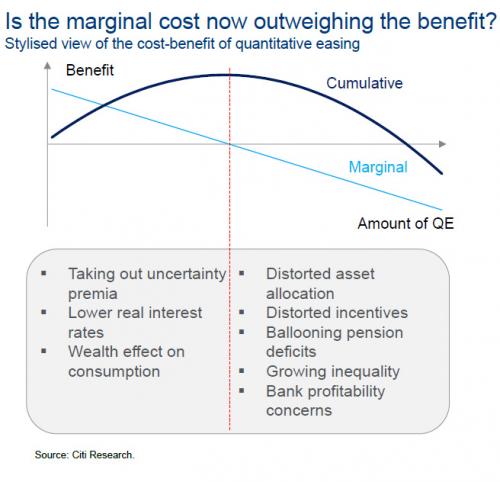

“The latest weekly report by Deutsche’s Credit Strategist Dominic Konstam finds something even more troubling: $1 trillion in central bank liquidity YTD – or roughly $250 billion per month – is not enough .. Konstam’s conclusion is that there are two outcomes: either asset prices drops, or central banks will ultimately be forced to inject even more liquidity .. The bottom line, however, boils down to the following chart first shown by Citi last September, demonstrating that the marginal cost of central bank liquidity injection is now negative…

… and is located in the lower right quadrant, something both markets and policy makers realize.

Which means that when stocks realize just how insufficient the record $1 trillion in central bank liquidity has become, central banks – which have stepped into every single market correction over the past 7 years with some ‘liquidity supernova’ – will, for the first time since the financial crisis – be out of tools… something Janet Yellen appears to have realized some time ago.”

05/07/2017 - Central Banks Injected A Record $1 Trillion In 2017 – “It’s Not Enough”?!

05/07/2017 - Central Banks Injected A Record $1 Trillion In 2017 – “It’s Not Enough”?!