FRA: Hi, welcome to FRA’s Roundtable Insight .. Today we have Charles Hugh Smith: Author, leading global finance blogger and America’s philosopher we call him. He’s the author of 9 books on our economy and society including “A Radically Beneficial World: Automation, Technology and Creating Jobs for All”, “Resistance, Revolution, Liberation: A Model for Positive Change” and “The Nearly Free University and the Emerging Economy”. His blog OfTwoMinds.com has logged millions of page views and is in the top 10 of CNBC’s Top Alternative Finance Sites. Welcome Charles!

Charles Hugh Smith: Thank you Richard, it’s always my pleasure to be on the program.

FRA: Great, I thought today we would do a focus on what many are seeing as a of loss of faith in government institutions. In particular government in general and the thesis behind this: what is driving this and what are the implications to the economy and to the financial markets.

Charles: Sounds like a great topic! I know before we started recording you were explaining that this is one of Martin Armstrong’s core theses about the next few years and so maybe you can take the lead and summarize Armstrong’s perspective on loss of faith in institutions.

FRA: Yes, he’s one of the most vocal people that are mentioning this thesis and so he sees it as stemming from a number of sources and we will explore those. But importantly also he looks at the implications of this two (Inaudible 2:01) economy, two of the financial markets and in particular movement away from public assets towards private assets. Public assets meaning anything government makes or produces like in terms of currencies, bonds whereas private assets would be equities and also things like precious metals.

Yeah, let’s take a look at what is driving this. We can break it down into a number of categories. We got growing political dysfunction, discontent, polarization at the political front that’s driving this loss of faith in government institutions. We also got economic factors in terms of purchasing power loss and you’ve got a number of charts to share on that. We’ve got also the limits of what central banks have been doing and how they painted themselves into a corner. So, we got dysfunction at the central banking point, we have also got dysfunction in government pensions. We see this happening especially in jurisdictions like Chicago or the state of Illinois, other states where municipalities are running into problems with unfunded liabilities and emerging government pension crisis in many jurisdictions of the western world. If you’d like to start off with some of your charts that you’ve shared and how you see the (Inaudible 3:54) pushing the loss of faith in government institutions?

Charles: Great, I think I’ll start out by setting two kind of contexts that seem to be global in their reach. In other words, we can look at every place from China to Japan to the EU to the US to emerging markets and find the same elements or characteristics of the relationship between the public and government. There’s a general sense of the loss of trust in the government’s narrative. In other words, the governments around the world in general are saying “everything’s fine, the status quo is working. Great for everyone and there’s very low inflation, wages are rising, and the economy is doing very well for everybody”. And we get the feeling they’re adjusting these statistics to support their narrative rather than really giving us the truth, which is probably considerably less rosy. So, we feel like we’re being either manipulated or being lied to as a means of supporting those few who are benefiting from the status quo.

Also, to kind of mask the reality that the general public has been politically disenfranchised. In other words, you go to the polls and in a democracy and you vote for somebody else, but the status quo never changes. And so, there’s that sense that we’re politically disenfranchised so if you feel that you really have lost your political voice and your financial voting power as well then you are going to lose faith in those institutions.

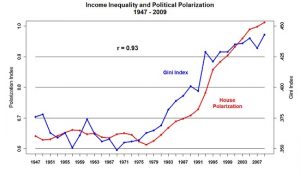

And so, I’m going to start with this chart of political polarization and income inequality:

We can see that the two track each other very closely. In other words, political polarization is highly correlated to the rise in income inequality. Which I think we can conclude that political polarization is just one indicator of the stress that occurs when people lose confidence in governance in general. They start trying to vote for someone on the extremes because voting for people in the middle of the spectrum hasn’t changed anything.

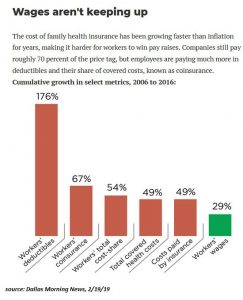

I have a chart here about wages and health care costs which are unique to the United States.

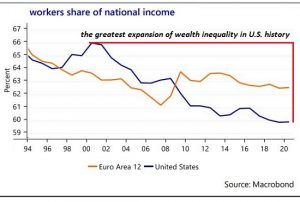

But I think in general this loss of purchasing power of earned income is global. In other words, globally governments are understating the loss of purchasing power and the stagnation of wages and we can see this in the worker’s share of national income which has really plummeted in the US but it’s declined even in Europe.

