WHAT IS THE DODD-FRANK ACT?

The Dodd-Frank Wall Street Reform and Consumer Protection Act, first passed in 2010, was set up to regulate and restrict banks’ influence in the financial markets. It was put forth with the goal of reducing the “too big to fail” status of banks, end bailouts, and to protect the consumer from abusive financial system practices while promoting transparency and accountability. The Act added new regulatory bodies in an attempt to maintain stability in the financial markets, and restricted their ability to engage in proprietary trading.

Primarily, the Act created the following:

The Financial Stability Oversight Council (FSOC) that regulates and responds to risks to the financial stability of the US, and promotes market discipline. This includes demanding banks they consider too large to increase their reserve requirements.

The Volcker Rule, which reduced the amount of speculative investments banks could engage in, thereby banning conflict of interest trading that banks could use to increase their own profits. This includes hedge funds and private equity funds.

The Consumer Financial Protection Bureau, which promotes transparency and accountability of banking practices, and allows financial irregularities to be reported.

As of February 2017, Trump has called for the reduction of the scope and regulations of the Dodd-Frank Act.

EFFECT OF POTENTIAL CHANGES

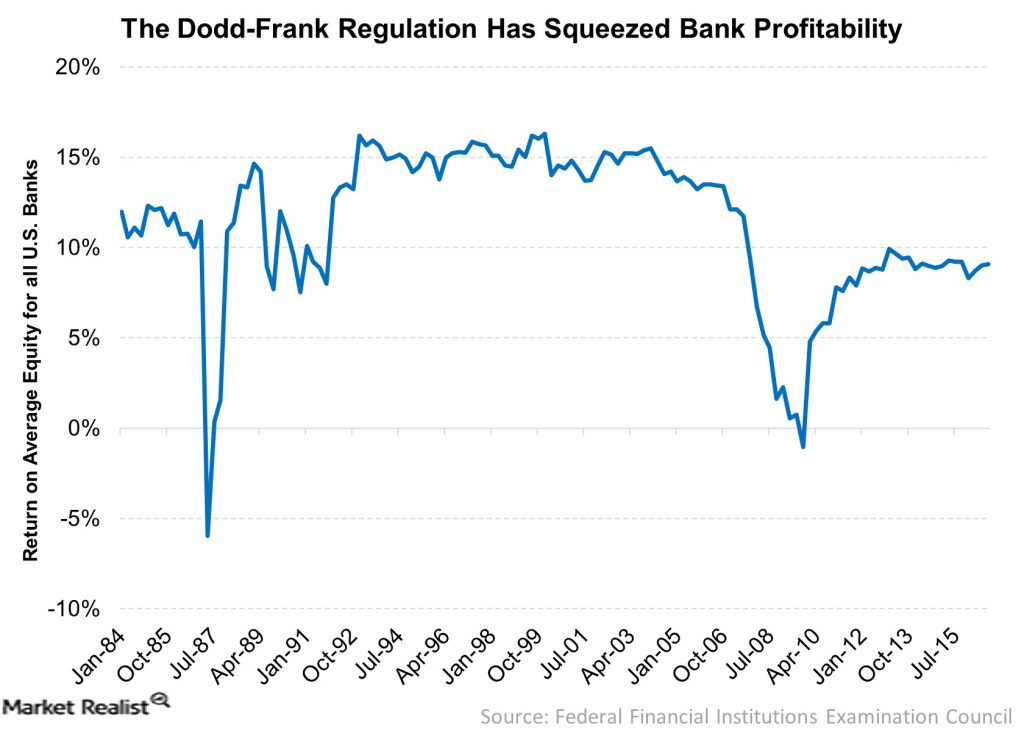

Some of the changes suggested directly target the Volcker Rule, which could give banks more freedom in engaging in speculative investing to increase their profits

Dave Sheaff Gilreath of Sheaff Brock Investment Advisors LLC notes that a decrease in regulations would have positive effects on stocks in the financial sector. Already stocks of big banks have jumped since the announcement.

As for small town banks, loosening the restrictions would make it easier for them to provide loans to local small businesses – their primary customers. Bank capital levels and credit quality would also be checked less often, and the overall compliance burden would be reduced. For smaller banks, this change could mean the difference between going into the red or not.

As Peter Boockvar notes, “Dodd Frank discourages traditional market makers to provide liquidity.” Large amounts of equity funding would help banks cope with a financial crisis.

Along the same lines is the likely delay of the fiduciary rule, intended to force investment advisors to recommend lower-fee investments to their clients, and to act in their best interest financially. However, this could also discourage banks from working with low net worth clients as it will definitely reduce income.

In addition to all this, Trump is going to replace Janet Yellen with someone sympathetic to his administration apparently one of his Wall Street compatriots, making it highly likely that future financial decisions will be weighted in favor of Wall Street and bankers.

Unfortunately, the eventual outcome is highly uncertain as it is still unclear what sections of Dodd-Frank will be repealed, rolled back, or modified. Regardless, Trump has made it clear that he intends to empower Wall Street despite what he says about helping Main Street.

By: Annie Zhou <a2zhou@ryerson.ca>

03/12/2017 - Potential Effects Of Changes To The Dodd Frank Act

03/12/2017 - Potential Effects Of Changes To The Dodd Frank Act