Blog

04/11/2018 - Fascinating, Insightful Grant Williams Interview Of Chairman Tony Deden Of Edelweiss Holdings

04/11/2018 - Fascinating, Insightful Grant Williams Interview Of Chairman Tony Deden Of Edelweiss Holdings

04/06/2018 - The Roundtable Insight: Peter Boockvar On The Monetary Experiments Of Central Banks

04/06/2018 - The Roundtable Insight: Peter Boockvar On The Monetary Experiments Of Central Banks

Download the Podcast in MP3 Here

FRA: Hi, Welcome to FRA roundtable insight .. Today we have Peter boockvar, he’s the chief investment officer for the Bleakley Financial Group and advisory, he has a product called the boockreport.com b o o c k report and that has great economic inside in perspective with lots of updates on economic indicators. Welcome Peter.

Peter Boockvar: Thanks Rich for having me again

FRA: Great, I thought we’d begin with some recent observation you made saying –basically we are in on the other side of an unprecedented experience of monetary largesse and experiment. Just wondering if you could elaborate on that.

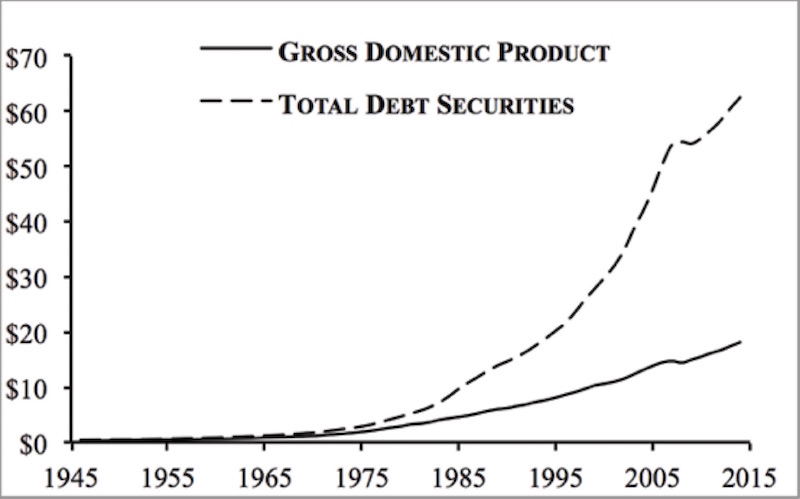

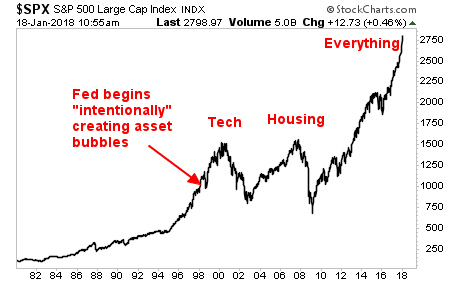

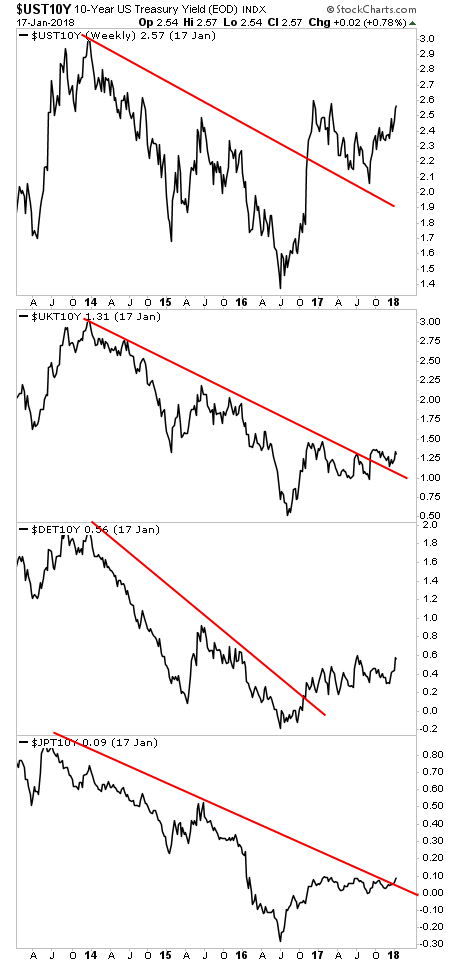

Peter Boockvar: Yeah so, the liquidity tide is beginning to go out it’s more pronounced in the US with the 6 interest rates that we’ve seen so far in addition to the fed’s balance sheet beginning to roll-off. Beginning on Monday, the trend in terms of that roll up we’ll go from $60 billion a quarter, that was $30 billion in Q4 and it will increase to $90 billion a quarter in Q2. Also as each day and month—week and month goes by when we get closer to the ECB finishing their quantitative easing program and we know the bank of Japan is and buying less JGB as they focus more on yield curve control. Had some couple rate hikes from the Bank of Canada, we’re going to get a rate hike from the Bank of England in May so this is Central Bank attempts to extricate themselves from many years have extraordinary policy so that’s why I refer to this as the other side of the mountain. Easing is very easy throwing that party is very easy trying to control the hangover in a pretty benign way if it is now the hard part.

FRA: And so are all central banks and major central banks in the world doing this or just a portion?

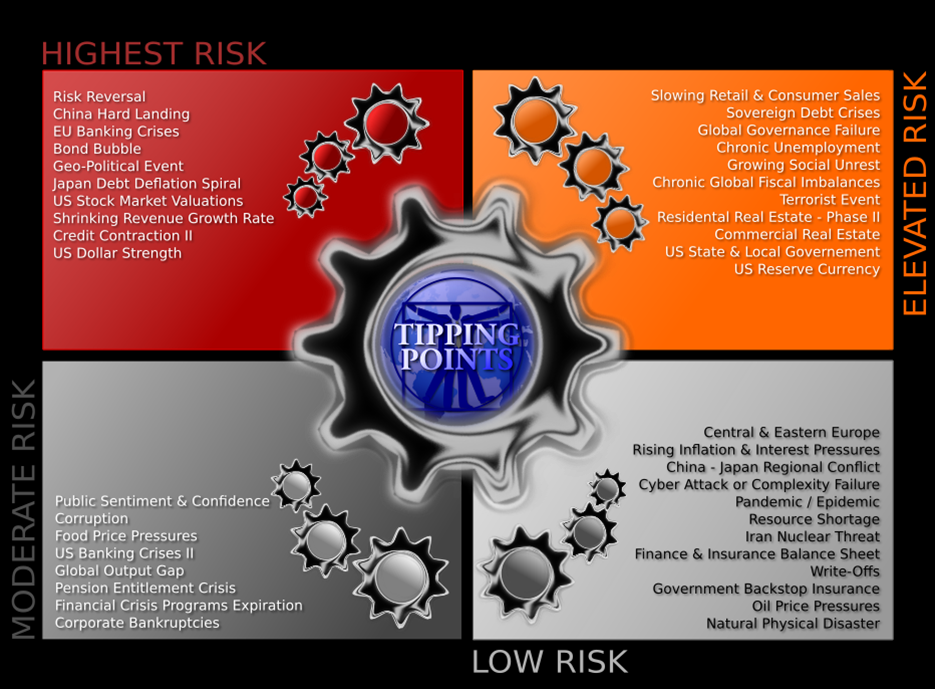

Peter Boockvar: Well the major ones and in in some fashion or I’m even of the ECB still doing QA they cut in half as a January. They’ll probably end up by the end of the year with another sharp Caper come October 1st. So doing this all together at the same time valuations across the world are stretch both of them fixed income and equities and there’s—creates vulnerability mean anytime central banks run a tightening cycle, the world becomes more vulnerable. Both n terms of growth –economy that’s very dependent on extraordinary low rates and also on asset prices that have become very elevated. So if you believe in a free lunch then everything will be fine, if you don’t believe in a free lunch –to 7 years of zero interest rates it can quintuple Balance sheet and negative interest rates around the world then you should be more circumstanced on how this all turns out.

FRA: Now looking at the Federal Reserve how high can interest rates go before other problems begin to set in namely the challenge of servicing the debt and also on interest rate related to derivatives?

Peter Boockvar: Well, look what happened to the VIX trade, the short VIX trade. We saw 30 basis point in the 10-year yield, 30 basis points that’s it and it blew up an entire trade. So I think that was one sign of how sensitive we are too modest changes in interest rates. Again because we’ve—so many years, attached and addicted and dependent on extraordinarily low rates both In terms of its impact on the economy and certainly asset price. Again one sign of potentially more to come, now the question is the persistent rise interest rate particularly on the short end and certainly with LIBOR. This is the rise in cost of capital, this rise in cost of servicing one debt begin to impact free cash flow and maybe not yet but we seem to be headed in that direction.

