FRA is joined by Bill Laggner to discuss non-housing debt, auto loans, and FinTech.

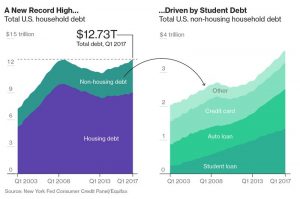

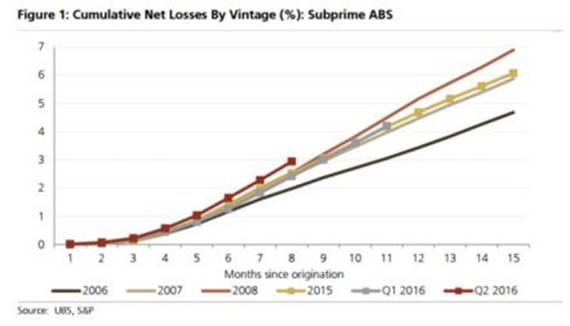

Non-housing debt is being driven mainly by student debt and the auto loan, which are part of the echo bubbles created post ’09, and the figures are alarming. We know that some of the student loan industry is underwritten by the government and the large banks, but there’s an auto loan bubble where the figures range up to $1.5T. A lot of this industry is not securitized. There’s a chunk of the industry that’s essentially private automobile loans, and they’re bundled and sold among high net worth investors. The number is larger than what the graph reflects to the right.

The government is intervening with student debt to recast the debt, alter the terms of the debt, extend the terms etc. We know we’ve never had a true recovery; we’ve had asset bubbles but the real economy is still struggling. What’s happened is that now there’s been lobbying efforts where they essentially want to allow these people to file bankruptcy, and of course the taxpayers would eat it. It’s just another example of the Austrians’ looking at the idea of monetary fiscal distortions where the governments subsidize credit, and when you subsidize credit you end up getting a lot of these takers that take the debt and worry about repaying them later.

When Obama left office, they had one set of default figures, and subsequent to his departure another set were introduced and the figures were significantly higher. What is the real default rate? It’s likely that half of the loans are highly delinquent over 60 days or defaulted.

Looking at bubbles, in 1988 Kevin Duffy wrote a piece with the Wall Street Journal about how Japan isn’t going to take over the world for a number of reasons, one of which being that their economy is a bubble. They had owned a lot of US real estate etc., and what was interesting about their bubble and real estate is that real estate prices became wildly inflated and they were issuing 100 year mortgages. If the person borrowing money died, his wife could inherit the mortgage and when she died the children would inherit. That’s how you underwrite a bubble: you create these lunatic fringe-type policies underwritten by policy makers. We’ve seen this go on for longer than most people would’ve thought; altering the mortgages, altering the terms, the taxpayers were subsidizing the programs, they’d recast the mortgage with lower interest rates and try to paper over this. But the real economy is hollowed out. By essentially destroying the foundation of a true vibrant economy with low or no regulation, little or no taxes, and incentive for capital to be formed and reinvested, you wouldn’t see this.

The economy is fragile. We’re seeing sectors of the economy roll over, and asset prices following suit, but the broad market is levitating – these large platform-like companies have been levitating the market – and central banks are raising interest rates. Credit is starting to tighten in parts of the economy; usually when you have credit tightening and there are bubbles that it’s set upon, that’s usually a recipe for disaster. But we don’t know. We could see a scenario where the economy rapidly slows in the second half of the year, and the Fed could start cutting interest rates. Who’s to say the central banks don’t collectively go to negative 100 or 200 basis points to try and put a floor under housing? When you let your mind get creative in a fiat system, there’s no limit to what they could do. It’s a confidence game and as more and more people start fleeing the system and buying gold or Bitcoin or a farm, you could end up having a major currency crisis in a developed world.

