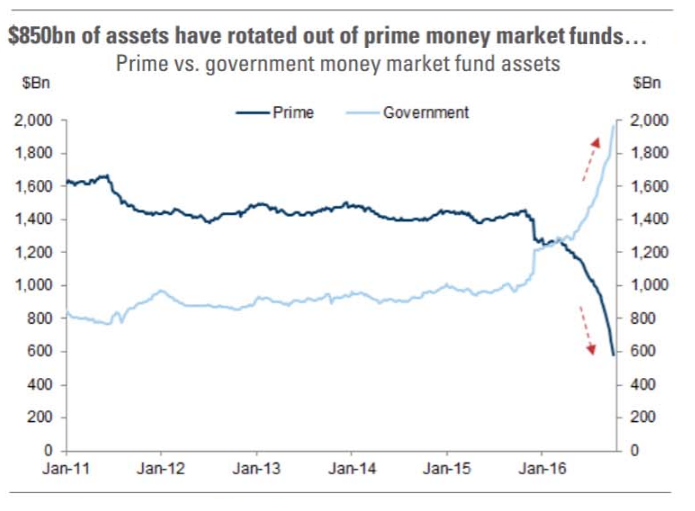

The bond market has peaked and is falling considerably. The falls in US treasury prices are likely to transmit into falls in sovereign debt prices around Europe, which in turn will threaten the European banking system.

If you get rising bond yields, you get falling stock prices. Equity markets will fall considerably on the back of rising bond yields. In the endgame, equities will become a way to protect yourself from inflation.

Property turns out to be very good protection from hyperinflation, but the amount of gearing in residential property market is staggering. If we get a rise in interest rates from the current level, a lot of people are going to be in severe difficulties. It will put off buyers on the market and possibly force sellers onto the market as well.

PRECIOUS METALS

In the short term, the reaction by which gold prices went up was quite natural. We see inflation picking up, bond yields falling, and interest rates rising but not enough to deal with the inflation problem. The Fed raising interest rates will be very aware of causing a systemic crisis if they raise rates too much. We have a potential for crisis with the rise in Fed funds rate to as little as 2.5%. If inflation goes to 5%, the Fed can’t respond to it, and gold will begin to anticipate that. Silver moves about twice as much as gold, and may be quite rewarding for speculator play. Gold is sound money and the dollar is less sound money, and that translates to higher gold prices.

The yields on bond will go up next year, in line with rising inflation, and there will likely be quite a lot of distress selling from people who went long in that market at the wrong price.

THE NEXT PHASE OF THE FINANCIAL CRISIS?

We will probably have a banking crisis of some sort – possibly in Italy – and as that crisis spreads, central banks will print money and this time it will be inflationary. China is already in the market for raw materials and putting in huge infrastructure to take her population into the middle class. The rush for infrastructure spending is happening in various countries at the same time, and this means rising commodity prices across the board.

Abstract by: Annie Zhou <a2zhou@ryerson.ca>

11/11/2016 - The Roundtable Insight: Peter Boockvar & Alasdair Macleod On The U.S. Elections’ Implications To The Economy & Markets

11/11/2016 - The Roundtable Insight: Peter Boockvar & Alasdair Macleod On The U.S. Elections’ Implications To The Economy & Markets

The end of the commodity boom that peaked in 2011 has forced the government to consider more sustainable ways to cultivate economic growth. With the mining sector struggling mightily, it is easy to fathom why the manufacturing sector is now the government’s favored sector. Most of the recently released regulations aimed at supporting producers at the cost of consumers.

The end of the commodity boom that peaked in 2011 has forced the government to consider more sustainable ways to cultivate economic growth. With the mining sector struggling mightily, it is easy to fathom why the manufacturing sector is now the government’s favored sector. Most of the recently released regulations aimed at supporting producers at the cost of consumers.