FRA is joined by Jeff Snider to discuss the shadow banking system and monetary policy.

As Head of Global Investment Research for Alhambra Investment Partners, Jeff spearheads the investment research efforts while providing close contact to Alhambra’s client base. In the nearly year and a half run-up to the panic in 2008, Jeff analyzed and reported on the deteriorating state of the economy and markets. In early 2009, while conventional wisdom focused on near-perpetual gloom, his next series of reports provided insight into the formative ending process of the economic contraction and a comprehensive review of factors that were leading to the market’s resurrection.

In 2012, after the merger between ACM and Alhambra Investment Partners, Jeff came on board Alhambra as Head of Global Investment Research. Currently, Jeff is published nationally at RealClearMarkets, ZeroHedge, Minyanville and Yahoo!Finance. Jeff holds a FINRA Series 65 Investment Advisor License.

FRA: So we have a real special treat. You’ve provided some slides that will be made available on the website and also in the body of our write-up. They provide some great insight into monetary policy evolution over the last couple of decades and what we’re going to be talking today is monetary policy in 2017: h the Federal Reserve is raising interest rates, why they’re doing that, and how the whole evolution over a long period of time, the last couple of decades, especially since the 1990s, has led to bubbles and overall economic chaos. So with that, if you want to start an overview of what you’d like to talk about and start getting into the slides?

SNIDER: We have a bit of a contradiction here because the Federal Reserve in 2017 wants to raise interest rates. I think they’ve made that very clear that’s what they’ve wanted to do all along for the last couple of years. Yet most people have an intuitive sense that the economy hasn’t ever recovered from the Great Recession. So we have this disconnect between what they’re doing and the way the world actually seems to be, and there doesn’t seem to be a good explanation for why all this has occurred the way it has. The reason for it is because the monetary system and the banking system have been drastically changed over the last few decades, especially during the 1990s, the all-important years that led monetary policy along a different path than the economy and the markets. So to understand what the Federal Reserve is doing today, you really have to review how monetary policy evolved as the banking and monetary system evolved.

FRA: And to begin with, on the first few slides you’ve got a quote from 1969?

SNIDER: Edwin Dale was a reporter for the New York Times. In early February 1969 he wrote an article that was called ‘Laughing At The Fed’. It was a fairly typical article for Edwin Dale, and Edwin Dale wasn’t a typical beat reporter for the New York Times, he was very well known, very astute observer of economics and monetary policy. The article had such an effect that two days after it was published, it was actually discussed in the FOMC meeting that followed just after. In fact, the best part of the story is that Frank Morris, who was the president of the Boston branch of the Federal Reserve, actually took it upon himself upon reading Edwin Dale’s article, and asked various banks in his bank district whether or not they were actually laughing at the Fed. Which, I think, is a pretty good starting point to tell you about the timeless nature of policy makers, how they can typically be thin-skinned and often probably too self-assured. And, furthermore, how none of the banks actually answered back that they were laughing at him when in fact you could be sure that as soon as they hung up the phone with Mr. Morris that they actually were laughing.

That was kind of the period in 1969; just on the cusp of what would become the Great Inflation. And it became the Great Inflation because Edward Dale was essentially right. The Federal Reserve had no idea what it was doing, even though it sounded like it was in command of every little minute detail. It’s almost a perfect mirrored start between then and now because nowadays things are very similar: the Federal Reserve makes a bunch of claims, does a bunch of things, and nothing ever seems to work. But that’s not the way it was. In 1969 when people were supposedly laughing at the Fed, to 1999, things had changed very drastically.

In 1999, Alan Greenspan was considered the maestro. He was essentially the most admired central banker in history. So we have to understand how it got that way, how the Fed in 1969 go from being a joke to, by 1999, being the apex of technocrats?

FRA: As you mentioned, no one was laughing by the late 1990s when Alan Greenspan was the maestro.

SNIDER: If you go back to that time period, if you’re old enough to remember the Dot Com era, Alan Greenspan was, on Wall Street at least, a god; even with the mainstream media he was something of a celebrity. I remember that his briefcase even had its own page on CNN.com when the internet was relatively young, because it was believed that you could tell whether or not the Fed was going to raise rates by what hand he was holding the briefcase. It got to be that kind of almost cultish behaviour because of his reputation and the reputation that people believed was based on actual condition.

