Richard Duncan is the Chief Economist at Blackhorse Asset Management in Singapore. He is the author of numerous books including, The New Depression: The Breakdown of the Paper Money Economy, and The Dollar Crisis: Causes, Consequences, Cures, an international bestseller that predicted the current global economic disaster with extraordinary accuracy. Since beginning his career as an equities analyst in Hong Kong in 1986, Richard has served as global head of investment strategy at ABN AMRO Asset Management in London, worked as a financial sector specialist for the World Bank in Washington D.C., and headed equity research departments for James Capel Securities and Salomon Brothers in Bangkok. He also worked as a consultant for the IMF in Thailand during the Asia Crisis.

Richard has appeared frequently on CNBC, CNN, BBC and Bloomberg Television, as well as on BBC World Service Radio. He has published articles in The Financial Times, The Far East Economic Review, FinanceAsia and CFO Asia. He is also a well-known speaker whose audiences have included The World Economic Forum’s East Asia Economic Summit in Singapore, The EuroFinance Conference in Copenhagen, The Chief Financial Officers’ Roundtable in Shanghai, and The World Knowledge Forum in Seoul. He runs a blog called https://www.richardduncaneconomics.com/ where he has a video newsletter service called Macro Watch, which is available to our listeners at a 50% discount using the code word: authority

I coined the term ‘Creditism’ to describe an economic system driven by credit creation and consumption, in contrast to Capitalism, which was driven by investment and savings. Creditism replaced Capitalism when money ceased to be backed by gold nearly five decades ago. But Creditism requires Credit growth to survive. The evidence presented in this video suggests that Creditism is in crisis globally because Credit is no longer increasing fast enough to drive global growth, even with record low interest rates. It is not possible to understand the global economic crisis without taking account of the exhaustion of Creditism.”

– Richard Duncan

Current Creditism trends:

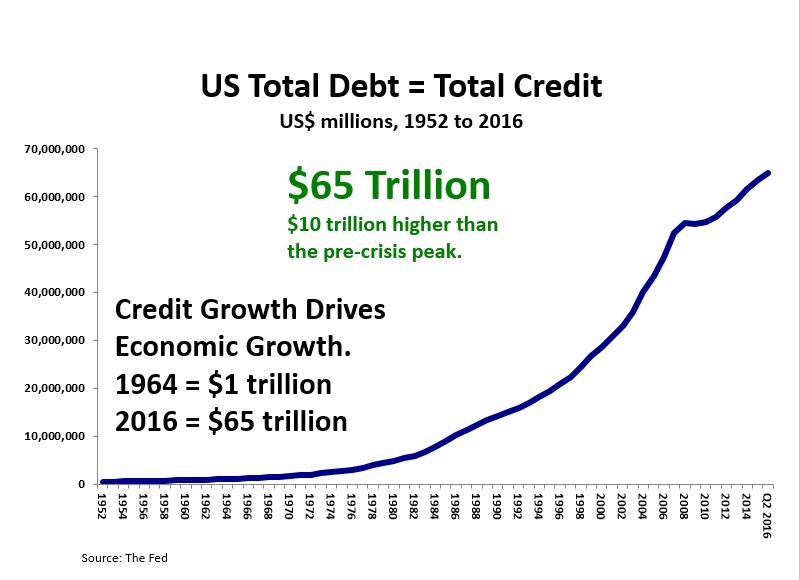

Once we stopped backing money with gold in 1968, the nature of our economic system changed very profoundly. Credit growth became the driver of economic growth. When we were still on a gold standard, there were constraints as to how much credit could be created, but after we stopped backing money with gold, all those constraints were removed and credit absolutely exploded. Total credit or total debt in the United States first went through one trillion dollars in 1964, and now it’s 66 trillion.

So it’s expanded 66 times in just over 50 years. This extraordinary explosion of credit in the US has completely transformed the global economy. It ushered in the age of globalization, it allowed countries like China to be revolutionized from a very poor, developing country, to the second largest economy in the world. What I’ve seen is even adjusted for inflation, every time credit has risen by less than 2% in the US going back to 1950, the US goes into a recession. And the recession doesn’t end until we get another big surge of credit expansion. So it’s crucial to be able to forecast credit growth if you want to be able to understand what’s going to happen in terms of economic growth. And it’s been very weak since 2008; we’ve now hit the point now where the private sector, the households, are so heavily in debt that they just can’t continue taking on new or additional debt to make credit expand enough to drive the economy.

So this is the real point: once credit started to contract in 2008, the global economy began to spiral into a new great depression. And it was only the expansion of government debt that prevented that from occurring. US government debt has more or less doubled since 2008, it is roughly $19 trillion now. It was the expansion of government debt that kept total credit expanding, and that prevented the world from collapsing into a depression.

