FRA: Hi welcome to FRA’s Roundtable Insight .. Today we have Charles Hugh Smith. He’s author, leading global finance blogger and America’s Philosopher. He’s the author of nine books on our economy and society including a Radically Beneficial World Automation Technology and Creating Jobs for All .. Resistance Revolution Liberation, A Model For Positive Change .. and The Nearly Free University & The Emerging Economy. His blog oftwominds.com has logged over 55 million page views in his number seven and CNBC top alternative fine sites. Welcome, Charles.

Charles Hugh Smith: Thank you, Richard. I don’t know if I can live up to that .. but I’m very excited about our topic today.

FRA: Oh yeah. You always do. Always live up. And today we’re talking about Cryptocurrencies. You’ve written a lot about that on your blog, including today as we speak with the potential Bitcoin price as you suggest going to the $17,000 level.

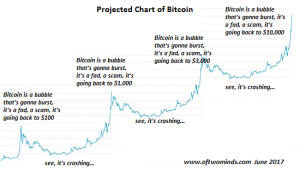

Charles Hugh Smith: Yeah that was my sort of back of the envelope forecast a year or so ago and last summer. You know I want to start out Richard by saying that you know there’s a lot of people have an emotional connection to this topic of Cryptocurrency. A lot of people are extremely skeptical or feel like it’s really not worth anything and certainly not worth you know $10000 per bitcoin and other people are kind of evangelistic about it and super excited about the Blockchain, you know disrupting all of the intermediaries in our financial system. And so I think what we’re going to try to do in our program is to be skeptical of the whole Cryptocurrency movement and be open to the potential benefits that it offers, but not like we’re not going to accept anything just uncritically. We’re going to look at everything .. We’re not going to put our belief structure in either camp either anti-Bitcoin or pro-Bitcoin. we’re just going to look at it as coolly and rationally and as we can and try to understand the value if there is value here.

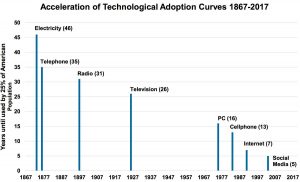

FRA: Excellent. And you’ve provided some charts that we will make available on the website .. maybe we can begin there with the technology adoption curve.

Charles Hugh Smith: Right. And you know it’s it’s almost unbelievable when you think about it, at least it is to me. That the whole Cryptocurrency space is only eight years old. I mean that Bitcoin protocol was released in 2009 and it really didn’t do anything for quite a while, it was kind of a hobby of certain people and Bitcoin trading under a dollar for quite a while and then under $10 for quite a while and then it kind of made a splash in 2013 with the Cyprus bailin .. which was at least one of the triggers that caused Bitcoin to suddenly come out of nowhere and go to about a thousand dollars .. and then various hacks into Bitcoin exchanges caused a complete selloff that drove the price back down into the $200 you know so there was a massive sell off.

But my point is this space is developing very quickly in a lot of different directions that are hard for us amateurs to track. In other words, there’s a proliferation of Cryptocurrencies, but there’s also a lot of development going on .. And then there’s a lot of development of trying to make the transaction rate of Bitcoin faster. You know for instance Bitcoin cash raised a block size from one megabyte to eight megabytes. And this .. was supposed to add a layer on top of Bitcoin that would process transactions much faster. Well that didn’t go because it was withdrawn because of technical difficulties. But you know it’s going to be very difficult to predict where the Cryptocurrency space will be in eight more years. That’s all I’m saying is that there’s a lot of development and innovation going on. And most of it we know will fail or drop away just as the Internet itself proved. But what we’re trying to do is ascertain the core value here. So that whether there will be some winners that will need to develop as as time goes on to meet the needs of people in our financial system .. That’s basically if it meets a need it will it will survive if it doesn’t really meet it. I mean if it doesn’t really have utility then it will fade in and become a novelty.

