FULL TRANSCRIPT:

FRA: Today we have a very special guest, Gordon T. Long. He is the co-founder of the Financial Repression Authority. He and I started it up. He has been publicly offering his financial and economic riding since 2010 following an international career in technology, senior management and investment finance. He brings a unique perspective to macroeconomic analysis because of his broad background which is not typically found or available to the public. Gordon was Senior Group Executive with IBM and Motorola for over 20 years. He founded the LCM Groupe in Paris, France to specialize in the rapidly emerging internet venue capital and private equity industry. He is a graduate Engineer at the University of Waterloo (Canada) with graduate business studies at the prestigious business school, University of Western Ontario (Canada).

Welcome Gord!

GORDON T LONG: Thank you Richard! That’s the Ivey School down at UWO.

FRA: Yeah. A great background just in all areas to give you that deep insight from different perspectives as you’ve always had.

GORDON T LONG: Well thank you, but it makes me feel like I’m an awfully old man, but I am…But Richard it’s nice to be on this end of a speaker because of all of the videos we did for FRA together…Videos versus the podcast we are now currently doing so it’s nice to be talking from this end.

FRA: You have done an incredible amount of the videos that we started off with over many years.

I thought today we’d look at the 2018 perspective. Over the last several years you have done a yearly analysis of what the risk are in the economy and the financial markets and put it all together, tying all the dots together, in a sort of thesis that you see happening. And you’ve graciously provided a number of slides that we’ll make available on the website and also as a part of the transcript we will write for this podcast. I thought that we would begin there by using that as a basis for our discussion.

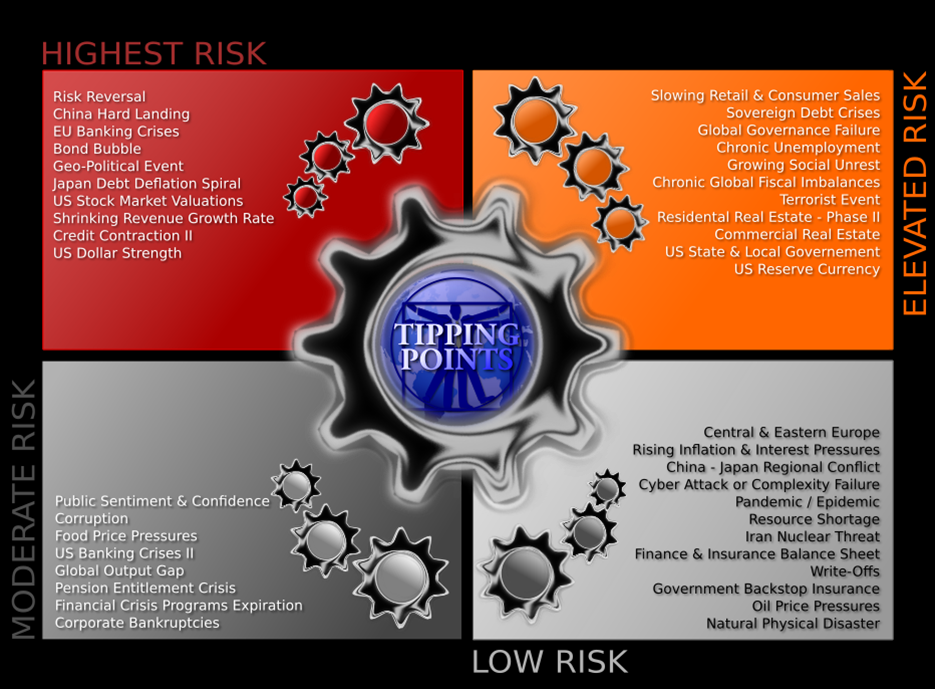

The first slide you illustrate a number of risks — Do you want to elaborate on those?