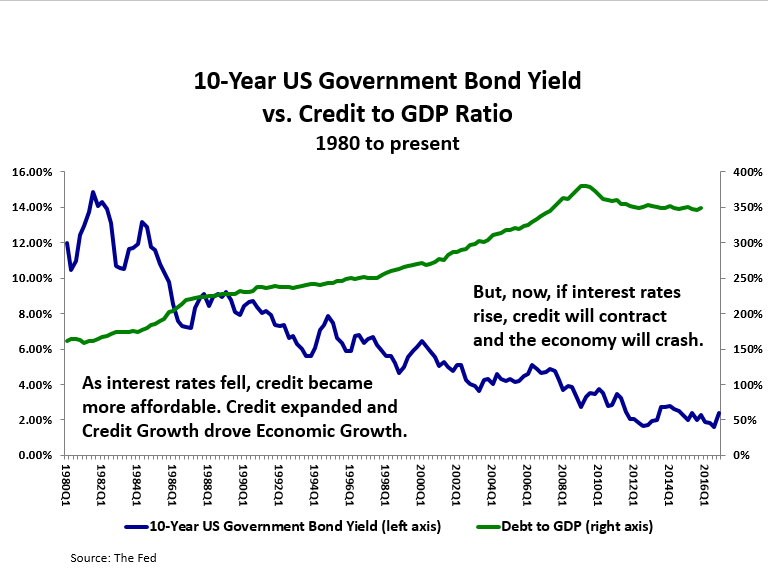

The key as to what is going to happen next to the US economy and the global economy is interest rates. Interest rates are crucial to the future of Creditism as I call it. Going back to 1980, interest rates in the United States have gone down very steadily.

The 10-Year US Government Bond Yield in the early 80s was as high as 15% and now it’s gone down to around 2.2% today. And as the interest rate fell, this made borrowing more affordable, so the Americans were able to afford more debt. They became increasingly indebted, and we can see this by looking at the ratio of total debt to GDP in the United States. Now when I talk about total debt or total credit, I mean all the debt in the country. The government debt, the household sector debt, the corporate debt, financial sector debt, all debt. In 1980, it was only around 150% total debt to GDP, now it’s about 350%. So as credit expanded, the credit growth drove the economic growth in the United States. And as the US economy expanded, US imports from other countries grew, and that drove the global economy.