FRA: So what really happened in the 1990s? Can you elaborate?

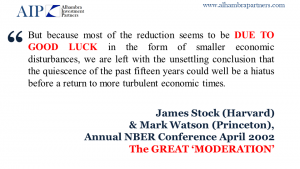

SNIDER: There was a lot of disagreement over what happened. If you were a stock investor, Alan Greenspan was the chief; even in the academic circles of mainstream orthodox economics, there was quite a bit of doubt. In 2002 for example, James Stock of Harvard and Mark Watson of Princeton delivered a presentation at the annual NBER conference that coined the phrase ‘the Great Moderation’. And what they were doing was try to figure out where this oasis of low volatility economy actually came from. They assigned several reasons for it, and one of the most intriguing and most relevant answers they came up with was what they called just pure good luck. What they meant by that was during the 15 years leading up to that point, during that decade and a half of what seemed to be a Great Moderation, there weren’t any of the usual kind of global monetary abnormalities that had plagued economic systems throughout history. From their position inside orthodoxy economics, especially in the academic side, that seemed to be just good fortune. When, in fact, there were other explanations for it that explained a lot more than just passable luck.

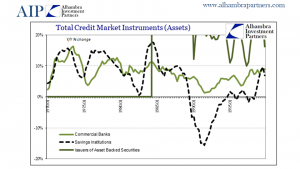

FRA: So take us through some of these initial slides here. You’ve got total credit market assets and how does the story develop over the last two decades?

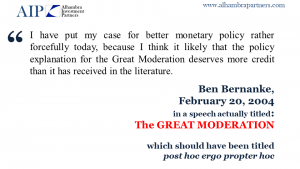

SNIDER: Policymakers themselves, again going back to the 1969 Edward Dale article, were very interested in taking credit for the Great Moderation. They wanted everyone to believe, as many people did, that they were in control of the economy. That by increasing or decreasing the Federal Funds Rate a quarter point at a time, they could engineer the so called ‘Great Moderation’. Ben Bernanke actually gave a speech in 2004 where he actually made that claim: that monetary policy, under interest rate targeting, actually deserved the credit for the Great Moderation. It was a view that many people came to adopt, including many in the official academic circles, as well as people inside the Fed, where it was almost a given that monetary policy was perhaps the most powerful thing on Earth and that by controlling the Federal Funds Rate, the Federal Reserve could make everything go. But if you actually go back into the 1990s and review what happened, what you’d find is that, again, a radical transformation.

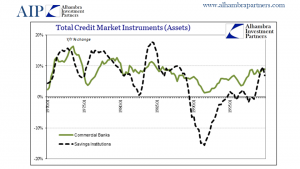

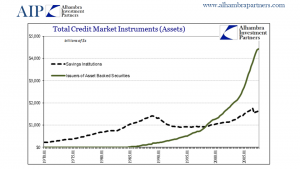

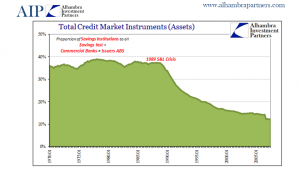

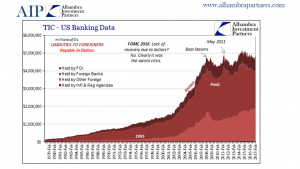

The S&L crisis that developed in the late 1980s pertained to what we all think of when we think of a bank: the bank as in taking in reserves of either cash or hard money, then the money multiplier taking that into levels of loans and deposits. The actual, traditional banking system. That wasn’t the only part of the banking system at the time, of course, but after 1990, after the S&L crisis, the traditional bank model essentially ended. By the mid-1990s, these new forms of banking and monetary advance had increased and grown so rapidly that they had surpassed the traditional model in every way, shape, and form.

I presented here just one of those possible avenues, which is the issuers of Asset-Bank Securities, the type of off-balance sheet arrangements that no one really became aware of until 2007 when it was too late. These were wholesale, modern vehicles for not just banking but securities, all sorts of money dealing activities… basically the whole range of what used to be done under the traditional banking banner were being done more and more under this brand new system that did not operate in the same way as a traditional bank. By 2007, the traditional banking system was a fraction of what it had been, even in 1990. So there was an enormous evolution of banking and even money because the way these things were funded over the 1990s.