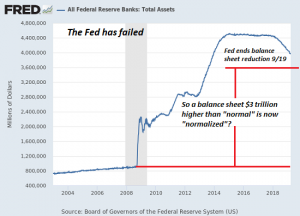

We’re constantly being told that everything is normal and like the federal reserve here in the US has added almost over 3 trillion dollars to its balance sheet and then it reduced it rather modestly. And it already declared that it’s going to end that reduction in its balance sheet and then call it normal.

But it’s clearly not normal so once again we have a sense that we are not really being told the truth. We’re being told what’s politically expedient to support the idea that the status quo is functioning and doing a great job for everyone evolved.

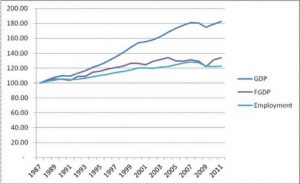

There’s the chart here I have of Financial GDP and GDP and employment.

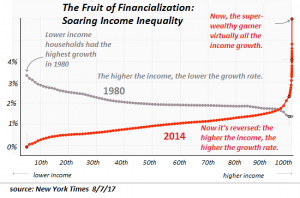

The basic idea here is if you subtract out the financial sector, most of which flows to the top 1/10th of 1%, then GDP is in the US has actually been flat. In fact, it tracks employment which has also been flat. So once again, we’re told this statistic of GDP is up 42% in the last decade which would sort of make us believe that we’re 42% better off but in actual fact most people are worse off. Their earning are stagnant and they are not 42% better off. That there’s all the gains that have been registered are in the financial manipulation sector and those flow to the top of the wealth power pyramid and we see that in this chart of The Fruits of Financialization.

Most of the income gains over the last decade flowed to the very top of the wealth pyramid, the top 1/10th of 1%. So, is there any wonder why people have lost faith in institutions when you look at all the things that are going on in the real economy that the government is attempting to mask or hide or massage to fit a simplistic and false narrative.

FRA: That’s a great chart and you got some others as well that shows at the same time the overall loss in purchasing power and how income is just not keeping up with rising expenses.

Charles: Right, and so when I hear you describe Martin Armstrong’s thesis, then it includes this idea that the loss of faith and institutional failure is going to occur first in Europe and possibly Japan and that would trigger a massive capital flow into the US, which despite its own loss of public faith is still in better shape economically than Europe or Japan. Maybe you could describe that, how loss of institutional functionality and loss of public faith is going to drive capital flows going forward.

FRA: Sure, so what he is saying is that the highest level is just a movement from public assets to private assets. The idea that if you’re into government bonds or government-based currencies, there will be a movement out of that, away from that and more into equities and into things like tangible assets, precious metals. As you mentioned, with the US being relatively OK compared to other countries due to the fact that they’re willing to kick the can down the road with more money printing, more quantitative using. They could be the last to go in terms of an emerging financial crisis phase 2.

So, what he sees as a scenario of developing where things happen first out of Europe. Europe especially by the problems with the euro currency, there is no fiscal union there. The European central bank has reached its limits of anything it can do. A lot of countries have borrowed from each other. There is a significant amount of debt, emerging pension crisis there as well at a significantly worse state than even with the situation in the US and so what he sees is an emerging euro crisis in Europe, in the European monetary union resulting in overall movement away from the euro and towards the US dollar. Also, this is being driven by a strengthening US dollar due to US dollar denominated debt internationally, so that’s likely to make things worse. We saw today emerging market currencies breaking down different countries as well so it’s all happening quite rapidly now. The end result as you see is an international capital flows towards US markets, US equity markets as well as non-European monetary union markets. So, Switzerland, Scandinavia, Norway, as well. There’s some movement there but generally overall to the US equity market.

Charles: I think that’s fascinating and you know I’ve been a dollar bull for many years which was often an unpopular view. Because people look at the problems in the US and they kind of extrapolate those problems and then they declare that the dollar should collapse right, and in actual fact I think it’s the opposite as you’re describing. I think we can quantify this a little bit in a couple of ways and I’d like to talk to that if we could. If we look at the yields on government bonds, of course the US’ is really up there. You could get almost 3% still compared to getting a quarter of a percent or half a percent elsewhere so it’s just makes financial sense to lock in a higher yield if you can right, if you’re a global money manager.

