Ronald-Peter Stöferle, Managing Partner & Investment Manager at Incrementum discusses with FRA Co-founder Gordon T. Long, the key points of his recent 2016 report, “In Gold we Trust.”

Ronald was born 1980 in Vienna, Austria, is a Chartered Market Technician (CMT) and a Certified Financial Technician (CFTe). During his studies in business administration and finance at the Vienna University of Economics and the University of Illinois at Urbana-Champaign, he worked for Raiffeisen Zentralbank (RZB) in the field of Fixed Income/Credit Investments. After graduation, he participated in various courses in Austrian Economics.

In 2006, he joined Vienna-based Erste Group Bank, covering International Equities, especially Asia. In 2006, he also began writing reports on gold. His six benchmark reports called ‘In GOLD we TRUST’ drew international coverage on CNBC, Bloomberg, the Wall Street Journal and the Financial Times. He was awarded 2nd most accurate gold analyst by Bloomberg in 2011. In 2009, he began writing reports on crude oil. Ronald managed 2 gold-mining baskets as well as 1 silver-mining basket for Erste Group, which outperformed their benchmarks from their inception. In 2014 he published a book on Austrian Investing

“One of the main aspects of the report is that we are in a bull market again.”

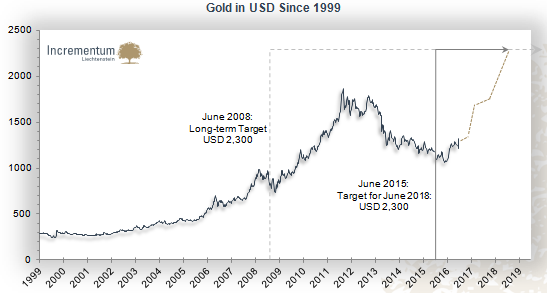

Gold Price Target for June 2018: USD 2,300

Hedge fund managers and investors were buying gold and mining shares a couple of months ago and now we are entering what the Dow Theory calls ‘the public participation pace.’ $2,300 USD is our long term target which is based on the fact we are expecting rising inflation rates. Right now we have a tremendous global slowdown and the strong USD has further fueled this slowdown.

It is confirmed however that gold is rising in every currency. And this is a strong sign for a bull market. The world believed that the Fed would hike interest rates but that didn’t happen and now with the Brexit we will definitely be in this current interest rate environment for longer, the US may even implement negative interest rates.

“The one obvious thing in the midst of this all is that central banks are really good at finding excuses for not raising rates’ now their excuse is Brexit.”

The strength of the dollar has had enormous consequences for commodities. There is a very high negative correlation between the strength of the USD and the health of commodity markets. Furthermore we have seen the effects in emerging markets that are highly dependent on a cheap dollar, the rising dollar acted as a rate hike.

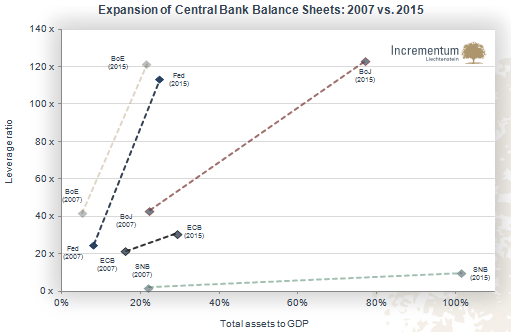

Expansion of Central Banks Balance Sheet: 2007 vs 2015

“There have been rumors about helicopter money and I am almost certain it will be implemented.”

With monetary experiments, central banks have been engaging into an all-or-nothing gamble, hoping it will eventually bring about the long promised self-supporting and sustainable recovery. The central banks‘ leverage ratios and the sizes of the balance sheets relative to GDP have enormously risen in the aftermath of the 2008 financial crisis. Lastly it doesn’t help Bank of Japan (BoJ) has taken this insanity several steps further than their peers have managed; the ECB has been comparably conservative, but is currently doing its best to catch up.

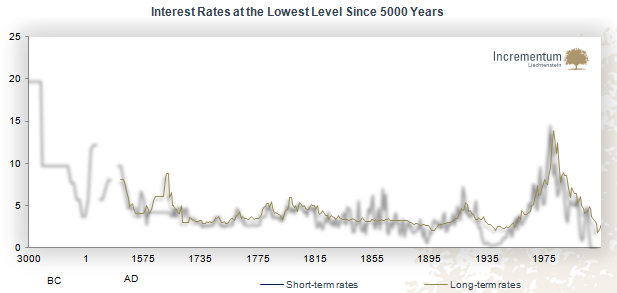

5,000 Years of Data Confirm: Interest Rates Have Never Been as Low as Nowadays

“The longer interest rates stay this low, the more fragile the system will become.”