FRA: And so at some point will the Federal Reserve over and other Central bank’s be constrained are limited in is normalization process?

Peter Boockvar: Umm…That’s a good question I think that that will the restraint will occur only if something breaks and I think they seem pretty intent on raising at least two more times this year I think they’ll start a front load that to give them the option whether they want to do some fourth one of the end of the year and they claim that the shrinking of the balance sheet is like watching paint dry and then will happen in the background but we know that if something happens—if markets fall and if the economy gets impacted then the FED will certainly reevaluate that policy but the problem is that if they don’t do the type of tightening that they want to do and that it somehow gets short-circuited by the market, it tells you that the FED is trapped in what they’ve created and that—them and the ECB and the bank of England. We’ve all become Japan and we had many years of lessons to learn from the Japanese by the bank of Japan getting trapped in their monetary policy and we learned none of that lesson Bernanke suppose a student of the great depression in Japan apparently studied the wrong thing because look at the situation that we’re in and 1.625% in the U.S. of the ninth year in an economic recovery and they just started shrinking their balance sheet. So we’re in dangerous land here in terms of the solid line. If things were to fall in terms of the economy or markets. Question is what is the strike price the fed put and hows the FEDs deal with it if we hit that strike—is we going to see more cuts all of the sudden? Well, they don’t have any more rates to cut. So this is going to be an interesting situation in the coming years.

FRA: And if there is a movement into recession territory—also fall in the financial markets with the Federal Reserve and other central banks being in a position to decrease interest rates and would that mean going into negative nominal interest rate territory?

Peter Boockvar: I do not believe the FED will ever go to negative nominal interest rates think you’ll blow up the money market funds. I think they’ll be riots in the streets of Washington, particularly from the AARP. So I don’t see that being politically possible and at the same time, I think that its proven that its really not a good policy. Negative interest rates is a tax on capital. It’s a tax on banks and banks will do their best to pass it on and if they don’t then they eat it themselves, but somebody has to eat the tax. So I don’t know understand the economic model to have negative interest rates is actually a good thing. I mean I understand the concept that it may force banks to go out and lend but still taxes it’s being eaten by somebody.

FRA: What about going into negative real interest rates by maybe forcing inflation to much higher levels?

Peter Boockvar: We’ve been—we’ve been in a negative interest rate environment for 10 years now so that’s like not like anything new. It would just really be more of the same and then in fact it’s negative real interest rate is what got us into this mess anyway in terms of creating all this debt and bubble type environment that we consistently seem to get ourselves into.

FRA: Speaking of tax on capital, what do you make of the recent developments on trade in terms of trade tariffs acting as a sort of the effective tax on the global economy?

Peter Boockvar: well, optically it certainly is I believe a big negative and I say optically because I’m not sure reality wise, I mean look at the steel (Unintelligble), that’s 70% of countries that we do business with has already been exempted. Half of our aluminum imports come from Canada and they’ve already been exempt. So on a dollar basis and I’m not sure it’d have that much of an impact, it will certainly hurt since the users of steel far outweigh those that produce it trying to separate what really what the economic impact is be going to be. It’ll only be felt, I just don’t think it’ll be as much as many fear. Now of course if this spirals and that’s a big problem I’m hoping that at least with China, theres some sort of agreement that this doesn’t become Become such a big deal and then holding out hope for that. So yeah it’s a risk and I’m not comfortable with Wilbur Ross and Peter Navarro making these decisions because I think they’re way off in this obsession with trade deficits, but I’m just hopeful that it won’t be that big of an economic deal— I’m more worried about the direction of interest rates and monetary policy right now even though of course the tariffs are not a good thing.

FRA: What about the last day or two here of the sell-off in the Fang stocks and a tech sector, is some of that due to concerns by the markets on the trade issues?

Peter Boockvar: I’m not sure that’s really on that I mean certainly semiconductor stocks and certainly would be potentially impacted, we certainly export a lot of consumer electronics also to China. So yeah, potentially but I think that the backdrop to the weakness in cap. tech is a few different things that granted we know that they became such outsized portions of the major indices, when you get to 500 + billion dollar market cap you obviously dominate the global market. Evaluations for some of them got expensive, I mean Facebook on a PE ratio basis pretty modest but on a price of sales basis, it was 10 times so it’s—but that was expensive as well and then once you throw in rising interest rates when people become more sensitive to valuation and we know Amazon evaluation is off the charts and then all of the sudden, threat to their business model. You know Facebook is (unintelligible) franchise I’m sure it’ll be fine but if it means that they’re going to grow more slowly if it means that advertisers are going to be more discriminating with their spend. Then not do as much on digital –maybe put it someplace else. That affects the growth rate, that affects the multiple and in stocks that I have been over owned and over loved and for many years this is what you get and obviously today Amazon getting impacted by the talk about the White House and Trump being obsessed with them and what to do about that, there’s no room for error. When you got to the valuation of levels at these companies did and now that you have both interest rate valuation and fundamental chinks in the armor it’s obviously something really important to pay attention to again, because they were such an outsized dominant presence in so many indices, so many ETF and so many mutual funds.

FRA: Do you think the sell-off in the tech sector will continue and deepen ?

Peter Boockvar: Yes I do. I don’t think that this is somehow settled in a week with a with a modest pull-back, considering how much do stocks have run up.

FRA: And what about on the—instead of doing trade tariffs could countries in central banks look at the competitive currency devaluation in terms of making the currency weaker for a trade competitiveness?

Peter Boockvar: I think we should have seen a version of that for many years but certainly the ECB wanted a week Euro and Japan wanted weak yen and we wanted a weak dollar and things like that is always an ongoing issue. Reserve Bank Australia wants a weak USA dollar and Bank of Canada wants a weak Canadian dollar and it seems like everybody wants a weak currency and what they should be really rooting for is not a weak currency, it should be a stable currency. but everyone’s trying to steal each other’s exports and I think it’s just an ongoing thing that there’s no sign of that changing anytime soon.

FRA: Will there be another round of that particularly—for example like in the US, the US administration may be wanting a lower dollar. Do you see that happening and what would be the mechanism to actually effectuate that to happen?

Peter Boockvar: well the (unintelligible) got so beat up, administration that’s so beat up for even raising the prospect of endorsing a week or dollar so I just don’t think that that’s some place that they’re going to go to, really anytime soon. I think I’ll be very implicit and left on said that they don’t mind a weaker dollar more so than anything more out right and overt.

FRA: And what do you make of China in terms of what’s happening credit crisis increase in credit, more infrastructure projects— overall how do you see China playing out ?

Peter Boockvar: I mean China’s—I mean it is so interesting in that terms of the debt accumulation has been extraordinary and banking system has become so big that I go back and forth and how this all plays out. Because the other hand they still have pretty good growth rates and im pretty bullish on China longer-term but certainly acknowledge short-term challenges they face in trying to deliver. Now they’re not going to do an outright deleveraging, their version of the leveraging will just try to be less quick or more slowly and sort of grow into it and I hope they have success but it’s likely going to be bumps in the road.

FRA: Moving to a fast-moving area topic of cryptocurrencies, what are your thoughts on the—on that do you think that governments will allow private base cryptocurrencies to co-exist alongside government currencies. You know from the monopoly power of the government?

Peter Boockvar: I mean, I think only if there was more—use of these cryptos for transactions. I mean if they’re just going to be more speculation sources of buying and selling them I don’t think they’re really going to care, but again I think if it’s stretched replacing that the payment system then I think that’s something that would wake them up.

FRA: And would that be a major driver of what you recently mentioned as potential for 90% of Bitcoin value to get wiped out?

Peter Boockvar: Well when I when I threw that out it’s I was really just talking more technically mean when I was referring to typically when an asset or stock goes parabolic, that usually ends up falling to where the parabolic move began and that was 1 to 3000 so that that’s the number I threw out that was not based on fundamentals. It was really just—okay well this is what happened in previous episodes of massive parabolic moves and you can argue that this was probably the greatest parabolic move ever that you typically give back the entire move. Just as the NASDAQ lost almost 90% of its value in 200 to 2002.

FRA: And on the major currencies—dollar, euro, yen where do you see the trend happening over the next year on that in terms of their trend movement?

