Interviews

11/07/2024 - The Roundtable Insight – Louis-Vincent Gave and Yra Harris on China, U.S. Elections, Gold, Emerging Markets

11/07/2024 - The Roundtable Insight – Louis-Vincent Gave and Yra Harris on China, U.S. Elections, Gold, Emerging Markets

11/01/2024 - The Roundtable Insight – Charles Hugh Smith on the China Real Estate Bubble

11/01/2024 - The Roundtable Insight – Charles Hugh Smith on the China Real Estate Bubble

Here are the links and references to the charts:

https://x.com/BurggrabenH/status/1847987146470178994

https://www.thecommoditycompass.com/p/chinas-paradox-under-xi

10/29/2024 - The Roundtable Insight – Judd Hirschberg on current insightful Technical Analysis of the Financial Markets

10/29/2024 - The Roundtable Insight – Judd Hirschberg on current insightful Technical Analysis of the Financial Markets

podcast to be posted shortly …

10/23/2024 - The Roundtable Insight – Elliott Wave’s Steven Hochberg and Peter Kendall together with Yra Harris on Technical and Fundamental Views of the Markets

10/23/2024 - The Roundtable Insight – Elliott Wave’s Steven Hochberg and Peter Kendall together with Yra Harris on Technical and Fundamental Views of the Markets

To subscribe to EWI services – link here: www.elliottwave.com/fra (disclosure – we are not making any compensation or referral fees on this)

10/04/2024 - The Roundtable Insight – Doug Casey on Geo-Political Risks, Gold and Investing in South America

10/04/2024 - The Roundtable Insight – Doug Casey on Geo-Political Risks, Gold and Investing in South America

Download the Podcast in MP3 Voice

09/23/2024 - The Roundtable Insight – Dennis Gartman, Angelo Gallo and Yra Harris on the Economy, Gold, Commodities and Yield Curve Trends

09/23/2024 - The Roundtable Insight – Dennis Gartman, Angelo Gallo and Yra Harris on the Economy, Gold, Commodities and Yield Curve Trends

Link Here to Download the Podcast

09/20/2024 - The Roundtable Insight – Peter Boockvar and Yra Harris on the Political Economy, Gold and Investing

09/20/2024 - The Roundtable Insight – Peter Boockvar and Yra Harris on the Political Economy, Gold and Investing

Link here to download the podcast

09/20/2024 - The Roundtable Insight – Charles Hugh Smith on How Asset Deflation Could Play Out

09/20/2024 - The Roundtable Insight – Charles Hugh Smith on How Asset Deflation Could Play Out

08/28/2024 - The Roundtable Insight – Rabobank’s Michael Every and Industry Veteran Yra Harris on Geopolitical Risks

08/28/2024 - The Roundtable Insight – Rabobank’s Michael Every and Industry Veteran Yra Harris on Geopolitical Risks

08/19/2024 - The Roundtable Insight – Tom Luongo and Yra Harris on Geo-Political Risks, Gold and Currencies

08/19/2024 - The Roundtable Insight – Tom Luongo and Yra Harris on Geo-Political Risks, Gold and Currencies

08/12/2024 - The Roundtable Insight – Bill Fleckenstein and Yra Harris on the Markets and Gold, Precious Metals

08/12/2024 - The Roundtable Insight – Bill Fleckenstein and Yra Harris on the Markets and Gold, Precious Metals

08/09/2024 - The Roundtable Insight – Charles Hugh Smith on Financial Repression and The Great Unwinding

08/09/2024 - The Roundtable Insight – Charles Hugh Smith on Financial Repression and The Great Unwinding

Download the Presentation in MP3

07/22/2024 - The Roundtable Insight – Daniel Lacalle and Yra Harris on Gold, Geo-Political Risks and the Global Economy

07/22/2024 - The Roundtable Insight – Daniel Lacalle and Yra Harris on Gold, Geo-Political Risks and the Global Economy

06/25/2024 - The Roundtable Insight – Charles Hugh Smith on Geo-Political Risks and the Economy

06/25/2024 - The Roundtable Insight – Charles Hugh Smith on Geo-Political Risks and the Economy

