Blog

05/17/2018 - The Roundtable Insight – Yra Harris And Peter Boockvar On How Credit Cycles Are Being Driven By Monetary Policy

05/17/2018 - The Roundtable Insight – Yra Harris And Peter Boockvar On How Credit Cycles Are Being Driven By Monetary Policy

05/14/2018 - Illinois Pension Crisis Causing Falling Property Values And Population

05/14/2018 - Illinois Pension Crisis Causing Falling Property Values And Population

“Illinois .. is following the EXACT pattern as the fall of the city of Rome itself .. More and more people just walked away from their property for there was NO BID .. Illinois is the NUMBER ONE state that now has a NET loss of citizens and people are fleeing that state .. There is absolutely no hope whatsoever of fixing this problem of a pension crisis in Illinois and every solution, like the current one from the Chicago Federal Reserve and its proposed 1% on property annually for the next 30 years, will fail in the end. The state has COLAs which insanely increase state employees’ yearly pensions by an automatic 3% annually, regardless of the inflation rate. Because Illinois does not have its own currency, it is then bound by the national value and international value of the dollar. Like Greece, as the dollar rises, Illinois is thrown into deflation. Its institutions are broken, and they will be remembered only by history .. when you plot the actual population of Rome, what emerges is a very interesting and a stark reality that applies to Illinois .. people could no longer afford to live there and they were forced to just walk away from their homes. The value of real estate went to ZERO!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! Beware!!!!!!!!!!!!!!!!!!!! History repeats!!!!!!!!!!!!!!!!!!” – Martin Armstrong

05/11/2018 - Underfunded Big Canadian Pension System – OMERS – Is Planning For Contribution Increases And Benefit Reductions

05/11/2018 - Underfunded Big Canadian Pension System – OMERS – Is Planning For Contribution Increases And Benefit Reductions

Danielle Park: “The Ontario Municipal Employees Retirement System (OMERS) is Canada’s largest defined benefit pension plan with $95 billion in net assets (as at December 31, 2017), administering pensions for almost half a million active, deferred and retired employees of nearly 1,000 municipalities, school boards, libraries, police and fire departments, and other local agencies in communities across Ontario.

After losing 15.3% or some $8 billion in value during 2008, the fund recovered over the past 5 years to achieve a top decile average return of 5.9% a year over the last decade. The target return however was 7.3% and so the plan reported a 94% funding ratio (6% capital deficit) in 2017. If the plan was able to achieve its current target return over the next 8 years, OMERS states that it “aims to return the Plan to full funding on a smoothed basis by 2025”.

A 94% funding ratio is robust compared with most other pension plans in the world today. And yet still, 10 years since the last recession and bear market–and the second longest running bull market for financial assets ever in history–OMERS (and other retirement savings plans) are approaching the next bear market still in a capital deficit.

The prospects of netting investment returns of 7.3% a year over the next decade from present price and yield levels, is even less likely than it was over the last decade. So OMERS managers have rightly resolved that the plan must remedy its funding deficit, as laid out on their website:

“Deficits will be funded through a combination of contribution rate increases and benefit reductions.”

Both of these approaches are highly distasteful to members, and increased contributions are anathema to taxpayers, especially since government budgets are already in growing deficit, and most private sector workers today have woefully inadequate retirement savings plans.

After years of kicking the can and pretending that magical markets will make up for insufficient contributions rates, math must be faced, and cutting or reducing annual benefit indexing is generally perceived as the least offensive place to start.

Today, the Civic Institute of Professional Personnel (CIPP) the union representing professionals in the municipal sector in the Ottawa area since 1953, sent this message to its members:

Dear CIPP Members:

OMERS, your pension plan, is currently considering changes to the plan that threaten the financial security of your retirement. Among these changes is the removal of guaranteed indexing of pension benefits. Having an indexed pension means that your retirement benefits are adjusted annually to keep up with the cost of living. Without this guarantee, your retirement income will be eroded by inflation year after year.

To inform you about the proposed changes and what we can do about them, CIPP is organizing an information Town Hall. The proposed date for the Town Hall is Wed, May 23, 2018. Please use the link below before 5:00pm on Monday, May 14th to indicate whether you are interested in attending. Once we know how many members will be attending, we will follow up early next week to confirm the date, time, and location. For those who can’t attend, we will be distributing further information, but this Town Hall will be your chance to ask questions and talk about protecting the financial security of your retirement. We hope to see you there.

On behalf of CIPP’s Board of Directors,

Jamie Dunn, Executive Director, CIPP

Because pension plans have tried for higher returns over the past few years through higher allocations to risky asset classes than ever before, they now face higher drawdown/loss prospects than in past cycles, as we approach the completion of the current one.

This is the tangled web of disappointment woven over the past 20 years in under-saving and over-promising return prospects and benefits/withdrawal rates. Unfortunately, all sides have played a leading role in today’s financial woes and there are no magical ways out.”

05/02/2018 - The Roundtable Insight: David Rosenberg & Yra Harris On Stagflationary Pressures & Volatility In The Economy & Financial Markets

05/02/2018 - The Roundtable Insight: David Rosenberg & Yra Harris On Stagflationary Pressures & Volatility In The Economy & Financial Markets

FRA: Welcome to FRA’s The Roundtable Insight .. today we have David Rosenberg and Yra Harris. David is Gluskin Sheff’s chief economist and strategist with a focused on providing a top-down prospective to the firm’s investment process and asset mix committee. He received both a bachelor and Master of Arts degree in economics from the University of Toronto. Prior to joining Gluskin Sheff he was chief North American economist at Merrill Lynch in New York for seven years during which he was consistently ranked in the institutional investor all-star analyst rankings. Prior to that he was chief economist and strategies for Merrill Lynch Canada based out of Toronto. He is the author of Breakfast With Dave a daily of distillation of his economic and financial market insights and I think now there’s espresso with David also that’s out. Yra is an independent trader, a successful hedge fund manager, a global macro consultant trading in foreign currencies, bonds, commodities and equities for over 40 years. He was also CME director from 1997 to 2003. Welcome gentleman.

DAVID: Thank you very much.

YRA: thank you Richard, this is a great honor for me, thanks.

FRA: yeah, it’s a great honor for having David on our show, first time and I thought we’d begin with some of David’s recent thoughts. You recently wrote about how Canadian equity markets go higher even US markets go lower as a hedge against inflationary pressures. Can you give us some insight on that?

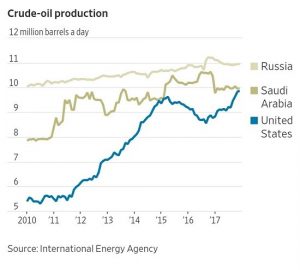

DAVID: Well sure, it’s not even an opinion it’s a fact in a sense that it’s happened so many times in the past and most recently in 2007 and in 2008 as the US market went down 20% in the opening months of the … market. The Canadian market was up 20% and of course, then the wheels fell off when it turned into a global near depression after AIG and Lehman collapsed. But it’s because the Canadian market being so exposed to the commodity cycle and energy and there are so many other sector correlations with the resource sector and the resource sector is classically psycho value. The SME of 100 is because the classic growth index, Canada doesn’t have much in the way of healthcare exposure, doesn’t have much way in a technology exposure. These are there groppy aspects of the US market that’s kept it alive and well for so long. Either you’re buying on the premise that we are entering into the late cycle, I think there’s a lot of evidence and if it late cycle then it’s value over growth and then if you’re talking about stylistic investing value over growth you have to understand if you look at North America Canada is deep value in terms of sector representation. The US is much more growth oriented. I look at it not just from historical experience in terms of late cycle investing but just looking at evaluations. The Canadian stock market right now trades at a forward multiple of a 14.7 times the coming year’s earnings estimates. In the United States that number is over 16. I look at some other benchmarks as well in terms of valuation matrix and wherever there’s been a day that the Canadian stock market has been this inexpensive relative to the United States.

