FRA: Hi, welcome to FRA’s Roundtable Insight .. Today we have Charles Hugh Smith. He’s author leading global finance blogger and philosopher, America’s philosopher, we call him. And he’s the author of nine books on our economy and society, including neurotically beneficial world automation technology in creating jobs for all resistant’s revolution liberation, a model for positive change, and nearly free university in emerging economy. So we will talk about those books today and he also has a blog of twominds.com. That blog has logged over 55 million page views and is number 7 CNBC’s top alternative finance sites. Welcome, Charles.

Charles: Thank you, Richard. Well, let’s hope that impressed your resume, I am able to shed some light with you on education jobs and the impact of automation.

FRA: Yeah. No, sure, yeah great background and insight as always. And you’ve been very generous in providing some charts today, which will make available on the website for people to download and to view if they listen to this podcast and so yeah maybe we begin with the big picture. What you think education is? Why there is a problem? Also maybe how financial repression initially has created a lot of debt in student debt market and then take it from there.

Charles: Ok, well I take a stab at it and you can fill in whatever I miss for which I’m sure will be a lot of changes. You know Richard the thing I concluded and I’m not alone in this, is that higher education throughout most of the developed world and even in fact even in the developing world, like China. It’s a cartel, in another word it functions like a cartel and this is part of the financial repression. aspect there is no competition in the university and college system in the United States. and that every school just boost the tuition based on its peers, and the reason why they have this cartel like pricing power is because they control the credentials. The issuance of credential, diploma, which students have been brainwashed into feeling that they must have or else they are doomed to a life of unfulfilling work and poverty and so this is given in pricing power and that’s completely unconnected to either the value of the credential they are issuing or to their competitive value compared to other universities. And so you’ll have a really pretty nothing special you know state school charging tens and thousands of dollars and not that much less really than Ivy leagues which often give scholarships as well because of their huge fund that they accumulate from you know they’re highly paid graduates. and so this has created a financial repression that focuses solely on the students of higher education.

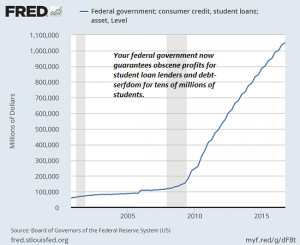

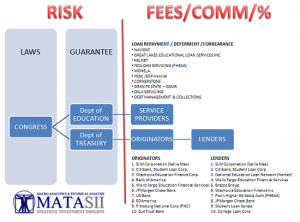

So we can see that student loans have risen from essentially almost nothing to 1.4 trillion and as this is weight more and more heavily on students and they start defaulting right and so the result of this is that cartel has now handed over the funding of its ridiculously over priced service to the federal government, which has now taken on all this student loan debt as an asset if you can believe that. And Gordon Long and I did a program where we drill down and discover that there is an enormous shadow banking system that which has benefited and profited immensely from processing all these you know trillion student loans.

FRA: yeah absolutely.

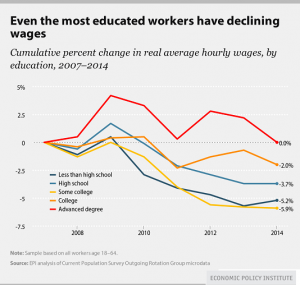

Charles: Yeah now as we seen these enormous costs increase, into like three or four hundred percent increases in tuition while the rest of the economy is more or less flat lined. We find it even the most educated worker has declining wages. And the chart I have submitted was from the 2006 era, you know the era of financial crises. and since then despite this so called recovery, wages of all workers have either stagnated, you know zeroed out or they declined as much as 5 percent.

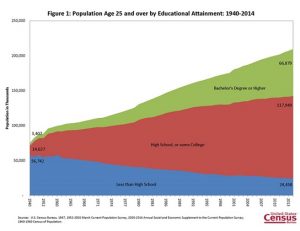

So even college educated people are not reaping any benefits from this enormously expensive higher education and I have another chart that shows as a percentage of the workforce the number of people with a bachelor’s degree and higher has of course been rising for decades and as a substantial part of the workforce now and so now we’ve been told that getting a bachelor’s degree or higher is like a ticket to you know permanent prosperity and all this and the numbers don’t add up with that.

