Deutsche Bank Predicts Intensifying Financial Repression as a New Global Bond Cycle Kicks Off

The signs abound from the current political rhetoric that trade and financial protectionism is in the wind. This is a major problem, especially with weak economic growth, central banks committed to higher inflation and stagnant (and even falling) productivity in the developed economies.

This has the potential to reverse 35 years of the “Bankers’ Bond Bonanza” and further intensify advancing Financial Repression.

Deutsche Bank Strategist Jim Reed concludes:

An oncoming lurch towards trade and financial protectionism — combined with aging populations and weak worker output — will intensify financial repression as a new multi-decade-long economic cycle kicks off this year.

……

Central bank bond-buying and stronger financial regulation in recent years, forcing financial institutions to up their domestic bond purchases, highlight how financial repression is in full swing. It’s going to get a lot worse

…….

“Maybe it will be more difficult in today’s integrated world to limit international capital flows in the same ways as after WWII (the last time Financial Repression was used to solve a US sovereign debt problem), so perhaps the cushion will come from a long period ahead of money printing and bond purchasing to ensure that there is no run on debt markets given the likely negative real returns.”

SOURCE 09-09-16 Deutsche Bank via ZeroHedge

Deutsche Bank: Bond Investors Are About to Get Crushed as a New Global Cycle Kicks Off

Weak growth, higher inflation, and stagnant productivity in developed countries will roil bond investors in the decades to come, as the benign global forces that have buoyed returns on financial assets for the past 35 years stage a sharp reversal. That’s the big-picture call from Deutsche Bank AG analysts who predict an oncoming lurch towards trade and financial protectionism — combined with aging populations and weak worker output — will intensify financial repression as a new multi-decade-long economic cycle kicks off this year.

“In our opinion we’re getting closer to a binary outcome for the global economy and financial markets,” the strategists, led by Jim Reid, wrote in a report on Thursday.

Now, there’s an inflection point in the global economy that is poised to create a perfect storm for bond investors: higher inflation, and strengthening political incentives to erode high debt burdens by hitting bond holders with effective haircuts, the bank argues.

Scenario 1 – The best case

Put bluntly the best realistic scenario for financial stability in the new era is that bond holders around the world see a slow real adjusted haircut over several years, probably over at least a couple of decades. The best example of this through history was the post WWII period where government debt was at similar levels to that currently seen. Over the next 35 years this debt was successfully eroded by a long period where nominal GDP was notably above bond yields. So bond holders took a large real haircut.

Scenario 2 – The hard break

Rather than an artificial reflation and slow successful non-systemic deleveraging, there is a genuine risk of a more binary outcome where a major country (countries) see(s) a hard default on its debt taking a lot of other debt with it domestically and possibly internationally. This is probably most likely to happen via politics – especially in Europe if a country decides to leave the single currency.Under this scenario, non-core government bond markets could see huge losses as the central bank backstop bid is removed.

A slew of analysts have warned bond investors in the coming years will be hit by negative real returns, citing stretched valuations, the prospect of rising price pressures from a low base, and monetary tightening in the U.S. Yesterday, DoubleLine Capital Chief Investment Officer Jeffrey Gundlach recommended that bond investors gear up for higher inflation and higher bond yields, saying, in a webcast, “This is a big, big moment” for financial markets, citing the prospect of rising rates. Japan’s sovereign debt market is embroiled in its biggest rout in 13 years with the 10-year benchmark climbing to minus 0.025 percent on Friday (compared with minus 0.06 percent on Wednesday, after a record-low of minus 0.3 percent in July) while the German 10-year benchmark rose to minus 0.010 percent as of 8:42 a.m. in New York. The 30-year note is at its highest level since June, after the Eurpoean Central Bank downplayed the need for more stimulus on Thursday.

ECB inaction is also the catalyst that has triggered a slide in 10-year U.K. gild and U.S. Treasury prices.