FRA: Yra have you seen that type of behavior in the financial markets in in your trading?

YRA: It’s interesting to see David and having read his work for so many years. Mine doesn’t take that type of analysis. I will read that and put that into my thought process but then I have to ask, David, about yesterday when to governor Palu speak and his concerns about that their Canadian personal debt levels were elevated and she’s like the bank of Canada is worried about them. How would that play into that scenario? That’s the question that would arise from the way that I would analyze this. I’d like to hear David speak to that.

DAVID: Right. I think that as far as I know the only central banker that is talking insistently about debt exposures and sensitivities and fragility is the Bank of Canada. I guess that’s partly because there’s no real bubble this time around in US household balance sheet. I would argue that even letting out the cash, we have some sort of a bubble in the US corporate balance sheets. Debt worldwide looking at governments, we all own this debt. We can say this … debt in US household balance sheets but the government debt, if we look at corporate debt, household debt. We’re in a situation now where globally outstanding debt in all levels of society is 164 trillion that’s with a T trillion dollars. We’ve already taken out the previous credit bubble peak of 2007 and half that debt and it might not be households in United State system, this time around. We’re get to a government debt bubble I’m sure looking at the future fiscal situation in United States half that debt is in Japan, China and the US. Basically this is a global situation, we just happened to have an honest central banker in Ottawa talking openly about it. He’s basically saying that this is actually one of the risks for the Canadian economy. We have NAFTA risks, we have really an incoherent energy policy to ship the oil out of Canada at the present time. Hopefully that’s going to change. We have divergent tax policies. All that is true. The Canadian economy even with the community boom is destined to underperform the Unites States economy. Of course we don’t have fiscal stimulus in the tax side that the US has so that goes without saying. You see that’s from my economics perspective and then when you put in a strategy a heart, what do you see? Well you’re on the correlations and you’ll see that the Canadian stock market, the TSX does not have that much of a correlation with the Canadian economy, believe it or not. That’s because most of the companies in Canada are truly global in nature. Even the Canadian banks, so you’d been thinking wow the Canadian banks, how much would be exposed. These are giant multinational corporations. You have banks like the bank in Nova Scotia that had a branch in Latin America before they ever had a bunch in Toronto. Going back a century or more. You go along the whole eastern seaboard in United States all you see are those green comfy couches from the Toronto dominion bank. You see what I’m saying basically is that the Canadian stock market has a much more torque to the global economy than it does to the Canadian economy. It doesn’t mean that there’s some special situations or some consumer cyclicals or consumer discretionary stocks that are relayed back into Canadian domestic demand. I will way suggest to stay away from those. I think the energy stocks here, McTaps are priced very attractively and I have nothing to do with the level of Canadian debt on the household site. You have a lot of Canadian companies you see if the bank of Canada hadn’t been keeping interest rates below the US and right now there’s a big negative interest rate spread. Look at where oil prices are right now. The Canadian dollar should be at 85 cents in quotes, should be but it’s not, it’s closer to 78 cents. Well there’s a lot of Canadian companies that have very high at us dollar revenue streams that we’re going to benefit immensely from this ongoing shall we say surreptitious policy in Ottawa to keep their Canadian dollar depressed. Something that doesn’t manage to make it to Donald Trump’s tweets is where the Canadian dollar is relative to the US dollar but that benefits a lot of Canadian exporters.

YRA: You think that that’s an active policy out of Ottawa that’s extended to central … heavily involved in that. Believe me I believe that … Certain as I can look to see what the Australian … When the RBA issued its statement the other night they all target currency whether they do it in the open but when you talk about the strength of your currency and your reason to keep interest rates on a hold … I understand the G40, I understand the G7 but if these are active policy then of course it gives leverage to the Ross Navarro Lighthouse Group about what countries are doing. So you think that that’s an act of policy approach from Ottawa?

DAVID: Well look there’s nobody that … Especially the central bank that’s going to come out and tell you where they would like to see the Canadian dollar. They’re not going to say directly. I think your comment before is right. I think of Steven Mnuchin’s comments in Davos which I believe he made on January the 24th which was like two days before the stock market peaked. Talking openly about the wonders over having a cheap us dollar. The trade weighted US dollar index is dominated by the euro and in the euro really peel back over the course of the past couple of weeks. I never really understood why I thought about 125 to begin with. The reality is that for Canadians what the Australian dollar does if you’re trading aussie currency you do business in Australia that’s obviously important but for Canada over three-quarters of our exports go to the US so that’s what really matters for the Canadian economy and for Canadian profits is that particular relationship. Maybe it is off the radar screen. You can’t have it both ways. If you’re going to have a situation where Donald Trump’s spray team and his NAFTA team creates this air of uncertainty. Nothing has happened yet and maybe we don’t get this solved until later this year if at all. What it does in Canada is it creates this cloud of uncertainty and when you’re uncertain because don’t forget if you’re setting up shop in Canada you’re not really just setting up shop as a business to service 35 million Canadians, you’re doing it the service 300 million Americans south of the border, that’s where the big market is. If you’re going to create a situation in Washington where you’re going to put this cloud of uncertainty over your chief trading partner called Canada you don’t get business investments. Business investment stays in the sidelines. Without business investment you don’t get a lot of growth, you don’t get a lot of employment. Nothing is zero in Canada but the economy is being held back by this air of trade uncertainty that is something that Canadians have imported from the United States. We didn’t start this whole thing, we got to renegotiate NAFTA. What that does is as the Fed raises rates the bank of Canada just says we’re on hold basically because we are frozen in time here for a variety of reasons. Stephen Poloz has mentioned several times that NAFTA uncertainty is part of it. What’s the … going to say? You’re deliberately keeping interest rates below where they are here and they’re artificially depressing the Canadian dollar. The Canadian government will say we’d rather not do that but because you’re creating this air of uncertainty because Canada is a much more intense export-oriented country than the united states is so NAFTA matters infinitely more for our economy than those in the states so naturally we are going to keep rates below and keep the Canadian dollar artificially below until something changes. We successfully renegotiate NAFTA, then that could all change. There is a method behind the madness whether or not it would ever be openly admitted. It’s funny because in the last policy review, the Bank of Canada just came out and lament about Canadian competitiveness. How our non-energy exports have lacked far behind what their models would say. That is code for we’re comfortable actually from a policy perspective having the Canadian dollar trade at competitive levels to make interest rates… or it should be for an extended through a period of time.

YRA: the amazing this is, and I am long term bullish on the Canadian dollar. First of all because, if we go back to the great financial crisis, for lack of a better word. The Canadian banks were certainly low capitalized. They did not suffer because of their lending risk. Their lending practices were so much better than the US banks probably by design. Number two there’s never been a quantitative easy program in Canada. There’s no quantitative easy program as Peter Boockvar would say. You have to go to quantitative tightening. I mean overall the underlying fundamentals to the Canadian financial system, yes I know they got a little bit of a bubble because they’re achieving rates over than it should be by regular market signaling. I think Canada is very well positioned. Once they work through the points that you just raised.