Peter Boockvar: I mean, I remain Bearish on the US dollar which I guess implies that I’m bullish on the others, it’s hard to get bullish on a yen in light of the monetary Mayhem that’s going on there. But im not excited about the dollar at all, I think the euro surprises to be on the upside as well. I would not be surprised if we saw 130 or 135 at some point because I’m relatively bullish on Commodities I just don’t like the Austrian and Canadian dollars and actually like the British pound. I think that’s the case and dealing with Brexit is everyone still pretty down on them and I think that actually turns out better than feared.

FRA: And what about gold why do you see that market this being a potential for another leg higher?

Peter Boockvar: It’s in part due to my conscious—my bearishness on the dollar and also my lack of any faith that the FED can somehow pull off this this monetary tightening in any smooth fashion. Self-landing is a rare occurrence and I think there is little to no chance that they accomplish at this time around so then the craziness that’s going on with the ECB and the Bank of Japan and I think the bull market again in December 2015 and I was really just getting started.

FRA: And are you still on agricultural fertilizers?

Peter Boockvar: I am. I am extremely bullish, I think we’re beginning to see a slow down and a decline in (unintelligible) stocks for (unintelligible)… in particular, the global demand for food is still in this perpetual rise upward so if the supply situation—can at least get contained, I think that there is a lot of upside or many asset classes that are down 50-75% from their 2011-2012 peaks and the agriculture and precious metals are two of the few that fall underneath that.

FRA: Any other asset classes that you like at this point?

Peter Boockvar: Umm… Those are the two broad ones that I like. Right now the investing landscape is getting more difficult, I mean they’re plenty of one-off situations that are interesting but in terms of looking at it from a macro perspective those are the two that intrigue me. I think bigger picture longer-term I still like emerging markets. I think that the growth rate is there and continue to be better and I think the valuation are much more attractive than in the US.

FRA: Which emerging markets in particular do you like?

Peter Boockvar: I haven’t felt like—so I still like China, again acknowledging the challenges they face, India, Vietnam, I actually like Brazil as well and I actually am warming up to Greece. The Athens stock market is down 85% from its 2007 peak.

and if the new democracy which of the opposition party—If their leader Mitsotakis wins in a possible early election this year or early next year he’s a business-friendly guy that would be a real game-changer for that country that has basically been through its own great depression over the past couple years.

FRA: Yes indeed, and that’s great insight Peter. Thank you very much your thoughts.

Peter Boockvar: Yeap, thanks for having me Rich.

FRA: And just wondering how can our listeners learn more about the your work, where can they go?

Peter Boockvar: If they’re interesting in reading my daily work, they can subscribe to boockreport.com, again its boockreport.com. B double o c k report.com and also the CIO and portfolio manager at the Bleakley Advisory Group and they can check out the website at Bleakley.com

FRA: Thank you very much Peter

Transcript by Alexander Nguyen

04/01/2018 - What Financial Crisis Will Be Caused This Time If Interest Rates Keep Going Higher?

04/01/2018 - What Financial Crisis Will Be Caused This Time If Interest Rates Keep Going Higher?

03/28/2018 - The Roundtable Insight: Bill Laggner On How Blockchain Will Revolutionize The Economy

03/28/2018 - The Roundtable Insight: Bill Laggner On How Blockchain Will Revolutionize The Economy

03/28/2018 - The Roundtable Insight: Charles Hugh Smith on Automation, Robotics and Universal Basic Income

03/28/2018 - The Roundtable Insight: Charles Hugh Smith on Automation, Robotics and Universal Basic Income

Download the Podcast in MP3 Here

03/22/2018 - The Roundtable Insight: Yra Harris On The Fed, Trade Tariffs, Italy, Gold & Currencies

03/22/2018 - The Roundtable Insight: Yra Harris On The Fed, Trade Tariffs, Italy, Gold & Currencies

Download the Podcast in MP3 here

FRA: Hi, Welcome to FRA Roundtable Insight .. today we have Yra Harris. Yra is a independent trader, successful hedge fund manager, global macro consultant trading foreign currencies, bonds, commodities and equities for over 40 years, he was also a CME director from 1997 to 2003. Welcome Yra.

Yra: Richard, nice to have you back from Argentina, I haven’t seen you the last time since you were in Singapore so–I cant really follow you. You’re like Waldo.

FRA: Ok, sure. Maybe we could begin with a feedback on what happened on this afternoon, federal reserve, FOMC (Federal Open Market Committee) needing your thoughts on fed share, Jay Powell statement and press conference.

YRA: Yeah—you know, It was interesting that I was just watching the CNBC before we starting going on and Rick Santelli hit it right on target. I’m a fan of Rick, but we don’t always agree. But he had it on target. The one good thing Jay Powell did is he basically said stop relying on (unintelligible]\), because when they go out, the main stream media loves them because it’s an easy way to understand the fed for what they think is understanding… The fed so they can ask questions about it and he basically—you know—These are projections you know—they kept asking about it and asking about and Powell was very (unintelligible) when he said we made a decision today, to (unintelligible) projections and projections you know are just there. projections, they’re not worth the paper that they’re written on and if you follow the fed and their history with their dot plot, they’re a joke and as I wrote last night, you can go back 2006. Our cash in was far better at comprehending where the economy was than those dot plot projections and that’s just our—being, you know all that wisdom. So I just cant stand these dot plots I wrote in the blog last night that he should erase 50 basis points today and put to rest by doing that. Put to rest to dot plots and say yeah you know what we’re going to watch things here. But with raising 50 points and holding until the balance sheet shrunk to $3 trillion. I think he would of done the market to a much greater service because he would of let markets be markets and if there’s one thing that I really like about Jay Powell is that he does have an understanding on the way market works and he seems to be more willing to let markets work and get rid of the theoretical nonsense that fill the air ways with the feds press conference. I do applaud what he did except that I really would of like to see 50 basis points in a whole. Not that I would you know, bullish or bearish the stock I care not about that one way or another cause, I’m going to trade what I see anyway and react accordingly. But it would of put feds note to me a much more interesting position and you know what they got to stop cow toeing to the markets. You know I like what he was doing while the markets were correcting back in February. That he even had Dudley say that 10% drop is small potatoes, so we need to become more market focus than fed focus. That is the end of that story.

FRA: Now instead of the 50 basis point, the raise being only 25, do you think that the fed independence is coming under pressure by the US administration by president Donald trump?

YRA: Not yet, but it will, it will and a lot says about it again is that he talked about it last night and ill expound on it is that, look it. You read every central bank release, whether it is the ECB, Swiss National bank last week was the paradigm of it cause all they talked about was setting policies relative to the currency.

The Australian bank discusses the value of the currency, every central bank (unintelligible) everybody is out there parading this concept of independence of central banks. while they’re all discussing the importance of the currency values when setting their interest rate polices.

Certainly the Japanese, so its all being done so—with the—Donald Trump wanting to turn around the trade deficit, you can’t help but say hey maybe they are actually onto something because they have an independent central bank well—(unintelligible) the independent central bank that goes upon its course based on what its seeing here you know based on domestic economic activity, while everybody else is setting it to international standards then tariffs become the—I guess the alternative especially when the feds is raising the interest rates and they’re the only central bank really raising interest rates… I know… the bank of England went half a basis point, quarter basis point and they are project to go a quarter basis point tomorrow which we will see. But everybody is looking at the international situation and when I read the fed today there wasn’t one statement about it. Of course we did have Powell and little brainer discuss head wins to tail wins which is on the growth of the international economy but everybody goes through currency value when discussing interest policies.

FRA: So with the feds shrinking its balance sheet and raising short term rates—Likely making the US dollar stronger, will that promote tariffs more on the trade tariffs?

YRA: well I think that if the dollar got stronger, you would see much more action… But the dollar hasn’t gotten stronger, so there’s something else or a few other things that are seem to be weighing on the dollar. Now Powell was asked about that and he spoke to—you know—enhance growth, I’m not sure that there’s enhance growth over Europe anyways, I’m not… I need to see a lot more because if that’s the case then the European equity market should be out performing but you know what? They’re way underperforming the worlds equity market. So I’m not quite buying into that argument yet, but you know I’m going to wait and see first. I just need to see more before I go down that road. You know there are many things in play here which we will see which is why we are getting an increase volatility on a global basis.

FRA: And you’ve written recently on thoughts by commerce secretary Wilbur ross in terms that there will be no trade war… Trading partner of the us will compromise on trade treaty, how would that factor in the US dollar, like the potential US dollar devaluation?