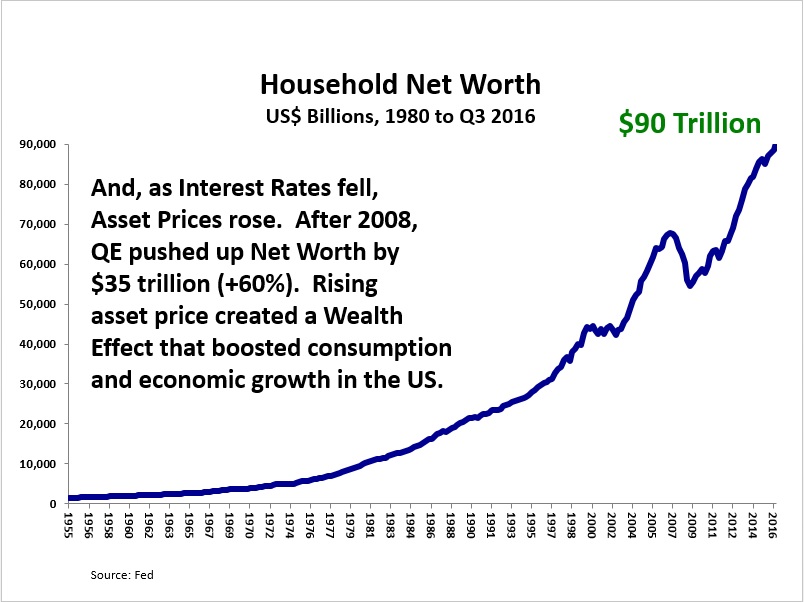

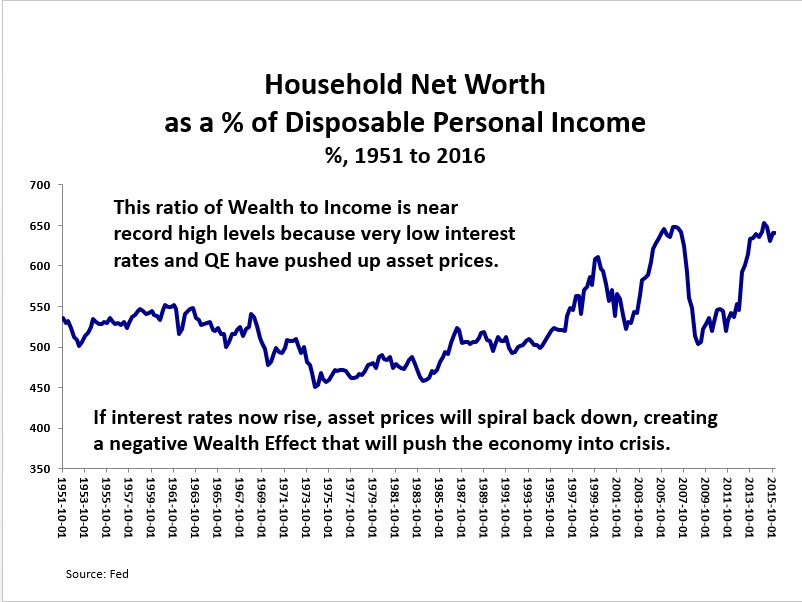

As interest rates have fallen, Asset prices have gone up. The stock market, property market, bond prices, they’ve all gone higher as interest rates have gone lower. The best measure of total wealth in the United States is household sector net worth.

Household net worth is now $90 trillion, it’s gone up by 60% since the post-crisis low in 2009. The reason this wealth has expanded is that the government and the fed took very aggressive action to reflate the global economy after 2008. The fed and the central banks around the world had interest rates to near 0% and reflated the global economy.

Going back to 1950, the ratio of wealth to income has averaged about 525%. During the property bubble, this ratio went up to about 650%, and of course, the property bubble blew up, and the ratio went back down to its normal level of about 525%. But now this ratio has once again expanded and is now at its back at its all-time peak level at 650% once again. And this is telling us that asset prices are very high, and the stock market is very expensive, property prices are expensive. And that means interest rates now begin to move higher, then asset prices are very likely to fall. So we’re seeing a situation now where interest rates are the key, because if interest rates move higher then credit is going to contract. That’s going to throw the economy into a severe recession, and on top of that asset prices would have a very significant correction or crash, that would cause a negative wealth effect, and that would also cause a US economy and the global economy to go back into severe recession, or worse.