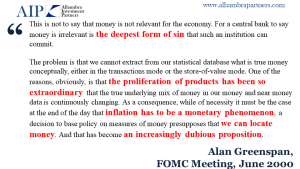

In fact, it was Alan Greenspan himself who noticed these kinds of things and mentioned them throughout the 1990s. I’m sure most people remember in December 1996, Greenspan’s irrational exuberance. But they remember it for all the wrong reasons. They think about the Dot Com Bubble and what they think of as a warning. But what he was really saying, if you read the speech before he got to irrational exuberance, what he was really saying is that the monetary correlation – the correlation between money growth and various money aggregates in the economy – had gone way off course during the 1980s. He was confident that by targeting just the Federal Funds Rate, that wouldn’t matter. In other words, he knew that monetary evolution was taking place. However, he felt that because the Federal Funds Rate was such a hugely powerful control mechanism, it wouldn’t matter that the Federal Reserve couldn’t even define money.

Any normal person in that situation, especially tasked with being head of the central bank, probably would be unnerved by it. But his reputation was such at the time and the conditions of how people perceived the economy, especially in 1990. It was a disconnect between what everybody thought he was able to do with the Federal Reserve and what he was actually able to do. And so proven through monetary policy there may be changes in the Federal Funds Rate, especially in the decade of 2000. You see this very big difference between what is supposed to happen and what does happen.

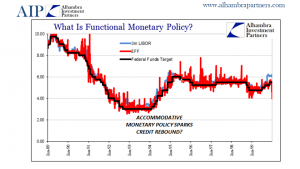

FRA: And that brings us to the concept of the functional monetary policy. We have a chart that sort of begins around 1989 and then goes into the 1990s that depicts accommodative monetary policy sparks credit rebound.

SNIDER: That’s what people conceive out of what the maestro was doing in the 1990s. He was moving the Federal Funds Rate around, either stimulating or tightening: the famous 1994 bond massacre when he tightened rates and engineered supposedly the soft landing for the middle 1990s. And there were other minor adjustments in the latter part of the decade. There was a 75 basis point rate cut around 1997-1998 related to the Asian flu, but overall what happened throughout the 1990s was that people got the idea that there was a correlation between what the Federal Reserve did with nothing more than the Federal Funds Rate, and this relatively calm period of economy where it expanded for a decade without any recession. Then 2001, the recession that did come was a very mild one, despite the fact that the Dot Com bust was an enormous event. So it really did seem like, on the surface, the monetary policy was a powerful instrument wielded by the best and brightest that we had to offer. Of course that really started to go awry with the housing bubble.

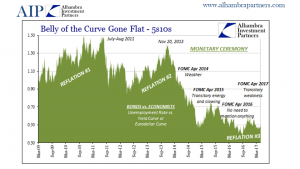

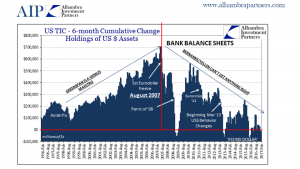

Really, the housing bubble goes back to 1995, and what we can see of the housing bubble conventionally is the housing mania portion, which is 2003 forward. During that period, we really start to see how monetary policy wasn’t what people thought it was. In fact, Greenspan’s Fed started to raise the Federal Funds Rate in lieu of 2004. He kept at it for 17 straight rate cuts, so that by June of 2006 the Federal Funds Rate had gone from 1.5% to 5.25%. Which sounds, on the surface, like a tremendous amount of monetary policy tightening, yet when you look around at that time and look through all the various statistic monetary economics, there was almost no detectable effect from that policy cut. In fact, conditions overall, especially monetarily outside of the traditional monetary statistics, it was actually the opposite. Greenspan intended to tighten but it was as if the banking system had simply gone insane in the opposite direction. It was expanding at an exponential, parabolic rate in almost every wholesale-shadowed capacity.

FRA: Moving past that into 2007-2008, as you show on the next slide, the interest rate going down and you question if this is accommodative money, not even close.