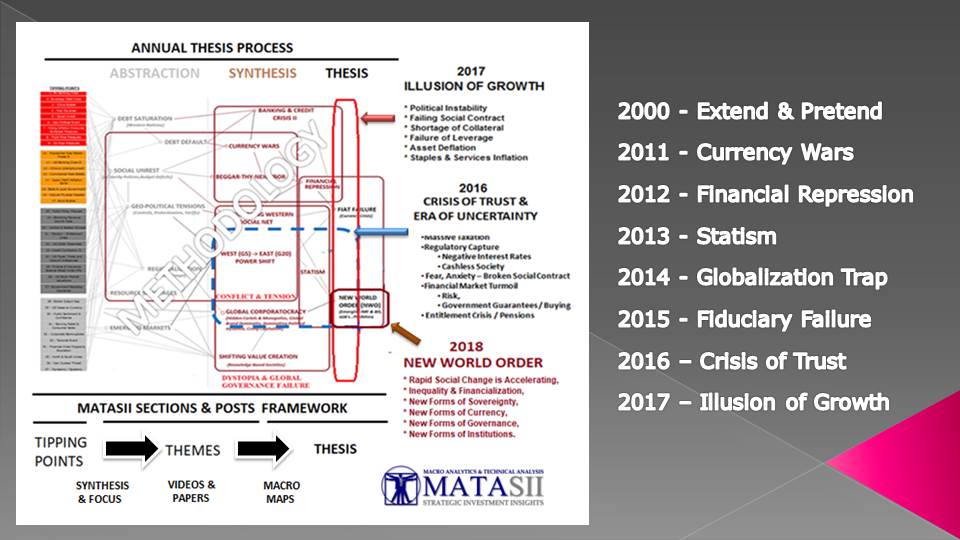

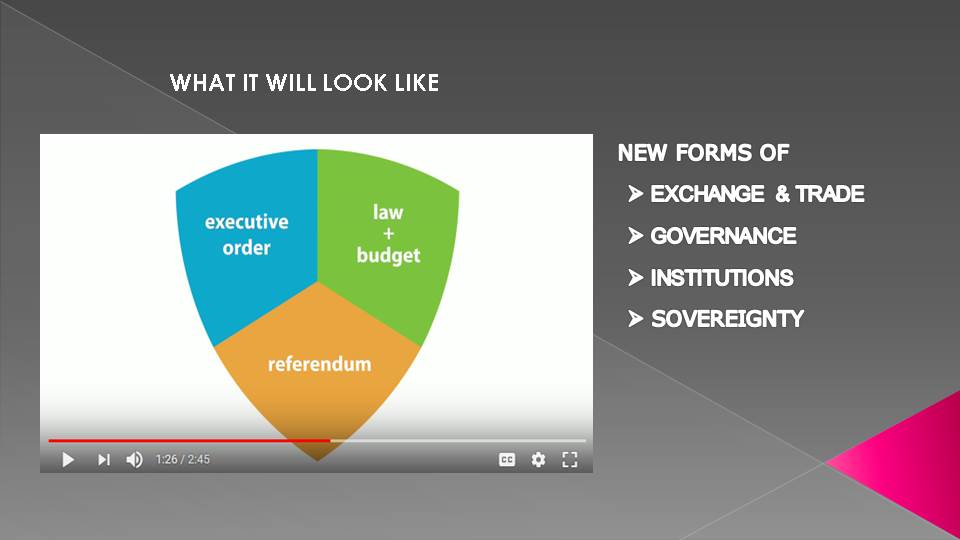

GORDON T LONG: Yeah, absolutely. As you’ve said I have been doing these every year. I started in 2010 where I actually started circulating it to my subscribers and into the public domain and it’s not where I chose a subject to write about. It starts with a process that I refer to as a “process of abstraction”. And the first part of that process is listing all of the tipping points that need to be tracked and watched without drawing any conclusions. In the first chart we are showing here are showing the risks which are grouped in from high to low risk in segments here. We had just over 34 last year which some of them are shown right here on this chart. This year going in we have 44 that we are following and tracking very closely. And when we take those risks and we start to follow them in a process of abstraction which I will show you how we come up with the thesis…But over on the right hand side of this chart you will notice a red box with 11, those are the new ones of the 44. This is the top 11. Quite a number of them have been there for a year, some of them for a couple years now…the bond bubble, China’s hard landing, Japan’s deflation, but what’s really showing up this year and has been moving into this hierarchy is the stock market valuations you see at number 2 as a tipping point. It hasn’t been up this high before, just maybe barely breaking the top 10 as it has grown. But also down at number 11, flows in liquidity and that is the magnitude of what the normalization by the Federal Reserve, effectively the taper program at the ECB and even the reductions in the rate of growth of money supply at the Bank of Japan. The “flows of liquidity”, which is still very high 135 billion a month, is falling and is mapped out to fall. These are some of the destabilizing factors that we see growing, not that the others here aren’t going away. And another one here is number 8, “credit contraction”. We are at the end of an extended expansionary period, one of the longest in history. We are going into our 9th year and we see signals that the business cycle and credit cycle has reversed and has started to fall off — With that is backdrop. The second chart here is really the process we flow. You see the coloured boxes on the left and then we start to abstract those and group them into themes and then from those themes we try and synthesize them and ask, “What are they trying to tell us?” as we move to the right. At the bottom you can see the kinds of things we track over at a site I have with my son called: Matasii.com. And we track all those and they’re in the public domain if you want to follow them or look at them. But it leads to these conclusions and that is the subject and you can see where it’s led us in previous years as they keep shifting around and the thesis papers that we wrote. What we find too is that we’re always at least 18 months to 2 years ahead of things before they really come into the fray and become major front and centre. When you really recognized financial repression back in 2012, it was pointing us earlier 2 years before that that it was going to be a major movement and that was as quantitative easing was starting to unfold in the United States. But this year it has forced us to talk about something called: “The New World Order” and I need to state right off the bat that it is not what the conspiracy buffs have been talking about for years. It just happens to be the same name. The new world order is basically a social change that is happening right now because of: the advent of networking and networking communications, the degree of inequality that is starting to surface across the developed worlds, the richer getting richer and the poorer getting poorer, and a number of other factors that we’ll get into, but it’s changing the forms governance, it is going to change the forms of institutions that haven’t changed since the Breton Woods at the end of the Second World War which were predominantly US-based institutions if you would: IMF, World Bank in Washington, the United Nations in New York. But these institutions haven’t really changed and the new world is going to force these changes. Governance, the whole idea of a sovereign state is changing. So in the paper we lay out what those changes are going to look like and how they’ll unfold.