FRA: Yeah I agree very much with those observations. I mean you have the growth of the block chain based economy that is just massive potential. And then the use of Cryptocurrencies as a payment mechanism for Blockchain based applications and services. Right now there’s about twelve hundred Cryptocurrencies in the universe. And we can see lots of mergers and acquisitions just like what happened in the Internet.com era. Many of those Cryptocurrency is either going out of existence or many of them merging, some acquiring others, so that space could then dwindle down to a very small number of you know of Cryptocurrencies.

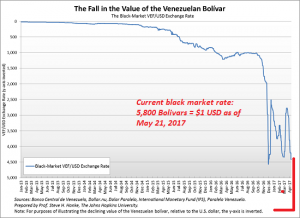

Charles Hugh Smith: Right and one of the other charts I proposed using for our program was a chart of the Venezuelan Bolivar, the national currency of Venezuela. And of course as we all know it used to trade about 10 to 1, in terms of the Bolivar to the U.S. dollar. And now last time I checked which was a few months ago it was trading around 6000 Bolivar to the dollar on the black market. So this currency is as experienced what we call, you know you can call it hyperinflation or a tremendous loss of purchasing power. That’s just basically destroyed the wealth of everybody holding Bolivar right. And so this is what we’re all concerned about with Fiat currencies. You know currencies that are created by Central Banks or national governments and that can be created without any restraints. And so this is what I think part of what’s driving the interest in Bitcoin and the Cryptocurrencies is what other financial mechanism is available to people who are trying to preserve their capital when their own national currencies are in free-fall.

FRA: Yeah exactly. Just recently there’s been a couple of quotes. One from Mike Novogratz on Bitcoin and one from Danielle DiMartino Booth on Bitcoin. And I would just like to read you that that. Mike says “this whole revolution came out of a breakdown of trust. It came out of the ’08 financial crisis when people said we no longer trust financial institutions, we don’t trust governments and in parts of the world today still. If you’re in Venezuela, it’s really hard to trust a Central Bank or in Zimbabwe. So the de-centralized revolution was Bitcoin is really the poster child of a response to the breakdown in trust.” And Danielle DiMartino Booth who is a former Federal Reserve Adviser to the Dallas Federal Reserve President, she mentions that “Bitcoin is a reflection of panic. It’s a reflection of people trying to get into a safe place knowing the major governments of the developed world have got their printing presses running 24 by 7. It’s a reflection of anxiety and fiat currencies and the fact it’s not practical to go back to a gold standard. What scares me most about Bitcoin, if the central bankers are studying it to figure out how the blockchain works. They are going to be controlling our spending with blockchain technology that is being perfected in the Cryptocurrency universe.” Comments?

Charles Hugh Smith: Wow. Yeah I think that those two, you chose quotes very wisely because those express very widely held views that you know we’ve all seen expressed by a number of commentators and observers over the last few years, which is Cryptocurrencies are one of the few avenues that an average person might have to escape the kind of financial repression that you know that you’ve covered in so many programs. In terms of capital controls, bail-ins, expropriations, and massive devaluation of the currencies. You know all these different tricks of financial repression, the elimination of cash. And that’s one of the driving factors, but then the fear on a lot of people’s part is that the central banks and central governments are not going to just stand still. They’re either going to issue their own blockchain currency and require their citizens to use only that Cryptocurrency or that they will try to ban or outlaw the existing Cryptocurrencies as an extension of the financial repression.

FRA: And everybody these days is talking about the price of Bitcoin where is that going .. you mentioned Venezuela on that chart – If we look at the history of the price of Bitcoin .. Going up to sort of the 1000 to 2000-dollar level. A lot of that seems to have coincided with Venezuelans in Venezuela and also Chinese in China looking to get money out of their countries – you know capital outflows and then from there, it seemed to have critical mass taking off to where it is today slightly over $10000 as we speak. Comments on that.

