Here is our view of the macro-economic state of the global economy and the risk factors going into 2017.

Overall, we continue to see ongoing adverse risks to investors from the unintended consequences of generally good-intentioned central bank and government policies and regulations arising from the challenges of managing escalating debt and fostering economic growth:

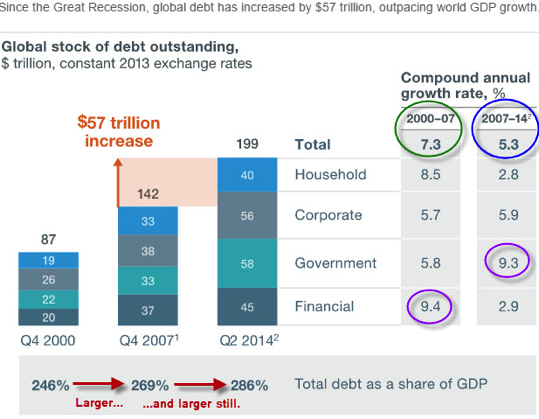

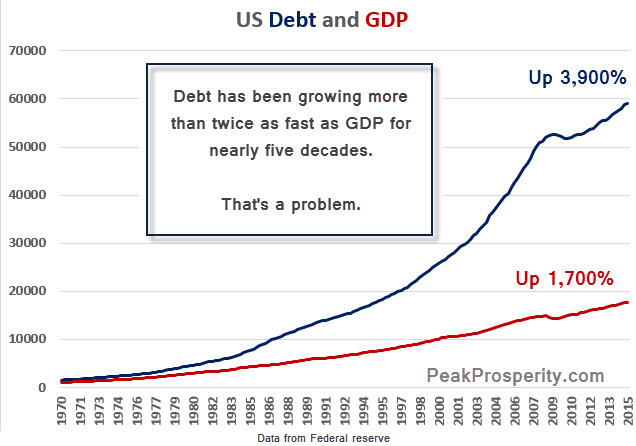

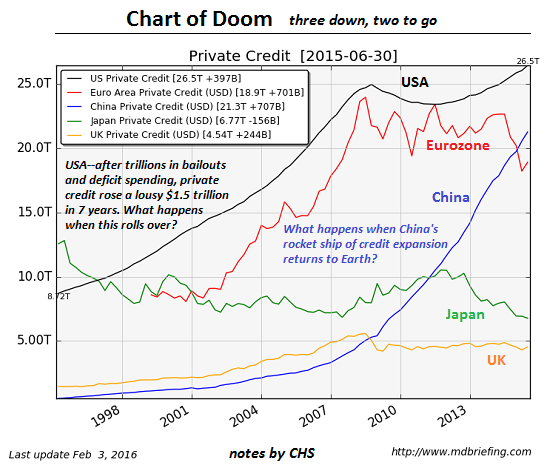

The results of these central bank and government policies and regulations are now being manifested as worsening public and private debt, a stagflationary global economy, an emerging public and private pension crisis, and unsustainable entitlement obligations.

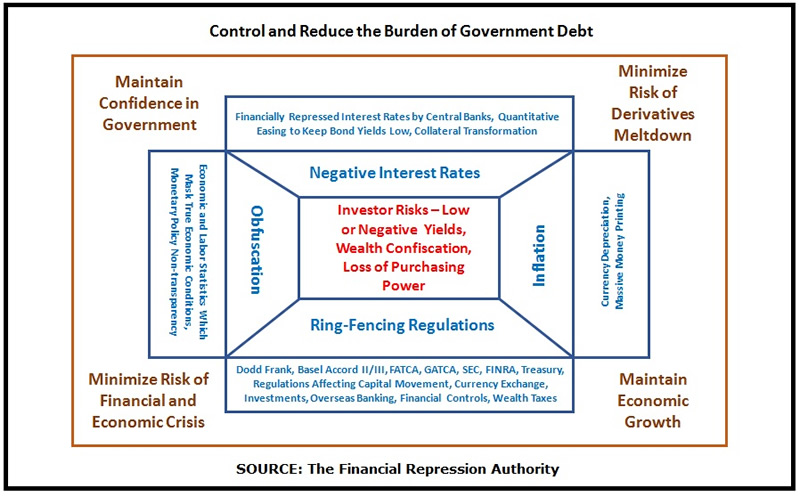

4 pillars of financial repression – negative interest rates (whether in nominal terms or in real terms), forced inflation, ring-fencing regulations and obfuscation – are in turn resulting from the above-mentioned central bank and government policies and regulations.

