Bearing Asset Management Fund Information and Contact Page

Bearing Fund – Long/Short Hedge Fund using the Principles of the Austrian School of Economics

Bearing Fund was one of the top performing macro funds during the last bubble implosion in ’07-09. Bearing Asset Management created the Bearing Credit Bubble Index (available on the net) which features the various enablers of the last bubble beginning in 2004-05.

Click on the contact button below to fill in the contact form – you will receive Bearing Asset Management’s “Stimulus Bubble Opportunities” deck – lots of charts & information!

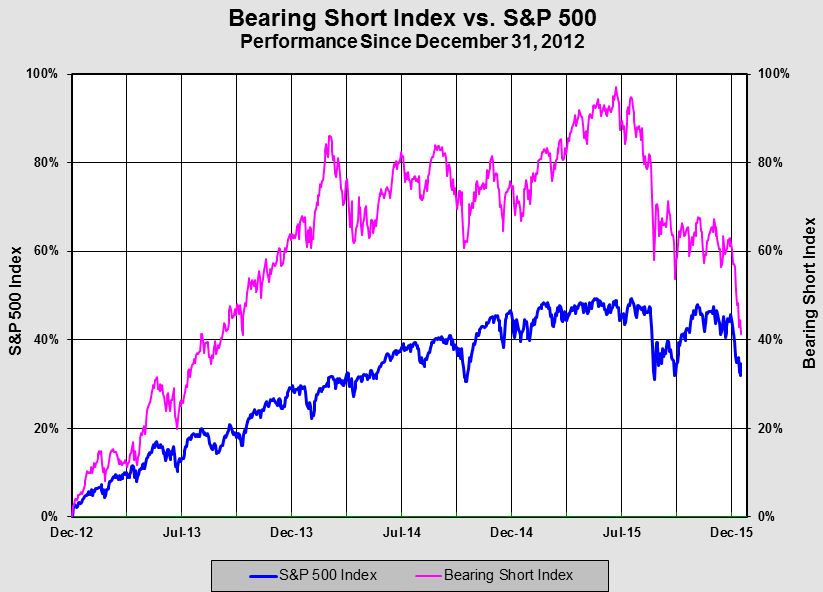

BEARING SHORT INDEX

December 14, 2015

About 18 months ago we constructed an equal-weighted index of our short selling universe at the time, 53 stocks. The list breaks down according to the following themes:

– Alternative energy (2)

– Asset managers (2)

– Bond insurance (3)

– Canadian banks (2)

– China and commodity-related (6)

– Consumer discretionary (2)

– Cyclicals (2)

– Europe (2)

– European banks (2)

– U.S. financials (4)

– High yield bonds (1)

– Housing (3)

– Luxury goods (4)

– Momentum/tech stocks (6)

– Pharmaceutical roll-ups (3)

– REITs – office (4)

– REITs – retail (5)

From its all-time high set on June 23, the Bearing Short Index is -20.3%. Over the same period, the S&P 500 is -4.8%. Of the 53 stocks in the index, 11 are down over 40% from their 52-week highs while 5 are down over 60%.In other words, the past six months have been ideal for short sellers and miserable for a number of high profile hedge funds which have been long many of these formerly highflying stocks. This underlying damage is being masked by the averages, propped up by the so-called “FANG” stocks: Facebook, Amazon.com, Netflix, and Google. Since June 23, these four stocks are up on average 31.5%.

Such a divergence is typical as an equity bubble is nearing its end, what we refer to as the “casino effect.” Essentially, as betting tables begin turning into losers, the compulsive gamblers refuse to leave the casino, instead gravitating to a smaller and smaller number of winning tables. At that point, the end is fairly predictable: no one leaves with any money in their pocket.