FRA Co-founder Gordon T. Long discusses with John Rubino

John Rubino is author of Clean Money: Picking Winners in the Green Tech Boom (Wiley, December 2008), co-author, with GoldMoney’s James Turk, of The Collapse of the Dollar and How to Profit From It (Doubleday, January 2008), and author of How to Profit from the Coming Real Estate Bust (Rodale, 2003). After earning a Finance MBA from New York University, he spent the 1980’s on Wall Street, as a currency trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He now writes for CFA Magazine and edits DollarCollapse.com and GreenStockInvesting.com.

GOVERNMENT INTERFERENCE

“Governments are acting like they don’t think they can handle a garden variety equities bear market anymore.”

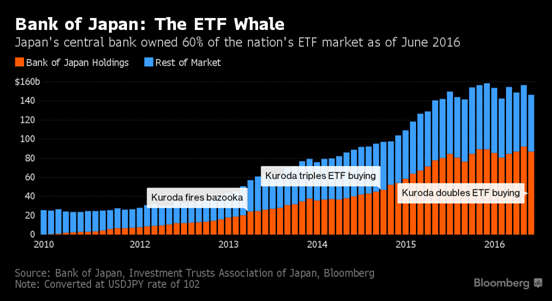

You’re seeing central banks all of a sudden become among the biggest buyers of equities in the world. It’s one thing to buy bonds and intervene in the interest rate markets, but another to buy equity. This is governments buying the industrial capacity of the world and from an Austrian Economics point of view, this is catastrophically dangerous.

“If the central banks of the world own all the major equities, then they get to direct investment by those corporations, and that’s a recipe for something that isn’t capitalism anymore”.

“Market based economies are the only method of organizing a society that’s been proven to work, to generate progress, and pull people out of poverty, and we’re actively doing away with that.”

HEDGE FUND PROBLEMS

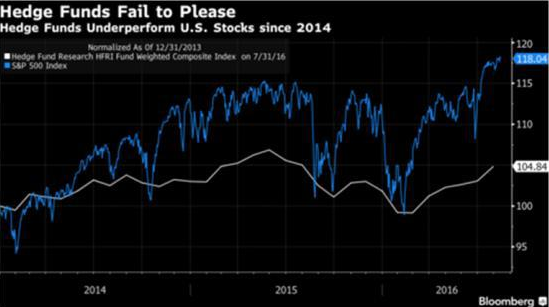

If you look at the hedge funds, you get a sense of how distorted our markets are. They’ve been under-performing, for example, the S&P 500. You could buy an ETF that charges next to nothing, and do better than the average hedge fund. You’re seeing big institutions pull money out of hedge funds and start buying ETFs and a lot of brand name hedge funds are folding or scaling back, and this is a really difficult time in that market. It’s not going to get better any time soon because governments are distorting markets more and more progressively by buying stocks indiscriminately, or forcing interest rates down to artificially low levels, and generally messing around with the price signalling of free markets.

A lot of the heavy hitters are shorting everything in sight and a big part of the reason is that they don’t trust the markets anymore. The people who have been worried about the market for years now have some high powered money on their side and assuming they’re right again, things are going to get interesting in the coming year.

Besides private placements, hedge fund money is also flowing into emerging markets stocks and bonds, and that’s a direct result of these developed markets being distorted by government actions.

CHANGES IN THE EQUITY MARKET

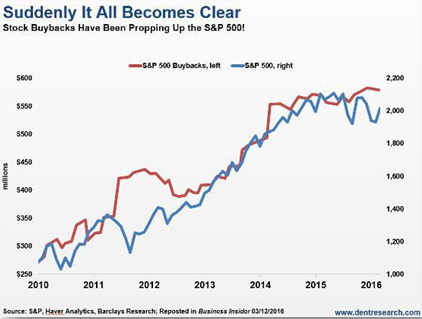

Corporate share repurchases involve hundreds of billions of dollars, but the flow into equities is slowing down dramatically. Corporations have hit the point where they can’t borrow anymore, and they’re starting to be punished for borrowing so much money to buy back their stocks. Buyback announcements are going down at the same time that corporate equity issuance is going up, for the first time since 2010 or so. At the same time, corporate insiders are selling stock at a rapid pace. These are things that usually precede bear markets or at least dramatic corrections in share prices.

“Somewhere in the US government there’s an agency that’s buying stocks aggressively right now. They just don’t tell us because they lie to us in ways some other central banks don’t lie to their people.”

On the one hand you have everything that relates to market valuations and rational behavior on the part of private sector actors pointing to a bear market, but you also have governments and central banks with effectively unlimited funds buying aggressively. That along with terrified foreign capital flowing into the US are two things, that if you are shorting the US market, you’ve got to be worried about. There are big forces contending, but we’ve never been here so we can’t say anything with certainty except that chaos is the inevitable result.

This is an incredibly hard time to manage money because it’s not about the fundamentals anymore. If those are your only tools, then you’ve got a real problem.

“I don’t envy professional money managers and I think that for most of them, this is going to end really badly… It’s highly unlikely that you’re going to make a perfect set of decisions when you’re still learning about this new world.”

THE MARKET IS NO LONGER A MARKET

“There’s not a single financial market that isn’t manipulated in some way by someone.”

There’s no actual free market that you can point to and participate in. This goes on until these guys run out of ammunition, when we don’t accept these fictitious fiat currencies as having some intrinsic value. As long as we’re willing to be fooled in that way, then governments have ammunition to continue to manipulate the markets. This could go on for a while, or blow up overnight; there’s no way to tell the timing.

People are starting to pick up on the fact that governments are trying to devalue their currencies, but it’s making more and more sense for people to move some of their fiat currencies into things that governments can’t make more of. That’s been gold and silver, lately. The gold and silver miners have been reporting phenomenally good numbers. You’re seeing precious metal miners report really low cost numbers and dramatically higher profit numbers, and they are almost alone in having this kind of a trend. It doesn’t mean they won’t have a big correction going forward, but it does mean that there are suddenly healthy businesses, and that’s a good place to be when you’re worried about the health of rest of the world.

We are now printing over $200B a month between the ECB, the Bank of Japan, and the Bank of England lately. What they’re doing is they’re rotating it. 95% of the world’s currencies are Bank of Japan, the Sterling, the Euro, and the Dollar, and if you can rotate them around there’s nowhere to run, other than hard currencies and outside that gain. Its called the Bernanke Doctrine of “Enrich-Thy-Neighbor”.

Almost everything in Keynesian economics is short term with terrible long term consequences. We’re living in previous Keynesian economists’ long term now and we’re suffering the consequences of previous policy mistakes. The guys in charge now are making bigger and bigger policy mistakes that we a few years from now, or our kids, will have to deal with.

“The idea that tweaking systems in the short run to keep it in a fictional equilibrium is all you need to do if you’re a government running an economy, is profoundly mistaken.”

Abstract by: Annie Zhou a2zhou@ryerson.ca

Video Editing by: Min Jung Kim http://minjung.kim@ryerson.ca

08/28/2016 - John Rubino: Have the Markets Now Become too Big To Fail?

08/28/2016 - John Rubino: Have the Markets Now Become too Big To Fail?