BoAML’s analysts are warning about the degree of Mispriced Risk and Central Bank Risk Manipulation according to a report by Zero Hedge:

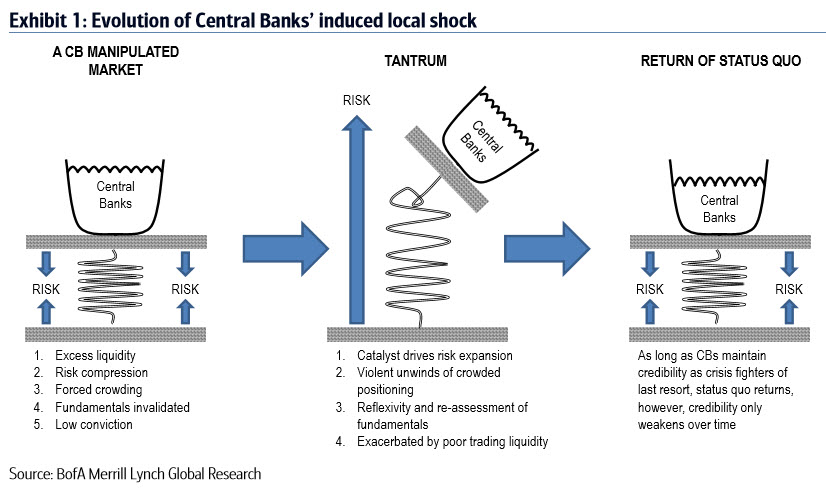

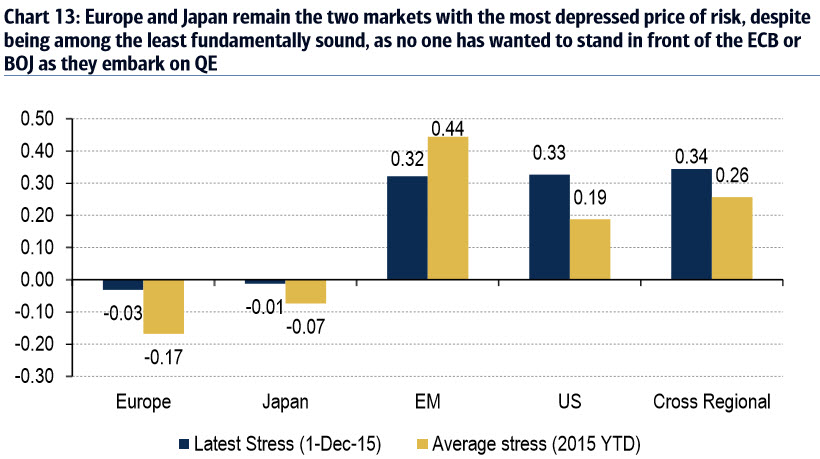

Essentially central banks, by unfairly inflating asset prices have compressed risk like a spring to unfairly tight levels. Unfortunately, the market is aware the price of risk is not correct, but they can’t fight it, and everyone is forced to crowd into the same trade. By manipulating markets they have also reduced investors’ inherent conviction by rendering fundamentals less relevant.

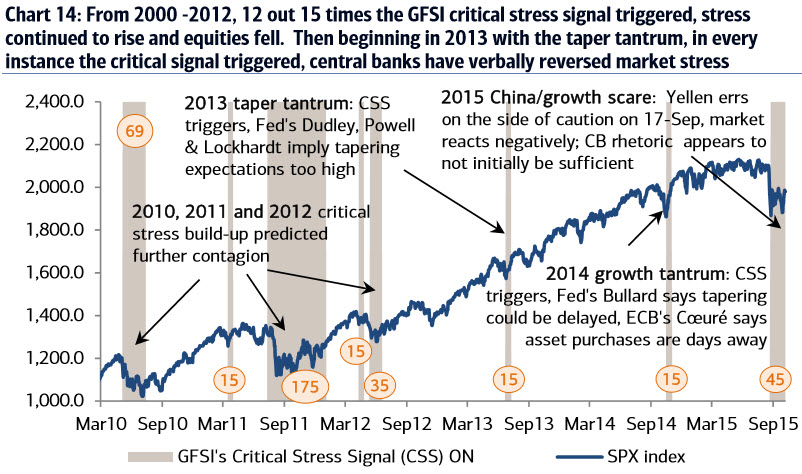

This then creates a highly unstable (fragile) situation that breaks violently when a sufficient catalyst causes risk to rise – overly crowded positioning meets a market with little conviction.

Catalysts can range from a “valuation scare” similar to Oct-14 or Aug-15 to a prominent investor stating that assets (e.g. bunds) are not fairly priced and are the “short of the century”.

The unwinds from these crowded positions are violent, but almost equally violent in some cases are the reversals, which are driven from investors crowding back in when they realize central banks are still there providing protection.

From this vantage point, it becomes clear that the biggest visible risk to financial markets is a loss of confidence in this omnipotent CB put.

READ FULL ARTICLE WITH GRAPHICS

12/24/2015 - BoAML Warns of Mispriced Risk and Central Bank Risk Manipulation

12/24/2015 - BoAML Warns of Mispriced Risk and Central Bank Risk Manipulation