CENTRAL BANKERS CAN’T STOP THE BUSINESS CYCLE

NOR THE DEATH BLOW OF A POST US ELECTION RECESSION

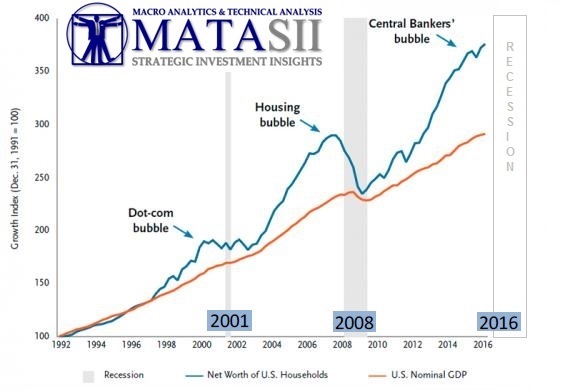

The central bankers are capable of achieving many extraordinary results but not all economic and financial problems can be solved by central bankers. Central Bankers for example have the power to solve liquidity issues, but it is impossible for them to solve solvency issues. Central Bankers through Financial Repression can transfer risk , however they can’t remove it from the system. Additionally, Central bankers may be able to delay a recession temporarily, but they can’t prevent the business cycle from running its natural course.

This inability to control the business cycle has the potential to be the unavoidable trigger that brings the great Central Bank Bubble to an end.

The US after eight years is by most comparisons overdue a recession. Unfortunately, the next recession is going to happen when the central bankers are least capable of further attempting to slow the inevitable. The central bankers may have delayed a US recession about as far as they are capable of doing.

A NEARLY PERFECT STORM BREWING

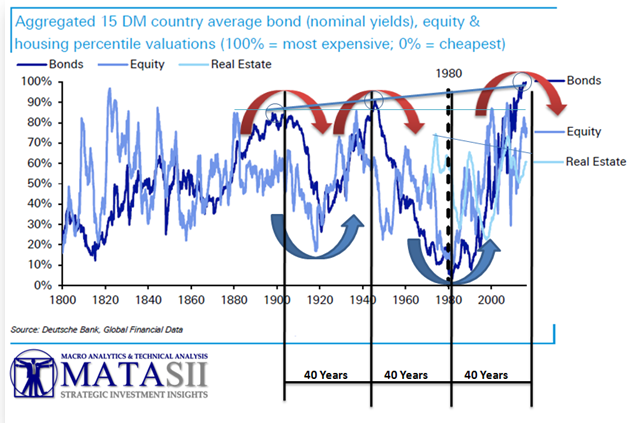

The market technicians of all persuasions are almost unanimously now calling for a major correction. What is most troubling in their work is that their indicators are not just short and intermediate term measures but critical long term indicators:

- KONDRATIEFF CYCLE: The 55 Year generational Kondratieff Cycle shows an overdue major downturn with a cleansing of debt as part of the end to what has been termed the “Debt Supper Cycle”,

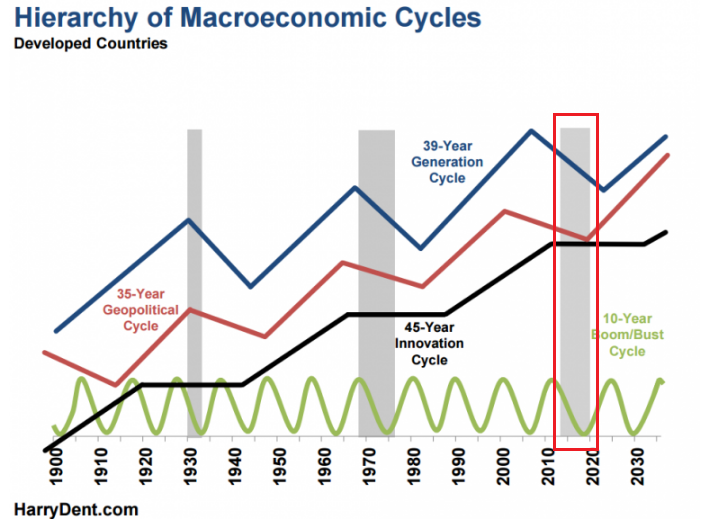

- DEMOGRAPHIC CYCLES: Harry Dent has done some major work on Demographic Cycles and cycles overall. I interviewed him for the Financial Repression Authority where you can find the video and he lays out the seriousness of the shifting demographics and how it overlays of many different types of cycles he has studied.

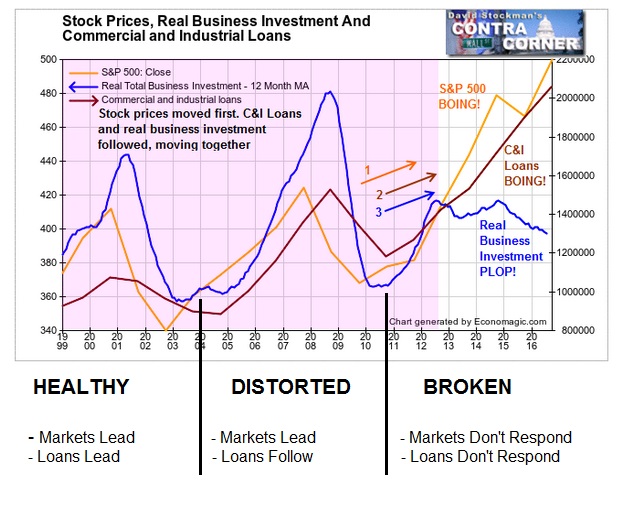

The mal-investment that recessions normally purge as part of a healthy capitalist system has reached such a level that deteriorating real total business investment has diverged from the S&P 500 Index as well as C&I Loans. In our opinion (which we have labeled here), sound business investment has shifted from being distorted to what can now only be described as broken. Corporate profits, sales revenues, margins and EBITDA cash-flow are all falling or are rolling over.

