Current events during the last few months have caused overwhelming uncertainty throughout the global economy, and the consequences of this uncertainty are particularly difficult to foresee. In particular, there are two major developments that have global investors on the edge of their seats – a revamping of the Dodd-Frank Act, and a proposed Border Adjustment tax.

The Dodd-Frank Act

The Dodd-Frank Act was signed into U.S. law in 2010 in a reactionary attempt to prevent incidents such as the financial crisis of 2008 from occurring again. The law’s main purpose was to hold banks more accountable for their actions and improve their risk management practices and policies. It also tried to increase transparency between banks and the public, as well as monitor profitable banks to increase their reserve requirement should they become “too big to fail”. The Dodd-Frank act generally makes banks hold more capital, which they’d prefer to invest. U.S. President Donald Trump recently made headlines in February when he said he planned to revise or completely throw out the Act, claiming it was hurting small businesses and small banks.

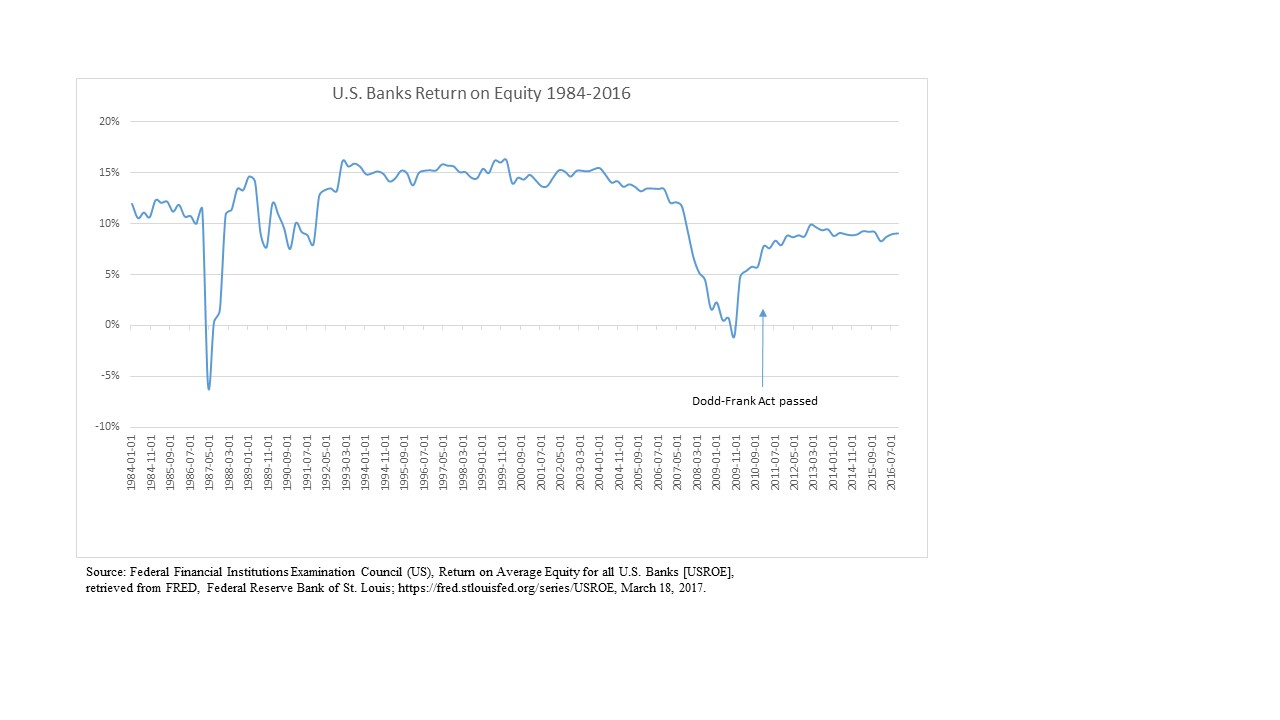

There would be several major implications for investors if the Dodd-Frank Act were revised or discarded completely. Estimating the consequences of this action requires some background information on how the Dodd-Frank act impacts banks. Below is a chart showing the average return on equity for all U.S. banks with every quarter from 1984-2016 (points shown every year).

Between 1984 and when the Dodd-Frank Act was signed in July 2010), banks made an average of 11.99% on their investments. After the Act was signed, banks’ return on equity fell to an average of 8.63%, meaning on average, banks made 3.36% less equity on their investments per quarter. This suggests that a weakened Dodd-Frank Act would create much more profitable banks on average. It’s also worth noting that smaller banks bear the largest burden from the Act since many cannot afford the external audits required by the Act.

