FRA is joined by Charles Hugh Smith in discussing income inequality as a result of central bank policies

Charles Hugh Smith is a contributing editor to PeakProsperity.com and the proprietor of the popular blog OfTwoMinds.com. He is the author of numerous books, including Why Everything Is Falling Apart: An Unconventional Guide To Investing In Troubled Times.

ENGINES OF INEQUALITY

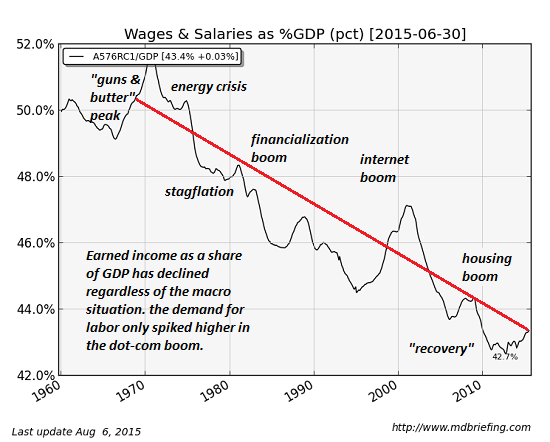

A lot of people are connecting the dots between rising income inequality and central bank policy. Wages as a percentage of GDP is a very broad-based method of saying how much the economic activity in a nation is ending up in the hands of wage earners as opposed to owners of capital or rent-seekers. We want to differentiate between rent-seeking – monopolies and cartels getting the government to protect their income streams and eliminate competition – as opposed to the innovative, creative destruction side of capitalism where growth and income inequality might be rising because the most talented and the most successful at allocating capital are benefiting. We can see that both of those forces are at work. A lot of people have noted that the top 5% of wage earners are scooping up most of the gains in wages while the bottom 90-95% are seeing stagnating wages.

If you look at GDP as a percentage of wages, it’s been declining since 1970. Something else is going on. Why are wages declining for decades? Clearly it’s connected to policies. 1970 coincides with the decoupling of the USD from gold, so from that point it all comes down to central banking policies and interventions by the Fed in the US.

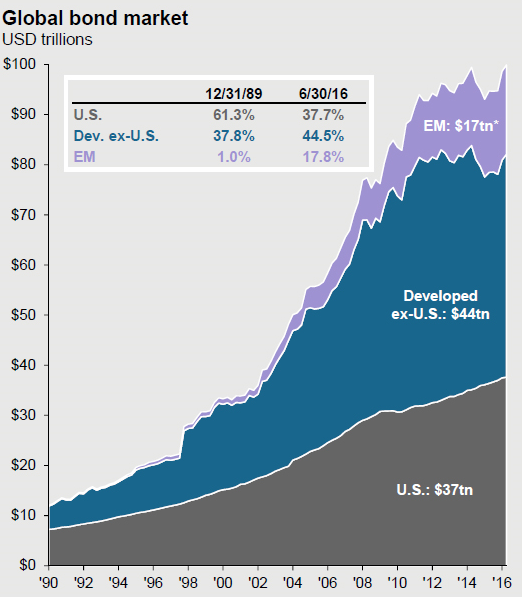

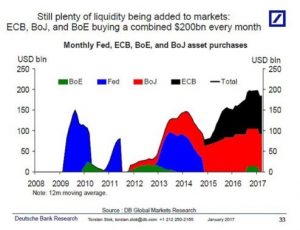

We can also look at debt. The primary function of central bank policies over the last few decades seems to be facilitating the expansion of debt at a rate that’s far faster than the expansion of GDP. The global bond market is basically the creation of debt instruments, and from 1990 there was about $10T in global bond market debt, and now it’s pushing $100T. We have to ask if the major economies of the world increase tenfold, and the answer is no. Looking at US sovereign debt, around that period it went from $3T to $20T. We can kind of follow that narrative and see what happens when debt is awarded and the acquisition of debt is easy for those closest to the money. There is a tremendous conservation of central bank policies, which is to lower interest rates and make it easier for banks and corporations to borrow money. This is one of the key drivers in wealth and income inequality.

