John Charalambakis is the Managing Director of Black Summit Financial Group, a boutique style asset and wealth management firm, which focuses on risk mitigation, capital preservation and growth through strategies that are rule based. Dr. Charalambakis has been teaching economics and finance in the US for the last twenty years. Currently he teaches economics at the Patterson School of Diplomacy & International Commerce at the University of Kentucky.

FINANCIAL REPRESSION

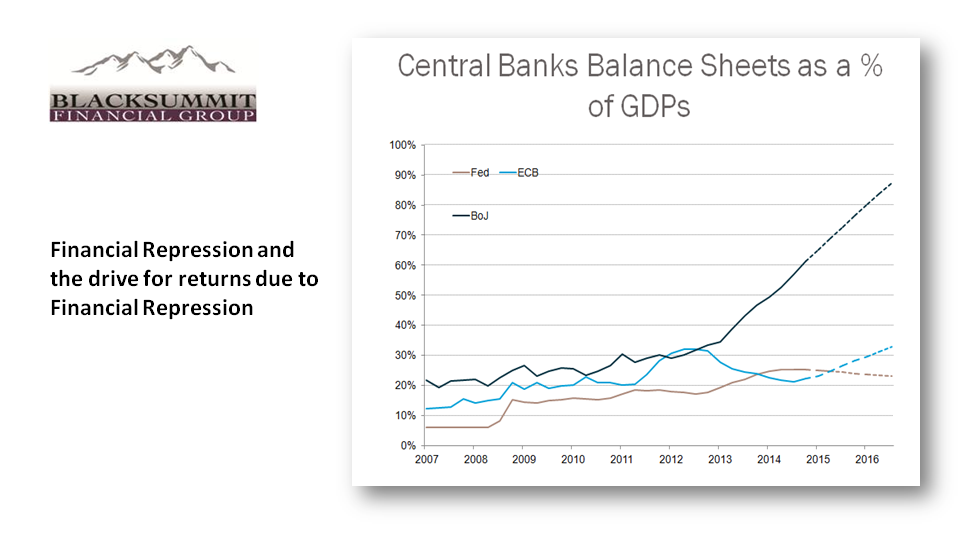

“The outcome of financial repression is when the role of the markets is diminished because of the actions of central authorities, such as central banks.”

Fed: Central banks of the United States, ECB: European central bank, and BoJ Bank of Japan

Assets under management have skyrocketed from about 7% in 2007 for the U.S Fed, to over 20% as of the end of 2015, increasing 3 times. Over this time, the GDP did not equally increase 3 times. This increase eventually leads to a greater role of central authorities. Looking at Japan in 2007, they had about 20% of their GDP in their balance sheet, currently they have over 90%, meaning the role of the markets is diminishing and the role of central authorities is increasing, creating financial repression.

Gord asks John what assets people should invest in, in this era of financial repression that would create a store of value, which may not bring in a yield, but would preserve their money.

GOLD – INTRINSIC VALUE ASSETS

“I think the goal of any pension fund, institutional or private investor should be capital preservation. Assets should have intrinsic value.”

“Assets that have intrinsic value such as gold or silver, historically have retained their value especially in times of crisis.”

John mentions how the price of gold in 2009 rose from about $500-$500 to $1900 because investors were seeking a safe haven of intrinsic value assets. “There is not enough gold for everyone. Only 1/3 of 1%, a miniscule number, is invested in precious metals.” Hypothetically if every manager by the end 2016 would invest just 3% of their wealth into precious metals, the price of gold would rise to an estimated $2700. Growing demand and financial stress can, and likely eventually will, create a financial crisis.

KEY PRINCIPLES OF THE AUSTRIAN SCHOOL OF THOUGHT

- Uncertainty is endogenous in the markets, and therefore investments should be based on rules. “Regardless of where the market temporarily may be moving, the investor, whether individual or institutional, should be guided by rules.”

- Investors, whether fortunately or unfortunately, are emotional beings, therefore there are psychological deficiencies caused through emotions, effecting investments. Due to these emotional deficiencies, investors must be disciplined, and once again be guided by rules

- The conventional methodology of 60/40, stock and bond rule is not adequate. It ignores the risk parity considerations. Investors should shift their portfolio based on the macro environment of risk, in order to take advantage of the more promising and safe investment at the time being. John mentions that in 2009-2011 bonds gave a much better return, because money had left stock and shifted to bonds. It also ignores the potential black swan phenomenon. A black swan phenomenon is likely to happen again and in greater frequency than we’ve seen before, we need to be prepared and eventually hedge our portfolios in such a way, that we are able to sacrifice some return for the sake of stability and preservation.

- Portfolios need to structure in such a way to survive in a macro and business cycle, as well as the credit cycle.

- Markets cannot escape realities of wealth creation. Nations do not become wealthy by printing money. Rather, wealth is created through free markets, when the entrepreneur is allowed to take risks, because risk liberates. “When there is excess regulation suffocating the entrepreneur, wealth cannot be created.” Investing in entrepreneurs and innovators, with proper risk analysis, can result in great returns.

“Unfortunately risks and stresses are being built up and portfolios are suffering the consequences. People think because they have wealth on a financial statement, that wealth can be preserve. When the markets collide, that wealth is destroyed because it is paper wealth, not real wealth.”

INFRASTRUCTURE INVESTMENT

“Infrastructure investment needs to be financed, usually countries finance infrastructure through deficit spending, and that cannot happen due to big holes in their budgets.” John questions whether or not the internal rate of return justifies infrastructure. He doesn’t believe the environment is mature enough currently, due to the possibility of a looming crisis in the next couple years. This would push back infrastructure spending.

PREPARING FOR A POSSIBLE CRISIS

- Analyzing risk, and understand where the risk is coming from.

- Anchor the portfolios. (Most usually used in hard assets)

- If applicable; hedge the portfolio either by selling covered calls, and collect premium by doing so, as well as mitigating risks. Individuals may also consider buying puts.

“Since we are in an era of financial repression you cannot expect the income from treasuries or CDs, explore all sources of income”

Kamilla Guliveva

02/06/2016 - John Charalambakis: IT’S ABOUT RISK MITIGATION & CAPITAL PRESERVATION!

02/06/2016 - John Charalambakis: IT’S ABOUT RISK MITIGATION & CAPITAL PRESERVATION!