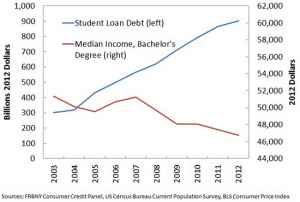

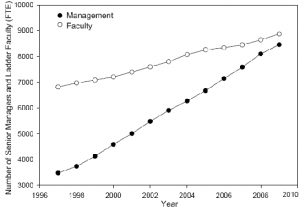

And we also have a chart here that shows student loan debt skyrocketing, but the median income earned by people that have a bachelor’s degree it has been declining. And so there is a mismatch here between the cost of education and the payoff. And people are looking around for answers like why is this? And of course, one reason is that the growth in higher education budgets is largely with results of more administration, more managerial staff being added while the actual teaching staff is not gone up by much.

I have a chart here that happens to be to the University of California system. Probably the largest public system in the US, just due to the size of California having 38 million people. And you can see that the number of management staff has skyrocketed while the number of teaching staff has edged slowly higher and they are about the same now. The system has almost as many administrators as it does professors and of course, as you and I were speaking before we started recording, the salaries in higher education are not in competition in the sense of the real world of entrepreneurism or managing in legitimate companies that turn a profit. A lot of these management positions are like they have assistant dead to an assistant associate dean of student affairs and the guy is making quarter million dollars.

It’s a completely out of touch with the private sector in terms of productivity and value of that position, which is really a net negative because the students are paying for all this additional management of their education and yet the quality of the education is clearly not keeping up with what the economy is demanding. Are you seeing the same thing?

FRA: Yeah the same thing in Canada where salaries could be 250 thousand and these are typically government type roles right positions and even though the University of Toronto, it’s also more than that because of the pensions, it could be 80 or 90 percent after they retire, so it’s just huge salaries and its rehashing and repeating the same course of teaching the same thing over and over again and there’s not much you know excitement to that. And you know you have to wonder what is the issue here, is its accreditation. Is that what is driving this you know partly and also the financial repression aspect of it. You know lower interest rates, the ability for the middle class to make loans right at high numbers so the wealthy could essentially pay cash; the poor have potential grants, so the middle class would have to come up with loans. Effects everybody has a virtually unlimited source of money to pay for the tuition and there is a play on the value of having an education, where everybody realizes that, but it’s gone beyond that where they are taking advantage of that value.

Charles: Right, right, and one pernicious aspect of financial repression is suppression of competition and so you know there is no competition really in higher education. The degree, there’s nothing in this whole system that actually measures in quantifies or compares the supposed education that student has gained or the value of the education and compare it to other competing schools. So studies like academic drift, which was a study that came a few years ago found that a huge percentage of university students in the US gained no appreciable knowledge after found years in a university. In other words, they didn’t really learn all that much, that could be identified. And so this has driven a movement away from businesses relying on credentials and grade point averages. For instance Google very famously used to focus on your grade point average and your course work and those kinds of stuff, and they realized it did not connect it didn’t correlate with the productivity and creativity of the worker so they have now moved away from that model and that the third of their hires don’t have bachelors degree or bachelors of science and no college degree at all, and so this is I think what’s what businesses and even government agencies are finding out that the credentials doesn’t say anything about the student which is why in my book in the university I suggested that the solution is a new model in which we are credit the student and not the institution in shirt the student has to prove that he or she has learned stuff and knowledge basis that are of value to the employers so that we would accredit each student and never mind the institution they would be out of it so if they failed to actually educate the student then they would get nothing.

FRA: so is it more of the alignment of the education towards what is being asked for or needed in the economy?

