The Financial Repression Authority is pleasured to be revisited by Ty Andros, Chief Investment Officer of the Sanctuary Fund. FRA Co-Founder Gordon T. Long has has a stirring conversation with Mr. Andros on a number of current economic developments and consequently, the things to unfold.

Ty began his commodity career in the early 1980’s and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Diego, and the University of Miami, majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView of which he is the CEO. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis. Ty prides himself on his personal preparation for the markets as they unfold. Ty is an expert in applying the indirect exchange method as a principle of the Austrian School of Economics in his investing approach.

THE AUSTRIAN SCHOOL OF ECONOMICS

It consists of 3 major components.

- Sound money and private property

- Free market capitalism

- Human behavior

The cycle we are going through now has happened hundreds of times in history and has led to the rise and falls of empires. It’s because of people forgetting the past and repeating the same mistakes. If you don’t have sound money, you really don’t have protection against the government. They can confiscate your money and they have been doing so since Bretton Woods.

“The money that we hold in banks is a worthless junk bond. The government has essentially become the mafia; they are scheming and transferring property to themselves.”

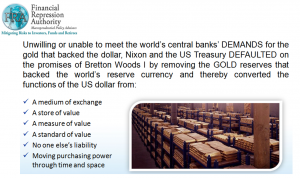

SOUND MONEY

The figure below outlines the specific functions of money:

If it doesn’t have these components then you’re not holding money. Until 1971 it had all those features, and it has been replaced with an I.O.U of fiscally and morally bankrupt politicians and banks. It is worth no more than the paper it is printed on.

“In my opinion, the gold and silver bear market is over so it is a prime time to start accumulating now.”

MARKET CAPITALISM AND WEALTH CREATION

Capitalism is about getting more for less and three groups of people being rewarded for it: The consumer because he is able to give his family a better life, the company which supplied it, and the employees within the company.

Socialism eats everything. Real wealth and income creation are in freefall. There will be no recovering. The confiscation of wealth is also known as runaway regulations, runaway debt creation, more taxes and currency debasement.

“Its pure confiscation, cannibalism, and slavery. It is eating the golden goose. It’s the people that aren’t self-reliant and don’t produce anything eating those that do.”

It’s pure confiscation, cannibalism, and slavery. It is eating the golden goose. It’s the people that aren’t self-reliant and don’t produce anything eating those that do. Nobody owns their homes, it’s simply a record that’s held in a database and all they have to do is misplace it. Nobody owns their stocks in their name and if you look at your banking agreement you don’t even have title to your money, the bank does. Slowly but surely they have removed everything. They don’t let you hold money because they can’t steal from it; real money has been outlawed.

“Gold is the currency of kings, silver is the currency of merchants, and debt is the currency of slaves.”

CURRENCY EXTINCTION EVENT

GDP is nothing of the sort, it’s just debt disguised as GDP. It is spending future wealth rather than creating future wealth for proper allocation to productive enterprises.

“We have nothing; we are just a bunch of debt slaves living in an illusion until we wake up.”

THE EVENTS OF 1971

President Nixon changed from a reserve backed system where the dollar was semi redeemable in gold and silver to a system that has no backing.

“It was the greatest heist in history. It was the greatest transfer of wealth from the public to the ‘bankseters’.”

He did this so that he wouldn’t have to operate in a prudent manner. Prudent manner means have to pass laws and have taxes which gives people a reason to get up in the morning and have the ability to do the capitalism which was discussed earlier. When you have bad laws and bad regulations, the economy will either collapse or they have to print the money to fill the whole; unfortunately they chose the latter.

![I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs. - Thomas Jefferson](http://izquotes.com/quotes-pictures/quote-i-believe-that-banking-institutions-are-more-dangerous-to-our-liberties-than-standing-armies-if-thomas-jefferson-283953.jpg)

“History has shown what happens to people who try to fix this system.”

Kennedy was taking the central bank back and creating silver backed money, 90 days later he was dead. Of course we will never truly know, everything is so covered up now and the government is incapable of telling the truth.

THE INDIRECT EXCHANGE

“This is how you go through a currency and financial extinction event. Exchange something of uncertain value, fiat money, for something of certain value, real wealth. This is the indirect exchange in simplest terms.”

So much of the ‘financialization’ of the economy is an illusion because it is not the real things going up; it’s the paper that they’re priced in losing its purchasing power

“The greatest applied Austrian economist in the world is none other than Warren Buffet. “

What Warren does is he sells paper which means liabilities are being debased by central bank’s printing presses and credit creation. If he writes an insurance policy for someone for $10 million, he now has a liability of 10 million, if he did this in 2000 that liability may be 5 million and simultaneously he took that money and bought the Burlington Northern Railroad, which is something that will just reprice to reflect the lower purchasing power it is denominated in. If we are in a depression or a boom, regardless the railroads will run. Half of his great track record is inflation that isn’t properly disclosed. He has been doing this since, coincidently 1971. He has been selling paper and buying real things with cash flow ever since.

Gold doesn’t cash flow but it is about to. Because of negative interest rates you’re paying somebody to borrow money from you. If you are able to hold your money without having to pay someone to hold it.The gold and silver bear market is over. As these destructive negative interest rates go deeper and deeper, people will eventually wake up. They’ve already woken up, this is what’s going on with the presidential race and particularly Donald Trump.

“This is the greatest insanity ever. It will be studied and written about for centuries. It is a much bigger example of stupidity and failing to learn the lessons of history. It is much larger in scale than the Great Depression because of the nature of globalization and the nature of man.”

Abstract written by, Karan Singh Karan1.singh@ryerson.ca

Video Editor: Sarah Tung sarah.tung@ryerson.ca

03/18/2016 - Ty Andros: “ITS A CURRENCY & FINANCIAL EXTINCTION EVENT!”

03/18/2016 - Ty Andros: “ITS A CURRENCY & FINANCIAL EXTINCTION EVENT!”