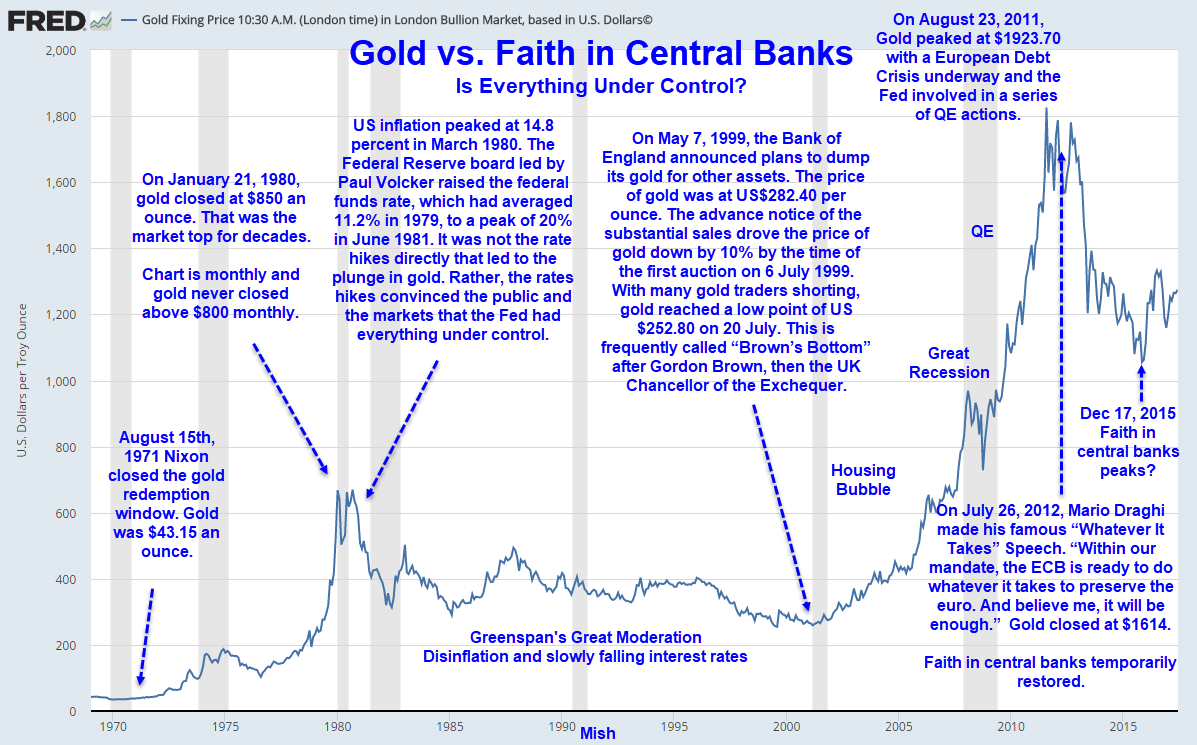

“Conventional wisdom says we need more inflation to deflate away the value of of debt on the books. As of November 30, 2017, Treasury Direct reported public debt as $20.59 trillion. That includes $5.67 trillion in debt we owe to ourselves (think Social Security). At higher rates of inflation, interest on the national debt would soar .. What a hoot! Despite massive amounts of QE the Fed could not hits its inflation target using its own measure of inflation as a definition. Somehow they magically believe that setting a higher target will in and of itself cause inflation .. Imagine what 6% mortgages would do to home price affordability .. Throw conventional wisdom in the ash can. In practice, the more debt and leverage the Fed stuffs into the system, the lower interest rates must be to support that level of debt .. Another round of debt deflation. a currency crisis, or both is in the cards. Timing is the only issue. It’s far too late to believe anything reasonable can be done about the mess the Fed has created .. Do yourself a favor, buy gold. It’s a strong favorite to soar when faith in central banks comes into question.”

01/04/2018 - Mish Shedlock: Debt Deflation Or A Currency Crisis Is In The Cards

01/04/2018 - Mish Shedlock: Debt Deflation Or A Currency Crisis Is In The Cards