SNIDER: It’s funny. It’s almost an exact mirror image of the rate hike. During the hiking regime of 2004-2006, the Greenspan Fed raised the Federal Funds Rate from 1% to 5.25%, and then starting in September 2007 the Bernanke Fed just reversed it – it went from 5.25% back to 1%. During that period where this is supposed to be a hugely accommodative interest rate cut or a series of interest rate cuts, you cannot classify that period as accommodative in any way, shape or form. In fact, it ended up in the first global financial panic since the 1930s.

So what are we witnessing here with the Federal Funds Rate? It isn’t stimulus when they cut the Federal Funds Rate, just as it wasn’t tightening when they raised it. So what is actual, functional monetary policy? What we find is that it ties directly to the evolution of banking and money primarily through the 1990s, how banking had changed from the traditional banking model to this wholesale model which at the time in 2008 people had started to refer to as ‘shadow banking’. The reason we call it ‘shadow banks’ is because the central bank, the Federal Reserve and its cousins throughout the globe, simply dropped the ball. They stopped caring about actual functional money because they thought the Federal Funds was all they needed to control.

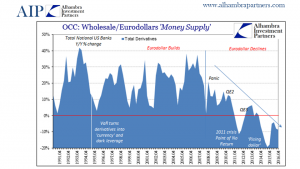

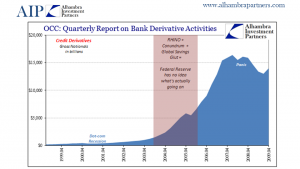

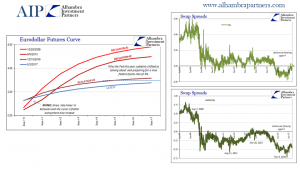

FRA: And the next two slides, if you can provide some elaboration from the office of the controller currency, getting into derivatives and how value at risk turns derivatives into ‘currency’ and dark leverage?

SNIDER: These are the other balance sheet factors that have, at various points in time, acted very much like money themselves. They’re very currency-like at times, especially the thing about interest rate swaps and credit default swaps. Credit default swaps, people probably remember from AIG, and the relation to subprime mortgages, but in fact the use of our credit default swaps was primarily related to balance sheet capital efficiency. In fact, most of the credit default swaps were primarily for primarily European banks to expand their balance sheet without having to raise additional cash. So what these derivative balance sheet factors tell us is, in general terms, bank behaviors. Whether they’re expanding, not necessarily how they’re expanding but how quickly they want to expand, and from that we can infer the global monetary system as it actually was, was expanding. Credit default swaps in particular, you look at during the period where Alan Greenspan was raising rates in the mid-2000s, the credit default swap market or at least the total gross notional written standing paid absolutely no attention to the Federal Reserve whatsoever. In fact, they increased geometrically throughout that period and into the period after it until the panic period started in 2007. So the banks that were off in this other shadow world were expanding rapidly all throughout the 1980s and 1990s and early 2000s. So we have to consider, was that this so-called good luck impetus that allowed the so-called Great Moderation to develop? Was it instead how banking was evolving and growing during that period rather than Alan Greenspan and his 25 basis point rate cuts and rate hikes in the Federal Funds Rate, which was in many ways an irrelevant marker.

FRA: What happened in 2016 from the financial crisis that caused the Federal Reserve to quietly surrender, as you quote?

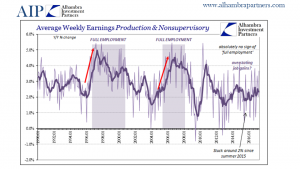

SNIDER: Well, the fact that the economy never recovered, to put it bluntly and blatantly, despite all expectation. To be fair, Federal Reserve officials like Ben Bernanke from the very start said that the recovery would be long sell. And he did so because they expected the banking irregularities and the bank panic and all of that would act as a drag on recovery rather than be a rapid event like there had been in typical recessions. They fully expected that it would be drawn out a little bit longer than maybe people were comfortable with. That, in the end, it would be a full recovery. Yet time and again we find that it wasn’t ever a recovery. Every time the economy was supposed to kick into high gear, something even close to recovery, it just never did. By 2016, the Fed was forced to admit defeat. They had tried four different QEs that had no success. It didn’t create the inflation they thought it would, and therefore there was no inflation and no wage gain and no recovery, so they had to admit what most other people had finally figured out many years before, that there was never going to be a recovery.