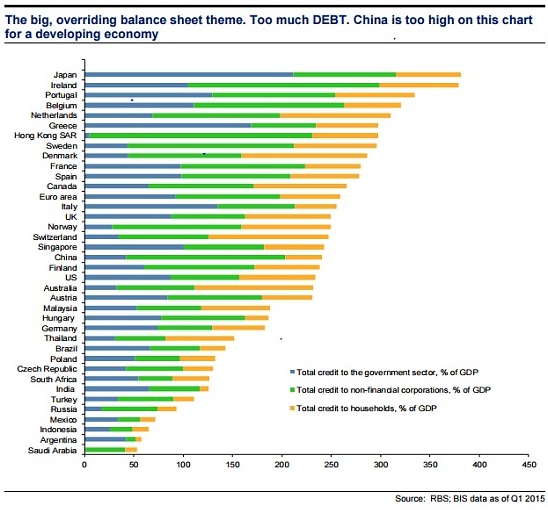

When the rent-seeking, exploitative part of the economy that used to be a relative modest percent of the economy, grows to 10-20% of the economy, it leaves less actual capital for innovators. We want to encourage innovators, but in the US we have a system where if you’re already extremely wealthy, then the Fed policies have enabled you to enlarge your rent-seeking at the expense of everyone else. Increasing levels of debt are yielding less economic growth over time, requiring more and more debt to get the same level of increase in economic activity.

DEBT AND DISTRIBUTION OF WEALTH

The debt has soared, and so has global financial assets, but not as much. There’s been a healthy expansion, but it’s completely asymmetric to the amount of debt that’s increased. In China, within a decade their total debt load has gone from $3T to $30T. A lot of other nations have followed that same pattern of skyrocketing debts and assets that have gone up but not by the same proportion.

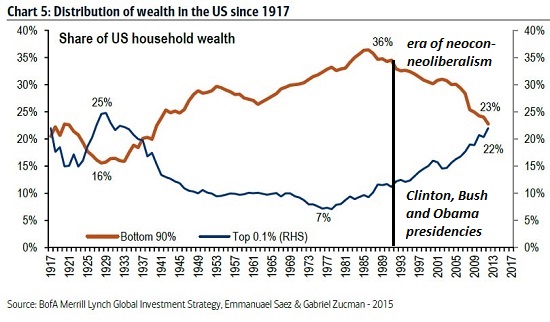

Distribution of wealth in the US since the 1917s has favored bottom 90% the most in the 70s and 80s, and then about 1990 it’s gone against wage earners. We can perhaps extrapolate these vast changes in wealth and income inequality and ask what the social changes are. A lot of people have pointed out that the election of Trump, Brexit, and the rise of the “right” parties in Europe are connected to the social disorders that are arising from this wealth inequality.

There’s potential for misattribution by the general public on why the financial crisis happened and why income wealth inequality is getting worse. Both Canada and Mexico has a larger, broader-based middle class than the US, and the Gini coefficient reflects that. Mainstream media doesn’t explain that the wealth effect only benefits those with assets or access to cheap credit that can be used to buy assets. This is where the central bank has created a vast social injustice, and that’s why the social cohesion is being lost. People recognize that these central bank policies are exacerbating social injustices. The fallacy of the central bank idea that if they create all this wealth in the wealthy class, some of it will trickle down and benefit the bottom 95%. But that trickle effect is very modest and not something the central banks can control. That’s a structural flaw in central bank policies.

The way you deal with financial crises is by forcing people to take losses all the way along the line. You don’t create moral hazard and bail people out and make it easy for people to avoid losses, because then you pile up a lot of bad debt that is hidden. Policy makers at central banks don’t address inequality, perhaps because they know they’ve failed in that area and it’s a problem they don’t have any influence on.

LOOKING FORWARD

Millennials are quite financially conservative and are aware that the generational burden is falling on them. They might not cleave to any of the political lines that we’re used to. It’s interesting because they favor more socialist agenda, in the sense that it reduces the inequality and injustice that is rising, but they may very well be conservative financially instead. There may be a hybrid political solution going forward.

We could get rid of central banks or limit them to providing liquidity in liquidity crises. If we went back to a market of private capital, that would instantaneously remove a lot of the benefits rent-seekers get from central bank policies and everyone would have a transparent market for capital. That would open up the capital market to innovators in a way the central banks have repressed.

There is a huge potential benefit to innovators and small enterprises in decentralized crypotcurrencies. These currencies have great value as they’re outside the control of central banks. If we can decentralize money and capital, that would open the door to a lot of solutions.

These distortions are building up systemic risk that’s beneath the surface. Right now central bank policies are all about masking risk, but the systemic risk is rising at the same time that benefits of adding more debt to the system are diminishing. There’s going to be a banquet of consequence in the next few years, and we can see it being prepared right now.

Abstract by: Annie Zhou <a2zhou@ryerson.ca>

03/13/2017 - The Roundtable Insight: Charles Hugh Smith On Inequalities And Distortions Caused By Central Bank Policies

03/13/2017 - The Roundtable Insight: Charles Hugh Smith On Inequalities And Distortions Caused By Central Bank Policies