DAVID: I agree with what you said but, I think that we really do have to complete the analysis in this sense because, there are some fundamental reasons why the Canadian economy is being held back. There’s a fundamental reason why a lot of capital investment has been deflected away from Canada. There’s a reason why the Canadian dollar is trading about seven cents below any semblance of equilibrium value. Still on the other side of the equation, we have … You could say well the United States is blowing its brains out on physical policy. Well that might be true. But for the here now, for the first time in decades, the net effect of corporate tax rates in the United States is lower those is in Canada. In Canada being the junior partner and younger brother, we have to have compelling reasons for companies to want to set up shop here. We have to have lower tax rates here. We’re not a price maker on tax policy globally. We’re a price taker not a price maker. It was disappointing that there was no reference outside of one sentence to any response to what happened in the United States. Vis-à-vis at least the corporate tax situation, and then you layer on the accelerated depreciation analysis. If you’re a North American company right now, you’re incentivized to the taxes from right now to book your revenues in the United States which means that’s where the employment and investment are going to be directed towards at the expense of Canada. We have diverging fiscal policies point number one. We don’t have a coherent energy policy which is a very big problem. Hopefully that could change, but that will take a lot of political will, especially at the federal level. On top of that, we do have the situation where consumer balanced sheets are over extended. How that plays out. Of course you do have overextended housing markets in Toronto and Vancouver, which is not 100% of the national market, but it’s still 35% of the national market, and that’s not exactly trivial. I would say that there are some constraints. There’s all this sort of things that is on the bank of Canada’s radar screen, they’ve talked about it. There’s still some I would have to say, you could argue that there are unresolved issues in the United States as well. There’s at least as many if not more can at the current time.

FRA: What do you think of the rising US dollar as a recent trend? Is that going to take place for a longer period of time or … Is it related to the nine trillion and overseas US dollar the nominated corporate then?

DAVID: Well I think that it’s … It’s this classic economics 101. It’s the country that is tightening monetary policy, and the country that is using fiscal policy is usually the country that has the stronger exchange rate. That generally comes through in relative industry differentials. To me the big surprise for the past year, up until the trade weighted dollar starts to really turn around, it’s Back to where it was the first week in January. There was a time where if you looked at the yearly trend in the US dollar, just in the opening months of the year was down roughly 10%. That was really what would go against any macroeconomic textbook would tell you where the currency should be going. Then there was the other side of the argument which is that we have this band of trade protectionist in Washington. You have a president who his whole professional life and now carries it inputs his political life has always made [unintelligible] the current account deficit is his modus operandi. There’s another side, another side to the equation that well, if United States is going to ever want a really balance its deficit, well it’s going to have depreciate it’s currency 10% which is exactly what happened. I think that as this comes down to the old market refrain that you typically get the currency that your president wants. It was no secret that president Trump, would have preferred to have a weak currency that boots exports. I think what’s happening now is this realization. The Fed futures contracts are pricing in more fed. You’re seeing in the UK Mark [unintelligible] is peeled back. The ECB has more less gone quiet. The BOJ is not going to be doing anything. The Bank of Canada the view the beginning of the year was that they were going to raise rates several times. The only central bank it seems right now that’s in play in terms of raising rates is the Fed. I think that’s been part of it. You’ve also seen … Although the data flow in the United States has not been very impressive. I can’t do summersaults over 2.3% GDP growth the same quarter that we got. The fiscal stimulus. Be that as it may it’s the old saying about, in the land of blind the one eyed man is king. I suppose the US with 2% growth is the king, because the data in the UK have been very weak. The data in the Euro zone in particular has been extremely soft over the course of the past few months. I think there is this view on a relative basis that these interest rates differentials are going to work in the US dollars favor. Even more than people thought a couple of months ago. I think that’s a starting to finally come through in the currency markets.

FRA: Yra your thoughts.

YRA: Well, being a currency trader for over 40 years, and I’ve written about it for the last year. … The dollar, there’s fiscal stimulus coupled with interest rates differentials, and how the central bank is raised their rates when nobody else is, sure as David directly says. There’s always been the backup to a stronger currency and where was it. I of course … I agree with it because, I go back to that when Trump was having all the manufacturing, CEOs at the White House back in January February 2017, and Mark Fields who was then the CEO of Ford comes out and immediately calls the currency manipulation the mother of all trade barriers. Well that’s evidently what got discussed at the White house, and that Trump [unintelligible] the euro moved from 106 pretty much history line all the way up to 125, 126. Which bothers one mind because … I’m not one who accepts the European growth story willy-nilly. I think that’s a lot of nonsense to me, I say that for many reasons. The missing dollar really has caused a lot angst to the market, a lot of large hedge funds had miserable years trying to make that trade. I stone cold agree with that. I think now that we’re getting a little more maturity and some more negotiating tactics, there’s no question in my mind that guys like Robert … and Ross Mnuchin, I’m not sure what to make of … Certainly the Navarro they will use the currency as leverage. Trump especially accepts that. It’s interesting David say that the president gets the currency that he wants eventually. I think that’s is true and now I think the market is just … It’s just liquidated in some of the short dollar positions and trying to work through their way through this, this understanding with the dollar differential, the interest rate differentials. Certainly favors the United States and now we saw … with a phenomenally devilish press conference last Thursday. I think the ECB would relish nothing more than the weaker euro. That gets a question I … My favorite train would probably be long gold and short all the fiat currencies, not necessarily the dollar expression because interest rates to the US of course are now … We can argue what are, but they’ve at least going to a real yield. I don’t think there’s anywhere else in the world of the main developed nations where you get a real yield, on your short of interest rates. I think at least the dollar will hold here barring any type of any misstep by the US administration.

DAVID: I’ll just add further that. Look at where the two year note is trading right now at two and a half percent. Then take a look and see where a two year German bond is trading at -0.6. You have over a 300 basis point gap. Not even taking out any real duration risk. Like coming to the front end of the US seal curve compared to we’re in Germany. That spread is widened out, you asked me what’s changed. If that spread is widened out in Americas favor to the tune of 40 basis points just in the past three months. I think that’s really what caught the raider screen a lot of FX traders and why the US dollar starting to come back to life there.

YRA: I agree and plus, in saying that because I know a lot of traders who … They would buy, well when you thought the Euro was going higher, they would do these as unhedged decisions because there wasn’t enough in it. Because if you put your hedges on, by the time you do it wasn’t worth doing. Now, there’s enough meat on that bone to do those things and still being able to hedge a position who wanted to generate a much greater return than you could have as David talks about. That 40% rise in the differential I significant to attract people’s attention.

FRA: In terms of volatility David why do you think markets have been more volatile this year versus last year?