Any questions on that, Richard?

FRA: Yes – Does this include also the network for blockchain technology and cryptocurrencies?

GORDON T LONG: Without question. It’s very central because one of the major changes we believe is going to be an exchange in trading around the world. And I’m not proposing that people should go out and buy Bitcoin, but I am saying that it and other factors like that are going to be with us in a massive way, and more importantly, the technology underlying it, the blockchain technology. So it’s going to and is already reinventing banking and you’ll that accelerating in a bigger way because it’s reflective of the sovereign state and borders are going away. Once you’re on the network…That’s the beauty of a product like Bitcoin and how many are there…a thousand different types now? But it says you can go anywhere in the world and do these transactions so how do you police it, tax it, regulate it? That’s the whole beauty of it – It’s self-regulating and self-policed, you don’t need governments and you don’t have the cost that goes with it. And that’s the model. I’m not trying to talk about Bitcoin; I am talking about blockchain and that model. One of the driving forces is that it will allow us to do away in some ways with a nation state. It doesn’t mean that we are getting rid of governance, but the governance of populations is going to change. We have a centralized approach to government, its top-down right? Well our forefathers never designed it that way. At least in the United States it was supposed to be the bottom-up, but it’s changed. And the technology and the network will allow that reverse and bring the control down to the bottom slowly because it’s not like the status quo is suddenly going to rollover, but these social changes are so big and so powerful and there will be some crisis in here that will force this change to happen.

FRA: On one of the slides you have: “The network is the instrument to control the governments or the governments will use it to control us.” Which way do you think it will go or do you think it will be a combination of both?

GORDON T LONG: It will be a war, that’s for sure. The governments will see it as taking away their power and their control and I don’t mean that negatively because they feel they need to have it to manage, but the reality is that they can be managed differently. You mention in the introductory that I had 20 years in corporate life so I was well acquainted with trying to run large scale organizations on a global basis. Back in the 80’s, the corporations were called international and they were just really beginning to grow. Growth internationally was far bigger than domestic and the problems that went with trying to do that and what came out of it with technology was that we had to decentralize. We were forced to decentralize and push it to the lowest level. It allowed us to downsize, right size, outsource, but to flatten organizations so that we could be more responsive and we could operate in more countries effectively. I’m kind of netting that out. Well our governments are actually in the same boat today. They need to be decentralized, but you can’t decentralize over a border though you can decentralize in the United States by pushing more control and power to the towns, but it’s going to be across borders. And we are seeing that really in effectively trade blocks today. That is where they are trying to work together in a coordinated fashion where they are trying to decentralize and have the power of a group, but they haven’t harnessed the technology to do it and that’s going to be a big part of the changes. So from a sovereignty standpoint at top-down, we are going to go to bottom-up. We’ve got inequality between nations within nations. What we’re going to have is equality across nations. These are going to be some of the changes we are going to start to see. Where we have country laws right now we are going to see international laws because globalization was never planned, it happened. Consequently, we never put institutions and laws in place to handle that. Yes, we have the international courts and the United Nations, but they’re not proactive. As Ronald Reagan said, “The government isn’t the solution. The government is the problem.” So they’re standing in the way of the degree and the speed of the change must have right now.

