FRA: Hi, welcome to FRA’s Roundtable Insight. Today we have Charles Hugh Smith, America’s philosopher. He’s a leading global finance blogger and author. He’s the author of nine books on our economy and society including A Radically Beneficial World: Automation, Technology and Creating Jobs for All. Resistance, Revolution, Liberation: A Model for Positive Change, and The Nearly Free University and the Emerging Economy. His blog, http://www.oftwominds.com has logged over 55 million page views and is #7 on CNBC’s top alternative finance sites. Welcome, Charles.

Charles Hugh Smith: Thank you, Richard. That makes me seem larger than I actually am in real life.

FRA: You’ve got a great blog, I mean I read it avidly. A wide range of topics from a very philosophical perspective

Charles Hugh Smith: Well thank you. Yeah, we’re living in extremely interesting times and it’s a struggle to contextualize all the information and news that we read you know? Like how does this fit together? And that’s one of the topics that we’re going to discuss today, how does this all fit into our era and the global economy?

FRA: Yeah so I thought today we might take a look at Central Bank buying of private assets, in particular equities. But there’s also buying of corporate bonds as well. What exactly is the extent of that and potential implications to the economy, to our overall economic system, moral hazard issues in terms of what that means philosophically?

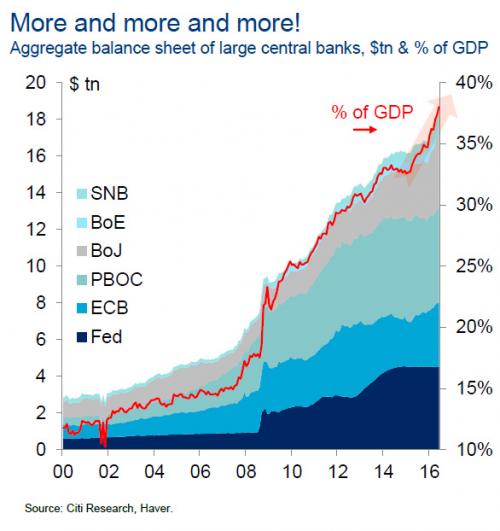

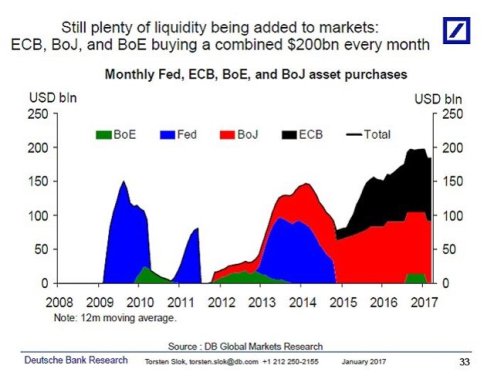

Charles Hugh Smith: Right, right. I think we all know that Central Banks have been buying just immense sums for like over 8 years now of sovereign bonds, corporate bonds, and more recently corporate equities either directly in specific companies like the Swiss Central Banks been buying Apple and Amazon I know. And then the Bank of Japan has been making huge purchases of ETFs, you know exchange traded funds which are basically index funds, pools of corporate equities. But nonetheless, enormous purchases of private sector equities which is unprecedented in a non-crisis situation.

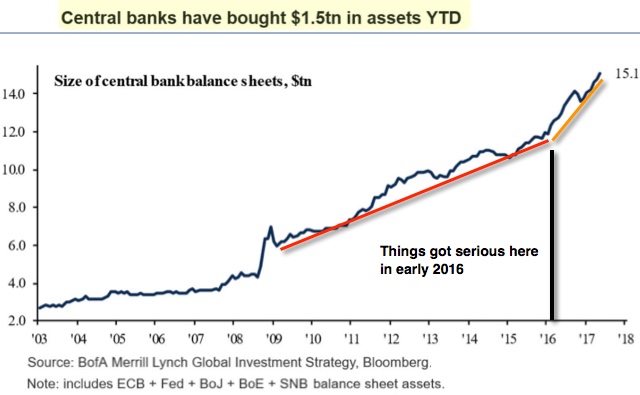

FRA: Yeah, they’re some statistics out there that indicate this year alone there’s been so far somewhere between one and two trillion of financial assets purchased by Central Banks, especially the European Central Bank and the Bank of Japan.

And a certain subset of that includes the buying of equities. And it’s not just those Central Banks, its Central Banks such as the Swiss National Bank as well. So those are major buyers of equities and the ECB is focused on corporate debts, so specific company bonds.