It’s important to note that since the Dodd-Frank Act was signed, the banks’ return on equity only had a standard deviation of .992%, while from 1984-2016, that same figure was a whopping 4.403%. This means that before Dodd-Frank, we would expect, on average, that a banks’ return on equity to deviate 4.403% from the mean each quarter, as opposed to a mere .992% after the Act was signed. This indicates that banks have been a much safer and more consistent investment under the Dodd-Frank Act.

That being said, the 4.403% standard deviation was heavily influenced by low and even negative equity returns in 1987 and 2008, due to economic recessions. It’s difficult to say whether or not the Dodd-Frank Act would have prevented these harsh economic conditions, but it’s reasonable to assume that it would have helped. After all, Dodd-Frank was enacted as a direct response to the financial crisis of 2008.

If the Dodd-Frank Act was changed or revised, a likely target would be the Volcker Rule. A report by the Federal Reserve defines the rule as an intention to “limit bank risk-taking by restricting or prohibiting certain speculative activities,” which limits a bank’s ability to engage in trade that doesn’t benefit their customers. This rule is very unpopular among banks, and eliminating it would mean a massive increase in proprietary trading. In September 2016, the Federal Reserve released an analysis of the Volcker Rule called “The Volcker Rule and Market-Making in Times of Stress”[1] in which they tested how the Volcker Rule affected bond liquidity. The analysis concluded that “the Volcker Rule has a deleterious effect on corporate bond liquidity, and dealers subject to the Rule become less willing to provide liquidity during stress times”. If this rule is eliminated, it could really shake up the financial investment market, and we see a reason to believe that there may not be enough support to keep the rule in place.

It’s difficult to judge the Dodd-Frank Act’s full impact because it hasn’t had to withstand a recession. In any case, reducing the regulations would alleviate the many burdens banks face today by allowing them to give out more loans and make more investments, which usually results in higher profits, but at a greater risk. Despite the increased risk, eliminating or weakening the law would be welcomed as good news by banks and financial investors. To be sure, the extent of their delight will depend on the degree to which the Dodd-Frank act will be changed.

[1] Bao, Jack, Maureen O’Hara, and Alex Zhou (2016). “The Volcker Rule and Market-Making in Times of Stress,” Finance and Economics Discussion Series 2016-102. Washington: Board of Governors of the Federal Reserve System, https://doi.org/10.17016/FEDS.2016.102.

What the Experts think

A great deal of notable investment experts would generally like to ease the burden that Dodd-Frank puts on banks to some degree. Peter Boockvar, the Chief Market Analyst to the Lindsay group, is hopeful the currently unknown changes to the Dodd-Frank act will be able to help small banks. He points out that “Smaller banks have been the most burdened by Dodd-Frank. The bigger banks, they can afford to hire thousands and tens of thousands of the compliance officers. It’s the small banks that have really suffered, and hopefully they get the most relief from any changes.” He also hopes changing the act will result in banks’ lending more. To do this, changes would have to focus on Dodd-Frank requiring banks to hold less of their capital; that way they could lend more.

However, he also points out that this is not an absolute solution to making banks lend more, saying, “We still need a willing lender and a willing borrower, hopefully this will facilitate that.” Yra Harris, a renowned trader with over 30 years of experience in all commodity trading, with additional expertise in currency markets, would prefer the Dodd-Frank act be replaced with Glass-Steagall, a piece of older legislation that would allow commercial banks and investment banks be separated. This would help improve banking transparency in line with Dodd-Frank’s goal, while also avoiding regulation that can once again be very harmful to the small banks.

Even though Dodd-Frank was passed to help prevent a financial crisis, many are afraid that it could actually exacerbate one. As stated before, the Federal Reserve has already concluded that at least the Volker rule makes it difficult to liquidate in times of stress, which could make banks very vulnerable should there be a crisis. Warren Buffet, one of the most famous and successful investors in the world, agrees with this. He has been quoted as saying that “Dodd-Frank has taken away the Federal Reserve’s ability to act in a crisis.”[2] As stated before, we haven’t been able to see what happens under the Dodd-Frank act during a recession, but Buffet believes that in the event of a financial crisis, the Dodd-Frank act could cause the Federal Reserve to be unable to respond effectively.