FRA: Yes, I can see the power of blockchain technology as providing decentralized platform to address some of those challenges of inequality by eliminating the middleman, for example, in transactions or services. But what about on cryptocurrency as one of those applications of blockchain — Do you think that governments will allow private-based cryptocurrencies to coexist with the monopoly power of fiat money that they have today?

GORDON T LONG: It depends on what government you’re referring to. I think our listeners are aware of the SWIFT system (Society for Worldwide Interbank Financial Telecommunication), we really have two sets of governments in the world, the developed countries and countries that I will simply refer to as the “bricks”. We have Russia, we have China and we have Brazil, we have India, we have countries that are outside of the formal developed countries with their currencies where they are debasing it, that is the developed countries. So when, for example, we pass sanctions against Russia, the way we impose them is ways through the SWIFT system and various forms. Well obviously there is a tremendous conflict and it leads into this whole concept of de-dollarization which is going to be one of the major changes in the next 24 months — It’s huge. The whole discussion that we should have on here is on de-dollarization, but the conflict that’s going on right now and part of the answer out of that is what’s going to happen to cryptocurrencies because it’s a way of getting around the controls that the central banks really have on the creation of money, the value of that money and the debasements of those currencies. Ever since Bernanke came in with his, “Enrich thy neighbour” and we have rotating debasement that is when we stop debasing, the ECB, and the BoJ. I have referred to them as the currency cartel, the four currencies, the big debtor nations, the USD, Euro, Pound and the Yen. That’s 95% of the currencies that are exchanged in the world and they’re the ones that are the primary debasement on the other side, which I was referring to, of the bricks. They are not debasing, but in many ways are trying to use gold-backing. So there is a fight that is going on and cryptocurrencies really bring that to the floor. Now Russia and China their problem with it is allowing money to flee out of China right now as capital flight. As it shakes itself out we’ve got these huge geopolitical issues that are facing us, but the cryptocurrencies are not going away. I’m not saying that Bitcoin won’t fail and something takes it place, I’m not saying for one moment that the government banks aren’t going to endorse it. But by endorsing it I’m referring it to controls and trying to use it as competitive advantages as opposed to it being a free open-sourced product like Microsoft Edge. If you go to Firefox, its open technology, there’s no charge and it’s open. It’s like Wikipedia. Once you open up that Pandora’s Box, you allow all the people in the world to participate in a really free democracy.

I’m not sure if I’m making any sense there, Richard, but this is how powerful the concept and the reality of the blockchain currency are because it takes it down to how you can vote. I actually lay out in the thesis paper examples and links to videos, which I encourage listeners to go and get the links, of people who have shown how you can take this technology and put it into democratic organizations from the ground up that can actually grow itself into a world organization…How voting would happen, how policies would be set, how individuals would participate in it at a town level, a state level, a regional level, right up through a global basis where you get a really participative democracy and it works in a much faster period. It sounds impossible, but there are just some brilliant people that are showing how to do it just as brilliant people that showed how blockchain and cryptocurrencies could work.

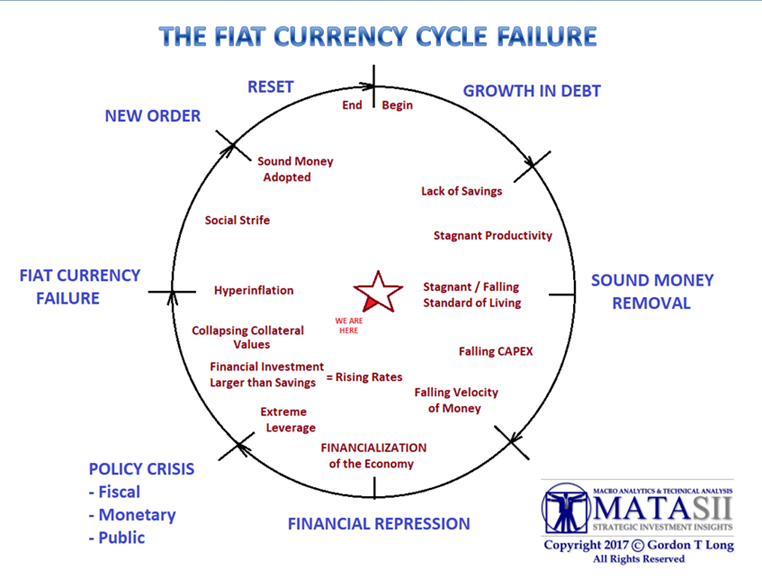

FRA: And do you see this evolution as being a part of a movement towards the fiat currency cycle failure as one of your slides indicates. Are we going to have a coming currency crisis?