Charles Hugh Smith: Right, and let’s discuss that a bit. So to explain as I understand it, and I’m not an expert, but as I understand it when Central Banks go to buy corporate bonds, they can go to the marketplace. They might be buying bonds that were issued a year or two or three years before by the corporation right? It’s the open market for corporate bonds. Or recently it appears they’ve been buying directly from the issuer, from the corporation. And this is quite a bit different because they’re basically funding corporations by snapping up their bond issuance without even going to the marketplace where they’d have to compete with other buyers and sellers and the market would price the risk factor in that bond. And so they’re really overstepping the market by buying directly from corporations. Do I have that basically right?

FRA: Yeah, I mean there’s all kinds of risks that come from this. I mean you can think of the distortions to the market in terms of valuations, price discovery, risk, the price of risk if you will. And then overall the associated issue philosophically is does it make sense for governments to buy specific company assets? Are they not then picking and choosing particular companies over above other companies? You know favouring certain companies by buying their stocks, by buying their bonds and not others, versus others.

Charles Hugh Smith: Right, and I think before we started recording you used the phrase “picking winners” right? And of course, all the stocks their buying are winners as long as their buying.

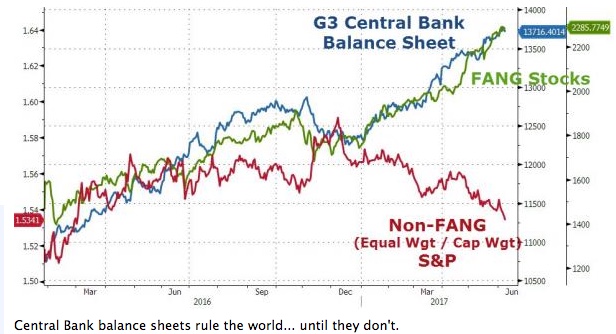

And I’m looking right now at a chart that showed the Central Bank balance sheet for the last say about 9 months and then the FANG stocks, you know the Facebook, Apple, Netflix, and Google. And they’re extremely correlated, extremely correlated.

So it suggests that Central Banks are buying these hot very large cap tech stocks and in a way, picking them as winners. Because if there’s steady buying by Central Banks in the hundreds of billions of dollars, then you basically created a floor under all these stocks that the Central Bank has picked as winners and that’s distorting the market. I recently wrote a piece that tried to describe a fairly subtle, at least to me, dynamic which is the markets are based on transparent information being available to all participants, right? And so when insiders say have an information asymmetry, like they know something the rest of us don’t, then of course that’s considered illegal because they can then benefit from that asymmetric knowledge. And so the market requires a free flow of information if it’s going to have the necessary foundation for price discover, risk assessment, pricing of risk and so on. So when Central Banks are setting a floor under the stocks they’ve picked as winners, they’ve actually deprived the market of essential information. And so my view is when you rob the market of information, then you’ve crippled all the participant’s ability to make a realistic assessment. And this may be part of the reason why we see stocks just lofting ever higher is there’s no information that would suggest risk might be rising beneath the surface because of all this Central Bank buying. So they’re basically stripping out the essential information from the market. And that’s making the market kind of beneath the surface much more fragile and much more unstable because the buying and selling is not an open market, it’s intentionally favouring a few large kept stocks. So we have to ask, what happens if Central Banks ever stop buying for whatever reason? What happens if the market starts falling? The Central Banks will sell, are they going to be bag holders or they’ll hold forever and buy more? I mean all these issues are unprecedented, right? Because in the past, Central Banks would famously buy the market in crisis. You know like when the market was crashing or going through a severe downturn they would institute the plunge protection team, right? Which would go in and buy enough equities or bonds to seize up the market and stop the crash and reverse that. And then all the computer programs would recognize the reversal and jump in and start buying. And so that kind of plunge protection team buying is one thing, but here we are eight and a half years into a supposed recovery, and they’re still buying a trillion and a half dollars in five months? I mean that’s unprecedented.

FRA: Yeah, and in terms of being able to get out, that’s a good question but maybe they cannot get out or they don’t want to get out. I mean you got issues of the baby boomers retiring, they may be looking to sell their stocks. So who is going to be the buyer in that case if there’s a large selling by the baby boomers? Pension funds as well, if there were to be a large selloff in the markets that would negatively severely affect the pension funds insurance companies. And the governments don’t want to have to bail those guys out like they had to bailout the banks back in the first financial crisis. Your thoughts?