Charles: Yeah, that is right its aligning the education with what is needed in the economy and also aligning it or realigning it with to the cost of education so worthless education should cost almost nothing. if the institution can’t actually help the student or learn what is needed then the institution doesn’t deserve the tuition and that would revolutionize the higher education but Richard I’m just going to shift just a little bit here, and talk about what do we mean by the emerging economy and how are the skills and the knowledge basis that employers need how is that changing and of course we all know the big deal, automation that a lot of human labor can be automated and or replaced by software and robots and following software and many other jobs are now requiring humans to know how to program robotics and program software so that it’s kind of a cooperative effort if you will between me and the forces of automation and the human laborer right? yeah and so that is a higher level of skills thought to be able to reprogram a robot and that sort of thing right? it’s not simple assembly work anymore and so we’re seeing the job market breakdown into these broad categories, of course, the high skill ones like full programmers and people who design software and who can actual engineer actual robotics, of course, there would be jobs for these people who are highly educated engineering types as it’s the middle sector its everybody below that very highly educated engineering math science kind of a sector, that whole thing is, the larger chunk of the economy is vulnerable to automation the larger chunk of the economy is vulnerable to Automation. Of course we’ve seen this and in many fields at starting with like factory work but it’s moving up the food chain to accounting and even legal work and of course in financial tech too right, haven’t you. I’m sure we have all seen the photo in those trading desks at major investment banks that used to have these huge rooms crowded with traders now there’s twelve people in the whole room,

FRA: Most of it can be done through trade processing platforms like calypso and more these are like derivatives trading platforms that can do pretty much everything front office middle office back office altogether in one system.

Charles: Right, right and so another factor here is Michael Spins, he is the economist who won the noble prize in economics for his work on explaining how work is nowadays in the global economy, some of it tradable and some of them not tradable and so that’s a key factor because if tradable work like programming software, that can be done anywhere in the world right? It’s a digital file so that imminently tradeable. Where like giving someone a hair cut or doing the landscaping like on a yard, you can’t outsource them, you can have immigrant laborer and you can try to import labor if you are short on laborer to do that kind of work but yeah, a lot of people are seeing that there is a dichotomy here that we’re going to divide into low skill non-tradable work like landscaping like perhaps even things like food service that, of course, that’s a mixed example because a lot of food services are already being automated as well. And so we have these two pressures, whatever is tradable is under pressure from globalization, in other words, the employers are going to have to ask can this same work be done elsewhere in the world for a lower price so that puts pressure on wages and high cost to develop world economies. And in the low skill nontradable sector such as yard work and taking care of elderly people and that sort of labor then the pressure there is can we automate some of this and so we are hearing from Japan where they’re really pursuing the idea of having some sort of simple basic robots that would provide some basic services to elderly people that are maybe bedridden. So the robot could come in and make sure that they take their medication on time, that sort of thing. And so again because there are facing a labor shortage and here in north America the pressure is the cost of labors just keeps going up, not so much the wage but the cost of labor overhead to pinch us, disability insurance and the health care at least in the U.S., less so in Canada I think. So we sort of seeing that if we combine these sources we can see there seems to be plenty of jobs that are low skill but they’re also going to be low wage and the non-tradable sector, coz there’s going to be a lot more labor that’s able to do that work then there is the abundance on the labor side, not the job side. There’ll be plenty of jobs but there will be even more people who are qualified to do that, but on the higher skill level there’s going to be perhaps a few more jobs but those jobs are often tradable so there is more global competition and pressure on wages even on highly educated highly trained people, you know salary. so

FRS: What is the future pertaining in terms of where the trend is if you had to advise somebody who is going to college and what they should study or should they go to college or how should they prepare for the world of work.