YRA: well you know that’s right, that’s what I call the Kudlow dilemma, Kudlow of course when he got into his post, chairman—chief economic advisor to the president, he said you know (unintelligible) dollar and short gold. Well, not so fast Larry. First of all, be very careful about this because if you have king dollar which Kudlow means a strong dollar. Now we all like a strong dollar if its done—If its effected by good policies, but bad policies and a strong dollar, well that’s not such a good thing. You know—I’m not (unintelligible) grow your way out. You may inflate your way out of your debt problem but you’re not going to grow your way out of the debt problem, so let’s get behind that and if the dollar got too strong then the impotence from the white house would be to have more tariffs because they are hell bent on shrinking this trade deficit so when Kudlow discusses that, he ought to be very careful about where he is going because this white house, Peter Navarro and Wilbert Ross will push for a weaker dollar because a weaker dollar is Mnuchin and Wilbert Ross both said in Davos, is sending soldiers to the ramparts in the trade war that exists every day. So, Kudlow, that’s the Kudlow dilemma. It’s going to be interesting to see how he deals with this. But if, you were to get a dollar rally or even what (unintelligible) said and pretty sure wrote in earlier the week when he talked about a possible rip your face off dollar rally. He was quoting what’s his name (unintelligible name) about that. I’d be very very careful with this administration, they will not tolerate a strong dollar at this point in time.

FRA: And if that were to happen what would be the mechanism to effectuate that through monetary policy with the fed with its independence be compromised?

YRA: Yes! That’s a very good question, we don’t know but you would have the treasury secretary just like he said in Davos talking the dollar down which everybody took great umbrage at, but we’ve had that before, you know—One of my issues with Kudlow—(unintelligible) I respect him for his intelligence, he’s been around a long time. He was a Reagan guy, but you know what the Reagan white house lead the battle through James Baker with the Plaza Accord. The Plaza Accord was an orchestrated attempt to drive the dollar down and how is it done? Really—by sitting everybody down in the plaza hotel and reaching this compromise. We’ll pay because the trade deficit are now going to become an issue for wall street in a way that they haven’t in many many years and they are going to start to effect the movements in the market. Not quite ready yet but these algorithms who think that they have factored in every variable that you need and every headline, they are going to be disrupted themselves by the coming impact if the trade deficit continues to grow. This white house will not sit quietly and they made it an issue, and coming into the election this is going to be an important issue for Trump to hold onto his core constituency.

FRA: And thinking globally—how do you see everything playing out in terms of trade. Will Europe introduce measures to protect against Chinese trade and Chinese investments? So you got Europe Asia the U.S., how do you see it playing out?

YRA: well—we’ve seen that already. There was that article FT (Financial Times) earlier in the week that was talking about how Germany is upset that China is targeting some of the corporate jewels of Germany and… believe me the French are the most protectionists trade orientated going back to— (unintelligible) and I don’t care what Macron says because he inherited that it’s a long standing French tradition—so you know what? As the United States leave the battle, you will see that they will all start tail coating… What the white house is trying to accomplish, so while the white house gets beat up today, it gets beat up today because its easy to beat up on the Trump white house for so many missteps that they made. You watch that the European will follow right on top of this, because they have as much with the Chinese and they run. you know—pretty good trade deficit with the Chinese themselves so lets pay attention to what really is going to take place here.

FRA: And ultimately could we then get global competitive currency devaluation—another round?

YRA: Well I think we already have them. You know even with the yen at 103, 104 or 105, the yen is weak and fairly dramatic especially against the euro currency as we’ve talked about for 3 or 4 years already. That has been an interesting play and even I think that the Europeans, especially the Germans have had enough of the weakness in the yen. If you listen to (unintelligible) again, (unintelligible) very upset in January that Mnuchin and Ross, you know—for the D20 agreed not to target their currencies. Well you know what? Who you fooling? Of course, go read the Swiss statement from the release last week when they held their interest rates at negative 75 basis points. It’s all directed against the currency and the Japanese, every time when you listen to (unintelligible) talk, well—we’re not quite ready we need to see inflation. It’s just a nice way of saying we are going to keep our interest rate policy as it is because it keeps pressure on the currency. Come on, let’s call it what it is. They’re all targeting their currency values by using their interest policies for domestic purposes, but you know what? Many variables are in play here which is what is leading to the heightened increased in volatility. And as we’re talking right now, gold is up 23 or 24 dollars and silver is up 45 cents. This is after a fed increase. The dollar is on its lows, stone cold on its lows. What’s going on here in the market is were going to find out. There’s definitely some significant moves and most importantly is that there are two ten yield curve steepened today. Because… of course they changed the dot plot where it seems that there are going to be three rate rises this year so everybody thinks it’s going to be pushed out further and the feds is not going to be as aggressive as previously thought. So the yield curve, the two ten actually steepened out about 3 or 4 basis points as I’m sitting here.

FRA: Hmm.. Do you see president Donald Trump implementing section 301 of the 1974 trade act where the president can impose duties—If there’s like a perceived violation of trade agreements?

YRA: Yeah… that’s a great piece (unintelligible) last week when they were or two weeks ago when they were discussing 232 on the trade expansion act in 1962 under Kennedy which was interesting when it was passed in October of 1962, that was during the Cuban missile crisis. But they put in these—section 301 of the act in 1974. They put them in just because it was the only way they could get these trade agreements through, is that there is leverage against what they deemed at target as unfair traders so in order to get congress to be able to sign onto it there has to be opt outs based on sort of penalties. So yeah, they’re going to vote. We’ve seen it before with the Japanese in the 80s and the 90s was one of the strengths of the Reagan movement to enact 301. They’re going to use whatever they can—like yesterday we saw them soften some of their demands about 50% car parts in US auto—for NAFTA but they soften on that. Of course, and we saw that the peso. The peso reality and the Canadian dollar was really strong today. There are all types of mechanisms in place where they’re sending messages. Hey you better sit down an pay attention, were serious. We put the seal of tariffs down. (unintelligible) yes we backed off a little bit. We have a lot of tools at our command and we are serious about writing some of the wrongs that we have deemed to taken place in over the last 30 or 40 years. You must pay attention to it because, they have shown that they are serious about this, so they are trying to get better negotiating in so Trump can stand tall and say see. See what I did? I over turned some of these past malpractices and it’s going to help us as business returns to the United States.

FRA: will any of this affect U.S. agricultural exports to china?

YRA: well—It will—there is some rattling, we can see hog prices go down, cattle prices go down, some grain prices are holding up pretty well. Even as we are coming into the Brazilian and Argentinian year grind, the south American harvest will bring a lot of supply into the market. Prices are holding up very well, now that the Chinese may threaten the U.S. agriculture and as you know Wilbert Ross strategically laid out—you have to give them credit because they have done their homework and said look it, they’re still going to be buying our soy beans, I’m not buying it but what Wilbert Ross—I think is timing is wrong on the steel and aluminum because the Chinese, there’s so much—Brazil at a record crop this year. The timing wise is bad, we should of waited about two months for the crop to be harvested and for those to be all distributed somewhat and then laid it out because then the Chinese would have less flexibility. Right now they have flexibility because they can buy more Brazilian beans right now and stick it to the US farmers which could really hurt trump in the November elections, because the American farmers are doing very well. This has been a discussion since the China lobby back in the 1940s. the American heart land wants to do business with china, they always wanted to do business with China and when they embargo China, in the 1940s and 50s when Mao came into power, it hurt the American farmers because it took all those businesses with Taiwan versus the peoples Republic of China stunted American export to a billion people. The Chinese number one have to feed their people, end of story and their growth of Chinese purchases of soybeans which is huge because of the diet changes and more protein base especially with higher grades of protein. You have to feed those animals and a lot of soy meals and the Chinese eat a lot of soybeans. So that demand curve goes ever higher, that’s just not going to change… we’re seeing 10 dollar soybeans which is historically pretty high soybean prices and that’s with record supply. You know—agriculture responds very well to capitalism as prices go higher they produce more, but the demand from china and other countries that have now reach much higher per capita income they consume much more protein so prices remain high no matter how many beans come onto the market.

FRA: Yeah. And the soybean meal needed to feed the chickens, there used to be a saying that they only had chicken on Chinese new years but now they have it every day. Finally, your thoughts on Italy, recently you mentioned the markets are underestimating the importance of current Italian political situation and your reference to Picaso dream.