Charles Hugh Smith: Right, well Richard we recently spoke about the millennial generation and some of the issues connected with it. And you’re absolutely right, as sort of a generalization, it’s fairly clear that the millennials income is lagging from previous generations and they have much higher student loan debt. So they’re not going to be able to fund their IRAs and 401Ks to the same degree as previous generations because even if they’re frugal they’re having to devote a lot of their income to pay down their student debt. And so that suggests there’s not going to be any secular movement generationally to buy equities because millennials simply don’t have enough money to buy a lot of equities to counterbalance the tremendous selling that will be going on over the next ten years as baby boomers retire and start drawing on pension funds which as you say have been invested in equities and will now have to be unloading them in order to fund their retirees. So if the Central Banks are going to replace an entire generation and all the pension funds globally, then they’re going to be owning a significant percentage of the entire bond stock market. And I’ve read numbers and I don’t know if they’re accurate or not, but apparently the bank of Japan owns roughly 30% of the entire Japanese equity market already. I mean that’s a significant percentage. And so what happens when that goes up to 50% or higher? And as you said before we started recording you used the term “financial alchemy” and there is an element, isn’t there, of what I call perpetual motion machine. The Central Banks just create money out of nothing, then they buy equities and bonds, and they can continue to do that with apparently no friction. There’s no risk and no friction, but is that really true?

FRA: Yeah, that’s a good question. I mean from the perspective of the Central Banks, if we look at the Swiss National Bank SNB, their driving factor of doing this, buying equity’s is a tool in the Central Bank policy tool chest in terms of trying to maintain their currency. So there’s a tendency for the Swiss Franc to get stronger. So by buying in particular U.S. equities you’re essentially buying the U.S. dollar thereby decreasing the strength or the value of the Swiss Franc. So what is essentially happening is a sort of financial alchemy. Whereby the Swiss National Bank is printing money out of thin air and then using that to buy real assets, stakes in real companies. I mean this can go on ad infinitum until they own all companies that are publicly listed.

Charles Hugh Smith: Right, right and then that’s an interesting point you raised about the sessity of Central Banks to maintain their currencies or in many cases attempt to devalue their currencies to keep their exports up. And so that’s certainly a driver for purchases of U.S. dollar based bonds and stocks. And of course, that also offers the benefit to other Central Banks of great liquidity, right? Like you can buy quite a bit of U.S. treasuries and unload them without pushing the market around much.

And the same is true of huge large kept stocks like Apple or Google and so on. So it’s interesting how stocks, equities, and bonds have become tools of currency manipulation. But the currency market is so much larger than bonds and equities, and of course, bonds are larger than equities. And so we see this sort of pyramid where when you’re going to play around with currencies you’re dealing with several trillion dollars moving around every day and then you move up to the bonds and it’s smaller and the equities are considerably smaller. I think that again it’s raising the risk in the equities market because the amount of capital that could be moving into stocks and bonds from Central Banks is unprecedented in size. And so we have to ask, what is the consequence of that in a crisis situation? Will Central Banks then have to buy another $5 trillion worth to stem the market crash? Or how are they going to respond? If they start selling then that alone can trigger a serious decline because they have now become buyers of size.

FRA: Yeah, we have several charts that we’ll put up on our write-up showing a very strong correlation between the level of Central Bank buying and the associated markets, it’s quite correlated.