Charles: Right, right, that’s an excellent question and I did write this book: “get a job and build a real career and defy of the wildering economy” and the reason why I characterize the economy as bewildering is it really is bewildering because there are all these big dynamics which we all touch upon whether the work you are trying to get is tradable whether it’s high enough skill can it be automated all of these things factor into jobs of the future. So there is a great Mackenzie report on automation and I think it sort of echoed what I’ve read else where in researching this topic which is what humans are good at and what machines are not good at is combining knowledge basis from various fields. Computers are really good at what is repeatable and can be broken down into definable task, and what they are not so good at is changing or adapting on the fly to changing circumstances, and so that’s the kind of skill set that everybody would benefit from having is try to develop multiple skill set and multiple knowledge bases so you could bring a couple of different sets of experience and knowledge to bear on problems because those are basically impossible to automate, at least in the existing technology, and that can be in a lot of different fields. It doesn’t have to be just in high end, we are not talking about high finance or programming software, it can be something like on the factory floor, with robotic arms and then the work changes because we got a different order, then the skill set that is going to be highly desirable is a worker who knows how to reprogram that robotic arm on the fly, in other words they can change the robot’s tasks and that with accuracy and speed that kind of skill is going to be valuable, so my point here is the whole range of skills from what we might call blue collars like welding and pipe fitting and construction, there’s going to be a lot of changes in those fields too, working with robotics and software and all the way up to health care and higher education itself. Not to mention industrial design, public relation and all the other fields that we think of as upper middle class.

FRA: Yeah, I see the same thing, I mean in terms of multi-disciplinary areas being brought together so like in the consulting world I see that happening with maybe a project involving compliance to a regulation but you know some aspects would have to do with it if you just look at IT itself a lot of that can be outsourced but once you have that, like an IT control, that needs to be put in place for a regulatory compliance this sort of that aspect to it the legal aspects that need to be considered and thought through and how they can be implemented together with the IT control sort of like a multi-disciplinary type of thinking.

Charles: Yeah, that is an excellent example Richard, and then on the global scale, then you can also add cultural knowledge because of the IT and the legal aspect of regulatory compliance then you also have the cultural issues to show up with making sure that the work force in a particular nation, is up to speed culturally, like why do we have to do this and how you educate each particular work force and so. Yeah, that’s a great example of what I am talking about, multi-disciplinary.

FRA: And just in general as you’ve mentioned earlier the ability to adapt quickly sort of the old idea of the adapt sort of the emphasis on the adaptability versus the big dinosaurs.

Charles: Yeah that is right and I think that Charles Darwin himself, famously said, it doesn’t go to the smartest, it goes to the most adaptable. And so one topic I also want to bring up, is that a lot of people in the automation field or in economics they often refer to the idea that well there is just going to be a lot of great opportunities for creative output, we are going to have a lot of people that are poets, making films and all these kind of stuff that. I just want to point out and I’m sorry if I just splash cold water on that but as we all know all the creative output is in super abundance in other words, everything is free now because there’s limitless number of songs and huge quantity of music and films and comics and cartoons and novels and stories and I mean any kind of creative output is in super abundance on the internet and so it’s very difficult to charge any money. You know to get more than 99 cents for an app or song or even an entire book is becoming a challenge. So it’s nice and I’m all for creative output in terms of self-expression and the fun of life, but in terms of making the middle class living my experience is that the number of people who make decent living at being a creator is pretty minimal and so I think the idea here is not to throw cold water on creativity but to say that learn the skills of creativity, which is often mixing and matching the multi-disciplinary skills we are talking about. Bringing a fresh perspective or looking with fresh eyes, but holding those creativity skills, but be able to bring bear on real world problems as opposed to thinking that I am going to be a poet or writer or you know an artist and I am going to make that my career. It is more likely is say for instance if you were super interested in that and had an act for say painting then you might want to get an internship with a curation staff, in other words, learn the ropes of how you would curate a collection and you’d be gaining skills into your interest in painting and your knowledge base, but you’ll be learning some skills that deal with real world and why people would pay you for the knowledge you have.

FRA: So I guess I mean one theme could be if you going into tradable skills that have to be some element of innovation and adaptability innovation, cutting edge if you will, but in the non-tradable that could also mean the job protection by regulations or jurisdiction based licensing, like you know lawyers can practice within certain jurisdiction, does that make sense.