YRA: The market has fallen asleep, they think that there’s going to be some type of center based coalition that everybody (unintelligible) and that the league are going to get tired of trying to deal with five stars—I think it’s a gigantic mistake because 69% of the popular vote in Italy went to the center right including 5 star and if you try to push them out in order to form a coalition that pleases the eurocrats in brussels and status quo in Italy. Well—(unintelligible) I think you’re going to be running into a major problem and I think that the markets are way underestimating the influence of this. And you get again (unintelligible) I can take or leave most days, but he’s been very good with this. In fact, he’s been writing his warning about what’s taken place and you better pay attention to it. It’s no—Its nothing that is insignificant but the market seems to want to downplay it but we’ll continue to watch this. You know, I laugh because we’ve discussed the European financial institution have a severe problem and if you look at the stocks on the European bank, the deutsche bank—(unintelligible) but all the banks are suffering because the amount of non-performing loans have no been resolved, especially in Italy. So they need to really work this out and yet the 5 star and the (unintelligible) really want to push into… you know what we don’t care where the restrictions are coming from—(unintelligible)—budget deficits, we need to get the economy going and the Italian economy even with these ridiculous low interest rates is not showing enough growth and more importantly with these low interest rates, the debt to GDP ratio, it will be sitting around 132% which is enormous with a much lower borrowing cost, so Italy as you know—major problems facing it. (unintelligible) knows and 5 star knows they’re going to get their way because Italy is not Greece, Italy is far too big… far too big and their impact upon the entire global financial system therefore becomes much greater and as it is how to all work out. This is a very interesting time and yet the market is complacent trying to look past it. But I’d be very skeptical about that.

FRA: Wow. Great insight Yra. How can our listeners learn more about your work?

YRA: Well.. You can certainly go to the financial repression authority, we have a treasure trove of discussion but on a daily and weekly basis. I blog from notes underground which you can get and register for free if you go to YraHarris.com you’ll be able to access it and—as much as I write, respondence to the blog are at such a high level of discourse that, that makes it a must go to place because we really discuss very important things and its done at a very high level I’m proud to say.

FRA: Yeah, excellent. Yeah, great, thank you very much Yra, thank you.

YRA: Richard, thank you as for the opportunity as always, we do get into a good look under the hood as we say.

FRA: Yeap, and we’ll do it again another time. Thank you Yra.

03/18/2018 - The Roundtable Insight: Gordon T Long Talks With Dr. Lacy Hunt

03/18/2018 - The Roundtable Insight: Gordon T Long Talks With Dr. Lacy Hunt

03/04/2018 - Danielle Park: Pensions Are Now Crushing Budgets

03/04/2018 - Danielle Park: Pensions Are Now Crushing Budgets

“The elephant of unsustainable pension management has been sitting in the theater of retirement planning for at least two decades. Now it is taking center stage. As obligations have soared, contribution levels have not kept up and management has opted for increasingly risky bets in the hopes of ‘winning’ the funds needed. It’s not working.

Plans that were fully funded 20 years ago, today have maybe two-thirds of the capital needed to cover benefit promises– and that optimistic estimate assumes zero bear markets and fantastical average real returns of 7%+ a year going forward.

The reality of the pension crisis was underlined again last week when the board of the largest $330+ billion US public pension plan, California Public Employees Retirement System (CalLPERS), voted to shorten its period for amortizing future investment losses from 30 years to 20 years. After losing $100 billion in 2008, followed by 10 years of QE-enabled capital markets since, the fund still has not recovered.

The net effect is that state and local governments and agencies will have to further increase mandatory contributions by diverting tax revenues needed for education, health care, roads, environmental protection and other public services.

…

Solutions include lowering benefit payments and indexing, delaying retirement ages, increasing saving/contribution levels, and in some cases expunging obligations in bankruptcy. None of these are popular, but this is reality.”

03/04/2018 - Martin Armstrong: The Crisis In Pensions

03/04/2018 - Martin Armstrong: The Crisis In Pensions

“The pension crisis at CalPERS is getting closer by the day. The State looks to be totally bankrupt by 2021-2022. CalPERS has just decided to increase the contribution of local governments and cities to their fund. The cities say they are approaching bankruptcy because of rising subsidies, but CalPERS itself is approaching insolvency. The problem is that there really is no real reform in sight. The choice is clear – CUT pension benefits of government employees or RAISE TAXES!. CalPERS simply needs a bailout and very soon.

Board Member Steve Westly even told The Mercury News that a bailout was needed and soon. Currently, CalPERS manages approximately $350 billion of future pension claims of its members. Recently, CalPERS passed an amendment to the statutes, which resulted in higher contributions for the California municipalities. The amount of contributions has been increased several times over the past few years and this time the cities do not appear to be able to handle the increased costs.

Once CalPERS was 100% funded with assets under management. In fact, they had a surplus in the good old days before Quantitative Easing. Right now, the system no longer has more than two-thirds of future claims. CalPERS itself expects an annual return of 7 percent on its financial investments. Most pension funds run by the States are insolvent or on the brink. This is what I have been warning about that the Quantitative Easing set the stage for the next crisis – the Pension Crisis. The Illinois Pension Fund needs to borrow up to $ 107 billion to meet its payment obligations. Promises to state employees are over the top and off the charts. This is why Janet Yellen at the Fed kept trying to raise rates stating that interest rates had to be ‘normalized’ for this was the crisis she knew was coming. And guess what – Europe is even worse and Draghi will not raise rates for fear that government will be unable to fund themselves.

There is NO WAY out of this crisis. The portfolio would have to be completely restructured and benefits reduced. Jerry Brown will do everything in his power to raise taxes and fees to try to hold CalPERS together. That is by no means a long-term solution.”

03/04/2018 - James Grant: Putting The Cart Of Asset Prices Before The Horse Of Enterprise

03/04/2018 - James Grant: Putting The Cart Of Asset Prices Before The Horse Of Enterprise

Grant’s Interest Rate Observer founder on moving rates from CNBC.

03/02/2018 - The Roundtable Insight: Charles Hugh Smith On The Current Conditions In The Financial Markets

03/02/2018 - The Roundtable Insight: Charles Hugh Smith On The Current Conditions In The Financial Markets

Download the Podcast in MP3 Here

02/24/2018 - The Roundtable Insight: Jim Bianco, Yra Harris & Peter Boockvar On Investing Implications Of Volatility & Inflation

02/24/2018 - The Roundtable Insight: Jim Bianco, Yra Harris & Peter Boockvar On Investing Implications Of Volatility & Inflation

FRA: Hi, welcome to FRA’s Roundtable Insight. Today we have Yra Harris, Peter Boockvar and a new guest, Jim Bianco. Jim is President and Macro Strategist at Bianco Research. Since 1990, Jim’s commentary have offered a unique perspective on the global economy and financial markets. Jim’s wide-ranging commentaries have addressed monetary policy, the intersection markets and politics, the role of government in the economy, fund flows and positioning in financial markets. He is a Chartered Market Technician (CMT) and a member of Market Technician’s Association. Yra Harris is an independent trader, successful hedge fund manager, global macro consultant while trading foreign currencies, bonds, commodities and equities for almost 40 years. Yra is also the CME Director from 1997 to 2003. Peter is Chief Investment Officer for the Bleakely Financial Group and Advisory. He has a newsletter product called the Boockreport.com. His great macroeconomic insight and perspective with lots of updates on economic indicators. Welcome gentlemen!

Jim: Thank you!

Peter: Hey Rich!

Yra: Thank you, Richard!

FRA: Great! I thought we’d begin with a discussion on volatility. We did a podcast recently with Chris Whalen about a week before the volatility began in the financial markets; this year volatility to a significant extent. Jim, have you been seeing that as a trend through your research or what are your thoughts on that?

Jim: Not as a trend. Pretty much the opposite. Volatility events like what we’ve seen over the last couple of weeks are not the creation of a trend, they are the exaggeration of a trend. So there was a trend in place already and that trend in place was a turn towards more volatility. The turn towards more volatility was driven by a belief that, for the first time in the post-crisis era, inflation was returning. I’d get technical on you for fifteen seconds. What happened with the volatility event is we caught a short-ball traders on the wrong side of the trade. They did one simple narrow thing; blew up the VIX Market. The volatility measure on the S&P 500 Index option. That’s all they blew up. When we found that that spiked from 12.5 to 50 in two days, we found out how important the VIX is to everybody else. It was their measure of risk. When they saw it go up 400% in two days, they overreacted and the next thing you know, the DOW is down 1600 points. What I want to emphasize is they didn’t create the trend. The trend is towards higher inflation and that higher inflation would bring higher volatility and they got caught in the wrong side of it. All derivative debacles like this are an exaggeration of a new trend that everybody got caught on, not the creation of it.

FRA: And Yra, your thoughts on that?

Yra: You can’t say it better.

