“What we’re really discussing is a mismatch between the amount of money pouring into commercial real estate and the actual return on that investment”

We have a large supply of commercial real estate out there but the supply is still increasing, they’re continuing to build and have overbuilt in many areas. Meanwhile, the demand side is low and is still moving downwards. There have been very high vacancy rates in the U.S. specifically in the office and retail sectors.

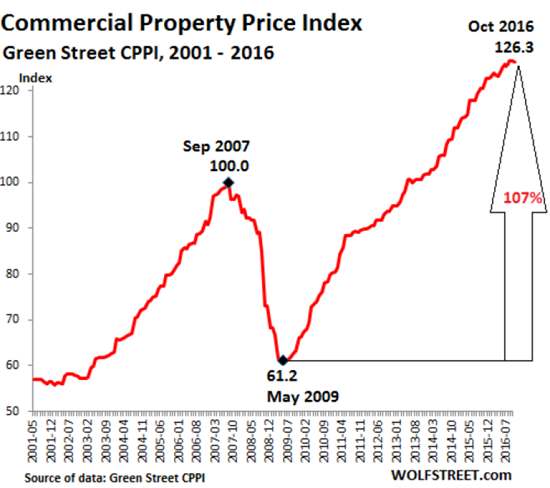

There is also generational trends in play, there is less demand for office and retail space because millennials are causing the office space standard to rise and retail is more often done online at websites such as amazon. At the same time, there are valuations that are sky-high, even higher than the financial crisis. This could boil over as soon as 2018, but the central banks should have enough tricks up their sleeves to save the system one more time, but they’re running out of rope to do that a third time.

From the podcast:

Charles: The commercial property price index has now exceeded the previous bubble top in the 2007-2008 period by about 25%. So we’ve got a bubble that exceeds the previous high, and that should alert us to the potential for some downside here.

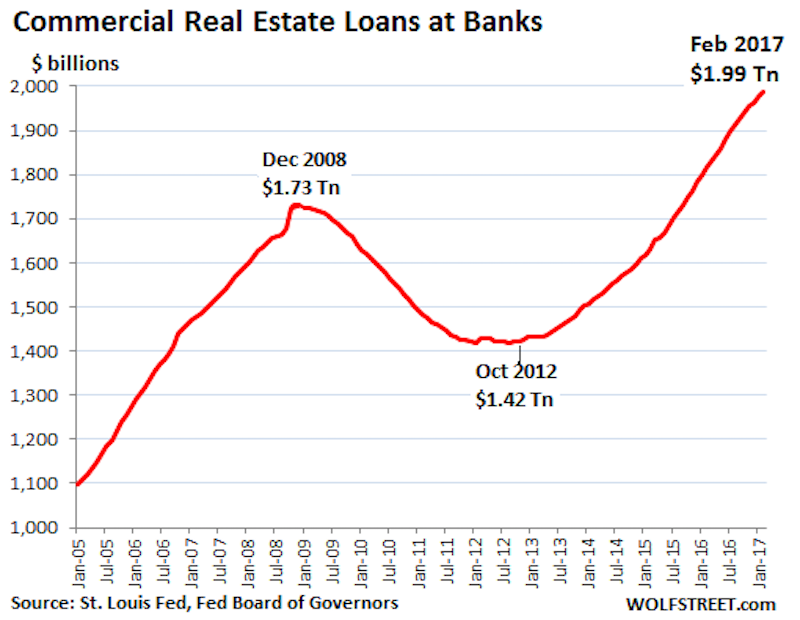

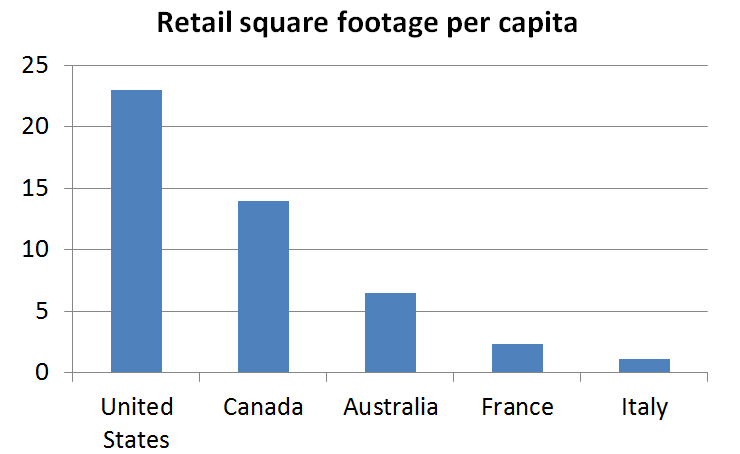

And if we look at commercial real estate loans at banks, then we see the chart is almost just an exact overlay of the price action. In other words, we’ve got more loans by about 25%, basically $2 trillion of U.S. commercial real estate loans. What makes that sobering is if we look at the retail square footage per capita.

We find that the United States has multiples, and so does Canada actually, has multiples of what other countries, advanced post-industrial companies like France and Italy. They have 2 or 3 of square foot per person and the U.S. has almost 25 and Canada has almost 15. So it looks like we’ve got a situation where there’s a lot of leverage debt on an overbuilt sector.