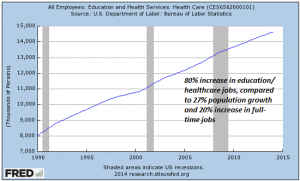

Charles: Yeah that’s good point Richard and I think when we talked about the millennial generation few programs ago, I mean that’s what we both read was that the millennial generation as a generalization is interested in say government employment because it is more secure, but the downside of that is that the economy that we are talking about it has a certain Darwinian element to it, which is you’re going to lean the skills to be part of the disrupter or you’re going to be the disrupted. and so the problem is all these protected industries, which would include health care, higher education, and the government sector itself; these are the low hanging fruit for disruption because they are extremely high cost and tend to be inefficient and they tend to be cartels or self-serving protectorates. you know that makes sure that their wealth funded and never mind if their productivity is actually declining or they’re not really solving any problems anymore.

And so those are the fields that are more likely to be disrupted then the fields that already been constantly disrupted. For instance, the automotive industry. I mean come on the thing is in constant turmoil already, so there’s not much you could disrupt the auto industry with constant and rapidly changing, but if you look at healthcare it’s still stuck in procedures and bureaucratic mindset that no longer require, technology has gone far beyond what we now deliver health care in the US is so annotated and obsolete, it’s laughable and everybody knows this but we haven’t been able to break out of it and innovate, but that will happen because the costs are crushing, the government and private sector. So I would hardly recommend young people not to count on allegory or a health care job or government sector job as being some sort of guarantee going forward, it’s going to be disrupted too.

FRA: Yeah there’s going to be lots of tension, I mean you already see it in Uber and Airbnb, right all these development going on and doing disruption to that type of cartelized industry.

Charles: That’s right, so in higher education is pretty clear that I mean what the model that I proposed and I’m not, again this is not unique to me, I mean we just have to look and say the German model for the way that they funnel students out of high school into apprenticeships or university, and to me the apprenticeship model works well. We can replace the university of curriculum with that kind of approach even in software or philosophy or anything else. That model would be a lot more affective and a lot cheaper than the way we do now where we sit in classrooms.

FRA: Yeah, I think I saw some statistics where Germany does that at a very high rate like seventy percent of apprenticeship programs, compared to only ten percent in the US, something like that.

Charles: That’s right, and it was just an article in foreign affairs about how the US used to have a much more robust system of what we used to call like trade schools, and that’s been allowed to decline any road in favor of everybody getting a bachelor’s degree. This has actually crippled our economy in some way because we’re lacking the skills that the economy needs and yet we’ve turned down lots of people with degrees that don’t really have a lot of value. You know, art history and gender studies and this kind of stuff, and I myself have a degree in philosophy which you know could qualify as worthless. But it did require a certain amount of rigor in thinking things through, and that has served me well. I would argue that philosophy should not be put into the worthless degree category, but it should be connected if at all possible with some engineering skills, or some finance skills or some other more applicable, would be the ideal multi disciplinary approach we’re talking about. Don’t major only in philosophy, major in something else as well and together the two will probably serve you well.

FRA: Actually myself, I’ve got an engineering degree, but a minor degree in the philosophy of science.

Charles: Oh excellent.

FRA: Yeah that’s interesting. What is the path then going forward, I guess you can mention a number of industries but the path is sort of generic, that people should come with a sort of thinking outside the box, look at potentially disruptive industries, you know where things can be improved and then maybe take courses online, or is that what you’re suggesting in terms of trying to get opportunities from that way not necessarily through the traditional bachelor degree or MBA type of approach?