FRA: The next few slides illustrate how the Fed was in fact destroying potential rather than initiating recovery.

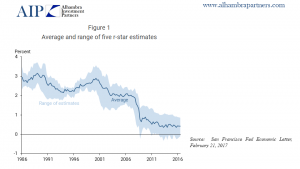

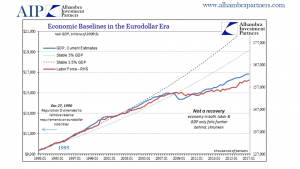

SNIDER: I don’t know if I would say the Fed was destroying potential so much as they were calculating the destroyed potential as a consequence of what they still think of as unknown. One of the primary ways that they arrive at that conclusion is what’s called R* or the natural rate of interest. The natural rate of interest is something that a Swedish economist had developed in the late 19th century, but lay dormant until the late 1990s when academics at Princeton and other place resurrected it. The natural rate of interest is supposed to be useful to monetary policy because it supposedly tells us where employment and inflation balances. In other words, what is the rate on money that won’t either spin the economy off into overheating or depress it too much into a depression. It’s not something that’s directly observed, so it has to be calculated through various mediums; there’s no actual agreement on what R* is. But what economists and policy makers have come to realize is that their calculation of R* since the panic in 2008 has basically arrived at that conclusion: that there basically is no recovery. And furthermore, there isn’t one coming. When you get to that point in terms of monetary policy, what that means is that there’s nothing left for you to do.

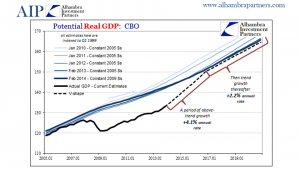

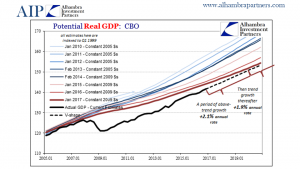

The FOMC discusses things like the output gap because that is supposed to tell them where they are in relation to this R* rate where risks of inflation and deflation are perfectly balanced, where unemployment can be the lowest without risking inflation overheating. What you find is that as the so called recovery developed, time and again they expected to get this burst of recovery-like growth to occur. When it didn’t happen, they’re forced to mark down their estimate of potential GDP and potential output to match the fact that it never happened. Over time, year after year, the level of potential just sank and sank and sank so that by 2016 there was very little distance left between potential and where GDP actually was. To the Federal Reserve policy makers, what that said was there was no output gap, or very little left. And if there was very little output gap left, there’s absolutely nothing for monetary policy left to do. At a situation where output and the level of potential are the same or nearly the same, stimulus is a waste of time.

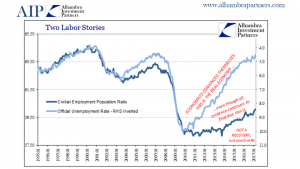

FRA: If we look at labor, one of your charts there, what happened to cause a divergence from 2010 up to today in terms of two labour stories?

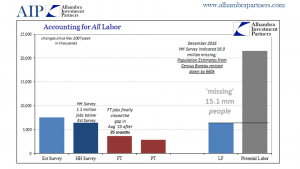

SNIDER: That gets back to, essentially, the mystery of where did the recovery go? For monetary policy makers, this is a global phenomenon, not just a US one. Specifically with the US, the participation problem is that for whatever reasons, a huge chunk of the potential labour force has never re-entered the labor market. They have either never entered during the recovery period, or those that were out of work in 2008 never went back. The size of that pool of missing labor is immense, perhaps 15 million or more.

