Chris Casey is a trusted advisor to many business owners and companies alike on their pool of investments within their portfolios. With a specialty in the Austrian School of Economics, the far less popular thread of the study especially here in North America, Chris combines a unique viewpoint on traditional economic themes with an expertise on the Austrian way of thinking.

As name would suggest, the Austrian School of Economics did in fact originate in Vienna, Austria. It was powered by what was called the “marginalist” revolution in the 1870’s, which aimed attention at diminishing marginal utility-that an individual’s given choice is made on the margin. With that said, the Austrian school is a body of thought that puts emphasis on the value products as being determined by its utility to the consumer. This is balanced with Keynesian economics which focuses on the importance of dissecting the nature of various aggregate economic variables such as output, employment, interest rates, and inflation.

The Western world is largely exposed to only the Keynesian study of economics, possibly causing narrow perceptions of the principles themselves. With the emphasis of both schools of thought centered around two very different principles, a basic understanding of both is essential to better understand the world around us and how it functions.

FRA: Hi, welcome to FRA’s roundtable insight. Today we have Chris Casey. He combines a degree in economics From the University of Illinois with a specialty in the Austrian School of Economics. He advises clients on their investment portfolios in today’s world of significant economic and financial intervention. He has also written a number of publications on websites including the Ludwig Von Mises Institute, Casey Research, and Laissez-faire Books. He’s a board member of the Economics Development Counsel with the University of Illinois, a policy advisor for Heartland Institute Centre and Finance, Insurance and Real-Estate. Welcome, Chris.

Chris Casey: Thanks for having me on today.

FRA: Great! Today we wanted to discuss an approach to investing that uses the principles of the Austrian School of Economics. Chris takes that approach with his clients, and we just wanted to explore in detail how he does that, and how it gives an edge to investing. Chris?

Chris: Sure. Well, anyone’s portfolio has exposure to two very significant and primary forces; and that is the business cycle, and that recessions could pop any kind of financial bubbles out there whether it’s the stock or bond markets, as well as inflation, although that’s not talked about in today’s circles as often as it should be, it’s certainly a significant threat to anyone’s portfolio as anyone who lived through the 70’s certainly witnessed.

The Austrian school has unique explanations for both of those economic phenomena as well as interest rates. Having a unique economic perspective, truly understanding the way the world works, and being able to interpret the repercussions of various economic actors within the economy whether it’s the federal reserve, other central banks, or the treasury issuing bonds etc. is really key to structuring one’s portfolio to protect yourself from these significant threats that are out there.

FRA: How do you apply this process…is it sort of like a flow chart-based approach? Do you look for certain characteristics, or do you look at the macro view first from that economics perspective? How do you actually approach that?

Chris: Well, we’re always trying to interpret what the true effects or repercussions of, for instance, Federal Reserve actions would be on the economy. For instance, while some people may believe that raising rates will stifle inflation, we realize that that’s one of but several tools that federal reserve uses to inject money into the economy, and therefore doesn’t have much significance nor does it happen right away relative to other tools at their disposal. It’s really an interpretation of the actions that are out there and it lends itself well to Contrarian Investing because it’s a great way to truly make money in any market. So in Contrarian Investing, you’re looking at any kind of price levels that are extreme highs or extreme lows and just as importantly, you have to look at a catalyst to bring those extreme price levels to their median or mean average over time. And if you have a catalyst that is out there that’s a true interpretation of how the economy works and you understand it but everyone else believes in something different even though you’re looking at the same data, I think that’s a significant advantage in structuring your portfolios.

FRA: That’s right the Austrian view places a strong emphasis on how the “interventionary”-type policies are distorting the price of risk, the price of money, interest rates, so that wouldn’t make sense. Do you do this on a daily basis; do you monitor central bank policies, fiscal stimulus policies, government regulations…how do you monitor what’s happening and the potential distortionary effects in the investment environment?

Chris: Sure, well, we’re looking at same data as everyone else is, it’s not like we have some special insights or we’re necessarily looking at different data, it’s really the interpretation of the data. Let me give you a couple of examples. A lot of people, a lot of mainstream wealth management firms, a lot of media within the finance industry take a lot of stock with what the Federal Reserve believes and does and says, which astounds me because they are the absolute worst predictors of future events of any prognosticator out there. Think about it like this, it’s one thing if you’re wrong about predicting the future, but the Federal Reserve is even wrong about predicting their own actions. I mean, how many people can you say that, or economic actors can you say that, are simply wrong in predicting what they will do in the future. Yet time and time again, they are. If you look at the Federal Reserve, you could look at previous pronouncements, you have Ben Bernanke in January of 2008 saying they don’t see any kind of recession, and famously he did the same with the housing bubble. I don’t know why anyone believes these people on anything that they believe will happen to the economy. It’s not because they have obviously more access to data than we do, it’s simply an interpretation of what’s going on. They simply have an unsound and fundamentally flawed understanding as to what causes recessions. They cannot explain a business cycle. If you cannot explain the root causes as to why something happens, then predicting when something will happen is no different than reading tea leaves. The whole point is that it’s a different interpretation, it’s a different lens on the same data that’s out there.