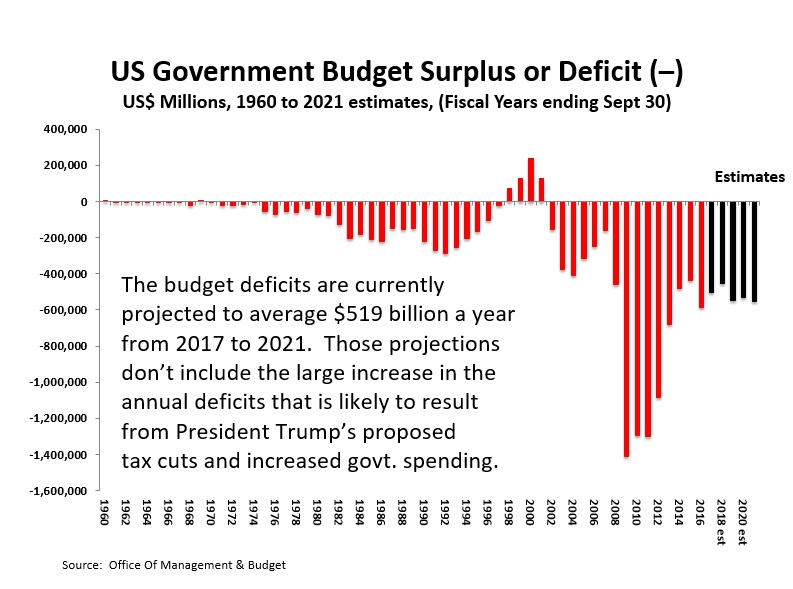

The US budget deficit

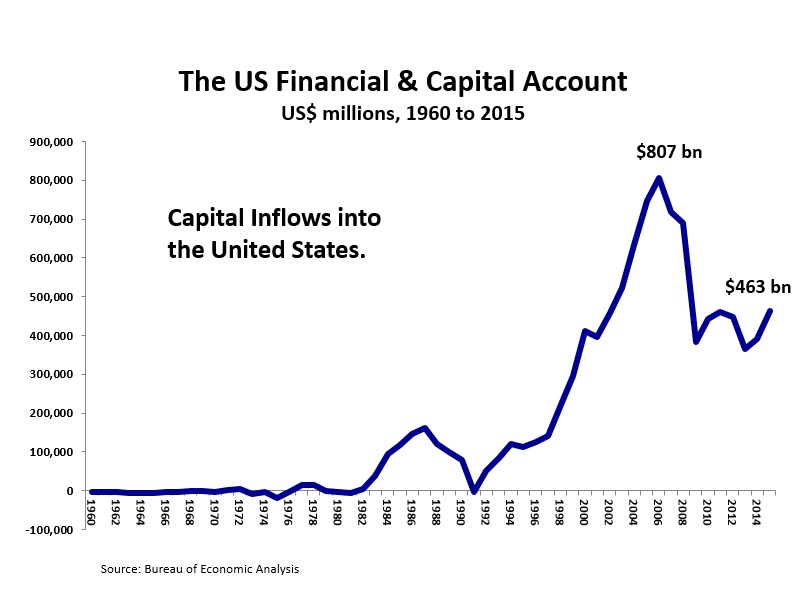

When the government borrows money it tends to push up interest rates. For instance, if the government doesn’t borrow anything then there’s less demand for money and interest rates will be lower. But if the government were suddenly to borrow $3 trillion, then that would suck up all the money available in the economy and that would push interest rates to very high levels. So when the government borrows more, it tends to push up interest rates. This is assuming all else is unchanged, but over the last many decades, something very important has changed. Once the Bretton Woods system broke down in 1971, the United States discovered they could run very large trade deficits with the rest of the world. This is important because it means the US will have very large capital inflows. When the US has a large trade deficit, it will have an equally large amount of capital inflows coming into the country to finance that trade deficit. The larger the capital inflows are, the easier it is to finance the government’s budget deficit at low interest rates.

In 2006 we had about $800 billion in capital inflow, and that was enough to finance the entire government budget deficit that year a few times over. So these inflows are very important financing the budget deficit at low interest rates. If Trump is successful in his promises to cut taxes and increase government spending, then it’s going to make their budget deficit considerably larger.

The Capital Inflows are the mirror image of the Current Account deficit. When the Current Account Deficit grows larger, the Capital Inflows also grow larger, making it easier to finance the budget deficit. But, when the Current Account Deficit shrinks, Capital Inflows also shrink, making it more difficult to finance the budget deficit at low interest rates.

President Trump’s plans to force US companies to bring their factories back to the US, to renegotiate trade deals and/or to impose trade tariffs on China and Mexico would all cause the US Current Account deficit to shrink. A smaller Current Account deficit would cause the capital inflows into the United States to shrink, too. Less capital inflows would mean less demand for US government bonds. That would push up interest rates and pop the asset price bubble. So, we must keep a close eye on the US Current Account Deficit because it will determine the size of the capital inflows.

What Could Cause Inflation to Rise?

Inflation has fallen since the early 1980s because increasing trade with low wage countries has pushed down US wages and the price of consumer goods. Now, however, if the US imports less from low wage countries, the price of manufactured goods will rise, US wages will rise, and inflation will rise. Forcing companies to bring their factories back to the United States or imposing trade tariffs on imported goods would cause inflation to increase. Increased government spending could also cause inflation to pick up.

The Undesirable Consequences of Eliminating the Trade Deficit

If the US reduces its imports, the global economy will shrink. If the US eliminates its $1 billion a day trade deficit with China, China’s economy could collapse into a depression that would severely impact all of China’s trading partners, and potentially lead to social instability within China and to military conflict between China, its neighbors, and the US. Additionally, if the US Current Account deficit returns to balance, the global economy will suffer from insufficient Dollar liquidity, which could cause economic stagnation or worse. A reduction of imports from low wage countries would cause US inflation to rise, which would push up US interest rates. The elimination of the Current Account deficit would cause a sharp reduction in capital inflows into the US, which would also cause US interest rates to rise. Higher interest rates would cause credit to contract and a sharp fall in US asset prices, which could cause the economy to go into recession. It could also cause a wave of credit defaults in the US and around the world, potentially leading to a new systemic financial sector crisis.

Moving Forward

The US could stimulate the economy “the old fashion way” by increasing military spending and starting a war, or they could invest in 21st century industries and technologies. We could invest a trillion dollars over the next 10 years in developing renewable, green, solar energy. And if we did that, we could then re-structure the entire US economy, and induce a new technological revolution that would be so profitable, that we would pay off these investments many times over. We could grow out of this crisis, rather than collapsing into a new great depression.

Conclusions

The proposals outlined thus far by President Trump suggest that:

- The budget deficit would grow larger (due to tax cuts and increase government spending);

- The current account deficit would shrink (due to renegotiating trade deals, bringing US factory jobs back to the US and possibly trade tariffs);

- And inflation would pick up (due to increased government spending, higher US wages, pressure on China to push up the RMB and, possibly, tariffs).

More about Macro Watch

Macro Watch is a video newsletter published by Richard Duncan. Every two weeks a new video is uploaded describing something important going on in the global economy, and how that’s likely to impact asset prices. Macro Watch monitors and forecasts credit growth and liquidity to measure and anticipate economic growth. You can subscribe to Macro Watch at https://www.richardduncaneconomics.com/ where you can save 50% with the discount code: authority

LINK HERE to download the MP3 Podcast

Summary by Jacob Dougherty jdougherty@Ryerson.ca

04/26/2017 - The Roundtable Insight: Richard Duncan On A Recipe For Disaster

04/26/2017 - The Roundtable Insight: Richard Duncan On A Recipe For Disaster