GORDON T LONG: I don’t know if we’re not already in it, Richard, and have been for a while, but yes, absolutely. This chart that we have here which is labelled, “Fiat Currency a Failure” really shows how we’re evolving. There is a little star in the middle in the red pointing to whereabouts we are in this cycle. I put out a chart, that’s included in the thesis paper, back at the time of the financial crisis called, “The Fiat Currency Failure” and the cycle that we would go through. This is a very simplified version of it. Once you get off sound money, you put yourself on a road map that nobody has ever retraced themselves from and has always ended in a fiat currency failure because at that point you’ve entered a fiat currency. But it starts at the top right here with growth and debt. Once you start growing your debt, in the case of the United States, when you consume more than you produce and you become a debtor nation and then all of a sudden you balance your trades out there is a lack of savings going on. You get stagnant productivity and what it does is it forces you into a fiat currency which we did officially in August of 1971. But now what starts to happen is you really get stagnant and falling standards of living because savings, which are typically in a capitalist system, invested into productive assets is what in fact improves your standard of living. That’s what allows a standard of living to increase and when that doesn’t happen, investments start to slow and you get falling capital expenditure and a falling velocity of money. You just had Lacy Hunt on and he’s very strong on what the issues of falling velocity of money are. But then it leads to what we’ve had for a long time, financialization of the economy which we now have. When you get the financialization of the economy all of these issues that you and I have talked about for years now associated with financial repression have become front and centre of the government trying to manage the economy at the best that it can do. But it leads to extreme leverage which we have now, unprecedented degrees of leverage, but it creates policy crises – Fiscal, monetary, public, that kind of disruption is where we are at right now. Before we get to the currency failure, the whole leverage itself has to start correcting and what happens then is really collapsing collateral values. There’s insufficient new savings and insufficient profits. And I’m talking about real profits which are coming from productive assets that are creating new profits which is new collateral, new value that underpins our society. We have $230 trillion of debt right now and you don’t lend money out without collateral. So what happens is all the money that has been lent out, the collateral has been repledged so many times, something called rehypothecation, across the global world within the Euro/Dollar system that the issue now is a shortage of collateral. Now if the collateral falls in value, let’s say that interest rates go up on bonds which means the bond price goes down, the collateral against those bonds is being reduced because what we do in our world right now is we’re making debt and asset. So we’re taking bonds and making it an asset and we’re pledging it as an asset. So when it goes down in price because interest rates are going up, you have to produce and pledge more collateral. Where’s that collateral going to come from if you don’t have new savings. That’s the era that we’re entering right now. Then, of course, we’ll have the governments forcing new kinds of systems or policy changes such as helicopter money to push more money into our society and that’s when we start to get into hyperinflation. We’re not there yet. We are still finishing a deflationary cycle because of the globalization, which is starting to peak. When I say peak, the rate of growth is what is beginning to peak. Once we get into fiat currency beginning to fail, we have the social strife and then we get these forced changes into these institutions and forms of government which I talked about earlier.

Didn’t mean to be long winded, Richard, because there’s a lot in that and we lay that out in the paper.