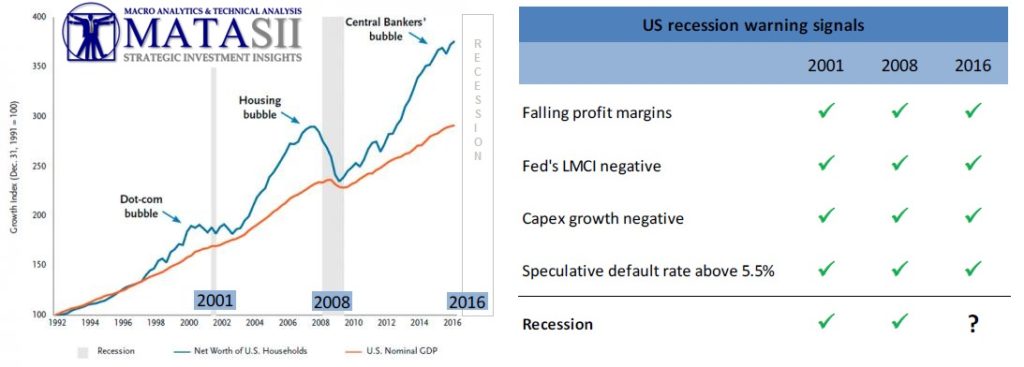

Every recession on record since the end of WWII (but one) has signaled the four warnings outlined here. That one exception had a completely different economic climate than the current one. The chances of a US Recession in 2017 should be considered highly likely.

The problem with the next US recession is that the magnitude of distortions and leverage in the system will potentially quickly cascade into a full scale, unmanageable economic problem and likely a full scale protracted recession (or even worse).

A “WHIFF” OF INFLATION

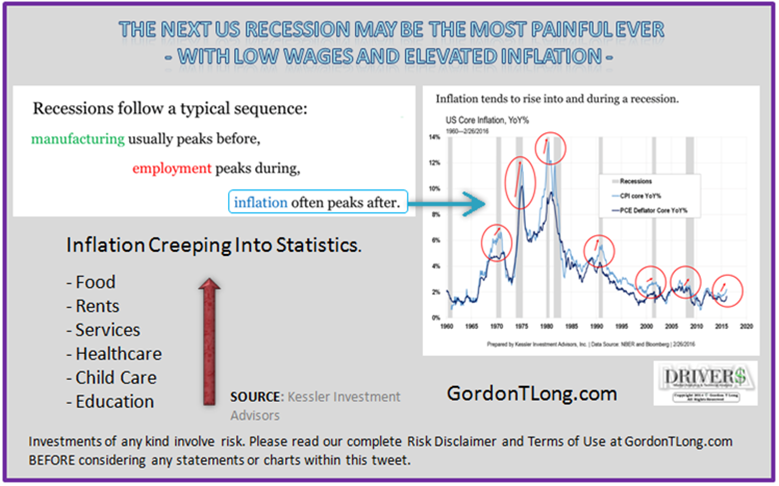

Few market watchers appear to appreciate that inflation tends to rise into and during a recession.

Consumer prices in U.S. rose in September at the fastest pace in five months. The Year-over-Year inflation rate is now the highest it has been since October 2014. Few are yet paying attention.

What this suggests is that the Fed will most likely remain on course for an interest-rate hike this year, immediately following the US Presidential election.

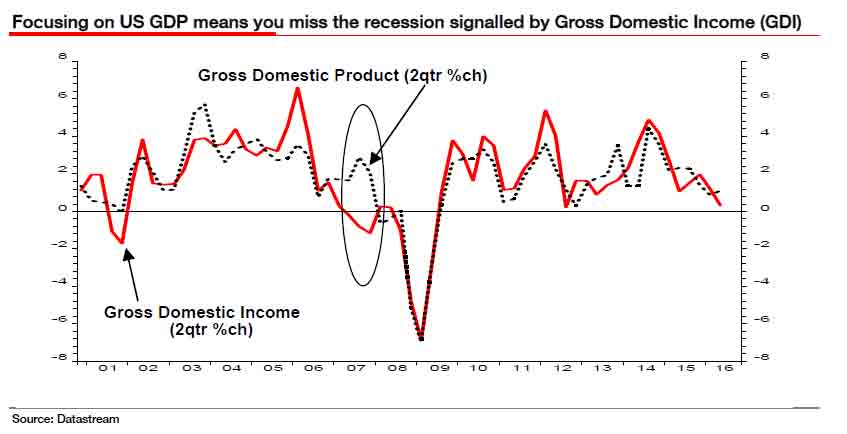

To many this is exactly the wrong medicine for the economy at exactly the wrong time especially when you consider Gross Domestic Income (GDI). Fed actions would almost assure the recession.

All US Recession discussion (currently “embargoed” by the mainstream media) will become headline discussion immediately AFTER the election, as the blame game then ensues on how the unprecedented negative campaign rhetoric was actually the root cause. This will be the politicos “cover” for massive fiscal spending and increases in the Fed’s balance sheet. Of course it won’t stop the recession nor the financial damage that will ensue.

Don’t say you weren’t warned!

10/22/2016 - CENTRAL BANKERS CAN’T STOP THE BUSINESS CYCLE – NOR THE DEATH BLOW OF A POST US ELECTION RECESSION

10/22/2016 - CENTRAL BANKERS CAN’T STOP THE BUSINESS CYCLE – NOR THE DEATH BLOW OF A POST US ELECTION RECESSION