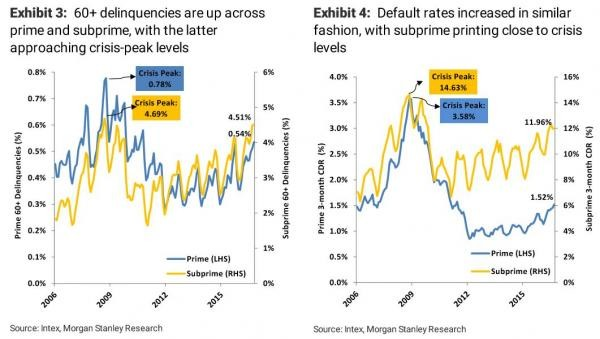

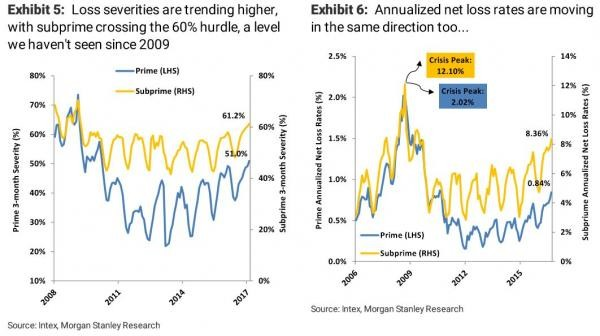

The governments have come in and created various fiscal interventions to try and provide credit to different groups, and when banks and governments provide credit people either take it or don’t. In this case they took it, especially in the west, and we got to see nine year car loans, some of which were sold off to Wall Street and securitized while others were held by respective automobile dealers. Or a secondary market was formed. When you have a pool of savings, the central banks have pushed people into the deep end of the pool and people started doing things with safe money that they would not typically do. When enough people do it, and you’ve got a bit of momentum from this massive credit echo boom, part of this whole boom in subprime and non-subprime lending has been underwritten by historically safe money.

What’s happening is that someone will originate a loan that is non-securitized, and the default rates start going up. It’s a bizarre world of credit finding its way into a part of the market that would typically charge a high rate of interest and it wouldn’t attract as much capital as it has. Again, another distortion from central bank folly.

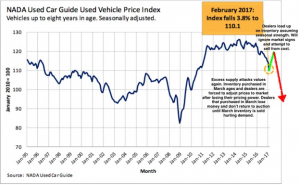

The lease bubble is primarily underwritten by the automobile companies themselves. The ability for these companies to, post ’09, go to the bond market to become credit providers of these “leases”, and then the terms in the lease market became loose. So it flows through on the purchase side or the lease side, and you get more of these cars leased.

Almost 4M vehicles are coming off lease in ’17 and ’18. There’s been enough leases coming off in ’16 where prices have rolled over, and at the end of this year and start of next year you’ll get a significant repricing of cars.

With regards to lending in the non-securitized, non-banking market, peer-to-peer lending has been massive over the last these years. Then you have these wealth advisers that offer credit lines against your stock and bond portfolio. Robo-advisors and these security lenders that are non-brokered dealers, non-bank lenders, have been lending money against securities. When you look at the peer-to-peer lending world, and then at some of the anecdotal pieces on other non-bank, non-securitization lenders against asset securities, you can see a number easily close to 300-400B based on all the new credit created in the last five years. Add that to the margin debt figures and then you’re talking about margin debt approaching $1T.

On the banking side, the bail-in model is going to be implemented throughout the developed world. The Fed is going to allow more failures this round and likely won’t step in for a non-bank lender. For housing, the government will do everything imaginable to prop up housing, but that’s not going to stop it from going down. They will come up with all types of creative ways to keep people in their homes. They’re not going to sit idle and watch housing go down 60-70%, but they’re not going to interfere with car loans and student loans and credit cards.

Housing prices in Canada will go down a lot. The government will lower rates and figure out ways to provide credit to people, but that’s not going to stop housing prices from going down to something closer to the norm in terms of wages. Over the last 6-7 years, we’ve essentially underwritten a casino-like economy. It’s amazing how many people are in this casino, gambling.

FinTech is one of the most fascinating things we’ve seen in the last 25 years. There’s a lot of crypto-currency being created that are suspect, but some of it is real. It’s a borderless way of transacting value through the rail system known as the public bloc chain. What’s happening is that you have really smart entrepreneurs that are throwing technology and decentralization to create alternative ways of holding and sending value. It’s an industry run by centralized parties that take somewhere between $3-4T out of the global economy through foreign exchange fees, credit card fees, ATM fees, etc. By creating these alternative forms of exchanging value that are decentralized and innovative and creative, you create an ecosystem where more and more people are exchanging products and services without traditional friction points from all these authorities. You have these fiat currencies and people are losing confidence in them, and a parallel ecosystem competing with a fiat system that’s flawed and centralized.

It’s very volatile, but there are very interesting entrepreneurs throwing a lot of human and financial capital at it. What’s happening with smart contracts and peer-to-peer value exchange is interesting. A lot of these companies are private; there’s a company in Russia that’s toying with the idea of accepting Bitcoin and making it available to buy and sell. You’re probably a year or two away from these companies going public. There’s a lot that needs to get sorted out in terms of security, scalability issues, and trying to take something technical and very complex and filtering it down to something that’s convenient and user-friendly for people. People are moving to these platforms and the regulators are lightly regulating them, so you’ll see evolution happen.

The takeaway is that we now have true competition to fiat currency.

Abstract by: Annie Zhou <a2zhou@ryerson.ca>

LINK HERE to get the MP3 Podcast

06/08/2017 - The Roundtable Insight: Bill Laggner On Debt Bubbles & The Emerging FinTech Revolution

06/08/2017 - The Roundtable Insight: Bill Laggner On Debt Bubbles & The Emerging FinTech Revolution