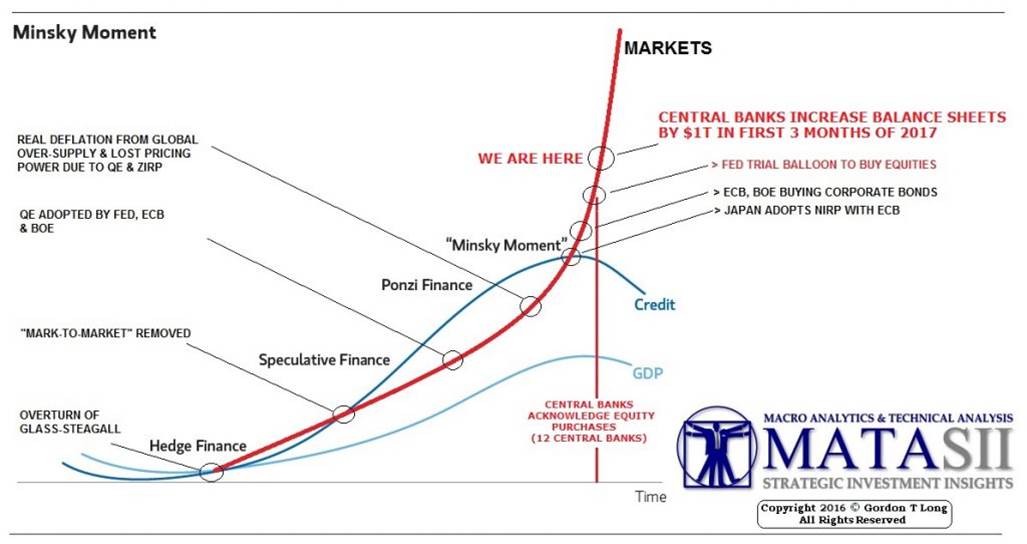

FRA: That’s great. There is a lot going on. On the next slide you mention where we are and that appears to be past the Minsky moment – Can you elaborate?

GORDON T LONG: Yeah Richard. You know governments aren’t going to roll over and quit on us. And I’m not about to say that markets are about to plummet because what governments are very good at doing is changing the rules. When they change the rules they allow things to accelerate. I can give you all sorts of examples of that. Remember the last financial crisis at the bottom of it we had a concept called “mark-to-market”. That was that all the books were so full of derivatives that they had to price them in a way that would price them to market. But to save the market, besides the 13 facilities that the bank came out with, the regulators changed it where they didn’t have to mark-to-market. They marked to fantasy. All of a sudden the bottom was in and the stock market took off and it was running ever since not because of that but it is an example of how they changed the rules. They could’ve never changed that rule is crises never hit, but we do that. So every time we get into a problem we change the regulations so that we change something else. Right now, even if the mark could start to fall, we have such a huge entitlement program, I think in the United States we are at least $10 trillion underfunded in total pensions at all levels – You can’t have that kind of collapse. So it says you got to keep the equities up. As you and I both know, the Bank of Japan is already buying equities. It owns 5% of the Nikkei, north of 70% of all ETFs. The Swiss National Bank buys $65 billion almost every quarter that we know about. A lot of the central banks, even the Norwegian central bank have been buying. So they are buying equities already. Apparently the Fed is not and the ECB is not and the Bank of England is not, but if we get into a crisis you can expect them to start buying equities in some fashion. I’m not saying that’s definitely going to happen, I’m just trying to give you an example that this is not over. They have not run out of tricks that they will bring forward to keep this thing going into this Minsky melt up. It goes back to that cycle we were talking about. You can keep doing it unless there is collateral somewhere and there is just not enough unpledged collateral out there right now unless they just print the money. Then what happens is you just print it without collateral, which is called helicopter money because that the basic derivative of helicopter money, then immediately you get hyperinflation. Whether that’s this year in 2018 or 2019, I don’t know, but I do know that over the next 3 years this big reversal that we talk about in the paper is going to unfold and is going to take away all the options from the governments that have fiat currencies.

FRA: Can you elaborate on how you see that happening and what the reversal may be?

GORDON T LONG: Yeah, absolutely. It is not my concept. This was actually a paper put out by the Bank of International Settlements in Switzerland. They were very clear that it is the most important paper they have put out in years. They were warning the central banks to say look, you’ve got to get off this paper money and you’ve got to start normalizing and you’ve got to do it now. And they’ve got the gun to do it. What they’re saying and what they argue is that the issue is that the demographics which are changing dramatically…You know the baby boomers aren’t buying as much, the Millennial’s don’t have as much money, at least in the United States, but around the world even in China where we’ve had a dramatic reduction in the growth in population, we don’t have the youth that’s coming on in relationship with the accumulation of wealth that the previous generations have had. So what we’ve seeing is that the rate of savings, and savings goes back to this building of collateral and underpinning debt and the rollover of the debt, is growing but at a certain rate which is a much slower rate. It is slower than the investment capital that is needed to sustain the debt levels and the growth levels we have right now. The delta, its difference, is growing at a significant rate. That is going to force yields to rise steadily because of supply and demand and not necessarily in a big spike, but consistently. As yields go out, it lowers the collateral value of the bonds and as we were saying earlier before we began the show, Richard, the global swaps marketplace is over $600 trillion and at least $400 trillion of that is in bonds. So a 1%/2% increase in rates is just a staggering reduction in the collateral value which has to be shored up. It’s like a giant margin call. For those who have had a margin call, you know it’s not a very good day. So that’s the problem and it’s like a glacier, it’s coming and we stop this. We can’t create the babies and the people to do it. And now we’ve got so much leverage in the system and they’ll try and stop it using pension plans, buying the market, printing the money and that’s what will eventually lead to a fiat currency failure.