Peter: In 2017, we saw a hiccup in the US. The Fed decided to raise rates three times instead of one. Let’s start shrinking our balance sheet. That was overwhelmed by the Bank of Japan and ECB. In early 2018, when rates continued to rise, when the inflation pressure started becoming more evident that this is not a short-term bliss. Maybe this is the beginning a more normalized interest rate trend. One of the analogies that I’ve given in the past is when the central banks are full on easing, it gives investors goggles and it makes everything look perfect. When that starts to change, when that liquidity flow starts to slow and rates start to move then those goggles start to clear up a little bit. Monetary policy became more important. Markets are very reactive nowadays. (5:03 – 5:06 would not play. The audio automatically skips it). All of the sudden it woke people up and said,” Uh oh. This is a big deal. This is twice the level of what it was in the summer of 2016. I better start reassessing my positioning. I better start reassessing my leverage. I better start reassessing what valuation I want to place on the S&P 500. VIX and all these other things became a symptom, of what I call now, a disease of rising inflation and rising interest rates that then caused this explosion in volatility.

Yra: There’s been an argument in the market place that inflation is rising but so what. Higher interest rates is not a bad thing. They take the idea that when it comes to inflation, it is either Zimbabwe and it is really bad or it does not matter but there is a middle ground in there which is critically important. I’ve been saying people to stop talking about the Fed. Central banks as a collective, are the easiest they’ve ever been in the post-crisis era. Their balance sheets are the highest they’ve ever been in the post-crisis era this week. If inflation returns, it puts into jeopardy that we’re gradual. Bernanke said,” We are going to get balance sheet back to $2T to 2.5T and it could take until 2026. He wrote it in 2016. It will take 8 or 10 years to get that. If we have inflation, maybe that 8 to 10 years is now 2 years. By the end of the year, you’re going to have a contraction out of the ECB and the BOJ. That’s where inflation matters. It’s going to force central banks to pull in a lot faster than people thought. One last thing. Wall Street runs into this trap all the time. Somebody points out a risk, everybody looks at their watch and says,” Well, we waited eight minutes. The market has not blown up. I guess that risk does not matter.” There’s a risk from all of this money printing. For the first time in nine years, we have an inflation fear and is now putting doubt in central banks. Now, what’s the first thing that markets do? They have a ___ (7:41 inaudible and the podcast skips it) over that. I think that this inflation fear that makes everybody say,” Bring it on! 3.25 is really good in interest rates.” Be careful what you wish for because that is going to cause a reversal especially in the BOJ. If we continue to see global inflation fears rise, the Fed is already tightening right now, that’s why I said do not talk about central banks. This should be a big deal for markets in 2018 and most people continue to dismiss it.

Peter: Just to add on, with respect to what you said, Jim, on balance sheets being at record highs. The analogy we have given out is that yes, they are at record highs but balloon with the air being central banks easing. There’s still air going into that balloon but there’s less air going in. If there’s less air going into that balloon, that balloon is still going to contract. I think it’s the rate of change that is really changing dramatically in terms of central bank (8:41 podcast skips it – inaudible).

FRA: Could the return of inflation force all central banks to accelerate their exit strategy or just some?

YRA: (9:03 – 9:07 inaudible) was just reappointed with a very (9:08 inaudible) group around him. (9:10 – 9:22 podcast skips it). … stand on fiscal policy is used on the sales tax. Draghi dug himself into a hole. (9:25 – 9:52 some are skipped and inaudible). … How do you get out of this? Peter and Jim are both right. Forget about the Feds. Everybody follows the Bernanke book but they’re stuck in a situation here. To me, that’s really dangerous.

Jim: One quick thing about the ECB. Draghi’s term has a little bit more than a year to go before he’s done. The tradition in the ECB is that the next ECB Chairman will probably be German. It does not have to be a German but probably will be a German. That’s code word for a very hard money person. If you’re going to get inflation and you’re going to get a German to run the ECB, you’re going to get a violent reversal in the next eighteen months. Look at two weeks ago. Two Thursdays ago when the DOW was down 1000 points, what was the catalyst story that everybody said? There’s inflation in the UK and the BOE (Bank of England) might have to double the rate hikes that they’re going with. When was the last time the BOE moved the US stock market? That might’ve been the first time. It’s all because of this idea that central banks is maybe peaking soon and starting to reverse. We haven’t had to deal with that possibility until the last two or three months. It was only in the last two or three months that we’ve only really started to see inflation. What Yra said is right that maybe Japan continues to pump money but they might not be enough to do it. If everybody else is going to reverse, then those global central bank balance sheet will peak. These markets will have a digestion problem with that.

Peter: Just to add on to what Jim said, even the Riksbank in Sweden, which is not necessarily relevant for the global economy, experimented with negative interest rates along with others. It’s a good symbolic gesture. They said they’re going to start the process of getting out of negative interest rates well before the ECB starts. Just going back to zero from negative is going to cost an extraordinary amount of loss. The ripple effect that that’s going to have on the world, I don’t think the people will appreciate it. I like to remind people in terms of the concept of risk happening fast. It was 2015 when, the German 10-year went from 6 basis points to 60 in one month and from 60 to 100 points a month later. This is Germany. Not Greece. Not a third-world country. This is a country that went from a 6 basis points to 100 in less than 2 months.

FRA: How could all of this translate onto a change in basic relationship between stocks and bonds? Jim, you mentioned there would likely be a change on that once again?

Jim: First of all, just as a point of emphasis. One of the things that could change it back another way is that if the doubt of inflationary fears go away. There was a mild form of inflation fears about a year ago and then it went away. The difference between now and a year ago is that we’re finding out that the market, collectively, is a bunch of Phillips Curvers. They’re looking at the stimulus from tax cuts, possibility of infrastructure spending, strong growth and that they’re concluding we’re not going to have inflation after we spend thirty years trying to say that the Phillips Curve does not creation inflation. If it is decided that there is inflation, then there is inflation. That’s where it is coming from. To your question about the stocks and bonds relationship, it changes all the time between the way that stocks and bonds trade together. In 1998 to 2000, it changed. What I used to call is under the inflation mindset. In the 1960s to 2000, the starting point of every discussion was, are we having inflation? If the answer was yes, if bond prices went down then stock prices went down. If the answer was no, the 80s and 90s, were not having inflation, then bond prices went up, interest rates went down went up. Bond prices and stock prices move together. Starting around 1998 to 2000, we switched that dynamic because we were worried about deflation. During the middle of that dynamic, we had long-term capitals, the Asian crisis, the tech bubble, sounds like the derivative thing we’ve been talking about the last few weeks as well. Throughout the 2000s until very recently, we worried about deflation. Are we having deflation? If the answer was yes, equity prices struggle. If there was no deflation, then equity prices went up. So now bond and stock prices move opposite of each other. What we’ve seen in the last few weeks is the decline of bond prices and stock prices together since the financial crisis that they both went down together. The day the DOW was down off 300 points. Up until 60 days ago, if you just randomly told me in the last nine years that the DOW was down 300 points, I would’ve said (16:40 – 16:42 inaudible). That’s the way we traded every single time. I think we’re shifting to an inflation mindset. Now where does that matter? In the last nine years, Wall Street has pushed this idea of a 60:40 portfolio. That it’s the optimal way to invest your money; sixty percent in equities and forty percent in bonds because something is always going up. Either there is no deflation and stocks are going up or there is deflation and bonds are going up. But under the new scenario, either they’re all going up or they’re all going down. Both of them have been falling together. So this idea where you can take a lot of risk with a 60:40 portfolio is going to be blowing up on people’s faces. This means that the relationship between stocks and bonds are transitioning right now. It takes around two years to fully transition it. I don’t know if it will take fully two years now but it will take at least months to do it. There will be periods where it does look like they’re transitioning but I do think that we’ve started that process.

FRA: And Yra, do you see that relationship also changing?

Yra: Yes. This whole risk parity. To me, what people don’t understand, is especially on the issue on how you get of out this. Ray Dalio said you’re going to shed tears if you earn cash. Talking about a coming change. That’s in a two week time period. It scared me. Ray Dalio is a great thinker.

Jim: Just to emphasize something on what Yra said that the single hardest thing to do for anybody that’s investing is to recognize the regime that the old rules stopped working. Most people can’t and they keep pounding away with the old rules until they are out of business. The single hardest thing to do in any type of investing is say that we’re now in a regime shift. If you’re wrong, you get wiped out and if there’s no regime shift and you say it is, you also get wiped out. If there is a regime shift and you don’t adapt, you get wiped out. That’s why we have this volatility and blow ups along the way.

Yra: That’s right. And what I think people fail to understand is not just Dalio’s position. It is everybody that has handled this book and tail-coated it. I know a lot of people in banks or foreign exchange traders who made a fortune and have tail-coated George Soros in the BOE. If BOE reacted like the Bank of France and raised interest rates to 100% and said,” We’re just going to do whatever we have to do and you have to pay the cost.” He wasn’t successful in breaking the (2:38 – 2:40 inaudible)… to exit that train would’ve been an enormous pain for all the people who followed them in. So whatever you think Dalio’s positions are, which I think are enormous is tail-coated and recreated the same trades in many other ways. I think that’s what we’re told in the last two weeks. He’s got a lot of company in this low volatility place.