In turn these 4 pillars are presenting the adverse risks to investors. For investors, the focus then becomes identifying assets (both public and private) and more importantly appropriate risk management in order to meet the investor goals of getting yield, preserving purchasing power and creating wealth.

Let’s look at the results mentioned above which are now being manifested – worsening debt, stagflation, pension crisis and entitlement crisis – as the key factors affecting the global economy and the financial markets heading into 2017:

Escalating Debt & Debt Servicing Costs, Unsustainable U.S. Entitlement Spending, A Slowing Global Economy

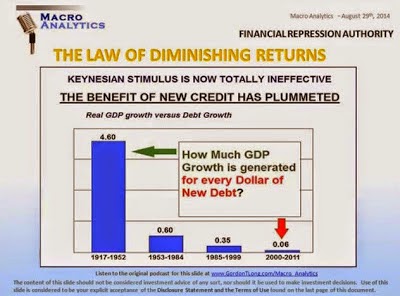

The combination of rising interest rates and escalating debt is causing debt servicing costs to escalate. This is putting a damper on global economic growth. Some charts on this are shown below. Central banks have attempted to alleviate the challenge through negative interest rates and forced inflation – 2 of the 4 pillars of financial repression. The debt challenges are not only in the U.S. – in China for example, non-performing loans are now at 15%-20% of GDP levels (according to Moody’s) .. and in Italy, the non-performing loan numbers may be closer to 25% of GDP levels!

On the fiscal challenges driving U.S. debt, entitlement obligations are now at 10% of GDP and rising! This trend is expected to escalate U.S. debt levels, given the trillions in unfunded liabilities obligated towards entitlements.

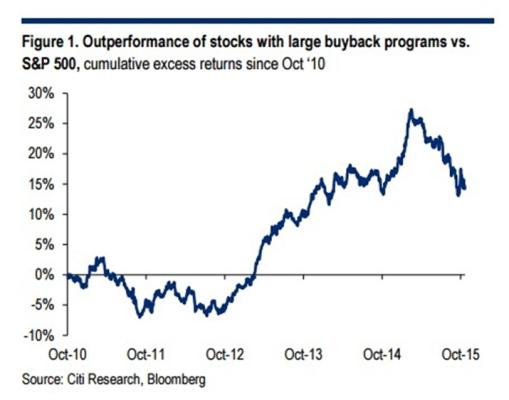

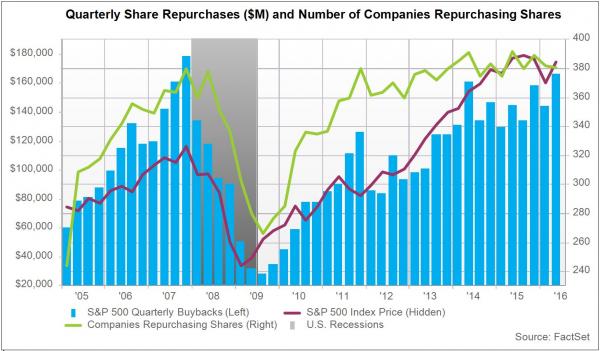

In addition, corporations have taken out a significant level of debt to use in buying back their equities – it has been estimated that there has been $620 Billion borrowed & used in this regard during the last 12 months alone.

This corporate debt will be a challenge in managing going forward, especially in a rising interest rate environment.

A Stagflationary Global Economy

Given the push by the new U.S. Administration through President-Elect Donald Trump to lower U.S. corporte taxation rates from 35% to 15%, this could be a major positive on the economy and the financial markets. In addition, Japan, Canada, the U.S. and China are implementing or are planning for major infrastructure fiscal-stimulus spending – although it may not be until into 2018 for the infrastructure spending in the U.S. and Canada to be implemented.

Putting all these developments together – the escalating debt challenges mentioned above, rising interest rates, rising inflation and global fiscal stimulus spending in a world of slowing global trade – this is all resulting in a stagflationary environment.