I hope I explained that easily.

FRA: Yes and it’s quite interesting.

GORDON T LONG: It’s a 70 page paper. I tried to summarize it in less than 70 words.

FRA: And with the pension crisis, how do you see that unfolding? What will pension funds be doing given this view that you see unfolding.

GORDON T LONG: Well, I think the pension plans right now are in the middle of a lot of changes that they know they have to do. I think they see a large amount of this pretty clearly, at least the better ones. They have been moving out of the stock market. I think they see a bigger run up, but they’re moving into private equities and exchange traded products. They are not looking for liquidity; they are looking for long-term investments. I think they are also counting on the government to come in and start to guarantee investments. I think you’ll see the governments come in and guarantee investments with payouts on it even if it’s with fiat currencies. I think that they are speculating that the major central banks will enter into buying the equity markets. If that’s the case they will stay in and start going heavily into the equity markets. I don’t think that they have bought into that quite yet – I have. I believe that’s where the central banks are pointed. There was a paper out that showed we have $400 million in pensions around the world globally, all totaled. Right now in the United States we have an $84 trillion underfunded pension entitlement – Where is that money going to come from? They just can’t print it. They have to make sure that it’s created through the financial markets and a big part of that is either in the debt market (bonds) or in the equities.

I’m getting a little off-track here, but it is an important point that right now as we talk here today, they are talking about funding the government’s debt and you know we got a $20 trillion thereabouts U.S. federal debt. And the tax plan on what it’s going to do and how it’s going to increase it. But we are squabbling over nothing because the United States debt is not $20 trillion; it is $84 trillion because of the unfunded liabilities associated with Medicare, Medicaid and other social programs that we’ve made commitments to that are coming due. We have 10,000 baby boomers a day that are retiring and we’ll have a 1,000,000 a year turning 70 years old next year. The rate at which they are now claiming and a number of people who don’t have the money to pay into it, the youth, is significantly out of line. But as bad as that is, that’s still not our debt. This is why this cycle is going to unfold because this debt is actually $220 trillion and you ask how I got this number and that’s what is called the fiscal gap. We’ve had Kotlikoff on a couple times and he’s even laid it out before congress – They know it. What the fiscal gap is let’s say we lend money to Puerto Rico. The U.S. doesn’t lend money to Puerto Rico, the banks do. What we do is we guarantee it and we guarantee it in what is called in accounting lingo, a contingent liability. So the banks lend the money, Puerto Rico pays the banks and by the way they couldn’t pay 6% when bankrupt, but now the banks want 12% or 14% because they are not worried about it. They gouge them because they know if they default we’re going to anti. We pay, if in fact, somebody goes broke. Well we have got $220 trillion because we’ve been bankrolling everyone in the world with “government aid” for whatever country and we have these contingent liabilities. Let’s say the U.S. economy actually suffered a recession or a slowdown and let’s just say 2% defaulted. Now we’re talking close to $5 trillion on $25 trillion

Am I making sense here?

FRA: Yes, absolutely.

GORDON T LONG: And that’s why this is a given. The question is just the timing of it. That’s why we’ve going to see a new world order because out of this crisis, it’s not all bad news. Out of this crisis is the natural set of changes that need to happen and there’s a better world on the other side of it.

FRA: Given this view of a potential unfolding, as you’ve indicated, what are your thoughts on the financial markets short-term, medium-term, long-term and the investment markets in general? How do you see that unfolding for the various asset classes like commodities, equities, bonds and currencies?

