Andreas Utermann, Allianz’s Global CIO was commended recently by Tom Keene on Bloomberg’s Surveillance for willing to even mention Financial Repression on a public broadcast, a subject it appears that is frowned upon in polite, well connected Wall Street circles.

What comes out in this short video interview by Bloomberg is that Allianz’s CIO expects Financial Repression to be around for the next generation. It simply isn’t about a few more years but rather about the next generation learning to live with it.

“It isn’t a question of years but about generations!”

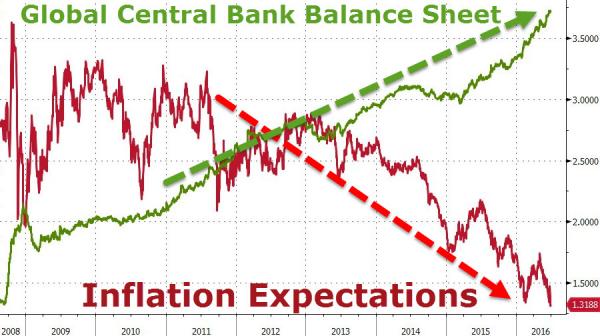

He firmly believes it has become quite evident that the current policy targets aimed at increasing inflation to 2% are not working. Policy makers just don’t know how to solve the problem. However, this will not stop the Macroprudential policies of Financial Repression.

Maybe most significant in the Bloomberg interview is that Utermann is willing to state publicly that he believes the Federal Reserve is intentionally behind the curve. The Fed want’s rates to rise behind increasing rates of inflation.

The Federal Reserve is intentionally behind the curve.

Because of Financial Repression the Fed want’s rates to rise behind increasing rates of inflation.

Listen to how Allianz believes you solve today’s yield problem …

Utermann: Suffering a Generation of Financial Repression

Andreas Utermann, global chief investment officer at Allianz Global Investors, discusses the factors holding back global central banks from normalizing interest rates, differing economic philosophies in the Eurozone, and dealing with chronic financial repression. He speaks on “Bloomberg Surveillance.”

10/03/2016 - Allianz’s CIO Andreas Utermann says: Expect to Suffer a Generation of Financial Repression

10/03/2016 - Allianz’s CIO Andreas Utermann says: Expect to Suffer a Generation of Financial Repression