Charles: Right, the ideal pathway that I’m suggesting for people that either don’t have the money or don’t want to waste four years getting a degree that may or may not actually serve them is to seek out the equivalent of an apprenticeship, and this is not going to be a formalized model that you get to join. You’re going to have to make your own apprenticeship, and that would be to seek out a mentor in the industry in which you think you have an interest, whether it be fashion design or you know some sort of art related field or health care. Whatever it is, I would seek out a working professional who would help design your curriculum so that it would actually serve the needs of the working environment that he or she actually understands, and so that might include getting a BA or a BS, but I would get right out of the gate out of high school, and I would be seeking and apprenticeship with work for nine months or a year for somebody who could layout a curriculum and if I could learn all that stuff online then I might not even need a BA or a BS. So that’s what I would do. And if it turns out they say, “look you really got to get this BA or BS”, then you know what your pathway is at least you know that your work will be rewarded, that its essential for what you want to do in life. You’re not just burning four years and getting a hundred thousand dollars in debt and finding out it doesn’t even really serve the economy or your own career path.

FRA: Maybe also thinking outside the box, I know a lot of people that we talk to on the program show have an international perspective. There’s also the idea of looking where high growth areas of the world are, like you know Myanmar, Burma. If you go there now you can basically start a business, whatever has worked in parts of Southeast Asia will likely work there. So you can set up that business, it could be serviced offices or car rental, whatever works elsewhere in Southeast Asia can be replicated there at this time.

Charles: You know Richard that’s an excellent point or super important point that I failed to mention so far, which is really where the value comes in the global economy is filling a scarcity. Where there’s a problem that hasn’t been solved, if you can bring those skills to bear, then you’ve got a guaranteed and a very exciting career. And I think you’re making a really big point here about places like Myanmar, is that there is a huge amount of developing world economies, you know there is so many scarcities that need to be filled there and there’s often a regulatory burden or a lack of infrastructure. I mean there’s often major problems that need to be overcome to get to fill the scarcity, but being part of those can be very rewarding and will require some research. You don’t just blow into some new culture and new nation and it operates by different rules. But again, if we follow the idea of an apprenticeship, if you get hired by somebody who would send you to another nation. Or if you just go there and try to find work and just say “I’m going to give this six months”, then you’ll probably learn a tremendous amount on the job, far more that you can possibly learn by going to school there.

FRA: I can think of my own experience too with the disruption of the internet. I was one of the first users of the internet back in nineteen eighty-three, and I did the whole internationalization of the internet in the nineteen nineties, so all over the world. Setting up internet service providers in different countries. That type of thinking outside of the box, international in scope and just bringing on a new disruption type of technology or process.

Charles: Right, and I guess in a similar vein, we could also say that these sclerotic, stuck in the past kind of sectors like health care and higher education that we’ve mentioned. There’s also huge scarcities in those industries that just aren’t recognized yet. And also as you say geographically, that if you’re the first into a market and with a first solution, and it could be as something as full as bringing a wealth of web related public relations and social media skills to a small town. And if you’re first there, then you can write your own ticket because you’re solving problems and there’s no body else to solve those problems.

FRA: And I think overall with countries in the past pulling financial oppression method of say currency, devaluation, competitive currency devaluations, it’s now moving into a realm, given that all countries are doing it at the same time. Coming down to a differentiator of innovation and how adaptable can your economy be, and how competitive can your economy be, more and more I think I see that globally.

Charles: Right, I would say that cryptocurrency as another example of how financial oppression can cripple an economy is that there’s going to be a huge expansion of block chain technology. So if someone was technically minded I would recommend they really dig in and burrow in, learn how to understand and code block chain technologies because the nations that enable this and encourage block chains are going to succeed far more than those that are trying to supress of repress it.

FRA: Yeah exactly, and that’s a great way to end our program show for today, and that’s great insights as always. Charles, how can our listeners learn more about your work?

Charles: Please visit oftwominds.com and you can read free chapters of my books and look at my archives and see what else I’ve got on tab. Please visit and I welcome your readership.

FRA: Excellent thank you very much Charles.

Charles: Okay thank you Richard, my pleasure.

08/02/2017 - The Roundtable Insight: Charles Hugh Smith On Where The Jobs Are

08/02/2017 - The Roundtable Insight: Charles Hugh Smith On Where The Jobs Are