06/12/2024 - The Roundtable Insight – Judd Hirschberg Updates with Technical Analysis of the Financial Markets

06/12/2024 - The Roundtable Insight – Judd Hirschberg Updates with Technical Analysis of the Financial Markets

Subscribe here and view the Geo-Political Risk Table:

06/03/2024 - The Roundtable Insight – Adam Rozencwajg and Yra Harris on Commodities and Geo-Political Risks

06/03/2024 - The Roundtable Insight – Adam Rozencwajg and Yra Harris on Commodities and Geo-Political Risks

Download the Podcast in MP3 Voice

Lots of discussion in this podcast about geo-political risks to the investor. Check out CedarOwl’s Risk Table for more info on geo-political risks to the investor.

CedarOwl Risk Table – Now Available

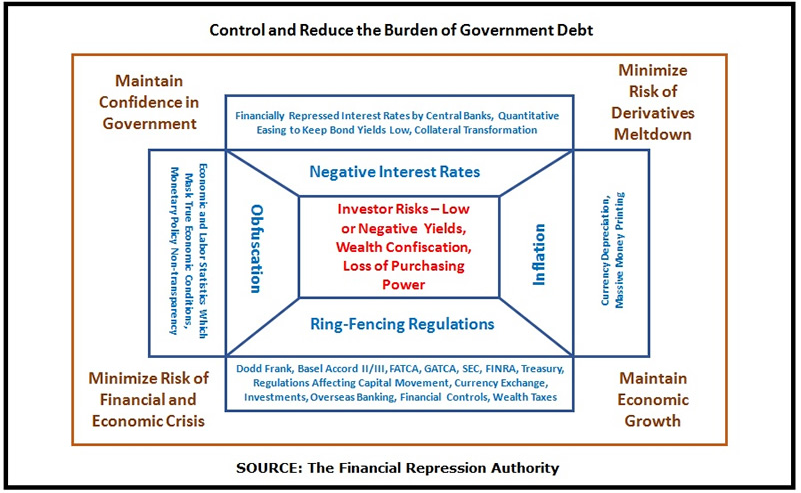

CedarOwl is making available its Risk Table – see link at the bottom of the page. The Risk Table is a continually-updated spreadsheet matrix which identifies and assesses existing as well as new risks stemming from risks associated with trends and events happening jurisdictionally around the world. These include but are not limited to government or fiscal policies, central bank policies, and regulatory environment changes.

LINK HERE TO CEDAROWL’S RISK TABLE (refresh the screen for updates)

Types of events include, but are not limited to:

- nationalization of businesses or properties by a country;

- expropriations or freezing of assets;

- impositions of new regulations on certain industries;

- commodity export bans;

- changes in rules on registered accounts like 401k plans, RSPs, Superannuation;

- regional conflicts or wars affecting economies and markets.

The matrix table also has CedarOwl‘s risk mitigation strategies which help CedarOwl with its investment process.

05/17/2024 - The Roundtable Insight Vision Series – Charles Hugh Smith on Gold and What Currency Systems Make Sense

05/17/2024 - The Roundtable Insight Vision Series – Charles Hugh Smith on Gold and What Currency Systems Make Sense

05/16/2024 - The Roundtable Insight – Sam Perry, Tobias Harris and Yra Harris on Japan at the Crossroads

05/16/2024 - The Roundtable Insight – Sam Perry, Tobias Harris and Yra Harris on Japan at the Crossroads

04/08/2024 - The Roundtable Insight – Legendary Investors Chris Wood and Yra Harris on Gold, Geo-Political Risks, and the Global Financial Markets

04/08/2024 - The Roundtable Insight – Legendary Investors Chris Wood and Yra Harris on Gold, Geo-Political Risks, and the Global Financial Markets

Download the podcast in voice format MP3 here

04/05/2024 - The Roundtable Insight – Charles Hugh Smith on Four Thematic Challenges Causing Economic and Social Dysfunction – and Solutions

04/05/2024 - The Roundtable Insight – Charles Hugh Smith on Four Thematic Challenges Causing Economic and Social Dysfunction – and Solutions