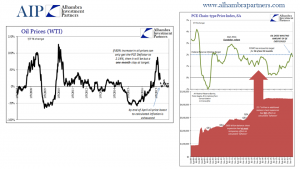

From the view of monetary policy in the unemployment rate, which figures into the output gap calculation as well, these people don’t matter. It’s as if the unemployment rate is an actual metric that’s appropriate for describing our economic situation to this day. But if that was the case, as the unemployment rate fell especially through 2014 and the start of 2015, we should’ve expected to see inflation start to rise. Instead, it obviously went the other way: inflation actually fell due to the oil prices and the slowdown of the economy due to the rising Dollar. So you have this very big disconnect between the size of the labor force which didn’t grow, and the fact that BLS was estimating almost robust job growth. Over time, what happened was that the Federal Reserve got to the point where they were figuring the unemployment rate described full employment, and because of that and the output gap they felt they had no choice but to start raising rates, no matter what the economic conditions were at the time. That’s why in December 2015 they raised the Federal Funds Rate for the first time even though the conditions at the time were near recession.

In fact, on the day they had announced that first increase in the middle of December, the Federal Reserve also announced that industrial production had shrank, which is usually a recession indicator. So you have striking contrast between what the Fed was doing and what the economy was doing. And it doesn’t really make sense except if you understand both monetary evolution and how monetary policy actually brought it about, essentially. The economy was so poor for so long the Fed basically gave up on any form of stimulus because they essentially said, this is it, this is as good as it’ll ever get.

FRA: As you mentioned, despite reflation sentiment rampant all over the world, there is still no momentum anywhere, just more of the same “recovery”.

SNIDER: That’s an unusual occurrence. At least in this historical cycle, when you have any sort of downturn, whether a recession or a near recession, there’s usually an upturn that’s equal or better. Usually there’s symmetry associated with those types of moves. I think there was the expectation, especially late last year and the start of this year, that that would be the case. Things were really bad, and seemingly possibly becoming a full recession early last year, but then escaping all that it should’ve been the case where the economy here and elsewhere started really meaningfully improving; not just some positive numbers switching off with negative numbers, but actual momentum very much like we saw in any other point in history. And that hasn’t happened. Q1 2007 GDP is probably the best example of that recently, where another quarter of hugely disappointing output growth that is actually perfectly consistent instead with the fact that the economy is as it is. Since 2007 it’s run at a reduced rate with very little monetary momentum that will allow for expansions to take hold for what we would know as a recovery.

It’s a global thing, where you find the same problems in China, in Europe, in Japan, Brazil, pretty much anywhere. That points us in the direction where the global economy can be synchronized. The list of suspects that could accomplish such a thing is exceedingly small. In fact, there’s only one thing on it, and that’s the global dollar system. It’s the only thing that could first of all create such a massive dislocation in 2008 and then make it a permanent factor. The fact that the money now functioned steadily and chronically since 2007 tells us a lot about these economic conditions and why, after every time the economy turned lower it doesn’t ever turn back higher again.

FRA: In your slides you also raised the concept of shadow money and how that figures into systemic disruptions. Can you elaborate on that to explain?

SNIDER: There’s quite a bit of debate about what’s driving banks to retreat. It’s essentially the major problem. Before 2007 banks grew exponentially; they grew as fast as they could in any way or shape they could, whether it was mergers and acquisitions, whether it was derivatives and money-dealing, whatever it was. After 2007 banks have done the opposite. Overall they may not have shrunk, but they aren’t growing either. The lack of growth is actually a contraction. Some people believe that’s because of regulations where things like Dodd-Frank and Basel III rules have imposed rules strictly on bank leverage in a post crisis period, but I’m pretty sure that’s not the case. In fact, what changed in 2007 was behavior.

The very fact that before 2007, it was thought that there was very little risk to these various kinds of shadow components. No matter what a bank was doing or what it could come up with, there was no risk to it. And even if there was any kind of trouble associated with the credit default swap book or repo book, the Federal Reserve based on the myth of Alan Greenspan as the maestro would be able to get everyone out of it. So the 2008 panic was very instructive in a way, because it showed banks the Fed had no idea what it was doing, and even if it did know what it was doing it was incapable of solving these problems. If you’re a bank post crisis, that’s a huge factor to how you set your balance sheet construction because you can no longer depend on the Fed. That point was driven home especially hard in 2011, when despite two QEs, the Fed had expanded the level of bank reserve in the system by $1.6T to the middle of 2011, yet there was another liquidity even in that year. In fact, it was so bad that in August 2011 the FOMC actually debated an option of bailing out the repo. For banks in that position and time period, it was a huge wakeup call that shadow banking activities were enormously risky. In fact they were so risky that it wasn’t worth the effort. It wasn’t worth the balance sheet to take them, especially given the economic circumstance where they depressed rate of output here and everywhere around the world. There was no reward for taking on that risk, so the risk paradigm shifted and so did balance sheet capacity shift. And because balance sheet capacity shifted, there was no economic momentum.