FRA: And Peter, your thoughts also?

Peter: I also think a lot of people lost perspective on the markets. When you turn on the T.V or the radio or when you read the paper, while earnings are great in the economy’s trade and therefore stocks are going to go up and I just want to point out that that’s from the end of 2012. So the calendar year at the beginning of 2013, the January 26th peak at the S&P, the S&P 500 was up 100%. Earnings since then, assuming 2018 assuming $100 to $150 per share, earnings should be up 60%. So the differences is actually multiple (21: 52 Inaudible). When interest rates rise or when people reassess what central banks are doing, why should people pay eighteen times their earnings? All of a sudden, within a week and a half, they decided let’s pay sixteen times with a one dollar change per earnings per share. Every one-term PE is 155 points (22:15 podcast skips, inaudible) while when we’re talking about two-term PEs, that’s 310 points. I think people need to have perspective that the stock market has ran well ahead of the rise in earnings and the difference is PE multiple expansions. It is now compressing because of the new regime change that we were talking about.

FRA: Could the rising interest rates in the U.S. cause us strengthening in the dollar (22:46)… rising defaults in the U.S dollar denominated debt in emerging markets which is estimated approximately $9T? Could that happen or could it also spur a financial crisis in Europe out of the bond markets? Would that mean that international capital flows coming into the U.S. towards U.S. dollar denominated assets? Just some potential scenarios. Jim, your thoughts?

Jim: I would come down on the idea of ‘no’. Let me explain what I mean by ‘no’. There’s this perception in markets that there’s all this money. There is no money heaven. No one ever loses this their money, it just gets allocated around. When the stock market goes down, but all the money from the bond market will come in to replace the stock market money that went down. I do not think you’re going to see some kind of reallocation where everybody is going to come running into the United States and it’s going to (23:53 podcast skips it, inaudible) the U.S. stock market and it is going to hurt them as well. I think the problem with the dollar, and I’ve been wrong with the dollar for several months now, is that the speculative flows are at record highs for some of them. Everybody is selling the dollar or is shorting the dollar right now. This has been keeping it unnaturally strong. If you wanted me to guess why we’re getting a persistent selling of the dollar, foreigners are basing their investments on who the president of the U.S. is. Sell the dollar. Investors have finally realized that it doesn’t matter. Eventually, that’s going to come back to foreigners and make them realize it matters. Your investments in a political idea might see a strengthening in the dollar. But are you going to see some kind of a wholesale run into the dollar that you were suggesting “no, I don’t think I’m going to see that.”

FRA: Yra, your thoughts?

Yra: I haven’t (25:12 – 25:13 Inaudible) … since Mark Fields’ comments back in 2017. Now, I’m fairly neutral towards it because it’s been a (25:24 inaudible) for people because interest rates in the United States are going up and (25:28 – 25:38 podcast skips it and inaudible). I’m scratching my head. If the deficit scare is real, I think what they did here by blowing the budget apart and the stimulus is that the people are a bit nervous. I don’t disagree with Jim because I’m really neutral with the dollar. If we go to real yields, Peter wrote about it today, the least positive on the short end of the paper rate I’d say is about 40 basis points based on the number that we have. The dollar would get a kick especially if the other central banks are just sitting there complacently because they would like their currencies to weaken anyway. I think Mario Draghi would like the Euro to weaken. I think the Japanese policies are driven by the desire for a weaker yen with the Trump agenda. People are being conscious and would like to see the dollar strengthen in relative to their own currencies. So, I’m going to wait. I don’t really have a good sense to where we go from here.

FRA: And Peter, your thoughts?

Peter: I’m bearish on the dollar in the short-term but considering the moves it has had, I’m definitely more uncertain about the very short-term move. We went into the year saying they’re going to increase the rates three times but then the markets really doubted it and now have the rising inflation that is probably happening. Higher inflation that’s not met by a rising Fed funds rate is typically dollar bearish. The Fed is going to raise three times this year. Take the Fed’s fund rate to a real rate of zero. That, of course, is well above where it is overseas, especially in Europe and Japan. But there is a reality that people still think it’s jamming around 2.0 even though maybe he’s not. But it’s still going to be on its gradual path. So there’s no way the Fed is getting ahead of the curve. They’re still going to be playing catch-up on top of better overseas economies that’s drawing dollars into other areas of the world. There are secular headwinds to the dollar but I’m less certain. I was very certain when the euro was 1.05 but much less certain when the euro is 1.25 in the short-term. I would not be surprised if, within the next two years, we see the euro at 1.40. It would not surprise me at all if we see the pound at 1.60. That’s were eventually heading within the next couple of years.

FRA: Jim, you mentioned this whole environment could be like the 90s when the markets went down and everything else. Where do investors and traders go to?

Jim: That’s the old 60:40 risk. Something is always going up. Yeah, I guess somebody is going to win the lottery today too. If an asset class is going to be rising, the answer is that they’re going to be small. Commodities might be rising but 95% of the money in the world is not in commodities. We’re creating a new asset class; cryptocurrencies. I, personally, think is an outgrowth of the rejection of policy. Inflation pressures financial markets. They go down. Stocks go down. Bonds go down. That was, ask Yra, that was the 1970s. I’m not saying we’re going to have high levels of inflation but what we’re going to have is that the stimulus will give you an appearance of high levels of inflation. So, I think that it’s going to be very hard to find, other than special situations like in the commodities markets, beyond that is going to be very difficult to find ideas where you can profit while returning to an inflationary environment.

FRA: And Yra, your thoughts?

Yra: I agree with Jim. What we’re going to see is (31:01 – 31:08 inaudible). Let’s say that the Phillip’s Curve may be able to get it right for a short period of time. We get higher interest rates. And now (31:27 – 31:30 inaudible)… 60:40 because they are both going to go down. I’m not a Phillip’s Curve advocate but if inflation does that. Those are both detrimental for corporate profits because rising wages with rising interest rates (31:42 – 31:53 inaudible). I just don’t see it. I know Peter has looked at this. (31:01 – 32:07). All these companies that borrowed a lot of money (32:09 – 32:15 inaudible). Take the interest rates expense, it is down to a really low level but we know that’s not going to last because for every one percent rise in the cost in borrowing, it’s going to hit discretionary spending levels dramatically. People are in for a shock here. It is really fascinating that (32:39 – 32:52 inaudible). It really does not make any sense. We’re much more worried about inflation. We know how to deal with inflation. In an interview that he did. So, you’re going to get into a feedback where at 60:40, they’re going to be sorry.

FRA: And Peter?

Peter: Just to quantify on what Yra said in terms of profit margins, lower labor costs and lower interest expense are the two biggest contributors for corporate profit growth from the 09 bottom. Just to quantify, there is about $13.5T of total business debt. So for every 100 basis points of interest cost, is $135B. Now, obviously, a lot of companies have turned down debt. But, generically speaking, in terms of labor costs, companies pay about $7T of labor cost every year. Let’s just combine that. (33:50 – 34:00 skips and inaudible)… higher costs that more than offsets the cut in the corporate tax rate from 35% to 21%. A lot of the estimates that is out there for earnings per share are all else equal analysis. It does not take into account higher labor cost and higher interest cost. When a lot of (34:23 – 34:24 inaudible) come out with their year-end price targets, it doesn’t include a lower PE ratio. It is static analysis. In terms of where to survive here, I would not be surprised if a two-year T-Bill paying 2.25% interest rate outperforms the equity market in a broad basket of corporate credit over the next few years. I think the commodity space is very interesting. I know a lot of people like to look at the demand side in terms of dictating prices but since that 2011 – 2012 peak in commodities, the (35:03 skipped) collapsed. Not only industrial metals, but also energy and particularly agriculture, which I’ve been very bullish on and on my belief on the dollar, I think gold and silver will outperform most equities and certainly fixed income within the next couple of years.

Jim: There’s $13T worth of debt and most of it has been turned out. This means rates goes up now but I’ve got 3 – 5 years to maturity. So I don’t see risk immediately. In the last ten years or so, there’s been a lot of people that have been turning up their debt through derivatives markets. They have been engaged in floating or fixed payments or receiving to take shorter-term debt and turn it out into longer-term debt. That is when you get a spike in volatility. Even that is going to start to come back to this day. Well I’ve got all of this short-term debt. The Fed is going to raise its rates. What am I going to do? I’m going to engage in swaps contracts in order to it mimic a 5-year note or a 10-year note but now it is more expensive to buy that swap contract because volatility is going up. That’s going to start hitting their bottom line too.