If you see what you described, which is the US dollar shortage. A scarcity since there’s so much money has been borrowed, denominated in dollars so there’s a global demand for dollars. It’s simply not there for the euro, yen or yuan. It’s just- none of those currencies have been borrowed basically, as heavily as US denominated debt so you’re actually getting a double benefit here if you buy a US treasury because you’re going to pick up any gains in the dollar as the dollar appreciates against other currencies and you’re going to pick up the higher yield. So, there’s that and then if you look at just some of the really basic measures of US central bank leverage and like for instance if you take the balance sheets of the central banks and you compare them with the GDP. You know the US is relatively low, the GDP is 20 trillion and the Feds balance sheet is 3.5 trillion or so. By any measure of generalized security of the economy and the banking system in the US is definitely less leveraged and has more buffer if you will, compared to these other economies. For instance, even China where everybody is feeling very confident that China is growing again and so on but they have over 40 trillion in debt and their GDP by some measure is still smaller than the US so they’re really leveraged out there.

And the other thing we talked about really quickly before we started recording which is that the eurozone is one mechanism right, the shared cross-border trade and employment flows and that kind of thing, the reduction of tariffs and so on. But the euro as a currency is another structure and that many of us have felt for years is flawed because it extends this currency to completely different and diverse nations and there is no fiscal controls over that currency. So, it strips away the power from individual nations to adjust their economy by letting their currency weaken. And it really doesn’t seem to work on a fundamental level. So maybe we can say in a way what many of us have been talking about since 2011-12 crisis in the eurozone. That it’s finally getting to the point where stuff is going to start breaking.

FRA: So, this all is contributing to central banks dysfunction to the point of coming out towards a loss of faith in government institution all of the result of going in that direction. The bond market, especially in Europe is just totally dysfunctional from the European central bank. They have gone to negative interest rates and the limits of what they can do by a quantity of using the same thing in Japan. Those two areas in particular seem to be problem points. At the moment, much worse than what the US situation is.

Charles: Right, and you know I think this is a great comment you just made about the limits of monetary easing policy, of lowering interest rates and buying assets. And so, then the other way that governments attempt to solve problems is through fiscal stimulus. They try to borrow 5% of the GDP or something and flood their economies with government spending. But if your bond market is dysfunctional then you’re not able to sell bonds and support this kind of very high fiscal deficit spending to boost your economy that way. If the bond market stops functioning then governments wouldn’t be able to spend so how do we call it, so generously by borrowing money in the bond market. So that I think could be a real problem and of course people are always looking at interest rates but if nobody wants to buy the bonds and then the central banks is having to monetized the bonds for the government to spend on fiscal stimulus, where is the limit there and of course many of us have looked to Japan and said, well is there any limit on how much money the central bank can monetize government debt. So, we may be running into those limits as well.

FRA: Exactly, and there’s one chart I’d like to contribute as well. It’s from Gallup done a little bit earlier this year, where they did a poll of Americans trying to name what the greatest problem facing the US.

https://news.gallup.com/poll/246800/record-high-name-government-important-problem.aspx

35% of Americans named the government, poor leadership or politicians as the greatest problem facing the US. This number has been increasing over time, there’s a great chart they have from their poll that we will have available on the website. We chose how in the early 2000s that number was only around 8%, 9% range, 10% and it’s just steadily gotten worse over the years, increasing to about 15% in 2010-2011 up to about 20% in 2013, 2015 and then more recently going much higher so from 25 to 30 to 35 currently. And Martin Armstrong also made a point of this, that it was back I believe in the Civil War that once the number gets up to 45% (Inaudible 20:54) or say the revolutionary war against the British. For revolutions to happen, the number gets about to the 45% range, that’s when things happen so we are not that far away from there, between 35%-45%.

Charles: I just want to mention antidotally that this loss of faith in institutions, I think arguably is extending even beyond government. In the sense that say higher education, admission scandal in the US, where private institutions as well as public universities have been caught up basically in this corruption scandal. I think people are looking at even private institutions and feeling that they are no longer trustworthy and so It’s like an erosion of the entire social contract.

One other quick comment about government, loss of faith in government is: I live part-time in California and you know California has very high taxes on virtually everything. I mean it’s got one of the highest sales taxes, really high property tax, really high-income tax and very expensive fees for everything having to do with the state and at the local government. And yet, they’re throwing billions of dollars at things like traffic congestion and public education and homelessness and yet none of these things ever seem to get better. And people’s day-to-day real-world life, they look at that. They’re sitting in tremendous traffic congestion, they’re standing on the subway, they’re seeing all this public infrastructure crumble or decay or simply not work very well and yet they’ve cast billions and billions of dollars’ worth of bonds, taxes keep going up.