While most experts agree changing the Dodd-Frank act can be a good thing, it’s important to change the correct parts. The goal of the revision is ultimately to increase lending and investment, and as Peter Boockvar has pointed out, the impact on lending will depend on what’s changed. For this reason, many are reserving judgment until we have a clearer understanding on the areas of Dodd-Frank that will updated.

[2] Quote from http://www.investopedia.com/news/buffett-doddfrank-fed-and-national-debt/

A Potential Border Adjustment Tax

There would be a tremendous impact on the global economy if the Trump administration is able to follow through on its promised Border Adjustment tax. The general idea is that U.S. exports produced domestically would not be taxed, but foreign U.S. imports would be subjected to the nation’s corporate tax. The resulting burden on importers would be offset by a projected 20% appreciation of the USD.

A 20% appreciation of the USD has the potential be very problematic for the rest of the world. The USD is extremely important in the context of global economic dealings. If U.S major trading partners are faced with a 20% appreciation of the USD and a significant Border Adjustment tax, it could cause major harm to the global economy, and be detrimental to worldwide trade. Foreign currencies rely heavily on the USD because of the current amount of debt floating around in USD, which makes it extremely dangerous for it to fluctuate.

In the United States, if the dollar does appreciate as expected, it won’t do so overnight. Between the Border Adjustment tax being implemented and the dollar reacting to the changes, the U.S. may see massive price increases on imported goods, leading to an overall decrease in consumption and spending in the short term.

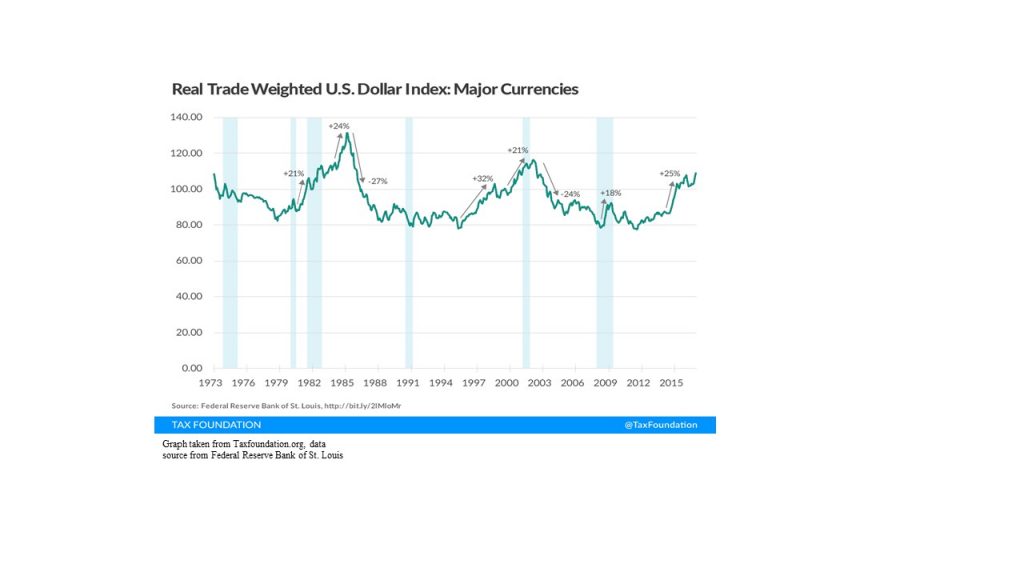

From a global investment perspective, a U.S. border tax would be harmful to other traders and currencies in the world. How likely is the dollar to appreciate? It’s difficult to say because the U.S. has never had a tax system like this before. Traditional economic models predict some amount of appreciation, but the extent is subject to debate. History shows that the USD has appreciated to these heights before, and been subject to high fluctuations.

One thing is clear: the U.S. government must proceed very cautiously if it does decide to levy a Border Adjustment Tax. Keeping in mind how much debt there is today and how many people rely on U.S. currency, implementing a Border Adjustment Tax has the potential to hurt both the world economy and U.S. economy simultaneously.

Foreign Response

The other factor to consider is how the rest of the world will respond to a Border Adjustment Tax. Many international leaders have made it clear they strongly oppose this tax and are prepared to fight it.

The Telegraph has reported that the EU is already preparing to take legal action against the World Trade Organization (WTO), in what could be one of the biggest cases in WTO history[3]. The Border Adjustment Tax seems to violate the rules set by the WTO, but a lawsuit would likely take many years to settle.