Negative interest rates are one of the last hopes to which policymakers cling. Meanwhile 5 currency areas (government bonds valued at more than USD 8 trillion have negative yields to maturity). When the centrally planned bubble in bonds finally bursts, it will be abundantly clear how valuable an insurance policy in the form of gold truly is

“Lose-lose situation for central bankers.”

- The long-term consequences of low/negative interest rates are disastrous (e.g. aggravation of the real estate and stock market bubbles, potential bankruptcies of pension funds and insurers)

- Normalizing interest rates would risk a credit collapse or rather a recession

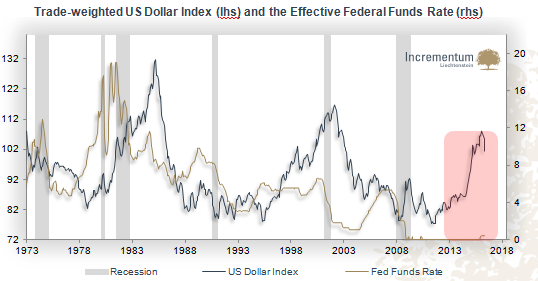

Trade-weighted US Dollar Index (lhs) and the Effective Federal Funds Rate (rhs)

“A strong dollar undoubtedly has consequences for the manufacturing industry, while a strong USD is also deflationary.”

The Fed wants a weaker dollar, but this doesn’t happen in one day, it is a process. We are making a really strong case for a recession happening in the US and it will have global consequences. A recession is a very normal thing; it is akin to your need for sleep. It is a way for the system to replenish.

“If the Fed fails with the normalization of interest rates, the already crumbling narrative of economic recovery could collapse.”

We are comparing this year’s oil prices to last year’s and last year the big plunge in oil prices started in July, so just do to that we will have rising inflation rates. But it is not only this there are many factors that indication rising inflation rates. The fact that gold and mining shares have done so well since the beginning of the year is indicative that inflation is going to be a big topic.

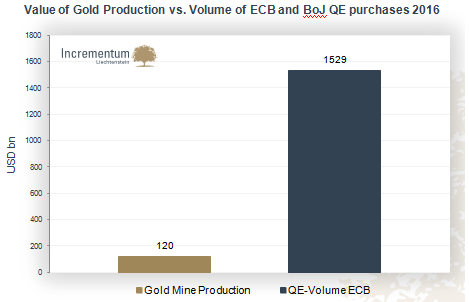

Value of Gold Production vs. Volume of ECB and BoJ QE purchases 2016

“Gold has to be physically mined, its global supply is exceedingly stable – holding it provides insurance against monetary interventionalism and an endogenously unstable currency system”

At a price of USD 1,200 per ounce, the ECB would have bought 4,698 tons of gold in the first quarter of 2016 (which is more than 6 times the value of globally mined gold). If the European QE program is continued as planned, it would be equivalent (assuming prices don’t change) to the value of 21,609 tons of gold (~12% of the total stock of gold of 183,000 tons ever mined). Adding the volume of the BoJ: the equivalent would be 39,625 tons of gold in 2016

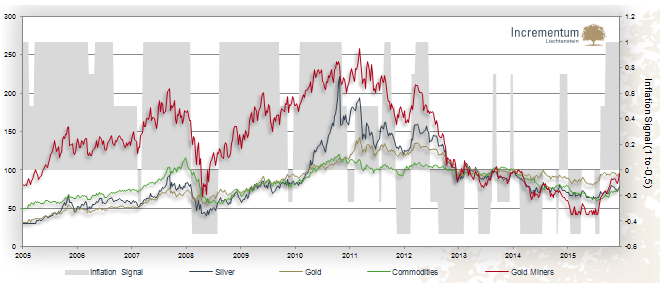

Incrementum Inflation Signal

“In the Long Term: If Currencies Depreciate, Gold Should Appreciate.”

It is a guide for investment allocations in our funds – depending on the signal’s message we shift allocations into or out of inflation-sensitive assets.

- Proprietary signal based on market-derived data as a response to the importance of inflation momentum

- Shorter reaction than the common inflation statistics

- For the first time in 24 months the Incrementum Inflation Signal indicates a full-fledged inflation trend is underway

Closing Remarks

“The market is a pain maximizer.”

In poker you have to bring some chips to the table and it’s no coincidence that China is massively buying gold. Not only has the central banked, but individuals as well. Central bankers just don’t like talking about gold. They pretend that it’s just lying around in the basement. I think we are already in the early stages of an inflationary pattern, but it is important to never rule out a deflationary event. Going forward we should prepare for much more government intervention and intervention from central banks. We are seeing that the medicine doesn’t work yet they will continue to give doses of it.

“In this current global monetary experiment that we are in, it just makes sense to hold gold.”

07/20/2016 - Ronnie Stoeferle: “IN GOLD WE TRUST!”

07/20/2016 - Ronnie Stoeferle: “IN GOLD WE TRUST!”