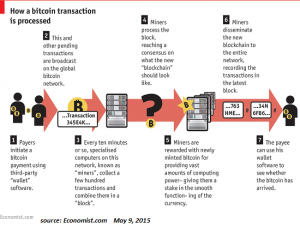

Charles Hugh Smith: Right. Well you know before we started recording you were speaking about the costs of mining Bitcoin and as being one factor in that we could use in its evaluation. And so let’s try to contextualize the discussion about the value of Bitcoin and you know a lot of people feel it should be zero because it’s not backed by anything. And of course then proponents say well there’s nothing backing all these national currencies either, there’s nothing backing the Dollar, the Yuan, the Yen or the Euro either. Which is technically true. And so let’s move on to valuation. One factor that’s in a lot of people refer to Bitcoin in particular as having a big impact on its evaluation is, it’s a scarce entity. In other words, there’s only 21 million Bitcoins that will ever be mined. And beyond that beyond that amount then there will be a fee structure to support the blockchain right. Because currently the whole blockchain is maintained, it’s basically paid for by the issuance of the admittance of new Bitcoins. And I think you had some numbers that you found on the estimates of how much that cost in terms of electricity and computing power to mine one Bitcoin.

FRA: Yeah you know with approximately $1000 US to perhaps $1200 US to mine one bitcoin. And that represents the cost of electricity and computing resources .. It’s similar in the gold world where it costs approximately $500 to $800 per ounce to mine one ounce of gold today. So on that basis, if we look at the value of gold being thirteen hundred dollars today relative to the cost of mining .. Bitcoin could approximately be valued at something like $1500 to $2500 dollars US relative to its mining cost.

Charles Hugh Smith: Right .. And so in that analysis it’s overvalued you know by a factor of four then. Alternatively, we can say in a world where national currencies and central bank currencies are no longer trustworthy because they’ve been created in vast sums and continue to be created to the tune of like $300 billion a month or more. That may be what’s really happening is gold is lagging and this has of course been frustrating to a lot of people who feel that maybe gold should be $5000 an ounce if Bitcoin is $10000, then gold shouldn’t be $1300 it should be $5000 an ounce. And so it may be that gold is lagging and to where it should be. But you know let’s look at the utility value of some of these alternative currencies and I’m including precious metals are the historical safe haven because they have intrinsic value and in the case of silver they have utility value as well. I mean that we all know that silver is not only pretty and a nice thing to make art out of, it’s also a an industrial metal with you know that it’s widely consumed. So we understand the utility value in the store of value of precious metals and then Bitcoin is obviously it’s a different animal because it’s a digital thing and it has no physical presence and no physical utility, but it is quite handy in terms of transferring capital around the world. And I myself have used it to pay editors and translators in other countries and you know there’s no fooling around with bank fees and you don’t have to fill out any of the capital control forms required by the Federal government. And this is of course why a lot of people feel that Bitcoin you know it’s all about money laundering and drug money. But I am just a little regular person here doing my running my little business and I used it to pay other people doing you know legitimate services for me. I file my tax return you know what little gain I made on my Bitcoin transactions .. So you know I think there’s a legitimate utility to the Bitcoin and the Cryptocurrency phase in terms of regular people transacting business globally.

FRA: Yeah sort of the mobility utility factor. And as mentioned earlier that seemed to what happened to propel the price to go from $1 up to $1000-$2000 dollars per Bitcoin. Especially from Venezuelans and Chinese using it .. Now there is a development just in the last month or two that I’d like to mention. That has to do with the Internet protocol of Bitcoin. So most if not all of the Cryptocurrencies are operating over the Internet, over the IP Internet Protocol space and there are technologies coming out now that are able to detect Bitcoin transactions, Bitcoin traffic, even if the traffic is encrypted. This is quite new. As that develops, this will actually make it possible for banks to look at bringing into regulatory oversight the Cryptocurrencies, the traffic that’s coming to and from the banks .. and even governments as well for Bitcoin traffic into and out of countries. So this mobility advantage initially may not hold as much you know, given this technological development. The government of China has long been looking at this on how to do it .. this technology can be used by banks and by governments.