And so, there’s a sense I think that’s growing that the government is incapable of solving the problems whether it’s from corruption or incompetence or the problems are simply unsolvable. Whatever the nature of it, people are now saying the government is no longer functioning. So, when you use the word dysfunctional, I think we can apply that extremely broadly. Like people don’t really care if it’s not dysfunctional from personal corruption of the insiders, they knew about that. Or some other insider sweetheart deals or whether it’s just general incompetence. And so whatever the cost people are no longer believing the government can do what it’s supposed to be doing for them and they don’t have a representative voice. They feel like in many states like California, it’s a one-party state right, it’s basically like the equivalent of the Soviet Union or some other communist regime. There’s one party that rules and even in other states that supposedly have two-party representation, whoever you vote for nothing ever gets better. And I think that sense is very wide spread. Which is why these outsiders have won elections in France like Macron, the Ukraine and Italy, around the world people are sort of desperate for representation that they are voting for complete outsiders, people that are outside the party system and so on. We are seeing I think lots of signs of that loss of public faith.

FRA: Exactly, this is a global phenomenon resulting in throwing the encumbrance out everywhere so it’s politicians that have not been career politicians but maybe candidates like in Italy, in the Ukraine that are actually getting elected now so it’s actually a global phenomenon. In your recent book “Pathfinding Our Destiny”, you actually highlight also how government is captive to special interests in big money, threatening the democracy so there is a lot of issues there where it’s driving that disenfranchisement feeling amongst the citizenry.

Charles: Absolutely, we see just example after example of some wealthy, Silicon Valley type or corporation pouring millions of dollars into some lobbying and hiring hot-shot attorneys and so on to basically change the regulatory structure in Washington to basically let them continue to do whatever they need to do to maximize their personal profit at the expense of the public interests. People are obviously- it’s like how you can look at this and not lose faith in these institutions. And a lot of people say the government has always been corrupt and there’s always been private money and it’s a little obvious, but I think the average person is unaware of the explosion. That it’s like an order of magnitude increase in lobbying and money pouring into these politicians’ campaigns and into lobbying. And so there used to be I believe, I don’t recall the exact numbers, but you’ve probably seen the same statistic that there used to be several hundred lobbyists in Washington D.C. and now I believe there’s something like 12,000. And you know they are all just giving away millions and millions of dollars and so something we touched on and I’ve touched on in my book is the system is breaking down because centralization itself is the problem.

If you aggregate all the power and capital into the hands of a few people at the top, where there be government or government private, then they are very liable to corruption and policy errors because you are not drawing upon the expertise you get if the system is decentralized. Where local communities and smaller banks and so on can solve their own problems by being flexible and adjusting and adapting to their local realities. I don’t think that you can say, and this is my personal opinion, I don’t think you can say “oh if only we elected a comedian here or something that the problem is going to be solved. I think that the government is too powerful and has too many controls over capital to be anything other than dysfunctional.” And I think people are starting to awaken to that that it’s the government’s structure, it’s not just who we elected that really just turns out to not really matter that much. Whether you call it the deep state or central state or whatever. So, I think what we are really talking about is a structural problem that has not yet been recognized.

FRA: And in your book you mention that to find that way to a better destiny we must create new localized structures, optimized for resilience and adaptability. As you just mentioned, something that is more flexible, decentralized, sustainable, democratic, opportunity for all, type of characteristics. How can we do the transition from where we are today towards that?

Charles: I don’t want to be cheating here but I want to mention that you and I are going to be talking about agile technologies in our next program next month. But I tend to think that there is going to have to be a disruption of the centralized status quo to kind of open up some room for other solutions. So, you know this crisis we are talking about where people just lose faith in the bond market and then that breaks down and then government funding breaks down. That when these large-scale centralized structures break down, then people are going to be more open to trying some other solution because you know human nature being what it is, if you can just kind of stick with what you know. The devil you know is better than the devil you don’t know. So, people would stick with the dysfunctional system until it breaks down so it’s like too bad, that’s probably the way it’s going to be. But we may need to have a financial and governmental crisis which will open up peoples minds really and willingness to take a look at some more decentralized solutions.

FRA: That’s the way forward as you conclude in your book, that better options are available if we are willing to explore.

Charles: Yes, that’s right.

FRA: Well it’s been a great discussion Charles, and how can our listeners learn more about your work?

Charles: Please visit me at OfTwoMinds.com, there’s free sample chapters of my book and extensive archives. Take a look, it’s all free!

FRA: Excellent, as you mentioned for our next discussion we will go into more detail on actual solutions, technologies that are happening that can be put in place to help meet your vision of a more decentralized, sustainable and democratic institution where there can be an increase of faith in those institutions.

Charles: Terrific summary for next month. Well, thank you very much Richard!

FRA: Great, thank you Charles!

05/06/2019 - The Roundtable Insight – Charles Hugh Smith on the Loss of Confidence in Institutions

05/06/2019 - The Roundtable Insight – Charles Hugh Smith on the Loss of Confidence in Institutions