DAVID: Well, where do I begin? I think that we are in a … Last year in some sense was easier from a policy perspective. Yellon … continuity from Ben Bernanke. Markets are very comfortable with her. We didn’t really know what to make of what was going to happen with healthcare reform. Obama care form that didn’t go through. Then moved on tax reform, that gave momentum and the administration of congress at the home run by the end of the year, but that increasingly was getting priced in. I guess that when president Trump talk about how governing can be complicated. I think this year is a lot more complicated. A lot of the good stuff that happened in terms of the deregulation, in terms if the tax release, that’s behind us. What’s ahead of us now are the other parts of the election campaign. Which is more problematic or certainly provides a lot more uncertainty for investors. It relates … We weren’t talking this much about trade policy last year. We weren’t talking … We all knew it was part of the election campaign, but we were told take the president seriously not literally. I think that people didn’t really take it too seriously, maybe they should have. Now we have trade, we have tariffs or the threat of tariffs on steel and on aluminum. And on… dairy farmers. Acrimonious talks at least at the outset of NAFTA. What’s happening on the China side, the European side, exemptions here and none exemptions there. We’re in a much more uncertain global trade environment. Who know when that’s going to get resolved or with the other. DC markets will react at the merchant to not just change but the prospects for change. Because everybody that manages money for a living, is ultimately not just a manager of investments but a manager of risk. The risk on global trade has changed. It’s changed in the way towards cost push inflation, when we’re already late into the cycle. We have that aspect to it. We can talk what heightens your political risks, but …heightens your political risk, they always seem to be around. I think the situation on trade, is fairly serious in terms of what it means for the market multiple. Because the market multiple basically, and that’s the story this year. The story this year wasn’t earning, the story is the fact the multiples has compressed. The multiple is the inverse of uncertainty. Actually I think about the heightened volatility. That’s part and parcel of the inverse of volatility. We have a lot more volatility because we have less liquidity, and we have a more generally uncertain environment. Upon the liquidity for the federal reserve in a second because I think that’s big part of it. Because the fed has to respond all of this. We have policy over here, creates cost push inflation, that’s definitely happening. We saw that in … report before that the Philly Fed survey. We are looking at this hard and soft data. You’re seeing cost push pressures and a lot of it is because of the shift and the trade situation. Look at the fiscal situation too. I don’t think anybody is anticipating, we’re going to go for $500 billion deficits which are high enough as it is to over a trillion dollars. I say that today when the treasury comes out with this free funding announcement. I think the market was speaking about corporate tax reform was a good thing, but they were thinking that the government would lower the rate but broaden the base, and that never happened. The base didn’t get broadened, there’s just more bills and whistles then we cut taxes to households, and then we put an extra few hundred billion dollars on spending just on top of that. I don’t think that investors were looking at trillion plus dollar deficits as far as the eye can see. Of course at a time when the fed is striking its balance sheet. Creates a situation where bond yields go up and interest rates are basically a very powerful valuation determinant for other asset classes. We’re going to interest rates backing up for a variety reasons. One of them is the shift in the fiscal landscape. That’s another reason why we got a more volatile environment. Is because and is reflective of the [vecks] being 60% higher this year on average than last year. Is because of the uncertainty on trade, the uncertainty on fiscal, in terms of deficit finance tax cuts. Not tax cuts funded by spending constraint. It’s funded by higher deficits. The bar market maybe having trouble with that, then that will come back into the stock market as we’re seeing with the lag. Then on top of that … responds. I thought it was actually very interesting. The view back in the fall of last year was that … was going to be just a clone of Janet Yellon, different gender, no Brooklyn accent mind you, but they just … this is a new … Not just the Fed chairman but the whole voting membership of the [FMC] is totally different. It is a more a … fed. You saw it right in front of your eyes. The first meeting, what does [Powel] do? Raises rates. Not just raises rates, raises the growth forecast, raises at the merge and the inflation forecast, raises actually at the margin his estimate of where the neutral funds rate it. That’s all in one meeting, and was already after the stock market had officially collected 10%, and we’re going through tremendous fluctuations and volatility. He doesn’t come out and say, by the way this is going to cause us to take down our forecast and move us to the slide like. It’s quite the contrary. We’re going to actually have to do more at the margin, and we actually raised our forecast. It’s for our firm believer, that the physical boost is coming down the pike even though we somehow missed a good part of another first quarter. He already proved his medal that, he’s not going to come to the investor. He’s not going to come hold your hand because the market rate is 10%. … Bernanke certainly would have done that, Yellon probably would have done that. Here we correct 10% first movers, hike interest rates? I think that for an investor, you don’t have a central bank watching your back than you had in the past of five, 10 or even 20 years. I think this is all being reflected in the shrinkage of the market multiple, to reflect the fact that the times are changing.

FRA: Right, your thoughts Yra also.

YRA: I wrote a large piece where I quoted … My daughter actually works at Bloomberg. She used it in a radio spot that she had done for Bloomberg, that the Greenspan put was kaput. Because you could hear it in the language, when … and others started talking about that … that there was a shift and that Powell had definitely had control over this fed and no others. Because usually you would get some dissonance but there’s been no dissonance. It’s like he wait it out to look it. I can’t be at odds with you there’s certain shifts here, and they all could hide behind the unknown of how that physical stimulus will pay out because we just don’t know. With higher interest rates, will that totally eat whatever benefits were coming from the fiscal stimulus? I’m a big believer and I think J. Paul is much more market oriented. We saw that going back to what David said. If we go back to the late January, early February, there was no, no comment from the fed when the market was down 10, 12 13% in those few days, that they were all worried about it. In fact it was basically stay the course which was what a breath of fresh air that is because, I think the central bank is reacting to markets. At every major reaction is a terrible thing. I thought that back in May, June of 2013, I thought Bernanke made a terrible mistake with the temper tantrum and immediately reacting. He should have stayed there of course. I think we would have been in a much different place and much better place. I was not a …policy to begin with. The more I see and the more that he has more respects for markets the more I respect him and … does have control of the spread at this time. I think David’s point is that …voting change we are getting a more hawkish, even guys like Cash … who’ve been just ridiculously devilish with comments at times are known falling into line even though he doesn’t vote. But it’s amazing I would think that he would think more … speak without a vote. His language is much more leaning towards a heated dichotomy … But certainly not us devilish as he previously was so I think that point is well taken.

FRA: Overall David do you see stagflation in the global economy or in maybe in certain regions?

DAVID: Well I mean I’m seeing notably in the US market and I wrote about it today in my daily and if we are going to define it as rising inflationary pressures and soft growth, I think that we have it. If the ISM yesterday for example, you’re taking a look at the dressing index or was it a price level in 7 years. The past couple of months the vendor delivery delay index which used to be a favorite at the fed going back 20-30 years ago that’s been over 60 now for the past couple of months. Extremely elevated backlogs at a 14-year high. We’re getting some real serious bottlenecks in the economy, there’s worker shortages across number of sectors especially in manufacturing and in transportation related areas of the economy and we’re starting to get some such shortages of materials and that’s one of the things I’m saying that’s caused part and parcel by the growing spectra of trade frictions and tariffs and so on top of what you’re seeing on the energy side which of course is a different story. We are getting a culmination of rising wage pressures, nothing that is dramatically accelerating but moving up and moving up faster than it has been in any other time of the cycle. As we saw last Friday with the employment cost index which is actually once again everybody focuses on average early earnings. The employment cost index I remember the day when that was actually the Fed’s preferred measure, nobody wants to talk about it right now but it’s growing at its fastest rate. Since we’re in the last cycle before the recession so we have rising inflationary pressures on the material side on the labor side and I’m not seeing escape velocity in the economy I think all were going to be left with, with this fiscal stimulus, I’m not talking about the corporate tax reform aspect to it, that was necessary and I was in favor of that. But a blowout on the fiscal side really is going to be … domestic fiscal deficits. Which are going to be a dead weight drag on the economy for years to come. I’m really quite astonished at all the supply siders out there that think that this is actually the fiscal stimulus part to this thing was what we needed. Quite to the contrary, they’ll be a big price to pay in terms of losing fiscal flexibility in the future as a result of what’s happened over the course of the past several months. Congress put that aside though. Yes I’m seeing that the economy disappointed. Look we went into the first quarter, the Atlanta fed was calling for 4% growth we got barely above 2. In our strip out inventories and net exports that GDP number in the first quarter what you call real final sales to domestic purchases which is a real key underlying number on what’s happening to the demand guts of the economy excluding the foreign sector, excluding stockpiling and it was 1.6. I remember the days we got a 1.6 unreal final sales will be talking about around is there recession around the corner? People seem to think that’s a good number today I guessed we’ve readjusted our definition of actually what a good economy is. Then in looking at some of the anecdotal data flow like the ISM index and some other numbers of the sector quarter I’m not seeing much of a list so they view that the first quarter was just a weather report I’m not so sure about that. I’m not seeing the economy right now is growing and my opinion and rather temperedly and we haven’t seen the full impact of the fed rate hikes and the balance seat adjustment hit the wheel side of the economy or the market just fully or at least just not yet. Inflationary pressures are rising. Well people come back to me and say well you’re talking about stagflation yes and then people naturally go back and say what about the 1970s? No we’re not going to go back from where bill buttons were not going to go back and listen to the [Gs] all day long. It doesn’t have to be like the 1970s just like when people … If I talked about a bubble, people say well it’s not the banks and it’s not … it’s not always about the banks it’s not about household balance sheets there’s different accesses. People say they … stag inflation because they think it only happened in the 1970s but a stagflation is strictly defined as soft growth and rising inflationary pressures. We do have that in our hands right now I’d say we have a mild case of stagflation by the way again what is one of the great edges or ways to benefit in that environment is to be really long tooth specific sectors. Energy stocks are a great hedge against the inflationary aspect of it and financials.

