Dodd-Frank represents Regulatory Policy that assures sub-standard credit and job growth in an Era of Financial Repression!

According to Christopher Whalen of Kroll Bond Rating Agency (KBRA) the 2010 Dodd-Frank law represents another “phase-shift” in regulatory policy that implies sub-standard credit and job growth for years to come, regardless of the level of interest rates or open market purchases (QE) of securities by the Federal Open Market Committee (FOMC) and other global central banks.

As a result, low levels of job creation and growth which are exacerbated by deflationary effect of low/negative interest rates, are driving a populist political backlash in the US and in Europe. The “surprise” result in the BREXIT vote this summer is likely to be repeated in future elections because of the ground swell of popular discontent at failed economic policies.

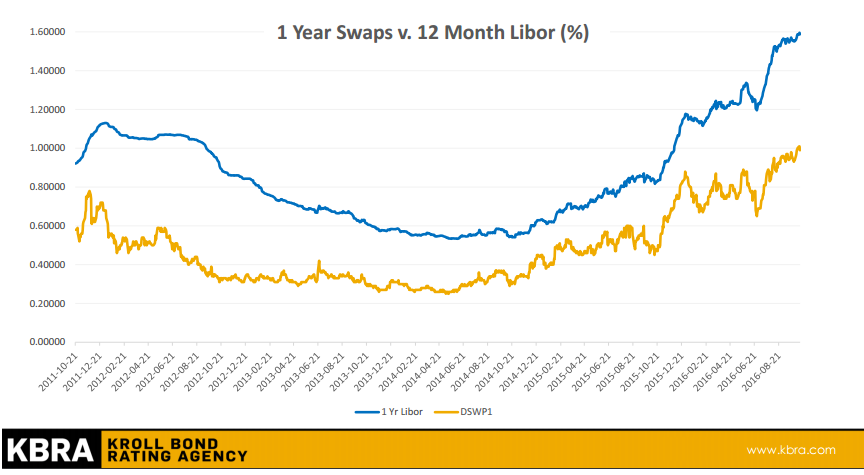

Markets are now starting to price in these risks, as evidenced by the widening gap in cost of dollar funding in the US and EU.

Christopher Whalen of Kroll Bond Rating Agency (KBRA) has just released a presentation discussing this. The presentation makes the following additional key points:

-

The “single mandate” for all governments is job growth, both for economic and political reasons. The FOMC pretends to have a “dual mandate,” but in fact the Humphrey Hawkins law makes “full employment” the paramount policy mandate before price stability or stable interest rates can even be considered.

-

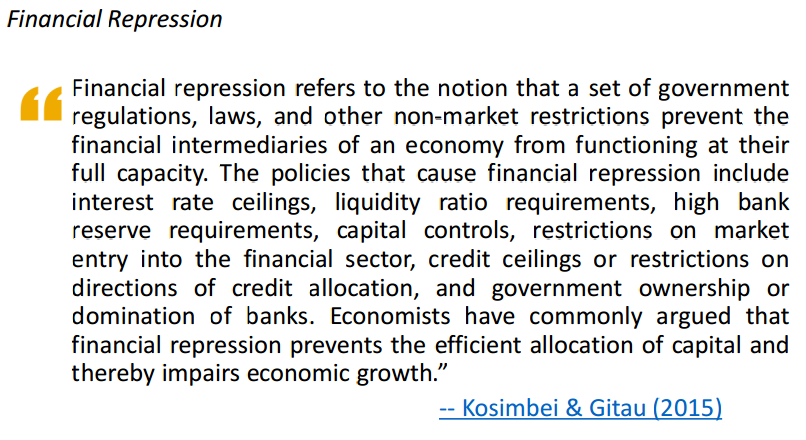

Since the 1970s, fiat money and the singular focus on full employment has gradually forced interest rates down to zero or below. The secular decline of interest rates, which is the centerpiece of “financial repression,” necessarily also drives deflation by taking income (carry) out of the economic system.

-

With negative interest rates, global central banks are depriving the global economy of trillions of dollars in income and thereby fueling a diminution of private capital and economic activity. Low interest rates and QE also lead to bad investment decisions, as in the case of oil, residential and commercial real estate, shipping and other asset classes.

-

The fixation of global monetary authorities with targeting employment has significant costs, including a steady level of underlying inflation that undermines consumer purchasing power (thus, today’s discussion of “income inequality”). The single mandate of full employment also facilitates periodic financial bubbles and crises resulting from the manic swings in monetary policy.

To view the presentation, click here.

11/02/2016 - Dodd-Frank represents Regulatory Policy that assures sub-standard credit and job growth in an Era of Financial Repression!

11/02/2016 - Dodd-Frank represents Regulatory Policy that assures sub-standard credit and job growth in an Era of Financial Repression!