FRA: And you mention also that they’re still building and a lot of places have been overbuilt?

Charles: Yeah, I dug up a chart called Retail Space under Construction, and this was a year ago first quarter 2016, but there are millions of square feet of shopping centers, malls, and specialty centers still under construction.

Now if these are all in extremely hot markets like Toronto, or Vancouver, Silicon Valley, Brooklyn, then of course there’s going to be a demand for this kind of space, but these white-hot markets are fairly limited and so there’s a suspicion that there’s a lot of space being added to an already extended inventory.

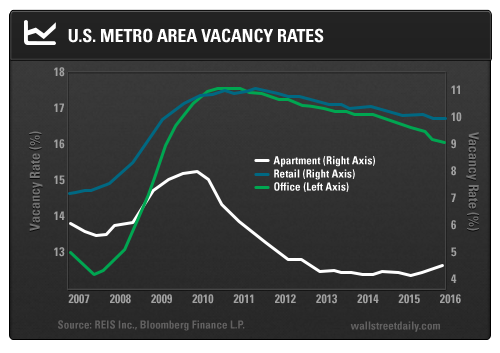

Charles: We can see that the residential vacancy rate has plummeted from the 2010 post financial crisis peak. And it’s essentially near zero, around 3% or 4%. But the retail and office vacancy rates are still hovering around 9% or 10% which is way above where they were in 2007 and 2008. So this vast expansion of credit and some of that money is pouring into retail and office commercial real estate, but the demand really isn’t there. And we know that because of these high vacancy rates.

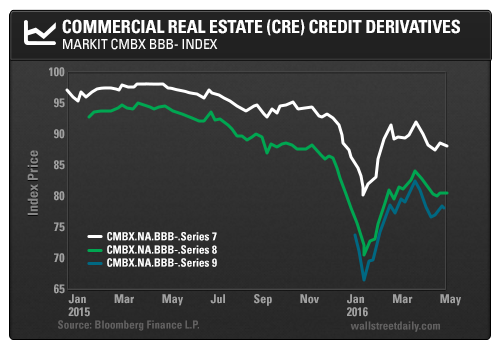

FRA: You also add a chart on commercial real estate credit derivatives which gives an indication of the risk inherent in commercial real estate, is this indicative of rising risk in that sector?

Charles: Right, this chart is credit derivatives and it’s a fairly high-risk series, its BBB not AAA, so this is the kind of credit derivatives that are sensitive to risk and interest rates. And there was a very steep decline, a spike down about a year ago, the first quarter of 2016 in these commercial real estate credit derivatives which showed that there was a heightened sense of “we better get out now” and limit our exposure to the credit derivatives on the commercial real estate sector. And it’s recovered, but it’s recovered to a lower high then it was. It was quite stable all the way through 2015. So this is telling us that the financial people that are exposed to the commercial real estate sector are starting to hedge their bets and starting to pull the trigger to minimize their exposure, which means they see a heightened risk.

Charles: Right, this chart is credit derivatives and it’s a fairly high-risk series, its BBB not AAA, so this is the kind of credit derivatives that are sensitive to risk and interest rates. And there was a very steep decline, a spike down about a year ago, the first quarter of 2016 in these commercial real estate credit derivatives which showed that there was a heightened sense of “we better get out now” and limit our exposure to the credit derivatives on the commercial real estate sector. And it’s recovered, but it’s recovered to a lower high then it was. It was quite stable all the way through 2015. So this is telling us that the financial people that are exposed to the commercial real estate sector are starting to hedge their bets and starting to pull the trigger to minimize their exposure, which means they see a heightened risk.

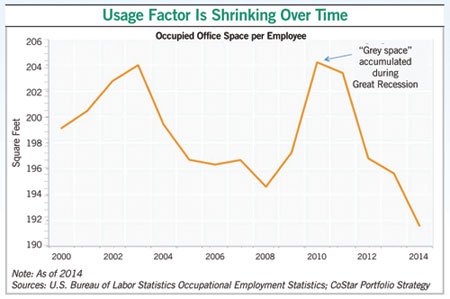

Charles: This chart shows how much space employers now provide to each of their employees. And that number is plummeting from 2010 as businesses have to get more efficient, they need less office space. And if you combine that with flex work and working at home and teleconferencing its hard not to conclude that we as an economy are going to need less office space. And in the retail sector, the number of stores closing is at an all-time high, it’s far exceeded the 2008 financial crisis peak.

So what we’re seeing is a huge fleeing and closure of the retail sector, and a lot of subletting going on in the office space sector, so there are corporations and retail business which are shedding space because that space is no longer generating sales and profits.

If you would like to learn more about Charles Hugh Smith’s work, you can visit his website at http://www.oftwominds.com/ where you can look at his archives and read free samples of his books.

Summary written by Jake Dougherty<jdougherty@ryerson.ca>

LINK HERE to download the podcast in MP3 format

04/16/2017 - The Roundtable Insight: Charles Hugh Smith On The Commercial Real Estate Bubble Caused By Financial Repression

04/16/2017 - The Roundtable Insight: Charles Hugh Smith On The Commercial Real Estate Bubble Caused By Financial Repression