FRA: Go ahead Yra.

YRA: With everything that you discussed does the US cover at this time. I know I have to put into the fed because all the signaling mechanisms that we’ve seen over my life in this business. in 41 years and I’ve looked at the yield curve as such an important indicator for so many years I’m not sure what it means in this but with all these consulates of debt, of course rising. We go back to the IMF and the number you … is 164 trillion but especially in the US with growing and I know I know this kind of funded on the short end which I would argue is probably a bigger mistake. But why should this curve be flattening at this time? Is it because the fed is being too … Or the market deems it to be too aggressive or is it still the impact of the QE from whatever the numbers are out of Japan and of course Europe we know those numbers that they actually exceeded it in April. Does that bother you at all David?

DAVID: I think that is … I’ve never really seen a fed tightening cycle fail to tightening the yield curve. Their two-year note is really sensitive to one thing and one thing only and that is fed expectations. You get out the longer end-of-the-year curve, say 10s of 30s and then there’s are confluence of factors between the term premium and real interest rates and replacing expectations. The longer you go in the curve, really the more complicated it is. Inflation expectations certainly have risen but they’re barely more than 2%, they are not rising other control. I mean they have risen. But then again the 10-year no yield is sitting close to 3% it’s not as to war 2 and a half anymore. The fed has already raised rates worth 150 basis points so far. Normally when they raise interest rates and you get towards this more mature phase of the tightening cycle the carb tends to flatten pretty dramatically. I’ve always talked about the yield curve. I’ve been in this business over 30 years and I’ll tell you that I always talked about the yield curve as a great leading indicator. I was screaming from the mountaintop when I was at Merrell back in ‘06 and talking about … Sorry.

YRA: That was great work…

DAVID: The thing is that the question I got … I would bring up the old cards at meetings and I’d talk about the meaning of the inverted yield curve at meetings and I would explain the yield curve at meetings. Today I go to a meeting and the first question I get is what do you think of the yield curve? All the business TV stations all about the yield curve. All the newspapers talked about the yield curve I’m starting to think because I have a real … that may be for the first time in 50 years the yield curve is not going to matter because it comes down to Bob Ferrell’s rule number 9 when all the experts in the forecast agree something else is going to happen. We may end up getting … The first time we get a recession actually without the yield curve having to invert. Remember other things were happening, the Fed where we have large scale deficits they may well be that and I think you’re right. They can’t fund 1.3 trillion dollars of gross new treasury born this year at the front end of the yield curve. Maybe the fact that they flooded the front end is why the yield curve was flat, maybe it re-steepens. I don’t know, it’s hard to really make book especially looking globally at the extent to which the central banks have added on so much duration to the balance sheet. That does the yield curve have the same meaning that it used to. I’ve changed my focus towards more of the general level of interest rates. Does the yield curve really matter? Let’s look at the United States. 47 trillion dollars of outstanding debt at every level of society. At the peak of the last cycle in 2007 it was 30 trillion. It’s gone from 30 to 33 trillion to 47 trillion. We’ve actually just blown out the peak of the debt level that defined the end of the credit cycle of 2007 by multiples. It actually boggles the mind. I actually never would have ever thought it could happen. I thought we were going to go through a real deleveraging cycle and in residential mortgages you could argue we did. We certainly didn’t do it with student loans or subprime models or autos in general certainly corporate balance sheets are extremely bloated. Look at the government sector commercial real estate. You can point your finger but I think it’s going to be more and especially a lot of high yield debt investment-grade debt, the leveraged loans, a lot of the stuff we’re going to be going through a master refinancing campaign in the next couple of years at higher interest rates. I think what happens if we aren’t going to get a default experience we’re going to get rice delinquencies. This isn’t so much a situation as to what it means in the banking sector at large but really the big bubble and this is true in Canada as well as in the non-bank financials that funded this thing. I don’t think the U-curve matters that much. I think the general level of interest rates and the powerful impact it’s going to have on debt servicing cost and the strains that come from that as this mountain of debt rolls over it’s going to be I think the real critical factor and so we might not even have a yield curve inversion putting the economy in recession this time it will just be that interest rates across a spectrum rose and created a tightening in financial conditions along the way.

YRA: Listen if there’s any buyer strike to us debt going on, we need greater premiums. It could happen and that’s why it’s very hard for me as being a … I love the work going back to ’06. I was a client of Merrill Lynch. I had a lot of … at the time. For me so I paid very close attention when you are rent because I’m a big believer in yield curves. I’ve done studying these for … I have a study that … going back 30 years so I pay attention because I’ve got the scars to prove being wrong. I go back to the UK in late 80s early 90s, I sat through 4 interest rate cuts and lost nothing but money I was low on guilts. The guilts keep going lower and shorter. I’m taking about futures prices. They kept going lower. I said how can this be happening? I learnt and bother to study I said I am missing something here. The guilts should have been rallying of course it went the other way and it really made me very aware of how these yield curves can move in ways that you won’t even think about. I’m paying close attention here, I think you added quite a bit. I remember in 2006, 2007 when they had 210 US curve actually voted 26 basis points which was very telling and then of course … Able to really time this what the lug is before when it comes because of course the SMP is one. … New heights. It was really matter. It does matter as you point out. That’s a great discussion I appreciate that.

FRA: Just finally your thoughts David on what have asset classes makes sense. How can the investors position themselves no specific names of companies or securities but generically your thoughts?

DAVID: Well look I think have to … I was saying that the theme for this year was its time to be the students not the teacher. In other words instead of trying to call the market why don’t we just heed the market message and I think that’s really important because the market is giving us a tremendous amount of information, a lot of it came down from when the early question about volatility. The extent of the volatility and the extent of the back-up and interest rates at the very front end of the yield curve is telling you something very important for the coming year. The 2-year not yield is alone a great leading indicator. When you get the … up 60% in this period of time and it sustained tremendous information that we were heading into we were in a transitional market. Basically what’s very important is for everybody to break out of the comfort zone of what works so well that cycle and understand that those trends are shifting. We’re in a transition right now so we are in a transition basically in my opinion in terms of what the markets are telling us that we are classically entering into a period where active investing is going to be far more superior than what’s worked which has been these blindfolded perceive ETF investing. I think that the markets are telling us that we’re going into a period where value is going to be surpassing growth for an extended period of time and I think that what you want to focus on you want to have more cash on hand than you normally do. Whatever your comfort level is. I think that long short strategies in the fixed income market generally speaking. Credit hedge funds good place to be. I’d be focusing on low data stocks with low GDP sensitivities so a little more defensive for a special situation. You want to protect yourself from rising interest rates especially the front end of the yield curve. The Fed is not done just yet so floating rate notes and as I said before the financials within the North American stock market. We actually have been doing quite well being a life insurance company and I think some inflation protection which is why I like the energy stocks. You might like to buy real return bonds or inflation protected securities, I think wouldn’t be a bad place to be. But I think that really morphing in towards that late cycle mindset and that means that if you don’t have commodity exposure in your portfolio you might want to start adding some. It also means by the way the Canadian dollar right now at 77, 78 cents will go to 85 sets if and when the bank of Canada ever closes the negative industry cap and allows the Canadian dollar to trade more with where the end of the line lower prices right now. Something else to keep at the back of your mind is that a North American investor getting some currency exposure in a currency that lagged well behind the US.