FRA: Great! Thank you very much gentlemen for your great insight. Just wondering, how can our listeners learn your work or go around? Jim?

Jim: Probably the easiest way is to follow us on twitter @BiancoResearch.com or at our website BiancoResearch.com

FRA: And Yra?

Yra: At YraHarris.com and the blog is from underground (36:58 – 37:10 inaudible). Food for thought.

FRA: And Peter?

Peter: My twitter is Pboockvar and subscribe to my daily writings at boockreport.com and my managing business is bleakley.com

FRA: Great! Thank you very much gentlemen.

02/14/2018 - Danielle DiMartino Booth On Federal Reserve Policy

02/14/2018 - Danielle DiMartino Booth On Federal Reserve Policy

Former analyst at the Federal Reserve Bank of Dallas Danielle DiMartino Booth thinks those expecting the Federal Reserve to continue the market support will likely be quite disappointed.

02/14/2018 - Martin Armstrong: The Sovereign Debt Crisis Is Here

02/14/2018 - Martin Armstrong: The Sovereign Debt Crisis Is Here

“The Romans never even had a national debt. Today, we have government hawking 100-year bonds. We have pension funds that required 8% returns and then governments ordering that the bulk of such funds if not 100% should be ‘conservative’ and invest in only government bonds. We are reaching a crisis point in longer-dated yields because investors are unwilling to lend money at low rates long-term. Smart money is beginning to wake up to the perpetual mismanagement of the long-term trend by the government. The central banks have been backing off of continually buying government debt and the Fed in the USA has announced it will not reinvest when its holdings of government debt mature .. This is the Sovereign Debt Crisis and Monetary Crises we face in the years ahead.”

02/14/2018 - BIS Chief Sees ‘Strong Case’ For Cryptocurrency Intervention

02/14/2018 - BIS Chief Sees ‘Strong Case’ For Cryptocurrency Intervention

“There is a ‘strong case’ for authorities to rein in digital currencies because of their links to the established financial system, Bank for International Settlements General Manager Agustin Carstens said.

‘If authorities do not act pre-emptively, cryptocurrencies could become more interconnected with the main financial system and become a threat .. Most importantly, the meteoric rise of cryptocurrencies should not make us forget the important role central banks play as stewards of public trust. Private digital tokens masquerading as currencies must not subvert this trust.'”

01/26/2018 - The Roundtable Insight: Chris Whalen, Yra Harris & Peter Boockvar On 2018 Trends & The Return Of Volatility

01/26/2018 - The Roundtable Insight: Chris Whalen, Yra Harris & Peter Boockvar On 2018 Trends & The Return Of Volatility

DOWNLOAD THE PODCAST IN MP3 HERE

FRA: Hi. Welcome to FRA’s Roundtable Insight .. Today we have Yra Harris, Peter Boockvar and a first time guest, Chris Whalen. Yra is an independent trader, a successful hedge fund manager; global macro consultant trading foreign currencies, bonds commodities in equities for over 40 years. He was also CME director from 1997 to 2003. And Peter is the Chief Investment Officer for the Bleakley Financial Group and Advisory at Bleakley and he has a newsletter product called The Boock Report. BoockReport.com. It offers great macroeconomic insight and perspective with lots of updates on economic indicators. Chris Whalen is an investment banker, author and Chairman of Whalen Global Advisors LLC which focuses on financial services, mortgage finance and technology sectors. He was a Co-founder and Principal of Institutional Risk Analytics from 2003-2013. He has held positions in organizations such as the House Republican Conference Committee…

Christopher Whalen: Yeah, talking about that.. (laughs). That’s okay. Most recently I ran and built up the Financial Institutions Group at Kroll Bond Rating Agency which was a lot of fun. Kroll is really an ABS house, first and foremost, commercial real estate and the rest of it. It’s still very small from competing with giants, but it was a lot of fun.

FRA: Great. And also he was on the board of directors for the Global Interdependence Center (GIC) in Philadelphia.

Christopher Whalen: Yes, that was David Kotok’s little project. You know it’s fun to mix business with pleasure. Fishing, central bankers go fishing.

FRA: Yes, I am actually going next month to the GIC conference in Buenos Aires and going fishing before that. There’s also fishing afterwards, sort of the Camp Kotok in Argentina.

Christopher Whalen: Well, some of them go to Maine. Ramiro Lopez Larroy and his kids will just show which is about 15 hours by plane. It’s a lot of fun. They are great people – A very diverse group at GIC. We’re going to Germany this year, the Bundesbank, so if you like monetary policy that would be a very good trip to go on. I would recommend that.

So, what would you like to talk about this morning?

Peter Boockvar: The Bundesbank has disappointed me for the last few years how they give Draghi the license to do what he has done.

Christopher Whalen: Well, they kind of had no choice. I find it amusing that northern Europe is cranking, and my relatives in Holland are having a great year, and yet southern Europe is not. That dichotomy is ultimately going to be very difficult for them to deal with. The Germans look at southern Europe and they just see more checks to be written. The politics of that is slowly undermining Merkel. It’s very interesting to watch. And then Berlusconi coming back in Italy – Isn’t that great?

Everyone: (laughs)

Christopher Whalen: I always tell people to read about Berlusconi and you’ll see where America is headed.

Yra Harris: Draghi will be making trips to Italy.

Christopher Whalen: Yeah. Draghi has been trying to keep Europe on ice by pushing debt cost down to zero, but the debt keeps growing. So, what are we really about here? There’s no fiscal discipline anywhere in the Western world and the Chinese don’t care. It doesn’t matter in China – It’s a political issue. That’s why I was writing about H&A recently because ultimately, whether that company survives or not, will be determined by uncle Xi. That’s how it works in China. There is no church and state, there is just the state.

Peter Boockvar: He may want to set an example though.

Christopher Whalen: Yeah, there were a little ostentatious, a little floppy with the parties, pasting their names on the side of office buildings around the world. I think we have 3 of them in New York. It’s quite fascinating.

FRA: A few weeks ago, Chris, you wrote an article, Bank Earnings & Volatility, I thought we could begin with some thoughts there. How have the Federal Reserve and other central banks’ actions affected the credit market, the financial markets and the economy, in general?

Christopher Whalen: Well, what the central banks have done is that they have removed a lot of assets from the market. They’ve gone out with a variety of new money, in the U.S. case: excess bank reserves, and they’ve bought treasury bonds and they’re bought also mortgage bonds. Of recent vintage, Fannie Mae, Freddie Mac, Ginne Mae paper which have 3, 3 ¼ and 3 ½ coupons with very low pre-payment rates. Those bonds are going to be around for a long time. In fact, one thing I remind people of is that about 30% of the market today is the FHA and Ginnie Mae and those loans are assumable so they will stay with the house. And the house will trade and the loan will be conveyed to the new buyer. It could be very interesting, over time, to see how that affects the portfolio. But essentially, the central banks have taken all of this duration out of the market and since they’re end investors, they are basically buying the paper on credit and they don’t hedge it. So the capital markets activity that you used to see around a lot of these positions when they were held by trading firms, banks and other who were going to trade the assets and cared about mark-to-market every quarter has greatly diminished — There’s no hedging. The Fed’s sought out hedging it’s block and it’s a problem now because the Fed is now illiquid. They can’t sell without creating a loss and they dare not do that because it gets them in trouble with the Republicans and the House who don’t understand monetary policy at all, but have a lot of opinions on it. And so you have this weird situation where the Fed essentially has their hands tied. They’re going to wait for the book to run off which they hope is about $20 billion a month. And I think that they could be wrong. I think that they could too wishful in terms of the runoff rate in terms of the mortgage paper. The mortgage companies are going to be around forever and the pre-payment rate is going to be very low, especially if rates continue to move up. That’s kind of what I see. The trading line on Wall Street, the earning will be greatly diminished by this. Then you have the vote to rule. So all of the books, the investment books that the banks use to trade every day, just the value of the assets are passive now. You put those 2 data points together and you will understand why Goldman Sachs and why all of the banks have seen an enormous reduction in their trading buy-ins.

The other issue is that the mortgage market is down so there is less hedging. The forward market for hedges, what’s called the TBA market, has a lot less activity. We’ll do a $1.5 trillion in mortgages this year which is down. The peak was $4.5 trillion during the 2000’s; we don’t want to do that.

Peter Boockvar: Yes and why aren’t we seeing an CNI loan growth?