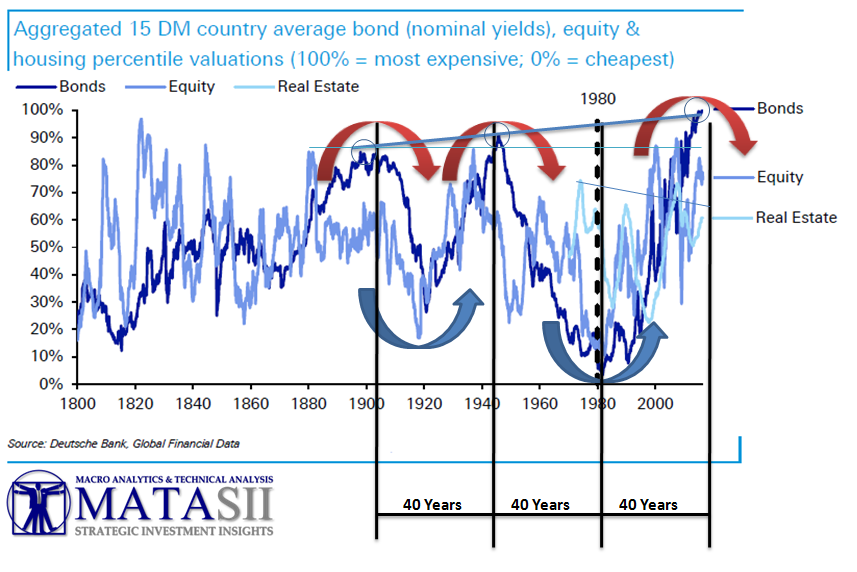

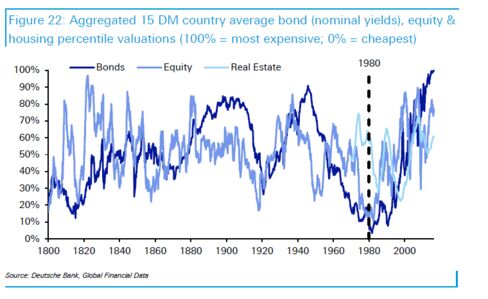

The Deutsche analysts take a structural view for fixed-income prospects with a sweeping sketch of the economic landscape, drawing upon a detailed data set going centuries back that suggest current asset valuations in 15 developed markets have hit their cyclical peak, after a bull run from the 1980s onwards. Valuations for housing and bonds relative to their historic inflation-adjusted prices now look stretched. The bank calculates that’s the case for equities too, relative to nominal GDP.

Benign globalization and demographic forces have tamed inflation in recent decades fueling stunning real returns in fixed income from the 1980s, while equities, despite the higher returns on offer, saw a much smaller level of outperformance in this period.

Central bank bond-buying and stronger financial regulation in recent years, forcing financial institutions to up their domestic bond purchases, highlight how financial repression is in full swing. It’s going to get a lot worse, the analysts say, though the counterpoint from some economists is that monetary policy is appropriately calibrated to the underlying natural rate of interest and beefier regulations are designed to make the financial system safer.

The Deutsche analysts say:

“It seems the status quo can’t hold for much longer. Monetary policy can’t be used as the predominant policy tool to the exclusion of the alternatives. Inequality surely can’t continue much further without a political backlash. Globalization and perhaps free movement/immigration can’t continue in its current form without a similar such social/political response.”

They conclude:

“Maybe it will be more difficult in today’s integrated world to limit international capital flows in the same ways as after WWII, so perhaps the cushion will come from a long period ahead of money printing and bond purchasing to ensure that there is no run on debt markets given the likely negative real returns.”

While equities will likely outperform bonds in the decades to come, the bank argues that the data suggests stocks will still lag their long-term return average. Although the prospect of lower real GDP in advanced economies is bad for both financial and real-economy assets, there’s at least one quantum of solace: Real wages are likely to rise amid a decline in populations of working age, the analysts conclude.

Deutsche Bank’s warnings follow Bank of America Corp. analysts last month, who reckon that financial assets are poised to underperform real-economy assets — such as commodities and collectible items — citing high financial-market valuations, and the prospect of looser fiscal policy, trade protectionism and wealth redistribution in developed countries. The bearish prognostications are premised on one big call, of course: there will be no positive productivity shock in advanced economies in the coming decades.

09/19/2016 - Intensifying Financial Repression as a New Global Bond Cycle Kicks Off

09/19/2016 - Intensifying Financial Repression as a New Global Bond Cycle Kicks Off