GORDON T LONG: Well it really gets bound to what you price it in and that is the U.S. dollar. Gold could be going up or down depending on what is happening to the U.S. dollar, right? So it’s really what’s going to happen in the shorter term — What kind of strength we’re going to see or weakness in the U.S. dollar. A big part of what you see with the U.S. dollar is often it is a flight to safety. If we have geopolitical problems, people tend to flow to the least ugly at the party, if you would. So the money will flow to the U.S. dollar which strengthens the dollar which has a certain behaviour in the asset markets. So we’re facing significant numbers of tipping points (opening slide) right now. Which one of these might create a shock that impacts the U.S. dollar and the various crosses right now? Because the moment we have this is what happens is that Japan takes home their money into the Yen because it’s been a safe currency for them despite the debasement of it and then the carry trade starts to contract. So that’s what you need

to watch. You need to watch what’s going to happen to the dollar. I personally think we’re going to have some pretty significant freights, in the next 6 months, in the financial markets because we’re at such levels it’s only natural. We haven’t had a 5% correction in historical lengths of time. 15%, 20% is perfectly normal in a market, but the leverage couldn’t handle that right now. As we see some of these normal adjustments in the market it’s going to be how we react to them. And whether the policies, which I was eluding to earlier, forces the central banks to reverse course of normalization and taper, whether it forces them to put into things such as helicopter money – Time will tell. These crises are going to happen and it depends on how people are going to react in the market.

I am not sure this is the time you want to be speculating in the markets. That last 5% or 10% can often be the most expensive. There’s a lot of places to invest right now besides the stock and the bond market.

FRA: What would be your suggestions for investors, generically, in terms of asset classes? Where can they protect themselves and get yield?

GORDON T LONG: The best advice I can give is to get out of the currencies and get into hard assets because real wealth, the real collateral we talked about, is hard assets. Money is something where you have to grow it, mine or build it and those are the hard assets. So put your money into those real items. Gold and silver have always been the epitome of a hard asset, but to be frank they are right now a manipulated paper market. I think that is pretty evident, but that doesn’t mean that you don’t have some level of those kinds of hard assets. There are a lot of various commodities. Look what’s happening with cobalt, nickel and lithium right now. There is no better performing hard assets then them; They are right off the charts. Why? Because off electric bolts, our cars and it’s not because I think there are going to be a lot of electric cars in Canada and the United States, but because that’s where they are going in China and India. There is no question. There are 50 new models coming out next year. As a Canadian, just go up to Cobalt, Ontario. They are blowing off their lids. Now that game has already happened, but the point is that those are the kinds of areas that are continuously being needed to be looked into. The reason they move is because people say, hey there is some real value here. I know junior gold mining stocks have restarted to move to. But I am not saying to do that. I am saying to look for hard assets.

FRA: You mention also private equity as a potential investment?

GORDON T LONG: For those who can participate in private equity. More typically in the United States you have to be an accredited investor, so you’re limited, but I do know there are new laws changed in Canada that allow you to have a certain percentage in private equity. They aren’t as liquid; they are longer term. But sometimes in a crisis you are just glad to have your money in a safe place.

FRA: Perhaps to end our discussion today we can go to your last slide on, “What All Politicians Can Be Expected to Do” with a quote from President Donald Trump.

GORDON T LONG: I put him up just to say he’s just like all the rest. No matter what, they are going to print the money. It’s not because they are bad people, it’s the only solution that they can agree on because it’s not their money. And Trump was quite clear before he became president he said we can’t go broke because we can print the money. And he said he was the king of debt and I’m not picking on Trump in the least in my comments. He’s a right-wing conservative and he believes this is the solution. So you can bet that as these events unfold, and they will unfold, that that’s the tact they will take. Once you know that then investing becomes relatively easy because once you understand the policies that the government is likely to take, your investment becomes a little bit easier.

FRA: Great insight as always, Gord. This has been a fascinating discussion. We’ll put up those slides.

How can our listeners learn more about your work?

GORDON T LONG: Right now I am pretty well restricted to my work because I am retired, I’m an investor, I just manage my own money and I do this work to really narrow in on where my investing should be, but I publish and put all of this at www.matasii.com and there’s a subscription service for it depending on what kind of detail you want to go down to, but a lot of it is right out on a public page. That’s www.matasii.com. If you sign up for the newsletter, we’ll send you a various list of things if you’re interested.

FRA: Well great. Thank you very much for being on the show. It would be great to do it in the near future again.

GORDON T LONG: Talk to you again, Richard.

< Transcript written by Daniel Valentin >

01/20/2018 - The Roundtable Insight: FRA Co-Founder Gordon T Long On The New World Order In 2018

01/20/2018 - The Roundtable Insight: FRA Co-Founder Gordon T Long On The New World Order In 2018