With this in mind, it seems likely that China will take swifter and more aggressive actions. Tax-news.com confirmed that China’s Minister of Commerce indicated that his country would indeed react were the U.S. to impose any sort of border tax[4]. Due to the large debt the U.S. owes China, the Chinese government has the ability to devalue the USD at any point and could use this to offset the tax. China could even impose its own tax on U.S. imports.

China would like to avoid resorting to these extreme measures, as it relies heavily on the U.S. for trade and would be hurting its own economy. Still, the Chinese government has made it clear that it will retaliate in some way if the tax is implemented. The impact of China’s response on the global economy will depend on what actions they choose to take. China’s response could help alleviate the damage the tax might inflict at a global level, but as of right now all we can do is wait and see.

[3] Source http://www.telegraph.co.uk/news/2017/02/14/eu-preparing-legal-challenge-against-donald-trumps-us-border/

[4] Source http://www.tax-news.com/news/China_Would_Respond_To_Any_US_Border_Tax____73557.html

What the Experts think

It’s important to remember that we’re looking at this from a global perspective and to anyone besides maybe in theory the United States, a Border Adjustment tax is incredibly dangerous. With that in mind, most economists and investment experts are extremely critical of how the Border Adjustment Tax is currently proposed. In a recent interview, Yra Harris warned of “a massive global slowdown” if the USD did indeed appreciate 20% on top of their border tax. He also warns that one of the most dangerous aspects of this is the massive amount of debt in dollars looming in the current global financial markets. If the USD appreciates by this extent, it poses a huge threat to all of the dollar-denominated debt being held in dollars overseas, “The variable of being the world’s reserve currency puts you in a far different position” Yra Harris adds. In short, much of the world economy relies on the relative strength of the USD and changing it without considering the unintended consequences is very short sighted. Peter Boockvar agrees, saying the tax would cause “a hit to the global financial system would bring on a wave of deflationary liquidation of assets that could really wreak havoc.”

He also points out that almost any way you cut it, the tax is a huge gamble because the U.S. is placing all of their chips in the value of other currencies and the dollar. He goes on to say, “Maybe the Dollar rallies, maybe it takes three years to adjust, and in the meantime the economy goes into recession because the price of goods rises to an extraordinary extent on an economy that’s dependent on consumer spending. And you throw in the $10T of Dollar related debt held by companies overseas that will get killed by the strengthening Dollar. If the Dollar weakens from this border adjustment tax, then the US goes into recession.”

Summary

The stocks for many banks have already gone up in expectation of less restrictive regulations. Whether or not this will be a continuing trend will largely depends on the extent to which banks can take advantage of having more freedom for their investments. The current regulations from the Dodd-Frank Act have caused banks to hold a high volume of bonds. If a change meant that banks would no longer need to hold as much, this could give them the freedom to be able to sell more, thereby raising the supply of bonds. If this happens, we can see a situation where the price of bonds lowers and the yield rises. Although, as Peter Boockvar pointed out, there still needs to be a willing buyer, and it will be interesting to see if the how the U.S. decides to deal with it. They can turn to the central banks to buy them, or when the Dodd-Frank Act is adjusted, they can add brand new regulations or incentives for the retail public to buy more bonds. There’s a very good chance it will come down to the central banks since it seems the main goal of revising Dodd-Frank is to reduce regulation as much as possible. Overall changes to the Dodd-Frank Act is a positive thing for investors in almost all scenarios, as it stands to increase banks’ profits as well as lending and general investment.

For the Border Adjustment tax, at least in the short run, we will likely see an increase in the price of commodities. Oil and gas prices are particularly vulnerable to rise if the tax is passed. In most scenarios, the tax will cause inflation throughout the U.S., but at the same time slow the country’s economic growth. That formula threatens to cause stagflation, which is a scary prospect to the United States, as it finally managed to consistently keep unemployment at a healthy level after the 2008 crisis. However, if this happens it can pose an opportunity for investors who can foresee the resulting inflation. Many investments such as oil and real estate move with inflation and tend to benefit during times when inflation is high.

Although the tax is expected to increase the value of the USD, we’re not sure if this will really be the case or not. This will depend on how the United Sates reacts to the short-term effects of implementing the tax, and how other countries respond. That being said, if the tax is implemented we can generally expect to see a rise in the USD unless others step in to change the scenario.

Author – Jacob Dougherty jdougherty@Ryerson.ca

03/24/2017 - Global Investment and Economic Implications of Current Events

03/24/2017 - Global Investment and Economic Implications of Current Events