FRA: Go ahead Yra.

YRA: I know we’ve been … Everything that David said I find common ground with it. I look at the Mexican peso outside the politics … Because they are really well positioned on their currency basis valuation … That’s why the trump administration is a big part of the equation. Besides that everything that David said is on my radar screen but the issue that … goes back to it and what I followed it through is of course the market exposure to not just a passive trade but the risk purity trade. Everybody talks about … how much they have or AQR but to me the reach in market is not just the massive positions of those to hedge funds but the amount of what I call tail coding. It always goes on. Because one somebody comes up with a formula there’s a lot of copy cats out there and I think that’s why we see volatilities explode. Because there were a lot of people mimicking Bridgewater and others and putting on the same position. I think that they have position on that they have no idea of how they absolutely will eat themselves and explode upon themselves and I view that as a phenomenal risk factor going forward and I don’t know how they escape from it other than going to the central banks and begging them to take their position.

FRA: That’s great insight gentlemen thank you very much for the discussion and just wondering how can our listeners learn more about your work David.

DAVID: Well I produce to dailies as I think you mentioned I produce Espresso with Dave and Breakfast With Dave. So with me it’s always about food. Feel free to email me if you want to get on our trial distribution list for the dailies that I do. My email address is Rosenberg SNB rosenburg@gluskinsheff. So Rosenberg@gluskinsheff.com or call me up at 401-668-188-919 and I’d be happy to facilitate that.

FRA: Great and Yra?

YRA: Okay as usual I’ve got so many things but I keep pushing out the blog that I write is most from underground … and rationalist who can go long. I keep writing there and I’m actively trading some … Always happy to discuss any types of trades that people may have. The discourse that goes on at the blog is really at a high-level. I’ve got a really high readership that … Whack jobs as I called them and we keep it to a very high level. This has been a great honor for me on another financial impression authority ability. I have great respect for Dave Rosenberg over all these years and we didn’t just go negative. Because what I thought about this I said well when we are going to be here because I know from reading David’s stuff and hearing him paying attention when he’s on these things and we wind up in a very doomsday scenario but that’s not it at all. In fact I tongue and cheek so all this is going to be a rendition of … very high level and I appreciate it.

FRA: Great thank you. We’ll end it there.

05/01/2018 - The RoundTable Insight: Max Horster On Investing In Climate Change

05/01/2018 - The RoundTable Insight: Max Horster On Investing In Climate Change

FRA: Hi. Welcome to FRA’s RoundTable Insight .. Today we have Max Horster. He’s the Managing Director and Head of ISS-Ethix Climate Solutions – a unit of Institutional Shareholder Services that enables investors to understand, measure and act upon the implications of climate change on investments. Max developed the industry’s leading methodology to gauge and assess climate impact on investment portfolios, resulting in the world’s largest database of company-level climate change data. He holds a Ph.D. in History from the University of Cambridge. Welcome, Max!

Max: Hi, Richard. Pleasure to meet you. Thank you.

FRA: Great. If you could start us with your background? How you got into this field? And your career?

Max: Sure. You mentioned that my focus used to be in history. After that, I ventured onto asset management. I worked for almost 5 years with a large global asset manager capital group and I was scared. I realized that a topic that’s really close to my heart is climate change which mattered to investors. With that thought in mind, I started a small company in Zurich, Switzerland and operated under the name South Pole Group. We were among the first to look into the topic of investments and climate change. That was 8 years ago. We were a little bit early. So at the time we started, the only investors interested in this topic was (1:49 inaudible). Mr. (1:51 inaudible) invested at the charge investor’s foundation or so – who wanted to understand whether the money that they invested is in line with their mission. But over the years, that changed dramatically and I think about 3 years or so, the topic has really brought mainstream investments. Mainstream investments come from entirely different angles which is from the risk perspective. So, not so much on how money helping (2:17 inaudible) but how the climate change affects the legislation and potentially affect returns. The market grew tremendously fast. As a leader of this market, we realize that, organically, we couldn’t keep up with the market growth. We were approached by quite a few organizations who were interested in acquiring us. So at some point, around the beginning of last year, beginning of 2017, we decided to enter a process. There was a handful of companies that were interested in acquiring us we’re gracious to be able to choose who we want to partner with and we decided to become a part of ISS (Institutional Shareholder Services Inc.) – which is probably known to this podcast as the largest provider of top government research and services proxy (3:23 inaudible). This is also one of the largest and certainly the fastest growing provider of ESG data (Enviroment Social Government data). Non-financial information. It’s the fastest growing in two ways – by organic growth and by acquisition (3:43 – 3:45 inaudible). Not the latest, I should say. Three weeks ago we added (3:48 – 3:52 inaudible) into our family as well. Since June 2017, we have been a part of ISS. We operate under the name of ISS-Ethix Climate Solutions. We basically do three things. We hep investors understand what climate change means for the investment and what the investments mean for the climate. We help measure (4:14 – 4:23 inaudible). Certainly, we help investors act upon that.

FRA: So, this is a fascinating topic area. Wondering what your thoughts are on climate change? Do you see global warming? Global cooling? Combination of the both? What industry’s sectors of the economy will be affected by climate change going forth?

Max: My view of climate change is impacted by the view of the scientific community on climate change. I’m not a climate fan myself. As you’re probably aware, the community of climate sciences is in agreement that … nobody is questioning that the climate is changing anymore I should say. There is still a bit of a debate of what the role of human being is in that – of mankind. Ninety-seven percent of climate fans say that man can play the role different degrees on this scientific event that is happening. Climate change is taking place. The community, policy makers and so on follow the scientific view that mankind is the reason for that – the reason for emitting greenhouse gases. The emittance of how we operate (6:05 inaudible) electricity. Therefore, in order to mimic the effects of climate change and reduce its effects and potentially combat climate change, we need to change as a world, as an economy, as a society. To the second part of the question, it is important to understand what the changes are that comes with climate change. To be clear, we differentiate between – we approach it from the risk perspective – we differentiate between transitional risk and predicted risk. Predictive risk is easily understood. When the climate changes, it can be warming and cooling, depending on what geography you’re at. The global climate is warming. However, there are some geographies where there is cooling because of its rippling effect. In general, when the climate is changing, certain physical effects happen – floods, drought but also heavy rainfall. Long-term changes also impact the economy. These physical effects are obviously impacting (7:58 – 8:02 inaudible). If you are producing fertilizers for southern Europe, due to climate change, agriculture won’t be possible any longer in the south of Europe. Your company might not be really affected by climate change but the market that you cater to is. It could affect the supply for your supply chain. We saw last year that the floods in Southeast Asia that the supply chain (8:30 -8:32 inaudible) were impacted by that. These are physical activity has affected every industry. Then, there are some transitional risks. Transitional risks are that come with the world closing in on climate change and trying to mitigate it. That is, of course, being done by regulators stepping in and saying we need to stop emitting CO2. This is triggered by society and changing the way they behave and the types of cars they drive and so on. This is what we call transitional risks and they’re heavily emit greenhouse gases and industries are impacted. That would be, for example, the oil and gas industry and the utility sector. At least the (9:27 inaudible) part of the utility sector, the energy sector in general. In these industry sectors, you have to differentiate between industries where they have to substitute technology that is kind of climate adjustable and where it isn’t. So, if you think about (9:48 – 9:50 inaudible) produce cars that are emitting less or no greenhouse gas emissions – electric vehicles substitute technologies for the combustion engine. You can also produce electricity through other (10:05 – 10:12 inaudible). Water, wind and solar. There are substitute technologies that means a company (10:20 – 10:21 inaudible) in a specific sector. The company can transition. There are also sectors that cannot transition – the oil company. An oil company is an oil company. If it doesn’t produce oil any longer, it falls into a different sector. This is how they approach looking at different sectors and what affects climate change legislation on one end and the climate change effect on the other end and how they affect those sectors.