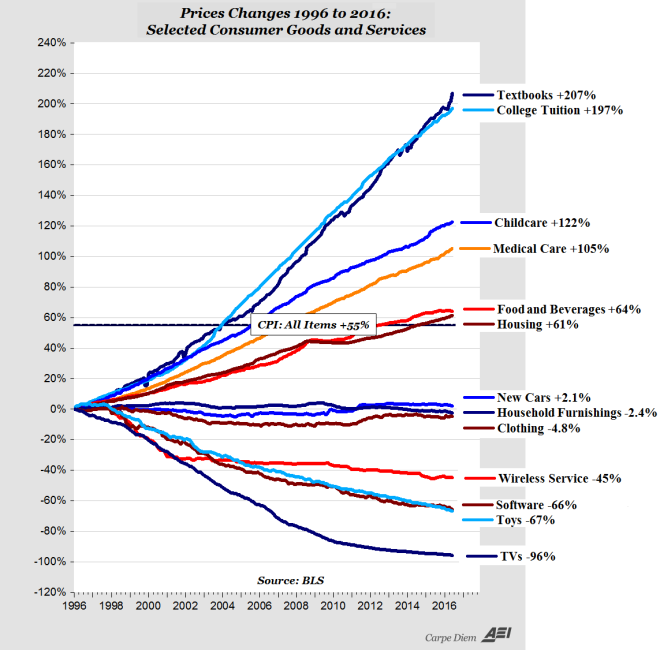

There is rising price inflation, generally being seen in things that people need – food, education, health care, and insurance – versus things where globalization or technological development has significantly brought costs down – electronics, consumer products, outsourced services, etc.

Hedge fund manager Dr. Albert Friedberg of the Friedberg Mercantile Group:”We are going to see an expansion of the federal deficit, we are going to see long term interest rates going higher, we are going to see a Federal Reserve chase after inflation going higher .. Our forecast, and the direction taken by our portfolios, is for accelerating inflation over the coming months. This phenomenon will take markets and officials by surprise, and I believe that it will change the world we know today. Financial repression will continue to be the order of the day, partly because central bankers will remain in intellectual denial and partly because of fears that rate normalization will bring economic activity tumbling down. The early part of this period of accelerating inflation should prove beneficial to many assets, among them commodities and well financed equities. Coming out of denial — beyond our investment horizon — will be painful and very damaging to debt burdened sovereigns and corporations.”

An Emerging Pension Crisis

The developed world is in an escalating pension crisis – both at the public level & at the private level. Pension funds are finding it increasing difficult to meet their obligations, given the very low or even negative interest rate financially repressed environment.

Danielle DiMartino Booth – Former Advisor to the Dallas Federal Reserve President: “There is a distinct cerebral pleasure, relief even, derived from lapsing into a state of suspended disbelief .. Add up all our great states and Moody’s math comes up with $1.75 trillion in what will be pension underfunding by the time we’ve said adios to fiscal year 2017. That represents a 40 percent jump from fiscal year end 2015 .. The Federal Reserve is fully aware of the inferno burning under the surface of the nation’s public pension system and the direct effect their interest rate policy has had in exacerbating pension underfunding .. Unlike other countries, whose pension disasters will also be all consuming, U.S. laws allow accounting chicanery that obfuscates the gravity of the degree of underfunding. But have no doubt, these chickens will come home to roost though these manias always last longer than we can envision.”

Here is a table showing underfunding challenges for some corporations:

Investment Environment Implications

Many of the fund managers, economists and industry leaders we follow and interview see the following potentials for the investment environment:

- selective opportunities in equities with the potential for a “Minsky Meltup” (see commentary by FRA’s Co-Founder Gordon T Long below)

- the potential for infrastructure-related and innovation-related investments, including those involving public-private partnerships (PPP)

- the potential for a strong commodity market, especially in base metals and agricultural commodities

- depending on the strength of the U.S. dollar and the unwinding of U.S. dollar denominated corporate debt, the potential for investments in emerging markets, especially those which have a focus in base metal and agricultural commodities

- the potential for a short-term bounce in U.S. Treasury bonds, before going lower for the medium-to-long term trend; this trend is bearish for most bond markets

- the potential for store-of-value assets in safe storage and secure jurisdictions of the world

- the potential for basic businesses with little or no debt, with little or no leverage and with high discounted free cash flows

A risk-mitigated approach to addressing the market, credit and operational risks can help an overall investment strategy. For 2017, we see intensifying operational risks – the war on cash and gold spreading, along with tightening capital and currency exchange controls, new regulations adversely affecting the freedoms in the movement of capital, new and increased wealth taxes at all levels, and adverse changes to rules affecting registered retirement and pension fund accounts.

FRA’s Co-Founder Gordon T Long thoughts on the Outlook into 2017 .. also LINK HERE to Gord’s analysis

12/24/2016 - Outlook For 2017

12/24/2016 - Outlook For 2017