Charles Hugh Smith: Right. And that’s an excellent topic and observation. I wasn’t aware of this technology, but I think what it raises for me is the regulation of the Cryptocurrency space is inevitable in developed economies. You know in other words like this is a normal trend. And frankly I think it’s a good trend in the sense that if you want to legitimize a new form of money it has to be regulated to some degree so that people won’t get ripped off by fraud, like people selling Bitcoin they don’t actually own or you know this kind of thing. And I also think that you know if people are fortunate enough to make you know a million dollars trading Cryptocurrencies, then why shouldn’t they pay the same taxes somebody that was fortunate enough to make a million dollars trading stocks or bonds or future contracts. So I think the advent of regulation is a positive development. And the reason why I say that also is some countries are embracing the Cryptocurrency space and I mentioned Japan which has legalized Bitcoin I mean fully. Right. And of course this is the third largest economy in the world. And South Koreans have basically given a pass. So they’re not going to ban it which is taken as a form of approval .. the U.S. itself has deemed Bitcoin and Cryptocurrencies as commodities. So in other words they are viewed as, if you’re trading Bitcoin – it’s viewed as equivalent to trading pork bellies or something. Right, it’s a commodity. So I think once a country like Japan, with a huge capital market and a vast economy now that it’s legalized the Cryptocurrencies it’s very difficult for other economies to say oh no we’re going to ban this. And I think we have to draw a distinction between common sense regulation of the Cryptocurrency space, like legalizing it and regulating it and taxing it right, as opposed to banning it. And I’m not so sure that banning it is going to work anymore. Because like I’ve explained on my blog a couple of times, if for instance the United States decided to ban Cryptocurrencies Well I could take my Bitcoin and you know my one Bitcoin or whatever and I could put it on a thumb drive or a so-called hard wallet. And then I could take it with me to Japan or I could mail it in a package with some other stuff. And then I could have an associate or friend in Japan you know upload it and deal with it in a legal country. Where they are legal in a legal setting for Cryptocurrencies and then transfer it into yen or dollars in that country where it’s legal to do so and then transfer it back to the U.S. And so you know if I can figure out a really simple workaround. Pretty much anybody can. So I think where a lot of people fear this tracking of Bitcoin and other Cryptocurrencies and then regulating it, is a bad thing. It doesn’t have to be a bad thing. I think it could be a positive development actually.

FRA: Yeah and it will accompany the growth in Blockchain services as the economy develops around those based services you know. The concept of an encrypted Excel spreadsheet type of ledger that Blockchain is.

Charles Hugh Smith: That’s right. And I’m glad you described it so succinctly. Because a lot of people are confused by it and that’s really what it is. It’s basically a ledger that’s public so everybody gets to see what’s been entered. And so that’s the utility value. Well you know let’s also talk about, go back to the financial repression part because one thing I’ve started to write about and other people have also started to write about is the possibility that we finally get some inflation. We all know that unofficial inflation, real world inflation, is running a lot hotter than official inflation, but so far the central banks of the world have created you know trillions upon trillions upon trillions of new currency and they’ve injected that into the financial sector. And there’s been only asset inflation. Right. In other words, stock markets have doubled and tripled. And you know bonds have risen in value and real estates gone back up to bubble levels but there hasn’t been a lot of real world inflation and certainly no wage inflation. So if we started to get inflation that’s going to create a real problem for the central banks because they won’t be able to emit in the quantities of currency they’ve been emitting because that will fuel inflation and inflation of course destroys capital, it destroys the savings, it destroys the purchasing power of wages and people actually have less money to spend, less purchasing power. You know also that’s I think another driver for the whole Cryptocurrency space is that if Cryptocurrency is perceived as something that is a store of value based on scarcity, then it becomes an attractive hedge against inflation.

FRA: Exactly that’s a good observation. So where do we go from here. Like what will happen? How do you see the Cryptocurrency space evolving? You know I guess we have private based Cryptocurrency. And then they’ll also be government based Cryptocurrency.