FRA: Does your firm, ISS, advice clients on climate change issues relating to ESG-CSR (Corporate Social Responsibility)?

Max: Yes. This is the core of what my group and I are doing. We advise and we provide data and screenings that help investors frame the topic of climate change. Then measure where they stand. These are risks that I mentioned; physical and transitional risks. First we would look at what the frame of the topic means. We help organisations that are sometimes very large asset managers or asset owners to understand what the topic of climate change for them and for their specific DNA. To give an example; If you are a government pension plan of the country that is heavily dependent on oil exportation, you might take a very different view on the topic of climate change than a church (?) investor. Or you might take a very different view than an insurance company that not only (12:01 – 12:03 inaudible) but also on the liability side that therefore affects the climate change. So framing the topic is the first step that we help investors with. We come in with our consultants and we help determine what climate change means and creating policies around it. Then, in the second step, we help measure where the client/investor stands. That is typically done by providing the investor with data. We can provide raw data because the investor has the capacity to run themselves where the big risks are and where the opportunities are or where the impact lies. More often the case, especially when an investor stops looking at this topic, they send us their portfolios and we run the analysis on their behalf. There, we create either (13:04 – 13:06) depending on who the stakeholder is and what the aim is. We create reports that point out, almost like a heat seeker, where the risks and where the opportunities are. We also suggest steps that the investors can take to address those.

FRA: In terms of all the actual tools and methodologies, what are those that the ISS use to assess the investment implications of investment asset classes in firms?

Max: Typically, what investors start with is called the investor’s carbon footprint. The logic is that you own, let’s say an equity portfolio, you own 0.1% of general electric. The investor’s carbon footprint allocates 0.1% of GE (Greenhouse Gas Emissions) to your portfolio to you first. Then you can do that for other companies and you can calculate your emission exposure. You can understand what your expose is to what amount of CO2. How many tons of CO2 does the company that I own emit? (14:25 – 14:28 inaudible) that against benchmarks. We understand whether you are you below the benchmark or not. The benchmark could also be your own portfolio two years ago (14:36 – 14:39 inaudible). That’s the very first step that an investor takes and is typically a very good one to start with. It has some limitations but it quantifies the topic of climate change that investors can process very well which are numbers. Tons of C02. CO2 in many geographies has a price. You can associate the price with us and you can convert tons of CO2 into, for example, basis points. You can say that the direct costs of greenhouse gas emissions that your investors are responsible for is equivalent to is half a basis point. That is a language that is understood and trusted across an organization. From then on, we analyze, what I mentioned before, the transition risks. These can be risks that can be very sector specific. We would tell you what other companies you are invested in. Let’s say in the oil and gas energy sector have exposure to (15:41 inaudible) or to arctic drilling or other practical steps in the transitioning world might face the risk of being reduced by the regulator block by the regulators. We look at physical risks. So, one of the physical risk exposure achieved in long-term off the company portfolio – when we look at what we would call “scenario analysis”, you might be aware that the world committed in the Paris Agreement to limit global climate change to well below 2 degrees. Keep in mind that we’re geared toward 6 degrees of global warming. So, if we really stick to this 2 degrees’ target which every country in the world signed, and those countries ratified, that means a lot of countries have to change. If we look at what companies in your portfolio can be 2 degree aligned in the future. Will we still have such a business model in such a world that we committed to transition to.

FRA: Through this work that you have been, how are investment asset classes affected by climate change overall? What have you seen?

Max: I would differentiate between liquid and non-liquid asset classes. The most important differentiation in our business world is to see why. Because when it comes to physical risks, we’re physically affected by climate change. The increase of floods, droughts, storms and so on and these risks are ten to fifteen years out. They increase over time, but in the liquid asset class, you’ve caused (17:33 inaudible) out of them. I would say physical risks – or let’s say liquid asset classes are very much focused on the transition risk. With the equity portfolio, you are concerned about a government committing to a (17:50 inaudible) tomorrow because at that moment, you might own a company that is larger and the (17:57 inaudible) might tip the share price. You’re not so concerned about the curious perspective but about the physical effect of climate change in ten to fifteen years because at that time, you might not own that company any longer. When you think about non-liquid asset classes, namely real estate and private equity. It’s an entirely different ball game. We see today that in these non-liquid asset classes that physical risks are being taken into consideration in the moment of the investment. In other words, if you build a hotel on the shores of Florida and you realize that the hurricanes are increasing in magnitude in terms of strength and number, that matters to you much more as that what it will look like in ten to fifteen years – how climate change impacts these storms. This is much more for you and for insurance companies on selling you insurance for that hotel.

FRA: Has the impact to the bottom line then – impact on profitability positive or negative? What classes or firms could be affected by this in terms of profitability? Positive or negative?

Max: It’s an interesting point. There’s a lot of studies being done on that right now and the question whether the risk of climate change is prized into company valuation already today. You do find a lot of studies that support this view – that companies that have the risks and opportunities that climate change are better under control than others; if you create a basket of them and run them against others’ index, there are studies out there that states that these companies are outperforming their peers. That is also a reason for increasing the amount for low carbon investments strategies that are currently being created or have been created the past few years where asset managers put together portfolios with such promise and (20:26 – 20:29 inaudible) – so that an outperformance is possible.

FRA: Very interesting. Do you know of any indexes like passive index or smart beta index that currently exists that focuses on firms with a view focusing on climate change?

Max: Yeah. I would almost turn it around. There is hardly any major index out there that doesn’t have some sort of a climate adjusted index summary. I would say they are at very different levels when it comes to education. The most basic ones are typically indices that either excludes fossil fuel companies – what I would refer to as a divestment approach and would resemble a reference universe without the oil, coal and gas companies – or take out or reduce exposure to companies that have a larger carbon footprint. They basically emit more emissions than their peers for the same output. They are less carbon efficient. This is kind of the first generation of indices and there you find (21:50 – 22:00 inaudible). What I am excited about are (22:06 – 22:07 inaudible) indices that are most sophisticated and try to investment in companies. For example, only companies that have a 2 degree targets and are committed to it. So, companies that are ready to say we are committed to the transition to be in alignment with the climate goal. There a lot of companies out there across all sectors. You invest only in companies with a climate strategy and don’t invest in those that don’t.

FRA: Interesting. How do institutional investors invest in climate change today and how can retail investors look to investing in climate change?

