ADVANCING FINANCIAL REPRESSION

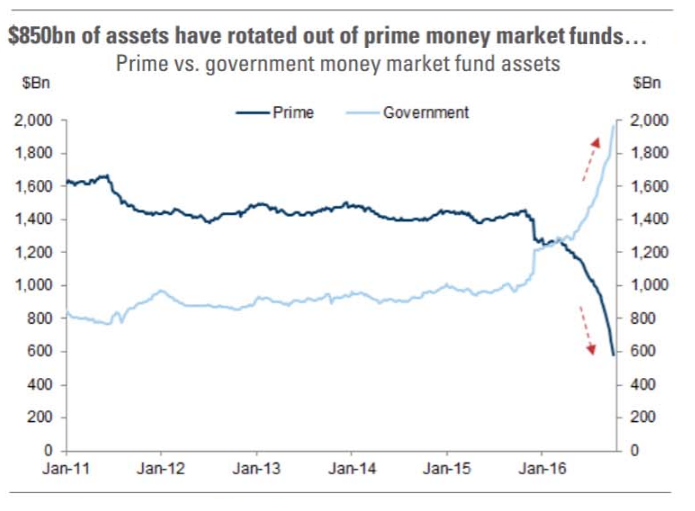

New SEC Regulatory 270-2a-7 Has Pushed Nearly $1T Prime Money Markets into Government Funds, Treasuries & Agencies

The SEC’s 2a-7 money fund reform adopted in 2014 has now gone into affect.

REGULATORY “REFORM”

- Requires prime money market mutual funds which invest in non-government issued assets such as short-term corporate and municipal debt to float their net asset value.

- Prime MMFs are allowed to delay client withdrawals under adverse market conditions.

The intent of the regulation according to the SEC’s final ruling was to prevent the sort of chaos that hit the money market after Lehman Brothers Holdings Inc.’s 2008 bankruptcy.

GOAL

- Give investors a way to monitor a fund’s health by tracking its fluctuating net asset value and

- To contain the fallout that could be caused by many investors cashing out at once

RESULT

- Many Prime MMFs are and have been converting their assets to government funds,

- Are not buying CDs anymore and

- Moving into Treasury’s and Agencies.

Nearly $1 trillion in assets have rotated out of prime money markets into government funds. – ZeroHedge

According to the WSJ, the new money-market fund rules “have made life more difficult for corporate treasurers and chief financial officers” because they face a sometimes unfamiliar array of investment options as they seek both to preserve and earn some return on their collective trillions.

SEC’s changes make it possible for some money funds to lose value, limit redemptions, undermining their appeal – WSJ

LIBOR rates are now through the roof, to the highest level since the financial crisis, with consequences that have yet to be determined.

10/14/2016 - New SEC Regulatory 270-2a-7 Has Pushed Nearly $1T Prime Money Markets into Government Funds, Treasuries & Agencies

10/14/2016 - New SEC Regulatory 270-2a-7 Has Pushed Nearly $1T Prime Money Markets into Government Funds, Treasuries & Agencies