David Rosenberg: Why Trump’s infrastructure and tax-cut plans will pave the road to economic ruin

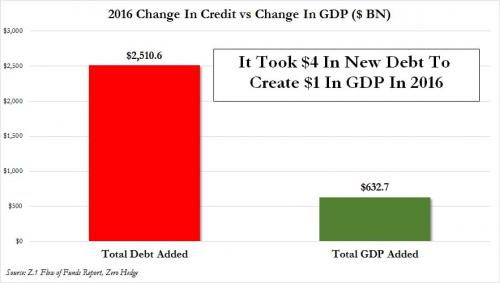

“The stock market seems to think that money grows on trees. But the reality is that a dollar borrowed today is a dollar sacrificed for economic growth in the future. The debt-to-GDP ratio under the Trump plan goes from 77 per cent today to 105 per cent by 2026. Within a decade, the United States will look like a peripheral European country. I can understand fully the backlash against the Clintons, but I cannot believe anyone deliberately voted for fiscal ruin .. To reiterate, it is 100 per cent true that monetary policy has hit the wall. That happened a while ago and is to be expected at the zero bound .. The challenge is that fiscal policy also is tapped out and the multiplier impact subsides at ever higher debt-to-income ratios. We have long seen this in Japan. We are seeing it now in real-time in China, and to a large extent in Canada as well. In other words, there is no baton to be passed from monetary to fiscal policy. While the market does feed off this perception today, at some point reality will set in.”

04/05/2017 - Deficit Spending (New Debt) Creating Diminishing Returns Of Economic Growth

04/05/2017 - Deficit Spending (New Debt) Creating Diminishing Returns Of Economic Growth