FRA: So do we have a shadow money driven economic depression?

SNIDER: I believe so. I think it’s pretty clear when you step outside of the traditional definitions of money, and you marry the evolution of the 1990s to the conditions of today. You can see how things evolved. Going back to the idea of the Great Moderation and what they called good luck, if it wasn’t ever good luck, it was due to these external factors which really weren’t external, but they were only external to the orthodox view. If it was due to these external monetary factors, then it makes sense. The Great Moderation was a temporary artificial period of calm that was created by monetary growth that was at times explosive growth. Where did asset bubbles come from? They came from the shadows, and the fact that the shadow system has been nothing but dysfunctional ever since, and so has the economy? That would be one hell of a coincidence, don’t you think?

FRA: Yeah. And what about the shadow banking system in China? Do you see problems there?

SNIDER: The Chinese system is a little bit different. Their banking system is a little more of the traditional model. That’s not to say a great deal of their growth, especially since 2009, hasn’t been in the shadows, because they’ve clearly tried to replicated the shadow system here but apparently they haven’t learned any of the lessons from the crises. It had grown enormously and they’re having all sorts of trouble in the Chinese version of the system, the very same way we had trouble ten years ago. We have funding mechanisms that are breaking down, creating all sorts of risks that people don’t really understand. Unfortunately that includes policy makers themselves. It’s all too easy to simply ignore this stuff when it seems to be working and things are growing well and it looks like the economy is growing with it, why ask any questions? If it ain’t broke, why fix it? Unfortunately, the problem is that once it does break, there is no fixing it. That’s where we are and that’s where China’s headed, but probably in a more managed cycle than we did in 2007-2008. Ultimately it’s the same thing. Once the contradictions of the monetary system and shadow system become apparent, there is no going back.

FRA: Given all this historical context, where do we go from there? Do you see a slowing global economy? You’ve got a few slides in there showing exports out of China slowing down, imports from China to the US slowing down, could it turn into a stagflation with rising inflation and slowing economic growth? Where do you see things headed in the next year or two?

SNIDER: Unless something substantially changes, and I don’t think the economy will substantially change, we’re kind of stuck in this disinflationary depression condition, which here in the US they call the low-growth state. The lack of compounding over time has an enormous cost and an enormous contraction. Unless the monetary system is substantially reformed, I don’t think this will change. In fact we know it won’t because in many ways the Japanese pioneered this very path 25 years ago. We are following along the Japanese path far too closely for my comfort. It’s instructive to look at Japan for what our future could look like. The problem with that is that the global economy isn’t the Japanese economy; more specifically, the global social and political system I don’t think will stand the two decades of absolutely no growth or very little growth.

We’ve already seen some of the social and political cohesion coming apart; the votes last year whether it be for Trump, Brexit, the Italian vote, there’s already been a great deal of political unrest that’s becoming a populist type of—I don’t want to say revolution or revolt, but it’s the backlash against an economic system that just doesn’t work. You have to wonder how long can we go in this current state where it doesn’t get better. No matter what happens, no matter what any of the supposed experts tell us to do, nothing will work because the monetary system isn’t working. There has to be a breaking point where either the political system realizes the dangers inherent in that condition and actually responds favorably by taking hold of the Eurodollar system and actually reforming it rather than trying to throw another QE into the mix. That’s a possible positive outcome. I don’t want to contemplate the possible negative outcomes because some of them are truly the worst kind of historical comparisons.

Transcript by: Annie Zhou <a2zhou@ryerson.ca>

LINK HERE to get the MP3 Podcast

06/15/2017 - The Roundtable Insight: Jeff Snider – We Have A Shadow Money Driven Economic Depression

06/15/2017 - The Roundtable Insight: Jeff Snider – We Have A Shadow Money Driven Economic Depression