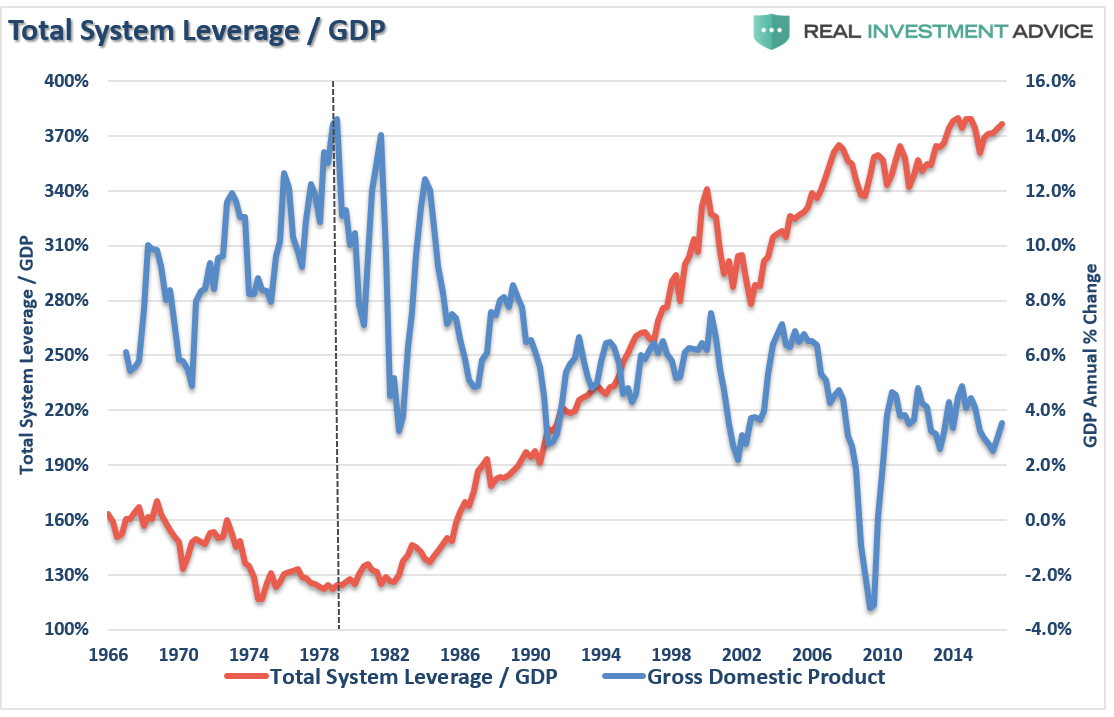

Charles Hugh Smith: Right, and if we look there’s a chart that I submitted, it’s called total system leverage, it’s from Real Investment Advice. Total system leverage which is really a proxy for liquidity provided by Central Banks and then GDP.

And we see that Central Banks have generated a tremendous increase in total financial system leverage, you know credit and liquidity. And yet GDP has been in a secular downtrend since the 80s. And so we’re also in a situation where the Central Banks are taking these unprecedented actions of interventions and manipulations in the market and yet actual growth is still declining. So we’re seemed to be getting less actual growth for the buck, right? For the Central Banks, there’s a definite element of diminishing returns in their purchases of private equities and bonds.

FRA: And there’s also another interesting study that was put into the Wall Street Journal EBSCO, they have some interesting results whereby what they did as a pole and they came up with a figure of 80% of Central Banks plan to buy more stocks. So this came out earlier at the beginning of the year. And then they did some survey on asking what areas equities, corporate bonds, government bonds, deposits with Central Banks and so on in terms of asset classes. They looked at the net percentage points of Central Banks saying whether they will increase or decrease future allocations in each asset class. And equities came right up at the top, plus 80. Corporate bonds number two at plus 43. So those are the two asset classes where there’s a focus by the Central Banks. And then after those two asset classes are government bonds, so that’s quite interesting. On the decrease side are deposits with Central Banks and deposits with commercial banks, so that’s quite interesting results.

Charles Hugh Smith: Yeah Richard that is extremely interesting. And it obviously speaks to the current uptrend shall we say in global stocks. And so clearly if Central Banks have prioritized buying equities, that’s very likely a driver of the current reflation as it’s called. And so what do we do in that kind of situation? Well, the easy thing to do it just go long equities and ride the thing higher, right? But how long can that go? And that of course is an open question.

FRA: Yeah that’s the big question, where is this all leading to? Does it end? Or due to the need to implement their monetary policies will Central Banks even perhaps accelerate their buying of equities? Not so much for trying to get ownership of companies but just as a tool in their policy chest of implementing policies. So if there’s sort of more currency devaluation, competitive currency devaluations in the world going on and the need for quantitative easing for monetizing debt. I mean this whole process can accelerate I think.

Charles Hugh Smith: In my view what the Central Banks are doing is creating a widening divide between the actual real economy of sales, profits, and productivity that once drove equity valuations. And so now the more it’s based on Central Bank buying then there’s a gulf that’s widening between the real economy and the stock market. And Central Banks view the stock market as a singling device, that’s part of the reason for this purchasing as you say, it’s to support equity valuations held by pensions but it’s also to signal to everyone that the economy is healthy because the stock market keeps going up. And so as the real economy stagnates and falters and the stock market keeps rising, then the stock market starts losing its signaling capacity because people will eventually catch on that the stock markets rising from Central Bank purchases but the real economy is stagnating or in decline. And so there’s a certain element of trust in this whole idea that a market is an open transparent market. And if you lose that trust and people think that it’s just being manipulated as a signaling device, then the Central Banks may lose that whole belief of the general public that the stock market actually does reflect the real economy. And so once that trust or faith has been lost, then the stock market is no longer a reliable signaling device and the Central Banks will kind of have been revealed as the power behind the curtain.

FRA: Yeah, exactly. Okay, that’s great insight Charles thank you very much. How can our listeners learn more about your work?

Charles Hugh Smith: Please visit me at http://www.oftwominds.com and you can read free chapters of my books and take a look at my archives and see what I’m coming up with in terms of solutions.

FRA: Excellent, excellent great insight and we’ll be having another discussion in about a month.

Charles Hugh Smith: Yes, look forward to it Richard, thank you very much.

Transcript written by Jake Dougherty <jdougherty@ryerson.ca>

06/25/2017 - The Roundtable Insight: Charles Hugh Smith On Central Bank Buying Of Equities

06/25/2017 - The Roundtable Insight: Charles Hugh Smith On Central Bank Buying Of Equities