FRA: Can you provide some specific examples of investment asset classes and how they are tied into an Austrian school of economics view?

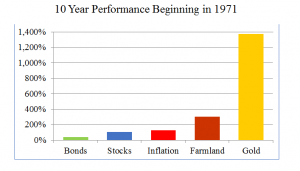

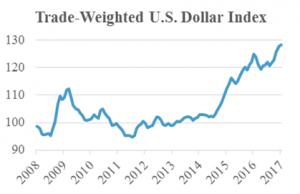

Chris: Well the one everyone always talks about is of course precious metals, and that’s because they understand the true nature of money and what money represents, what it does not represent, and therefore they understand the dangers of a Fiat currency in today’s world and its ability to create inflation. Let me just reiterate what a Fiat currency is because a lot of people just assume it means paper money, it doesn’t. Fiat means by force. It’s government required use of money, legal tender laws, and the ability to print money that’s unbacked by any kind of commodity. So we’ve obviously had that in full blown mode since 1971, and because of that we’ve experienced significant inflation in the 1970’s. The Federal Reserve has printed a huge amount of money since the 2008 recession, so people think, well why haven’t we had inflation since then? There’s a couple forces at play, it’s not a simple matter of the stock of money goes up and prices go up automatically. There are some deflationary forces to the extent that loans are called in or loans are repaid, there’s time elements, there’s a lag. It’s very possible that the demand for money has gone up, and that’s a key element to the price level equation…what is the demand for money? In times of uncertainty and in times of extreme low growth when people are afraid, the demand for money, I’m sure, goes up, so that’s been keeping a damper on inflation as well.

FRA: What types of investments would provide yield and preservation of purchasing power?

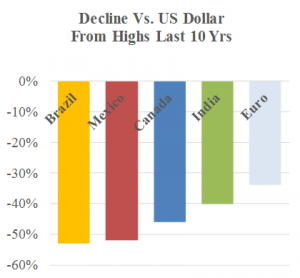

Chris: In addition to, obviously precious metals, I think you want to look for any kind of investment or economic activity where you are getting paid in more stable and increasingly valuable foreign currency, but you have your costs in dollars. Let me give you a couple of examples that exist in the real world: in Russia over the last couple of years the Ruble has fallen tremendously relative to the US dollar, but if you look at their commodity producers, if you look at an oil company there, they’re getting paid in international markets in dollars. Meanwhile their costs are lower relative to their revenue. Another example would be in Brazil, we have the same thing happening with producers, their costs have fallen dramatically and yet they’re getting paid on the international market in dollars. And so people should look at that and think about what will happen next in the US, how could they position themselves to benefit from any kind of US inflation. US farmlands are a good example. Much like Brazil, the same thing could happen here, we saw that in the 1970’s when the price level essentially doubled over a ten year period, farmland prices went up about threefold, so they more than kept pace with inflation because the more farmers started exporting, as dollars became cheaper for foreigners to buy, their real sales went up in real terms, their land value went up in real terms. So that’s another way to play inflation, not just a knee-jerk reaction to precious metals but actually looking at other areas where you could benefit between the discrepancies in currencies.

FRA: What about other investments in agriculture, does that make sense as well in agricultural commodities or companies focused in that sector?

Chris: If farmers are doing better, if they’re wealthier, if their underlying land values are better, I’m sure that there’s a lot of by-products that they will do very well. We haven’t looked at any in particular, but there are certainly a ton of products that would do quite well on that scenario

FRA: Given the Austrian School of Economics places a big emphasis on debt, in a negative sense, would it make sense to look at investments where there are business with little or no debt, little or no leverage?

Chris: I wouldn’t say that the Austrians necessarily view debt per se, negatively, they certainly view the non-repayment of debt negatively because that affects everyone in the economy, and they are strong believers in property rights and contractual obligations. But they do view government debt extremely negatively, for a number of reasons: morally, constitutionally, and just economically. They would advocate a balanced budget and much lower debt levels to the extent where there is no debt overall which we haven’t seen since the time of (pres.) Andrew Jackson.

FRA: Yeah, exactly. Would it be possible for the government to consider some type of migration plan from a Keynesian based to an Austrian based management of the debt? Is that possible or could that be proposed, perhaps, as an evolutionary?