Charles Hugh Smith: Right. Right. And my sense is the value of of Cryptocurrencies like Ethereum and Dash and Bitcoin, in other words, we can call these the leading Cryptocurrencies. The value is that they’re non-state, non-central bank, non-government right. And so I don’t see a Cryptocurrency issued by the Bank of China or the Federal Reserve as having any value because the the control of how much of that Cryptocurrency is emitted, is created, is of course still in the hands of the bank and so on. I think the fear of anybody that is at all skeptical of how government and central banks work, as the central bank and say oh well there’s only going to be 21 million of these coins issued and then the next morning they say Oh well actually we’re going to issue $300 billion and then it’s $300 billion. And then that currency has no value at all. And so I think that we have to kind of specify that the value of Bitcoin is that being decentralized, you can’t change the protocol. No one person or agency can say no we’ve decided to issue $210 billion of Bitcoin. Now it doesn’t work like that. And even if somebody claimed that we’re going to do this to the Bitcoin protocol the miners and everybody, the participants in the Bitcoin ecosystem, they would have to follow along and support that. And if they didn’t support it, then that fork would die and others would just vanish. And so if I declare, hey I’m going to start a new version of Bitcoin that there’s a billion coins and nobody comes along to mind that. In other words, maintain the Blockchain, then my version just dies it goes to zero because there’s nobody to support the Blockchain. So there is a rough and ready very free market kind of democracy, if you will, and a lot of people have criticized Bitcoin because it major miners obviously have a lot more influence than people who are mining as a hobby and so on. And so there are blocks of self-interested people who can dominate these Cryptocurrencies. And that’s a danger for sure. But it’s a lot different than having nine people meet in a room and decide to add a zero to the money. Yeah. And so I think that government and central bank versions of Cryptocurrency are going to go nowhere because they’re not again for the elements you described earlier in the program. There’s really no reason to trust them.

FRA: I mean they may be mandated by governments to use just like you know currencies today of the countries of the world. But I guess with the coexistence with private based Cryptocurrencies, the ones that make sense will be ones that are you know operating within the financial system. Even if they’re outside of the banking system, if you will, but still within the financial system. And the ones that are based on sound money, so that they have limited numbers that they can be printed or perhaps they’re based on a commodity like gold.

Charles Hugh Smith: Right. Right. And I think that you raise an excellent point that what people are seeking is sound money and sound money that has utility. In other words, it’s not just a store of value, but it’s a means of exchange and so there’s certainly a role for the precious metals. And that’s why a lot of people are saying if you’re going to go in terms of recommending a hedge that you should have both precious metals and some Cryptocurrency, you know exposure, even if it’s you know one percent or something. But I think you know I would say we’re sort of an equivalent of the Internet or the the world wide web around 1995. You know so we have it back when the first browser emerges. Right. And Mozilla and all that and all the assumptions that we would have drawn that have all turned out differently. Right now there is like Yahoo was the first for the most asked and and and then Yahoo faded and lost all of its advantages. And so we you know to say where will Bitcoin be in eight years. Gosh I would hate to even say. I mean it could it could be surpassed by a new Cryptocurrency or an entirely new Cryptocurrency protocol and then it becomes a legacy system. That’s definitely a possibility right. Something comes in that’s faster better cheaper and it’s going to it’s going to take all the market space away from the existing Cryptocurrencies you know. And that’s what we want. We want innovation, we want faster better cheaper. And that’s part of what we like about the Cryptocurrency space is it’s still open to that kind of thing compared to so much of the developed economies are controlled by monopolies, cartels, central banks, governments, which are only self-serving. You know they only choose policies and enforce policies that protect the few at the expense of the many. On the other hand Bitcoin could transition into being something that’s slow and secure. It’s never going to work in terms of buying a coffee at Starbucks with Bitcoin and that’s just a dead duck. It’s a transaction rate it’s just too small, but it might be useful in interbank transfers or large financial transfers. Maybe Bitcoin will find a home in that space. While other Cryptocurrencies will arise to take care of the the transactions on the level of consumer goods. You know we don’t know.