Max: I would say that institutional investors, depending on what you’re looking at, the large asset owners in Europe have all started to look into the topic of climate change and the flagship asset owners in the U.S. have as well. The same goes for Australia and Japan. The way that they approach is that they first want to figure out where they stand. So they do kind of a status quo assessment of what is my first climate change today? And then they typically set themselves some sort of either a pathway so they have a climate strategy. Now, more often than not, their strategies might include targets. Their target could be: we commit to bring down the carbon intensity of our portfolio by 20% by 2020 or we want to bring up the companies that have a climate strategy in our portfolio. Another element that would be involved in the ISS would be the topic of (24:10 – 24:13 inaudible). In North America, the number of shareholders on the topic of climate change were at an all time high last year with 89 shareholders that addresses the topic of climate change. This year, now it is April 2018, we are already at the same amount. We expect that this number would be much higher this year and these are the shareholders that ask companies to close greenhouse gas emissions or to get themselves a 2-degree target. These shareholders are increasing its effect by institutional investors who often drive those in some sort of a collective engagement initiative. (25:00 -25:05) New York, California and so on as well. They are getting involved and then they look for products that help them to manage their greenhouse gas emissions or climate impact in general to manage that bound. That’s also a reason why we see increasing investment products popping up in that space. Retail investors, it is a bit of a different story but there are now online platforms available for retail investors where they can basically go online and type in the name of a fund that is available for retail investing and see how the climates affects us. One that we have been building on behalf of the European Union is called Climatrix. Climate Tricks minus waiting.org (I cant find the website). That is a platform where you can look every after 5000 largest retail funds that are registered for sale so it includes some U.S. funds as well and check them for the climate affects. Free of charge. You just go on there and you type in the name of the fund and it tells you whether the fund has one to five (26:36 – 26:40 inaudible) data points that is something easier to digest which is kind of a leaf system. So five leaves is obviously better than four. That is something that retail investors can do invest there and they can, of course, walk into their bank and talk to their advisors and ask for climate adjusted investment product. There is an increasing amount available.

FRA: Wow! That is interesting. Finally, where can investors find more information on climate change investing and also learn more about your work?

Max: We produce quite a bit of research as you can probably tell. You can find it at ISSgovernance.com. Where you then can look for climate solutions and mail us or reach us. Other resources that I find useful are thinktanks. There are two in particular that deals with investors about climate change. One is carbon trekker and the other one is called the two-degree investment initiative. Great resources, especially for methodology. Great way to read up on different approaches to investment in climate change.

FRA: Great insight on the whole industry here and investing in climate change, Max! Thank you very much for coming onto the program show.

Max: Thank you for having me!

By: Karl De La Cruz

04/30/2018 - The Roundtable Insight: Nomi Prins & Yra Harris On How Central Bankers Control Markets & Dictate Economic Policy

04/30/2018 - The Roundtable Insight: Nomi Prins & Yra Harris On How Central Bankers Control Markets & Dictate Economic Policy

Download the Podcast in MP3 Here

FRA: Hi welcome to FRA’s Roundtable Insight .. Today we have Nomi Prins and Yra Harris. Nomi has worked on Wall Street as a managing director at Goldman Sachs and ran the international analytics group as a senior managing director at [Bear Stearns] in London before becoming an author. Now a journalists, public speaker and media commentator, she’s the author of 6 books. Her writing has been featured in the New York Times, Forbes, Fortune, The Guardian and The Nation among others. Yra as an independent trader, a successful hedge fund manager, global macro consultants training, foreign currencies, bonds, commodities and equities for over 40 years. He was also CME director from 1997 to 2003. Welcome Nomi and Yra.

NOMI: Thank you very much.

YRA: Thanks Richard.

FRA: Well Nomi is coming out with a new book to be released on May 1st. It’s titled Collusion: How Central Bankers Rigged the World. She focuses on five area, Mexico Brazil china japan and Europe and she’s actually scoured the world to write this. Visiting Mexico city, Guadalajara, Monterrey, Rio de Janeiro, Sao Paulo, Brasilia, Porto Alegre, Beijing shanghai, Tokyo, London, berlin and other cities throughout the united states. That’s a lot of traveling Nomi.

NOMI: That sounded like a lot of travelling when you said it Richard. Yes that happened.

FRA: Is that how it came about? Was it through these struggles that you gained this insight how did you get this inside also through your work?

NOMI: The insight itself yes it came from traveling on the ground and that was a result of really watching what happens since the financial crisis in terms of what the federal reserve has done and what other major central banks have done that we know about publicly in terms of advocating and creating and manifesting … Money policy as well as a quantitative easing or asset purchasing policy. It’s asset purchasing of bonds in the US, it’s the ETFs in japan, it’s corporate bonds in Europe are effectively a collaborative process that really had different effects for the major countries versus the more developing countries and also even as it was coming about in the wake of the financial crisis, had a lot of worries and criticisms been brought up about it. What I wanted to do is discover how those words and criticisms impacts on more of the developing countries. We’re part of the results of the Federal Reserve ECB Bank of Japan process of this particular policy. It was a combination of seeing what was going on and wanting to feel it and examine it and research it from the levels of those countries.

FRA: Is this collusion more of a hand off of a baton for example between central banks or is it actually central bank that are more in close coordination with each other?

NOMI: The main central bank that coordinated in the wake of the financial crisis and even before it became public knowledge in the fall of 2008. This was going on in the beginning of 2007 and throughout 2007 is that they worked together to for example have a lot of dollars in the market , in the central bank reserves system to be available in the case of a crisis. They kind of knew in advance what could be happening but to the public of course a particular federal reserve did this through Ben Bernanke. The face was, we’ve got this, there’s no housing crisis, nothing bad is going to happen, everything is fine. In reality central banks the major ones the G7 ones were already starting to work together to mitigate any potential liquidity or money crises that could result from any financial implosions. That was already going on but then once the financial crisis was in a bit of full mode in the fall of 2008 and the spring of 2009 those conversations became much more frequent, the types of coordinated policies amongst these banks became more frequent, the amounts of them more epic in terms of what was swapped between central banks. Like I’ll give you dollars you give Euros and so forth throughout the process to create a global tranquility on the outside that was really fabricated by these central banks. As the years went on different types of timing periods were used to sort of catalyze this type of collusion or group collaboration again. For example in 2012 when there was a more pronounced credit crisis in Europe and so far and it goes on to this day. If the fed raises rates a bit and it hampers the stock markets and all of a sudden there’s a lot of chaos or turbulence and the European central bank as adjusted will step up and say, “We’re are not touching our rates, our rates are good low where they are. We’re going to continue with our quantitative easing or a corporate buy in process so don’t worry.” That’s where the global collusion comes and of course if you’re outside of this main group of these central banks, you’re either acting with them or against them depending on what you need to do for the domestic situation in your own country. For example Brazil when it has high inflation had to do different managers relative to what the fed was doing but that also hurt it politically? A lot of different pools and studs came in that developed countries throughout this process.

FRA: Yra have you seen similar behavior between the central bucks from your observations?

YRA: Are you throwing fuel on my fire on what didn’t know. How do I know? (unintelligible) We’ve known each other 3 or 4 years but I’ve been discussing this with (unintelligible) for years. Nomi can I just ask you a question? Are you familiar with Bernard Connolly?

NOMI: I’m not. It sounds like I should be.

YRA: You ought to be yes. If you’ll give Richard (unintelligible) I’ll send you (unintelligible) We’ll talk about it later but Bernard Connolly who was at AIG London (unintelligible) He wrote a book called The Rotten Heart of Europe. Written in 1995.

NOMI: Wow, okay.