Chris: Well I don’t think anyone in government actually subscribes to the Austrian school of economics, which is unfortunate, but out of the thousands of economists, very few of them would even be aware of the school, let alone understand or believe in any of its principles. I just don’t see anyone within the government, in any significant way, migrating economic policies towards an Austrian viewpoint.

FRA: Do you know of any studies or empirical analysis with regard to using the principles of the Austrian School of economics for investing? Are there any past performance studies that indicate taking this approach has advantages and can provide an edge to investing?

Chris: I’m not aware of any, and frankly it would be very difficult to conduct those, but more importantly I’m not sure exactly what those results would show meaning I’m not sure how beneficial someone simply believing in Austrian economics would have an advantage over others. I mean, we use it, we believe it is an advantage but just knowing about it doesn’t necessarily do anything, you have to really act on it. It’s not foolproof either. The Austrian Economics will help you identify bubbles and the catalysts to pop those bubbles. It will tell you about the direction and magnitude of markets, perhaps, but it won’t tell you anything about the timing, or at least that’s the trickiest part. In my mind, timing is far less significant when you have those other attributes nailed down because otherwise you’re “picking up nickels in front of a steamroller”. So, I’m not aware of any studies that would be interesting down the road, it’s also a pretty small data set of people who actually believe in this and act on it.

FRA: Given the level of government intervention of central bank policies that intervene in the economy and in the investment environment on a long term basis, how does one address the challenge of timing, as you just mentioned? Is it a matter of waiting a certain period of time or are there tipping points where the distortions have just become too large and there will be a reversion to the meaning of Contrarian type-based approach? How do you actually look at the timing challenge?

Chris: I do believe that direction and magnitude are more important. Let me give you an example: 2008 was a horrendous time. You had businesses thinking about where they have their cash, whether or not it’s even safe in a bank, that’s how fearful they were. The unemployment rate literally shot up in 7/8 months to 10% from maybe a high 4(%) in early 2008. You cannot understate the severity of that recession. Now from that, the government and Federal Reserve and treasury did exactly what they should not have done. They should have let these liquidations happen, they should have let the recession run its course but instead they did everything wrong. They printed a lot of money, they ran huge deficits, and all they did was cause dramatic and increased distortions within the economy. So make no mistake, what happened in 2008 was devastating, could be dwarfed by what comes down the pike based on what’s happened, because the distortions are even greater. The longer this has gone on, the greater the distortions are allowed to run their course and the more severe will be the contraction; the beneficial time period where we restore the structure of production to how it should be. So, timing to me just isn’t as important as magnitude and direction.

FRA: I see, yeah. Given what’s happening in the economy and what’s happening with central bank policies, not only with the central bank of the US, the Federal Reserve, but other central banks around the world, as well as government policies on fiscal stimulus, the potential for increased infrastructure. Given that, and from an Austrian school perspective, where do you see the asset classes preferable to be in over the next 6-12 months, 1-2 year period?

Chris: Well perhaps more importantly, is to what you should be in, is to what you should NOT be in. I think everyone should start looking at Cryptocurrencies in some form, emerging markets are very tempting based on not only the disparity in values between currencies but based on the disparity in relative values between their markets. Farmland, as I mentioned, I think is attractive. There are certain one-off sectors that have nothing to do with the economy which should do well regardless as to what happens. So for instance, uranium, or cannabis for that matter. But more importantly than these areas that one may want to consider, are areas that you should avoid; certainly anything within the equity markets that’s highly overvalued based on historical norms, I think, people should think about not having it in their portfolio. Certainly any kind of debt instruments are potentially at risk with rising interest rates, so you may want to lighten up on those. So in general, those are some themes to embrace or consider as well as what to avoid.

FRA: Great, and how can our listeners learn more about your work and your services?

Chris: More importantly than that, is what we believe in and how we apply Austrian economics. We have a lot of content on our website. I would just encourage people to check out our website which is WindRockWealth.com, and certainly our contact information is on there as well.

FRA: Excellent! We will be posting this podcast as well as a number of charts and graphs that Chris will be providing on the website. We will also do a write-up abstract-transcript of this interview for anyone who wants to read that, including the charts and graphs. Thank you very much, Chris.

Chris: Thank you.

Abstract written by: Tatiana Paskovataia <tatiana-p28@hotmail.com>

LINK HERE to download the MP3 Podcast

03/22/2017 - The Roundtable Insight: Chris Casey on The Austrian School of Economics and Why It May Be Time To Change Our Perspectives

03/22/2017 - The Roundtable Insight: Chris Casey on The Austrian School of Economics and Why It May Be Time To Change Our Perspectives