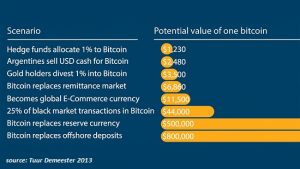

FRA: You had a chart that shows if Bitcoin replaces or becomes part of reserve currency. We could see prices in the $500000-dollar range:

Charles Hugh Smith: I know and it’s so funny because you know I’ve been following Bitcoin, but I never bought any and I was just kind of an interested observer until I needed it. As for its utility value, in other words, I needed to get some to buy some Bitcoin in order to pay the translators I had in Venezuela because that was the only form of currency that they could they could access right. That made sense. And if you think that the world economy is going to enter a time of instability where a lot of things start falling apart then of course we can say that Bitcoin or other Cryptocurrencies will well maintain their utility value for that reason. In other words, if people can access it and and pay their debts and buy stuff with it or buy other currencies with it, then its going to have utility value.

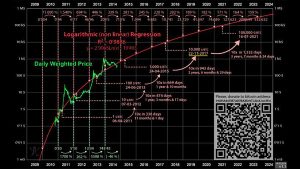

Charles Hugh Smith: I have another chart here the logarithmic progression of Bitcoin and its obviously kind of a rough guess, but this chart suggests that there is a logarithmic function to the number of days that it takes for Bitcoin to advance tenfold. In other words to go up by ten times and so it was kind of like how long did it take to go from a dollar to 100 an hour to a $10 then to $100 in $2000 and then to ten thousand. And so of course we can play these kind of games and you know those of us who like charts you know we love like tracking charts and projections and stuff, but it certainly we don’t know.

FRABut actually your logarithmic regression chart does seem to be fairly accurate. The November 22 date for $10000 is pretty much on track.

Charles Hugh Smith: Yeah it is. And this was I think the projection was made in late 2014. So by this chart, if we follow if that regression kind of goes continues as charted, then we would be at $100000 Bitcoin in 2021. So while we have to wait a whole four years. Yeah and of course I’m laughing because this is all speculation right, but we really don’t know what’s going to happen and what I like to say is this is the way markets should operate. They shouldn’t be manipulated by central authorities. So they always go higher and there’s never any retrace, there’s no volatility. You know volatility has been destroyed in a stock market, it’s been erased. And so there’s no real price discovery because there’s no volatility, there’s no price discovery. So Bitcoin is extremely volatile and to me, part of that is number one it has a very low float you know that of the 70 million Bitcoin. Several million, at least several million, are estimated to have been lost and in hard drive crashes and things like that. So the founders have about a million Bitcoin that they’ve never touched and never moved. For whatever reason and a lot of people are pursuing the idea of hold on for dear life, otherwise known as HDOL. And so the actual tradable float of Bitcoin is probably a relatively small percentage of that 17 million or 18 billion Bitcoin that are out there. So you got a very small float and like a small float in stocks, you get big volatility when there’s a small float and then if the more open the market is the more volatility you have. Right because you’re exposed to human emotions and there’s more surges of euphoria and panic and all the things that drive volatility, so I don’t see volatility going away.

FRA: Well that’s excellent insight for a balanced view. How can our listeners learn more about your work?

Charles Hugh Smith: Please visit me at oftwominds.com.

FRA: Great thank you very much Charles for being on the show. We’ll do it again.

Charles Hugh Smith: Yeah. Thank you so much Richard. My pleasure. Great topic.

Submitted by Boheira Manochehrzadeh <bmanoche@ryerson.ca>

DOWNLOAD/LISTEN TO THE PODCAST

12/02/2017 - The Roundtable Insight: Charles Hugh Smith Insights On Bitcoin and Cryptocurrencies

12/02/2017 - The Roundtable Insight: Charles Hugh Smith Insights On Bitcoin and Cryptocurrencies